IRS Form 15110 Instructions

If you received a CP08 notice, you might be eligible to claim the additional child tax credit on your income tax return. To do this, you might need to complete and return IRS Form 15110, which you probably received with your notice.

In this article, we’ll walk through through everything you need to know about IRS Form 15110, including:

- How to complete and file IRS Form 15110

- How to respond to your CP08 notice

- What the additional child tax credit might mean to you

Let’s begin by going over this one-page form, step by step.

Table of contents

How do I complete IRS Form 15110?

This one-page tax form is relatively straightforward. Let’s begin at the top with the contact information fields.

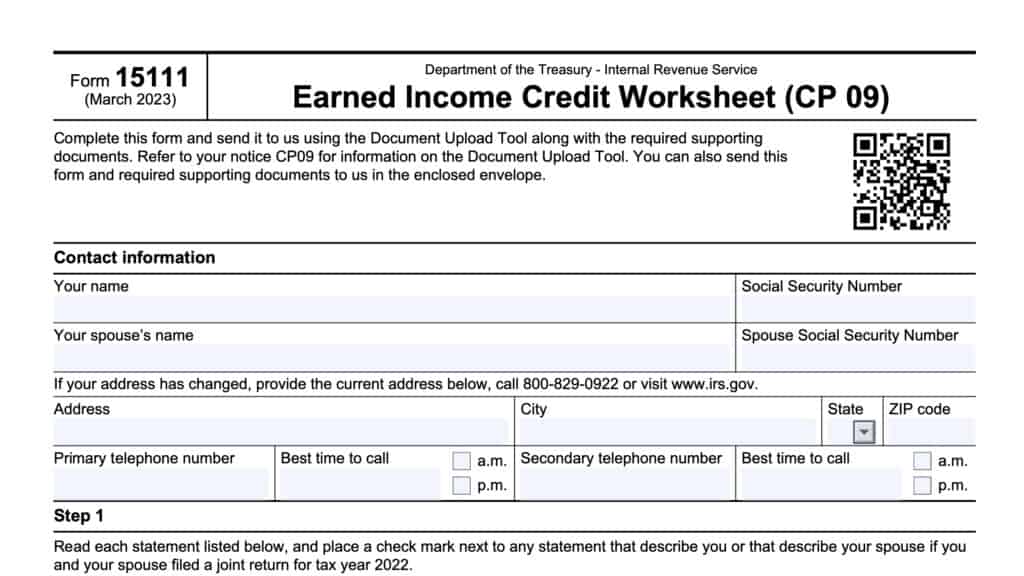

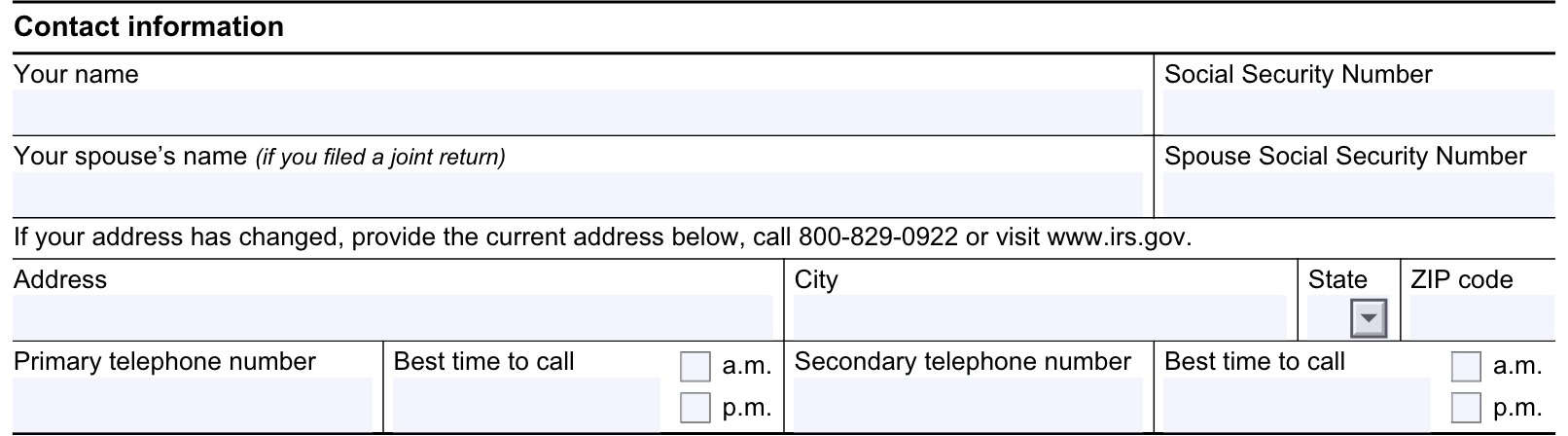

Contact information

Enter your complete contact information so that the Internal Revenue Service can verify your tax records, and in the case there are any follow up questions.

Taxpayer name and Social Security number

Enter your name and Social Security number (SSN) as they appear on your federal income tax return. If you do not have an SSN, you may be able to use your individual taxpayer identification number (ITIN).

However, you must have applied for your ITIN prior to your original tax return due date:

If you apply for an ITIN on or before the due date of your 2023 return (including extensions) and the IRS issues you an ITIN as a result of the application, the IRS will consider your ITIN as issued on or before the due date of your return.

Schedule 8812 Instructions

Spouse’s name and Social Security number

If filing a joint tax return as a married couple, enter your spouse’s name and Social Security number as they appear on your income tax return.

Taxpayer address

Enter your complete address as it appears on your most recent tax return. Include the following information:

- Street name and number

- City

- State

- Zip code

If your address has changed since you filed your most recent tax return

If you recently moved, you should call the IRS at: (800) 829-0922. You may be able to change your address over the phone after providing additional information to verify your identity.

Another way to update your taxpayer address is to file IRS Form 8822, Change of Address. This is the official change of address form for the IRS.

Telephone number

Enter at least one phone number in this field, as well as a preferred time to receive a phone call. You may enter up to two phone numbers here.

Eligible child information

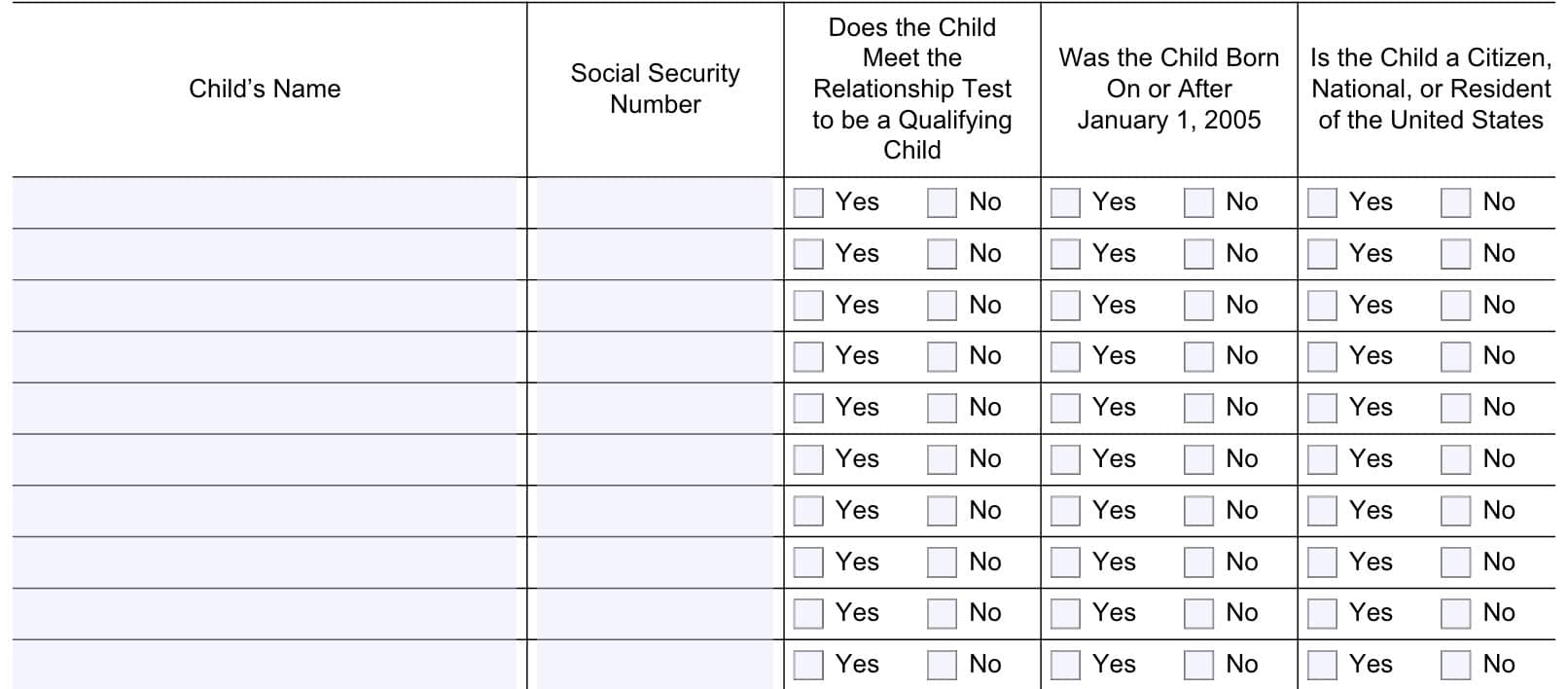

For each eligible child, you will need to enter the following information:

- Child’s name

- Social Security number

Social Security number requirement

For the child tax credit and the additional child tax credit, all qualifying children must have obtained a Social Security number before the due date of your individual tax return.

If a child has obtained an ITIN, but not a Social Security number, he or she may still qualify for the credit for other dependents (ODC), but not the child tax credit or additional child tax credit.

Qualifying child questions

In addition to providing the child’s name and Social Security number, you must answer 3 questions to determine whether or not each child meets the eligibility criteria.

- Does the child meet the relationship test to be a qualifying child?

- Was the child born on or after January 1, 2005?

- Is the child a citizen, national, or resident of the United States?

Let’s take a closer look at each question.

Does the child meet the relationship test to be a qualifying child?

To pass the relationship test, qualifying children must be related to the taxpayer. According to the IRS, below are the relationship types that qualify:

- Son or daughter

- Stepchild

- Eligible foster child

- Brother or sister

- Half-sister or half-brother

- Stepbrother or stepsister

- Adopted child

A qualifying child can also be the child of any of these relatives.

Example: John Doe’s brother, James, passed away several years ago, leaving John to raise James’ son, Adam. Adam is 10 years old and is John’s dependent. There are no other surviving relatives.

Because Adam is John’s dependent, Adam would qualify as an eligible child for the child tax credit and the additional child tax credit.

Was the child born on or after January 1, 2005?

A qualifying child must be under the age of 17 as of January 1 of the tax year that you want to claim the child tax credit on your federal income tax return.

At the time of this writing, IRS Form 15100’s most recent version was as of April 2023, so this question appears to apply to taxpayers regarding their 2022 income tax return.

For claiming this credit in regards to a 2023 tax return, this question would be changed to the following:

Was the child born on or after January 1, 2006?

Is the child a citizen, national, or resident of the United States?

The final question simply asks whether or not each child is a U.S. citizen, national, or resident. Dependent children who are not residents or citizens are not eligible for the additional child tax credit.

Eligible child criteria

Below the qualifying children information fields, you’ll need to indicate how many children qualify. A child may qualify for the additional child tax credit if you answered Yes to all of the questions. However, if you answered No to any questions, then the child is ineligible for this refundable tax credit.

Filing considerations

Most likely, you received a copy of this form with your CP08 notice, informing you that you might be eligible for the additional child tax credit. Here are some things that might help you better understand how this impacts you.

What is a CP08 notice?

A CP08 notice is the official notice from the Internal Revenue Service that indicates a taxpayer may be eligible to claim the additional child tax credit, but that:

- The taxpayer did not claim the additional child credit on their tax return, and

- The IRS needs more information to make a determination

Watch this informative video to learn more about your CP08 notice.

Let’s take a closer look at the additional child tax credit, as well as other tax credits that you may be eligible for.

Additional child tax credit

The additional child tax credit is the refundable portion of the child tax credit. Before we dive deeper in to the additional child tax credit, let’s take a closer look at the child tax credit.

What is the child tax credit?

The child tax credit is a tax credit that qualifying households may claim to reduce their income tax liability. The maximum child tax credit is $2,000 per qualifying child, per year.

Child tax credit eligibility criteria

To be eligible for the child tax credit, a child must:

- Be under the age of 17 throughout the entire tax year

- Be a relative of the taxpayer

- Have lived with the taxpayer for over 50% of the tax year

- Exceptions exist for children born or deceased during the year, temporary absences, or kidnapped or missing children

- Not have filed a joint tax return during the tax year

- May file a joint return if only to claim a refund of withheld taxes or estimated tax payments

- Be U.S. citizen, U.S. National or a U.S. resident alien.

- Must have a Social Security Number issued by the Social Security Administration before the due date of your tax return (including extensions).

If a child is eligible for the child tax credit, then he or she is also eligible for the additional child tax credit.

Child tax credit/Additional child tax credit limitations

Certain limitations apply to taxpayers based upon income and each taxpayer’s unique situation.

Income phaseouts may apply

Taxpayers with adjusted gross income of less than $200,000 (or $400,000 for married couples filing jointly) may experience a phase-out of the child tax credit or additional child tax credit. You may need to complete Schedule 8812 to determine whether or not you are able to claim a partial tax credit based upon income.

You cannot claim the additional child tax credit if you exclude certain foreign income on your tax return

According to the IRS, ACTC is not allowed if you or your spouse (if filing a joint return) file either IRS Form 2555, Foreign Earned Income or Form 2555-EZ (excluding foreign earned income).

The additional child tax credit is refundable. What does that mean?

The child tax credit, up to $2,000 per child, is considered a nonrefundable tax credit. This means that the child tax credit can reduce a taxpayer’s tax liability to zero (no income tax), but cannot generate an additional refund.

The additional child tax credit is the refundable portion of the child tax credit. This means that the additional child tax credit can produce an additional tax refund, even if there is no tax liability for the year.

Currently, the additional child tax credit is $1,600 (of the $2,000 child tax credit) for each child. In other words, the child tax credit looks like:

- $400: Nonrefundable tax credit

- $1,600: Refundable tax credit (Additional child tax credit)

Other tax credits I might be eligible for

Whether or not you are able to claim a child tax credit or additional child tax credit, you may consider looking at these other tax credits.

Credit for other dependents

The credit for other dependents may be available to taxpayers when:

- Their child no longer qualifies for the child tax credit

- Their dependent is not a qualifying child (i.e. other family member)

The credit for other dependents is a $500 nonrefundable tax credit. Like the child tax credit, there is an income phaseout that begins at $200,000 ($400,000 for married taxpayers filing jointly).

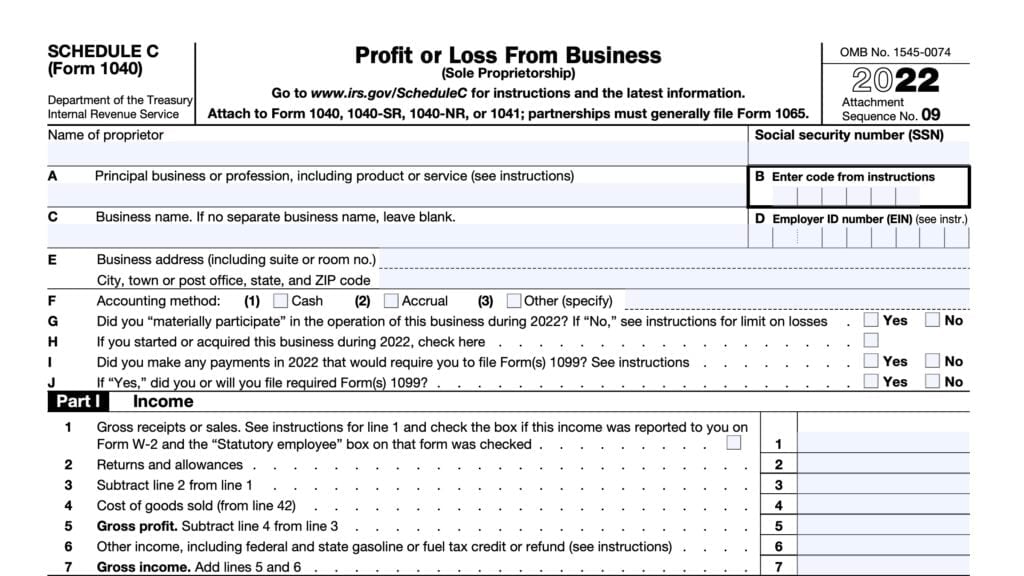

Earned income credit

The earned income credit, sometimes referred to as the earned income tax credit, EIC, or EITC, is a tax credit specifically for lower to mid-income taxpayers.

EITC is a refundable tax credit, so you may be able to claim this credit without having a tax bill. Some taxpayers may be eligible for the EITC without a qualifying child. Below are some more details about eligibility requirements and credit amounts.

EITC eligibility requirements

To claim the EITC, a taxpayer must:

- Have worked and earned income under $63,398 (married filing jointly)

- Have investment income below $11,000 in the tax year

- Have a valid Social Security number by the due date of your tax return (including extensions)

- Be a U.S. citizen or a resident alien all year

- Not file IRS Form 2555, Foreign Earned Income

- Meet certain rules if you are separated from your spouse and not filing a joint tax return

Additional rules and exceptions may apply to the following:

- Military members

- Clergy members

- Taxpayers and their relatives with disabilities

EITC credit amounts

EITC credit amounts may differ based upon each taxpayer’s income and family size. The maximum credit for 2023 is as follows:

| Number of children or dependents | Single, Head of household, or Qualifying widow(er) | Married filing jointly |

| Zero | $17,640 | $24,210 |

| One | $46,560 | $53,120 |

| Two | $52,918 | $59,478 |

| Three or more | $56,838 | $63,398 |

Regardless of family size, investment income cannot be more than $11,000 per year to qualify for the EITC.

EITC income limits

Below are the maximum earned income credits available, based upon family size:

- No qualifying children: $600

- 1 qualifying child: $3,995

- 2 qualifying children: $6,604

- 3 or more qualifying children: $7,430

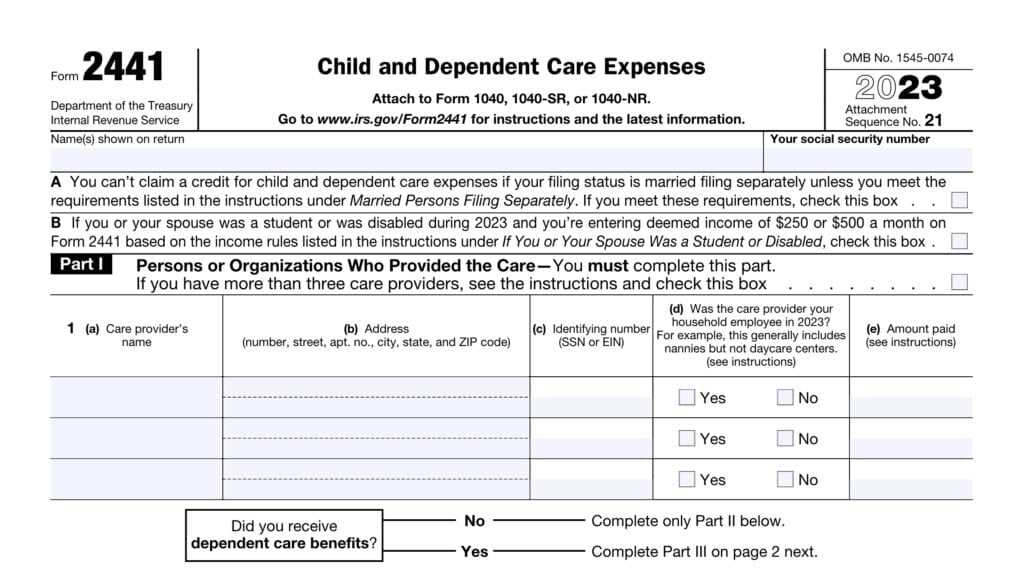

Child and dependent care credit

If you pay for someone to watch your children or a dependent while you are working or actively seeking employment, you might be eligible for the child and dependent care credit.

You can learn more about claiming the child and dependent care credit in the IRS Form 2441 instructions.

Education credits

If one or more of your children is attending college, you may be able to claim a tax credit for qualified higher education expenses by filing IRS Form 8863. There are two types of tax credits available:

- American opportunity tax credit: Up to $2,500 per year for 4 years

- 100% tax credit for the first $2,000 spent on qualified higher education expenses, then 25% of the next $2,000

- Up to $1,000 is a refundable credit

- Limited to the first 4 years of higher education

- Lifetime learning credit: Up to $2,000 per year

- 20% of qualified higher education expenses, up to $10,000 per year

- Available for an unlimited number of years

Video walkthrough

Frequently asked questions

Generally, taxpayers use IRS Form 15110 to provide information about children who may qualify for the additional child tax credit. The taxpayer may have received an IRS notice because they did not claim the additional child credit on their original tax return.

If you received this form in response to a CP08 notice, you should use the document upload tool on the IRS website. You may also use the envelope provided in your notice. If you do not have the original envelope, then you should send the completed form to the IRS address in the CP08 notice.

The child tax credit offers a total credit amount of up to $2,000 for eligible families. The additional child tax credit is the refundable portion of the child tax credit, currently $1,600. The refundable child tax credit may create a federal tax refund, even if there is no tax liability.

According to the form instructions, you can only provide additional information for eligible children listed on your tax return. If you want to add a child as a dependent, you must file an amended tax return using IRS Form 1040-X.

Where can I find IRS Form 15110?

You may find the latest version of IRS forms such as IRS Form 15110 on the IRS website. For your convenience, we’ve enclosed the latest version of this tax form in our article.

Si desea completar la versión en español del formulario 15110 del IRS, descargue este archivo.