IRS Form 3949-A Instructions

If you’ve witnessed tax evasion, tax fraud, or other tax code violations, you might be tempted to report your concerns to the United States Internal Revenue Service. But the big question is how to make such a report. This article will walk through IRS Form 3949-A to help you understand:

- When to use Form 3949-A to report alleged tax violations

- When not to use IRS Form 3949-A to report violations of tax laws

- How to fill out IRS Form 3949-A so the IRS can properly investigate the possible criminal activity

Let’s start by walking through IRS Form 3949-A, step by step.

Table of contents

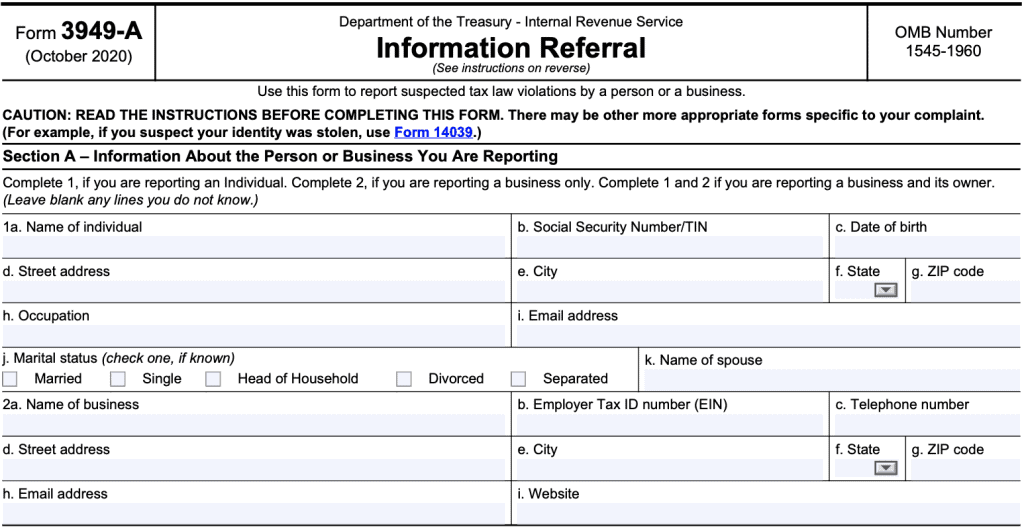

How do I fill out IRS Form 3949-A?

This one-page tax form contains 3 sections, which we’ll review one at a time.

Section A: Information About the Person or Business You Are Reporting

If you’re reporting an individual only, then complete Part 1. For reporting a business only, complete Part 2. If you’re reporting a business and the business owner, then complete both Parts 1 and 2.

Part 1: Individual

In Part 1, you’ll complete the following information:

- Name of individual

- Social Security number, if available

- Date of birth, if known

- Street address. This includes city, state, and zip code

- Occupation

- Email address, if known

- Marital status

- Name of spouse, if applicable

Part 2: Business

In Part 2, you’ll complete the following to the extent possible:

- Business name

- Employer identification number

- Telephone number

- Street address, including city, state, and zip code

- Email address, if available

- Website URL, if applicable

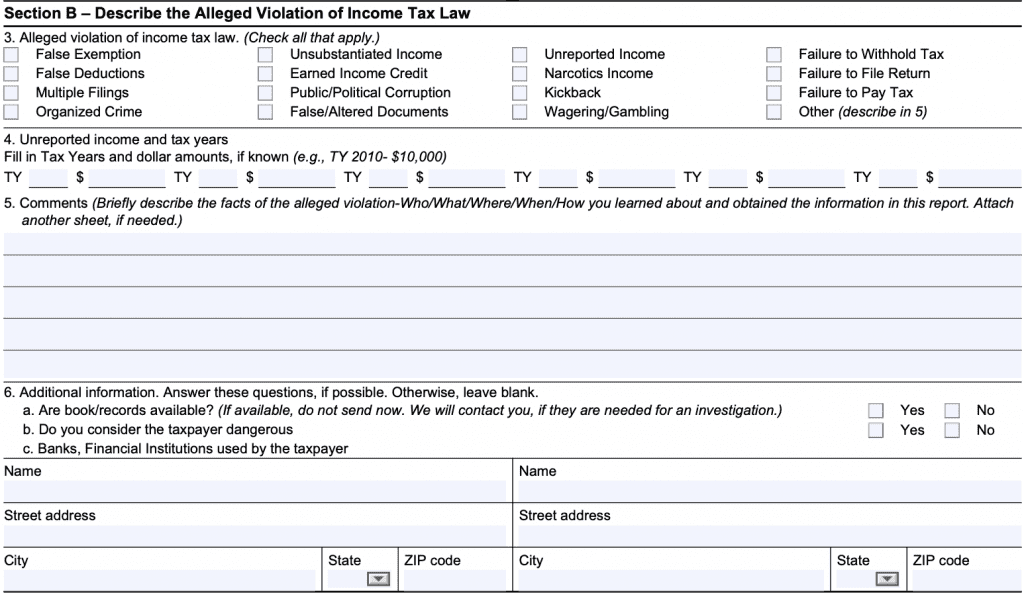

Section B: Describe the Alleged Violation of Income Tax Law

In Section B, you will find details about the suspected tax violation.

Part 3: Alleged violation of income tax law

In Part 3, you’ll check all applicable boxes. Below is a list of each violation, along with a description:

False Exemption

Claimed persons as dependents they are not entitled to claim.

False Deductions

Claimed false or exaggerated deductions to reduce their taxable income.

Multiple Filings

Filed more than one tax return to receive fraudulent refunds.

Organized Crime

Member of a group of persons who engaged in illegal enterprises such as drugs, gambling, loansharking, extortion, or laundering illegal money through a legitimate business.

Unsubstantiated Income

Reported false income from an unverifiable source in order to get a false refund.

Earned Income Credit

Claimed Earned Income Credit (EIC) which they were not entitled to receive. They may have reported income they did not earn or claimed children they were not entitled to claim.

Public/Political Corruption

Public official or politician violated laws against using their position illegally for personal gain.

False/Altered Documents

Changed documents, such as a W-2 or Form 1099, or created fake documents to substantiate a false refund.

Unreported Income

Received cash or other untraceable payments, such as goods or services, and did not report the income.

Narcotics Income

Received income from illegal drugs or narcotics.

Kickback

Received illegal payments or kickbacks in exchange for referring the business of a government agency or other business towards a company or for influencing business decisions that result in part of the payment for the business received or service performed being returned to the person who made the referral.

Wagering/Gambling

Did not report income received from wagering or gambling.

Failure to Withhold Tax

Individual or business did not withhold legally owed taxes from income paid to their employee(s), such as Social Security or Medicare taxes. Example: A business treated employees as independent contractors and issued Forms 1099, with no tax withheld, instead of a W-2.

Failure to File Return

Individual or business has not filed returns legally due.

Failure to Pay Tax

Individual or business has not paid taxes legally due.

Part 4: Unreported income and tax years

In this section, list, by tax year and dollar amount, the approximate amount of unpaid taxes.

Part 5: Comments

In plain language, briefly describe the facts of the situation. Use the 5 Ws methodology to describe how you learned about this information:

- Who

- What

- When

- Where

- How

Use additional sheets if there is too much information to include on one form. Be sure to add as much information as possible. One of the reasons complaints end up unresolved is because a complaint often lacks specificity.

Part 6: Additional information

Include any additional information:

- Whether or not books and records are available to substantiate the allegations

- Whether or not your consider the taxpayer to be dangerous

- Banks and financial institutions used by the taxpayer

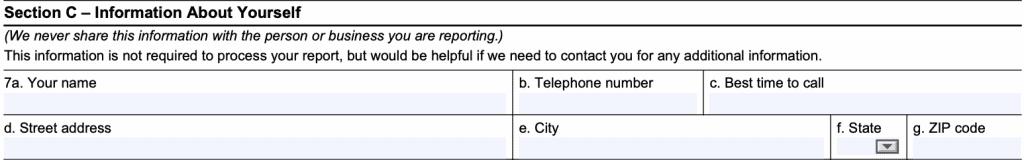

Section C: Information About Yourself

This section is considered optional. The IRS recognizes the importance of keeping a whistleblower’s identity (or that of a potential whistleblower) confidential, and does not require the reporting person’s name or personal information to pursue enforcement efforts.

However, the federal government can only go as far as the available information can take them. If they need to clarify something, then having the complainant’s contact information is the best way for the investigators or revenue agents to follow up.

When do I use Form 3949-A to report a tax cheat?

According to the Internal Revenue Manual, the tax law violations reported on this form may include the following:

- False exemption or deductions

- Multiple filings

- Organized crime

- Unsubstantiated income

- Earned income credit

- Public or political corruption

- False or altered documents

- Unreported income

- Narcotics income

- Kickbacks

- Wagering or gambling

- Failure to withhold tax

- Failure to pay tax

- Failure to file return

- Other suspected violations not reported on another form

When do I NOT use Form 3949-A to report suspected violations?

According to the form instructions, you should not use IRS Form 3949-A to report in the following situations:

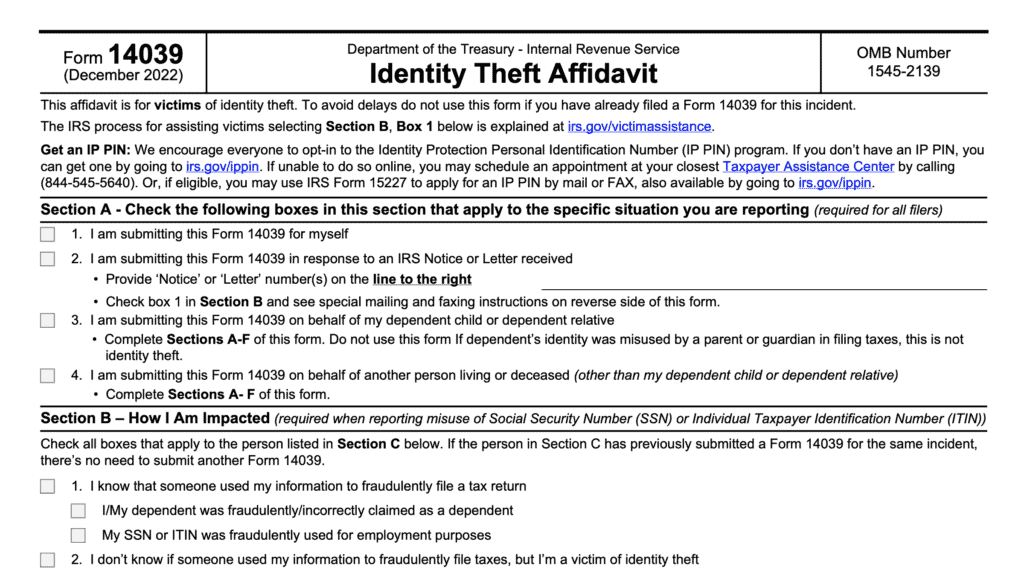

Stolen identity

If you believe that your identity was stolen and used for fraudulent activity like claiming a false tax refund, you should not use Form 3949-A. Victims of identity theft should use IRS Form 14039, Identity Theft Affidavit to report identity theft cases.

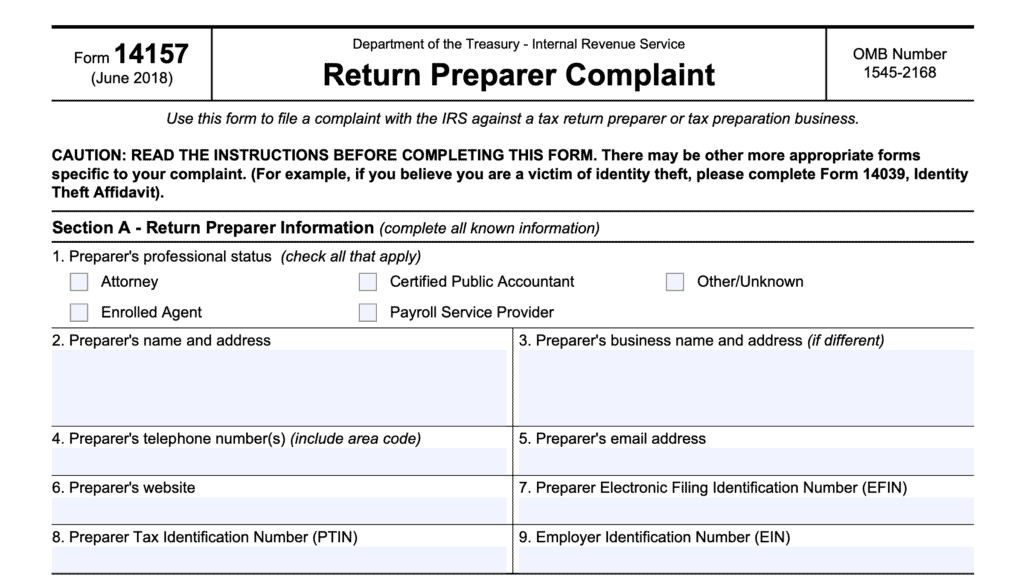

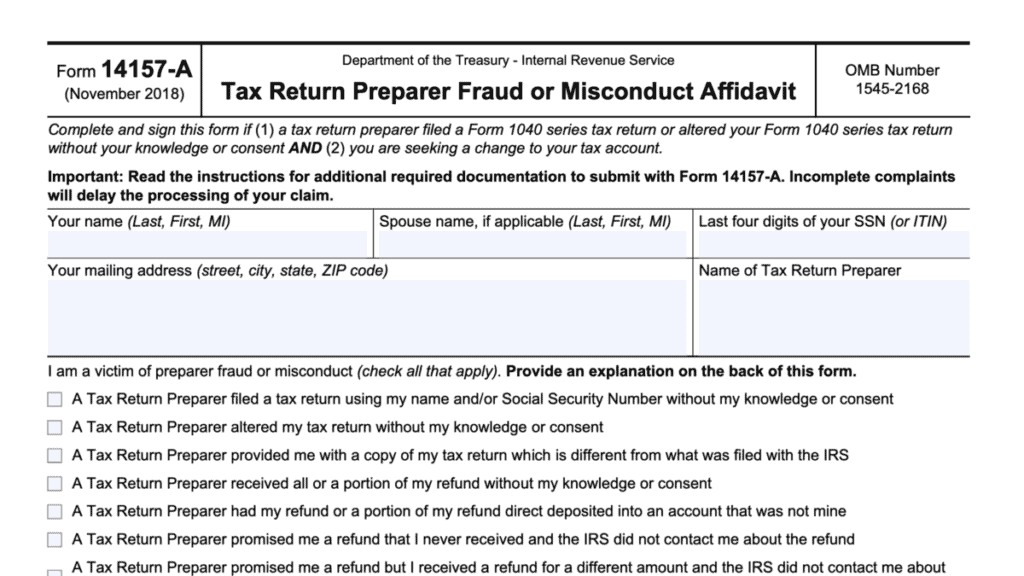

Suspected misconduct by your tax return preparer

If you believe that your tax preparer engaged in some sort of personal misconduct, you should file IRS Form 14157, Return Preparer Complaint.

If your paid preparer filed a return or made changes to your federal income tax return without your authorization, file both Form 14157 and IRS Form 14157-A, Tax Return Preparer Fraud or Misconduct Affidavit. Submit both forms to the address instructed on Form 14157-A.

Someone claimed your exemption or dependent for tax purposes

If you received a written notice from the IRS about a person claiming your exemption or dependent as a false exemption, then you should follow the instructions on the notice. Do not file IRS Form 3949-A.

Abusive tax avoidance scheme

To report an abusive tax avoidance scheme, promotion, or the promoter of such a scheme, you’ll want to use IRS Form 14242, Report Suspected Abusive Tax Promotions or Preparers. Contact the IRS for more details on how to obtain a copy of this form.

Misconduct or wrongdoing by a tax exempt organization

To report misconduct or wrongdoing by a tax-exempt organization, or officers, directors, or authorized persons from a tax-exempt organization, use IRS Form 13909, Tax-Exempt Organization Complaint (Referral) to report that organization to the IRS.

Reporting information and expecting an award

If you have enough information and believe the tax issue qualifies for a reward under the IRS Whistleblower Program, then do not use this form. Instead, use IRS Form 211, Application For Award For Original Information to report this situation to the IRS Whistleblower Office.

Video walkthrough

Frequently asked questions

IRS Form 3949-A, Information Referral, is the tax form that anyone can use to report alleged tax law violations by an individual, a business, or both. A properly completed Form 3949-A, with sufficient information, allows the IRS to quickly direct the report to the correct IRS office responsible for the investigation.

You should not file IRS Form 3949-A if you have been given specific instructions by the IRS or if there is a more appropriate form for the tax situation you are reporting. This might include cases of identity theft, tax preparer misconduct or abuse, or frivolous tax shelters or schemes.

The IRS will route your form to the appropriate office based upon keywords or selections in Section B-3 (alleged violation of income tax law), or in B-5 (comments). Once the form is in the appropriate office, that office may conduct an audit or investigation, depending on the circumstances in that case.

Where can I find a copy of IRS Form 3949-A?

You may find a copy of this online form on the IRS website or by downloading the form below. Please be sure to download the 2020 version of the form, not the 2007 version. Below is the correct copy of this form.