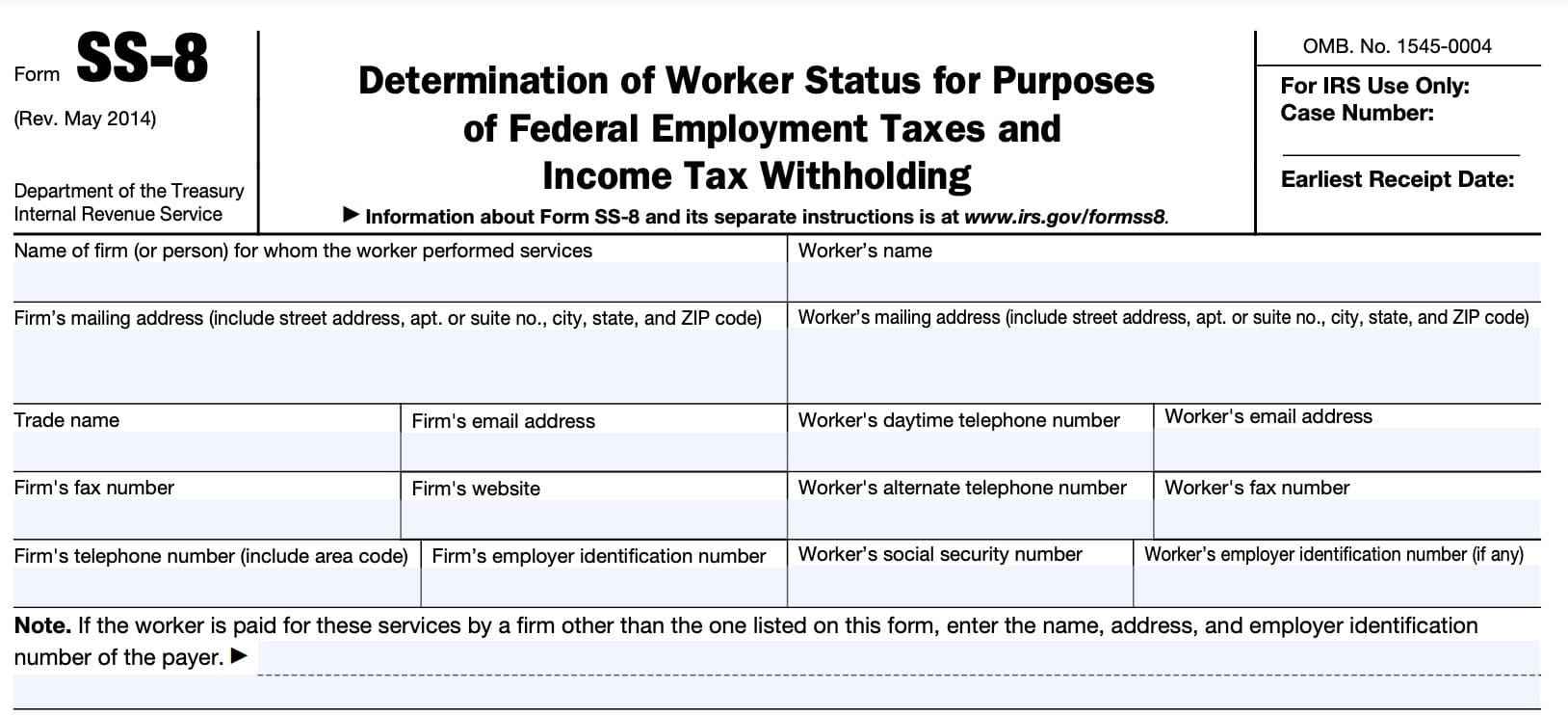

IRS Form SS-8 Instructions

The difference between being an employee and being an independent contractor has never been more hazy than it is in today’s society. To help minimize the number of misclassified employees, the Internal Revenue Service created Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding.

In this tutorial, we’ll go over Form SS-8, including:

- Line by line detail on how to complete this form

- Reasons why a worker’s classification is important

- Frequently asked questions

Let’s start by walking through this form, step by step.

Table of contents

How do I complete Form SS-8?

There are 5 parts to this four-page form:

- Part I: General Information

- Part II: Behavioral Control

- Part III: Financial Control

- Part IV: Relationship of the Worker and Firm

- Part V: For Service Providers or Salespersons

Before we get into Part I, let’s spend a little time at the top of Page 1.

Top of the form

At the top of the form, you’ll enter relevant information about the specific worker, as well as the company or firm employing the worker.

Most of the information fields are relatively straightforward. For example, you’ll want to include important information such as:

- Name of the worker and the firm

- Mailing address for both parties

- Email address, phone number, and fax number for both parties

- Firm’s employer identification number (EIN)

- Worker’s Social Security number (SSN)

Be sure to include as much contact information as possible, to ensure that the Internal Revenue Service has multiple ways to contact you for more information.

Also, if the worker is compensated by a third-party, enter the name, address, and employer identification number of the payer.

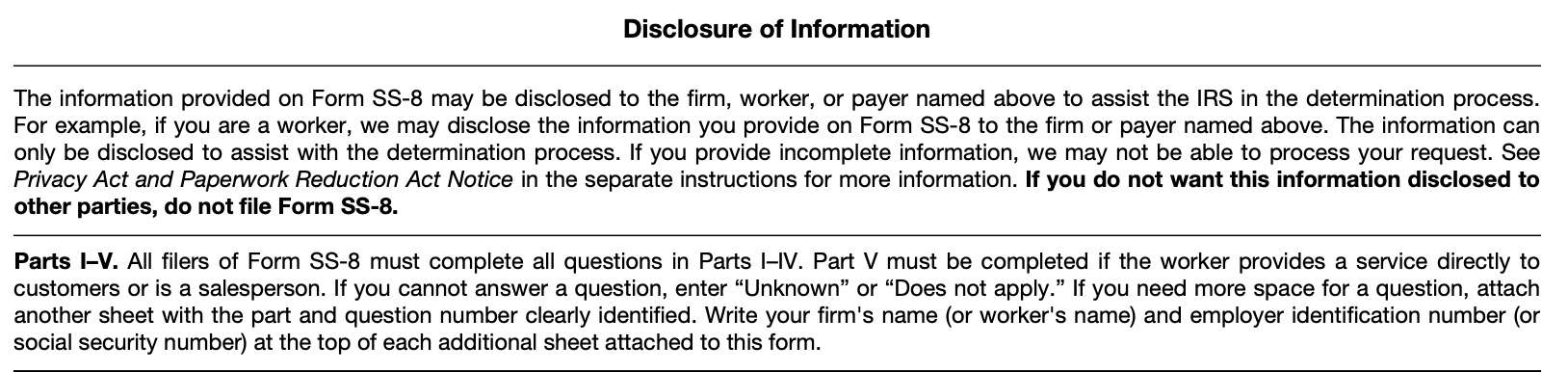

Information disclosure

The disclosure section contains some important information for each of the involved parties. Here are some things you should know:

Any information you provide to the IRS can be shared with the other party.

The IRS may need to gather information from both sides before issuing a determination letter about a worker’s status. For example, if a worker files Form SS-8, he or she should expect that any information will be disclosed to their employer.

The disclosure section even states, “If you do not want this information disclosed to other parties, do not file Form SS-8.”

Incomplete information will not be considered

All filers of the SS-8 Form must complete Parts I through IV in their entirety. Only complete Part V is the worker provides direct customer support or if the worker is a salesperson.

If you need additional space, attach as many sheets as you need. Be sure to identify each sheet with the part and question number clearly identified. Also, enter your firm’s name or the worker’s name, as well as the firm’s employer identification number (EIN) at the top of the form.

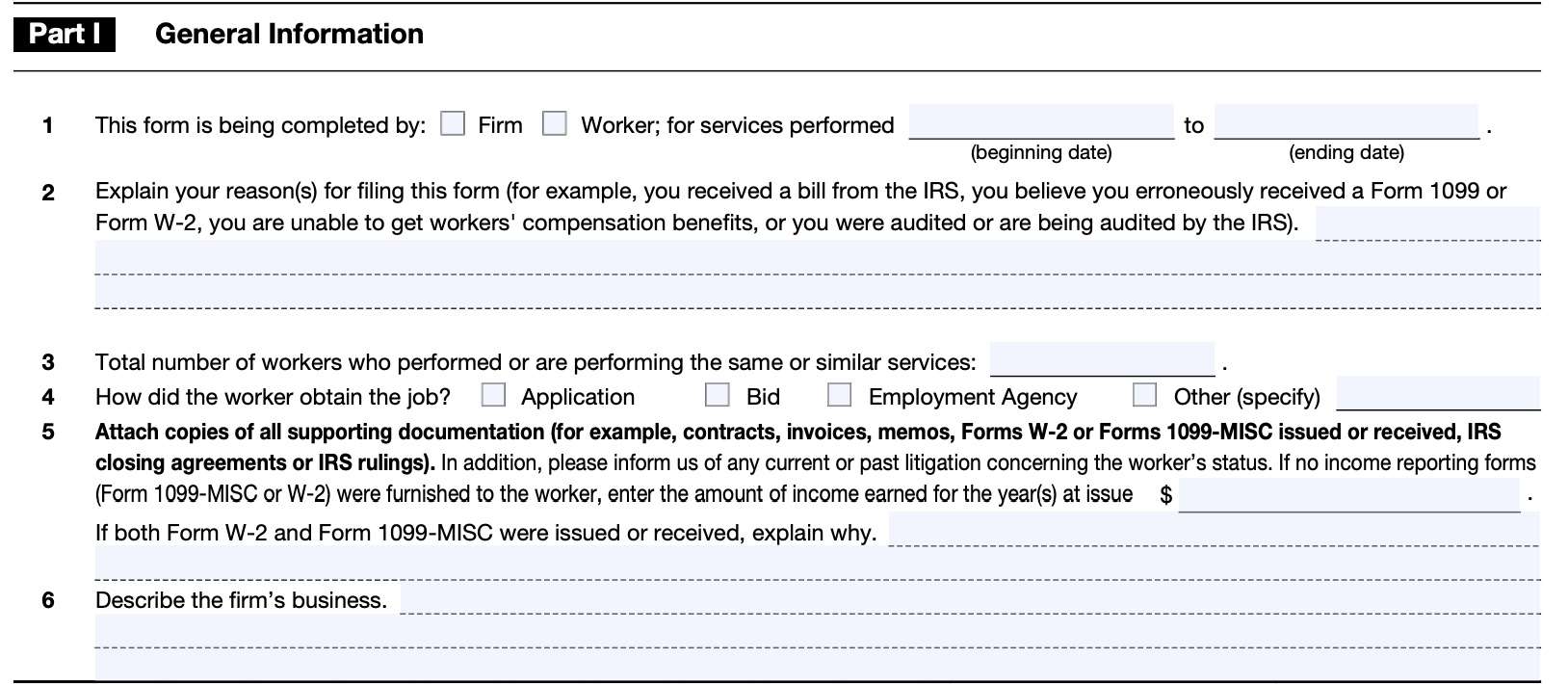

Part I: General Information

In Part I, you will enter general information about the nature of the worker’s relationship with their employer. Let’s start with Line 1.

Line 1

Check the appropriate box, depending on whether you are the worker trying to obtain classification as an employee, or if you are the firm, seeking IRS determination of the status of a worker.

Also enter the dates that the worker performed services for the company or firm.

Line 2

Enter the reason you are completing this form.

If you are a worker, reasons might include:

- You received a Form 1099 when you believe that you should have received a Form W-2

- You are not able to receive workers’ compensation benefits

If you are the employer, you may believe that you should not be responsible for payroll taxes on behalf of an independent contractor.

Line 3

Enter the total number of workers who either performed, or are currently performing the same services as the worker mentioned on this Form SS-8.

Line 4

Check the appropriate box regarding how the worker obtained his or her current assignment:

- Application

- Bid

- Employment agency

- Other source (specify in the space provided)

Line 5: Supporting documentation

List all supporting documentation that you want the IRS to consider as part of the Form SS-8 determination process.

Examples of additional documentation may include:

- Previously issued versions of Form 1099-MISC or Form W-2

- An employment contract or a written agreement describing work relationships

- IRS rulings or determinations applicable to this situation

Line 6

In this line, describe the firm’s business.

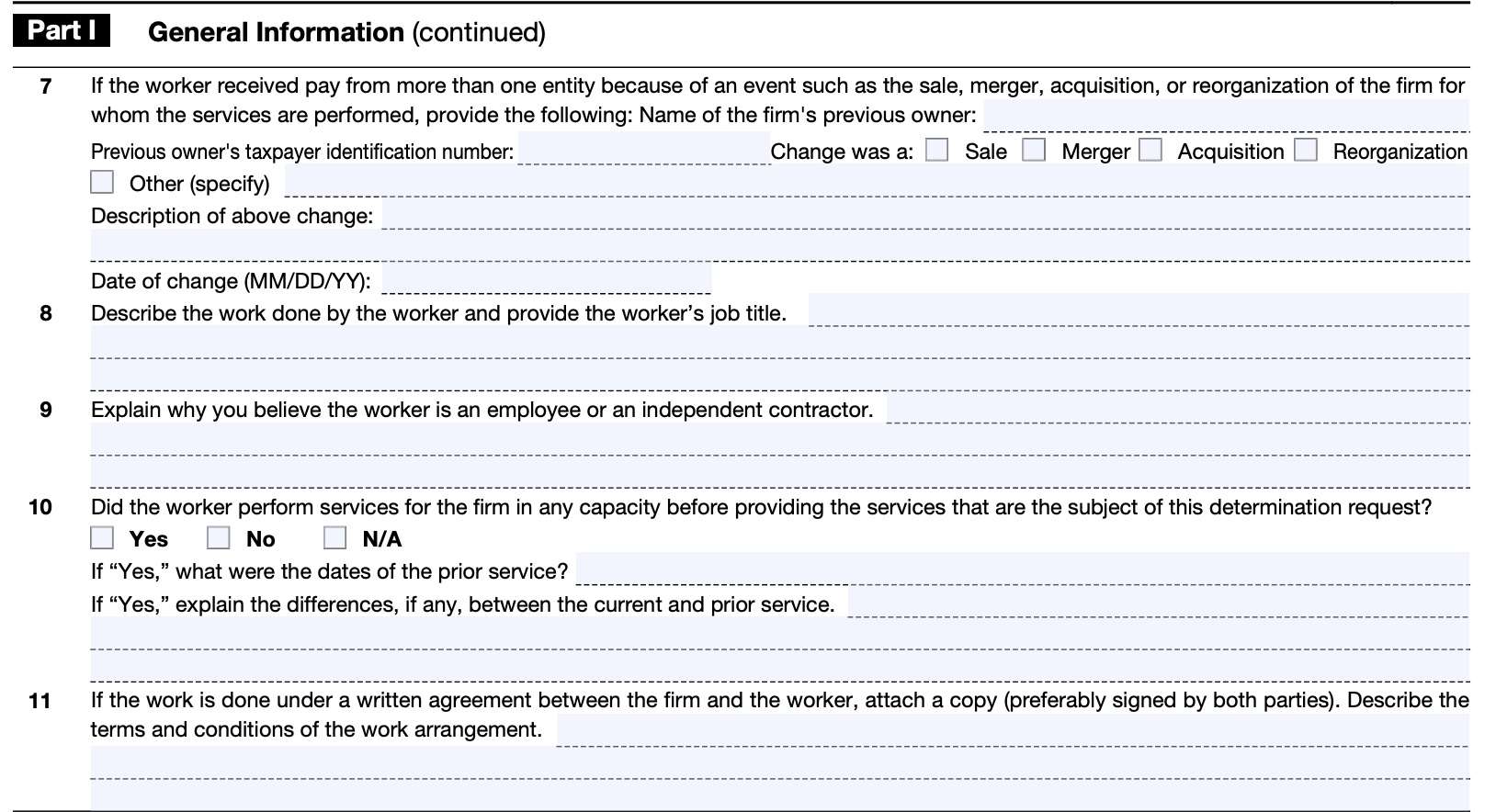

Line 7

Complete Line 7 only if the worker received pay from multiple entities because of one of the following significant events involving the firm:

- Sale

- Merger

- Acquisition

- Reorganization

If any of those apply, then enter the name and taxpayer identification number of the previous owner.

Also indicate the type of change by checking the appropriate box and providing a written description. Finally, enter the date of change.

Line 8

Provide the worker’s job title, and provide a written description of the type of work that the worker performs.

Line 9

Provide a written explanation of why you believe the worker should be classified as an employee or as an independent contractor.

Line 10

Indicate whether or not the worker performed services for the firm in any capacity before providing the services that are the subject of the determination request.

If so, indicate the dates of prior service and note any significant differences between the current service and prior service.

Line 11

If the work was being performed under a written agreement, attach a copy of the agreement and describe the terms and conditions of the work arrangement.

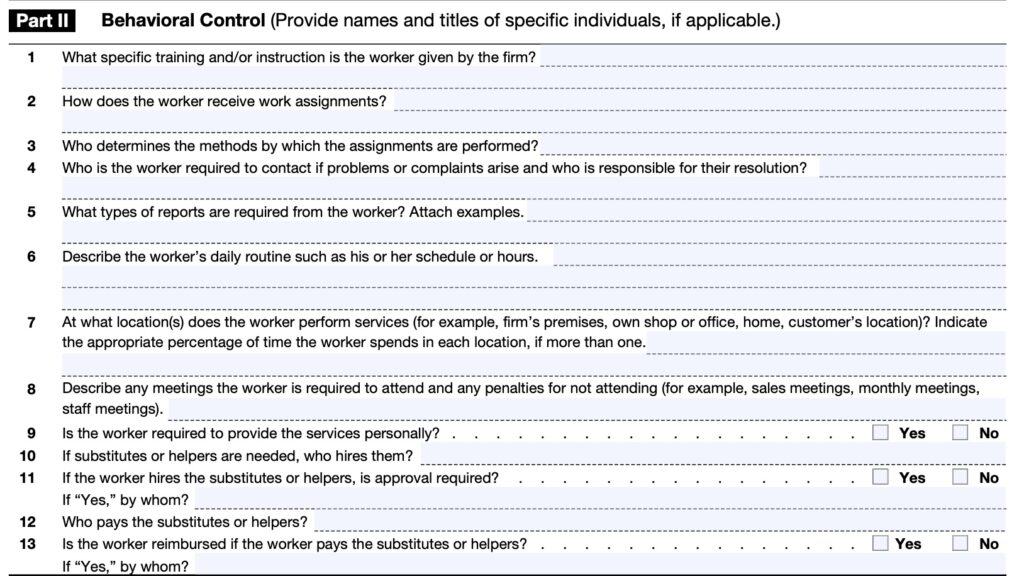

Part II: Behavioral Control

In Part II, you will enter information regarding the worker’s job assignments within the company or firm. The IRS will use this information to determine whether the business owner is:

- Exercising supervisory control over the worker’s behavior, like that of an employee, or

- Whether the worker has flexibility to control how and when the work gets done, as expected in independent contractor relationships

Let’s begin with Line 1.

Line 1

Did the firm provide any specific training or instruction to the worker as part of their relationship? If so, please describe.

Line 2

How does the worker receive work assignments? Provide names and titles of specific individuals, such as work supervisors, who may assign work to the worker.

Line 3

Who determines the methods by which the assignments are performed?

In other words, does the worker have any flexibility in determining how they perform their duties, or does the firm control how the worker completes their assigned tasks?

Line 4

Enter the name and title of the person that the worker should contact if he or she encounters problems or complaints. Does the worker have authority to resolve certain problems or complaints, or do they merely escalate matters to a supervisor who makes that determination?

Line 5

Is the worker responsible for submitting reports? If so, attach samples of such reports.

Line 6

What is the worker’s daily routine? Does the worker get to decide his or her schedule, or does the firm assign specific times or hours that the worker must be available?

Line 7

Where does the worker perform their services?

Does the worker work on site at the company’s location, in their own office or home, or at a customer’s location?

If there is more than one location, how much time does the worker spend at each place?

Line 8

Is the worker required to attend meetings? If so, describe the meetings, and any penalties that might apply for non-attendance.

Examples of meetings might include:

- Sales meetings

- Monthly meetings

- Staff meetings

- Performance reviews

Line 9

Does the firm require the worker to personally provide services? Answer ‘Yes’ or ‘No.’

Line 10

If substitutes or helpers are required to perform work, who is responsible for bringing them on? Does the worker control who may perform additional work, or is the firm responsible for the entire relationship, including bringing additional help at their discretion?

Line 11

If the worker can bring on additional help, does the worker need to seek approval beforehand? Answer ‘Yes’ or ‘No.’

Line 12

If required, who pays the helpers or additional workers? Does that responsibility lie with the worker or the firm?

Line 13

If the worker pays additional helpers, does the firm reimburse the worker for those costs? Answer ‘Yes’ or ‘No.’

If the answer is ‘Yes,’ who reimburses the worker?

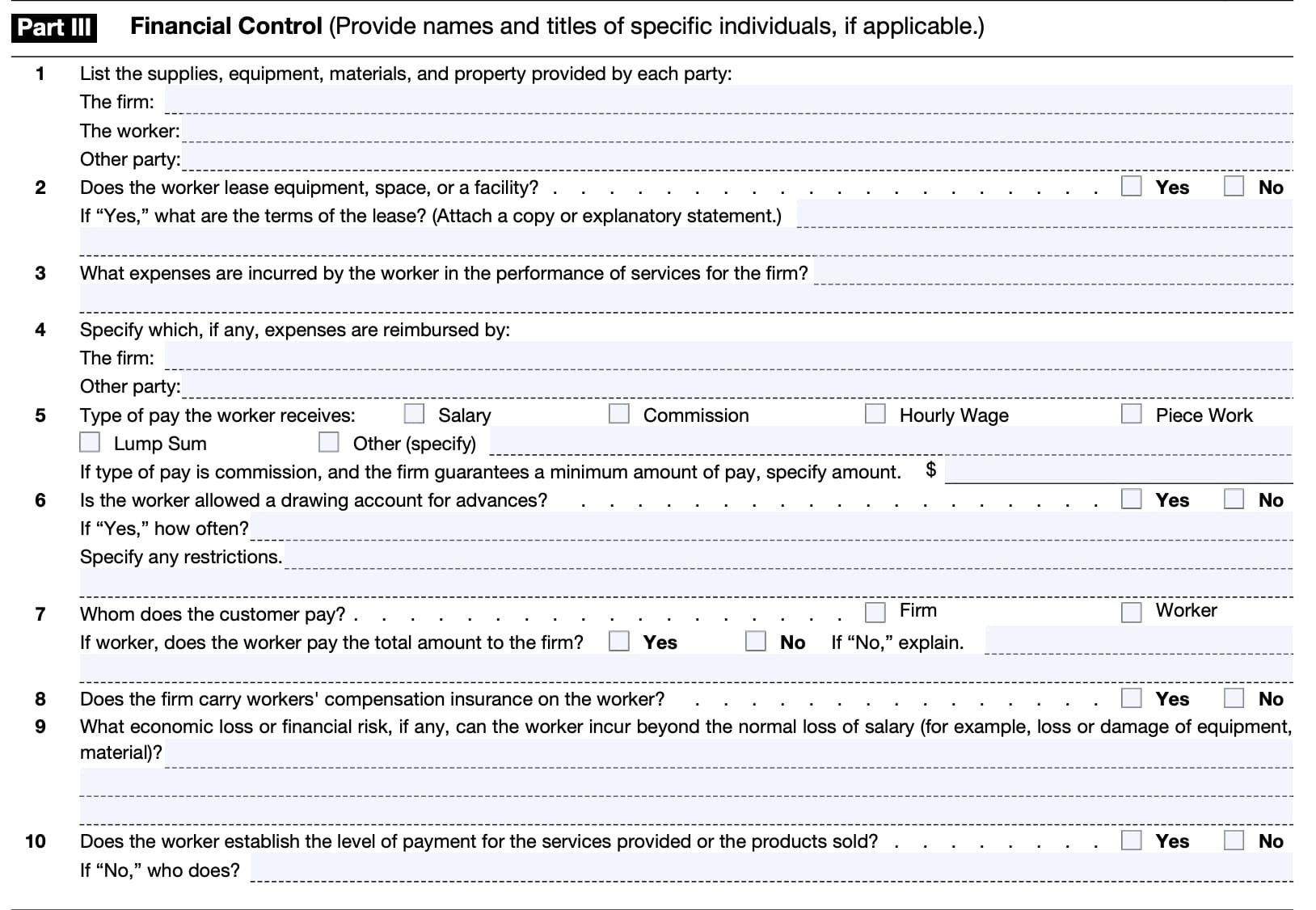

Part III: Financial Control

Part III helps the IRS better understand the financial compensation provided, and other additional information, such as:

- Who pays out of pocket for resources needed to perform the worker’s job duties

- How the worker is paid

- Whether or not the worker has control over compensation matters

Let’s start at the top.

Line 1

List the supplies, equipment, materials, and provided by each property:

- The firm

- Worker

- Another party

Line 2

To perform their duties, does the worker lease equipment, space, or a facility?

If the answer is ‘Yes,’ indicate the terms of the lease. You can attach an original copy of the lease or a statement that outlines the circumstances of the lease.

Line 3

Does the worker incur any expenses in the performance of their services for the firm? If so, list those expenses.

Line 4

If the worker does incur expenses, specify those expenses (if applicable), that either the firm or a third party reimburses to the worker.

Line 5

How is the worker paid? Check the appropriate box:

- Salary

- Commission

- Hourly wages

- Piece work (worker is paid for each item produced)

- Lump sum

- Other means (specify in the space provided)

If the worker is paid on commission, does the firm guarantee a minimum amount of pay? If so, indicate the minimum payment amount.

Line 6

Is the worker allowed to have a drawing account for advances? Indicate ‘Yes’ or ‘No.’

If ‘Yes,’ how often can the worker use this account? List any restrictions that may apply.

Line 7

Who receives payment from the customer? Is it the firm or the worker?

If the worker receives customer payments, does the worker pay the total amount to the firm? If not, explain how the payments work.

Line 8

Does the firm carry workers’ compensation insurance on the worker? Indicate ‘Yes’ or ‘No.’

Line 9

Is the worker responsible for economic loss or financial risk, other than loss of income? For example, is the worker responsible for lost or damaged equipment or material?

Line 10

Does the worker establish the payment level for services provided or products sold? If not, who sets the prices?

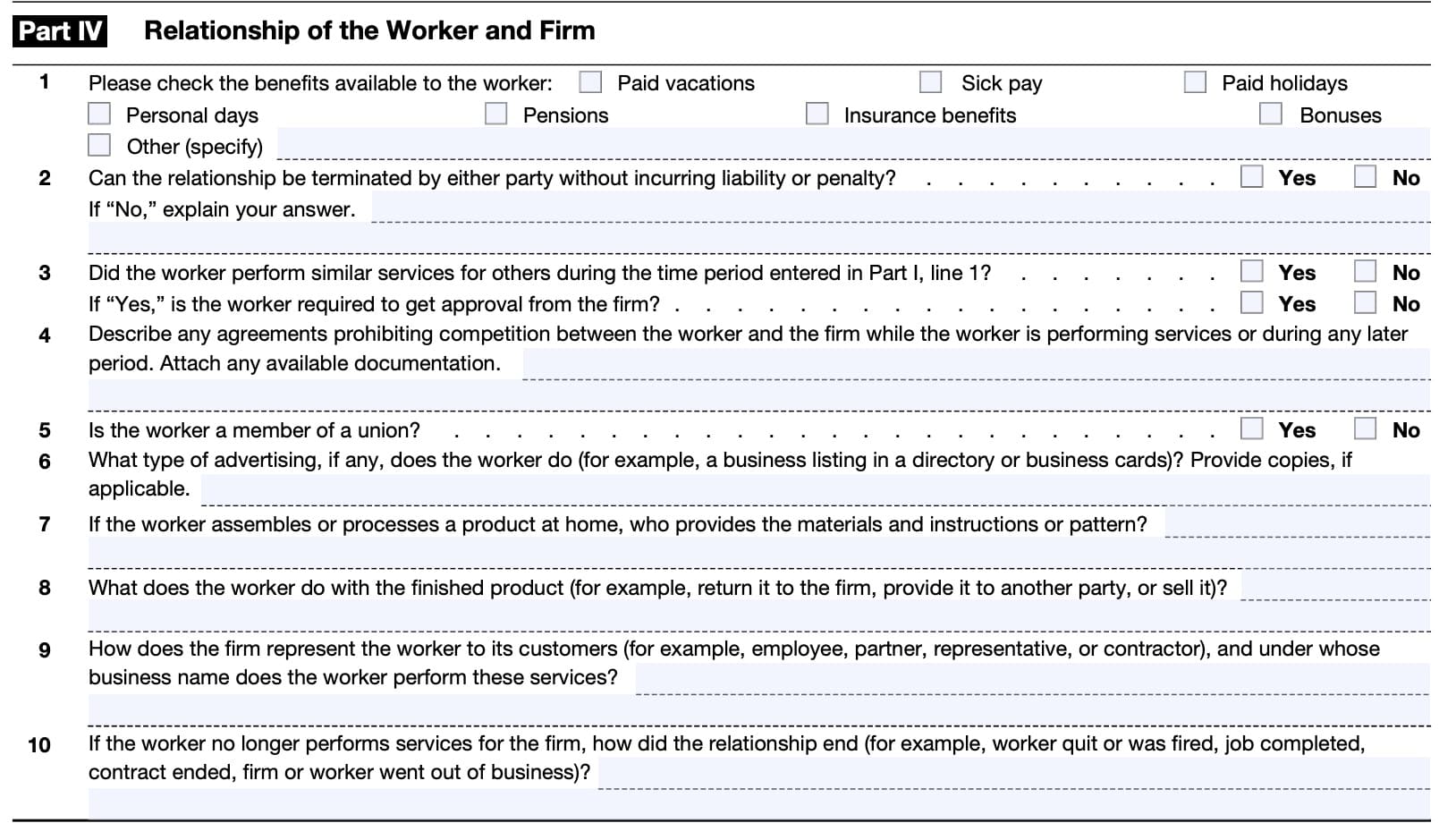

Part IV: Relationship of the Worker and Firm

Part IV questions help the IRS better understand the worker’s work relationship with the firm and other workers. This could include understanding things like:

- Whether the worker has flexibility over time off or job availability

- Whether or not the worker provides similar services for other companies

- Union membership

Let’s go over Part IV, starting with Line 1.

Line 1

Check all of the following benefits that are available to the worker, if applicable:

- Paid vacations

- Sick pay

- Paid holidays

- Personal days

- Pensions

- Insurance benefits

- Bonuses

- Other benefits

- Specify other benefits in the space provided

Line 2

Can either party terminate the work relationship without incurring a penalty? Check ‘Yes’ or ‘No.’

If the answer is ‘No, provide a written explanation.

Line 3

Did the worker perform similar services for other companies during the time period in Part I, Line 1? If so, did the worker have to obtain permission before performing these services?

Line 4

Describe any agreements that might prohibit competition between the worker and the firm while the worker is performing services, or during any period after employment. These might be known as non-compete agreements or non-solicitation agreements.

If applicable, attach any supporting documentation.

Line 5

Is the worker a member of a union? Answer ‘Yes’ or ‘No.’

Line 6

Does the worker advertise? What type of advertising does the worker perform? Examples might include:

- Having a business listing in a directory

- Owning or handing out business cards

- Operating an independent website advertising products or services

If possible, provide copies of any advertising samples.

Line 7

Does the worker assemble or process any products out of their house? If so, who provides the materials or instructions on this process?

Line 8

If the worker completes a finished product, where does it go? Does the worker:

- Return the item to the firm

- Provide the item to a third party

- Sell the item

Line 9

How does the firm represent the worker’s status? Is the worker considered a partner, employee, representative, or a contractor?

Under whose business name does the worker provide services?

Line 10

If the worker is no longer employed by the firm, how did the business relationship end? Was it due to:

- Completion of work contract without being renewed

- Worker quit working for firm

- Worker was fired from firm

- Firm went out of business

Provide details.

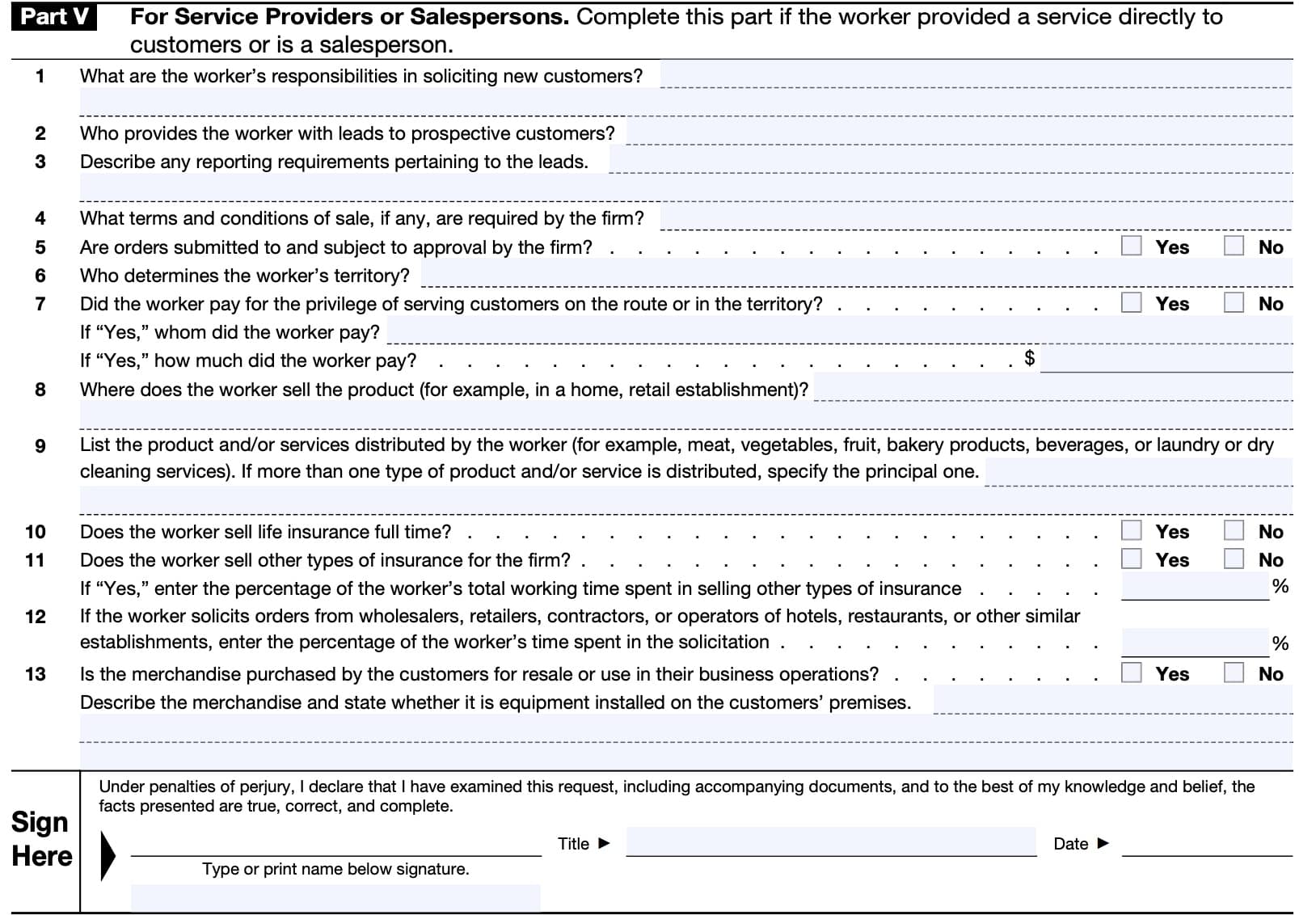

Part V: For Service Providers or Salespersons

Part V is completed only when the worker either:

- Is considered a service provider for customers, or manages customer relationships, or

- Is employed as a salesperson

If you do not have to complete Part V, simply sign and date the form at the bottom. If applicable, enter your job title.

Let’s start with Line 1.

Line 1

Describe the worker’s responsibilities, if any, in soliciting new customers or clients.

Line 2

Who provides the worker with prospective customer leads?

Line 3

Are there reporting requirements with regards to customer leads? If so, provide additional details.

Line 4

Are there any terms and conditions of sale, that the firm requires? If so, list them.

Line 5

Are customer orders subject to firm approval? Does the worker have to submit orders for review? Check ‘Yes’ or ‘No.’

Line 6

Who determines the worker’s sales territory?

Line 7

Did the worker have to pay for being able to serve customers on a specific route or within a specified sales territory? Indicate ‘Yes’ or ‘No.’

If yes, who received the money, and how much did the worker have to pay?

Line 8

Where does the worker sell the product? Do they sell it out of a retail establishment, or out of their home?

Does the worker sell the product online?

Line 9

List the products and services that the worker distributes. If there is more than one type of product or service, indicate the principal one.

Line 10

Does the worker sell life insurance full-time? Answer ‘Yes’ or ‘No.’

Line 11

Does the worker sell other types of insurance? Indicate ‘Yes’ or ‘No.’

If yes, what percentage of the worker’s time is spent selling other forms of insurance?

Line 12

If the worker solicits orders from hotel or restaurant operators, wholesalers, retailers, contractors, or operators of hotels, or restaurants, enter the percentage of the worker’s time spent in soliciting orders.

Line 13

Is the merchandise purchased by the customers for resale or use in their business operations? Indicate ‘Yes’ or ‘No.’

Describe the merchandise and state whether it is equipment installed on the customers’ premises.

Video walkthrough

Watch this video tutorial to learn more about how to use Form SS-8 to obtain a determination of a worker’s status.

Frequently asked questions

Firms and workers file Form SS-8 with the IRS to request an IRS determination of the status of a worker for purposes of federal employment taxes and income tax withholding. Part of the determination includes identifying who should pay the employer’s share of FICA tax.

A company is responsible for withholding income taxes from an employee and for paying half of the overall FICA tax. An independent contractor is responsible for their own tax withholding and for paying self-employment taxes for Medicare and Social Security purposes.

Where can I find Form SS-8?

As with other IRS forms, you may find IRS Form SS-8 on the IRS website. For your convenience, we’ve attached the latest version to this article.