Schedule SE Instructions

Everyone who has self-employment income must file Schedule SE with their income tax return to calculate their self-employment tax obligation. Traditionally, this used to only apply to a self-employed person.

With the rise of independent contractor status replacing full-time employees and side hustles as part of the gig economy, more people are self-employed individuals (to some extent) than ever before. Which makes Schedule SE even more pertinent.

In our comprehensive guide, we’ll cover everything you need to know about Schedule SE, including:

- How to complete Schedule SE

- Optional methods to calculate earnings for self-employment tax purposes

- Additional questions about self employment

Let’s start with an overview of Schedule SE.

Table of contents

How do I complete Schedule SE?

There are two parts to this one-page tax form:

Before we proceed to Part I, you’ll need to complete the taxpayer information field at the top of the schedule. Enter the following information:

- Name of the person reporting net self-employment income

- Social Security number of the person with self-employment income

Let’s start at the top of Part I.

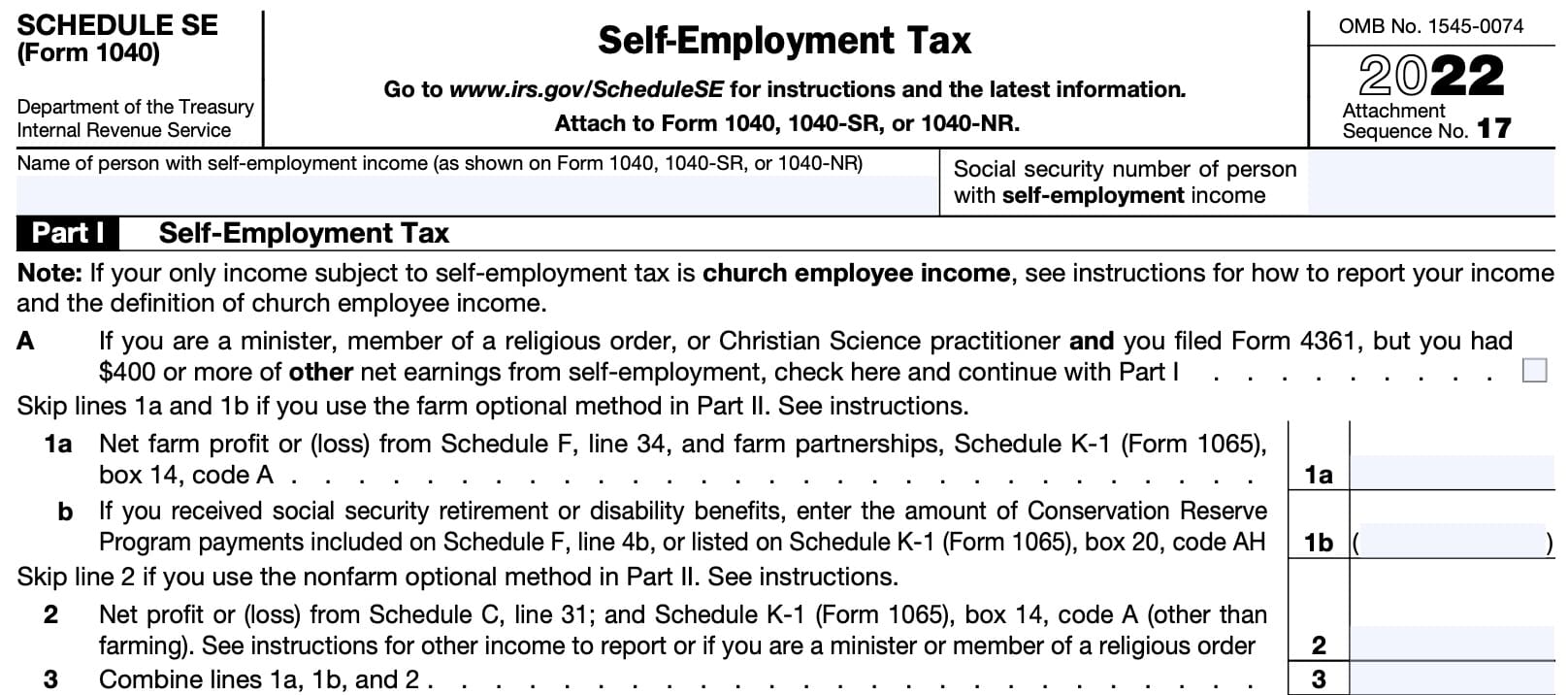

Part I: Self-Employment Tax

In Part I of this form, we’ll calculate the self-employment taxes you may owe when you file your individual income tax return.

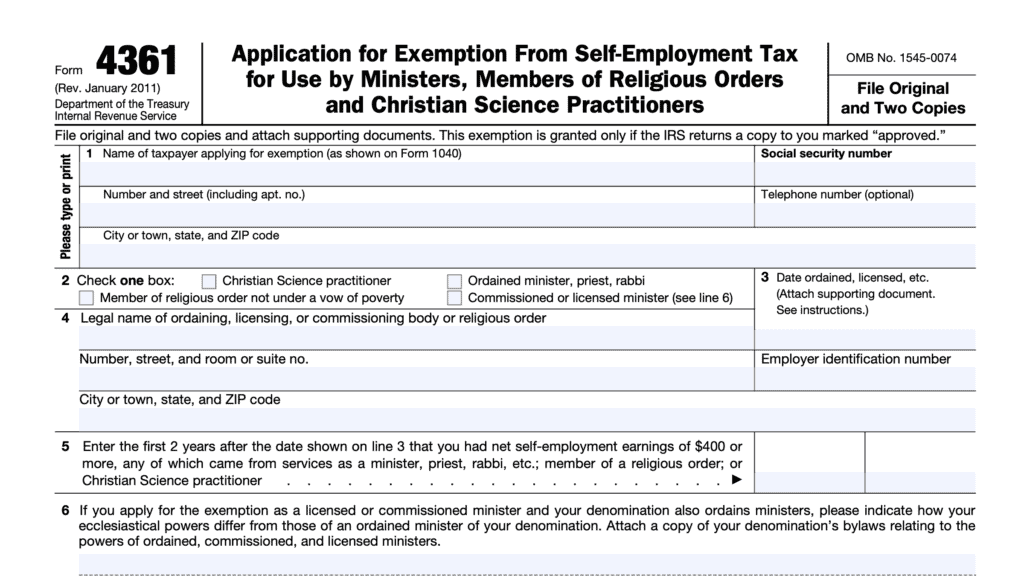

Line A

Check the box in Line A if all of the following apply:

- You are a minister, member of a religious order, or Christian Science practitioner

- You filed IRS Form 4361 to opt out of Social Security coverage & apply for an exemption from self-employment taxes, and

- You had $400 or more of other net earnings from self-employment

However, if you are a church employee, and your only self-employed income is church employee income, then you’ll do the following:

- Skip Lines 1 through 4b

- Enter ‘0’ on Line 4c

- Go directly to Line 5

Otherwise, proceed to Line 1, below.

Line 1

If you use the farm optional method in Part II, you can skip Lines 1a and 1b. Proceed directly to Line 2, below.

In Line 1a, enter any net farm profit or loss (losses in parentheses), from either:

- IRS Form 1040, Schedule F, Line 34 (Profit or Loss from Farming), or

- IRS Form 1065, Schedule K-1, Box 14, Code A (Farm partnerships)

In Line 1b, for any taxpayers receiving Social Security benefits, such as retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on either:

- Schedule F, Line 4b, or

- Schedule K-1, Box 20, Code AH

Line 2

If you use the nonfarm optional method in Part II, below, skip Line 2 and proceed to Line 3. Otherwise, enter any profit or loss from:

- Schedule C, Line 31, or

- Schedule K-1, Box 14, Code A (other than farming)

Line 2 instructions for Ministers, Members of Religious Orders, and Christian Science Practitioners

If you checked the box in Line A, then you will use IRS Schedule SE to calculate the amount of self-employment tax you need to pay.

In this case, you’ll report your total self-employment income in Line 2, including any SE income from services performed. Do not report these earnings under Line 5, as these earnings are not considered church employee income.

In addition, you’ll report the following items in Line 2:

- The rental value of a home or an allowance for a home furnished to you

- Including payments for utilities

- The value of meals and lodging provided to you, your spouse, and your dependents for your employer’s convenience

Do not include the following:

- Retirement benefits you received from a church plan after retirement, or

- The rental value of a home or an allowance for a home furnished to you after retirement

- Including payments for utilities

If you were a duly ordained minister who was an employee of a church and you must pay SE tax, the unreimbursed business expenses that you incurred as a church employee are not deductible as an itemized deduction for income tax purposes. Instead, subtract any allowable expenses from the total profit reported on Line 2 and attach an explanation.

If you were a U.S. citizen or resident alien serving outside the United States as a minister or member of a religious order and you must pay SE tax, you can’t reduce your net earnings by any of the following items that you might claim on IRS Form 2555:

- Foreign earned income exclusion

- Foreign housing exclusion

- Foreign housing deduction

Line 3

Combine Lines 1a, 1b, and 2. Enter the result in Line 3.

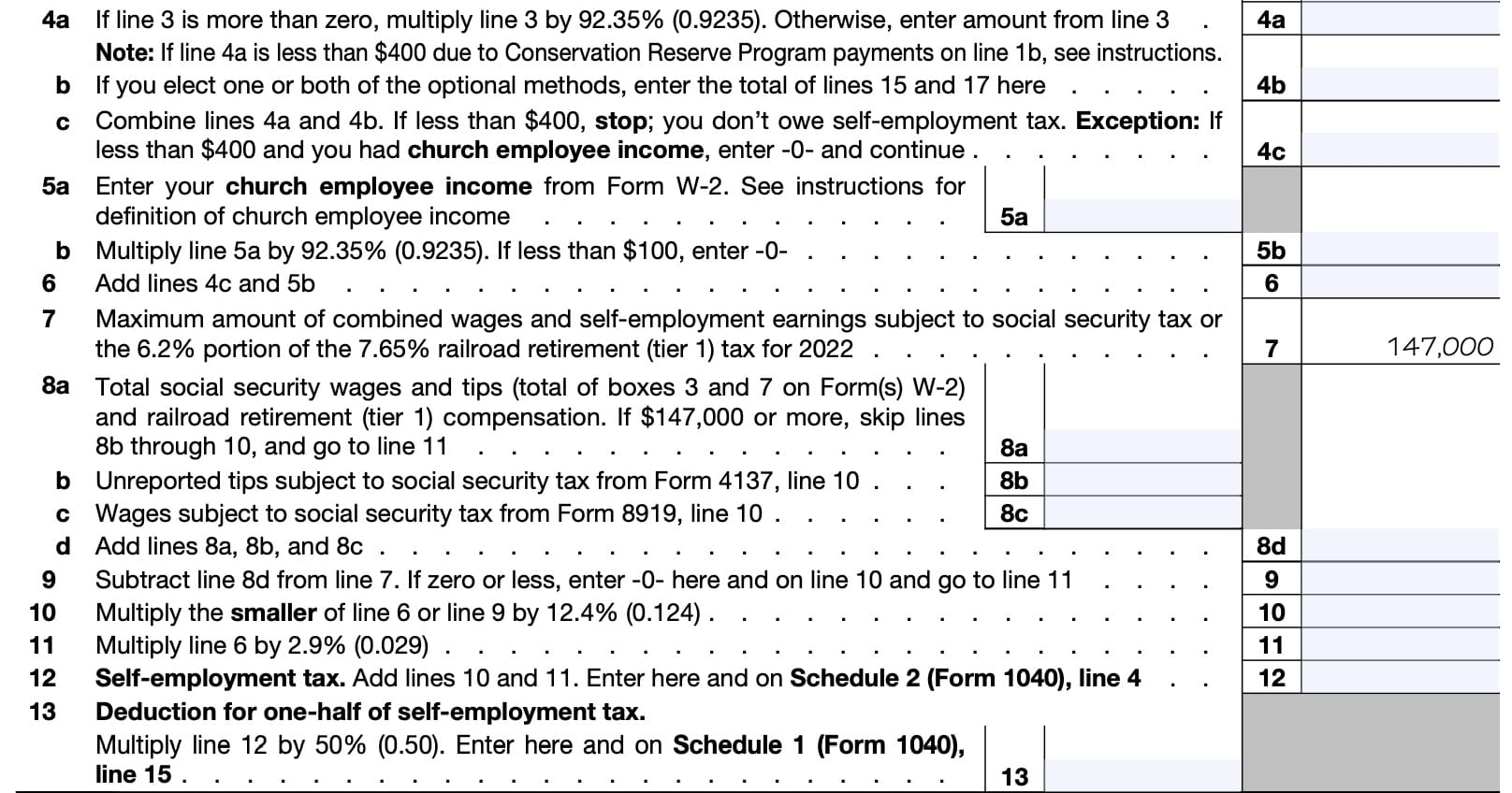

Line 4

In Line 4a, if Line 3 is greater than zero, then multiply the Line 3 amount by 92.35% (0.9235). Otherwise, enter the Line 3 amount here.

For Line 4b, if you elect either or both of the optional methods described in Part II, then enter the total of:

In Line 4c, add Lines 4a and 4b.

If the result is less than $400, then stop. Unless you entered a value for Conservation Reserve Program payments on Line 1b, you do not owe self-employment tax.

You do not have to complete the rest of the Schedule SE tax form unless you are a church employee. On Line 5, church employees must enter any church employee income reported to them on Form W-2.

However, if both Lines 4a and 4c are less than $400 and you have an amount on Line 1b, combine Lines 1a and 2.

- If the total of Lines 1a and 2 is $434 or more, file Schedule SE (completed through Line 4c) with your tax return.

- Enter -0- on Schedule 2 (Form 1040), Line 4.

- If the total of Lines 1a and 2 is less than $434, don’t use Schedule SE unless you choose an optional method to figure your SE tax.

Line 5

If you had church employee income reported to you on Form W-2, enter the total amount of your reported income on Line 5a.

Multiply the Line 5a amount by 92.35%. (0.9235). Enter the result in Line 5b.

Line 6

Add Lines 4c and 5b. Enter the result here.

Line 7

Do not enter any information in Line 7. This line represents the maximum amount of combined wages and self-employment earnings that are subject to either:

- Social Security tax, or

- 6.2% of the 7.65% Railroad Retirement Tax Act (RRTA) tax for the year

For tax year 2022, this amount is $147,000. For the 2023 tax year, the amount is $160,200.

Line 8

In Line 8a, enter the total amount of the following:

- Social Security wages & tips

- Social Security wages: Box 3

- Social Security tips: Box 7

For Line 8b, enter any unreported tips that are subject to Social Security taxes as reported on IRS Form 4137, Taxes on Unreported Tip Income, Line 10.

In Line 8c, enter any wages subject to Social Security tax from IRS Form 8919, Uncollected Social Security and Medicare Tax on Wages, Line 10.

Add Lines 8a, 8b, and 8c. Enter the total in Line 8d.

Line 9

Subtract Line 8d from Line 7. If the result is zero or less, enter ‘0’ on Line 10, then go directly to Line 11.

Otherwise, go directly to Line 10.

Line 10

Multiply the smaller amount of the following by 12.4% (0.124):

This represents your Social Security tax. Proceed to Line 11.

Line 11

Multiply the Line 6 amount by 2.9%. This represents your Medicare tax.

Line 12: Self-employment tax

Add Lines 10 and 11, then enter the result here and on IRS Form 1040, Schedule 2, Line 4. This represents your total self-employment tax.

Line 13: Deduction for one-half of Self-employment tax

Multiply the Line 12 amount by 50% (0.50), then enter the result in Line 13. This represents the tax deduction you are entitled to for one half of the self-employment tax.

Enter this number on Line 15 of IRS Form 1040, Schedule 1.

Part II: Optional Methods to Figure Earnings

Only complete Part II if you are interested in using either of the optional methods to report your total income for self-employment tax purposes. Before we jump into Line 14, here are some reasons you may want to use either (or both) of the optional methods to report your total income.

Benefits of optional methods

Social security coverage

The optional methods may give you credit toward your social security coverage even though you have a loss or a small amount of income from self-employment. The down side is that you may pay more in total self-employment tax.

Credits affected by earned income

Using the optional methods may qualify you to claim one of the following tax credits from either IRS Form 2441, Schedule 8812 or Schedule EIC:

- Child and dependent care credit (IRS Form 2441)

- Additional child tax credit (Schedule 8812)

- Earned Income Credit (Schedule EIC)

The optional methods also might give you a larger credit if your net income from self-employment (without using the optional methods) are less than $6,040.

Calculate these tax credits with and without using the optional methods to see which option works best for you.

Self-employed health insurance deduction

The optional methods of computing net earnings from self-employment may be used to figure your self-employed health insurance deduction.

Other items affected by adjusted gross income (AGI)

Using the optional methods may decrease your AGI. Decreases in AGI may also impact other tax benefits that are subject to an AGI limit or phaseout.

Calculate your your AGI with and without using the optional methods, then choose the method that results in lower total income taxes.

With that said, let’s start by walking through the farm optional method.

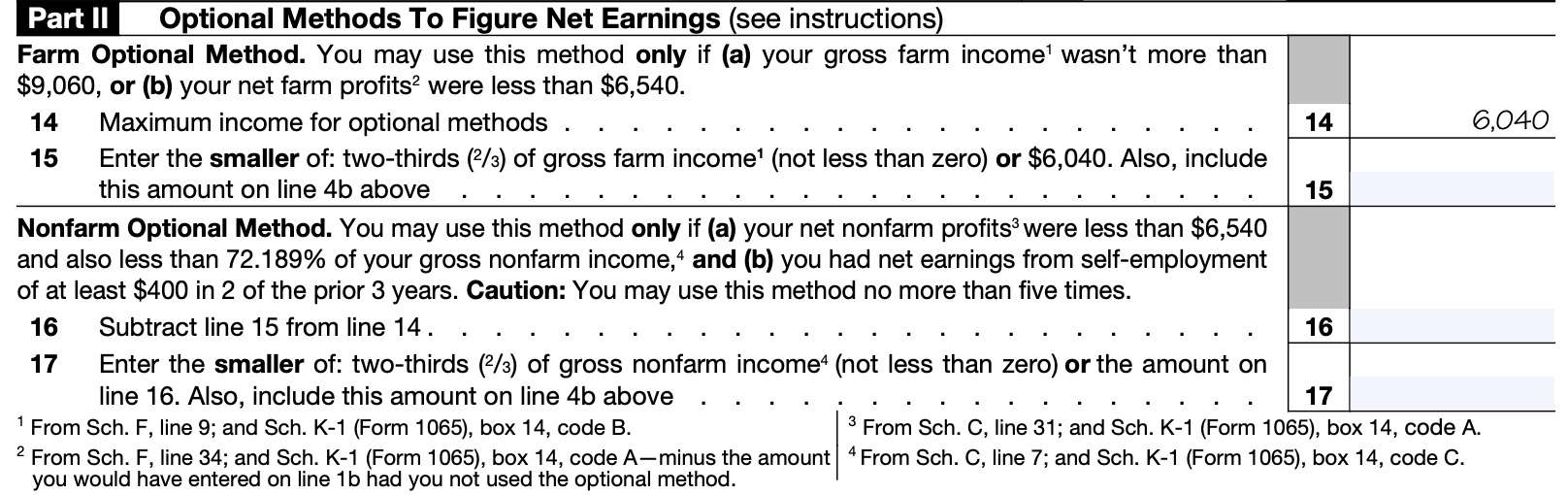

Line 14

Before starting Line 14, you should know the requirements. You may only use the farm optional method if either of the following apply:

- Your gross farm income was not more than $9,060, or

- From Schedule F, Line 9 and Schedule K-1, Box 14, Code B (Form 1065)

- Your net profit from farming was less than $6,540

- From Schedule F, Line 34, and Schedule K-2, Box 14, Code A, minus the amount you would have entered on Line 1b had you not used the optional method

Assuming you qualify, you’ll see that Line 14 is automatically completed for you. If not, enter $6,040.

Line 15

In Line 15, enter the smaller of the following:

- Two-thirds (2/3) of your gross farm income, but not below zero, or

- $6,040

Enter this number on Line 4b, above.

Line 16

Before starting Line 16, you should know the requirements. You may only use the nonfarm optional method if all of the following apply:

- Your net nonfarm profits were less than $6,540, and

- From Schedule C, Line 31, and Schedule K-1, Box 14, Code A (Form 1065)

- Your net nonfarm profit is less than 72.189% of your gross nonfarm income, and

- From Schedule C, Line 7 and Schedule K-1, Box 14, Code C

- You had net self-employment earnings of at least $400 in 2 of the prior 3 tax years

Assuming that is the case, subtract Line 15 from Line 14. Enter the result here.

Line 17

In Line 17, enter the smaller of:

- Two-thirds (2/3) of gross non farm income, or

- From Schedule C, Line 7 and Schedule K-1, Box 14, Code C

- Line 16

Enter this amount on Line 4b, above.

You can use the nonfarm optional method to figure your earnings from self-employment for only 5 years. The 5 years don’t have to be consecutive.

Video walkthrough

If you want to learn about how to calculate your self-employment tax using Schedule SE, check out our instructional video!

Frequently asked questions

Church employee income is wages you received as an employee, other than as a minister, member of a religious order, or Christian Science practitioner, of a church or qualified church-controlled organization that has a certificate in effect electing an exemption from employer Social Security and Medicare taxes.

There is no longer a long Schedule SE and a short version. Schedule SE used to have a long Schedule SE and a short version that certain taxpayers could use after completing a flowchart. However, in 2020, the IRS replaced both versions with the current form.

Under the Self-Employment Contributions Act, or SECA, the tax is generally 15.3% of your taxable income from self-employment, up to the Social Security contribution limit, which is $160,200 for 2023. The tax is 2.9% on any taxable income above this limit, which helps pay for Medicare benefits.

All taxpayers must file Schedule SE if the amount on Line 4c of Schedule SE is $400 or greater, or who reported church employee income of at least $108.28.

How do I find Schedule SE?

You can find Schedule SE on the IRS website. For your convenience, we’ve attached the latest version to this article as a PDF file.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!