IRS Schedule F Instructions

If you participated in farming activities, or sold crops or farm animals for a profit, you may need to complete IRS Schedule F when filing your income tax return.

In this article, we take a close look at IRS Schedule F, including:

- How to complete IRS Schedule F

- Reporting farm income and expenses under the cash and accrual methods

- Other considerations when completing Schedule F

Let’s start with a deep dive into the form itself.

Table of contents

How do I complete IRS Schedule F?

There are four parts to this two-page tax form:

- Part I: Farm Income-Cash Method

- Part II: Farm Expenses-Cash and Accrual Method

- Part III: Farm Income-Accrual Method

- Part IV: Principal Agricultural Activity Codes

Let’s go through each part, starting at the top.

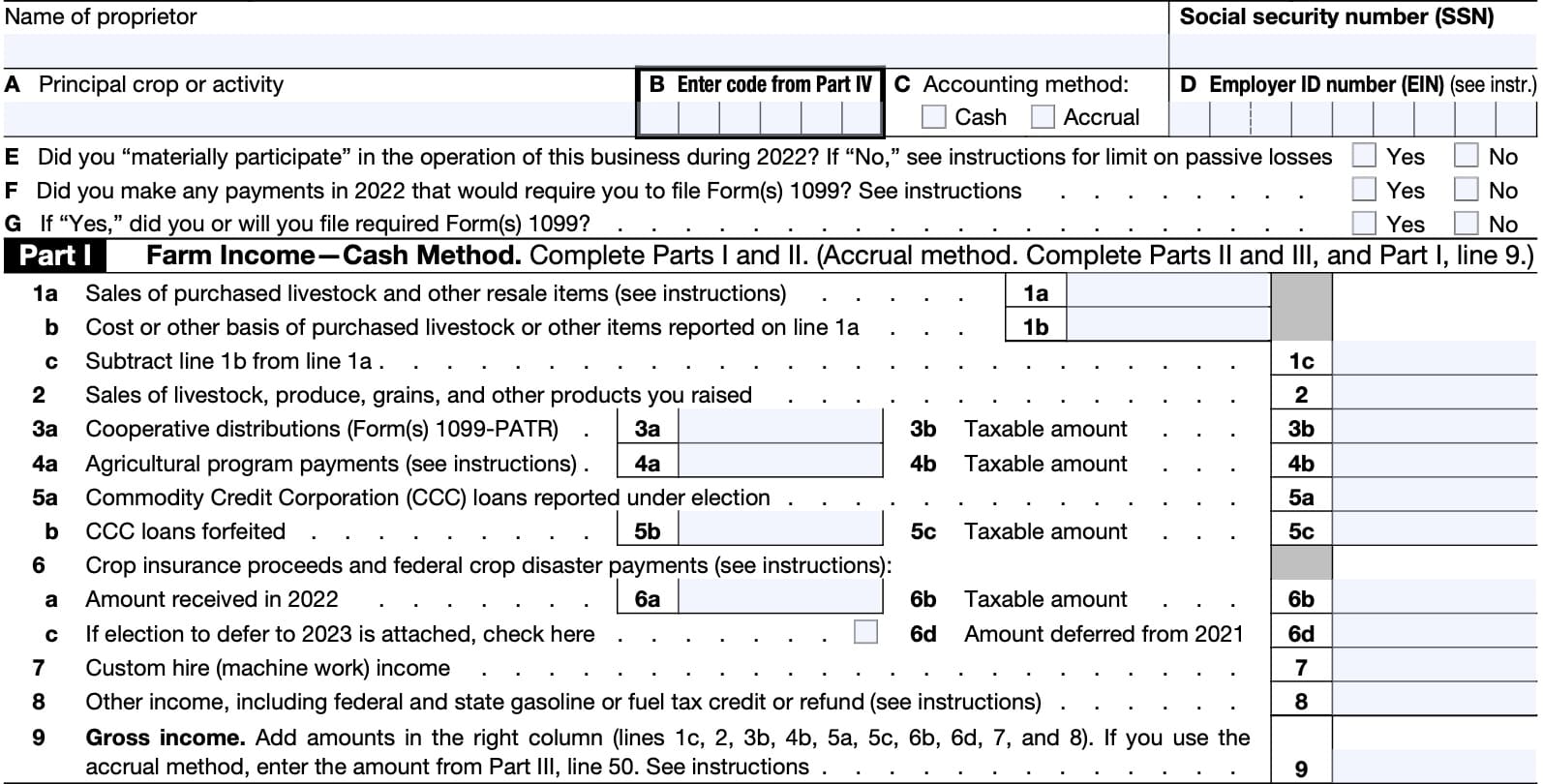

Taxpayer information

Before we begin with Part I or Part II, let’s go over the taxpayer information fields at the very top of the form.

Name of proprietor & Social Security number

At the very top of the form, enter the name and Social Security number, if you’re operating a farm as a sole proprietorship.

However, if you are operating the farm owned by an estate, trust, or partnership, do not complete the Social Security number field. Instead, leave this blank and enter the employer identification number (EIN) in Line D, below.

Line A: Principal crop or activity

Enter the primary crop or farming activity of your farm.

Line B: Enter code from Part IV

Enter one of the 17 principal agricultural activity codes listed in Part IV, below.

Line C: Accounting method

Enter the appropriate accounting method.

Cash method

If you use the cash method of accounting, then you’ll complete Part I and Part II to report your farming income and expenses.

In most cases, the cash method requires taxpayers to report income in the year in which they actually or constructively received it and deduct expenses in the year paid.

For certain expenditures resulting in an asset with a life over 12 months, you may only be able to deduct part of the total expense in the first year. IRS Publication 225, Farmer’s Tax Guide, contains additional information about accounting methods used in farming.

Accrual method

If you use the accrual method for accounting purposes, then you’ll complete Part II and Part III to report income and expenses from farming activities. You’ll also report amounts from Line 50 as gross income on Line 9, in Part I.

When using the accrual method, taxpayers generally report income in the year in they earned it and deduct expenses in the year incurred, even if they didn’t pay them in that taxable year.

Line D: Employer ID number (EIN)

Enter the EIN that was issued to you on Form SS-4.

Don’t enter your SSN or another taxpayer’s EIN. If you don’t have an EIN, leave Line D blank.

You need an EIN only if you:

- Have a qualified retirement plan

- Must file employment, excise, alcohol, tobacco, or firearms returns, or

- Are a payer of gambling winnings

Line E

Check ‘Yes’ if you materially participated in the operations of this business during the tax year. If you did not materially participate in farming operations and you have a net loss, then there may be limits on the amount of the loss that you can deduct, according to passive activity rules.

Material participation

The requirements for material participation are the same as those outlined in IRS Schedule C, Line G. In other words, the taxpayer must meet one of the seven requirements outlined below:

- You participated in the activity for more than 500 hours during the tax year.

- Your participation in the activity for the tax year was substantially all of the participation in the activity of all individuals for the tax year

- Including individuals who did not own any interest in the activity

- Participated in the activity for more than 100 hours, and at least as much as any other person, including individuals who did not own an interest in the activity

- Activity is a significant participation activity for the tax year, and you participated in all significant activities for more than 500 hours during the year

- A significant participation activity involves the conduct of a trade or business where you participated in the activity for more than 100 hours during the tax year

- You materially participated in the activity for any 5 of the prior 10 tax years

- The activity is a personal service activity in which you materially participated for any 3 prior tax years.

- Based on all the facts and circumstances, you participated in the activity on a regular, continuous, and substantial basis for more than 100 hours during the tax year

Line F

If you made any payments in 2022 that would require you to file any 1099 Forms, check the “Yes” box. Otherwise, check “No.”

Generally, you must file Form 1099-MISC if you paid at least $600 in rents, services, prizes, medical and health care payments, and other income payments.

Line G

If you are required to file IRS Form 1099 for any reason, then select ‘Yes.’ Otherwise, leave blank.

Part I: Farm Income-Cash Method

If you use the cash method of accounting, then you’ll need to complete Part I. If you are an accrual method taxpayer, go ahead to Part II, below.

Line 1a: Sales of purchased livestock and other resale items

In Line 1a, enter the sale of purchased livestock or other resale items.

If you sold livestock because of drought, flood, or other weather-related conditions, you can elect to report the income from in the year after the year of sale if all of the following conditions apply:

- Farming is your primary business

- You can show that you sold the livestock only because of weather-related conditions

- Your area qualified for federal aid

Line 1b: Cost or other basis of purchased livestock or other items reported on line 1a

Enter the cost or other basis of any livestock or other items that you reported the sale for in Line 1a, above.

Line 1c

Subtract Line 1b from Line 1a. Enter the result in Line 1c.

Line 2: Sales of livestock, produce, grains, and other products you raised

Enter any revenue that you received for any farming products that you raised.

Also, if you received rents based on crop shares or farm production and materially participated in the management or operation of a farm, report these rents as income here.

Line 3a: Cooperative distributions

If you received a Form 1099-PATR, then list your total distributions from cooperatives in Line 3a. This includes the following:

- Patronage dividends

- Nonpatronage distributions

- Per-unit retain allocations, and

- Redemptions of nonqualified written notices of allocation and per-unit retain certificates

If you received property as patronage dividends, report the fair market

value of the property as income.

If you received per-unit retains in cash, show the amount of cash.

If you received qualified per-unit retain certificates, show the stated dollar amount of the certificates.

Line 3b: Taxable amount of cooperative distributions

Don’t include as income any patronage dividends from buying personal or family items, capital assets, or depreciable assets.

Because you don’t report patronage dividends from these items as income, you must subtract the amount of the dividend from the cost or other basis of these items.

Line 4a: Agricultural program payments

Enter on the total of the government agricultural program payments that you received during the tax year.

This includes the following amounts:

- Price loss coverage payments

- Agriculture risk coverage payments

- Coronavirus Food Assistance Program payments

- Market Facilitation Program payments

- Market gain from the repayment of a secured Commodity Credit Corporation (CCC) loan for less than the original loan amount

- Diversion payments

- Cost-share payments (sight drafts)

- Payments in the form of materials or services

These amounts are usually reported to you on either:

- IRS Form 1099-G, or

- Form CCC-1099-G (from the Farm Service Agency)

Line 4b: Taxable amount

In Line 4b, enter only the taxable amount of payments listed in Line 4a.

For example, don’t report the market gain shown on Form CCC-1099-G on Line 4b if you elected to report CCC loan proceeds as income in the year received. In this situation, you would not recognize a gain because you previously reported the CCC loan proceeds as income.

However, if you didn’t report the CCC loan proceeds under the election, you must report the market gain on Line 4b.

Line 5a: Commodity credit corporation (cCC) loans reported under election

In most cases, you don’t report CCC loan proceeds as income. However, if you pledge part or all of your production to secure a CCC loan, you can elect to report the loan proceeds as income in the year you receive them.

Make this report in Line 5a, and attach a statement to your return showing the details of the loan.

Line 5b: CCC loans forfeited

Include the full amount forfeited on Line 5b, even if you reported the loan proceeds as income. This

amount may be reported to you on IRS Form 1099-A.

If you did elect to report the loan proceeds as income, you generally won’t have an entry on line 5c.

But if the amount forfeited is different from your basis in the commodity, you may have an entry on Line 5c, below.

Line 5c: Taxable amount

If you didn’t elect to report the loan proceeds as income, also include the forfeited amount from Line 5b on Line 5c.

Line 6: Crop insurance proceeds and federal crop disaster payments

In most cases, you must report crop insurance proceeds, such as federal crop disaster payments, in the year you receive them.

However, you can elect to include certain proceeds in income for the year following the tax year of the loss.

Line 6a: Amount received in the tax year

Enter the total crop insurance proceeds you received in the tax year, even if you elect to include them in income for next year.

Line 6b: Taxable amount

Enter the amount of proceeds that are taxable.

Line 6c: election to defer proceeds

If you elect to defer any eligible crop insurance proceeds, you must defer all such crop insurance proceeds from a single trade or business. This includes federal crop disaster payments.

Line 6d: Amount deferred from prior tax year

Enter any crop insurance proceeds you received in the prior tax year and elected to include in income the current year.

Line 7: Custom hire (machine work) income

Enter any income from custom hire or machine work activities that you received as supplemental income in Line 7.

Line 8: Other income

Enter any other income not otherwise reported in Lines 1 through 7. This may include:

- Illegal federal irrigation subsidies

- Bartering income.

- Income from cancellation of debt

- Generally reported on IRS Form 1099-C

- State gasoline or fuel tax refunds you received in the tax year

- Any amount included in income from Line 3 of IRS Form 6478, Biofuel Producer Credit

- Any amount included in income from Line 10 of IRS Form 8864, Biodiesel, Renewable Diesel, or Sustainable Aviation Fuel Mixture Credit

- The amount of credit for federal tax paid on fuels claimed on IRS Schedule 3 from the prior tax year

- Any recapture of excess depreciation on any listed property, if the business use percentage of that property decreased to 50% or less in the tax year.

- Includes any Section 179 expense deduction

- Use Part IV of IRS Form 4797, Sales of Business Property, to figure the recapture.

- The inclusion amount on leased listed property, other than vehicles, when the business use percentage drops to 50% or less.

- Any recapture of the deduction or credit for clean-fuel vehicle refueling property or alternative fuel vehicle refueling property used in your farming business.

- Any income from breeding fees, or fees from renting teams, machinery, or land that isn’t reported on IRS Schedule E (Form 1040) or IRS Form 4835.

- The gain or loss on the sale of commodity futures contracts if the contracts were made to protect you from price changes.

- These are a form of business insurance and are considered hedges.

- If you had a loss in a closed futures contract, enclose the amount of the loss in parentheses.

- The amount of any payroll tax credit taken by an employer for qualified paid sick leave and qualified paid family leave under the FFCRA and the ARP.

Line 9: Gross income

Add the following amounts from the right column of IRS Schedule F:

Add amounts in the right column (lines 1c, 2, 3b, 4b, 5a, 5c, 6b, 6d, 7, and 8).

If you use the accrual method, simply enter the amount from Line 50, below.

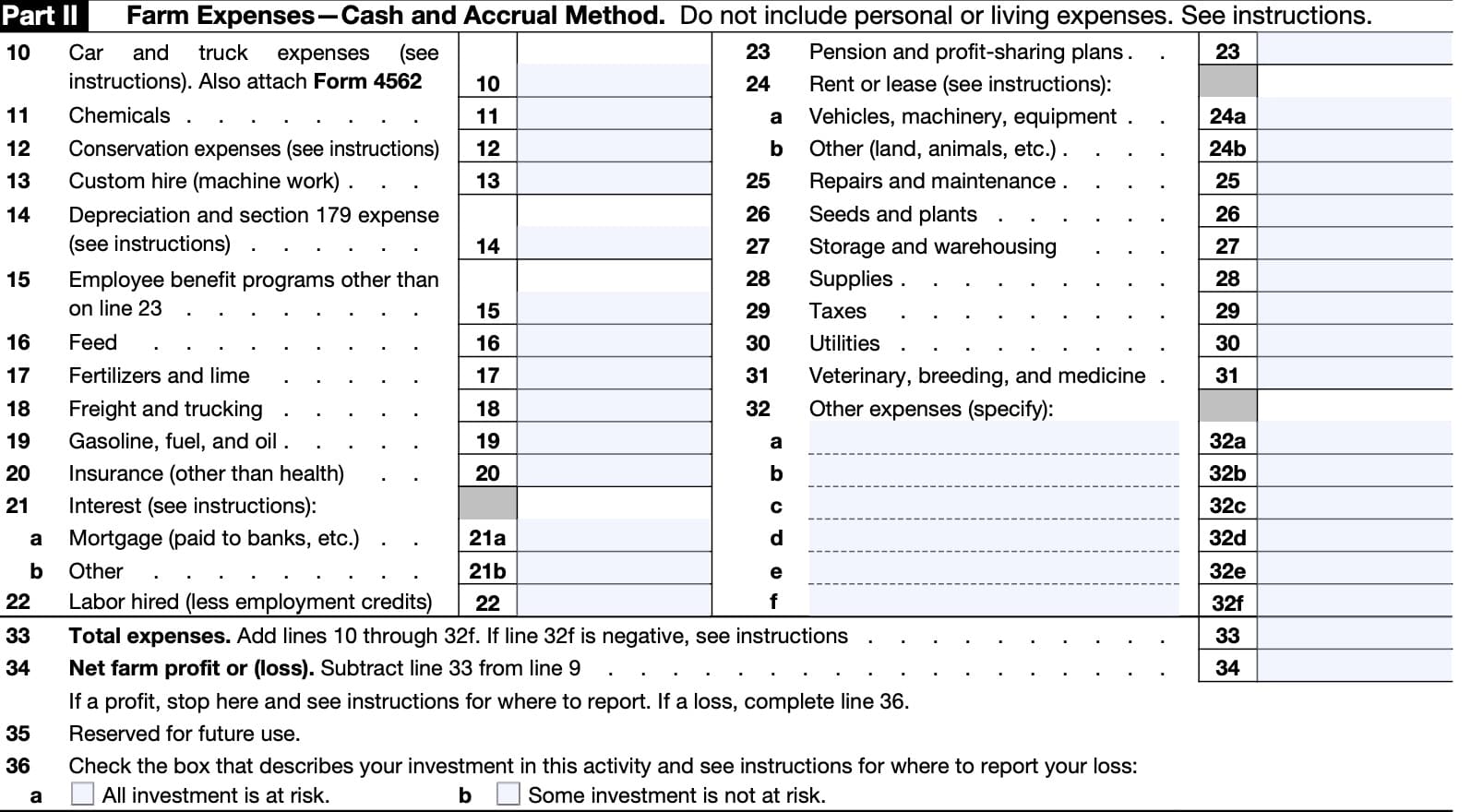

Part II: Farm Expenses-Cash and Accrual Method

In Part II, cash and accrual taxpayers will enter farm-related expenses. However, do not include any of the following:

- Personal or living expenses that don’t produce farm income

- Expenses of raising anything you or your family personally used

- The value of animals you raised that died

- Inventory losses

- Personal losses

Capitalizing expenses

If you produced real or tangible personal property or acquired property for resale, you must generally capitalize certain expenses to your inventory or other property, unless you are a small business taxpayer.

A small business taxpayer is one that

- Has gross receipts of $27 million or less for the 3 prior tax years, and

- Is not a tax shelter, according to Internal Revenue Code Section 448(d)(3)

If you capitalize your expenses, don’t reduce your deductions on Lines 10 through 32e by the capitalized expenses. Instead, enter the total amount capitalized in parentheses on Line 32f, then enter “263A” in the space to the left of the total.

Prepaid farm supplies

In most cases, if you use the cash method of accounting and your prepaid farm supplies are more

than 50% of your other deductible farm expenses, your deduction for those supplies may be limited.

Prepaid farm supplies include expenses for feed, seed, fertilizer, and similar farm supplies not used or consumed during the year.

They also include the cost of poultry that would be allowable as a deduction in a later tax year if you were to:

- Capitalize the cost of poultry bought for use in your farming business and deduct it ratably over the lesser of 12 months or the useful life of the poultry, and

- Deduct the cost of poultry bought for resale in the year you sell or otherwise dispose of it.

If the limit applies, you can deduct prepaid farm supplies that don’t exceed 50% of your other deductible farm expenses in the year of payment. You can deduct the excess only in the year you use or consume the supplies, except for poultry, which can be deducted as outlined above.

Line 10: Car and truck expenses

When it comes to vehicle expenses, you have two choices:

- Take the standard mileage rate, or

- Deduct the actual expenses of operating your car or truck

You must use actual expenses if you used five or more vehicles simultaneously in your

farming business, such as in fleet operations. However, you can’t use actual expenses for a leased vehicle if you previously used the standard mileage rate for that vehicle.

Standard mileage rate

You can take the standard mileage rate for 2022 only if you:

- Owned the vehicle and used the standard mileage rate for the first year you placed the vehicle in service, or

- Leased the vehicle and are using the standard mileage rate for the entire lease period.

If you take the standard mileage rate:

- Multiply the business standard mileage rate from January 1, 2022, to June 30, 2022, by 58.5 cents a mile; then

- Multiply the business standard mileage rate from July 1, 2022, to December 31, 2022, by 62.5 cents a mile;

Add to this amount your parking fees and tolls, and enter the total here.

Don’t deduct depreciation, rent or lease payments, or your actual operating expenses.

Actual expense method

If you deduct actual expenses, then include the following business-related expenses on Line 10:

- Gasoline & oil

- Repairs

- Insurance

- Registration and license plates, etc

Show depreciation on Line 14. Enter rental or lease payments on Line 24a.

If you claim any car or truck expenses (actual or the standard mileage rate), you must provide the information requested on IRS Form 4562, Part V. Be sure to attach Form 4562 to your return.

Line 11: Chemicals

Enter the cost of chemicals used in your farming or agricultural business in Line 11.

Line 12: conservation expenses

Deductible conservation expenses are generally those that are paid to:

- Conserve soil and water for land used in farming,

- Prevent erosion of land used for farming, or

- Assist in endangered species recovery

These expenses can include costs incurred for the following:

- The treatment or movement of earth, such as leveling, grading, conditioning, terracing, contour furrowing, and the restoration of soil fertility

- The construction, control, and protection of diversion channels, drainage ditches, irrigation ditches, earthen dams, watercourses, outlets, and ponds

- Brush eradication

- The planting of windbreaks

- The achievement of site-specific management actions recommended in recovery plans approved pursuant to the

- Deductible conservation expenses are generally those that are

- paid to conserve soil and water for land used in farming, to prevent erosion of land used for farming, or for endangered species recovery. These expenses include (but aren’t limited to)

- costs for the following.

- The treatment or movement of earth, such as leveling,

grading, conditioning, terracing, contour furrowing, and the restoration of soil fertility. - The construction, control, and protection of diversion

channels, drainage ditches, irrigation ditches, earthen dams,

watercourses, outlets, and ponds. - The eradication of brush.

- The planting of windbreaks.

- The achievement of site-specific management actions

recommended in recovery plans approved pursuant to the Endangered Species Act of 1973.

Your deduction can’t exceed 25% of your gross income from farming (excluding certain gains from selling assets such as farm machinery and land). You can carry forward excess expenses to a future tax year.

Line 13: Custom hire (machine work)

In Line 13, enter amounts paid for custom hire or machine work in which the machine operator furnished the equipment.

Don’t include amounts paid for rental or lease of equipment you operated yourself. Enter those expenses on Line 24a.

Line 14: Depreciation and Section 179 expense

You can deduct depreciation of buildings, improvements, cars and trucks, machinery, and other farm equipment of a permanent nature.

Don’t deduct depreciation on any of the following:

- Your personal residence, furniture, or other personal items

- Land

- Livestock you bought or raised for resale

- Other property in your inventory

You may expense a portion of the cost of certain property that you purchased for your farm business during the tax year under Section 179. Use IRS Form 4562 to make the Section 179 and to calculate depreciation expense.

Line 15: Employee benefits other than on Line 23

In Line 15, you can deduct contributions to employee benefit programs that are not part of a pension or profit-sharing plan reported on Line 23, below. Examples of such benefits include:

- Accident & health plans

- Group-term life insurance

- Dependent care assistance programs

If you made contributions on your own behalf as a self-employed person to a dependent care assistance program, complete IRS Form 2441 to figure your deductible contributions to that

program.

Contributions you made on your behalf as a self-employed person to an accident and health plan or for group-term life insurance aren’t deductible on Schedule F.

However, you may be able to deduct on the amount that you paid for health insurance on behalf of yourself, spouse, or dependents on IRS Schedule 1, Line 17, even if you do not itemize tax deductions on Schedule A of your income tax return.

You must reduce your Line 15 deduction by the amount of any credit for small employer health insurance premiums determined on IRS Form 8941.

Line 16: Feed

Enter any feed-related costs in Line 16.

If you use the cash method, you can’t deduct the cost of feed your livestock will consume in a later year unless all of the following apply:

- The payment was for the purchase of feed rather than a deposit

- The prepayment had a business purpose and wasn’t made for tax avoidance purposes.

- Deducting the prepayment won’t materially distort your taxable income

If all of the above apply, you can deduct the prepaid feed when paid, subject to the overall limit for prepaid farm supplies. Otherwise, you can only deduct the prepaid feed when actually consumed.

Line 17: Fertilizers and lime

Enter amounts that you spent on fertilizer and lime during the tax year.

Line 18: Freight and trucking

Enter freight and trucking costs that you paid or incurred during the year.

However, do not include the cost of transportation incurred in purchasing livestock held for resale as freight paid.

Instead, add these costs to the cost of the livestock.

Line 19: Gasoline, fuel, and oil

Enter the amount you spent on gasoline, fuels, and oil during the tax year.

Line 20: Insurance (other than health)

Deduct on this line premiums paid for farm business insurance. For employee accident and health insurance, deduct those amounts on Line 15, above.

The following are not deductible for tax purposes:

- Amounts credited to a reserve for self-insurance, or

- Premiums paid for an insurance policy that reimburses lost earnings due to sickness or disability (i.e. disability insurance)

Line 21: Interest

Before discussing how to capture interest payments on Lines 21a or 21b, we should discuss how interest allocation rules might apply to.

Interest allocation rules

The tax treatment of interest expense differs depending on its type. For example, home mortgage interest and investment interest are treated differently.

Interest allocation rules require you to allocate your interest expense so it’s deducted or capitalized on the correct line of your return and receives the right tax treatment.

These rules could affect how much interest you are allowed to deduct on IRS Schedule F. Generally, taxpayers must allocate interest expense by how the loan proceeds are used.

Before entering an amount on Line 21a or 21b, see the IRS Form 8990 instructions to determine whether you are required to limit your business interest expense or whether you

can elect not to limit your business interest expense.

Line 21a: Mortgage interest

Enter the interest that you paid to banks or other financial institutions for which you received IRS Form 1098, or a similar statement, if the following apply:

- You are not required to limit your business interest expense, and

- You have a mortgage on real property used in your agricultural activities

Line 21b: Other

If you paid interest that otherwise reduces net farm income, but you didn’t receive a Form 1098, enter the interest on Line 21b.

Line 22: Labor hired

Enter the amounts you paid for farm labor, but do not include amounts paid to yourself.

Reduce your deduction by the amount of tax credits claimed on the following:

- IRS Form 5884, Work Opportunity Credit

- IRS Form 8844, Empowerment Zone Employment Credit

- IRS Form 8845, Indian Employment Credit

- IRS Form 8932, Credit for Employer Differential Wage Payments

- IRS Form 8994, Employer Credit for Paid Family and Medical Leave

In Line 22, you may include the cost of boarding farm labor, but not the value of any products they used while living on the farm. Only include what you paid household help to care for farm laborers.

Line 23: Pension and profit-sharing plans

Enter your tax deduction for contributions to employee pension, profit-sharing, or annuity plans in Line 23.

If the plan included you as a self-employed person, enter contributions made as an employer

on your own behalf on IRS Schedule 1, Line 16, not on IRS Schedule F (Form 1040).

In most cases, you must file the applicable form listed next if you maintain a pension, profit-sharing, or other funded-deferred compensation plan.

IRS Form 5500-EZ

File this form if you have a one-participant retirement plan that meets certain requirements. A one-participant plan is a plan that covers only you (or you and your spouse).

IRS Form 5500-SF

You may file this form electronically with the Department of Labor if you have a small plan (fewer

than 100 participants in most cases) that meets certain requirements.

IRS Form 5500

File IRS Form 5500 with the U.S. Department of Labor for any pension plan that doesn’t meet the requirements to file Form 5500-EZ or Form 5500-SF.

Line 24: Rent or lease

Line 24a: Vehicles, machinery, equipment

Enter the business portion of any vehicle or machinery rental costs. However, if you rented or leased equipment for more than 30 days, you may need to reduce your tax deduction by an inclusion amount.

Line 24b: Other (land, animals, etc.)

In Line 24b, enter the cost of leasing other property, such as farmland.

Line 25: Repairs and maintenance

Enter amounts you paid for repairs and maintenance of farm buildings, machinery, and equipment that are not payments for improvements to the property.

Amounts are paid for improvements, if they:

- Improve or make your property better

- Restore major aspects of your property, or

- Adapt your property to a new or different use

Improvements generally must be capitalized. Don’t deduct repairs or maintenance on your home.

Line 26: Seeds and plants

Enter the cost of seeds and plants in Line 26.

Line 27: Storage and warehousing

If you incurred storage or warehousing costs as part of your farming expenses, enter those amounts in Line 27.

Line 28: Supplies

Enter the cost of supplies incurred in the business of farming.

Line 29: Taxes

Enter the amounts you paid in the form of taxes in this line.

Deductible taxes

You can include the following types of taxes:

- Real estate and personal property taxes on farm business assets

- Social security and Medicare taxes you paid to match what you are required to withhold from farm employees’ wages.

- Do not reduce your deduction by refundable portions of tax credits for qualified sick and family leave wages on an employment tax return. Report these credits on Line 8 as income

- Federal unemployment tax

- Federal highway use tax

- Contributions to state unemployment insurance fund or disability benefit fund if they’re considered taxes by the state tax department, or under state law

Nondeductible taxes

The following are taxes that you cannot list on Line 29:

- Federal income taxes, including your self-employment tax.

- You can deduct one-half of self-employment tax on IRS Schedule 1 (Form 1040), Line 15

- Estate and gift taxes

- Taxes assessed for improvements, such as paving and sewers

- Taxes on your home or personal-use property

- May be deductible as an itemized deduction on IRS Schedule A

- State and local sales taxes on property purchased for use in your farming business.

- You must capitalize these taxes as part of the cost of the property

- Other taxes not related to your farming business

Line 30: Utilities

Enter amounts you paid for gas, electricity, water, and other utilities incurred in the business of farming. Don’t include personal utilities.

Telephone expenses

Generally, you can’t deduct the base rate (including taxes) of the first telephone line into your residence, even if you use it for your farming business. But you can deduct expenses you paid

for your farming business that are more than the cost of the base rate for the first phone line.

For example, if you had a second phone line, you can deduct the business percentage of the charges for that line, including the base rate charges.

Line 31: Veterinary, breeding, and medicine

Include any veterinary, breeding, or other medical expenses as expense deductions in Line 31.

Line 32: Other expenses

In Line 32, enter any other expenses that do not belong in one of the previous lines. Below are some of the more common expenses that may be included as expense deductions.

At-risk deduction

Any loss from this activity that wasn’t allowed last year because of the at-risk rules is treated as a deduction allocable to this activity in the current taxable year. See IRS Form 6198 for more details about at-risk rules.

Bad debts

IRS Publication 535, Chapter 10, contains additional information about bad debts.

Business startup costs

You may elect to deduct up to $5,000 of certain business startup costs in the year that you start your farming business. However, this limit is reduced, dollar for dollar, if your startup costs exceed $50,000.

The rest of your startup costs must be amortized, on IRS Form 4562 over a 15-year period, beginning with the month that you began your farming business.

Business use of your home

You may be able to deduct certain expenses for business use of your home, subject to limitations. You may also be able to use a simplified method to figure your deduction. Use the appropriate worksheets in Pub. 587

to figure your allowable deduction. Don’t use Form 8829.

De minimis safe harbor for tangible property

able to elect to use a de minimis safe harbor to deduct amounts

paid for certain tangible real or personal property used in your

farming business. If you elect the de minimis safe harbor for

the tax year, enter the total amounts you paid for property qualifying under the de minimis safe harbor on line 32. Don’t include these amounts on any other line. For details, see chapter 1 of Pub. 535.

Energy efficient commercial buildings deduction

You may be able to deduct part or all of the expenses of modifying an existing commercial building to make it energy efficient. IRS Form 7205 contains additional information.

Forestation and reforestation costs

Reforestation costs are generally capital expenditures.

However, for each qualified timber property, you can elect to expense up to $10,000 ($5,000 if your filing status is married filing separately) of qualifying reforestation costs paid or incurred in the tax year.

You can elect to amortize the remaining costs over 84 months on IRS Form 4562.

The amortization election doesn’t apply to trusts, and the expense election doesn’t apply to estates and trusts.

Legal and professional fees

You can include any fees charged by accountants and attorneys that are ordinary and necessary expenses directly related to the business of farming.

Include fees for legal advice, tax advice and for the preparation of tax forms related to your farming business. Also, include expenses incurred in resolving asserted tax deficiencies related to your farming business.

Tools

You can deduct the amount you paid for tools that have a short life or cost a small amount, such as shovels and rakes.

Travel and meals

In most cases, you can deduct expenses for farm business travel and 50% of your business meals.

But there are exceptions and limitations. See the instructions for IRS Schedule C, lines 24a and 24b.

Preproductive period expenses

If you had preproductive period expenses that you are capitalizing, enter the total of these expenses in parentheses on Line 32f (to indicate a negative amount). Enter “263A” in the space to the left of the total.

Excess business loss limitation

Noncorporate taxpayers may be subject to excess business loss limitations. You must apply the at-risk limits and passive activity limits before calculating any excess business loss.

Definitions

An excess business loss is the amount by which the total deductions attributable to all of your trades or businesses exceed your total gross income and gains attributable to those trades or businesses plus $270,000 (or $540,000 in the case of a joint return).

A “trade or business” includes, but is not limited to:

- IRS Schedule F activities

- IRS Schedule C activities

- Business activities reported on IRS Schedule E

- Any activity reported on IRS Form 4835

Business gains and losses reported on IRS Form 4797 and IRS Form 8949 are included in the excess business loss calculation. This includes farming losses from casualty losses or losses by reason of disease or drought.

Excess business losses that are disallowed are treated as an NOL carryover to the following tax year.

Line 33: Total expenses

If Line 32f is a negative amount, subtract it from the total of Lines 10 through 32e. Enter the result here.

Line 34: Net farm profit (or loss)

Net loss

If Line 33 is more than Line 9, don’t enter your loss on line 34 until you have applied the at-risk rules and the passive activity loss rules.

At-risk rules

In most cases, if you have a loss from a farming activity and amounts invested in the activity for which you aren’t at risk, you must complete IRS Form 6198 to figure your allowable loss.

If you have any of the following amounts not at risk, check the box in Line 36b:

- Nonrecourse loans used to finance the activity, to acquire property used in the activity, or to acquire the activity that aren’t secured by your own property (other than property used in the activity).

- An exception exists for certain nonrecourse financing borrowed by you in connection with holding real property

- Cash, property, or borrowed amounts that are protected against loss by:

- Guarantees

- Stop-loss agreements

- Similar arrangements

- Amounts borrowed from a person who has an interest in the activity, or who is a related person under IRC Section 465(b)(3)(C)

You may also need to file IRS Form 461, which limits business losses.

Net profit

If Line 9 is greater than Line 33, and you don’t have prior year unallowed passive activity losses, subtract Line 33 from Line 9. The result is your net profit.

If Line 9 exceeds Line 33, and you have prior year unallowed passive activity losses, you must calculate the amount of prior year passive activity losses that you may claim by using IRS Form 8582.

Make sure to indicate that you are including prior year passive activity losses by entering “PAL” to the left of the entry space.

If you checked the “No” box on Line E, you may need to include information from this schedule on IRS Form 8582, even if you have a net profit.

Reporting net profit or loss

Once you have figured your net profit or loss, report based upon your taxpayer status, outlined below.

Individuals

Enter your net profit or loss on Line 34 and on

- IRS Schedule 1 (Form 1040), Line 6

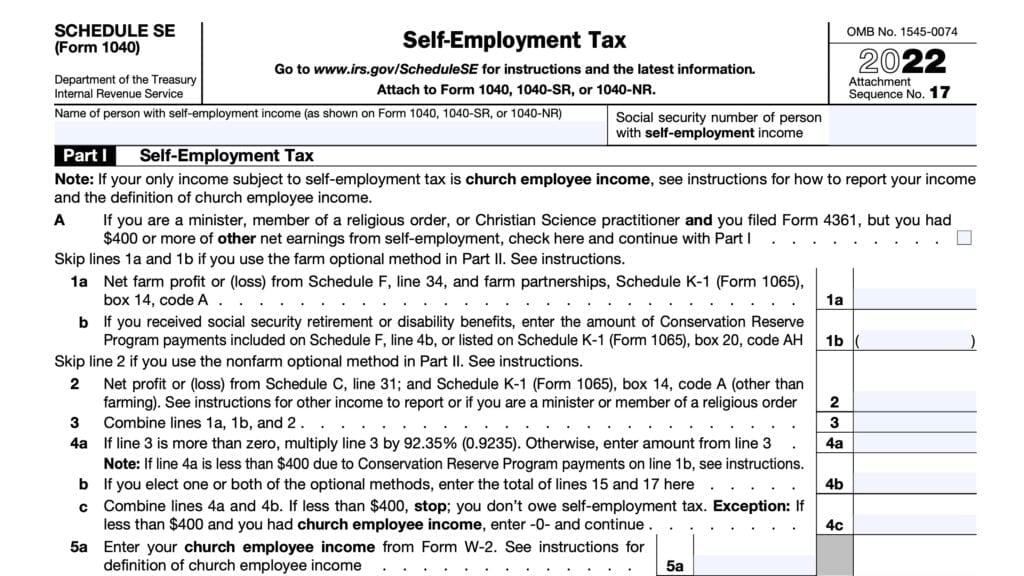

- IRS Schedule SE, Line 1a

Nonresident aliens should enter the amount on Schedule SE if you are covered under the United States Social Security system due to an international social security agreement.

Partnerships

Enter the net profit or loss on Line 34 and on IRS Form 1065, Line 5. Excess business loss rules are applied at the partner level.

Trusts and estates

Enter the net profit or loss on Line 34 and on IRS Form 1041, Line 6.

Line 35: Reserve for future use

Leave blank.

Line 36

Check the appropriate box. If some of your investment is not at risk, then see the at-risk rules, located in the Line 34 steps, above.

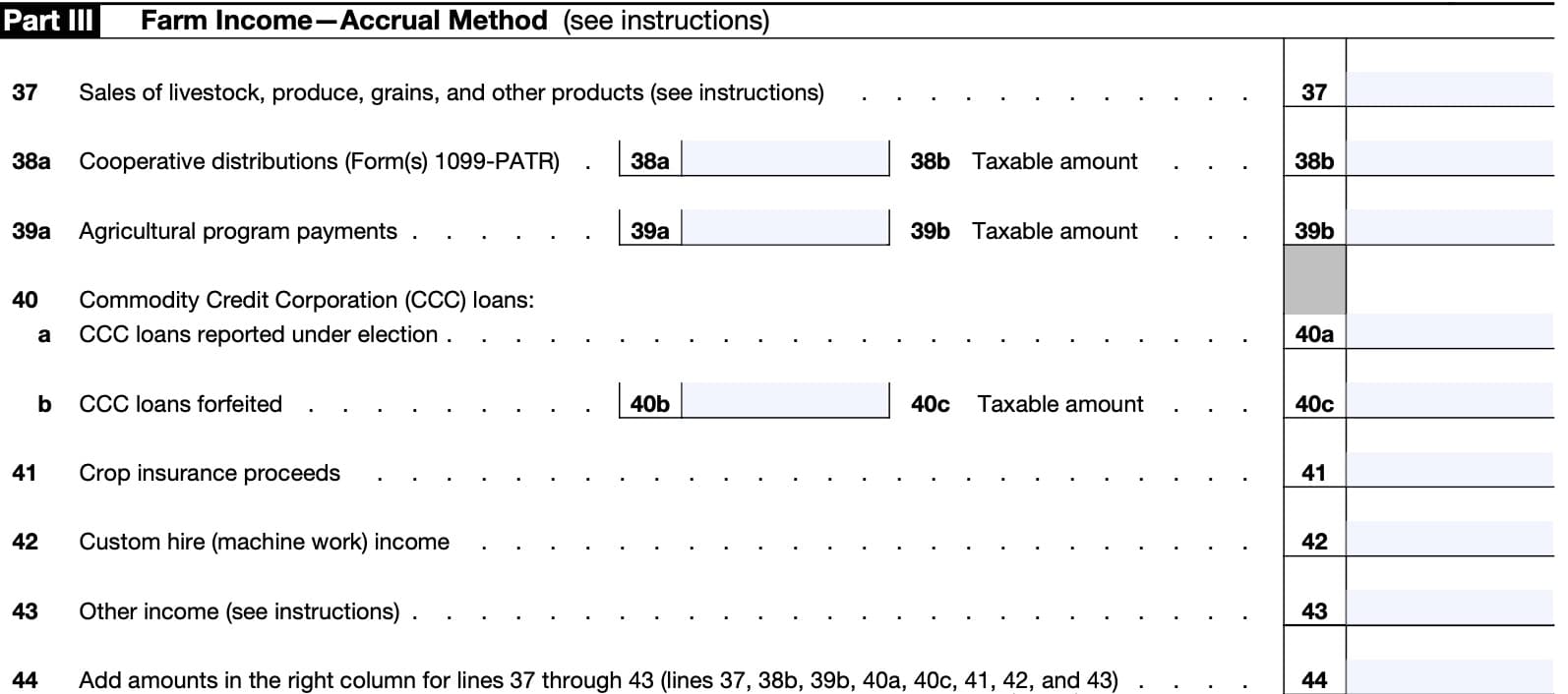

Part III: Farm Income-Accrual Method

You may be required to use the accrual method of accounting. If you use the accrual method, report farm income when you earn it, not when you receive it.

In most cases, you must include animals and crops in your inventory if you use this method.

Line 37: Sales of livestock, produce, grains, and other products

Enter the sales of livestock, produce, grains, and other products, as outlined in Part I.

Use the Line 1 instructions for any sales related to purchased items, and the Line 2 instructions for reporting sales of any items you grew.

Enter the total in Line 37.

Line 38: Cooperative distributions

Follow the instructions for Line 3a and Line 3b, in Part I.

Line 39: Agricultural program payments

Follow the instructions for Line 4a and Line 4b, in Part I.

Line 40: commodity credit corporation (CCC) loans

Follow the instructions for Line 5a, Line 5b, and Line 5c, in Part I.

Line 41: Crop insurance proceeds

Enter any proceeds from crop insurance in Line 41.

Line 42: Custom hire (machine work) income

Enter any income from custom hire or machine work activities that you received as supplemental income in Line 42.

Line 43: Other income

Enter any other income not otherwise reported in Lines 37 through 42. This may include:

- Illegal federal irrigation subsidies

- Bartering income.

- Income from cancellation of debt

- Generally reported on IRS Form 1099-C

- State gasoline or fuel tax refunds you received in the tax year

- Any amount included in income from Line 3 of IRS Form 6478, Biofuel Producer Credit

- Any amount included in income from Line 10 of IRS Form 8864, Biodiesel, Renewable Diesel, or Sustainable Aviation Fuel Mixture Credit

- The amount of credit for federal tax paid on fuels claimed on IRS Schedule 3 from the prior tax year

- Any recapture of excess depreciation on any listed property, if the business use percentage of that property decreased to 50% or less in the tax year.

- Includes any Section 179 expense deduction

- Use Part IV of IRS Form 4797, Sales of Business Property, to figure the recapture.

- The inclusion amount on leased listed property, other than vehicles, when the business use percentage drops to 50% or less.

- Any recapture of the deduction or credit for clean-fuel vehicle refueling property or alternative fuel vehicle refueling property used in your farming business.

- Any income from breeding fees, or fees from renting teams, machinery, or land that isn’t reported on IRS Schedule E (Form 1040) or IRS Form 4835.

- The gain or loss on the sale of commodity futures contracts if the contracts were made to protect you from price changes.

- These are a form of business insurance and are considered hedges.

- If you had a loss in a closed futures contract, enclose the amount of the loss in parentheses.

- The amount of any payroll tax credit taken by an employer for qualified paid sick leave and qualified paid family leave under the FFCRA and the ARP.

Line 44

Add the amounts from Lines 37 through 43, above. Enter the total in Line 44.

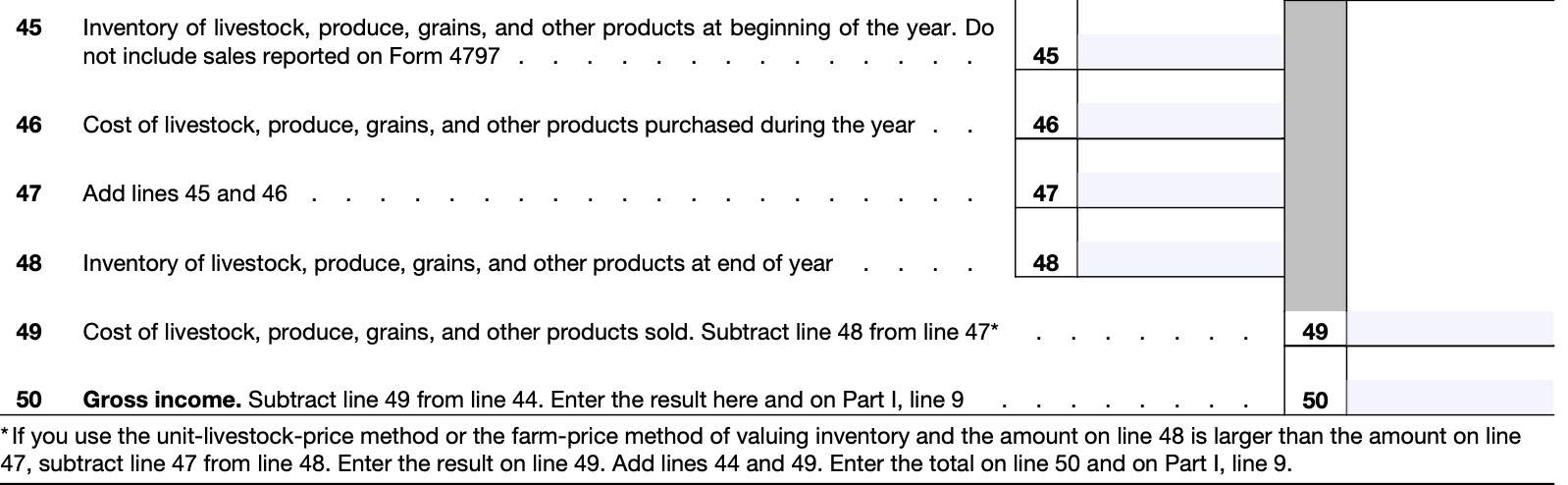

Line 45: Inventory of livestock, produce, grains, and other products at beginning of the year

Enter the inventory of livestock, produce, grains, or other products from the beginning of the tax year. However, do not include any sales that you reported as sales of business property on IRS Form 4797.

Line 46: Cost of livestock, produce, grains, and other products purchased during the year

Enter the cost of livestock, produce, grains, or other products that you purchased throughout the tax year.

Line 47

Add Line 45 and Line 46. Enter the total here.

Line 48: Inventory of livestock, produce, grains, and other products at the end of the year

Enter the end of the year inventory for livestock, produce, grains, or other farm products.

Line 49: Cost of livestock, produce, grains, and other products sold

Subtract Line 48 from Line 47, then enter the result here.

If you use the unit-livestock-price method or the farm-price method of valuing inventory and the Line 48 amount is larger than the amount on Line 47, then do the following:

- Subtract Line 47 from Line 48

- Enter the result on Line 49

- Add Lines 44 and 49

- Enter the total on Line 50 and on Part I, Line 9.

Line 50: Gross income

Unless otherwise indicated in Line 49, subtract Line 49 from Line 44. Enter the result here and on Line 9, in Part I.

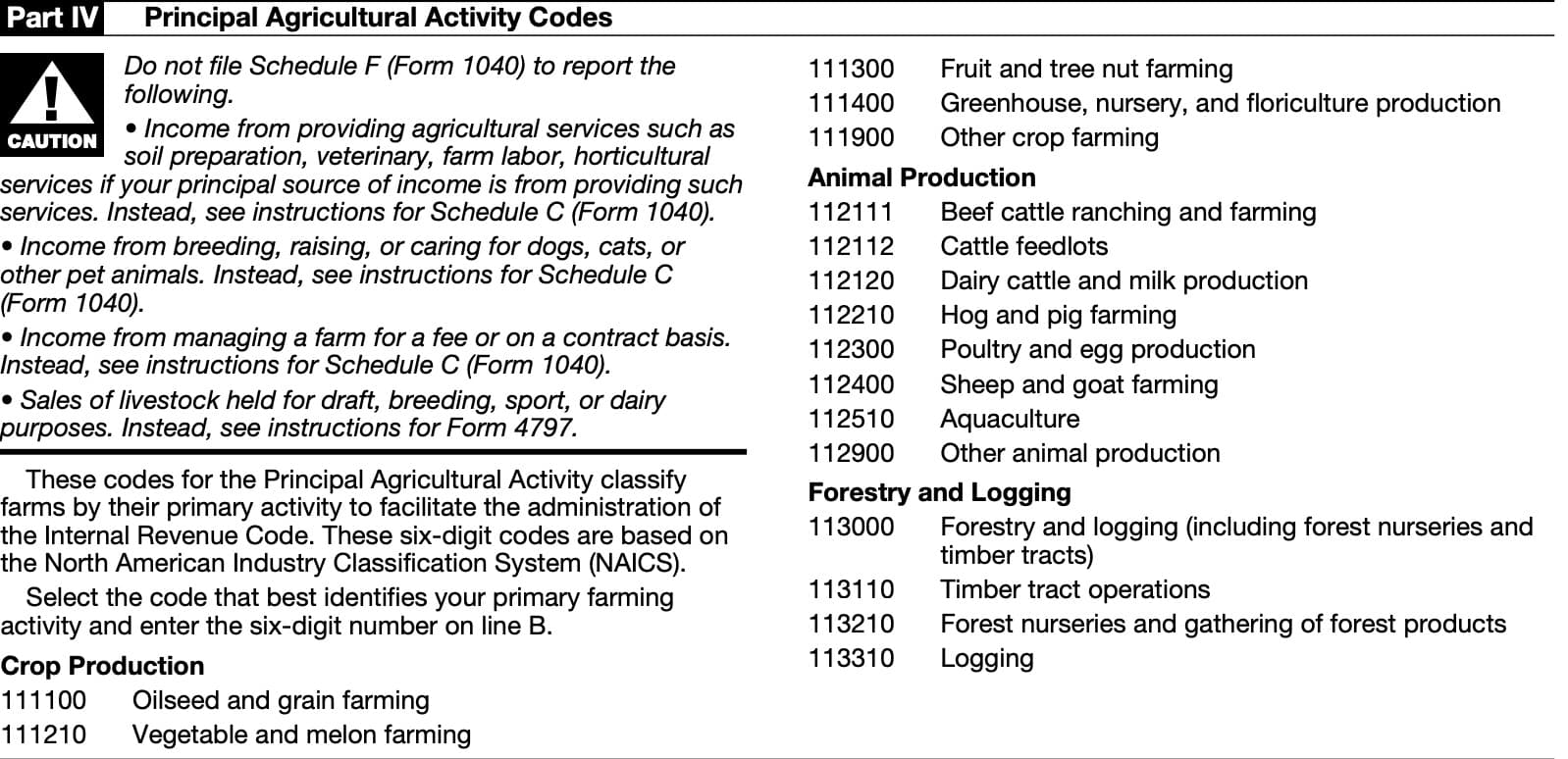

Part IV: Principal Agricultural Activity Codes

Part IV contains principal agricultural activity codes as determined by the North American Industry Classification System (NAICS). Below is a listing of each code and its definition, according to NAICS.

Use the best-fitting code for your Line B entry at the top of IRS Schedule F.

Crop production

111100: Oilseed and grain farming

This industry group comprises establishments primarily engaged in (1) growing oilseed and/or grain crops and/or (2) producing oilseed and grain seeds. These crops have an annual life cycle and are typically grown in open fields.

111210: Vegetable and melon farming

This U.S. industry comprises establishments primarily engaged in one or more of the following:

- Growing melons and/or vegetables (except potatoes; dry peas; dry beans; field, silage, or seed corn; and sugar beets);

- Producing vegetable and/or melon seeds; and

- Growing vegetable and/or melon bedding plants

111300: Fruit and tree nut farming

This industry group comprises establishments primarily engaged in growing fruit and/or tree nut crops. The crops included in this industry group are generally not grown from seeds and have a perennial life cycle.

111400: Greenhouse, nursery, and floriculture production

This industry group comprises establishments primarily engaged in growing crops of any kind under cover and/or growing nursery stock and flowers. “Under cover”” is generally defined as greenhouses.

111900: Other crop farming

This industry group comprises establishments primarily engaged in

- Growing crops such as tobacco, cotton, sugarcane, hay, sugar beets, peanuts, agave, herbs and spices, and hay and grass seeds, or

- Except oilseed and/or grain; vegetable and/or melon; fruit and tree nut; and greenhouse, nursery, and/or floriculture products,

- Growing a combination of crops

- Except a combination of oilseed(s) and grain(s) and a combination of fruit(s) and tree nut(s).

Animal production

112111: Beef cattle ranching and farming

This U.S. industry comprises establishments primarily engaged in raising cattle (including cattle for dairy herd replacements).

112112: Cattle feedlots

This U.S. industry comprises establishments primarily engaged in feeding cattle for fattening.

112120: Dairy cattle and milk production

This industry comprises establishments primarily engaged in milking dairy cattle.

112210: Hog and pig farming

This industry comprises establishments primarily engaged in raising hogs and pigs. These establishments may include farming activities, such as breeding, farrowing, and the raising of weanling pigs, feeder pigs, or market size hogs.

112300: Poultry and egg production

This industry group comprises establishments primarily engaged in breeding, hatching, and raising poultry for meat or egg production.

112400: Sheep and goat farming

This industry group comprises establishments primarily engaged in raising sheep, lambs, and goats, or feeding lambs for fattening.

112510: Aquaculture

May include finfish farming and fish hatcheries, shellfish farming, or other aquaculture activities.

112900: Other animal production

This industry group comprises establishments primarily engaged in raising animals and insects (except cattle, hogs and pigs, poultry, sheep and goats, and aquaculture) for sale or product production.

These establishments are primarily engaged in raising one of the following:

- Bees

- Horses and other equines

- Rabbits and other fur-bearing animals

- Producing products from such animals, such as honey

Establishments primarily engaged in raising a combination of animals with no one animal or family of animals accounting for one-half of the establishment’s agricultural production (i.e., value of animals for market) are included in this industry group.

Forestry and logging

113000: Forestry and logging (includes forest nurseries and timber tracts)

113110: Timber tract operations

This industry comprises establishments primarily engaged in the operation of timber tracts for the purpose of selling standing timber.

113210: Forest nurseries and gathering of forest products

This industry comprises establishments primarily engaged in:

- Growing trees for reforestation and/or

- Gathering forest products, such as gums, barks, balsam needles, rhizomes, fibers, Spanish moss, ginseng, and truffles

113310: Logging

This industry comprises establishments primarily engaged in one or more of the following: (1) cutting timber; (2) cutting and transporting timber; and (3) producing wood chips in the field.

Video walkthrough

Watch this informative video to learn more about reporting farming profit or loss on IRS Schedule F.

Frequently asked questions

Farmers must report their operating income and expenses on Schedule F, when filing their income tax return. Net farm profit or loss is reported on Line 34. Net farm income is subject to self-employment tax.

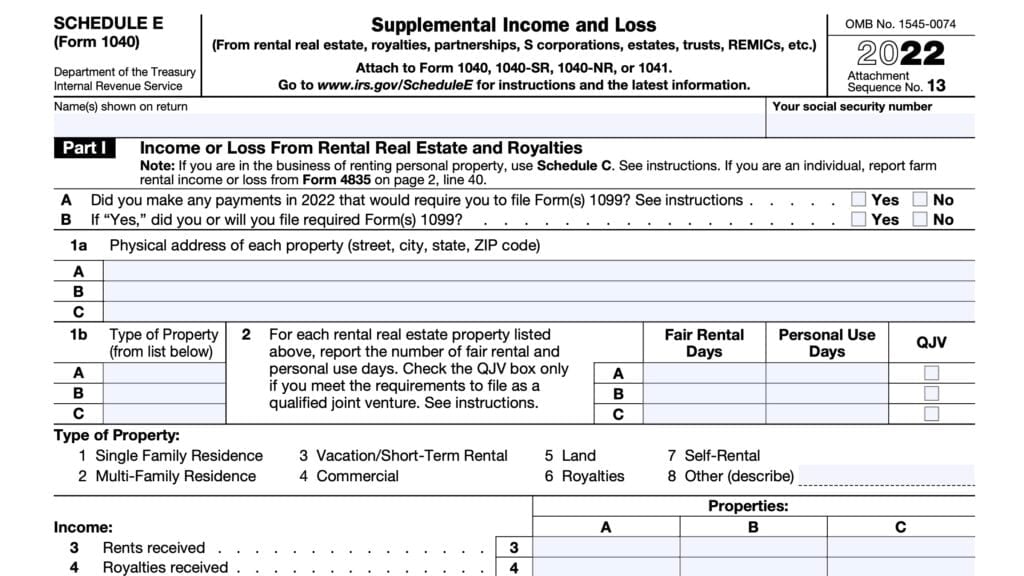

Generally, Schedule F is used by farmers if they materially participated in producing a crop. Farmers who generate income through rental income will report that income on Schedule E. Unlike Schedule F, Schedule E income generally is not subject to self-employment tax.

Where can I find IRS Schedule F?

You can find this tax form on the IRS website. For your convenience, we’ve attached the latest version here.

Related tax forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!