IRS Form 6198 Instructions

Business owners enjoy many tax break opportunities under the Internal Revenue Code, such as deducting business losses on an income tax return. As a general rule, being able to take a tax deduction largely depends on whether the owner is actually taking an entrepreneurial risk. In this article, we’ll cover the IRS’ at-risk rules and how to use IRS Form 6198 to determine:

- Profit or loss from an at-risk activity for the current year

- Amount at risk for the current tax year

- Amount you can deduct for your business losses in a given tax year

Let’s start by walking through IRS Form 6198, step by step.

Table of contents

How do I complete IRS Form 6198?

Fortunately, this tax form is only one page long, so it’s not terribly long. There are 4 parts to IRS Form 6198, which we’ll go through, one at a time.

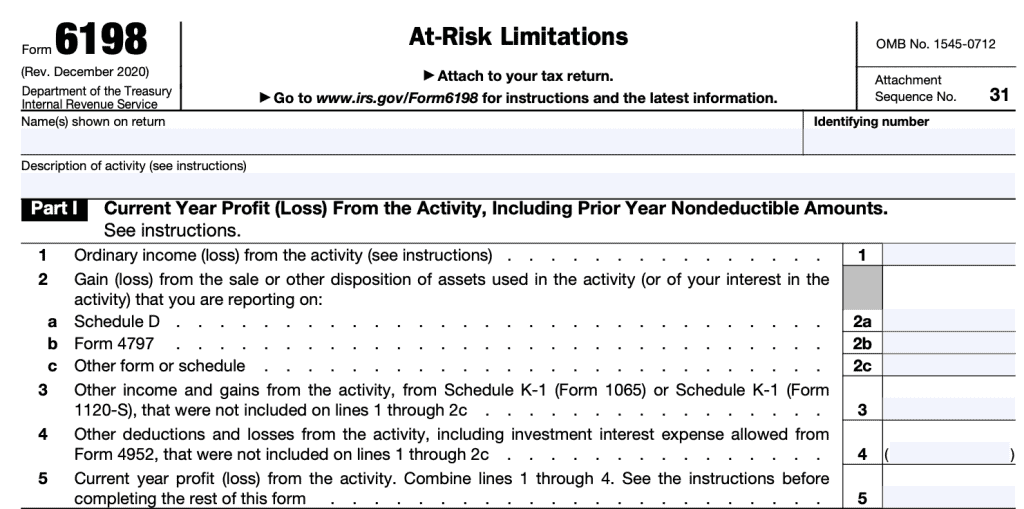

Part I: Current Year Profit/Loss From the Activity, Including Prior Year Nondeductible Amounts

In Part I, you will calculate the current year profit or loss.

Line 1: Ordinary Income

For taxpayers other than S-corporation shareholders or partners

Enter your ordinary income or loss from the at-risk activity without regard to the at-risk limitations. This is the amount you get when you subtract your total deductions from your total income from the activity for the current taxable year.

This includes any deductible loss from previous years not allowed because of the at-risk rules.

For S-corporation shareholders or partners

Enter the amount from box 1 of your current year Schedule K-1, plus any deductible loss from previous years not allowed because of the at-risk rules.

Line 2: Gain or loss from the sale or other disposition of assets used in the activity or business interest

Combine all capital gains and losses and ordinary gains and losses from the sale or other disposition of assets used in the activity or of your interest in the activity. Enter gains and losses without regard to:

- At-risk limitations

- Any limitation on capital losses, or

- Passive activity loss limitations

For taxpayers other than S-corporation shareholders or partners

Include any prior year losses that you could not deduct because of the at-risk rules. This includes your current year:

- Schedule D (Form 1040 or Form 1040-SR),

- Form 4797, Sales of Business Property, or

- Other forms and schedules

However, do not include any item on Line 2c that belongs on Schedule D or Form 4797. Also, enter the form number or schedule letter to the left of the entry space for any amount you enter on Line 2c.

For S-corporation shareholders or partners

Include current year gains and losses and prior year losses attributable to the activity that you could not deduct because of the at-risk rules.

Line 3: Other income and gains from the activity

For partners or S corporation shareholders, include other income and gains from Schedule K-1 that you did not include on Lines 1 through 2c.

Line 4: Other deductions and losses from the activity

For partners or S corporation shareholders, include other deductions and losses from Schedule K-1 that you did not include on Lines 1 through 2c.

If you have investment interest expense from your at-risk activity:

You must complete IRS Form 4952, Investment Interest Expense Deduction, to figure your allowable investment interest deduction. Also, you must determine the amount attributable to the at-risk activity.

You will find this on Line 8 of Form 4952. Reduce the allowable investment interest deduction on Form 4952 by the amount you carry over to Form 6198. If you filed Form 6198 for the prior tax year, include any investment interest expense from the prior year that was limited due to the at-risk rules.

Line 5: Current year profit or loss from the activity

Combine Lines 1 through 4. If there is a profit, you may not have to complete the rest of the form. However, you will want to report all of the information, and keep a copy of Form 6198 with your tax records.

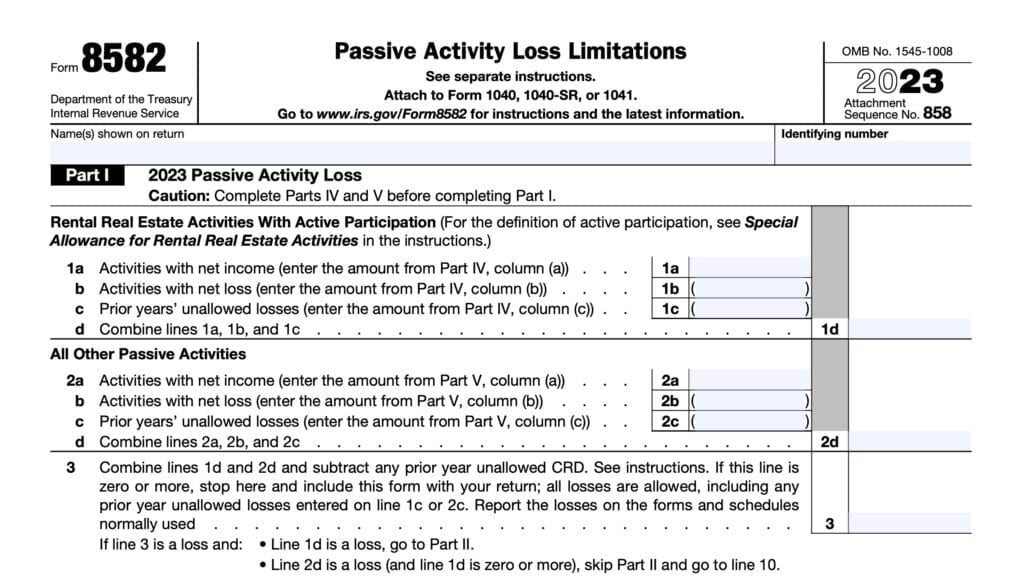

If your current year profit is from a passive activity and you have a loss from any other passive activity, see the instructions for whichever form applies:

- IRS Form 8582, Passive Activity Loss Limitations, or

- IRS Form 8810, Corporate Passive Activity Loss and Credit Limitations

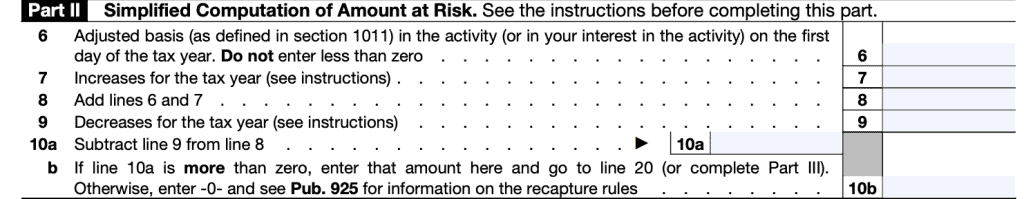

Part II: Simplified Computation of Amount at Risk

In Part II, we will use a simple calculation to determine the at-risk amount of the investment. However, you can only use Part II if you know your adjusted basis:

- In the activity or

- In your interest in the partnership’s or S corporation’s at-risk activity

If this doesn’t apply, skip down to Part III.

Line 6: Adjusted basis in the activity on the first day of the tax year

Sole proprietors or other taxpayers who file either Schedule C or Schedule F cannot reduce this by any liabilities. Do not enter a number less than zero.

If you are a partner, you may need to refer to IRS Publication 541: Partnerships. S-Corporation shareholders should refer to the instructions for IRS Form 1120-S.

Line 7: Increases for the tax year

Do not include any increases in Part I, as noted on Lines 1 or 3. Do include the following changes:

Net fair market value (FMV) of property that you own, but not used in the activity, which secures nonrecourse loans used.

This could include loans that:

- Finance the activity

- Acquire property used in the activity, or

- Acquire your interest in the activity

If any property is included here, be sure to include the outstanding balance of any nonrecourse loans on Line 9, below. See instructions for more detailed guidance.

Cash and adjusted basis of other property contributed to the activity during the tax year.

If you used your own assets to repay a nonrecourse debt, and you included an amount above, the repayments cannot be more than the amount by which the loan balance exceeds the net FMB of property owned, but not used in the business activity, to secure the debt.

Loans used to finance, acquire property, or acquire interest in the activity, and qualified nonrecourse financing.

Do not include amounts already included, either in Line 6 or Line 7.

Percentage depletion for this year deducted in excess of the adjusted basis of depletable property for the activity.

If applicable.

Line 8

Add Lines 6 and 7.

Line 9: Decreases for the tax year

Do not include any increases in Part I, as noted on Lines 1 through 4. Do include the following changes:

Nonrecourse loans

This includes nonrecourse loans, other than qualified nonrecourse financing used to finance the activity, acquire property used in the activity, or acquire your interest in the activity.

Only include amounts that were previously included on Line 6 (Increases for the tax year).

Cash, property, or borrowed amounts protected against loss

This includes amounts protected against loss by a guarantee, stop-loss agreement, or other similar arrangement. Enter this amount only if it was included on line 6.

Do not include items covered by casualty insurance or insurance against tort liability.

Amounts borrowed from a person who has an interest in the activity other than as a creditor or is related person.

Enter these amounts only if they were included on line 6 and not included under (1) or (2) above.

This applies only to activities described in (1) through (5) under At-Risk Activities, earlier. See Pub. 925 for definitions and more details.

Withdrawals and distributions during the tax year.

This includes both cash and the adjusted basis of noncash items (less nonrecourse liabilities to which the noncash items are subject) — including assets used in the activity to repay certain debts.

Nonrecourse liabilities included on Line 6 of property you contributed to the activity.

If applicable.

Line 10

Subtract Line 9 from Line 8.

If the amount on this line is smaller than Line 5, you may want to complete Part III to see if Part III gives you a larger amount at risk.

If the amount on Line 10b is zero, you may be subject to the recapture rules. See Pub. 925 for more details.

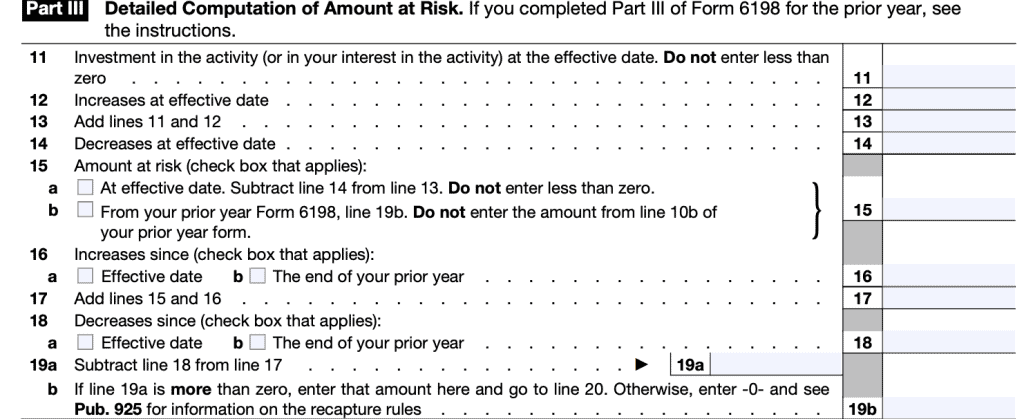

Part III: Detailed Computation of Amount at Risk

Use Part III of Form 6198 if you are not able to use Part II, Simplified Computation of Amount at Risk.

If you completed Part III of Form 6198 for this activity for the prior tax year, skip lines 11 through 14. Then, see the instructions for lines 15 and 16, and the instructions for line 18, later, to determine the amounts to enter on those lines.

Effective Dates

For most at-risk activities, the effective date is the first date of the first day of the tax year after 1975.

For wells, any well started prior to September 30, 1978 is not subject to at-risk rules. For wells started on October 1, 1978 or later, the effective date is usually October 1, 1978.

Real property placed into service after 1986 may be subject to at-risk rules. See the instructions for more guidance.

If the activity began on or after one of the effective dates shown below and you did not complete Part III of Form 6198 for this activity for the prior tax year, skip lines 11 through 14. Enter -0- on line 15 and complete the rest of Part III.

We will not cover Lines 11 through 14 in this guide. If Lines 11 through 14 may apply to your situation, see the instructions for more details.

Line 15: Amount at risk

Check the appropriate box. This is either:

- At effective date, or

- From prior year’s Form 6198, Line 19b.

In either case, do not enter less than zero. Do not include the amount from Line 10b of the prior year form, and do not include amounts not at risk.

Line 16: Increases

Select the appropriate box. If you previously filed Form 6198, check Box b and include the following:

- Net FMV of property owned (not included in business) that secures nonrecourse financing

- Cash and adjusted basis of other property added since the effective date

- Loans for which you are personally liable

- Total net income since the effective date (do not include a number less than zero)

- Gain recognized on the transfer or disposition of all or part of the activity or of your interest in the activity since the effective date

- Amounts included in income because at-risk amount was less than zero

- All money from outside the activity used since the effective date to repay loans included on Lines 14 and 18

- Percentage depletion deducted in excess of the adjusted basis of the depletable property for the activity since the effective date

- If you are an S corporation shareholder, enter the loans you made to your S corporation since the effective date

Line 17

Add Lines 15 and 16.

Line 18: Decreases

Include the following amounts:

- Cash, property, or borrowed amounts protected against loss by a guarantee, stop-loss agreement, or other similar arrangement entered into since the effective date

- Amounts borrowed since the effective date from a person who has an interest in the activity other than as a creditor, or a related person

- Cash and the adjusted basis of other property withdrawn or distributed since the effective date

- Recourse loans (and qualified nonrecourse financing) changed to nonrecourse loans since the effective date

- Total losses from this activity deducted since the effective date

- Take into account only those years in which you had a net loss. Do not include current year losses or deductions.

- Do not include losses or deductions not taken because of at-risk rules

- Nonrecourse liabilities of property you contributed since the effective date

- Any other at-risk amounts included on Line 15 that changed to not at risk amounts since the effective date

- If you are an S corporation shareholder, do not include any loans that were assumed by the corporation or that were liens or encumbrances on property you contributed to the corporation since the effective date if the corporation took the property subject to the debt

For loans, enter the original amount of the loan you incurred, not the current balance.

Line 19

Subtract Line 18 from Line 17.

If the amount on line 19b is zero or less, you may be subject to the recapture rules. See Pub. 925. If the amount on 19b is more than zero, enter that amount and go to Line 20.

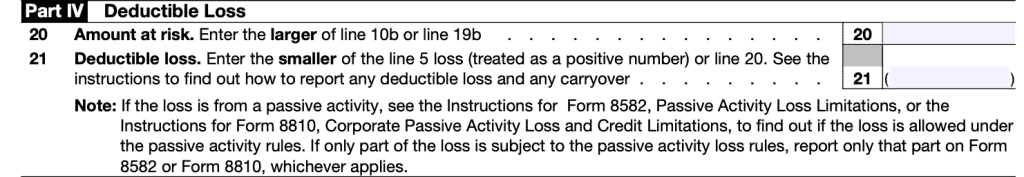

Part IV: Deductible Loss

Line 20: Amount at risk

Enter the larger of Line 10b or Line 19b, above.

Line 21: Deductible loss

Enter the smaller of:

- The loss on Line 5

- The loss on Line 20

If the loss on Line 5 is equal to or less than the amount on Line 20, report the items in Part I in full on your return, subject to any other limitations such as the passive activity rules and capital loss limitations. Follow the instructions for your tax return.

If the loss on Line 5 is more than the amount on Line 20, you must limit your deductible loss to the amount on Line 20, subject to any other limitations.

Video walkthrough

Watch this instructional video for step-by-step guidance on completing IRS Form 6198.

Who is affected by the at-risk rules?

The IRS at-risk rules apply to the following types of taxpayers:

- Individuals, to include partners and S corporation shareholders

- Estates and trusts

- Certain closely held C-corporations

Closely held C-corporation

IRS Publication 925 contains additional information on closely held C-corporations. According to the publication, a closely held corporation exists if “at any time during the last half of the tax year, more than 50% in value of its outstanding stock is owned directly or indirectly by or for five or fewer individuals.”

Use the following rules to determine whether more than 50% of the corporation’s stock is owned by five or fewer individuals:

- Stock that is owned for or by a corporation, partnership, estate, or trust is considered to be proportionately owned by shareholders, partners, or beneficiaries. This applies to direct or indirect ownership.

- An individual is considered to own the stock if it is owned by direct family members. This includes:

- Brothers and sisters (including half brothers and half sisters)

- Spouse

- Ancestors

- Lineal descendants

- Option holders are considered to be the owners of the underlying stock.

- When applying rule (1) or (2), stock considered owned by a person under rule (1) or (3) is treated as actually owned by that person. Stock considered owned by an individual under rule (2) isn’t treated as owned by the individual for again applying rule (2) to consider another the owner of that stock.

- Stock that may be considered owned by an individual under either rule (2) or (3) is considered owned by the individual under rule (3).

These additional guidelines exist to prevent spreading out shareholder’s stock to circumvent the at-risk rules.

What activities are subject to at-risk rules?

The Internal Revenue Service defines the following activities as being subject to IRS at-risk limitations:

- Holding, producing, or distributing motion picture films or video tapes.

- Farming.

- Leasing Section 1245 property, including personal property and certain other tangible property that’s depreciable or amortizable.

- Exploring for, or exploiting, oil and gas.

- Exploring for, or exploiting, geothermal deposits, for wells started after September 1978.

- Any other activity not included in (1) through (5) that’s carried on as a trade or business or for the production of income.

With the addition of (6), it appears that every business activity is subject to IRS at-risk rules. However, that depends on the amount at-risk in your business venture. Below is the IRS’ definition of what is not at-risk.

What is not at-risk?

You are not considered at risk for any of the following:

- Nonrecourse loans

- Investments protected against loss

Nonrecourse loans

Nonrecourse loans are loans where the lender has no means to seize property if the borrower defaults on payments. The investment is considered not at-risk if the nonrecourse loan is used to:

- Finance the activity

- Acquire property used in the activity

- Acquire the taxpayer’s interest in the activity, unless the nonrecourse loan is secured by the taxpayer’s own property not being used in the business activity.

However, a taxpayer is considered at risk for qualified nonrecourse financing secured by real property used in the activity of holding real property (other than mineral property).

Investments protected against loss

This includes cash, property, or borrowed amounts used in the activity that are protected against loss by:

- A guarantee

- Stop-loss agreements

- Similar arrangements

This does not include casualty insurance or insurance against tort liability.

Amounts borrowed from a person who has an interest in the activity or related person

Not at-risk amounts include anything borrowed for use in the activity from:

- A person who has an interest in the activity other than as a creditor, or

- A related person under Section 465(b)(3)(C)

However, this does not apply to:

- (a) amounts borrowed by a corporation from a person whose only interest in the activity is as a shareholder of the corporation, or

- (b) amounts borrowed after May 3, 2004, and secured by real property used in the activity of holding real property (other than mineral property) that, if nonrecourse, would be qualified nonrecourse financing.

This begs the question, “What is nonrecourse financing?”

What is nonrecourse financing?

According to Publication 925, qualified nonrecourse financing is financing for which no one is personally liable for repayment and that’s:

- Borrowed by the taxpayer in connection with the activity of holding real property,

- Secured by real property used in the activity,

- Not convertible from a debt obligation to an ownership interest, and

- Loaned or guaranteed by any federal, state, or local government, or borrowed by the taxpayer from a qualified person.

What is a qualified person?

According to the IRS Form 6198 Instructions, a qualified person is a person who actively and regularly engages in the business of lending money. This might include a loan officer for a bank, credit union, or savings and loan association.

However, a qualified person is not:

- A person related to you unless:

- The person would otherwise be a qualified person but for the relationship and

- The nonrecourse financing is commercially reasonable and on the same terms as loans to unrelated persons,

- The seller of the property (or a person related to the seller), or

- A person who receives a fee as a result of your investment in the property (or a person related to that person).

For real estate investment purposes, this precludes seller-financing as qualified nonrecourse financing.

Certain other cash or property

The at-risk rules apply to any cash or property contributed to the activity or to your interest in the activity that is:

- Financed through nonrecourse indebtedness or protected against loss through a guarantee, stop-loss agreement, or other similar arrangement; or

- Borrowed from a person who has an interest in the activity other than as a creditor or who is related under section 465(b)(3)(C) to a person (except you) having such an interest.

However, this does not apply to:

- (i) amounts borrowed by a corporation from a person whose only interest in the activity is as a shareholder of the corporation, or

- (ii) amounts borrowed after May 3, 2004, and secured by real property used in the activity of holding real property (other than mineral property) that, if nonrecourse, would be qualified nonrecourse financing. See Pub. 925 for definitions.

However, you do not have to file Form 6198 if you:

- Are engaged in an activity included in (6) under At-Risk Activities, earlier, and

- You only have amounts borrowed before May 4, 2004, which meets the requirements of borrowing from a related person or a person with an interest in the business activity, as described above.

Frequently asked questions

Below are some of the more common questions people might have about at-risk rules and IRS Form 6198.

If you have multiple business activities, you may have to either aggregate them onto one form or file separate forms for each business. This depends on the types of business you own, and whether they’re subject to the aggregation rule or the separation rule, as outlined in the Form 6198 instructions.

Generally speaking, any taxpayer subject to the IRS at-risk limitations must file IRS Form 6198. This includes estates, trusts, certain closely held C-corporations, partners in a partnership with amounts not at risk, S-corporation shareholders with amounts not at risk, and individuals who file Schedule C, Schedule E, or Schedule F.

According to IRS Publication 925, Passive Activity and At-Risk Rules, the at-risk rules limit a taxpayer’s losses in an activity to the amount at risk in the activity. In other words, the at-risk rules specifically preclude a taxpayer from taking a tax deduction on business activities where there is no real risk of losing their investment.

Where can I find a copy of IRS Form 6198?

You may find a copy of this tax form on the IRS website, or you may download the PDF version below.

Related Tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!