IRS Form 8582 Instructions

IRS Form 8582 is used by noncorporate taxpayers to report passive activity losses for the current tax year. This form also allows the taxpayer to report the application of previously disallowed passive activity losses to offset passive activity income.

This article will walk you through what you need to know about IRS Form 8582, including:

- What IRS Form 8582 is used for

- Which taxpayers must file Form 8582

- How to complete the form

- Frequently asked questions

Contents

Table of contents

Let’s start by going over the form, step by step.

How do I complete IRS Form 8582?

There are 9 parts to this three-page tax form:

- Part I: Passive Activity Loss

- Part II: Special Allowance for Rental Real Estate Activities With Active Participation

- Part III: Total Losses Allowed

- Part IV: Complete This Part Before Part I, Lines 1a, 1b, and 1c

- Part V: Complete This Part Before Part I, Lines 2a, 2b, and 2c

- Part VI: Use This Part if an Amount Is Shown on Part II, Line 9

- Part VII: Allocation of Unallowed Losses

- Part VIII: Allowed Losses

- Part IX: Activities With Losses Reported on Two or More Forms or Schedules

Before we start, we should point out one thing. Parts IV and V must be completed before starting with Part I.

We’re covering these in chronological order based on how they’re presented on the form, not the order in which you’ll complete them. Let’s begin with Part I.

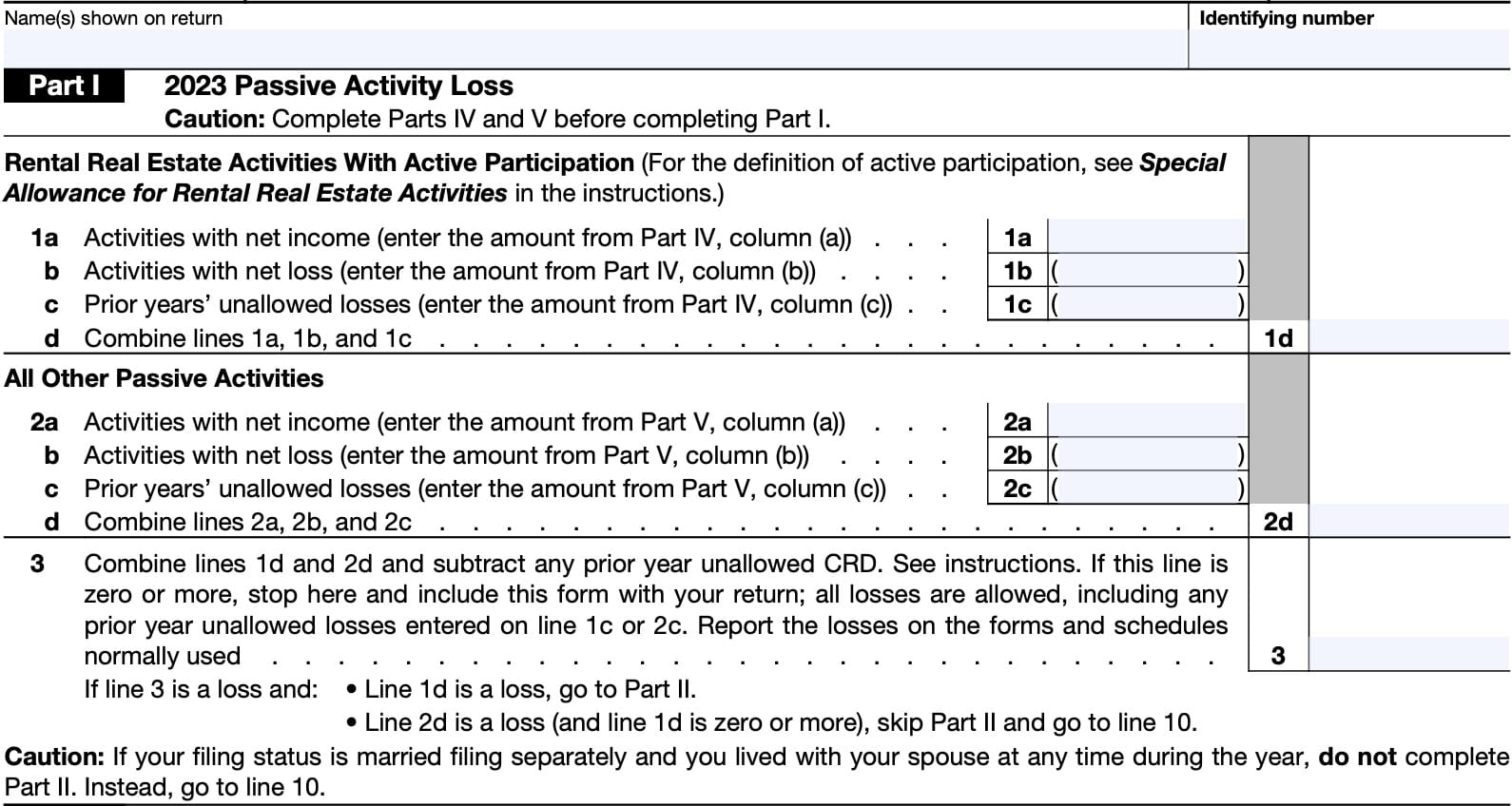

Part I: Passive activity loss

In Part I, you’ll bring forth the calculations from:

- Lines 1a-1d: Real estate rental activities with active participation (from Part IV)

- Lines 2a-2d: All other passive income activities (from Part V)

Line 1

For Line 1, you’ll enter the following:

- Line 1a: Enter the amount from Part IV, column (a)

- Line 1b: Enter the amount from Part IV, column (b)

- Line 1c: Enter the amount from Part IV, column (c)

- Line 1d: Combine Lines 1a-1c

Line 2

For Line 2, you’ll enter the following:

- Line 2a: Enter the amount from Part V, column (a)

- Line 2b: Enter the amount from Part V, column (b)

- Line 2c: Enter the amount from Part V, column (c)

- Line 2d: Combine Lines 2a-2c

Line 3

On Line 3, you’ll combine Lines 1d and 2d.

If Line 1d is a loss, proceed to Part II.

If Line 2d is a loss and Line 1d is zero or more, skip Part II and go to Line 10 (Part III).

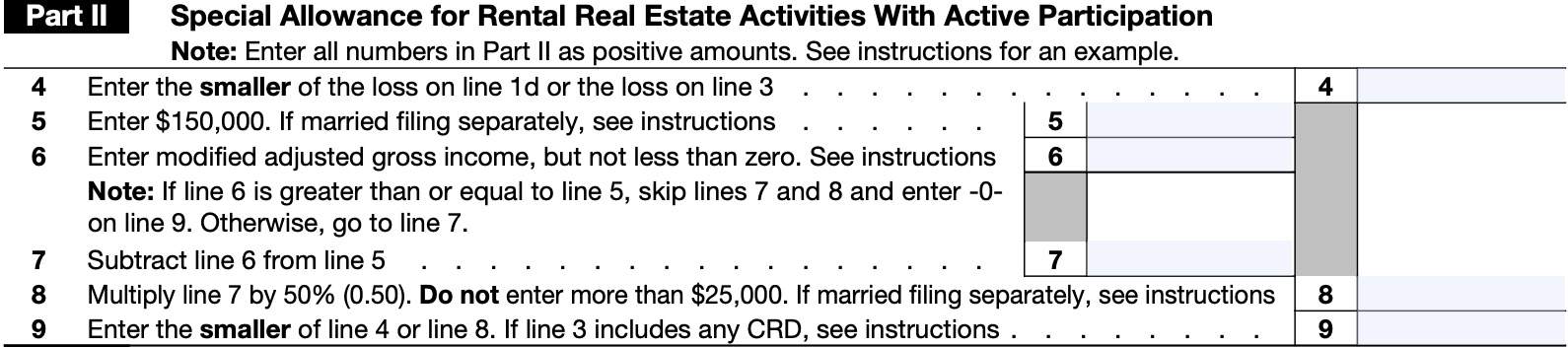

Part II: Special allowance for rental real estate activities with active participation

In Part II, you’ll calculate the maximum special allowance for real estate rentals.

Line 4

On Line 4, you’ll enter the smaller number of:

- Loss on Line 1d

- Loss on Line 3

Line 5

For Line 5, you’ll enter $150,000 unless your filing status is Married Filing Separately (MFS). In this case, the form instructions state to enter $75,000.

Line 6

You’ll enter your modified adjusted gross income (MAGI) n Line 6. For purposes of this form, your MAGI includes your adjusted gross income (AGI) minus the following:

- Passive income or loss included on Form 8582

- Rental activity losses allowed to real estate professionals

- Overall loss from a publicly traded partnership (PTP)

- Taxable Social Security and Tier 1 railroad retirement benefits

- Deductible IRA contributions

- Deductible contributions to select pension plans

- Deduction allowed for the deduction of self-employment income taxes

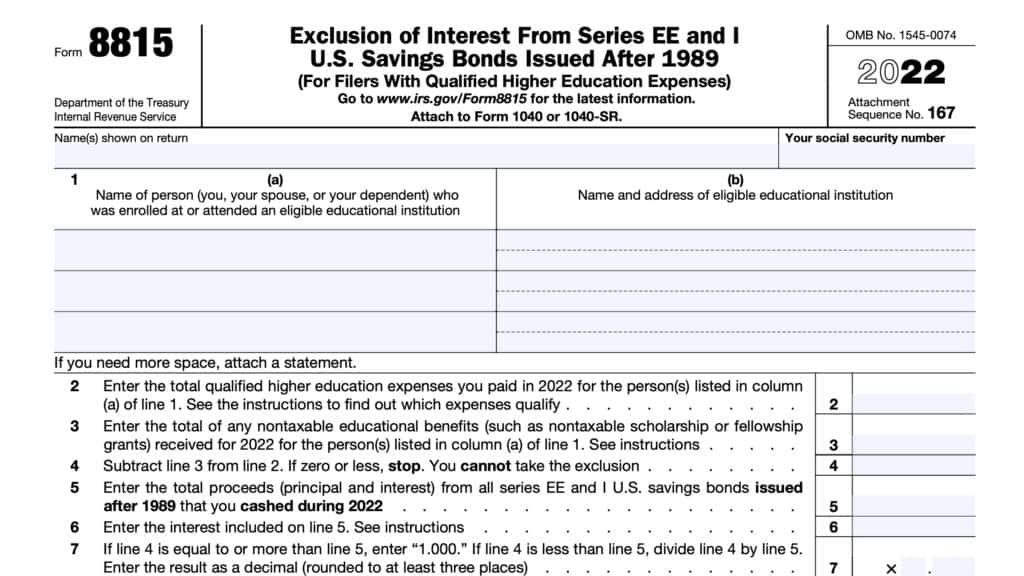

- Interest income exclusion from Series EE and I savings bond used to pay higher education expenses

- Exclusion of amounts received under an employer’s adoption assistance program

- Student loan interest deduction

- Deductions allowed for foreign-derived intangible income

If Line 6 is greater than Line 5, skip Lines 7 and 8 and enter ‘0’ on Line 9. Otherwise, go to Line 7.

Line 7

Subtract Line 6 from Line 5.

Line 8

Multiply Line 7 by 50%. However, you will not enter a number greater than:

- $25,000 if filing under a household status other than MFS

- $12,500 if filing as MFS

Line 9

Enter the smaller of Line 4 or Line 8. If Line 6 (above) was greater than Line 5, enter ‘0.’

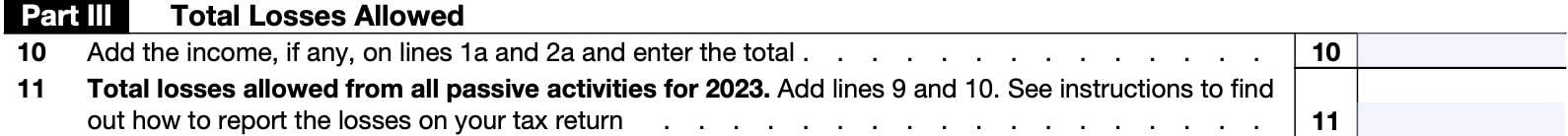

Part III: Total losses allowed

In Part III, you’ll calculate the total passive losses allowed.

Line 10

You’ll add the total income, if any, from Lines 1a and 2a.

Line 11

Add Lines 9 and 10 and enter the total here. You’ll use Parts IV through IX below to determine:

- Which unallowed losses will be carried forward to future tax years

- Which allowed losses you can use to lower your taxable income, and where to report them on your tax return

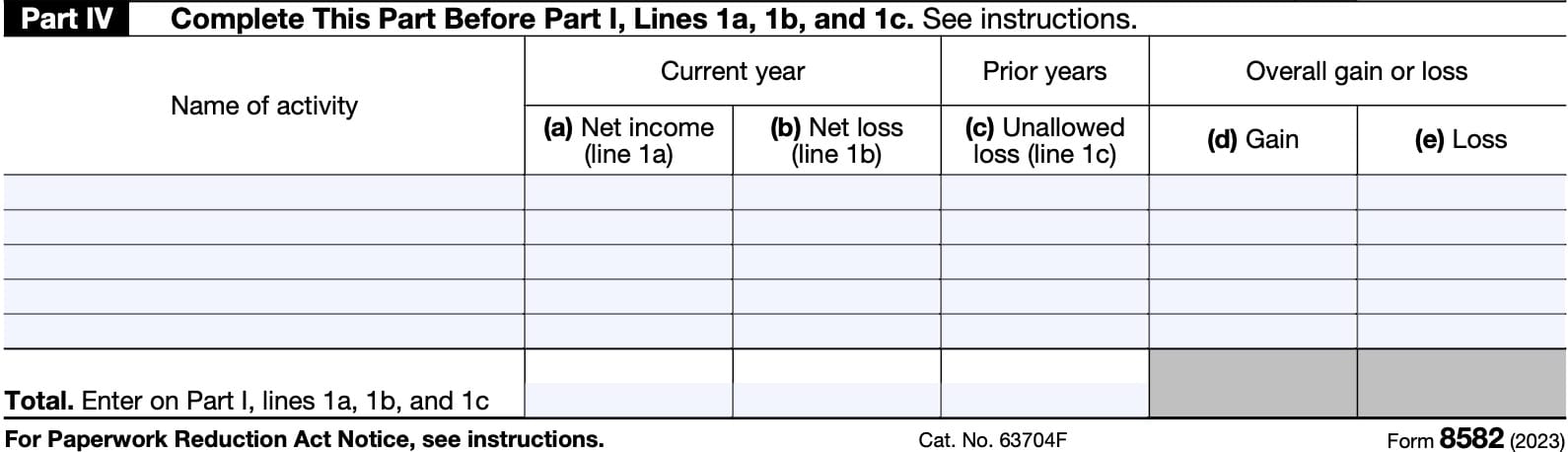

Part IV: Complete this part before Part I, Lines 1a, 1b, and 1c

Part IV is specifically for rental real estate activity. You’ll enter the name of each activity here, as well as:

- Column (a): Current year net income

- Column (b): Current year net loss

- Column (c): Prior year unallowed losses

- Column (d): Overall gain

- Column (e): Overall loss

At the bottom of Part IV, you will combine the amounts in Columns (a) through (c). These numbers will be reported on Lines 1a through 1c as outlined below:

- Report Column (a), Net income, on Line 1a

- Report Column (b), Net loss, on Line 1b

- Report Column (c), Unallowed loss, on Line 1c

If you have activities that show an overall loss in Column (e), then you must allocate your allowed loss on Part III, Line 11 by completing either Part VI, VII, VIII, or IX below.

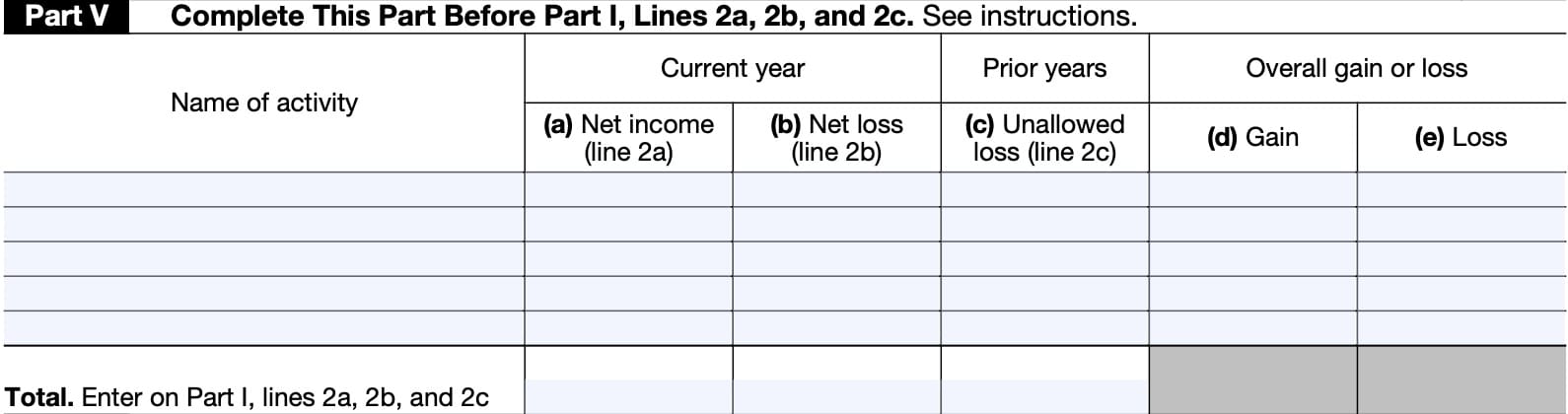

Part V: Complete this part before Part I, Lines 2a, 2b, and 2c

Part V is very similar to Part IV. However, it is specifically for:

- Passive trade or business activities

- Passive rental real estate activities that don’t qualify for the special allowance, AND

- Rental activities other than real estate

As with Part IV, you’ll enter the name of each activity here, as well as:

- Column (a): Current year net income

- Column (b): Current year net loss

- Column (c): Prior year unallowed losses

- Column (d): Overall gain

- Column (e): Overall loss

At the bottom of Part V, you will combine the amounts in Columns (a) through (c). These numbers will be reported on Lines 2a through 2c as outlined below:

- Report Column (a), Net income, on Line 2a

- Report Column (b), Net loss, on Line 2b

- Report Column (c), Unallowed loss, on Line 2c

If you have activities that show an overall loss in Column (e), then you must allocate your allowed loss on Part III, Line 11 by completing either Part VI, VII, VIII, or IX below.

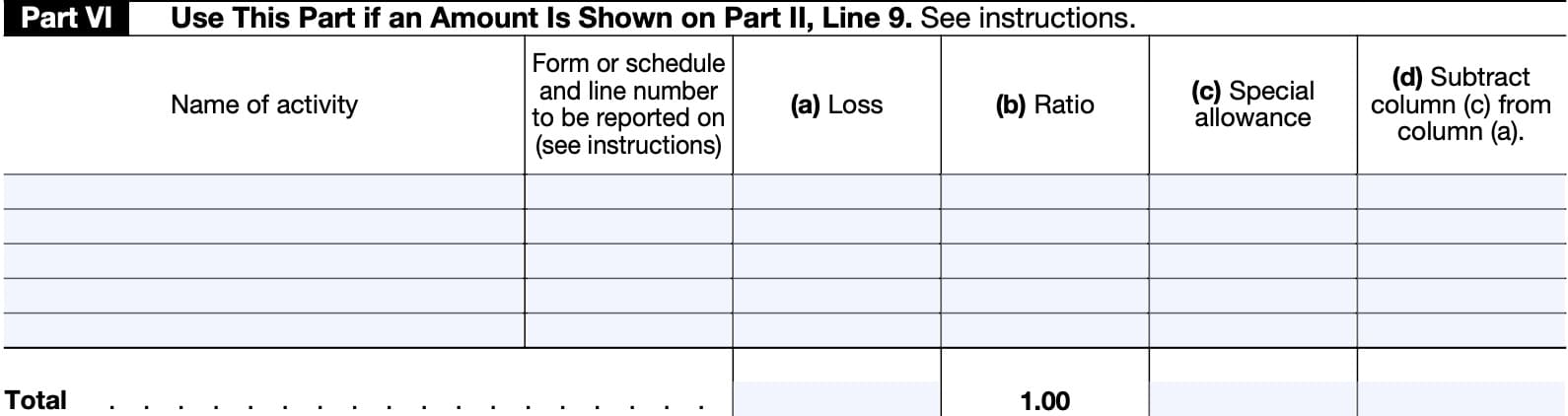

Part VI: Use this part if an amount is shown on Part II, Line 9

You’ll use Part VI to calculate the special allowance for real estate. If you entered an amount on Part II,

line 9, list on Part VI all activities with an overall loss in column (e) of Part IV.

For each activity, you’ll list:

- Activity name

- Form or schedule and line number (for example, IRS Schedule E, Line 28A)

- Column (a): Loss

- Column (b): Ratio

- Column (c): Special allowance

- Column (d): Subtract Column (c) from Column (a)

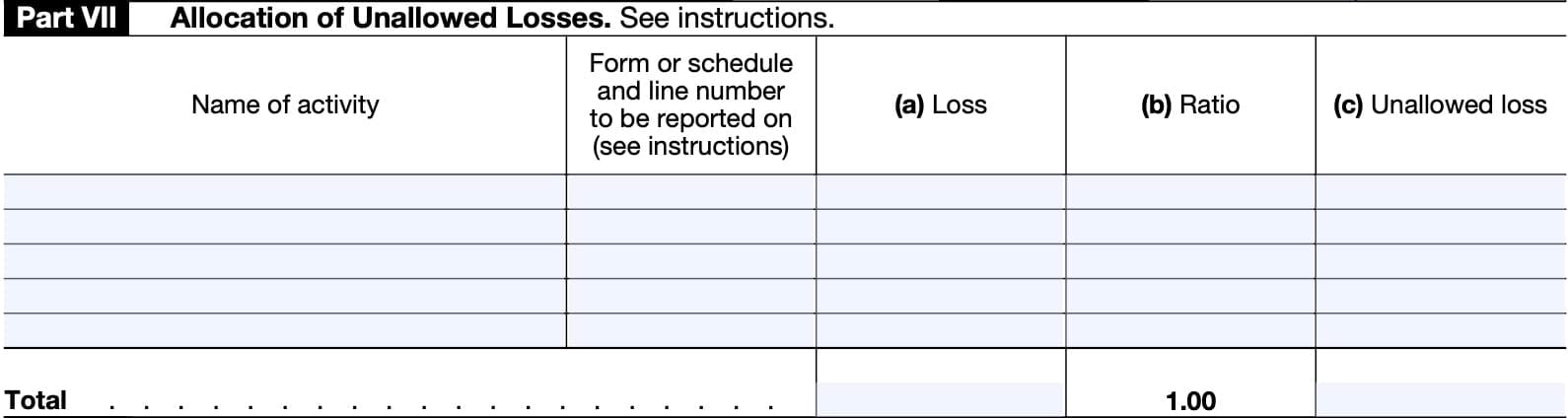

Part VII: Allocation of unallowed losses

You’ll complete Part VII if any activities have:

- A overall loss in column (e) of Part V, or

- Losses in Column (d) of Part VI, or

- Losses in Column (e) of Part IV if you did not have to complete Part VI

Otherwise, you’ll complete Part VII in a similar manner to Part VI. For each activity, be sure to include:

- Activity name

- Form or schedule and line number

- Column (a): Loss

- Column (b): Ratio

- Column (c): Unallowed loss

To calculate the unallowed loss for Column (c), you must:

- Line A: Enter, as a positive amount, Part I, Line 3

- Line B: Enter Part II, Line 9

- Line C: Subtract Line B from Line A

From there, you’ll multiply the ratio in Column (b) above by the amount in Line C. This is the number you’ll place in Column (c) for each activity.

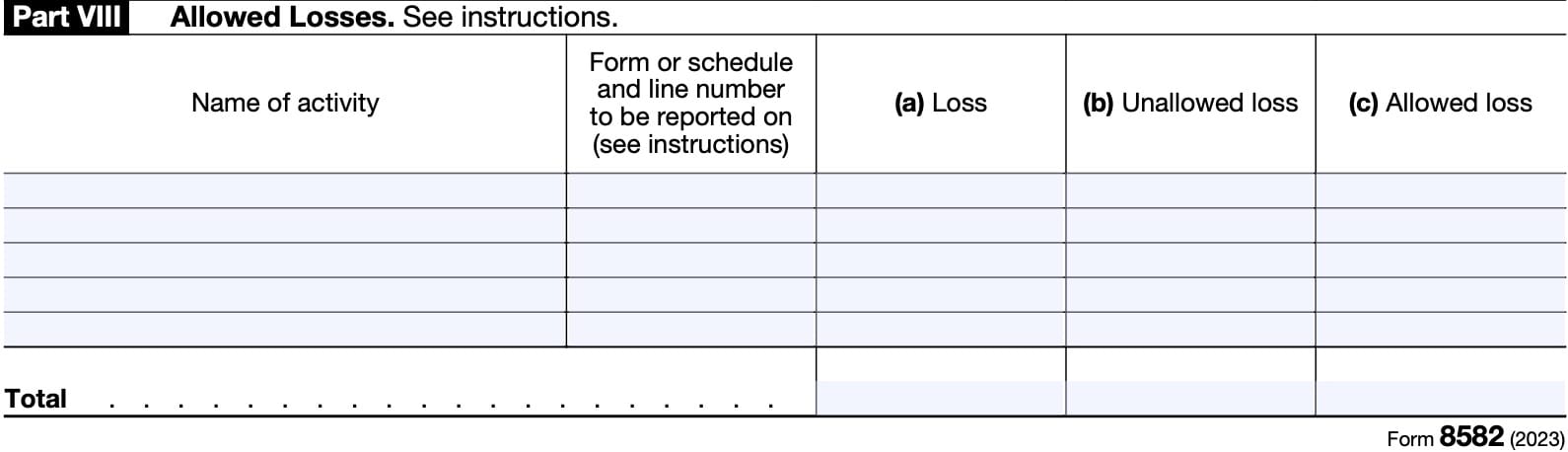

Part VIII: Allowed losses

You’ll use Part VIII for any activity reported in Part VII where the entire loss is reported on one form or schedule and no separate transactions need to be identified.

For example, you will report all of the allowed loss from an activity in Part VII on Schedule E of your Form 1040. You’ll use Part VIII to determine the allowed loss, even if that allowed loss is from two different tax years (i.e. current year and prior year unallowed loss).

For each activity, you’ll list:

- Activity name

- Form or schedule and line number

- Column (a): Loss

- Column (b): Unallowed loss

- Column (c): Allowed loss

For Column (a), you’ll add the total losses reported in Columns (b) and (c) from Parts IV and V.

Column (b) is the same number as Column (c) from Part VII.

To calculate Column (c), you’ll subtract Column (b) from Column (a). This is your allowed loss.

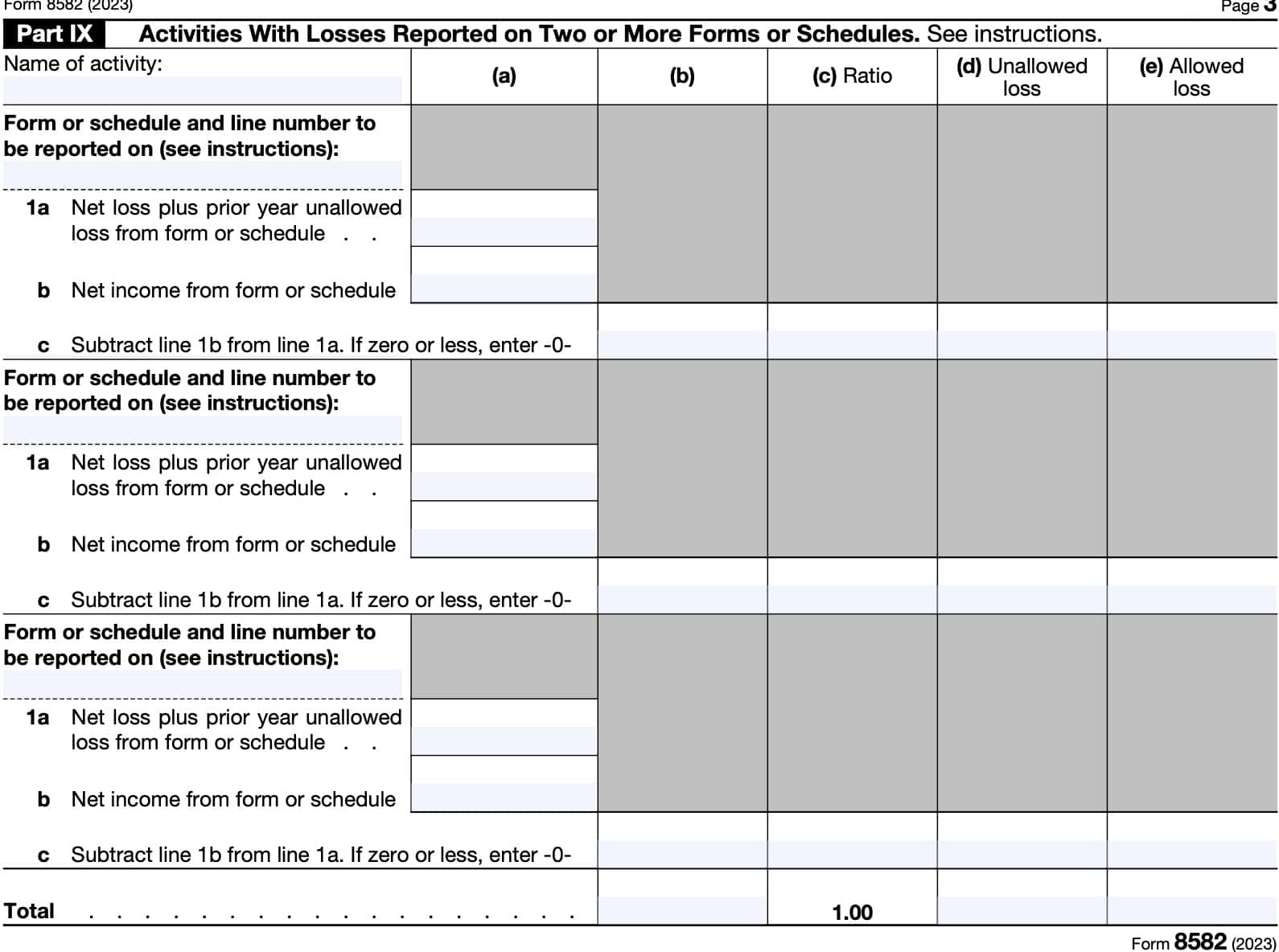

Part IX: Activities with losses reported on two or more forms or schedules

Part IX is where your tax professional earns their keep.

This part helps the taxpayer calculate allowed losses for activities reported on two or more forms or schedules, if those losses were to cause a difference in tax liability. Or in different sections on the same schedule.

The most common forms and schedules are:

- IRS Schedule C, Profit or Loss from Business

- IRS Schedule E, Supplemental Income & Loss

- IRS Schedule F, Profit or Loss from Farming

- IRS Form 8949, Sales and Dispositions of Capital Assets (28% tax rate losses and non-28% tax rate losses

Because of the wide variety of possibilities, you should have your tax professional complete this section. However, the IRS website also contains instructions for this step, depending on the forms and schedules involved.

Who files IRS Form 8582?

Individuals, estates, and trust who have passive activity deductions must file IRS Form 8582, unless they qualify for an exception.

Passive activity loss exceptions

Certain exceptions exist to the passive activity loss limitations:

- If the taxpayer qualifies for a special allowance as a real estate professional actively participating in rental real estate activities

- If the taxpayer sells their interest in the passive activity in the same tax year as incurring the activity loss

Special allowance for rental real estate activities

For real estate professionals, there exists a special allowance that allows rental real estate losses to be reported on Schedule E, instead of Form 8582.

However, to qualify for this allowance, the following must be true:

- Real estate rental activities with active participation were the only passive activity

- There are no passive loss carried forward to the current year from a prior-year tax return

- Total loss is $25,000 or less ($12,500 for married individuals filing separate returns)

- If married and filing separately, taxpayer lived apart from spouse for the entire taxable year

- Modified adjusted gross income (MAGI) is $50,000 or less for single individuals ($100,000 if married filing a joint return)

- No real estate rental properties are held in a trust, estate, or as a limited partner in a limited partnership

Any rental real estate activity that does not meet the real estate professional allowance criteria is considered a passive rental real estate activity.

What activities are not considered passive activities?

According to the Internal Revenue Service, the following are considered nonpassive activities:

- Trade in which you materially participated for the tax year. There are various tests that the IRS uses to determine material participation.

- The most common test is whether the taxpayer worked at least 500 hours during the tax year in that business activity.

- Rental real estate activity in which you materially participated in as a real estate professional

- Working interest in an oil or gas well, as long as it’s owned directly by the taxpayer

- Trading personal property for the owners of interests in this activity

If you need to make a determination on whether your business activity is subject to passive loss rules, you should talk with your tax advisor.

Video walkthrough

Watch this instructional video for step by step guidance on IRS Form 8582.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

A passive activity loss is when the total loss, including prior year unallowed losses, from passive activities exceed the total income from passive activities.

Generally speaking, passive activities include:

-Trade or business activities in which you did not materially participate

-Rental real estate activities, regardless of participation level

Usually, losses from business activities may be used to offset income from other sources. However, losses incurred from passive activities usually cannot be used to offset nonpassive income. As a general rule, if passive losses exceed passive activity income, then they cannot be used in the current tax year. In this case, those passive activity losses (PALs) are usually carried forward to future years when they may be used to offset future passive income.

Where can I get a copy of IRS Form 8582?

You may download a copy of IRS Form 8582 from the IRS website or by clicking the file below.

Related tax forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!

What do you think?

Let me know what you think of this article in the comments. If you feel like this article helped you, please share it, pin it or tag me. And if you have any additional tips, please share them in the comments.