Form SSA 1724 Instructions

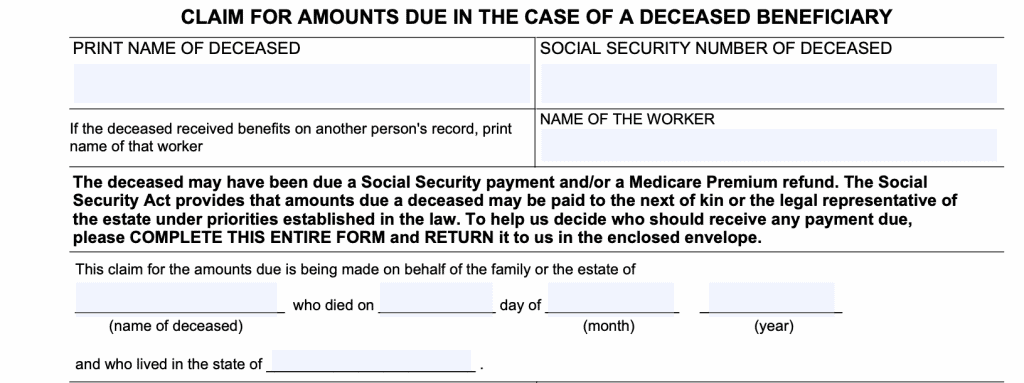

If you’re handling the affairs of a deceased relative, you should know that unpaid Social Security benefits or Medicare refunds might go to the decedent’s estate. And if that’s the case, you’ll need to complete and submit Form SSA-1724 (technically Form SSA-1724-F4) to the Social Security Administration (SSA).

Table of contents

Let’s start with how to complete this form.

How do I fill out SSA 1724?

Form SSA 1724 is fairly straightforward. Although it does not have instructions, most of the fields are self-explanatory. Let’s start with the header, which contains the decedent’s information.

Deceased person’s information

In this section, you’ll complete the deceased individual’s information. This includes the following information:

- Printing the name of the deceased

- Deceased’s Social Security Number

- Date of death

- State of residence

If the decedent received benefits on another person’s record, print the name of that person.

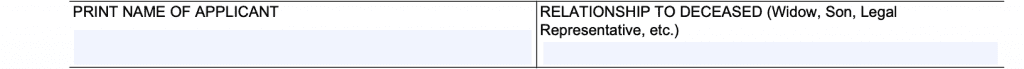

Applicant’s information

In this section of the form, you’ll complete the information requested:

- Print name of the applicant

- Applicant’s relationship to deceased

Next of kin information

The next of kin information takes up most of the form. It’s important to include ALL of the information as requested by the SSA.

The Form SSA-1724 will give specific instructions on the required information. Omitting information outside of these instructions doesn’t necessarily change entitlement to unpaid benefits. However, omissions may impact payment.

Let’s start with the surviving spouse section.

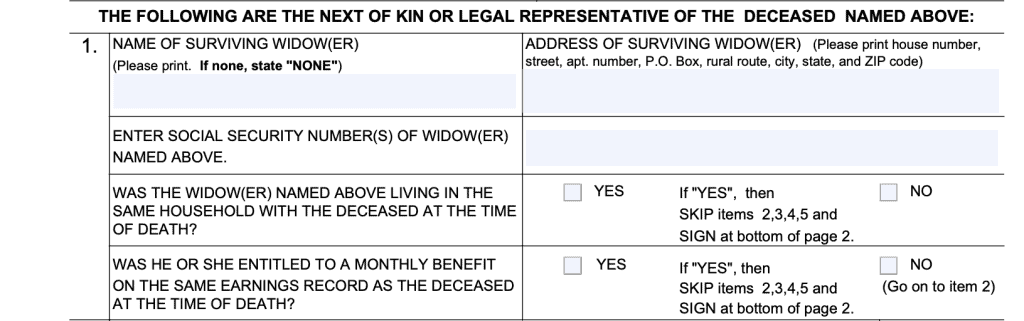

Item 1: Surviving spouse

If there is a surviving spouse, you’ll enter:

- Spouse’s name

- Spouse’s address

- Spouse’s SSN

Address

For all claimants, the survivor’s mailing address includes:

- House number

- Street or apartment number

- P.O. Box number

- City

- State

- Zip code

If the surviving spouse was living in the same house as the decedent, he or she will:

- Select “Yes” for the box that says, “Was the widow(er) named above living in the same household with the deceased at the time of death?”

- Skip items 2-5

- Sign at the bottom of page 2

If the surviving spouse was receiving monthly benefits on the same earnings record as the decedent, he or she will:

- Select “Yes” for the box that says, “Was he or she entitled to a monthly benefit on the same earnings record as the deceased at the time of death?”

- Skip items 2-5

- Sign at the bottom of page 2

In cases where there is no surviving spouse, write “NONE” in the name block and move to Item 2.

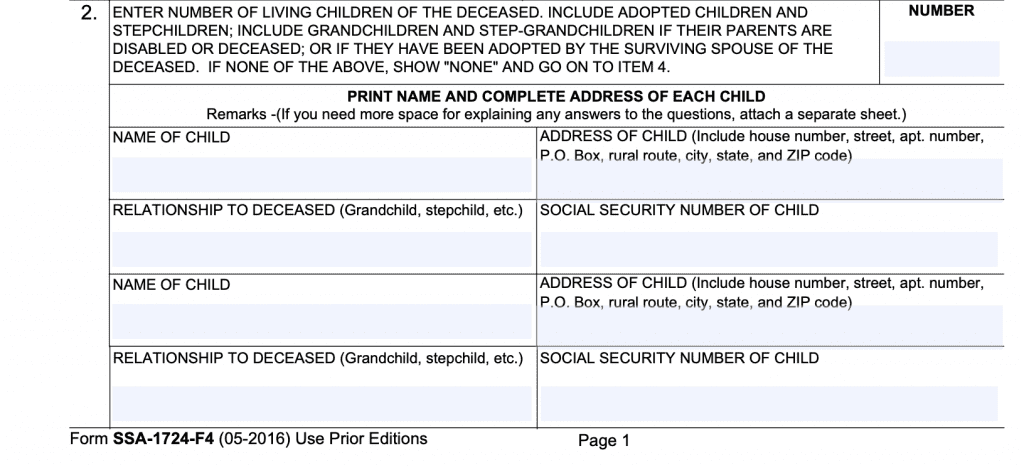

Item 2: Children of the deceased

In item 2, you’ll enter the number of living children of the decedent. Specifically, include:

- Adopted children

- Stepchildren

- Grandchildren and step-grandchildren if:

- Their parents are disabled or deceased, or

- If the surviving spouse of the deceased adopted them

For each child, include:

- Name of the child

- Child’s address

- Child’s relationship to the deceased individual

- Child’s Social Security Number

You may need more space for additional explanations. If so, attach a separate sheet with the form when you submit it.

If there are no children of the deceased, go directly to Item 4 (skipping Item 3).

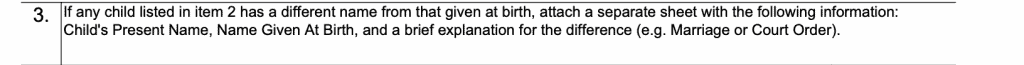

Item 3

If there is a listed child of the deceased that has a different name from their given birth name on their birth certificate, you’ll need to attach a separate sheet with the following information:

- Child’s current name

- Child’s birth name

- Explanation for the difference (court order, marriage certificate, etc).

Unlike Item 1, neither Item 2 nor Item 3 specifically state to skip Item 4. Once you have completed Item 2 or Item 3, proceed to Item 4.

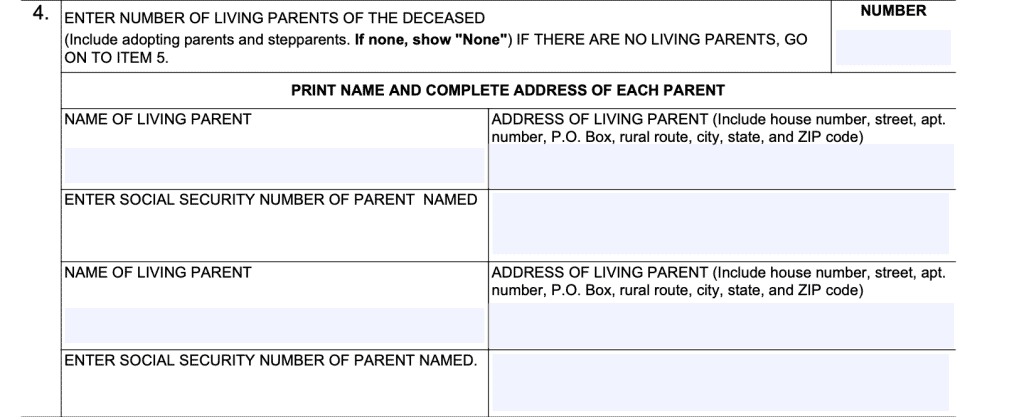

Item 4: Parents of the deceased

In Item 4, you’ll enter the number of living parents of the deceased individual. If there are none, enter “None” and go to Item 5. Include adopting parents and/or stepparents.

For each living parent, include:

- Parent’s name

- Parent’s address

- Parent’s Social Security Number

Once complete, you can move down to the next item.

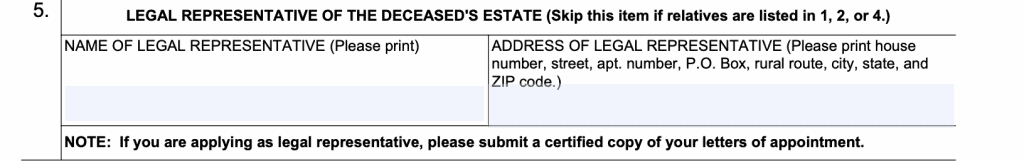

Item 5: Legal representative of the deceased’s estate.

If no family member can complete this form, then the legal representative will complete this section. If there are surviving relatives (either Items 1, 2, or 4 are filled out), then skip down to the signature block.

The legal representative will fill in their contact information (name and address). The representative will also have to submit a certified copy of letter of appointment.

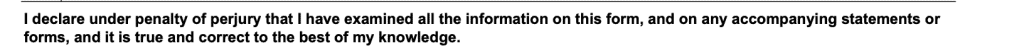

Signature

The signature field is where the applicant states, under penalty of perjury, that they are eligible for the unpaid benefits and refunded premiums.

Underneath the perjury declaration, the applicant will:

- Sign their full name.

- Current date

- Telephone number (include area code)

- Mailing address (house number and street, apartment number, PO Box or rural route)

- City

- State

- County

- Zip code

The applicant will also provide their direct deposit payment address for their financial institution. This will include:

- Account type (checking or savings)

- Nine digit routing number

- Account number

The rest of this field only needs to be filled in if the applicant signed “X” as their legal signature. If that’s the case, two witnesses are required to sign stating that they know the applicant. Each witness is also required to provide their full address.

Once you’ve completed the signature field at the end of Page 2, that’s all you’re required to fill out. However, Page 3 contains useful information that the Social Security Administration is required to disclose.

The Privacy Act Notice contains this information.

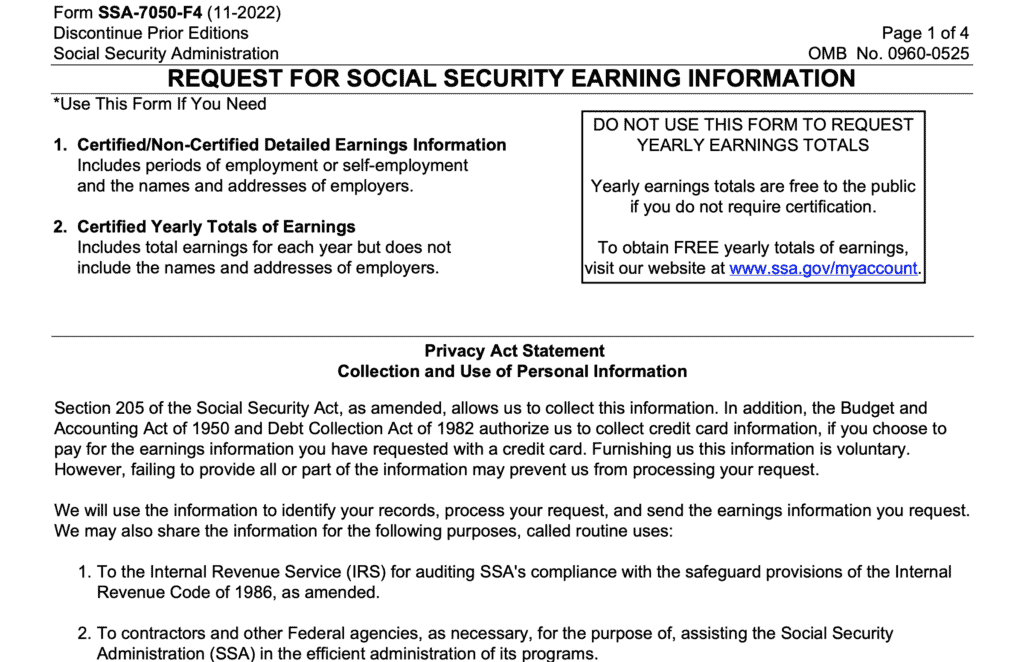

Privacy Act Notice

As a federal agency, the SSA is required to follow all applicable federal laws when it comes to the use of any person’s information. The Privacy Act Notice notifies you exactly what rules apply.

Social Security Act

The Social Security Act authorizes the SSA to collect. information for the purpose of determining the beneficiary’s payment. Although providing this information is voluntary, the SSA may not be able to make the appropriate Social Security payment or reimburse a beneficiary’s premiums without it.

The Social Security Administration may also use this information to:

- Help improve the efficiency and integrity of Social Security programs

- Comply with Federal laws requiring the release of information from Social Security records,

- Make determinations for eligibility in similar health or income programs at the federal, state, and local levels

- Facilitate research for the improvement of Social Security programs

You can find a complete list of routine uses in the Privacy Act Systems of Records Notices, which you can find online or at your local Social Security office.

Paperwork Reduction Act Statement

This section states that this form meets the requirements of the Paperwork Reduction Act of 1995. Their time estimate to complete this form is 10 minutes.

Video walk through

If you prefer, we’ve created this instructional video that covers SSA-1724. Feel free to watch this video first, then re-read the article to cover any of the finer points.

Frequently asked questions about Form SSA-1724

Form SSA-1724 is also known as: Claim For Amounts Due In The Case Of Deceased Beneficiary.

If the Social Security Administration owed the deceased unpaid SSA benefits or a Medicare premium refund, then completing form SSA-1724 would be the first step towards claiming that money.

SSA-1724 is a three page document. However, the applicant only needs to fill out two pages. According to the SSA’s time estimate in its Paperwork Reduction Act statement, an applicant should only take about 10 minutes to complete this entire form.

Generally speaking, the proper beneficiary should complete this form. That person will likely be either the legal representative of the deceased person or the next of kin. Usually, the next of kin is also the legal representative of the estate, but not always.

The SSA uses a specific order of precedence to determine the proper beneficiary. Since there is a slight difference between the order of precedence for Social Security benefits and Medicare premium refunds, we’ll list each of them separately.

If you need help, you can go to your local Social Security office, or contact their toll free number at: 1-800-772-1213, Monday through Friday from 7:00 to 7:00 (local time).

Deaf or hard of hearing persons can call the SSA TTY number at 1-800-325-0778 or call using a relay service, like Sorenson.

You can submit your completed form to your local Social Security office. For assistance, call the SSA’s toll-free number at: 800-772-1213, Monday through Friday from 7:00 to 7:00 (local time).

Deaf or hard of hearing persons can call the SSA TTY number at 1-800-325-0778 or call using a relay service, like Sorenson.

In the case of a deceased Social Security recipient, the SSA will pay unpaid Social Security benefits in the following order:

1. A surviving spouse who was either living in the same household as the deceased at the time of death, or who, for the month of death, was entitled to a monthly benefit on the deceased person’s record;

2. Children entitled to a monthly benefit on the same record as the deceased;

3. Parents who, for the month of the person’s death, were entitled to a monthly benefit on the decedent’s Social Security record;

4. A surviving spouse who doesn’t meet the requirements in #1, above;

5. Children who do not meet #2 above;

6. Parents who do not meet #3 above; or

7. The legal representative of the deceased person’s estate.

The order of entitlement for a deceased beneficiary’s Medicare premiums is slightly different from unpaid benefits. In the case of a deceased Medicare beneficiary, the legal representative of the decedent’s estate is listed as the first beneficiary, instead of last:

1. The legal representative of the deceased person’s estate, or

2. A surviving spouse who was either living in the same household as the deceased at the time of death, or who, for the month of death, was entitled to a monthly benefit on the decedent’s Social Security record;

3. Children entitled to a monthly benefit on the same record as the deceased;

4. Parents who, for the month of death, were entitled to a monthly benefit on the decedent’s Social Security record;

5. A surviving spouse who doesn’t meet the requirements in #2, above;

6. Children who do not meet #3 above;

7. Parents who do not meet #4 above.

Where can I find a copy of SSA-1724?

You can find a fillable form of this document on the SSA website in PDF format. For your convenience, we’ve attached the most current version to the end of this article.

Related forms

What do you think?

Let me know what you think of this article in the comments. If you feel like this article helped you, please share it, pin it or tag me. And if you have any additional tips, please share them in the comments.