IRS Form 15107 Instructions

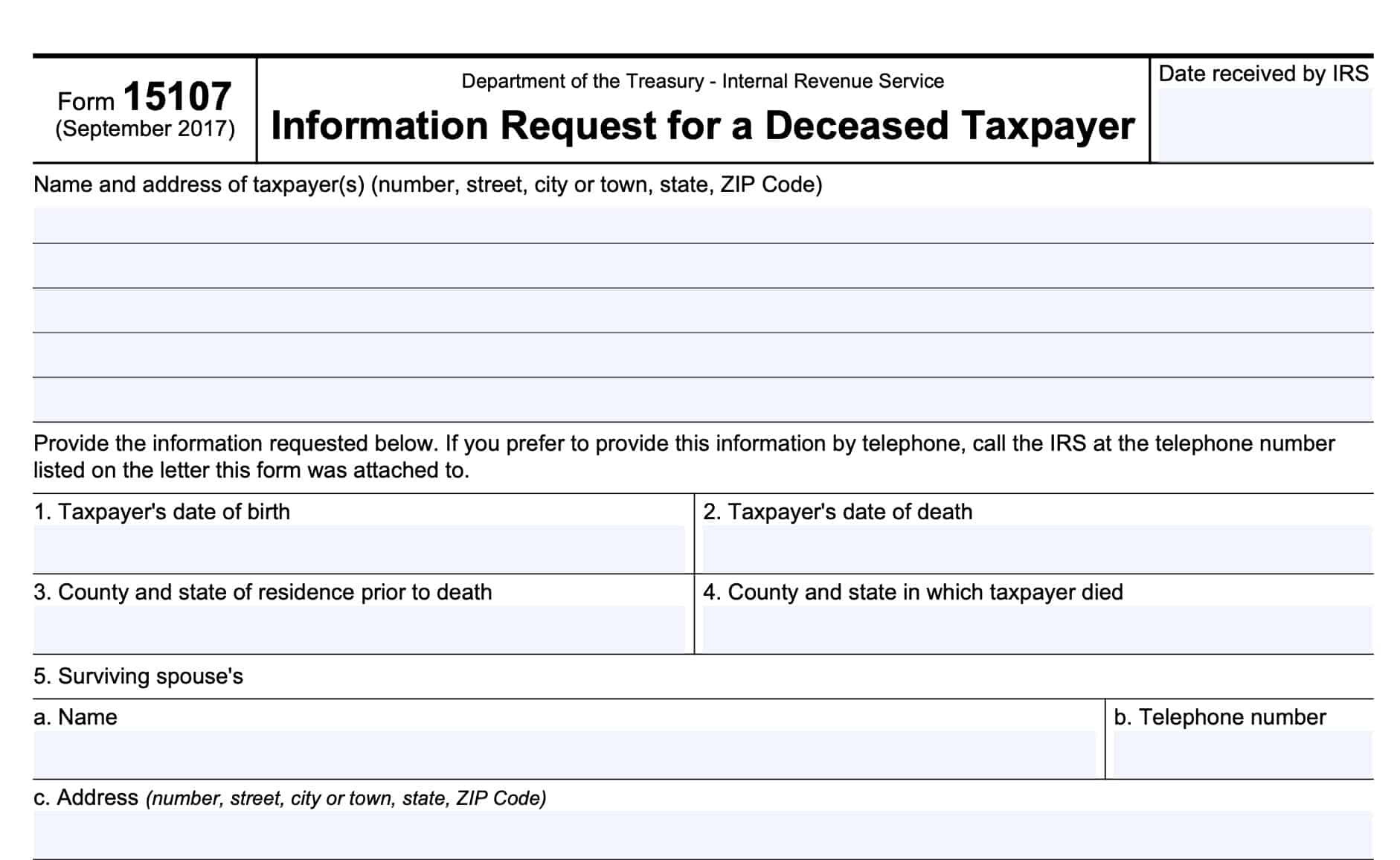

When a taxpayer passes away, the Internal Revenue Service may request information to help reconcile issues with his or her tax account. The IRS does this by sending an information request, known as an LP60 notice, to the taxpayer’s last known address along with IRS Form 15107, Information Request for a Deceased Taxpayer.

In this article, we’ll walk through everything that you should know about this tax form, including:

- How to complete IRS Form 15107

- How to file IRS Form 15107

- Frequently asked questions

Let’s start with a step by step walkthrough of IRS Form 15107.

Table of contents

How do I complete IRS Form 15107?

This one-page tax form is very straightforward to complete. In fact, the Internal Revenue Service doesn’t provide form instructions for this particular form, like they normally do.

Let’s take a closer look at IRS Form 15107, beginning with the information fields at the top of the form.

Top of form

Above Line 1, enter the name and most recent address of the deceased person. This should include the following information about the decedent:

- Street number

- Street name

- City or town

- State

- ZIP code

Once you complete the information fields at the top of the form, go ahead to Line 1.

Line 1: Taxpayer’s date of birth

In Line 1, enter the decedent’s date of birth in YYYYMMDD format.

Line 2: Taxpayer’s date of death

Enter the decedent’s date of death as it appears on his or her death certificate.

Line 3: County and state of residence prior to death

In Line 3, enter the county and state where the deceased taxpayer lived immediately prior to his or her death.

This should match the information you entered at the top of the form, unless special circumstances apply.

Line 4: County & state in which the taxpayer died

Enter the county and state where the taxpayer passed away.

Line 5: Surviving spouse information

If the deceased person had a surviving spouse, then enter the following information:

- Line 5a: Spouse’s name

- Line 5b: Telephone number

- Line 5c: Spouse’s address

Once complete, proceed to Line 6.

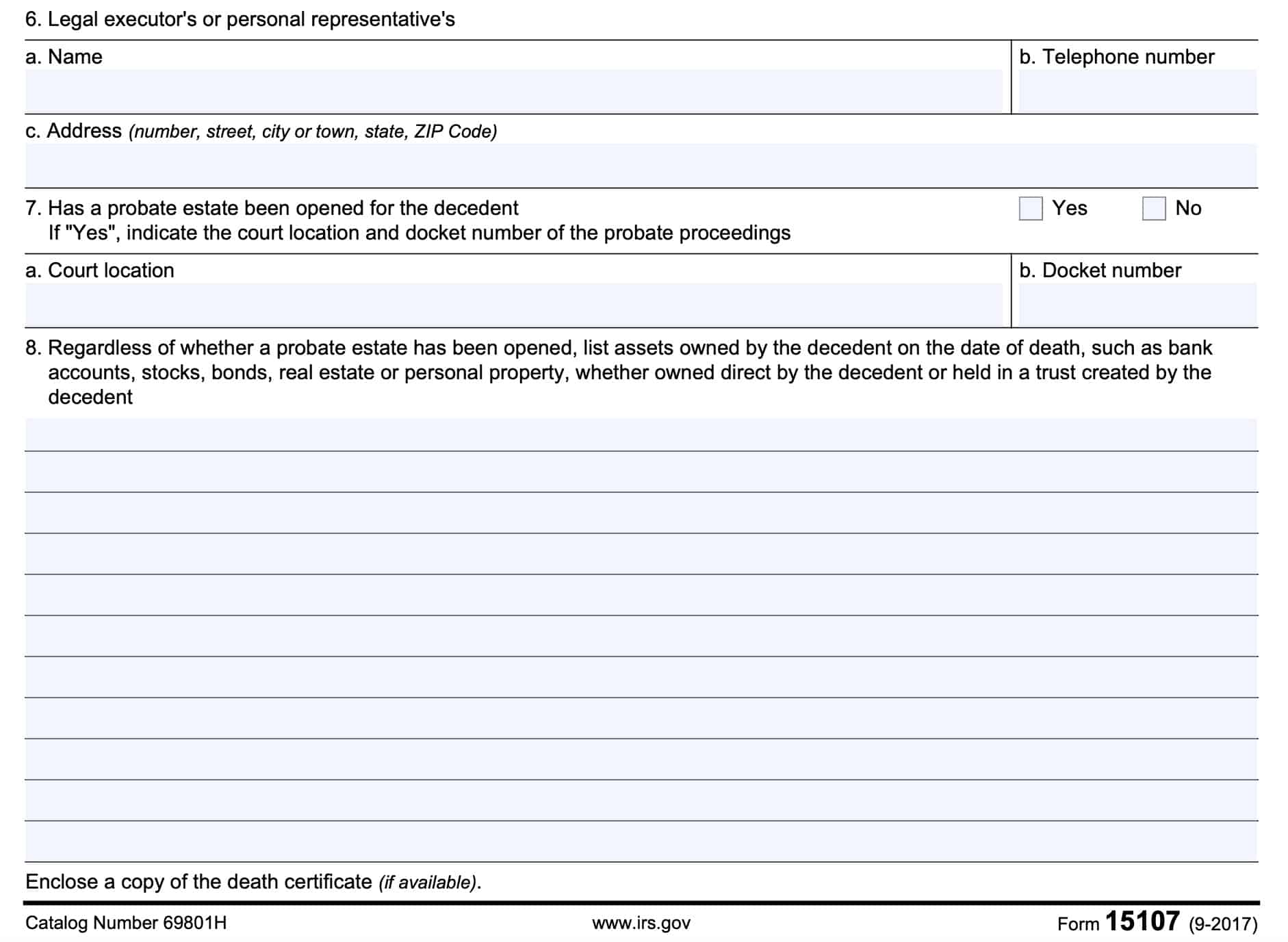

Line 6: Legal executor or personal representative information

If there is an executor or personal representative that is named in the late taxpayer’s estate planning documents, then list the following information:

- Executor or personal representative’s name

- Telephone number

- Address, including city, state, and zip code

Line 7: Has probate been opened for decedent?

Answer whether or not a probate estate has been opened for the decedent’s estate. If so, then list the probate court location and docket number as well.

Line 8: List of decedent’s assets

Provide a list of the deceased taxpayer’s assets on the date of death. This can include any of the following:

- Bank accounts or accounts from other financial institutions

- Investments, such as stocks, bonds, or mutual funds

- Real estate holdings

- Personal property

- Closely held business interests

Include everything the decedent owned, regardless of whether they owned it directly or in a trust created by the decedent.

Filing considerations

Below are some considerations about filing IRS Form 15107.

How do I file IRS Form 15107?

Generally speaking, you should submit your completed Form 15107, along with a copy of the death certificate, to the IRS service center that sent you the LP60 notice.

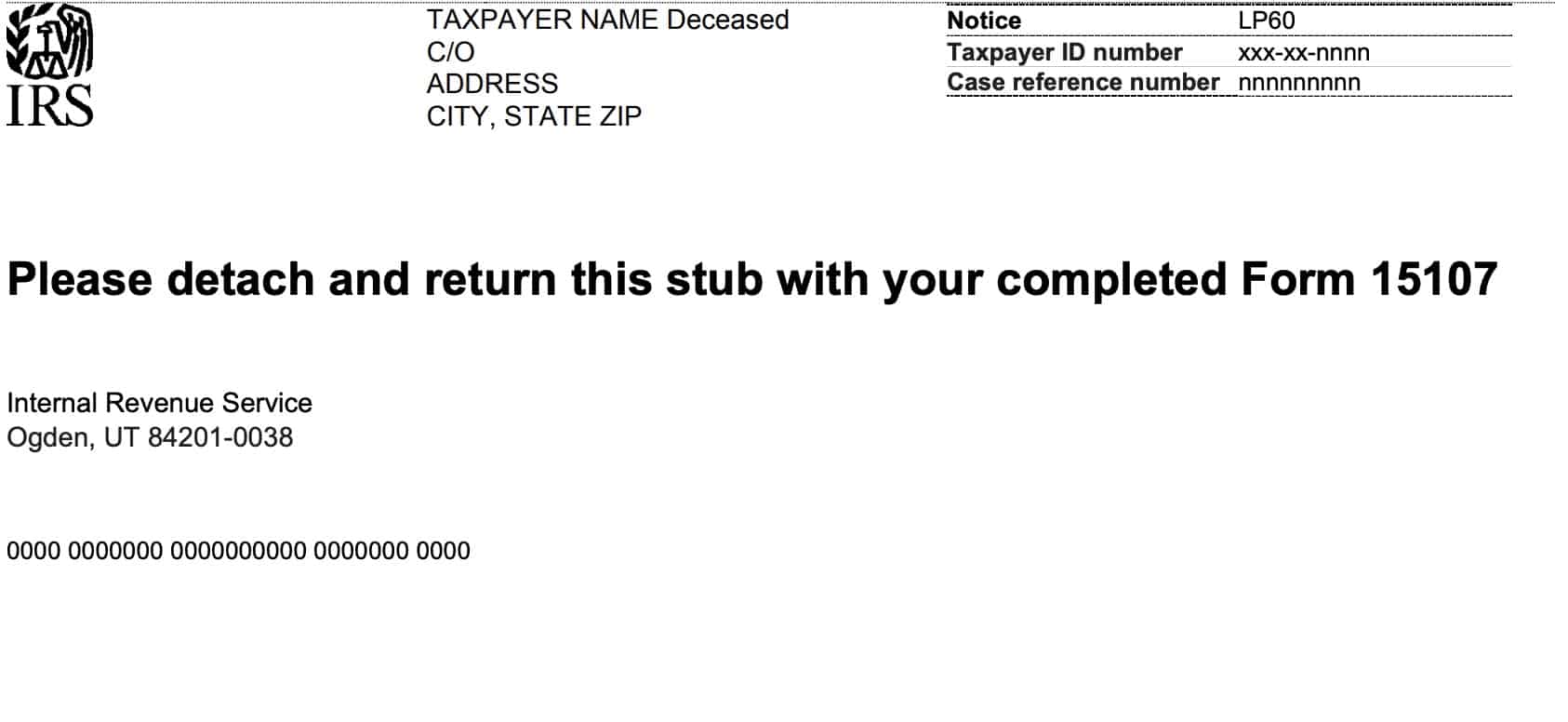

What is an LP60 Notice?

When the IRS is attempting to reconcile the tax account on behalf of a deceased taxpayer, they may send an information request to the taxpayer’s last known address. This information request is known as an LP60 notice.

The LP60 notice usually will contain the following information:

- Notice date

- Case reference number

- Contact phone number

To learn more about how to respond to your LP60 notice, watch this YouTube video below.

At the bottom of the LP60 notice is a detachable stub. This stub, which may contain the decedent’s Social Security number or other federal tax ID numbers, is the form that you should submit, with the completed Form 15107, in the envelope provided.

When it comes to taxes, what else do I need to do on the decedent’s behalf?

Each tax situation is unique to the individual taxpayer. However, the IRS website has a dedicated page for common tax issues relating to deceased taxpayers. This page covers common issues such as:

- Filing a final tax return

- Requesting a decedent’s tax information

- Claiming a tax refund

- Identity theft

Let’s take a closer look at some of these items.

Filing a final tax return

In general, a final tax return is filed in a similar manner as a normal individual tax return. However, there are certain adjustments that you may need to make, based upon the decedent’s tax filing status and the timing of their death.

You can find more information in the instructions for either IRS Form 1040 or IRS Form 1040-SR.

Requesting a decedent’s tax information

To ensure that a decedent’s estate does not have outstanding tax liabilities from prior tax years, you may need to request a tax transcript.

An executor or personal representative can request a decedent’s tax transcript by filing IRS Form 4506-T, Request for Transcript of Tax Return.

Claiming a tax refund

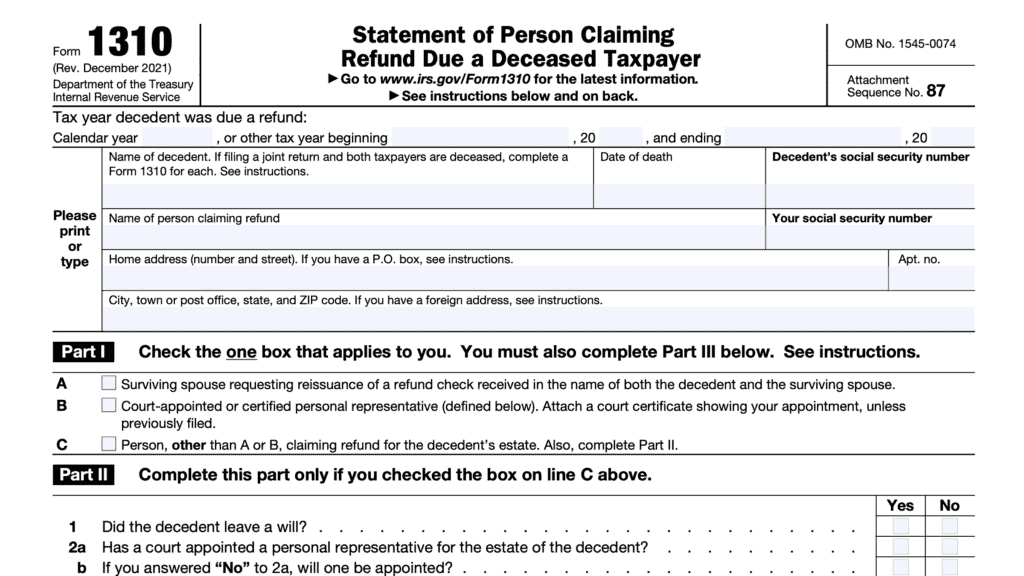

To obtain a tax refund for a deceased taxpayer, you might need to file IRS Form 1310, Statement of Person Claiming Tax Refund Due a Deceased Taxpayer.

This does not apply to surviving spouses or personal representatives filing an original tax return on the decedent’s behalf.

Identity theft

The IRS warns taxpayers about identity theft, even with deceased taxpayer’s information. To report the possible theft of a decedent’s tax information, you should consider filing IRS Form 14039, Identity Theft Affidavit.

Watch this video for more detail about reporting the possible theft of a deceased person’s tax information.

Video walkthrough

Watch this instructional video for a step by step tutorial on responding to an IRS information request on behalf of a deceased taxpayer.

Frequently asked questions

You do not have to complete this tax form. If you prefer, you may call the telephone number at the top of the letter that you received from the Internal Revenue Service. This letter is known as an LP60 Notice.

Surviving family members may receive an IRS notice, known as an LP60 notice, requesting additional taxpayer information for a decedent. This may be because the decedent owed back taxes, was owed a tax refund, or had another tax matter the IRS is trying to resolve.

Where can I find IRS Form 15107?

You can obtain a copy of this tax form from the IRS website. For your convenience, we’ve attached the latest version of IRS Form 15107 just below.

If you prefer the Spanish version, select the second file below.