IRS Form 4768 Instructions

If you’re an executor of an estate who must file a federal estate tax return, it may take a long time to distribute the decedent’s taxable estate. In many cases, executors must file an estate tax extension using IRS Form 4768.

In this article, we’ll walk through everything you need to know about this tax form, including:

- How to complete IRS Form 4768

- Filing considerations

- Frequently asked questions

Let’s begin with step by step instructions on how to complete IRS Form 4768.

Table of contents

How do I complete IRS Form 4768?

This one-page tax form contains four parts:

- Part I: Identification

- Part II: Extension of Time to File

- Part III: Extension of Time To Pay

- Part IV: Payment to Accompany Extension Request

We’ll walk through each part, step by step.

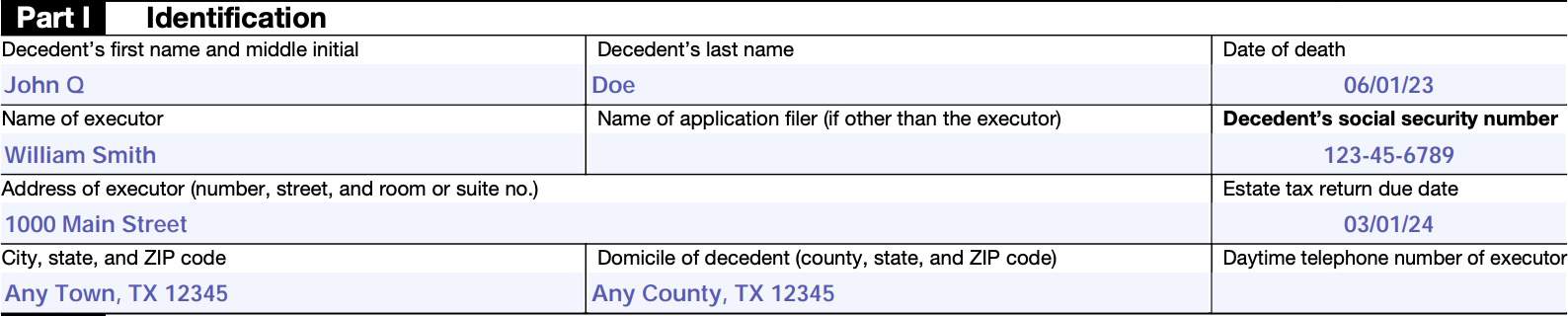

Part I: Identification

In this section, we’ll provide information about the decedent and the executor.

Line 1

Beginning at the top, enter the decedent’s first name, middle initial, and last name, followed by the decedent’s date of death.

Line 2

Just below, enter the name of the executor, name of the application filer (if not the executor), followed by the decedent’s Social Security number. If the executor and the filer are the same person, leave the middle field blank.

Line 3

On the third line, enter the executor’s address (street name and number), followed by the estate tax return’s due date.

Estate tax return due dates

The due date for an estate tax return depends on the type of return being filed.

IRS Form 706 & IRS Form 706-NA

For IRS Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return and IRS Form 706-NA, United States Estate (and Generation-Skipping Transfer) Tax Return, the due date is 9 months after the date of the decedent’s death.

If there is no numerically corresponding date in the 9th month, the due date is the last date of the 9th month.

IRS Form 706-A

For IRS Form 706-A, United States Additional Estate Tax Return, the due date is six months after the taxable disposition or cessation of qualified use.

IRS Form 706-QDT

The due date for IRS Form 706-QDT, U.S. Estate Tax Return for Qualified Domestic Trusts, is on or after January 1 following:

- Any calendar year in which a taxable event occurred,

- A distribution that was made on account of hardship, or

- Nine months after either:

- The death of the surviving spouse, or

- Failure of the trust to qualify as a Qualified Domestic Trust (QDOT)

Under no circumstances will the due date be later than April 15 of the same calendar year.

Line 4

At the bottom of Part I, enter the city, state, and zip code for the executor, the decedent’s domicile (county, state, and zip code), and a daytime telephone number for the executor.

Tax professional’s note

If the IRS disapproves your request, you should receive a notice of denial of the extension in the mail. If your address is not up to date in the IRS records, then you should take the time to update your address by filing either of the following:

Part II: Extension of Time To File Form 706, 706-A, 706-NA, or 706-QDT (Section 6081)

In Part II, we’ll provide information about the tax return and reasons to request an extension.

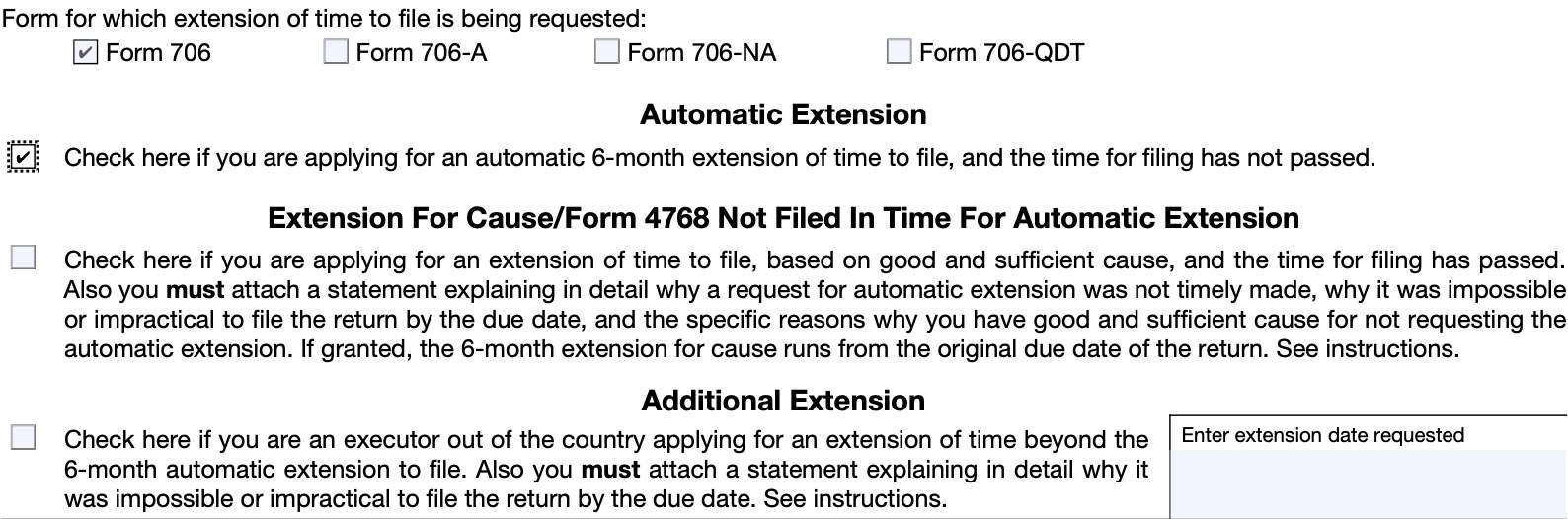

Form for which extension of time to file is being requested

At the top of Part II, indicate which type of tax return for which you are requesting an extension:

- IRS Form 706: United States Estate (and Generation-Skipping Transfer) Tax Return

- IRS Form 706-A: United States Additional Estate Tax Return

- IRS Form 706-NA: United States Estate (and Generation-Skipping Transfer) Tax Return, Estate of Nonresident Not a Citizen of the United States

- IRS Form 706-QDT: United States Estate Tax Return for Qualified Domestic Trusts

Below this section, there are three types of extensions that you might consider.

Automatic extension

Upon request, the IRS grants an automatic six-month extension of time, as long as the filing deadline has not already passed when the request is submitted. If you are requesting an automatic extension, select this box and move down to Part III (if necessary), or Part IV.

If your extension request is granted, the IRS will not contact you. Simply keep a completed copy of your extension request with your records.

Extension for cause/Form 4768 not filed in time for automatic extension

Check this box if you are applying for an extension, but the filing deadline has already passed. You must attach a written statement explaining the following:

- Why you did not timely request an automatic 6-month extension of time,

- Why it was impossible or impractical to file the return by the due date, and

- Specific reasons why you have good and sufficient cause for failing to timely request an automatic extension.

For approved good-cause extensions, the six month extension for cause runs from the original due date of the return, not the date that you filed Form 4768 or the date of approval. Keep a completed copy of your extension request in your records.

As with the automatic extension, the IRS will not notify you with an approval or an effective date. Unless otherwise notified by the Internal Revenue Service Office processing your request, your extension will be 6 months from the original due date.

Additional extension

In general, only an executor who is located outside the United States may request an additional extension of time beyond the six-month period after the original due date. To do this, you must check the box and provide a written explanation why it is impossible or impractical to file this return by the filing date.

Form 706-A and 706-QDT filers

For IRS Forms 706-A and 706-QDT, the qualified heir or trustee/designated filer must also include the date and a description of the taxable event.

Requesting automatic extensions and additional extensions

The IRS encourages executors who may need additional time to separately request an automatic extension first, before the due date. From there, the executor can request the additional extension.

You cannot combine both an automatic extension and an additional extension on the same Form 4768. Requesters must submit each request on a separate form.

You should file the application for an additional extension early enough for the IRS to consider the application before the requested extension date.

As with the automatic extension, the IRS will not notify you with an approval or an effective date. Unless otherwise notified by the Internal Revenue Service Office processing your request, you should plan to file your estate tax return by or before the requested extension date.

Tax Professional’s note

The federal law, Treasury Regulations, and IRS guidance do not appear to set a firm limit on how long you can request an additional extension for filing an estate tax return. Nor does there appear to be much guidance on factors that the IRS may consider when making a decision.

However, Internal Revenue Manual 5.5.5.2 indicates the following with regards to an additional extension to pay estate taxes owed:

Additional extension requests can be granted for up to 12 months at a time for a maximum of 10 years, for tax determined by the taxpayer on the return. On amounts determined as deficiency, the extended time for payment of the taxcannot exceed four years from the date fixed for payment (see IRC Section 6151(c)) of the deficiency, for up to one year at a time.

With that understanding, you should expect that an IRS employee will have to make a judgment call on your request, based upon the facts that you are presenting about your estate tax return. For optimal results, keep this in mind when determining your extension date.

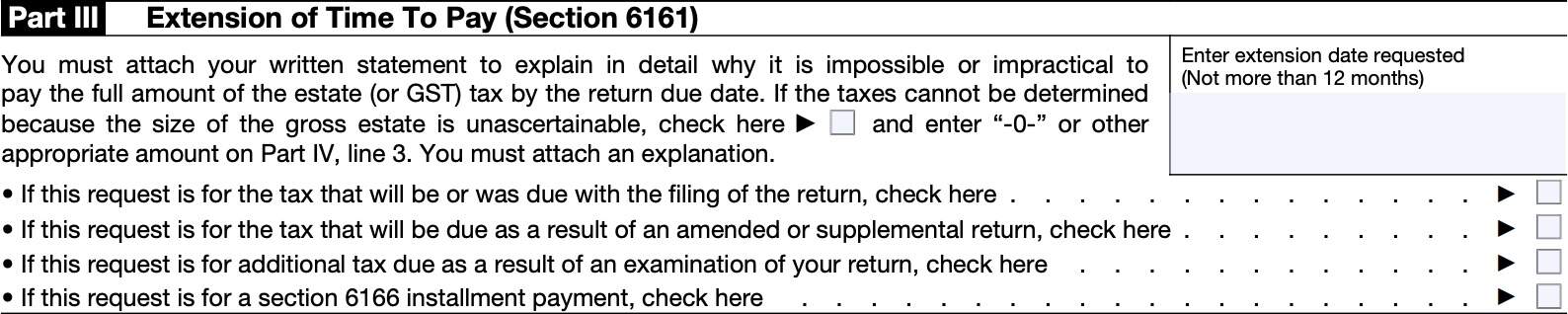

Part III: Extension of Time To Pay (Section 6161)

Internal Revenue Code Section 6161 allows for an extension of time to pay estate tax or generation-skipping transfer tax liabilities, provided the executor can show reasonable cause.

The IRS can approve extensions for up to one year at a time, up to the following maximums:

- Extension of time to pay: 10 years

- Extension of time to pay a tax deficiency: 4 years

To receive an extension for payment, you must provide a detailed explanation and demonstrate good cause in a written statement. Submit this statement as an attachment to your completed form.

Types of reasonable cause

Treasury Regulations Regulations Section 20.6161-1(a) indicates the following as examples of reasonable cause:

- Estate has sufficient liquid assets to pay taxes due. However, the assets are located in several jurisdictions, and the executor cannot readily collect them with reasonable effort

- A substantial part of the estate consists of assets with rights to future payments. These assets cannot be liquidated or borrowed against without causing significant harm to the estate.

- Estate includes a claim to substantial assets that are subject to litigation. The size of the gross estate is unascertainable on the due date

- Estate doesn’t have sufficient funds, even though the executor has made reasonable efforts to convert assets into cash.

In addition to your attached reasonable cause statement, you must:

- Enter your requested extension date, not to exceed 12 months

- Check the appropriate box(es)

If the taxes cannot be determined because you cannot ascertain the size of the gross estate, check the appropriate box, then enter ‘0’ on Part IV, Line 3.

Also, check the appropriate box based upon the type of request. There are four possible boxes:

- The request is for the tax that will be due when the original return is filed

- The request is for the tax that will be due as part of an amended return or supplemental return

- The request is for additional taxes due as part of an IRS examination

- The request is for a Section 6166 installment payment

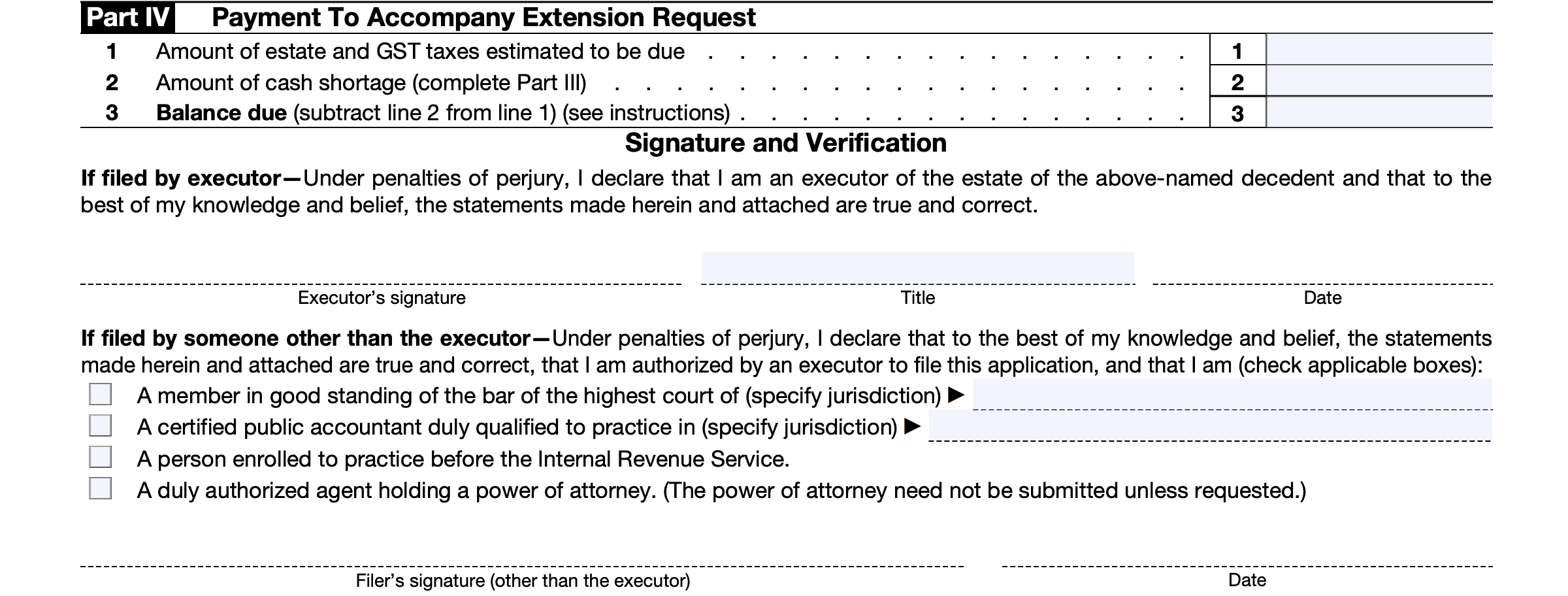

Part IV: Payment To Accompany Extension Request

Generally, the IRS will only grant an extension of time to pay for the amount of cash shortage in the decedent’s estate. In Part IV, you’ll indicate the amount of the cash shortage, and how much tax can be paid with the extension request.

Line 1: Amount of estate and GST tax estimated to be due

In Line 1, estimate the amount of tax due.

Line 2: Amount of cash shortage

Indicate the amount of cash shortage. You must include a statement of assets already distributed. Also, if applicable, include a plan for partial payments during the extension period.

Line 3: Balance due

Subtract Line 2 from Line 1. This represents the balance due with your completed Form 4768. Please note that any submitted payment will not be refunded if there is a remaining tax liability, even if the payment exceeds the non-deferred liability amount.

Instead, the excess payment will be applied to other tax liabilities under IRC Sections 6402 and 6403.

How to make your estimated tax payment

Executors sending a tax payment with IRS Form 4768 should do the following:

- Make the check or money order payable to: “United States Treasury“

- Write the decedent’s (or qualified heir’s) Social Security number and type of federal tax return on the payment

- For example, Form 706

Interest on outstanding balances

Even with an approved extension, interest will accrue on any outstanding balance after the original due date. The IRS will calculate interest based upon the prevailing interest rate and outstanding balance due.

For this reason, the IRS highly recommends that executors pay as much of the tax liability as possible by the original due date.

Tax professional’s note

The IRS will always recommend that taxpayers pay as much of an outstanding tax bill as possible. That’s the IRS’ primary job: to collect tax revenue from taxpayers.

As the executor, you must strive to balance your obligations to all stakeholders, including your fiduciary obligations to the estate and its beneficiaries.

On the one hand, you should not allow a tax bill to accrue interest if there is a significant amount of money sitting in the form of cash in a banking account. On the other hand, selling a lot of valuables at a deep discount simply to get the IRS off your back may not be in the best interest of the estate’s beneficiaries.

Signature & verification

If you are the executor of a decedent’s estate, sign the top part of the form, under ‘If filed by executor.’ Also enter your title and the date.

Note that you are signing this document under penalties of perjury.

If you are not the executor of the estate, sign the bottom, under ‘If filed by someone other than the executor.‘ In addition to the normal representations under penalty of perjury, your signature indicates that you are one of the following:

- An attorney in good standing

- If applicable, check this box and select the jurisdiction that represents the highest court for which you are entitled to practice law.

- A certified public accountant (CPA) duly qualified to practice

- Select this box and specify the jurisdiction where you maintain your credentials

- An enrolled agent

- An enrolled agent is authorized to practice before the Internal Revenue Service

- An authorized agent holding a power of attorney.

- If applicable, you do not need to submit the power of attorney unless otherwise requested.

Check the appropriate box, then sign and date in the Signature and Verification field.

Filing considerations

Below are some additional filing considerations for IRS Form 4768.

Who should file IRS Form 4768?

There are several different types of people who may be able to file IRS Form 4768, depending on the circumstances.

Estate executors

An executor filing Form 706 or 706-NA for a decedent’s estate may file Form 4768 to apply for an extension of time to file under IRC Section 6081(a) and/or an extension of time to pay the estate tax under section 6161(a)(2).

If there is more than one executor, only one is required to sign Form 4768.

Persons recognized to practice before the IRS

The following people may also file an estate tax return extension request:

- Authorized attorney

- Certified public accountant (CPA)

- Enrolled agent

- Agent holding a power of attorney

Check the appropriate box if applicable.

Other designated persons or interested persons

The following people may also file an extension request:

- Qualified heir who plans to file IRS Form 706-A

- Trustee or designated filer who is filing IRS Form 706-QDT

When to file IRS Form 4768

The IRS provides the following guidance for filing deadlines, based upon the nature of the extension request.

Automatic extension (Part II)

If applying for an automatic extension, you should plan to file your extension request by the original due date for the applicable tax return.

Extension for cause (Part II)

If you have good cause, you should file Form 4768 no later than 6 months after the original due date for the applicable return. Your filing should also contain explanations for the following:

- Why you did not request the automatic tax-filing extension

- Why you did not file a complete return by the original due date

Additional extension (Part II)

There is no strict guidance on when to apply for the additional extension (generally only available if the executor is out of the country). However, you should file Form 4768 early enough to give the Internal Revenue Service time to review the application before the extended due date.

Extension of time to pay (Part III)

You should file a request for extension of time to pay estate tax by the original due date of the estate tax return. Otherwise, the IRS probably will not consider your extension request.

How to file IRS form 4768

Below is some additional IRS guidance for how to file Form 4768.

- File a separate extension form for each tax return you’re requesting an extension for.

- Check the appropriate form number in Part II

- File your tax return before the extension expires

You must use a separate Form 4768 to request an extension to pay the following:

- The tax due shown on Form 706

- The tax due as a result of an amended or supplemental Form 706

- The additional tax due as a result of an IRS examination of Form 706

- The tax due as a section 6166 installment payment

When requesting an extension of time to pay, don’t send Form 4768 with Form 706. You must mail it in a separate envelope to the appropriate Internal Revenue Service Center.

Where to file IRS Form 4768

Send your extension request to the following IRS address:

Internal Revenue Service Center

Attn: Estate & Gift, Stop 824G

7940 Kentucky Drive

Florence, KY 41042-2915

Filing by private delivery service (PDS)

If you are filing your extension request through a private delivery service (i.e. FedEx, UPS, etc.), you should use the following address:

Deliveries by PDS should be made to:

Internal Revenue Service Center

Attn: Estate & Gift, Stop 824G

7940 Kentucky Drive

Florence, KY 41042-2915

The IRS maintains a list of designated services on the IRS website. The PDS can tell you how to get written proof of the mailing date.

Video walkthrough

Watch this instructional video for step-by-step guidance on IRS Form 4768.

Frequently asked questions

Yes. You do not have to pay penalties with an approved extension. However, any outstanding tax liability accrues interest beginning on the day after the original due date.

Internal Revenue Code Section 6081 grants certain extensions of time for tax return filings. In the case of estate taxes, the IRS can grant an extension of up to 6 months. If the executor of a decedent is located overseas, the IRS may be able to grant more time after the expiration of the extension period.

Internal Revenue Code Section 6161 grants certain extensions of time for paying taxes. In the case of an outstanding estate tax payment, the Treasury Department (via the Internal Revenue Service) may approve extensions in one-year increments for up to 10 years in the case of an outstanding tax liability. For an estate tax deficiency as determined by the IRS, this extension is limited to 4 years.

No. According to the IRS instructions, you must complete a separate Form 4768 for each extension request requested in Part II. You may include an extension to file and an extension to pay on the same request.

Where can I find a copy of Form 4768?

You can obtain a copy of this tax form from the IRS website. For your convenience, we’ve attached the latest copy of Form 4768 to this article as a PDF file.