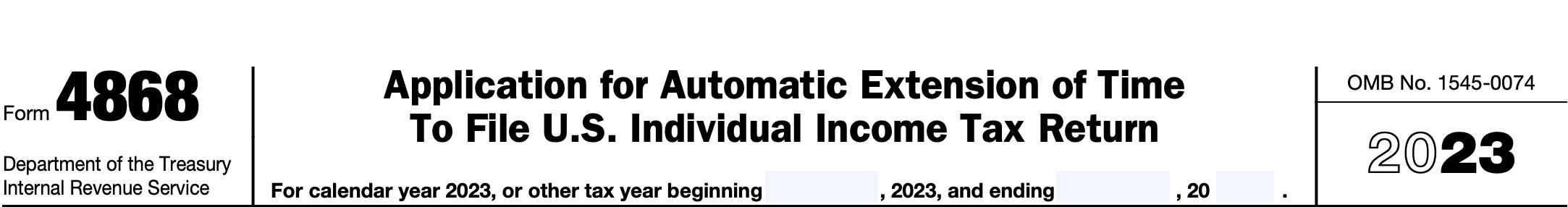

IRS Form 4868 Instructions

For most taxpayers in the United States, tax returns are due by April 15 of the year following the applicable tax year. Taxpayers who are not able to file their U.S. individual income tax return by this time can file IRS Form 4868 to receive an automatic six-month extension to their filing deadline.

In this article, we’ll walk through IRS Form 4868, so you understand:

- How to compete and file IRS Form 4868

- What the automatic extension includes and does not include

- Other frequently asked questions about tax filing extensions

Let’s start by walking through this tax form, step by step.

Table of contents

How do I complete IRS Form 4868?

This tax form is relatively straightforward and contains two parts:

We’ll go over each part in depth, but first, let’s take a look at the information fields just above Part I and Part II.

Tax year

Calendar year taxpayers may leave the very top of Form 4868 blank. However, if you are a fiscal year taxpayer, you should complete the information fields indicating the beginning and ending dates of your fiscal year.

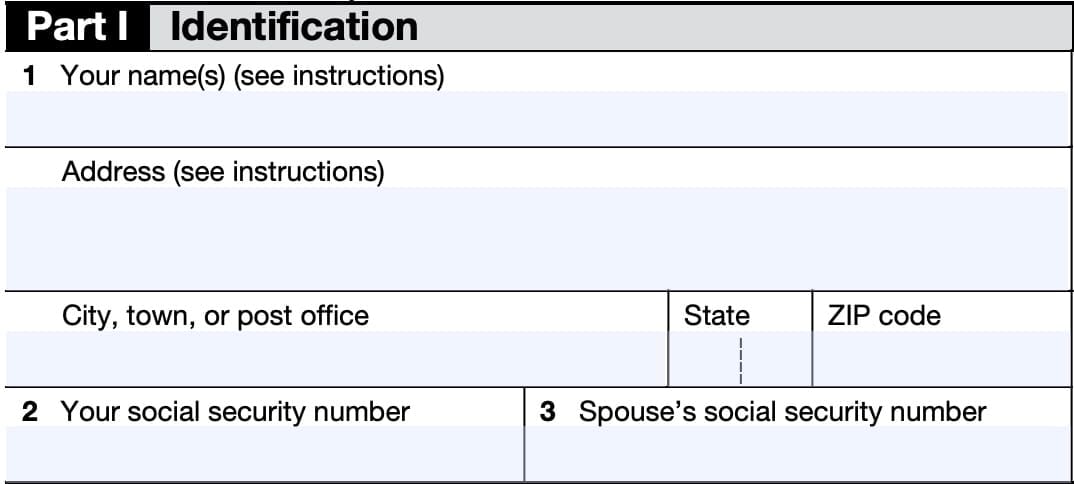

Part I: Identification

In this part, you’ll enter your information so the Internal Revenue Service understands which taxpayer is requesting an automatic extension of time to file their individual tax return.

Let’s start with Line 1.

Line 1

In Line 1, you’ll enter your name and address as it should appear in your federal income tax return. Married taxpayers filing a joint return should include the name of both spouses.

If you want the IRS to send correspondence to a different address or different person

For taxpayers who wish to receive IRS correspondence at an address other than where you live, then you should enter that address, instead.

If you want the correspondence sent to someone who is authorized to act on your behalf, then include that person’s name (in addition to your name), and address on the form.

Name or address changes

Report any name changes to the Social Security Administration before you file IRS Form 4868 with the Internal Revenue Service. Doing so will help avoid any delays in processing your extension request.

If you changed your mailing address since you last filed a federal tax return, then use IRS Form 8822, Change of Address, to notify the IRS of this change. Changing your address on IRS Form 4868 will not update your tax record.

Line 2: Taxpayer’s Social Security Number

In Line 2, enter the complete Social Security number that appears first on your tax return.

If you are filing IRS Form 1040-NR as an estate or trust, then enter your tax entity’s employer identification number (EIN) in Line 2 instead.

Line 3: Spouse’s Social Security Number

If applicable, enter the spouse’s complete Social Security number in Line 3.

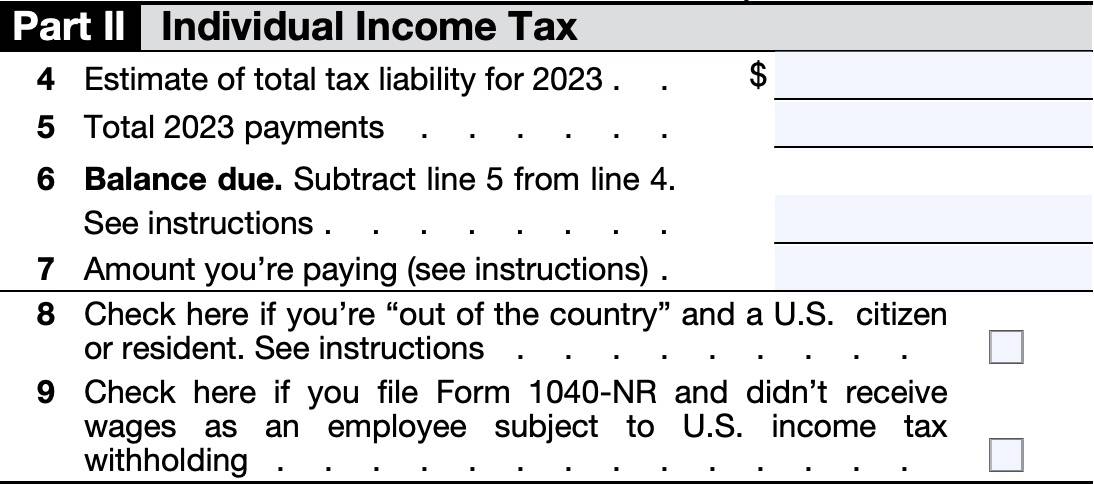

Part II: Individual income tax

In Part II, we’ll estimate your tax liability for the given tax year, calculate total estimated tax payments, and determine your outstanding balance due.

Line 4: Estimated of total tax liability

On Line 4, enter the total tax liability you expect to report on your tax return:

- Form 1040, 1040-SR, or 1040-NR filers: Line 24

- Form 1040-PR filers: Line 6; or

- Form 1040-SS filers: Line 6

If you expect your overall tax bill to be zero, then enter ‘0.’ However, the IRS may refuse to accept your automatic tax extension request if you submitted an unreasonable estimated of your tax liability.

Line 5: Total payments

Enter the total payments you expect to report on your tax return:

- Form 1040, 1040-SR, or 1040-NR filers: Line 33

- Does not include tax payments on IRS Schedule 3, Line 10

- Form 1040-PR filers: Line 12

- Form 1040-SS filers: Line 12

For Puerto Rico taxpayers filing IRS Form 1040-PR and Form 1040-SS, do not include any amounts that you’re paying with this extension request on Line 5.

Line 6: Balance due

Subtract Line 5 from Line 4.

The remaining amount represents your current balance due. If this amount is a negative number, you may expect a tax refund when you eventually file your individual tax return.

Line 7: Amount you’re paying

You can still qualify for an automatic six-month extension if you cannot pay the balance due on Line 6.

However, your outstanding balance is subject to a failure to pay tax penalty as well as interest on both the unpaid balance and additional penalties. The penalties and interest start to accrue on the day after the original tax deadline, and continue to do so until the outstanding balance is paid in full.

Line 8

If you’re out of the country on the regular due date of your return, then check the box on Line 8.

The Internal Revenue Service clearly defines the term out of the country, as it pertains to Line 8.

Out of the country

Individual taxpayers are allowed an automatic two-month extension without filing Form 4868 as long as:

- They are considered out of the country on the original tax filing due date

- They are either a U.S. citizen or U.S. resident

The IRS considers you to be out of the country if:

- You live outside the United States and Puerto Rico and your main place of work is outside the United States and Puerto Rico, or

- You’re in military or naval service on duty outside the United States and Puerto Rico.

Although you are not subject to a late-payment penalty during this two-month extension, interest will still accrue on outstanding balances paid after the regular April 15th deadline.

If you file IRS Form 4868 and check the box in Line 8, the IRS will grant 4 additional months to your automatic extension. This gives overseas taxpayers the same 6 month extension beyond the regular deadline as taxpayers living in the United States. However, any late payment penalty will apply during the additional 4 month extension period.

Taxpayers who need additional time to meet the bona fide residence or physical presence test

Taxpayers may request an extension by filing IRS Form 2350, Application for Extension of Time to File U.S. Income Tax Return, if this extension will allow them to meet either test. Generally, the extension is for 30 days, but might be granted for up to 90 days for taxpayers who must allocate moving expenses.

Line 9: Form 1040-NR filers

Check the box here if:

- You did not receive wages subject to U.S. income tax withholding, and

- Your tax return is due June 15, instead of in April

How do I file IRS Form 4868?

You must file Form 4868 before the tax deadline. You can do this by e-filing Form 4868 with your tax software, or you can send a paper copy.

E-filing

In general, tax filers using commercial tax preparation software may request their extension online.

Additionally, the IRS Free File website contains this form, which you may use to request an extension at no cost.

You can also find additional information about which companies are part of the IRS FreeFile program. Generally, larger tax preparation services, such as H&R Block and TurboTax, are not part of the IRS FreeFile program.

Filing in paper form

The IRS provides location information for taxpayers who wish to mail their IRS extension form. The location depends on two factors:

- Taxpayer location

- Whether the taxpayer is submitting payment with their extension request

Summary of IRS filing locations by state

| If you live in: | And you are making a tax payment, send your completed Form 4868 to: Internal Revenue Service | And you are not making a tax payment, send your completed Form 4868 to: Department of the Treasury, Internal Revenue Service Center: |

| Florida, Louisiana, Mississippi, Texas | P.O. Box 1302, Charlotte, NC 28201-1302 | Austin, TX 73301-0045 |

| Arizona, New Mexico | P.O. Box 802503, Cincinnati, OH 45280-2503 | Austin, TX 73301-0045 |

| Arkansas, Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, Wisconsin | P.O. Box 931300, Louisville, KY 40293-1300 | Kansas City, MO 64999-0045 |

| Pennsylvania | P.O. Box 802503, Cincinnati, OH 45280-2503 | Kansas City, MO 64999-0045 |

| Alaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, North Dakota, Ohio, Oregon, South Dakota, Utah, Washington, Wyoming | P.O. Box 802503, Cincinnati, OH 45280-2503 | Ogden, UT 84201-0045 |

| Alabama, Georgia, North Carolina, South Carolina, Tennessee | P.O. Box 1302, Charlotte, NC 28201-1302 | Kansas City, MO 64999-0045 |

| A foreign country, American Samoa, or Puerto Rico | P.O. Box 1303, Charlotte, NC 28201-1303 | Austin, TX 73301-0215 |

| If you are: -Excluding income under Internal Revenue Code Section 933, -Using an APO or FPO address, -A dual-status alien -A nonpermanent resident of Guam or the U.S. Virgin Islands, or -Filing IRS Form 2555 or IRS Form 4563 | P.O. Box 1303, Charlotte, NC 28201-1303 | Austin, TX 73301-0215 |

| All foreign estate and trust Form 1040-NR filers | P.O. Box 1303, Charlotte, NC 28201-1303, USA | Kansas City, MO 64999-0045, USA |

| All other Form 1040-NR, 1040-PR, and 1040-SS filers | P.O. Box 1303, Charlotte, NC 28201-1303, USA | Austin, TX 73301-0215, USA |

Video walkthrough

For step by step guidance on completing and filing your tax extension request, watch this instructional video.

Frequently asked questions

No. Filing IRS Form 4868 allows for automatic extension to file your income tax return without a late filing penalty. However, your tax liability is due at the original filing deadline. Penalties and interest accrue on the unpaid balance beginning on the day after the original due date.

The automatic extension allows taxpayers an additional 6 months, regardless of reason. The IRS generally cannot grant extra time unless other circumstances warrant so.

According to the IRS, the late payment penalty is equal to 1/2 of 1% of the unpaid balance (.5%) per month, up to a maximum of 25%. A late filing penalty is equal to 5% of the unpaid balance per month, up to 25%.

Where can I find IRS Form 4868?

You can find IRS Form 4868 on the IRS website. For your convenience, we’ve included the most recent version in this article, below.