IRS Form 2350 Instructions

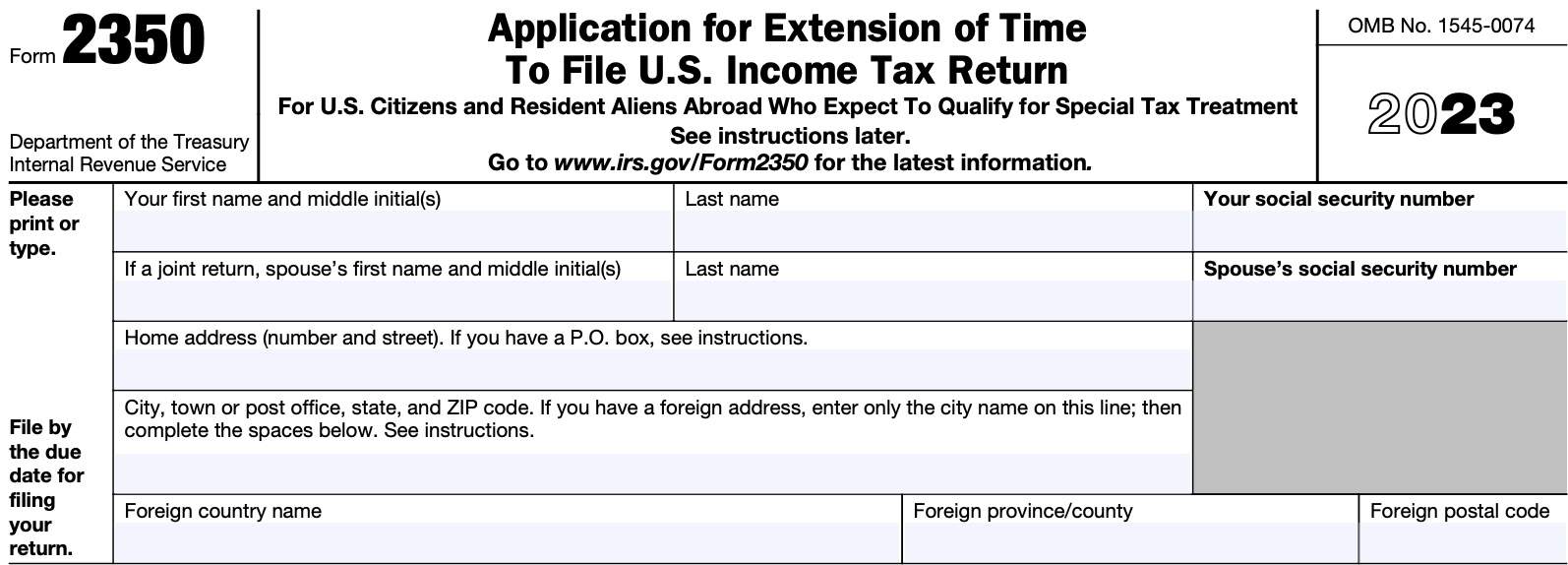

U.S. citizens and resident aliens living abroad qualify for an automatic tax-filing extension of two months, simply for living overseas. However, if you’re expecting to claim the foreign earned income exclusion or foreign housing exclusion, you’ll want to file IRS Form 2350, if you need extra time to meet the presence requirements.

In this article, we’ll walk you through IRS Form 2350, including:

- How to complete IRS Form 2350

- When you need to file IRS Form 2350 and how to do so

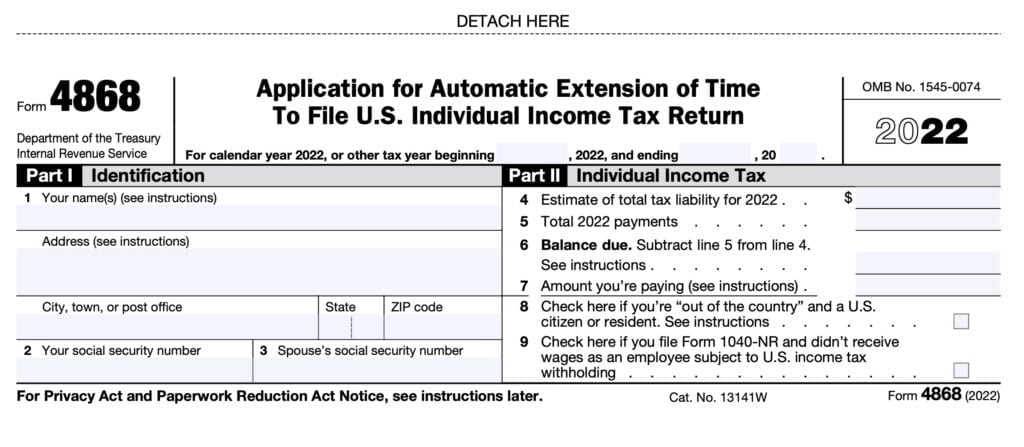

- When you need to file IRS Form 4868 instead

Let’s start by walking through this tax form, step by step.

Table of contents

How do I complete IRS Form 2350?

Let’s take a look at this one-page tax form, beginning at the very top.

Taxpayer information

At the very top of the form, you’ll enter the following information:

- Taxpayer name and Social Security number

- Spouse’s name and SSN, if married filing a joint return

- Home address, including city, state, and ZIP code

- Foreign address: enter city name, then country name, province and postal code

Extension request

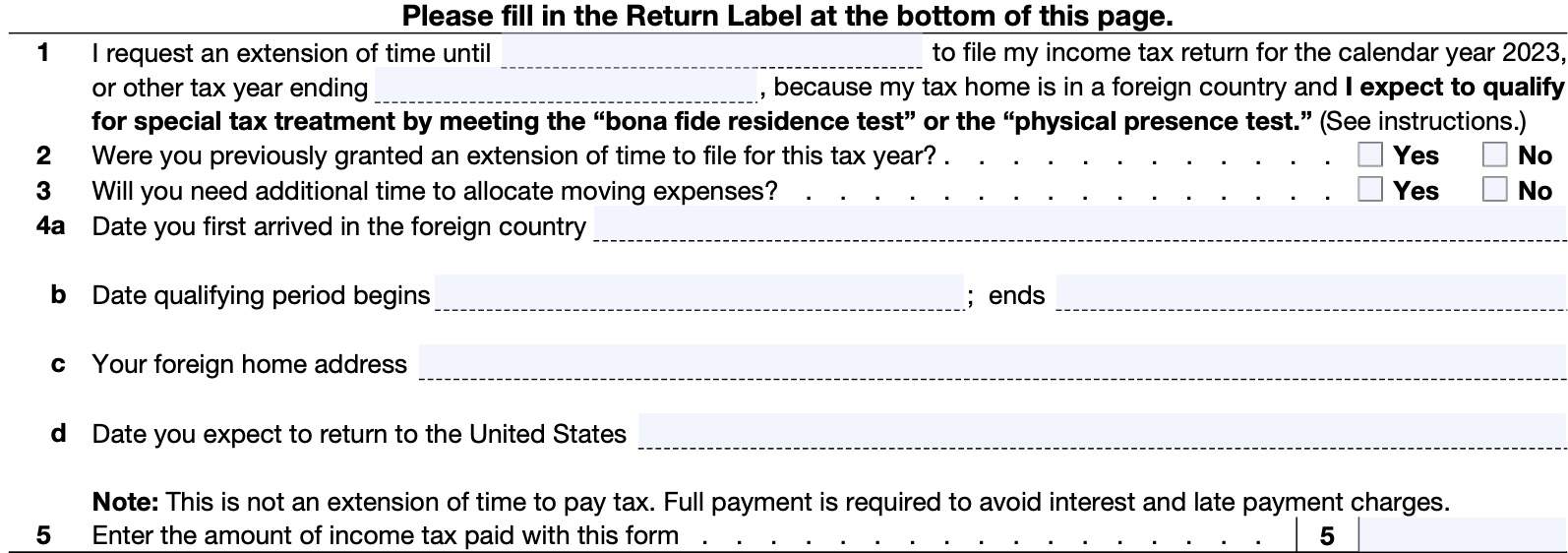

In the middle of Form 2350, you’ll see specific questions regarding your extension request. Let’s start with Line 1.

Line 1

Enter the appropriate date for which you need the Internal Revenue Service to approve your extension request. You can qualify for an extension under either the bona fide residence test or the physical presence test.

Bona fide residence test

To meet this test, American citizens must be a bona fide resident of a foreign country (or countries) for an uninterrupted period that includes an entire tax year. A U.S. resident alien who is a citizen or national of a country with which the United States has an income tax treaty in effect may also meet the bonafide residence test.

If you plan to qualify for the bona fide residence test, enter the date that is 12 months and 30 days from the first day of the following tax year. If you are allocating moving expenses, this should be 90 additional days.

For a calendar year return, this would be 12 months and 30 days from January 1 of the calendar year after your tax return year.

Physical presence test

To meet this test, you must be a U.S. citizen or resident alien who is physically present in a foreign country (or foreign countries) for at least 330 full days during any 12-month period.

If you plan to qualify under the physical presence test, enter the date that is 12 months and 30 days from your first full (24-hour) day in the foreign country. If you are allocating moving expenses, this should include up to 90 days.

For a tax year that is not a calendar year, then you’ll need to enter the ending date of your tax year as well.

Line 2

Answer whether or not you previously requested (and were granted) an extension of time to file your individual tax return for the current year.

Line 3

Check whether or not you need additional time to allocate moving expenses.

Line 4

In Line 4, you’ll answer questions about the new country you’re living in.

Line 4a

Enter the date you first arrived in the foreign country.

Line 4b

Enter the beginning date and the ending date of your qualifying period.

The beginning date of the qualifying period is the first full (24- hour) day in the foreign country. This usually is the day after the arrival date in Line 4a, above.

The ending date is the date you will qualify for special tax treatment by meeting the physical presence test or bona fide residence test.

Line 4c

Enter the foreign address where you are currently residing.

Line 4d

Enter the date, if applicable, that you plan to return to the United States. If you currently do not have a planned return date, leave this line blank.

Line 5

In this line, enter the amount of income tax you are sending with your extension request. Later, when you file Form 1040, you’ll enter your extension payment on IRS Schedule 3, Line 10.

When it comes to your tax liability, there are a couple of things you should recognize.

Federal taxes and filing your tax return

You may file Form 1040 or Form 1040-SR at any time before the extension expires.

However, your additional extension doesn’t include an extension for paying federal taxes. Your tax liability is due by the original income tax return filing deadline.

If you don’t pay the amount due by the regular due date, you will owe interest. You may also

be charged penalties.

Interest

You will owe interest on any tax not paid by the regular due date of your return, even if you qualify for the 2-month extension because you were out of the country.

The interest runs until you pay the tax. Even if you had reasonable cause for not paying on time, you will still owe interest.

Late payment penalty

The late payment penalty is usually ½ of 1% of any amount due (other than estimated tax) not paid by the original due date. In tax year 2023, this would be April 15th of 2024 for most taxpayers. For people who qualify for an automatic two-month extension for being out of the country, this would be June 17, 2024.

The IRS charges a late payment penalty for each month or part of a month the tax is unpaid, up to a maximum penalty of 25%. You might not owe this penalty if your late payment is due to reasonable cause and not due to willful neglect.

Attach a statement to your federal tax return, not to the Form 2350, explaining the reason.

Late filing penalty

A late filing penalty is usually charged if your return is filed after the due date (including extensions). The late filing penalties are usually 5% of the tax not paid by the regular due date for each month or part of a month your return is late, up to a maximum of 25%.

If your return is more than 60 days late, the minimum penalty is the smaller of:

- The balance of tax due on your income tax return, or

- $485

You might not owe the penalty if filing late is due to reasonable cause and not due to willful neglect. Attach a statement to your return, not to the Form 2350, explaining the reason.

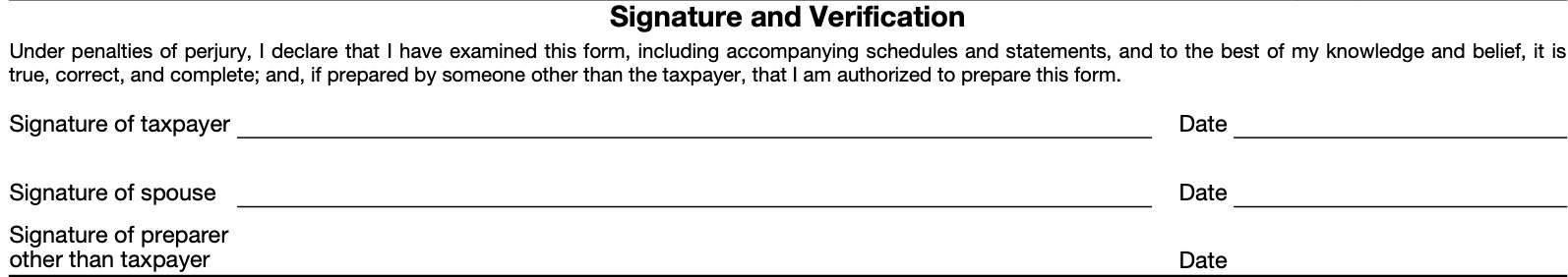

Signature and verification

In this area, you’ll sign under penalties of perjury that your submission is complete and accurate to the best of your knowledge. If your are married filing a joint return, your spouse should also sign.

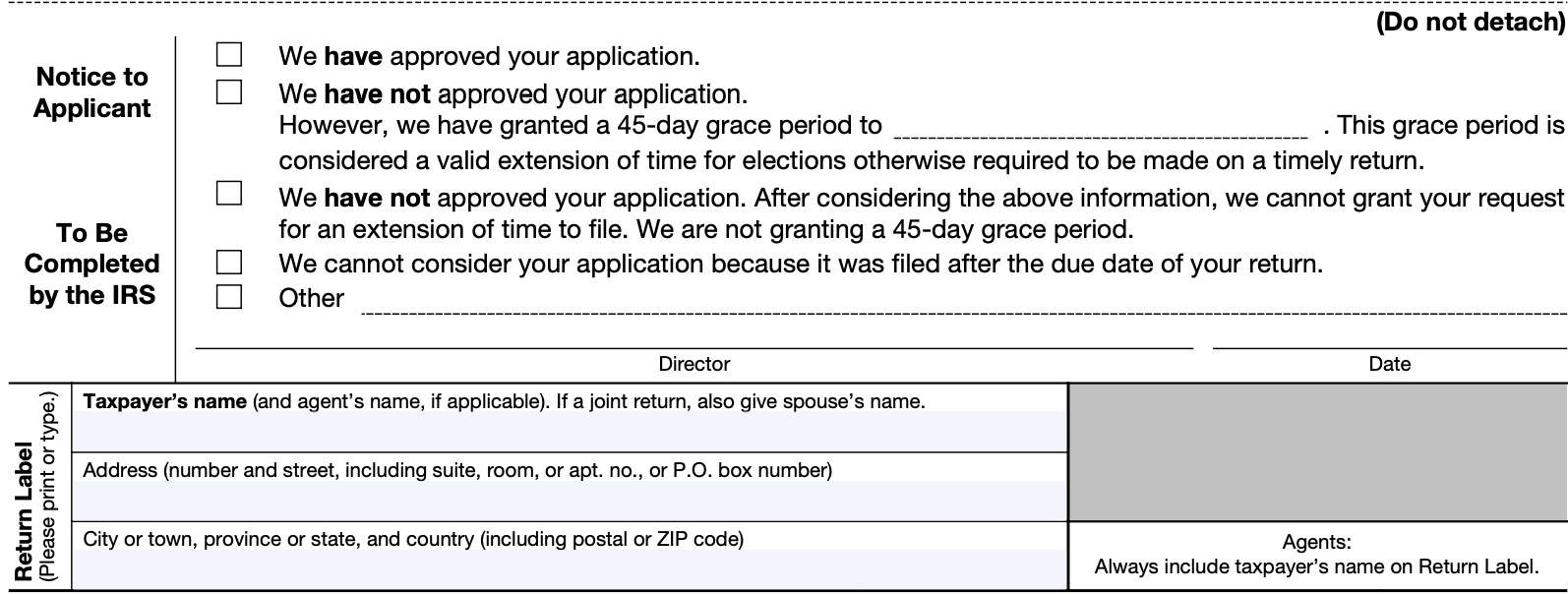

IRS response

While the top part of this section will contain the IRS response, you’ll need to complete the return label information. In the return label, include the following information:

- Taxpayer name (and spouse’s name, if filing a joint return)

- Address

- City, state, ZIP code

Filing IRS Form 2350

File your extension request by the original due date of your tax return.

Mail your completed paper form to the following address:

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0045

Video walkthrough

Watch this instructional video for step by step guidance on completing this IRS extension form.

Frequently asked questions

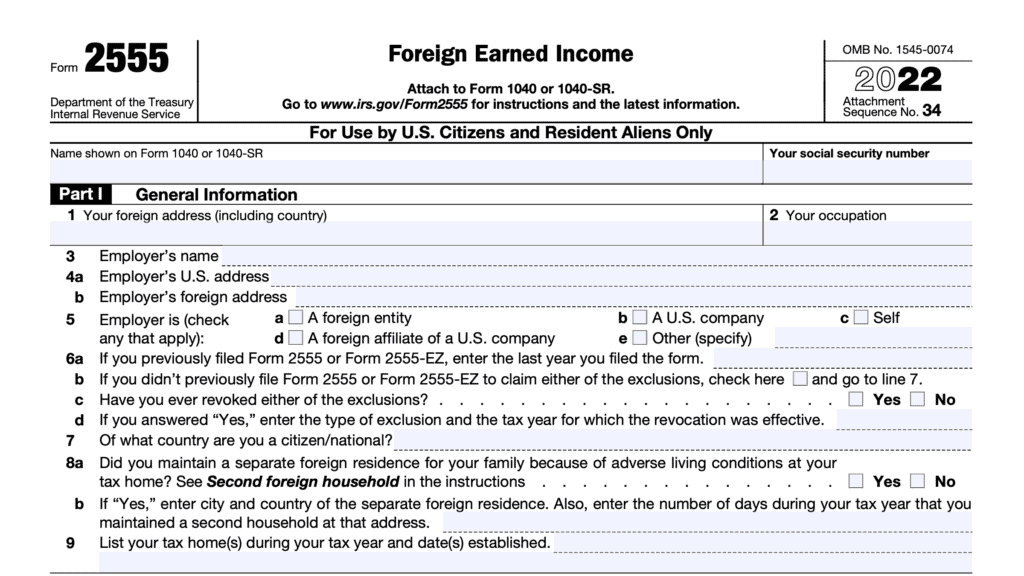

You should file IRS Form 2350 if you expect to file IRS Form 2555 to claim the foreign earned income exclusion or the foreign housing exclusion, and you need additional time to meet either the bona fide residence test or the physical presence test.

No. The Internal revenue service expects all taxpayers to pay their estimated tax liability by their tax return’s original due date.

IRS Form 4868 grants an automatic extension of time for anyone to file a U.S. income tax return. IRS Form 2350 specifically applies to taxpayers who expect to qualify for the foreign earned income exclusion and need extra time to meet one of the residence tests.

Where can I find IRS Form 2350?

As with other IRS tax forms, you can find IRS Form 2350 on the IRS website. For your convenience, we’ve included the latest version in this article, just below.