IRS Form 1040-ES Instructions

If you owed more than $1,000 with last year’s tax return, or if you paid an additional tax for not paying enough taxes over the course of the year, you might be interested in using IRS Form 1040-ES to help calculate your tax obligation for the following tax year.

In this article, we’ll break down IRS Form 1040-ES so you can clearly understand:

- How to complete your IRS Form 1040-ES vouchers and make estimated tax payments

- Alternatives to mailing your estimated tax payments to the IRS

- How to use the IRS estimated tax worksheet to calculate your tax bill throughout the year

Let’s start by going over the form itself.

Table of contents

IRS Form 1040-ES Instructions

Unlike most tax forms, IRS Form 1040-ES doesn’t have a clearly defined use. Different taxpayers may use this form in several acceptable ways:

- Use the payment voucher to make estimated tax payments based upon their tax preparer’s recommendation

- Use the estimated tax worksheet to calculate anticipated tax liability, based upon previous year’s tax information

However, the Internal Revenue Service does not mandate the use of Form 1040-ES for either of these purposes, either. So we’ve broken up the instructions into two parts, based upon your preference:

- Completing the payment voucher

- Using the estimated tax worksheet to calculate expect your expected tax bill

Let’s start with the payment voucher.

How to complete the Form 1040-ES payment voucher

If you want to make quarterly tax payments, you can certainly use this voucher to do so.

We’ll go through the voucher, some additional IRS guidance about using the voucher, and some alternatives for people who would like to use another method to pay estimated taxes.

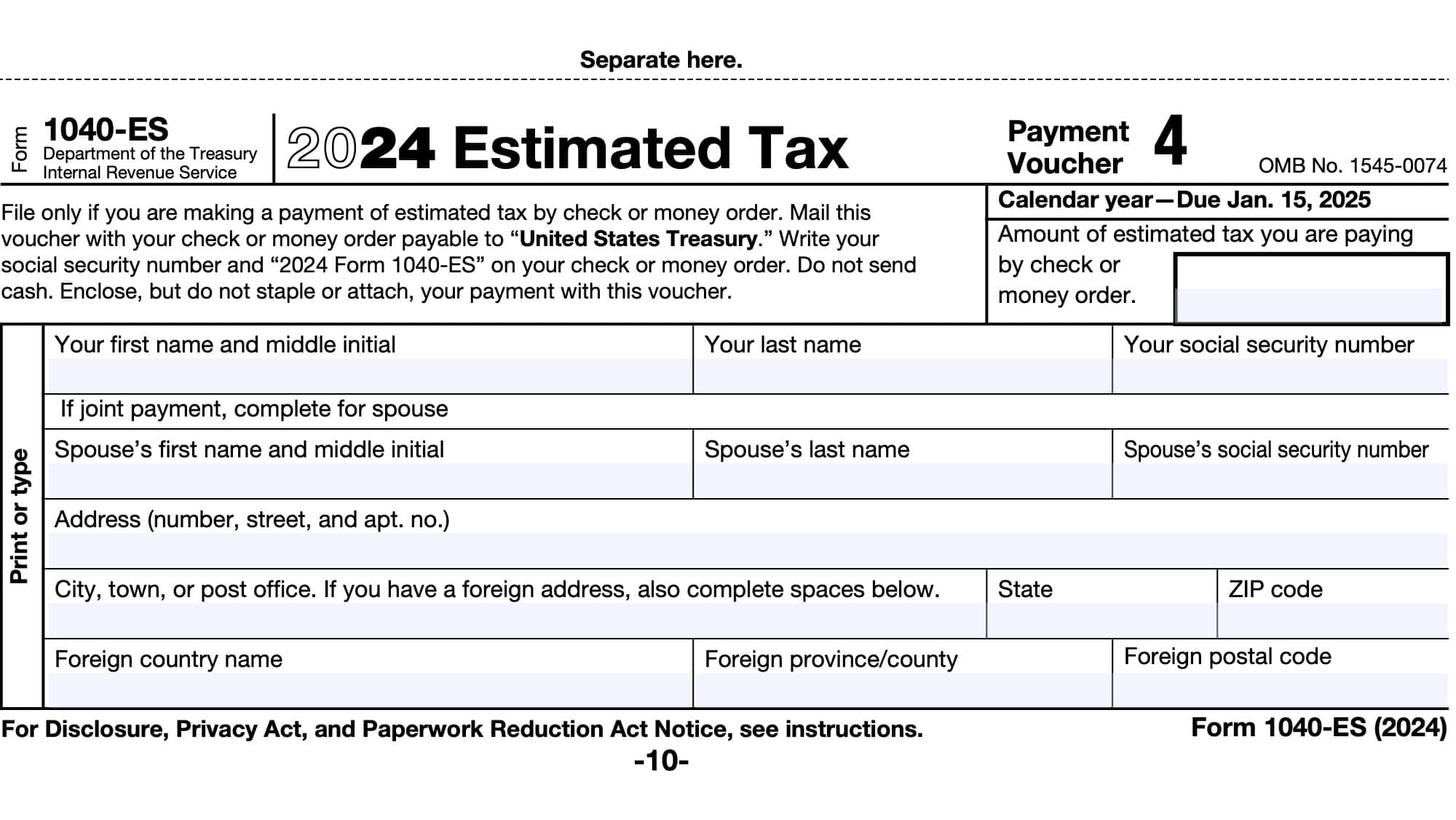

Estimated tax payment

In the box on the upper right hand corner, enter the amount of estimated tax you’re paying for the quarter. You only need to complete this voucher if you’re mailing a check or money order to the IRS to pay your quarterly federal taxes.

You may enter an amount based on your calculations on the Form 1040-ES worksheet, or based upon your tax professionals’ recommendation.

In fact, when I was actively working with clients as a financial planner, we used to prepare estimated tax vouchers for our clients during our tax planning meetings.

Taxpayer name

Enter your first name, middle initial, and last name in the applicable boxes. If you are filing a joint tax return with your spouse, you’ll need to enter your spouse’s name as well.

Social Security number

Enter your Social Security number in the applicable box. If you have an individual taxpayer identification number (ITIN) instead of a Social Security number, you may enter that number here instead.

Taxpayer address

Enter your address in the appropriate fields, including:

- City

- State

- ZIP code

If you have a foreign address, use the foreign address fields to list the foreign country, county or province, and postal code.

Note: If you have recently moved, the IRS recommends that you file IRS Form 8822, Change of Address, to notify the federal government of your new address. This will help minimize confusion and errors when processing your quarterly payments.

Writing the check or money order

When you write the check or money order, be sure to:

- Make it out payable to, “United States Treasury“

- Write your SSN and “2024 Form 1040-ES” on your check or money order

- Do not send cash

- Enclose, but do not staple, the payment with your voucher

For tax year 2024, below is the schedule of vouchers and the due dates for each quarterly payment:

- Payment Voucher 1: April 15, 2024

- Payment Voucher 2: June 17, 2024*

- Payment Voucher 3: September 16, 2024*

- Payment Voucher 4: January 15, 2025

*Alternate date since the original due date falls on a weekend or legal holiday.

Alternatives to submitting your Form 1040-ES voucher

Although this voucher is available for anyone to use, the IRS also recommends paying online through the IRS website. There are several online payment options.

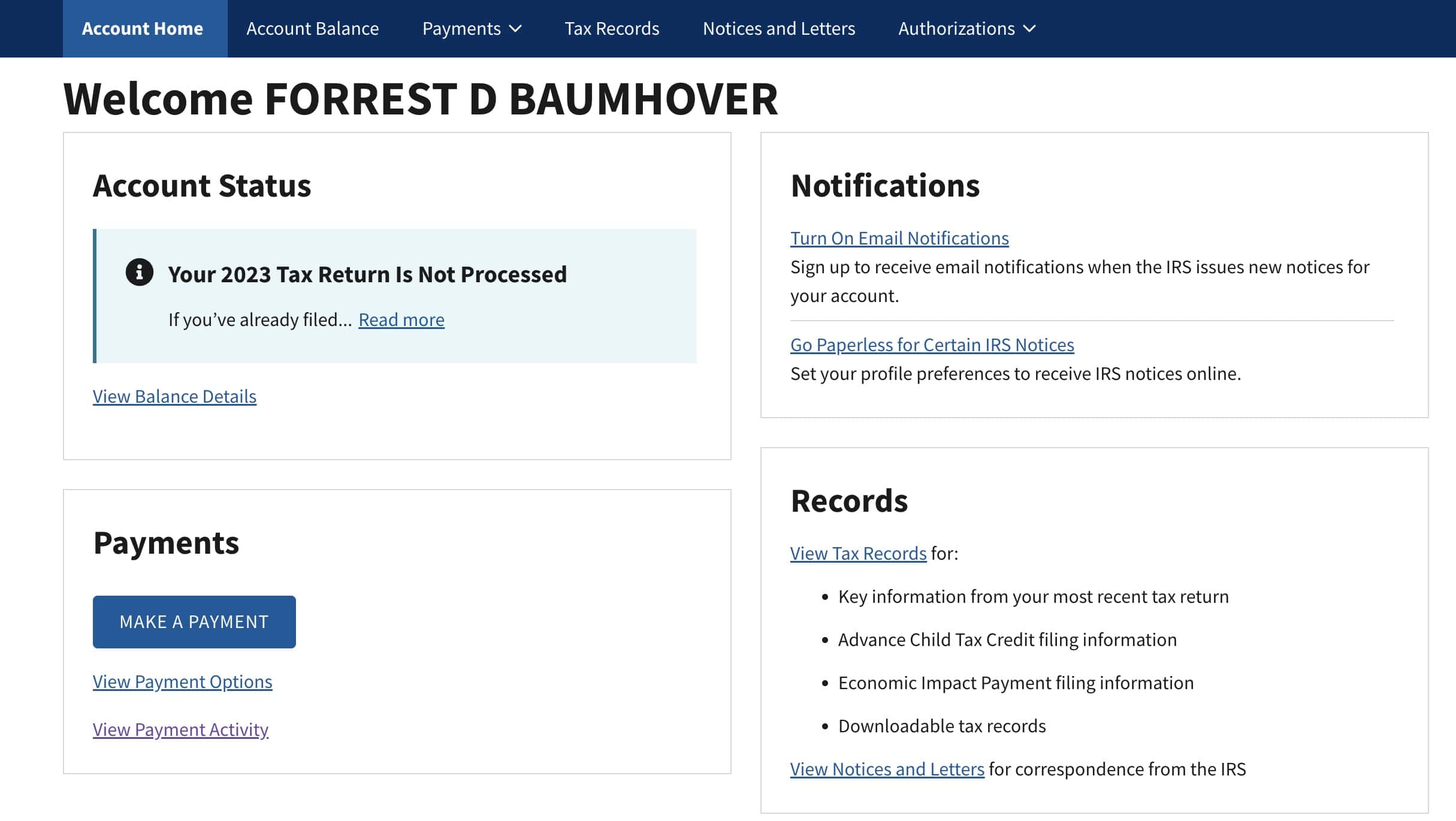

Use your IRS account to pay from your banking account

If you have an IRS account, used to pull online tax transcripts and other information, you can log into your account. From there, you’ll see the ‘Make a Payment’ option in the lower-left hand corner of your screen.

When you select the ‘Make a Payment’ tab, you’ll go to a screen where you can choose whether to pay from your banking account or by credit card.

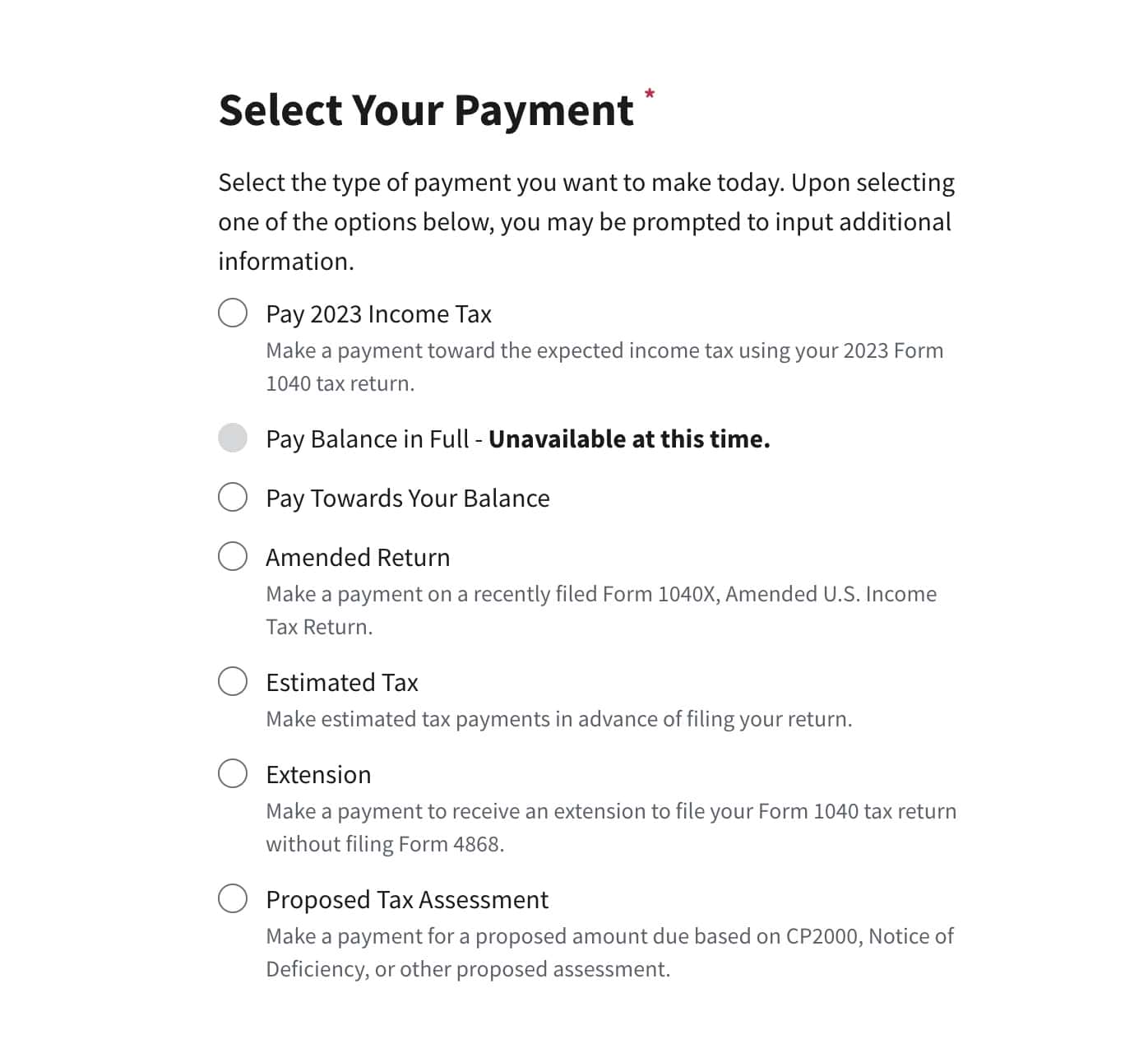

You can also choose from the following types of payments:

- Estimated tax towards your current year tax bill

- If you haven’t filed your prior year tax return yet, then your current year will be listed as your prior year.

- In the below example, I haven’t filed my tax return yet, so any payments that I make would be applied to my 2023 tax return, not my 2024 return.

- Pay balance in full (may not be available, if you haven’t filed a tax return for the prior tax year)

- Pay towards your balance

- Amended return

- Estimated tax

- Extension

- Proposed tax assessment

If you do not have an IRS account, or if you don’t want to use your IRS account to make estimated tax payments, you can simply go through the IRS website.

Use the IRS website to pay directly from your banking account

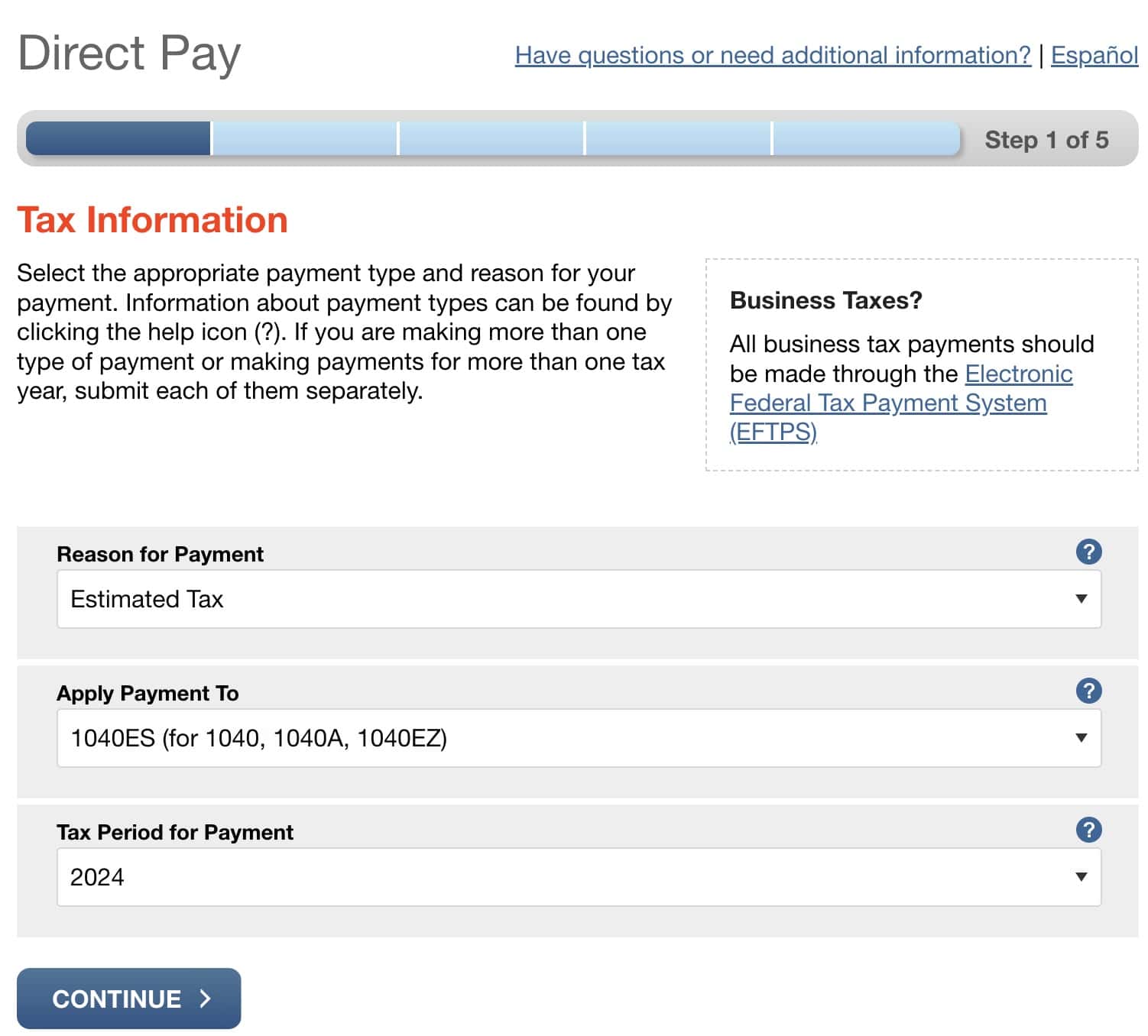

The IRS Direct Pay system will process your tax payment in a similar manner to using your IRS account.

The difference is that you don’t need to use any log-in credentials. On the other hand, you’ll need to pay particular attention as you’re inputting information to avoid any mistakes.

From the Direct Pay menu, select:

- Reason for Payment: Estimated Tax

- Apply Payment To: 1040ES (for 1040, 1040A, 1040EZ)

- Tax Period for Payment: Current tax year

You’ll still go through a series of screens where you verify your identity. You’ll need to have information from your previous year’s tax return handy, as well as information about your address and filing status.

Pay by credit card

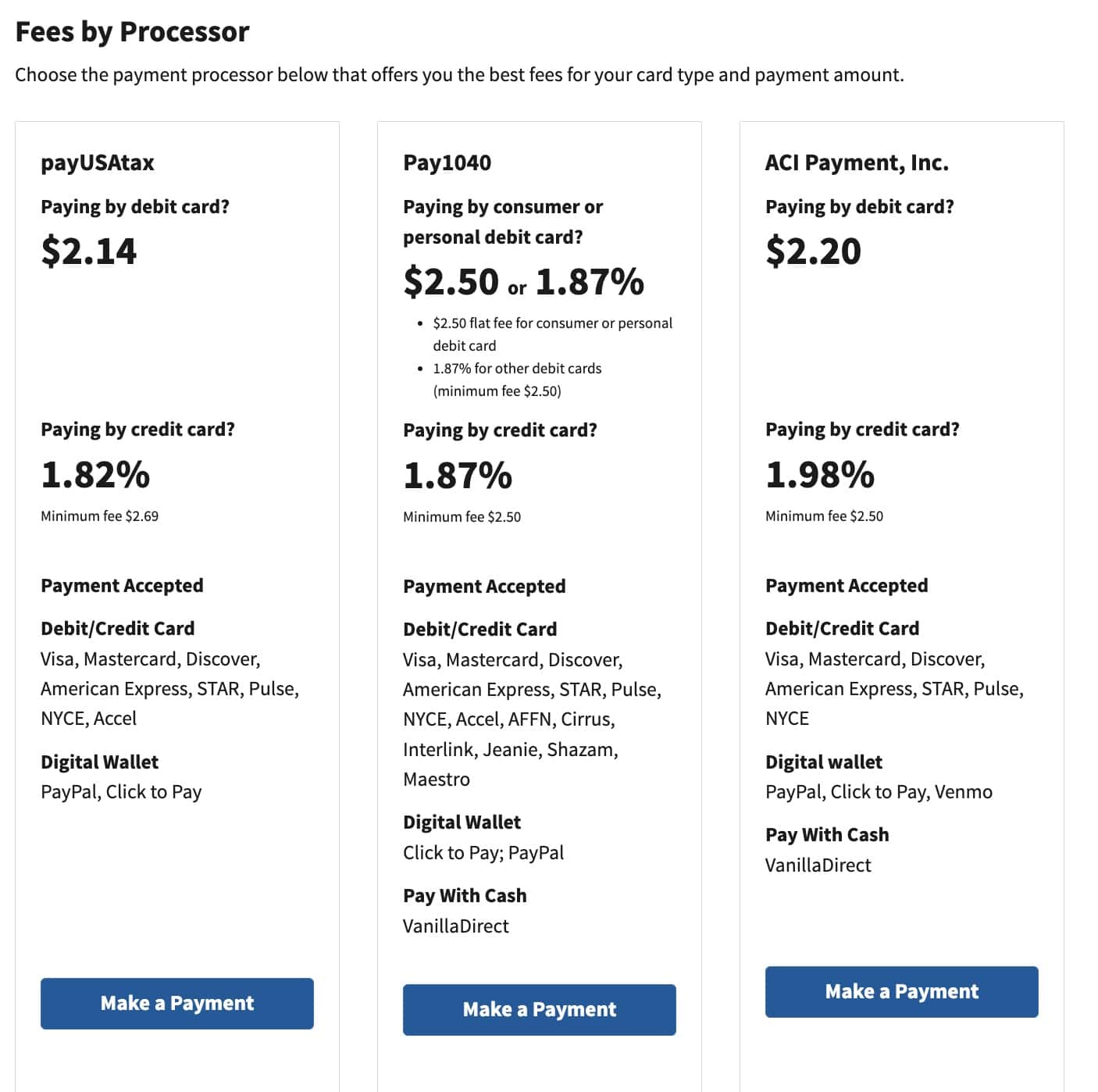

Finally, you can pay by credit card.

I don’t recommend this method for people who can pay by checking or savings debit because the IRS outsources this to third parties. These third party contractors attach credit card processing fees to these transactions.

Fees can range from a flat rate of $2.14 (for debit card transactions), to a percentage fee of up to 1.98%. Whether you can or cannot afford these fees, they simply do not make sense in the vast majority of situations.

Why you might consider using a different tax payment method

Security comes to mind as the top reason for using an alternative payment approach for paying your quarterly taxes.

If you complete and mail your 1040-ES form, you have to:

- Put your Social Security number on the written form

- Enclose a check with the form

- Send the form via mail to the IRS office for your state

So, you’re hoping that:

- Your check arrives intact

- No one steals your check

- No one steals your Social Security number

All of which takes time. Using an online payment method allows you to receive instant verification that your payment was accepted and processed.

Although you might not use Form 1040-ES to mail your tax payments, you may be able to use the estimated tax worksheet to estimated your taxable income and calculate your quarterly payments. Let’s take a closer look.

How to complete the Estimated Tax Worksheet

The estimated tax worksheet is fairly straightforward. Let’s take it one step at a time, beginning with Line 1.

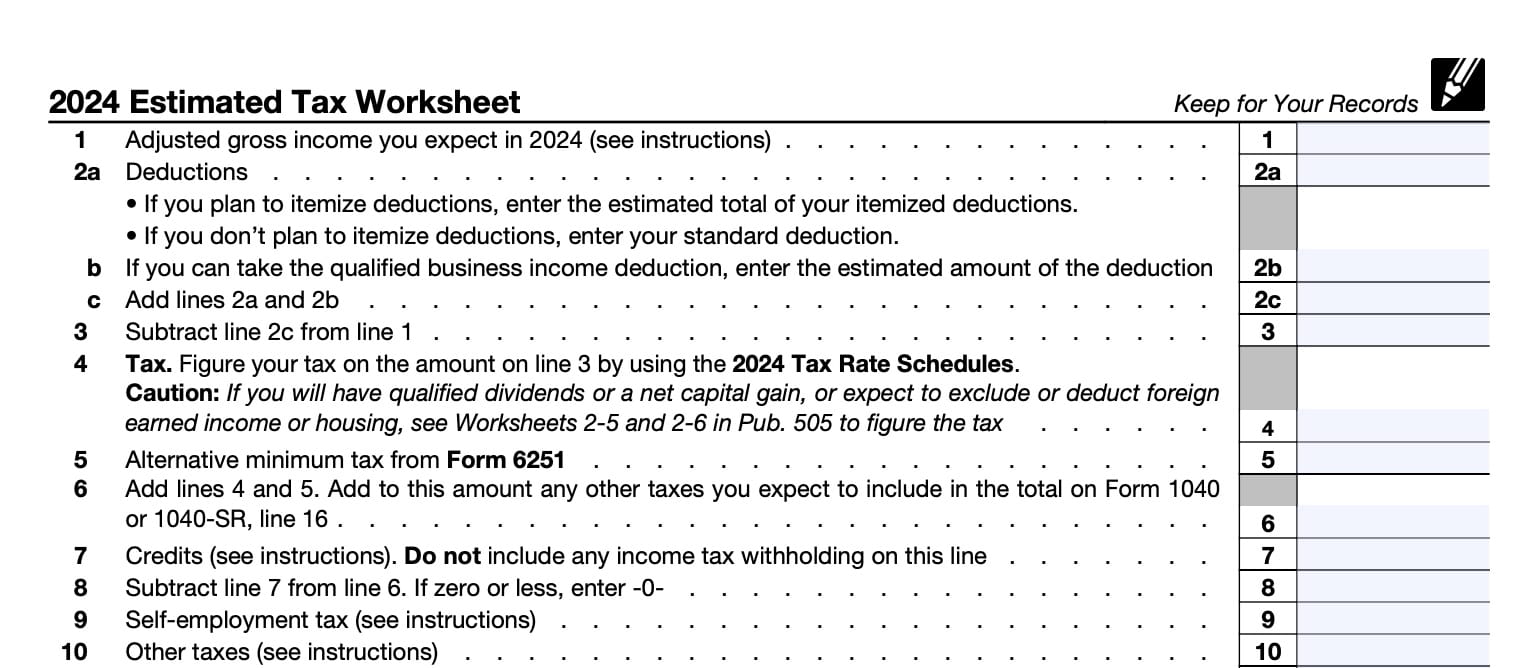

Line 1: Adjusted gross income you expect

Enter the adjusted gross income (AGI) you expect to report this year. You might be able to use last year’s numbers, if you expect your income to be the same. Your AGI is your total income minus adjustments to income.

When figuring the AGI you expect in 2024, be sure to consider items that might have changed from the previous tax year.

Tax changes for 2024

Below is a summary of the tax changes you should account for when estimating your AGI for the tax year.

Increased Standard Deduction

Here are the standard deductions for 2024, by tax filing status:

- Married filing jointly or qualifying surviving spouse: $29,200

- Head of household: $21,900

- Single or married filing separately: $14,600

For taxpayers who are age 65 or older, blind, or both, you may be entitled to a higher standard deduction.

If you are an unmarried individual (either single or head of household), you can add the following amounts to your standard deduction:

- Age 65 or older or blind: $1,950

- Age 65 or older and blind: $3,900

If you’re married (filing a joint return or separate returns) or a qualifying spouse, then you may make the following adjustments to your standard deduction:/

- Age 65 or older or blind: $1,550

- Age 65 or older and blind: $3,100

- Both spouses 65 or older or both spouses blind: $3,100*

- Both spouses 65 or older and both spouses blind: $6,200*

*Only applies to married couples filing a joint return, not separate returns.

You can also watch this video to learn how to use the standard deduction worksheet.

Social security tax

For 2024, the maximum amount of earned income (wages and net earnings from self-employment) subject to the social security tax is $168,600.

Additional child tax credit increase

For 2024, the maximum additional child tax credit amount that you can claim on Schedule 8812 is $1,700 for each qualifying child.

Adoption credit or exclusion

For 2024, the maximum adoption credit or exclusion for employer-provided adoption benefits that you can claim on IRS Form 8839 has increased to $16,810. In order to claim either the credit or exclusion, your modified adjusted gross income must be less than $292,150.

For more details on figuring your AGI, the form instructions direct you to IRS Publication 505, Chapter 2, Line 1: Expected AGI.

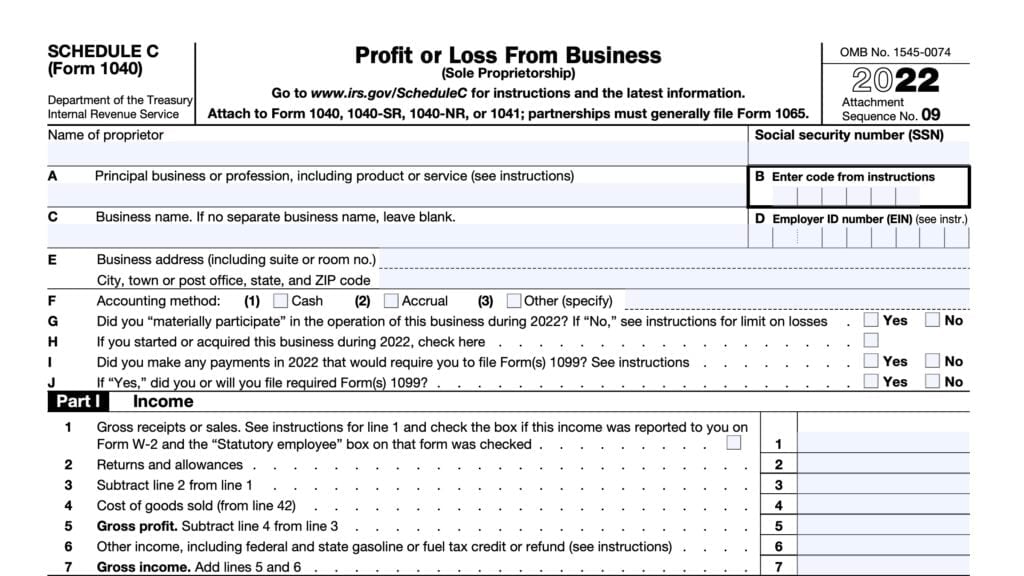

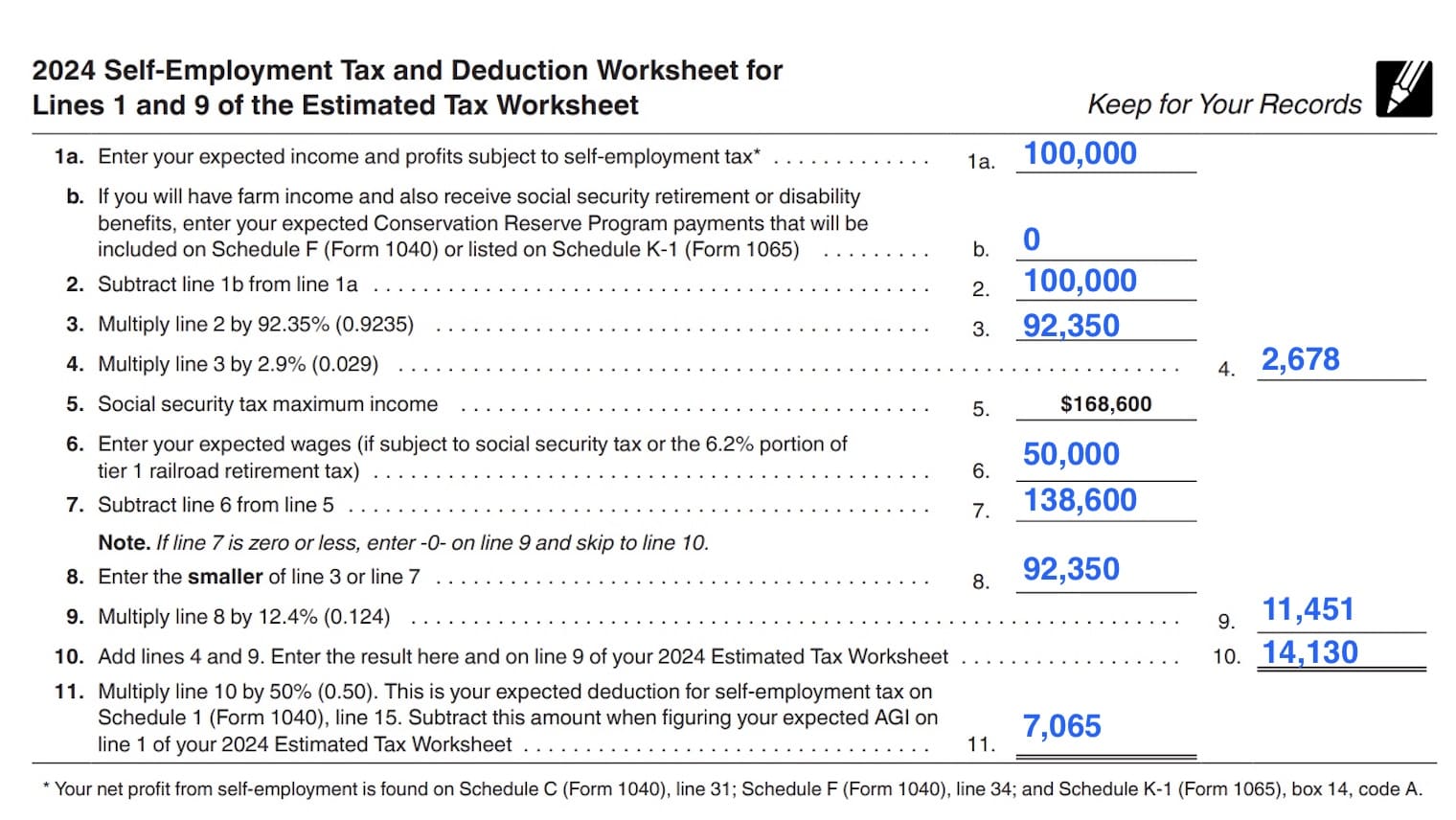

Self-employed individuals, you should complete the 2024 Self-Employment Tax and Deduction Worksheet for Lines 1 and 9 of the Estimated Tax Worksheet to figure the amount of self-employment taxes to subtract when figuring your expected AGI.

This worksheet will also give you the amount to enter on Line 9, below. Here’s is an example of the completed worksheet, using $100,000 self-employment income and $50,000 salary income.

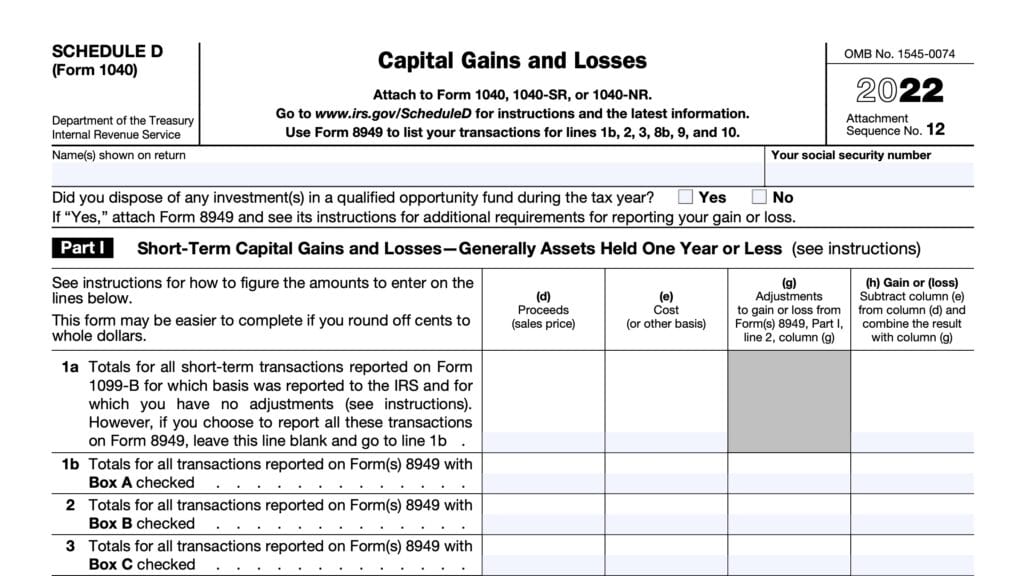

Line 2a: Deductions

Enter your deductions in Line 2a. If you plan to itemize deductions on Schedule A, enter the estimated total of your itemized deductions.

If you don’t plan to itemize deductions, enter your standard deduction.

Line 2b: QBI deduction

If you expect to claim the qualified business income (QBI) deduction, enter that amount here. You can either use IRS Form 8995 (simplified calculation) or IRS Form 8995-A, if you cannot use the simplified method.

Line 2c

Add Lines 2a and 2b, then enter the result here. If you do not plan to claim the QBI deduction, you can simply carry Line 2a to Line 2c.

Line 3

Subtract Line 2c from Line 1. Enter the result here.

Line 4: Tax

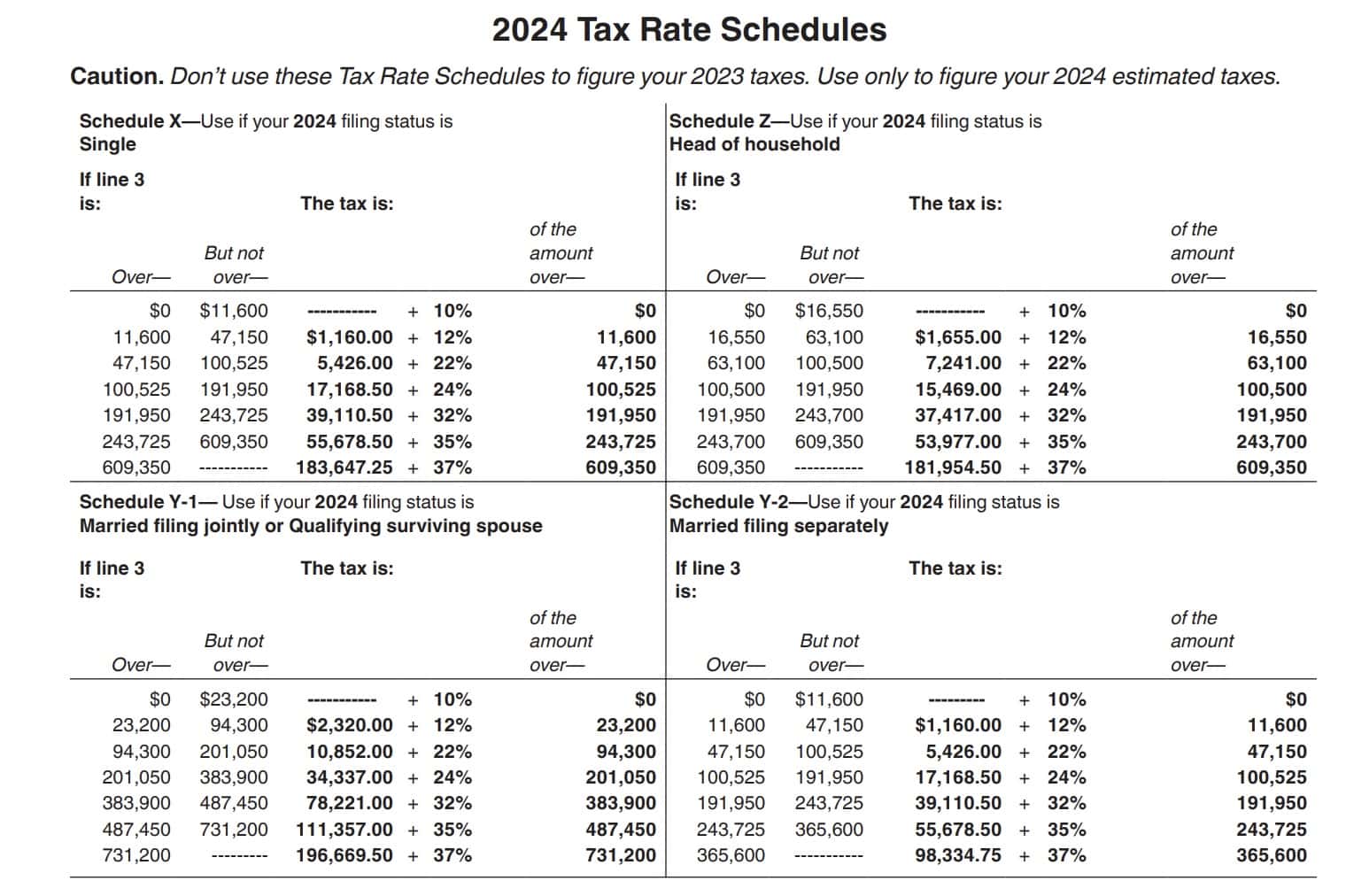

You can calculate your estimated tax by using the tax rate schedules, located below.

Line 5: Alternative minimum tax

If you plan to use IRS Form 6251 to calculate alternative minimum tax, then enter that amount here.

Line 6

Add Lines 4 and 5, then enter the amount here. Add any other taxes that you expect to include on your IRS Form 1040 or IRS Form 1040-SR.

Line 7: Tax credits

Enter any tax credits that you expect to receive in Line 7.

If you expect to claim the child tax credit, additional child tax credit, or credit for other dependents on Schedule 8812, you can look at last year’s Schedule 8812 as a reference point.

For other available tax credits, you should also review last year’s Schedule 3, Lines 1 through 6z.

Line 8

Subtract Line 7 from Line 6. Enter the difference here.

If the result is zero or a negative number, enter ‘0.’

Line 9: Self-employment tax

Enter the amount of self-employment tax that you calculated on the self-employment tax worksheet here.

If you and your spouse make joint estimated tax payments and both of you have self-employment income, you will have to figure the self-employment tax for each of you separately. Enter the total on Line 9.

When estimating your 2024 net earnings from self-employment, be sure to use only 92.35% (0.9235) of your total net profit from self-employment. This will help you account for the tax credit you receive for the employer’s portion of SE tax.

Line 10: Other taxes

For reference, you can review your prior year tax return to see if there are any additional taxes on Schedule 2. Enter the total of those additional taxes with the following exceptions:

Exception 1

Include household employment taxes from Schedule 2 (Form 1040), Line 9, on this line only if:

- You will have federal income tax withheld from:

- Wages income reported on Form W-2,

- Pension or annuity income reported on IRS Form 1099-R,

- Gambling winnings reported on IRS Form W-2G, or

- Other income sources, such as miscellaneous income reported on Form 1099-MISC

- You would be required to make estimated tax payments to avoid underpayment penalties even if you didn’t include household employment taxes when figuring your estimated tax.

If you meet either of the above, include the total of your household employment taxes on Line 10.

Exception 2

You do not have to pay the following taxes until the due date of your income tax return. Do not include them on Line 10.

- Uncollected social security and Medicare or RRTA tax on tips or group-term life insurance, Schedule 2, Line 13

- Recapture of federal mortgage subsidy, reported on Schedule 2, Line 17b

- Excise tax on excess golden parachute payments as reported on Schedule 2, Line 17k

- Excise tax on insider stock compensation from an expatriated corporation, Schedule 2, Line 17m, and

- Look-back interest under Section 167(g) or 460(b), from Schedule 2, Line 17n

- Calculated on either IRS Form 8697 or IRS Form 8866

According to the form instructions, the following taxes may warrant additional consideration, based on your tax situation:

- Additional Medicare Tax, calculated on IRS Form 8959

- Net Investment Income Tax (NIIT), calculated on IRS Form 8960

- Repayment of the first-time homebuyer credit, on Form 5405

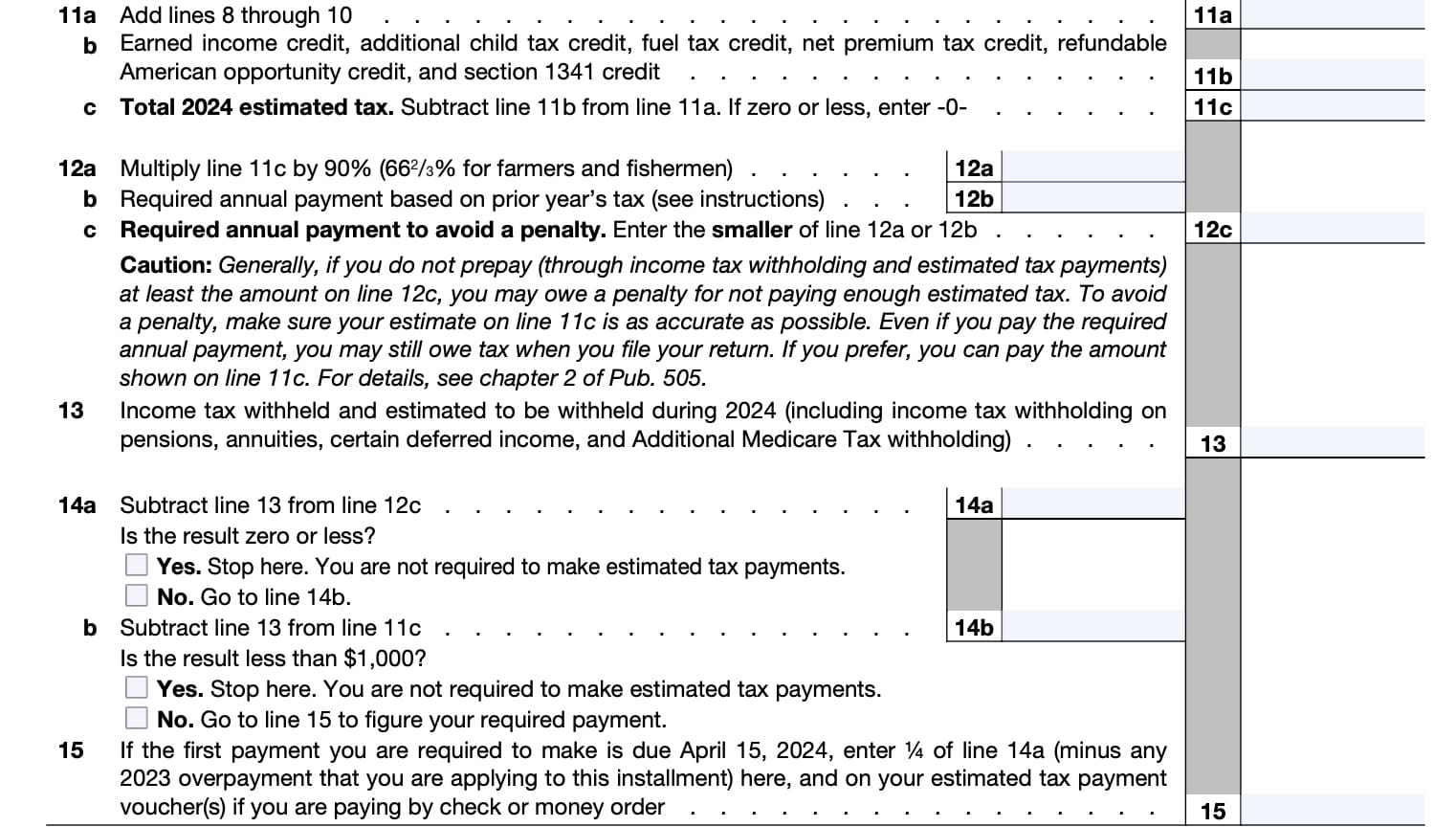

Line 11a

Add Lines 8 through 10. Enter the total in Line 11a.

Line 11b

Enter the total of the following tax credits:

- Earned income credit, calculated on Schedule EIC

- Additional child tax credit, as reported on Schedule 8812

- Fuel tax credit

- Net premium tax credit

- Refundable American Opportunity credit

- Section 1341 credit, also known as a claim of right repayment

Line 11c: total estimated tax

Subtract Line 11b from Line 11a. Enter the result here.

If the result is zero or a negative number, enter ‘0.’

Line 12a

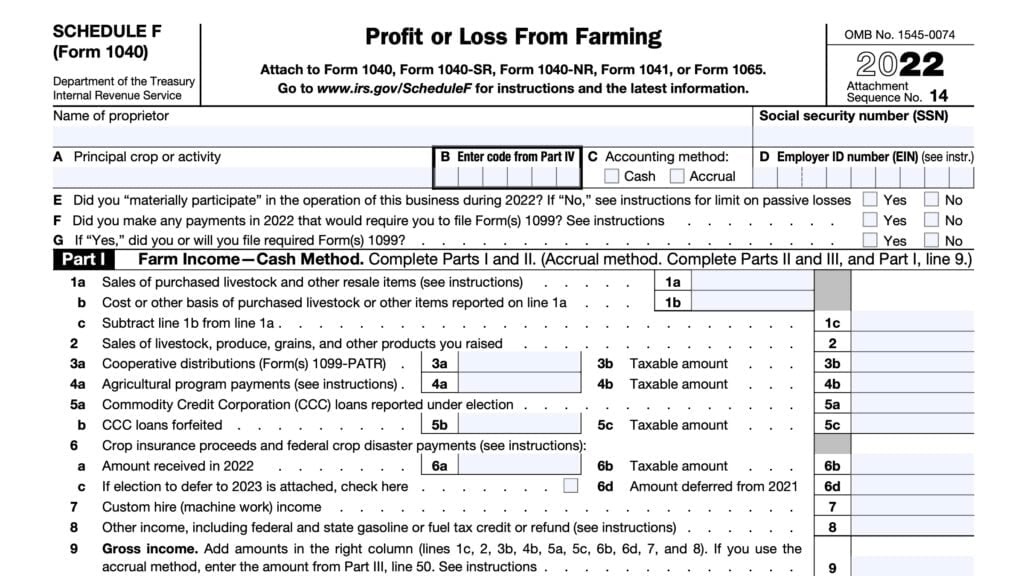

Multiply Line 11c by 90%. If you are a farmer or fisherman, and file IRS Schedule J, multiply this amount by 2/3, or 66 2/3%.

Line 12b: Required annual payment based on prior year’s tax

Enter your required tax payment based on the prior year’s tax liability. Enter your prior year tax bill unless one of the following applies to you.

AGI exceeds a certain amount

If the AGI from last year’s tax return exceeded $150,000 ($75,000 for married couples filing separately), enter 110% of your prior year tax bill instead of 100%.

This does not apply to farmers or fishermen.

You will file a joint return but did not last year

Add the tax shown on your prior year return to your spouse’s tax from his or her prior year return. Enter the total on Line 12b.

You filed a joint return but will not file one this year

If you filed a joint return for 2023 but you will not file a joint return for 2024, first figure the tax both you and your spouse would have paid had you filed separate returns for 2023 using the same filing status as for 2024.

Then multiply the tax on the joint return by a fraction, the numerator being the tax you would have paid had you filed a separate return, over the total tax you and your spouse would have paid had you filed separate returns.

Enter this amount on Line 12b.

If you didn’t file a tax return or your 2023 tax year was less than 12 full months

Do not complete Line 12b. Bring the Line 12a amount down to Line 12c.

Figuring your 2023 tax

Use the following instructions to figure your 2023 tax.

The tax shown on your 2023 Form 1040 or 1040-SR is the amount on Form 1040 or 1040-SR, line 24, reduced by:

- Unreported social security and Medicare tax or RRTA tax from Schedule 2, Lines 5 and 6;

- Any tax included on Schedule 2, Line 8, as calculated on IRS Form 5329, on excess contributions to one of the following:

- An IRA

- Archer MSA

- Coverdell education savings account

- Health savings account

- ABLE account, or

- Excess accumulations in qualified retirement plans

- Amounts on Schedule 2 as listed under Exception 2, earlier; and

- Any refundable credit amounts on:

- IRS Form 1040 or 1040-SR, Lines 27, 28, and 29

- IRS Schedule 3 Lines 9 and 12, and

- IRS Schedule H Lines 8e and 8f.

Line 12c: Required annual payment to avoid a penalty

Enter the smaller of:

- Line 12a

- Line 12b

Line 13: Income tax withheld and estimated to be withheld

Enter the total of all estimated income tax withholding. This includes tax withholding on pensions, annuities, certain deferred income, and additional Medicare tax.

Line 14a

Subtract Line 13 from Line 12c.

If the result is zero or a negative number, stop. You do not need to make estimated tax payments.

If the number is positive, go to Line 14b.

Line 14b

Subtract Line 13 from Line 11c. If the result is less than $1,000, stop. You do not need to make estimated tax payments.

If the result is $1,000 or more, then you must make estimated tax payments.

Line 15

If your first tax payment is due April 15, 2024, then multiply Line 14a by 1/4. Subtract any tax overpayment from your prior year return.

Enter the total here and on your estimated tax payment voucher (or vouchers) if you are paying by check or money order.

Video walkthrough

Frequently asked questions

No. You can use IRS Form 1040-ES to pay estimated tax. You can also pay income taxes throughout the year by increasing tax withholdings or by making payments on the IRS website through your IRS account or the Electronic Federal Tax Payment System.

If you’re required to make estimated payments in addition to voluntary withholding, then your first quarterly payment is due on the same day as your prior year’s tax filing deadline.

Where can I find IRS Form 1040-ES?

As with most tax forms, you can find IRS Form 1040-ES on the IRS website. For your convenience, we’ve enclosed the latest version here, in our article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!