IRS Schedule H Instructions

If you have household employees, you might need to file IRS Schedule H with your federal income tax return. In this article, we’ll walk through this tax form, and everything you need to know, including:

- How to complete and file IRS Schedule H

- How to calculate employment taxes with Schedule H

- Frequently asked questions about Schedule H

Let’s start with a step by step walkthrough.

Table of contents

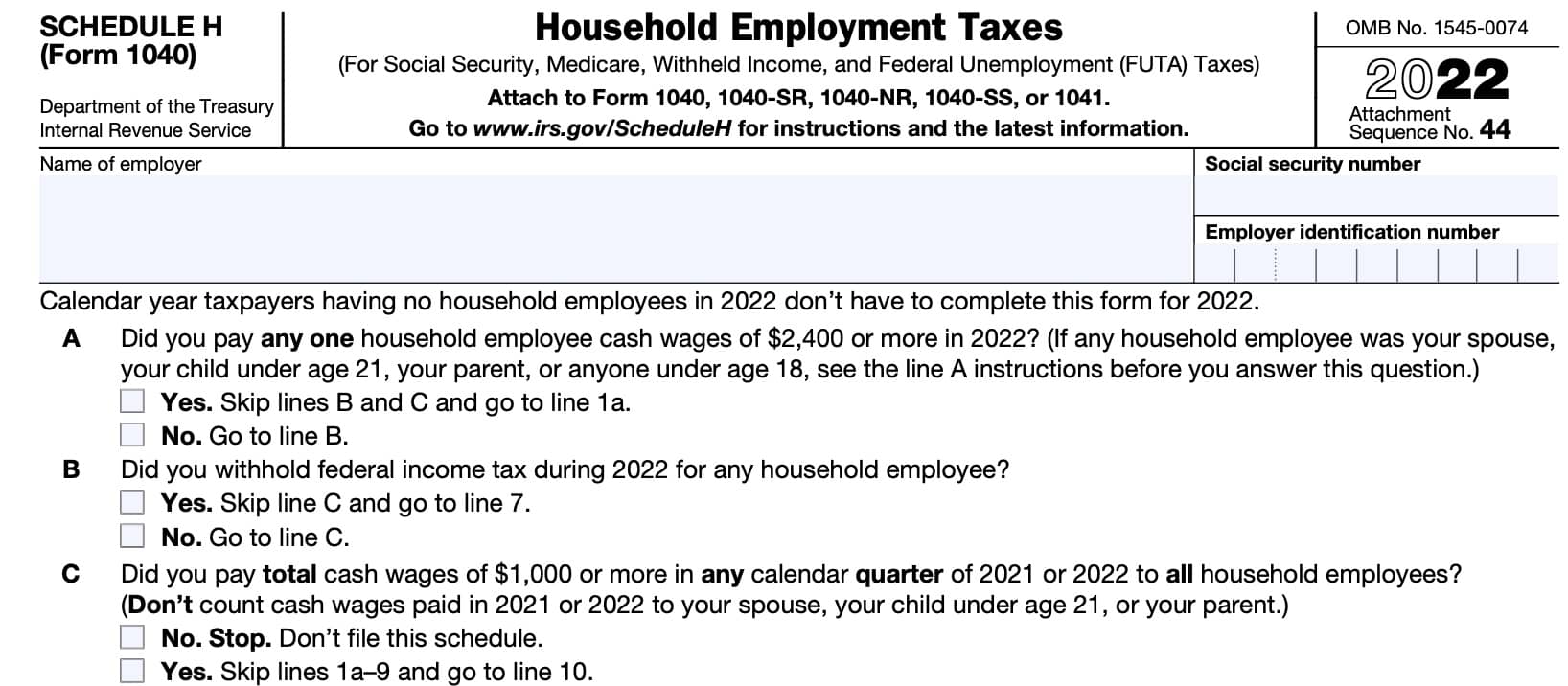

How do I complete IRS Schedule H?

There are four parts to this two-page tax form:

- Part I: Social Security, Medicare, and Federal Income Taxes

- Part II: Federal Unemployment (FUTA) Tax

- Part III: Total Household Employment Taxes

- Part IV: Address & Signature

Before we go to Part I, let’s start with the information fields at the top of Schedule H.

Top of Schedule H

In the top section of Schedule H, you will need to enter the following information:

- Name of employer

- Taxpayer information as it appears on your income tax return

- Social Security number

- Employer identification number (EIN)

If you do not have an EIN, then you must obtain an EIN if you are required to file Schedule H with your tax return.

How to obtain an employer identification number

If you have household employees, you will need an EIN to file Schedule H.

If you don’t have an EIN, you may apply for one in one of several ways:

- Online: Go to IRS.gov/EIN to submit an online application

- Can obtain EIN immediately

- Application: Complete IRS Form SS-4, then submit by fax or mail

- Fax: Can obtain EIN within approximately 4 business days

- Mail: Can obtain EIN within approximately 4 weeks

Once you’ve completed these fields, you’ll need to answer several questions to determine if you need to file Schedule H.

Household employee questions

The Internal Revenue Service will consider your answers to the following three questions when trying to determine whether you need to file Schedule H.

Question A

Did you pay any one household employee cash wages of $2,400 or more in the tax year?

If the answer is ‘Yes,’ then you may skip Question B and Question C, and go directly to Line 1a. If no, then go to Question B.

When answering this question, do not take into consideration any of the following persons:

- Your spouse

- Your child who is under the age of 21

- Your parent

- Any person under the age of 18 during the tax year

Question B

Did you withhold federal income tax for any household employee?

If you withheld federal income taxes for any household worker during the tax year, then skip Question C and go directly to Line 7.

Otherwise, go to Question C.

Question C

Did you pay total cash wages of $1,000 or more in any calendar quarter to all household employees?

If the answer to Question C is ‘Yes,’ then you can go directly to Line 10. Otherwise, stop here.

If the answer to all three questions is ‘No,’ then you do not need to file Schedule H with your personal income tax return. Also, if you are a calendar year taxpayer, and you have no household employees during the year, you do not need to file Schedule H, even if you did so last year.

Just in case, your starting point depends on which question you answered Yes to:

- Question A: Start on Line 1a

- Question B: Start on Line 7

- Question C: Start on Line 10 (skip Part I completely)

Let’s move on to Part I.

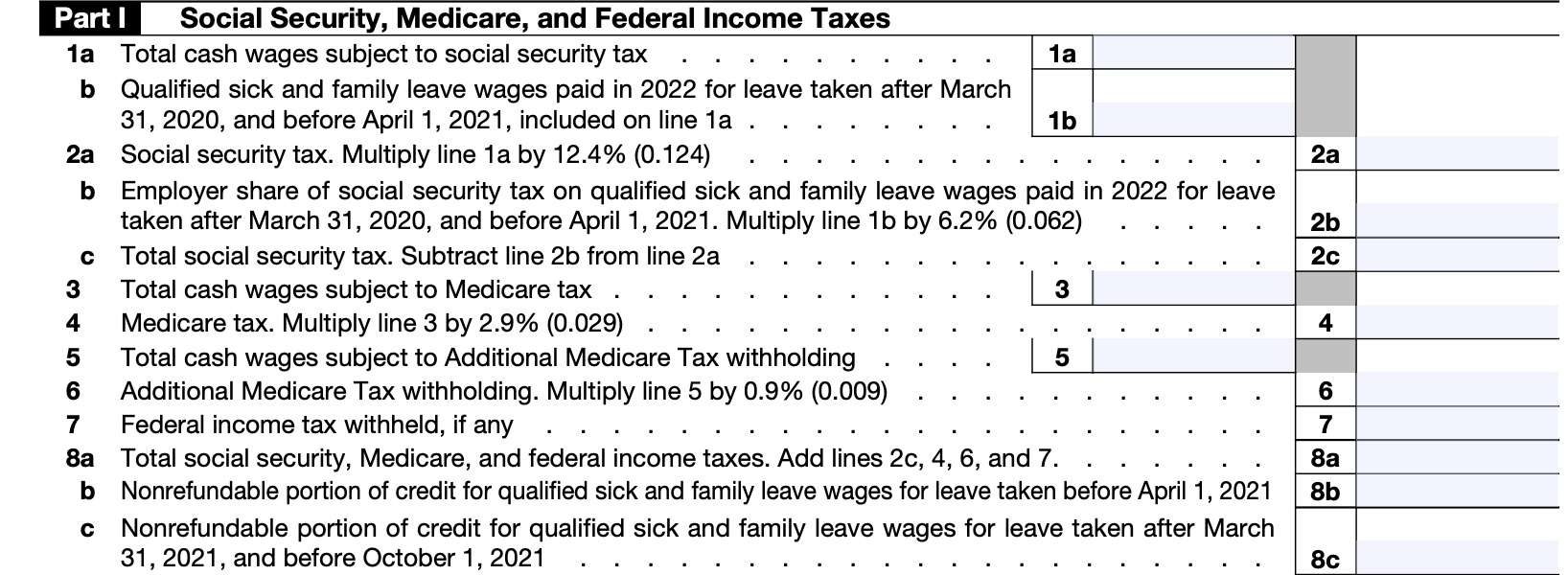

Part I: Social Security, Medicare, and Federal Income Taxes

In Part I, we’ll calculate the amount of taxes that you need to withhold or pay, based upon your household payroll. This includes:

- Social Security taxes

- Medicare taxes

- Federal income taxes

Let’s start with Line 1.

Line 1

There are two parts to Line 1, primarily due to a one-time change to the Social Security withholding requirement that occurred during the coronavirus pandemic.

Line 1a: Total cash wages subject to Social Security tax

In Line 1a, enter the total cash wages that are subject to Social Security tax, up to the Social Security wage base limit.

For 2022, the Social Security wage base limit is $147,000 for each employee. Only include the first $147,000 of each employee’s cash wages when calculating the Social Security tax responsibility.

Cash wages

Cash wages can include include wages paid by check, money order, or cash. However, cash wages don’t include the value of noncash items that you might give to a household worker, such as:

- Food

- Lodging

- Clothing

- Transit passes

Cash that you give to an employee in place of these items are included in cash wages and subject to tax payments.

However, you are only required to report these cash wages if you paid a household employee $2,400 or more in cash wages during the tax year. This is known as the $2,400 test.

Line 1b

In Line 1b, report the amount of qualified sick and family leave wages paid in 2022 for leave taken after March 31, 2020, and before April 1, 2021, that you included on Line 1a. Due to a one-time COVID update to the tax laws, employers are not responsible for the employer portion of Social Security tax on wages paid during this time frame.

Line 2

Line 2a: Social Security tax

In Line 2a, multiply the Line 1a amount by 12.4%. This represents both the employer’s portion and the employee’s portion of the total Social Security tax responsibility:

- Employer’s responsibility: 6.2% (except on qualified sick & family leave wages paid for leave taken after March 31, 2020 and before April 1, 2021

- Employee’s responsibility: 6.2%

Line 2b

In Line 2b, multiply Line 1b by 6.2%.

Line 2c: Total Social Security tax

Subtract the Line 2b amount from Line 2a. This represents the total Social Security tax responsibility after accounting for the COVID moratorium on employer-paid Social Security taxes.

Line 3: Total cash wages subject to Medicare tax

Enter the total cash wages that you paid in 2022 to each household employee who meets the $2,400 test. Unlike Social Security taxes, there is no limit on wages subject to Medicare tax.

Line 4: Medicare tax

Multiply Line 3 by the Medicare tax rate, which is 2.9% (0.029). This represents This represents both the employer’s portion and the employee’s portion of the total Medicare tax responsibility in equal amounts:

- Employer’s responsibility: 1.45%

- Employee’s responsibility: 1.45%

Enter the result in Line 4.

Line 5: Total cash wages subject to Additional Medicare Tax withholding

Individuals who earn over $200,000 in any given tax year may be responsible for paying additional Medicare tax. Enter the total cash wages that you paid to any employee in excess of $200,000.

Line 6: Additional Medicare Tax withholding

Multiply Line 5 by 0.9% (0.009). Enter the result here.

Line 7: Federal income tax withheld

If applicable, enter the amount of federal income tax that you withheld throughout the year.

As a household employer, the federal government does not require you to withhold federal income tax from wages you pay a household employee. You should withhold federal income tax only if your household employee asks you to withhold it and you agree.

If this is the case, then the employee must give you a completed Form W-4, which will instruct you on the amount of federal taxes to withhold.

Line 8

In Line 8, we’ll total the amount of Social Security, Medicare, and federal income taxes, then we’ll make adjustments based upon certain changes to the tax code due to COVID-19.

Let’s start with Line 8a.

Line 8a: Total Social Security, Medicare, and federal income taxes

Add the following lines, then enter the total in Line 8a:

If you are not looking for a paid leave tax credit for qualified sick or family leave wages, you can enter the Line 8a amount into Line 8d, then proceed directly to Line 9. Otherwise, proceed to Line 8b, below.

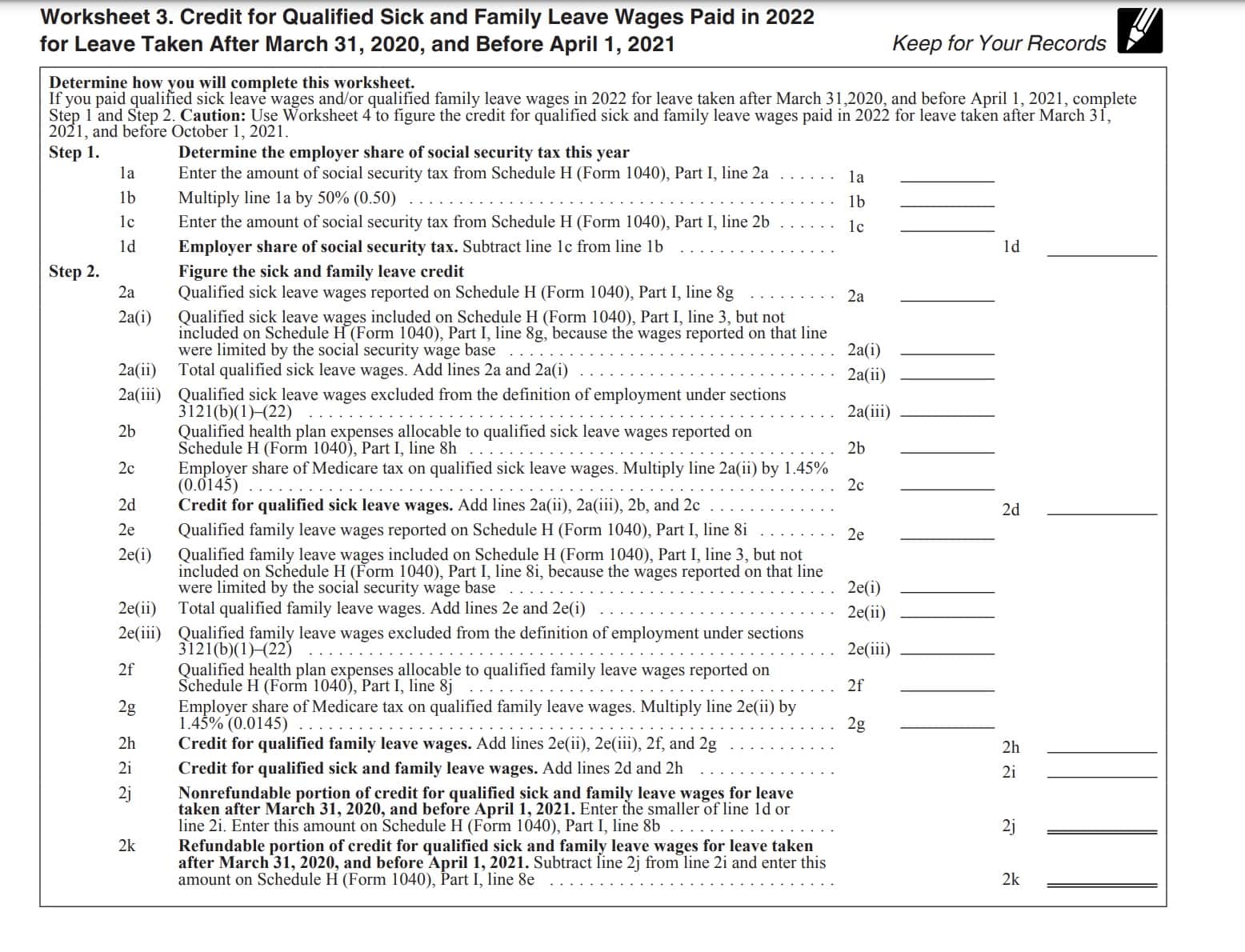

Line 8b

Complete Line 8b only if qualified sick leave wages and/or qualified family leave wages were paid in 2022 for leave taken after March 31, 2020, and before April 1, 2021.

In Line 8b, enter the nonrefundable portion of the credit for qualified sick and family leave wages for

leave taken after March 31, 2020, and before April 1, 2021. To arrive at this amount, you’ll need to complete the following worksheet (Worksheet 3 in the Schedule H instructions).

Once you’ve completed Worksheet 3, enter the number from Line 2j of the worksheet. This represents the nonrefundable portion of the tax credit.

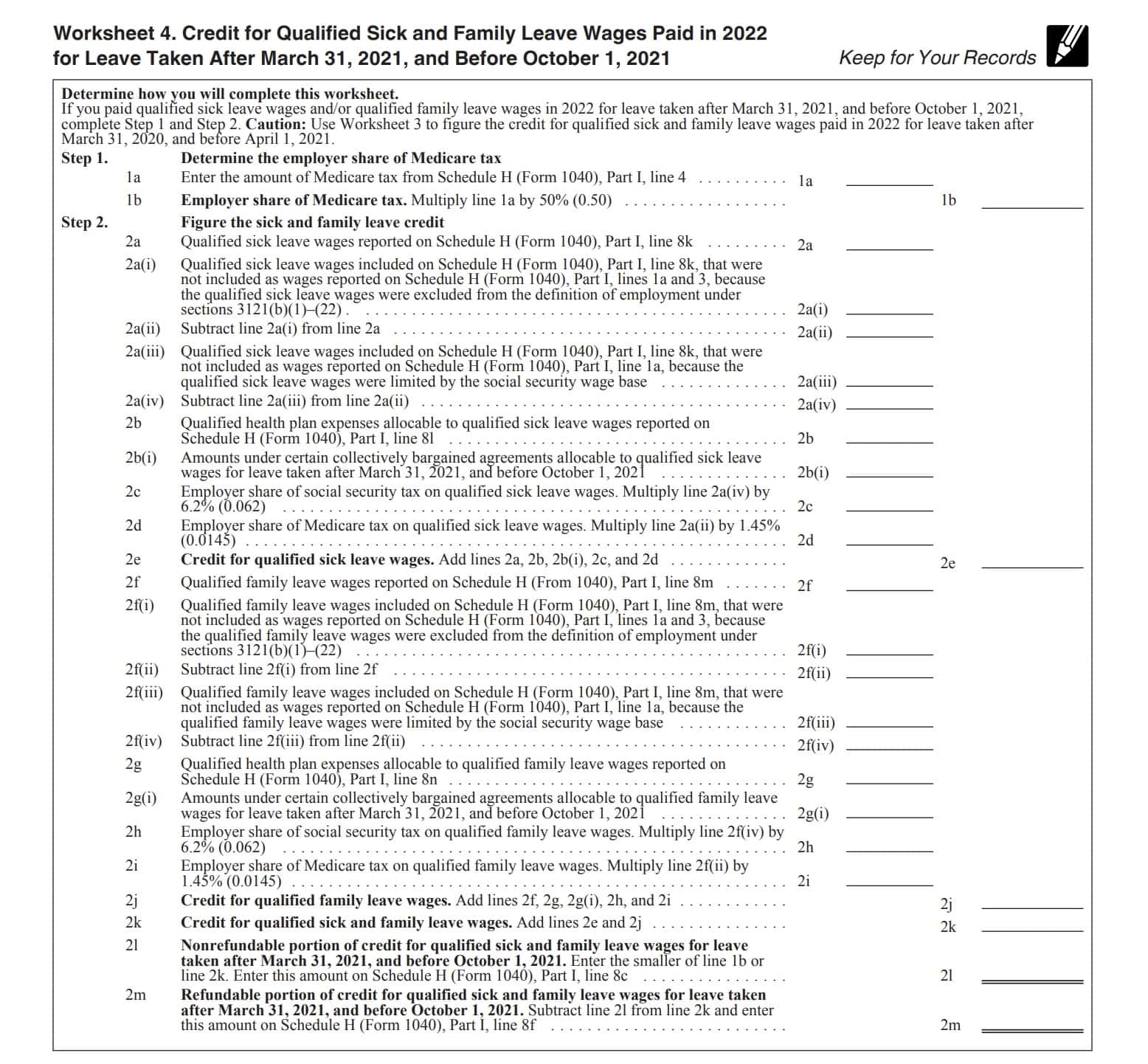

Line 8c

Complete Line 8c only if qualified sick leave wages and/or qualified family leave wages were paid in 2022 for leave taken after March 31, 2021, and before October 1, 2021.

In Line 8c, enter the nonrefundable portion of the credit for qualified sick and family leave wages for

leave taken after March 31, 2021, and before October 1, 2021. To arrive at this amount, you’ll need to complete the following worksheet (Worksheet 4 in the Schedule H instructions).

Once you’ve completed Worksheet 4, enter the number from Line 2l of the worksheet. This represents the nonrefundable portion of the tax credit.

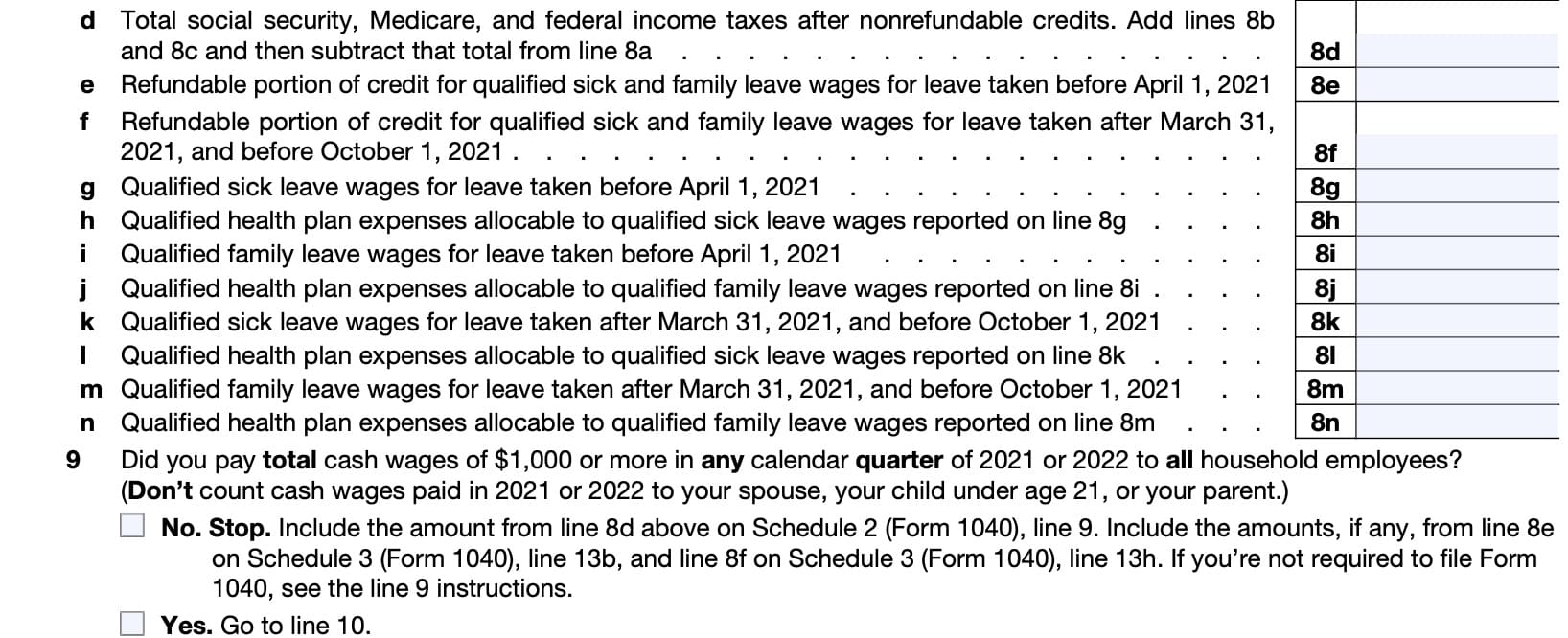

Line 8d: Total Social Security, Medicare, and federal income taxes after nonrefundable credits

Add Line 8b and Line 8c together. Subtract this total from Line 8a, then enter the difference here.

Line 8e: Refundable portion of credit for qualified sick and family leave wages for leave taken before April 1, 2021

Enter the refundable portion of this credit, which you’ll find on Line 2k of Worksheet 3.

Line 8f: Refundable portion of credit for qualified sick and family leave wages for leave taken After March 31, 2021, and before October 1, 2021

Enter the refundable portion of this credit. You’ll find this number on Line 2m of Worksheet 4.

Line 8g: Qualified sick leave wages for leave taken before April 1, 2021

Complete Lines 8g and 8h only if qualified sick leave wages were paid in 2022 for leave taken after March 31, 2020, and before April 1, 2021.

Enter the qualified taxable (subject to Social Security tax) sick leave wages you paid in 2022 to your employees for leave taken after March 31, 2020, and before April 1, 2021.

This is the same number that you will enter on Line 2a of Worksheet 3.

Line 8h: Qualified health plan expenses allocable to qualified sick leave wages reported on Line 8g

Enter the qualified health plan expenses allocable to qualified sick leave wages paid in 2022 for leave taken after March 31, 2020, and before April 1, 2021.

This is the same number that you will enter on Line 2b of Worksheet 3.

Qualified health plan expenses

The credit for qualified sick leave wages and qualified family leave wages is increased to cover the qualified health plan expenses that are properly allocable to the qualified leave wages for which the credit is allowed.

These qualified health plan expenses are amounts paid or incurred by the employer to provide and maintain a group health plan but only to the extent such amounts are excluded from the employees’ income as coverage under an accident or health plan.

The amount of qualified health plan expenses generally includes both the portion of the cost paid by the employer and the portion of the cost paid by the employee with pre-tax salary reduction contributions. However, qualified health plan expenses don’t include amounts that the employee paid for with after-tax contributions.

Line 8i: Qualified Family leave wages for leave taken before April 1, 2021

Complete Lines 8i and 8j only if qualified family leave wages were paid in 2022 for leave taken after March 31, 2020, and before April 1, 2021.

Enter the qualified taxable (subject to Social Security tax) family leave wages you paid in 2022 to your employees for leave taken after March 31, 2020, and before April 1, 2021.

This is the same number that you will enter on Line 2e of Worksheet 3.

Line 8j: Qualified health plan expenses allocable to qualified Family leave wages reported on Line 8i

Enter the qualified health plan expenses allocable to qualified sick leave wages paid in 2022 for leave taken after March 31, 2020, and before April 1, 2021.

This is the same number that you will enter on Line 2f of Worksheet 3.

Line 8k: Qualified sick leave wages for leave taken After March 31, 2021, and before October 1, 2021

Complete Lines 8k and 8l only if qualified sick leave wages were paid in 2022 for leave taken after March 31, 2021, and before October 1, 2021.

Enter the qualified taxable (subject to Social Security tax) sick leave wages you paid in 2022 to your employees for leave taken after March 31, 2021, and before October 1, 2021.

This is the same number that you will enter on Line 2a of Worksheet 4.

Line 8l: Qualified health plan expenses allocable to qualified sick leave wages reported on Line 8k

Enter the qualified health plan expenses allocable to qualified sick leave wages paid in 2022 for leave taken after March 31, 2021, and before October 1, 2021.

This is the same number that you will enter on Line 2b of Worksheet 4.

Line 8m: Qualified family leave wages for leave taken After March 31, 2021, and before October 1, 2021

Complete Lines 8m and 8n only if qualified family leave wages were paid in 2022 for leave taken after March 31, 2021, and before October 1, 2021.

Enter the qualified taxable (subject to Social Security tax) family leave wages you paid in 2022 to your employees for leave taken after March 31, 2021, and before October 1, 2021.

This is the same number that you will enter on Line 2f of Worksheet 4.

Line 8n: Qualified health plan expenses allocable to qualified family leave wages reported on Line 8m

Enter the qualified health plan expenses allocable to qualified sick leave wages paid in 2022 for leave taken after March 31, 2021, and before October 1, 2021.

This is the same number that you will enter on Line 2g of Worksheet 4.

Line 9

Did you pay total cash wages of $1,000 or more in any calendar quarter of 2021 or 2022 to all household employees?

When answering this question, do not consider your spouse, your child who is under 21 years of age, or a parent.

If the answer is Yes, then proceed to Line 10. If the total for any quarter in 2021 or 2022 is not $1,000 or more, check No, stop here, and include the amount from Line 8d on IRS Schedule 2 (Form 1040), Line 9.

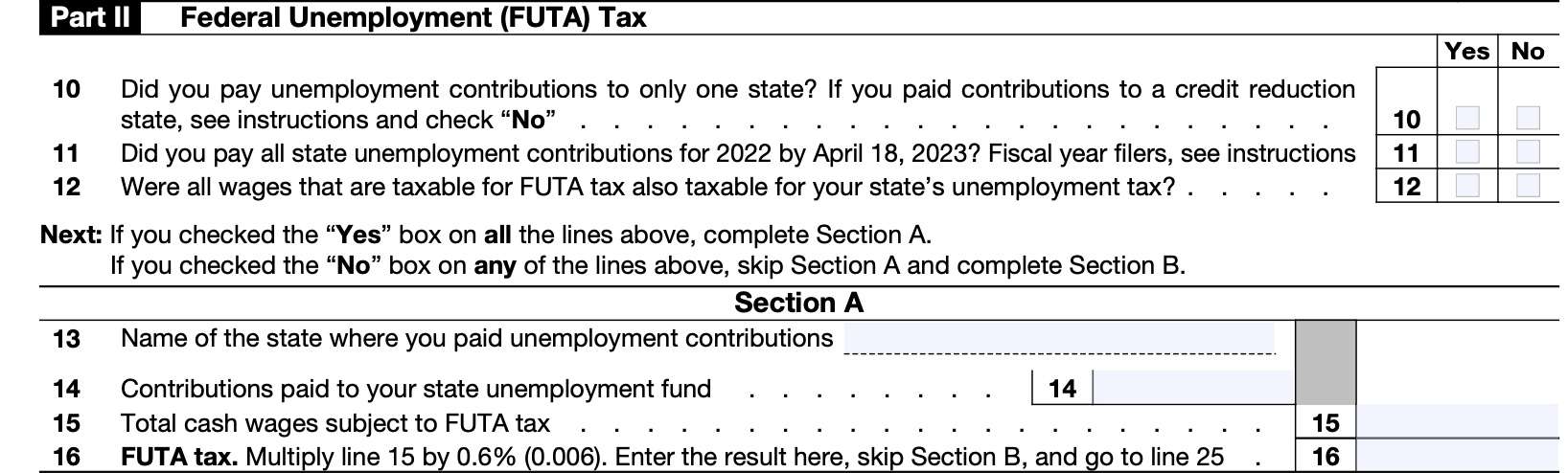

Part II: Federal Unemployment (FUTA) Tax

In Part II, we’ll calculate the employer’s federal unemployment tax (FUTA) responsibility.

The employer’s FUTA tax responsibility

The FUTA tax applies to the first $7,000 you pay to each employee during a calendar year after subtracting any payments exempt from FUTA taxes. In 2022, the FUTA tax rate was 6.0%, which only employers pay from their own funds.

Don’t collect or deduct FUTA tax from your employee’s wages. Employers may be able to

take a credit of up to 5.4% against the FUTA tax, resulting in a net FUTA tax rate of 0.6%. However, the employer must have made required contributions for 2022 to the respective state’s unemployment fund by April 18, 2023.

Line 10

For Lines 10 through 12, answer each question Yes/No.

Did you pay unemployment contributions to only one state?

If you paid contributions to a credit reduction state, then you’ll need to check No, then follow special directions to complete Line 23, below. For more information on how to complete Line 23, see the Schedule H instructions.

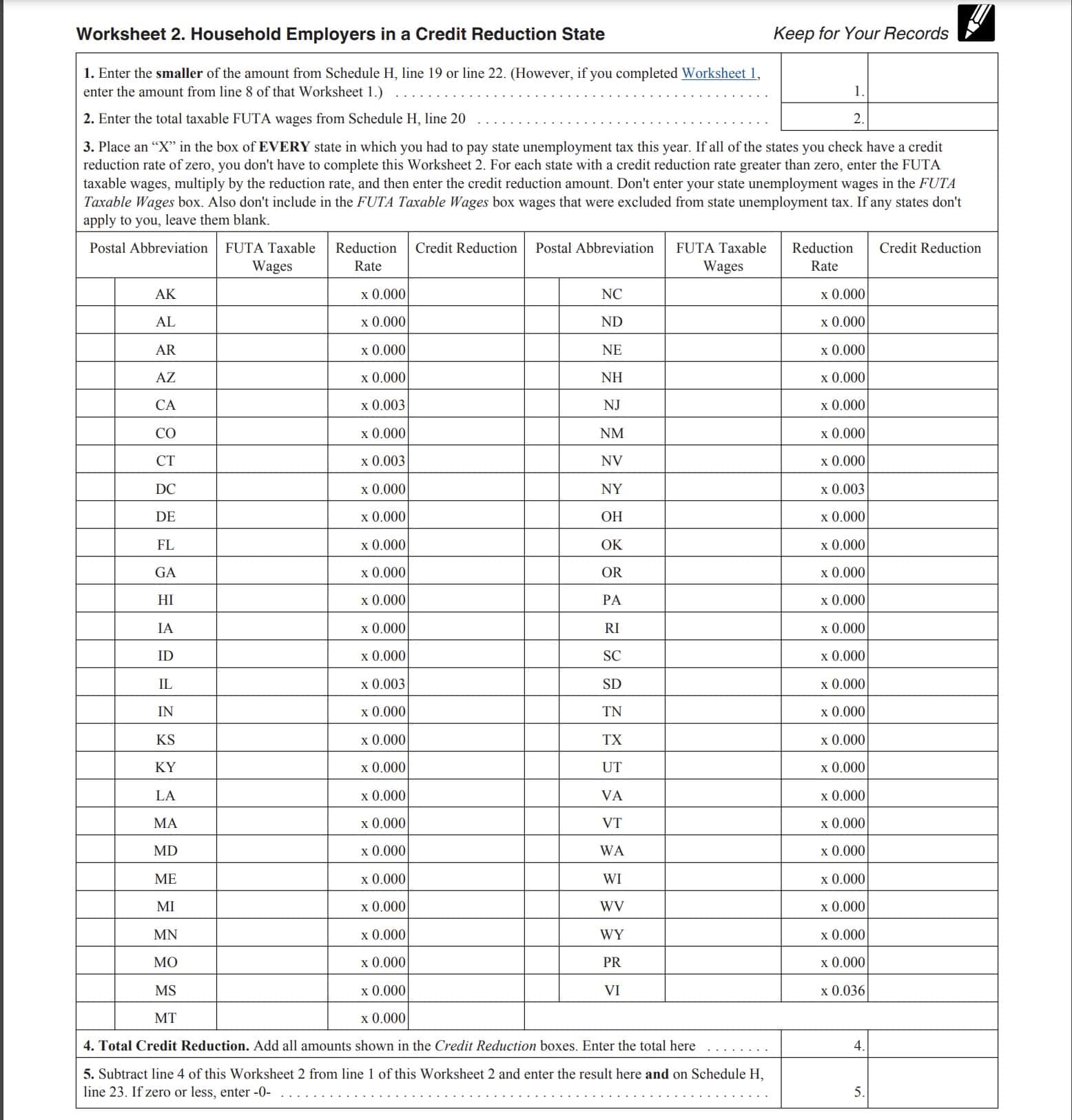

Credit reduction states

A state that hasn’t repaid money it borrowed from the federal government to pay unemployment benefits is a credit reduction state, as designated by the Labor Department. If an employer pays wages that are subject to the unemployment tax laws of a credit reduction state, that employer must pay additional federal unemployment tax.

The following are considered credit reduction states for tax year 2022:

- California

- Connecticut

- Illinois

- New York

- U.S. Virgin Islands

Line 11

Did you pay all state unemployment contributions for 2022 by April 18, 2023?

If you are a fiscal year filer, and you paid all state unemployment contributions for 2022 by the due date of your return (not including extensions), check the Yes box on Line 11. Otherwise, check No.

Line 12

Were all wages that are taxable for FUTA tax also taxable for your state’s unemployment tax?

If you checked Yes to all three questions in Lines 10 through 12, go to Line 13. Otherwise, skip Lines 13 through 16, and go to Line 17.

Line 13

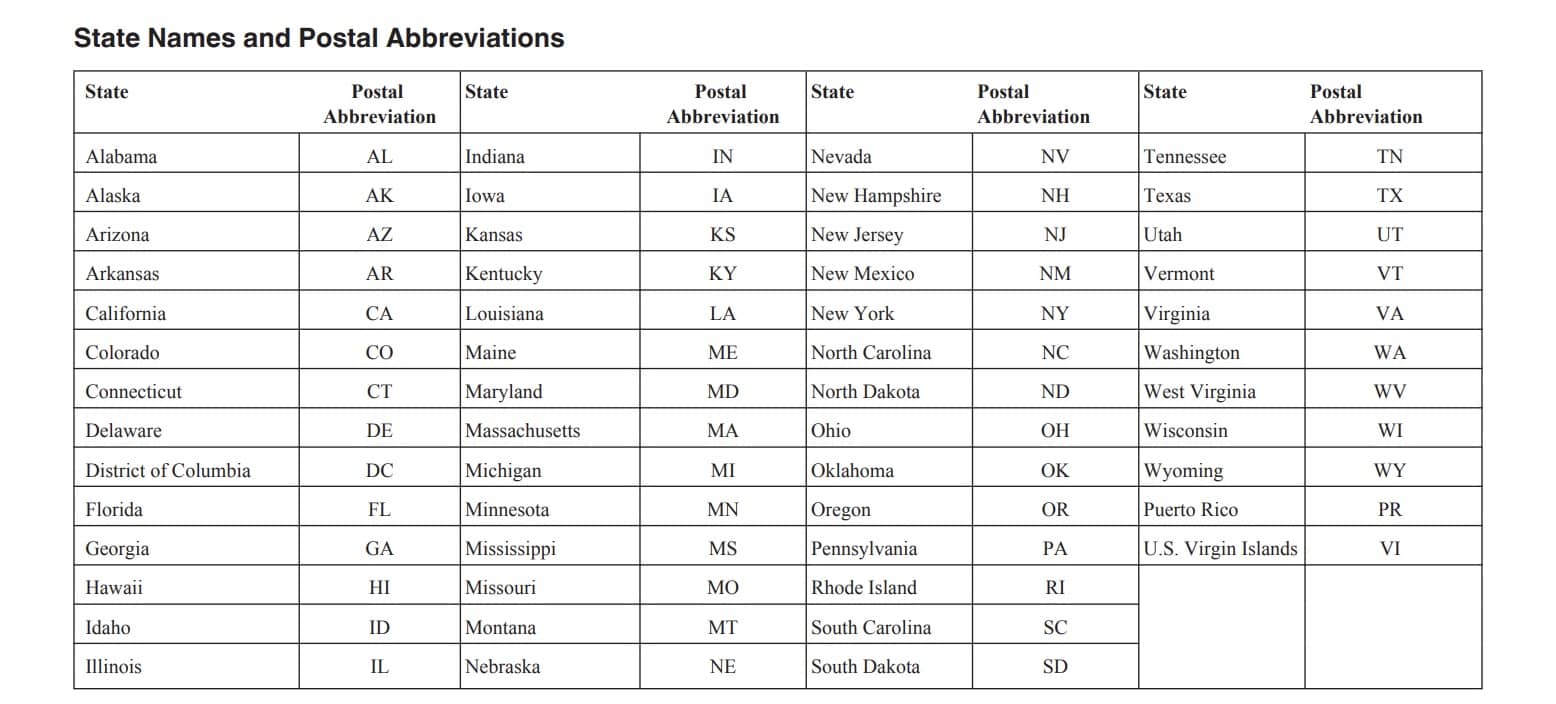

Enter the name of the state where you paid unemployment contributions. Use the two-letter abbreviation of the name of the state (or the District of Columbia, Puerto Rico, or the U.S. Virgin Islands) to which you paid unemployment contributions.

If you are not sure about the postal abbreviation for your state or territory, use the reference table shown below.

Line 14

In Line 14, enter the total amount of unemployment taxes that you paid to your state’s unemployment fund. If you didn’t have to make contributions because your state gave you a 0% experience rate, enter “0% rate” in Line 14.

Line 15: Total cash wages subject to FUTA tax

In Line 15, enter the amount that you paid in 2022 to each household employee, up to $7,000 per person. This includes employees that you paid less than $1,000.

However, don’t include cash wages paid in 2022 to any of the following individuals:

- Your spouse

- Your child who was under age 21

- Your parent

Line 16: FUTA Tax

Multiply the wages on Line 15 by 0.6% (0.006), then enter the result.

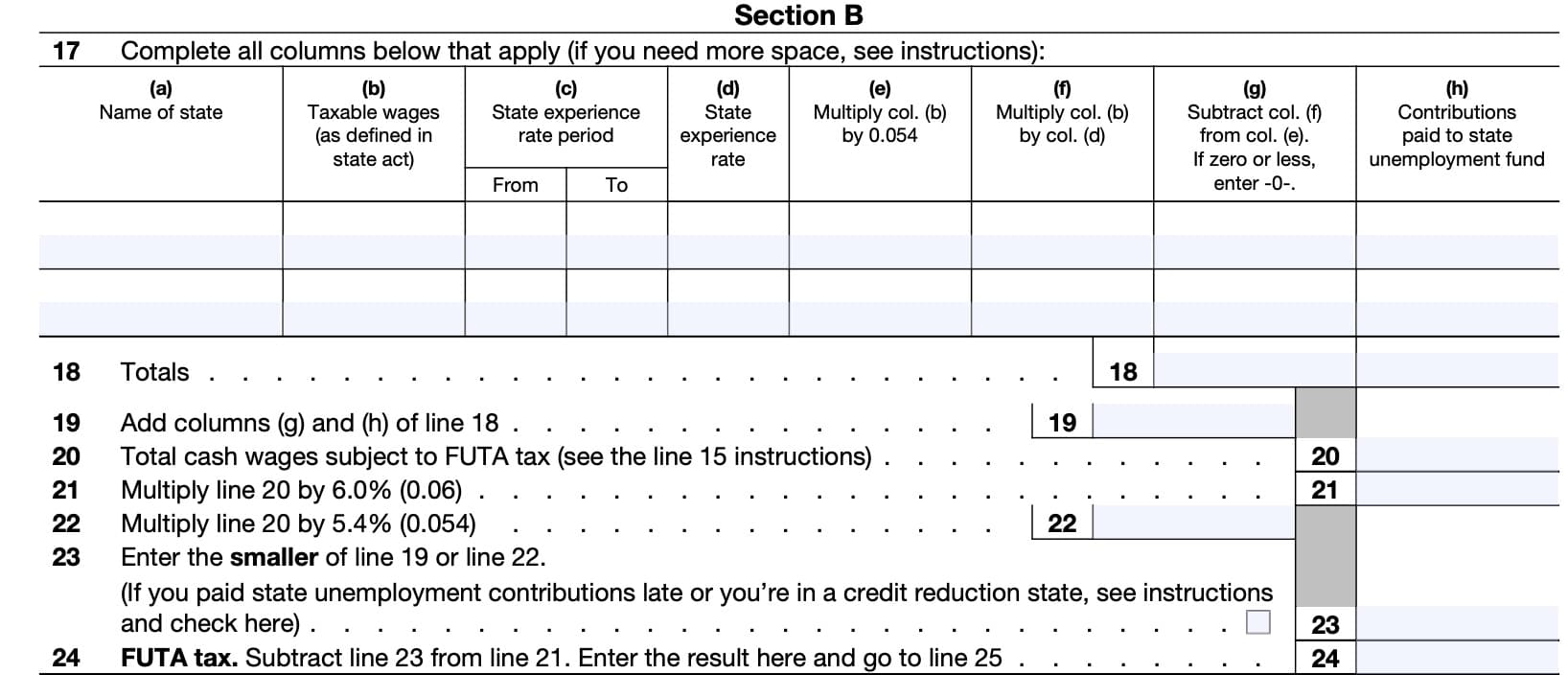

Line 17

Only complete Lines 17 through 24 if you checked No to one of the questions on Lines 10 through 12.

In Line 17, complete all applicable columns for each state. Columns in bold are mandatory, even if you were not given an experience rate.

- Column (a): Name of state

- Column (b): Taxable wages

- If your state experience rate is zero, enter the amount of taxable wages you would’ve paid taxes on

- Column (c): State experience rate period

- Mandatory if your experience rate was 5.4% or higher

- Column (d): State experience rate

- Mandatory if your experience rate was 5.4% or higher

- Column (e): Multiply Column (b) by 0.054

- Column (f): Multiply Column (b) by Column (d)

- Column (g): Subtract Column (f) from Column (e)

- If negative, enter ‘0.’

- Column (h): Contributions paid to state unemployment fund

- Enter the amount you paid before your tax return’s due date

For more space, use an additional sheet formatted to contain the same columns as Line 17. If you do not complete all applicable columns, you might not be eligible for the FUTA tax credit.

If you were given a rate for only part of the year, or the rate changed during the year, you must complete a separate line for each rate period.

Line 18: Totals

For all states that you entered in Line 17, add the totals of Column (g) and Column (h). Enter the totals in their respective column for Line 18.

Line 19

Add the Column (g) and Column (h) totals from Line 18. Enter that result here.

Line 20: Total cash wages subject to FUTA tax

Enter the total cash wages subject to FUTA tax. For more detail about which cash wages are subject to FUTA, see the guidance for Line 15, shown earlier.

Line 21

Multiply Line 20 by 6.0% (0.06). Enter the result here.

Line 22

Multiply Line 20 by 5.4% (0.054). Enter the result here.

Line 23

For Line 23, enter the smaller of:

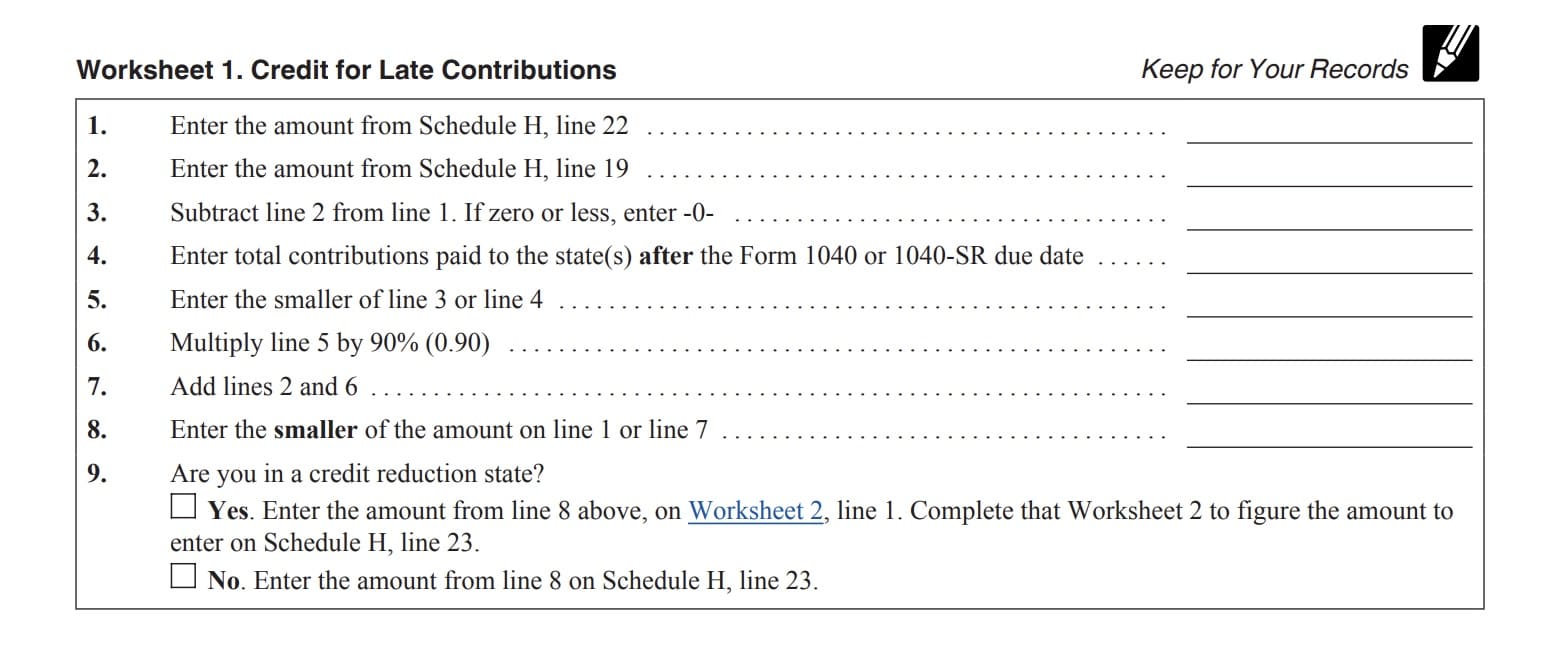

If you paid state unemployment contributions after the due date of your individual tax return, or if you’re in a credit reduction state, you will need to use one of the following worksheets to determine the amount you should enter in Line 23.

Late state unemployment contributions

If you made state unemployment contributions after the due date of your original individual income tax return (without extensions), then you’ll need to use Worksheet 1 from the Schedule H instructions to calculate the amount to enter in Line 23.

Credit reduction state

If you live in one of the previously credit reduction states, use Worksheet 2 to calculate the number you should put in Line 23.

Line 24: FUTA Tax

Subtract Line 23 from Line 21. Enter the result here, then go to Line 25.

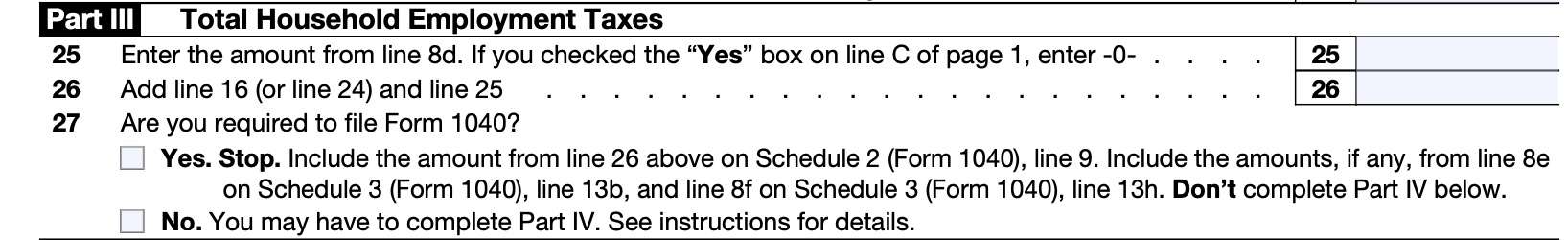

Part III: Total Household Employment Taxes

In Part III, we’ll calculate your total household employment tax responsibilities.

Line 25

In Line 25, enter the amount from Line 8d. However, if you checked Yes on Question C above, or if there is no entry on Line 8d, enter ‘0.’

Line 26

Add the amounts on Line 16 and Line 25.

If you were required to complete Section B of Part II (Lines 17 through 24), then add the amounts on Line 24 and Line 25. Enter the total here.

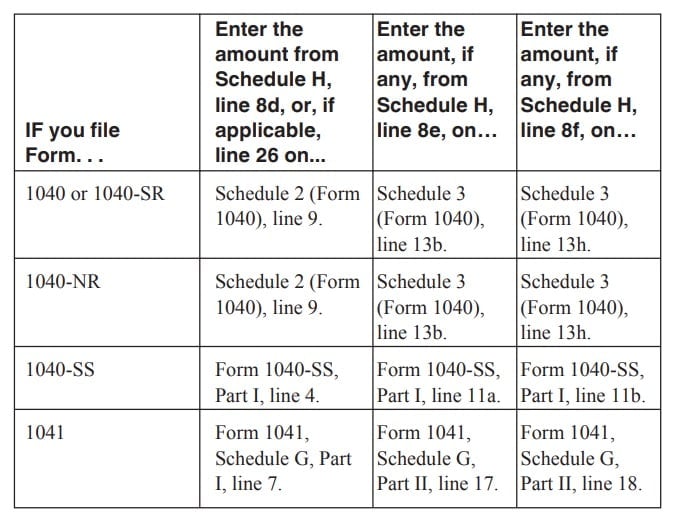

Line 27: Are you required to file IRS Form 1040?

Follow the instructions in the chart outlined below to determine whether you need to file IRS Form 1040.

If you have to file a tax return, then stop here. Include the Line 26 amount on IRS Schedule 2, Line 9. Also, include any of the following amounts on IRS Schedule 3, as applicable:

Do not complete Part IV.

If you do not have to file a tax return, then proceed to Part IV.

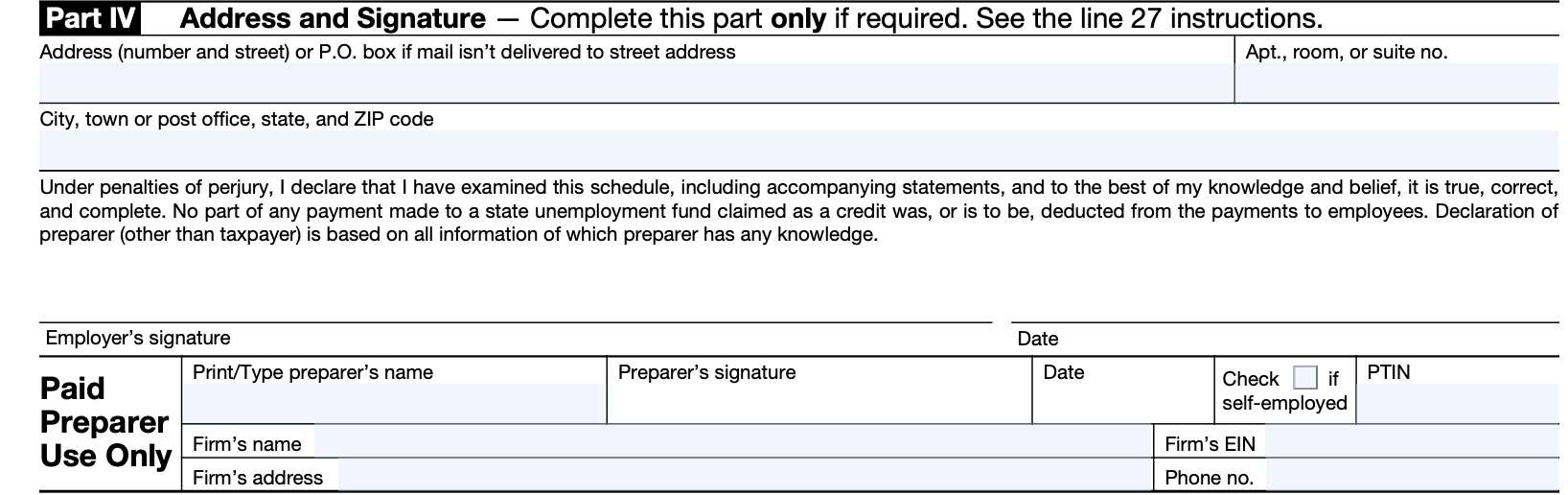

Part IV: Address & Signature

If required, enter the following information, then sign the bottom of Schedule H:

- Taxpayer address

- Use P.O. Box if mail isn’t delivered to your normal street address

- City, state, zip code

If you are using a paid tax preparer, such as a certified public accountant or enrolled agent to prepare your tax returns, then that person must complete the Paid Preparer Use Only section at the bottom of the form.

Video walkthrough

Watch this instructional video to learn more about reporting household employment taxes on IRS Schedule H.

Frequently asked questions

Taxpayers use Schedule H to report employment taxes paid on behalf of household employees. This could be taxes paid from a household employee’s wages, or it could be payroll taxes that the employer must pay separately.

If you paid more than $2,400 in wages to any single employee in a tax year, withheld federal taxes on behalf of any household employees, or paid more than $1,000 in cash wages in any quarter to all employees, you must file Schedule H.

The IRS considers any person who performs work in your home, where you control how the work is done, to be a household employee. Examples of household employees may include housekeepers, nannies, home nurses, maids, gardeners, or babysitters.

Where can I find IRS Schedule H?

As with any other tax form, you may find the IRS Schedule H form on the IRS website. For your convenience, we’ve attached the most recent version of Schedule H to this article as a PDF file.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!