IRS Form 8959 Instructions

As part of the Affordable Care Act, the federal government created an additional tax on Medicare wages above a certain threshold amount. This additional tax is only imposed on high earners, who must also report their tax liability to the Internal Revenue Service as part of their federal income tax return. To do this, taxpayers must file IRS Form 8959.

This article will walk you through this tax form, specifically:

- Who must pay the additional Medicare taxes

- How to complete and file IRS Form 8959

- Where to find this tax form

Let’s start by walking through this tax form, step by step.

Table of contents

How do I complete IRS Form 8959?

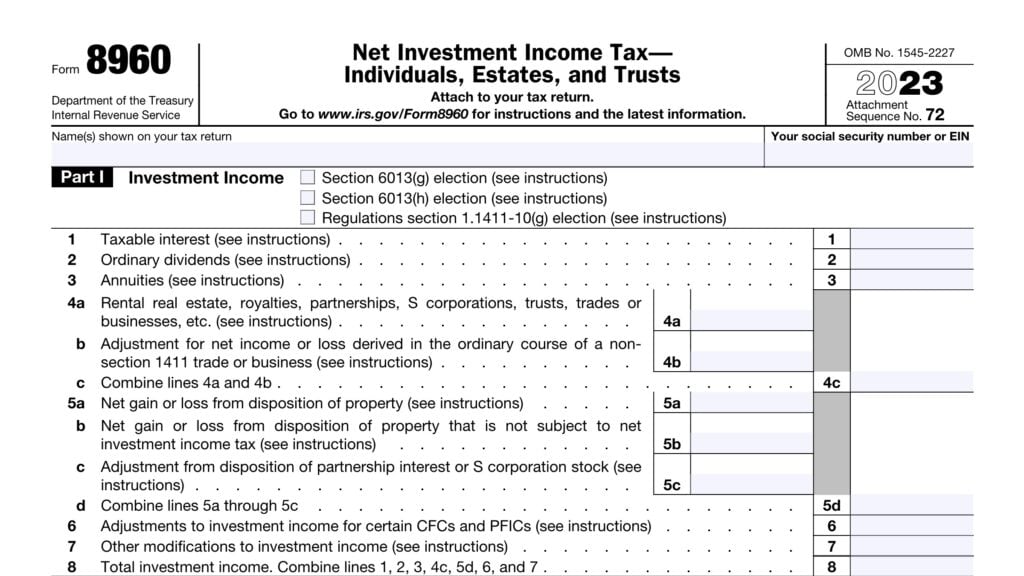

There are 5 parts to this 1-page tax document:

- Part I: Additional Medicare Tax on Medicare Wages

- Part II: Additional Medicare Tax on Self-Employment Income

- Part III: Additional Medicare Tax on RRTA Compensation

- Part IV: Total Additional Medicare Tax

- Part V: Withholding Reconciliation

Most taxpayers won’t complete all parts, but we’ll go through each part in detail.

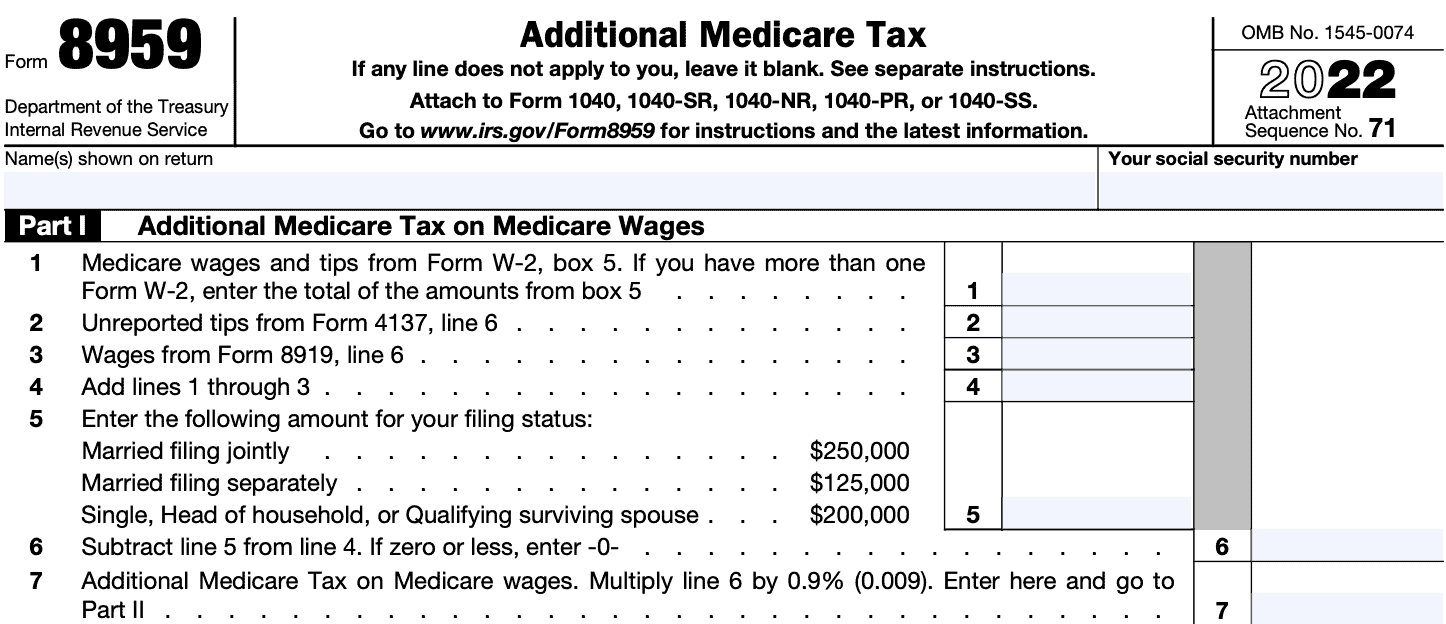

Part I: Additional Medicare Tax on Medicare Wages

In Part I, taxpayers will calculate the total additional tax on Medicare wages. If you have no Medicare wages but you have self-employment income, skip to Part II. If you have neither Medicare wages nor self-employment income, but you have RRTA compensation, skip to Part III.

Before completing each line, enter your name as shown on your tax return. Also enter your full Social Security number.

Line 1: Medicare wages and tips from Form W-2, Box 5

Enter the total Medicare wages and tips from Form W-2. If you have multiple W-2 forms, or you and your spouse have Medicare wages reported, then enter the total of all W-2 entries.

Line 2: Unreported tips from IRS Form 4137

If you have unreported tips on Form 4137, Line 6, enter them here. Include any amounts earned by your spouse.

Line 3: Wages from IRS Form 8919

IRS Form 8919 reports information on uncollected Social Security tax or Medicare tax. If there are any wages on Line 6, enter them here. Enter any additional wages on your spouse’s Form 8919, if applicable.

Line 4

Combine Lines 1 through 3 and enter the total in Line 4.

Line 5

Enter the appropriate amount based upon your tax filing status:

- Married filing jointly: $250,000

- Married filing separately: $125,000

- All other filing statuses: $200,000

- Single, head of household, qualifying surviving spouse

Line 6

Subtract Line 5 from Line 4. If the total is zero or less, enter ‘0.’

Line 7: Additional Medicare Tax on Medicare wages

Multiply Line 6 by 0.9%. Enter the result here, then proceed to Part II (self-employment income), Part III (RRTA income) as applicable. If you have neither self-employment or RRTA income, proceed directly to Part IV.

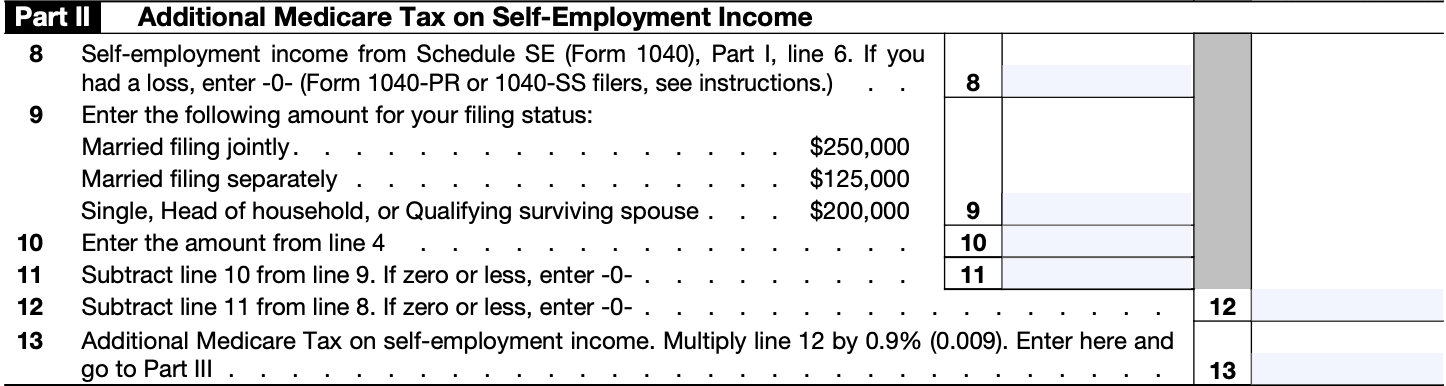

Part II: Additional Medicare Tax on Self-Employment Income

If you do not have self-employment income, but you have RRTA compensation, proceed to Part III. If you have neither self-employment income nor RRTA compensation, go directly to Part IV.

Line 8: Self-employment income from Schedule SE

If you filed Schedule SE, enter the amount from Part I, Line 6. If you reported a loss, enter ‘0.’ For multiple schedules, enter the total amount.

For taxpayers reporting less than $400 in self-employment income, do not include this amount. However, if Line 5b is greater than $100, then include that amount in Line 8.

Line 9

Enter the appropriate amount based upon your tax filing status:

- Married filing jointly: $250,000

- Married filing separately: $125,000

- All other filing statuses: $200,000

- Single, head of household, qualifying surviving spouse

Line 10

Enter the amount from Line 4.

Line 11

Subtract Line 10 from Line 9. If zero or less, enter ‘0.’

Line 12

Subtract Line 11 from Line 8. If zero or less, enter ‘0.’

Line 13: Additional Medicare Tax on self-employment income

Multiply Line 12 by 0.9%. Enter the result here, then proceed to Part III (RRTA income) as applicable. If you do not have RRTA income, proceed directly to Part IV.

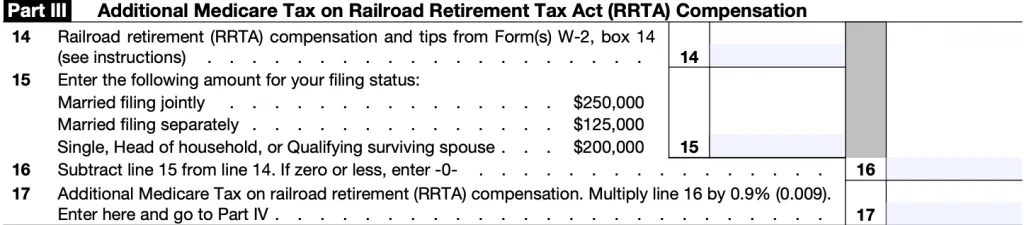

Part III: Additional Medicare Tax on RRTA Compensation

If you do not have RRTA compensation, go directly to Part IV.

Line 14: RRTA compensation and tips

Enter the total RRTA wages and tips from Form W-2, Box 14. If you have multiple W-2 forms, or you and your spouse have RRTA wages reported, then enter the total of all W-2 entries.

Any employee representative subject to RRTA taxes should include the total compensation subject to Tier 1 Medicare tax as reported on Line 2 of all Form CT-2 filed during the tax year.

Line 15

Enter the appropriate amount based upon your tax filing status:

- Married filing jointly: $250,000

- Married filing separately: $125,000

- All other filing statuses: $200,000

- Single, head of household, qualifying surviving spouse

Line 16

Subtract Line 15 from Line 14. If zero or less, enter ‘0.’

Line 17: Additional Medicare Tax on RRTA compensation

Multiply Line 16by 0.9%. Enter the result here, then proceed to Part IV.

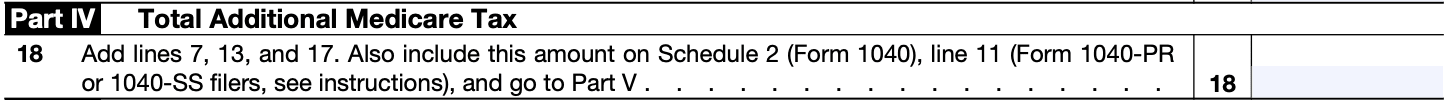

Part IV: Total Additional Medicare Tax

Line 18

Add Line 7, Line 13, and Line 17. Enter the total here and include it on Schedule 2, Line 11, then proceed to Part V.

For taxpayers filing Form 1040-PR or Form 1040-SS, enter the total on Line 5, Part I of your respective tax forms.

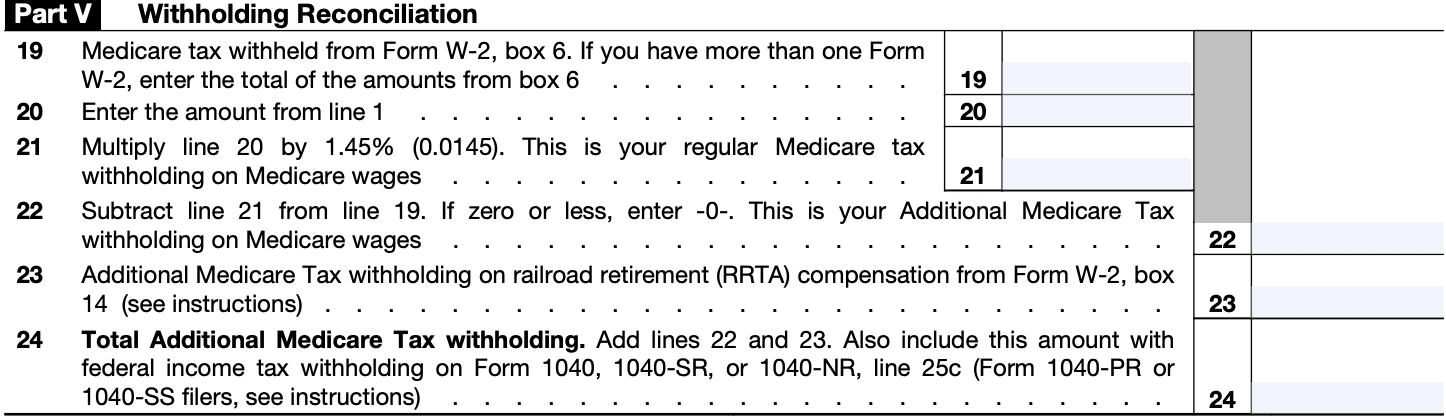

Part V: Withholding Reconciliation

In Part V, we’ll reconcile what you’ve already paid with your total Medicare tax liability.

Line 19: Medicare tax withheld by employer

Enter the total Medicare tax withheld on your Form W-2 by your employer. This amount will be located in Box 6.

If you are reporting with your spouse, or you have more than one Form W-2, enter the total of the amounts reported in Box 6.

Also include the following:

- Uncollected Medicare tax on tips

- from Form W-2, Box 12, Code B,

- Uncollected Medicare tax on the taxable cost of group-term life insurance over $50,000

- from Form W-2, Box 12, Code N.

When reporting multiple amounts, include the total of all such amounts.

Line 20

Enter the amount from Line 1.

Line 21: Regular Medicare tax withholding

Multiply Line 20 by 1.45%, or 0.0145. This represents your regular Medicare tax withholding on Medicare wages.

Line 22: Additional Medicare Tax withholding on Medicare wages

Subtract Line 21 from Line 19. If this number is zero or negative, enter ‘0.’ This represents additional Medicare tax withholding.

Line 23: Additional Medicare Tax withholding on RRTA compensation

Include any additional Medicare tax withholding, as reported on Form W-2.

If you have multiple W-2 forms, or you and your spouse have RRTA wages reported, then enter the total of all W-2 entries.

Any employee representative subject to RRTA taxes should include the total compensation subject to Tier 1 Medicare tax as reported on Line 2 of all Form CT-2 filed during the tax year.

Line 24: Total additional Medicare Tax withholding

Add Line 22 and Line 23. Include this amount on Line 25c of:

- Form 1040

- Form 1040-SR

- Form 1040-NR

Taxpayers filing IRS Form 1040-PR or Form 1040-SS should enter this amount on Line 12, Part I of their respective forms.

What is IRS Form 8959?

IRS Form 8959, Additional Medicare Tax, is the federal form that high earners must file with their income tax return to reconcile the following:

- How much their employer withheld in Medicare taxes during the tax year

- The amount of Medicare tax the taxpayer owes for the entire tax year

- How much additional Medicare tax needs to be paid when they file Form 1040

This begs the question of who must pay this additional tax.

Who must pay the additional Medicare tax?

All taxpayers must pay the additional Medicare tax if their total income from certain sources exceeds their earnings threshold in the calendar year. These sources of income subject to additional Medicare tax include:

- Medicare wages

- Railroad Retirement Tax Act wages

- Also referred to as RRTA compensation

- Self-employment compensation

What is the earnings threshold for the additional Medicare tax?

The earnings threshold for the Medicare additional tax depends on the taxpayer’s filing status. These thresholds, which are not indexed for inflation, are reflected below:

| Filing Status | Threshold Amount |

|---|---|

| Married Filing Jointly | $250,000 |

| Married Filing Separately | $125,000 |

| Single | $200,000 |

| Head of Household | $200,000 |

| Qualifying Surviving Spouse | $200,000 |

Who must file IRS Form 8959?

According to the IRS form instructions, the following taxpayers must file this form with their annual tax return:

- A taxpayer whose Medicare wages and tips on any single Form W-2 (box 5) are greater than $200,000.

- A taxpayer whose RRTA compensation on any single Form W-2 (box 14) is greater than $200,000.

- Taxpayers whose total Medicare wages and tips plus self-employment income, if any, are greater than the threshold amount for the applicable filing status in the chart on this page.

- This includes the Medicare wages and tips and self-employment income of the taxpayer’s spouse, if married filing jointly

- Taxpayers whose total RRTA compensation and tips (Form W-2, box 14) is greater than the threshold amount for applicable filing status in the chart on this page.

- Includes spouse’s RRTA compensation and tips, if married filing jointly

Video walkthrough

Watch this instructional video for detailed guidance on completing Form 8959.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

Taxpayers who must file Form 8959 should attach this tax form to their federal income tax return.

The additional tax rate is 0.9% of all Medicare wages, RRTA compensation, and self-employment income above the threshold amounts. For example, John Smith is a single taxpayer with $250,000 in Medicare wages. On top of his normal Medicare tax, John would pay an additional 0.9% on the $50,000 he earned above the threshold amount, or $450.

Not everyone who must file IRS Form 8959 must pay the additional Medicare tax. For example, a taxpayer whose Medicare wages are over $200,000 must file Form 8959. But if the taxpayer is married and filing a joint return, he or she might not have to pay additional tax unless those Medicare wages exceed $250,000.

Where can I find IRS Form 8959?

Like most tax forms, you can find Form 8959 on the IRS website. For your convenience, we’ve enclosed the most recent version at the bottom of this article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!