IRS Form 8962 instructions

Taxpayers who obtain qualifying health insurance coverage and meet certain income thresholds may be eligible for a premium tax credit to help offset the cost of maintaining health care. Some taxpayers may even qualify for an advance premium tax credit. To determine this, you must complete IRS Form 8962, Premium Tax Credit.

In this article, we’ll walk through everything you need to know about IRS Form 8962, including:

- How to complete IRS Form 8962 as part of your tax return

- How to calculate taxes you may owe or credits you may claim with your tax return

- Special situations that may impact the amount of the premium tax credit you can take

Let’s start with an overview of this tax form.

Table of contents

How do I complete IRS Form 8962?

There are five parts to this two-page tax form:

- Part I: Annual and Monthly Contribution Amount

- Part II: Premium Tax Credit Claim and Reconciliation of Advance Payment of Premium Tax Credit

- Part III: Repayment of Excess Advance Payment of the Premium Tax Credit

- Part IV: Allocation of Policy Amounts

- Part V: Alternative Calculation for Year of Marriage

Before we start at the top with Part I, let’s complete the information at the top of the form. Enter your taxpayer name as shown on your tax return, as well as your Social Security number. If you entered an individual taxpayer identification number (ITIN) on your tax return, you may use that number here.

Just above Part I, you’ll see a box marked A. Before we discuss Box A, let’s talk about how the premium tax credit works for married taxpayers.

Married taxpayers

Generally, married taxpayers must file a joint income tax return in order to claim the premium tax credit. However, there are two sets of exceptions for certain taxpayers who are married and filing a joint tax return.

Exception 1: Certain persons living apart

You may file your return as if you are unmarried and make a premium tax credit claim if one of the following applies to you:

- You file a separate return from your spouse on Form 1040 or Form 1040-SR because you meet the requirements for married persons who live apart under Head of Household in the Instructions for Form 1040.

- You file a separate tax return

- You paid over half the cost of keeping up a home for the tax year

- Your home was the main home of your child, stepchild, or foster child for more than half of the tax year

- You can claim the child as a dependent, or you could do so except that the child’s other parent can also do so under IRS guidelines

- You file as single on your Form 1040-NR because you meet the requirements for the exception for married persons who live apart under Married Filing Separately in the Instructions for Form 1040-NR

Exception 2: Victim of domestic abuse or spousal abandonment

Exception 2 exists for victims of domestic abuse or spousal abandonment. If you are a victim of domestic abuse or spousal abandonment, you can file a return as married filing separately and take the premium tax credit if all of the following apply to you:

- You are living apart from your spouse at the time you file your tax return.

- You are unable to file a joint return because you are a victim of domestic abuse or spousal abandonment.

- You check the box on Line A of your Form 8962 to certify that you are a victim of domestic abuse or spousal abandonment.

- You have not previously used this exception to claim the premium tax credit for 3 consecutive years.

Line A

According to the form instructions, you should check this box to claim the premium tax credit under the following conditions:

- You are married filing a separate tax return

- You are a victim of domestic abuse or spousal abandonment,

- You qualify for Exception 2, outlined above

Let’s move on to Part I.

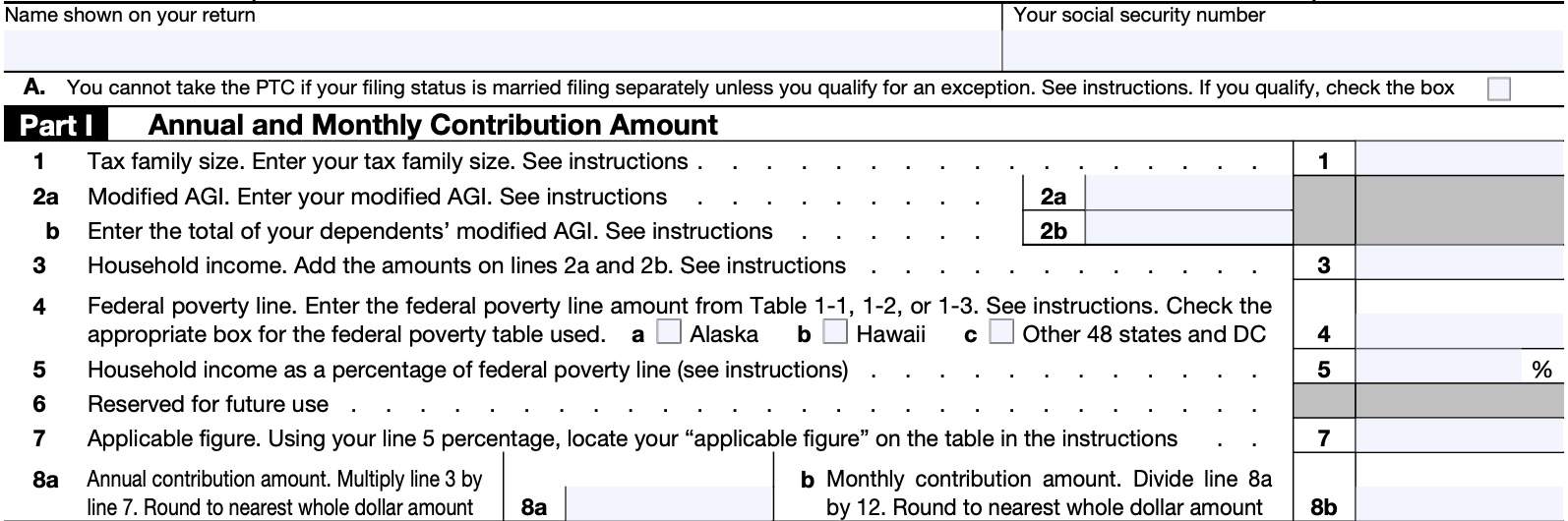

Part I: Annual And Monthly Contribution Amount

In Part I, we’ll calculate the expected contribution amounts based upon your modified adjusted gross income in relation to the federal poverty level.

Line 1: Tax family size

Determine the number of individuals in your tax family using your tax return. Your tax family generally includes:

- Yourself

- Your spouse if you’re filing a joint tax return

- Your dependents

If another taxpayer can claim either yourself, your spouse, or another family member as a dependent on their federal tax return, then you cannot include the same person in your family size calculation for this form.

Line 2a: Modified AGI

Enter your modified adjusted gross income (MAGI) for purposes of claiming the premium tax credit.

Modified adjusted gross income calculation

You can use Worksheet 1-1, located in the Form 8962 instructions to calculate your MAGI. For your convenience, we’ve included the steps, line by line, below.

- Enter your AGI* from Form 1040, 1040-SR, or 1040-NR, Line 11

- Enter any tax-exempt interest from Form 1040, 1040-SR, or 1040-NR, Line 2a

- Enter any amounts from IRS Form 2555, Lines 45 and 50

- Line 45: Foreign earned income exclusion or housing deduction

- Line 50: Housing deduction

- Form 1040 or 1040-SR filers: If Line 6a is more than Line 6b, subtract Line 6b from Line 6a and enter the result

- Add Lines 1 through 4.

*-If you are filing IRS Form 8814, Parents’ Election To Report Child’s Interest and Dividends, then you may need to make some adjustments. If Line 4 on Form 8814 exceeds $1,250, then you must enter the sum of the following income items in the calculation for Line 2b below, instead of Line 2a:

- The sum of the tax-exempt interest from Form 8814, Line 1b

- The lesser of Form 8814,

- Line 4, or

- Line 5; and any

- Nontaxable social security benefits your child received

Line 2b: Dependents’ Modified AGI

Enter on the combined modified AGI for your dependents who are required to file an income tax return because their income meets the income tax return filing threshold.

You can use Worksheet 2-1, located in the Form 8962 instructions to calculate your dependents’ MAGI. For your convenience, we’ve included the steps, line by line, below.

- Enter the AGI* for your dependents from Form 1040, 1040-SR, or 1040-NR, Line 11

- Enter any tax-exempt interest for your dependents from Form 1040, 1040-SR, or 1040-NR, Line 2a

- Enter any amounts for your dependents from Form 2555, Lines 45 and 50

- For each dependent filing Form 1040 or 1040-SR: If Line 6a is more than Line 6b, subtract Line 6b from Line 6a and enter the result

- Add Lines 1 through 4. Enter here and on Form 8962, Line 2b

*-This requirement only applies to dependents who must file a tax return because their income meets the income tax filing threshold.

Line 3: Household income

Add the income amounts from Line 2a and Line 2b. Enter the total here. If the total is negative, enter ‘0.’

Line 4: Federal poverty line

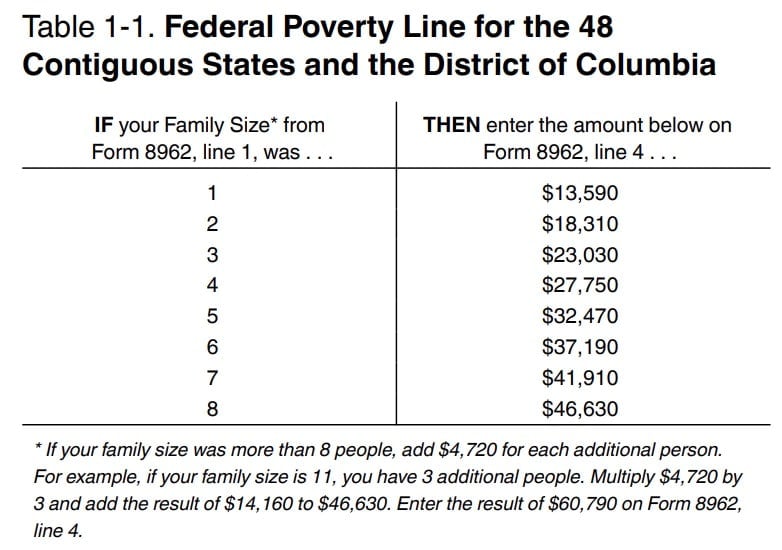

Based upon your family size and state of residence, you’ll need to enter the federal poverty line amount from the applicable table:

- Table 1-1: Federal Poverty Line for the 48 Contiguous States and the District of Columbia

- Table 1-2: Federal Poverty Line for Alaska

- Table 1-3: Federal Poverty Line for Hawaii

Additionally, check the appropriate table that you used.

Table 1-1: Federal Poverty Line for the 48 Contiguous States and the District of Columbia

If you used Table 1-1, be sure to check Box c under Line 4.

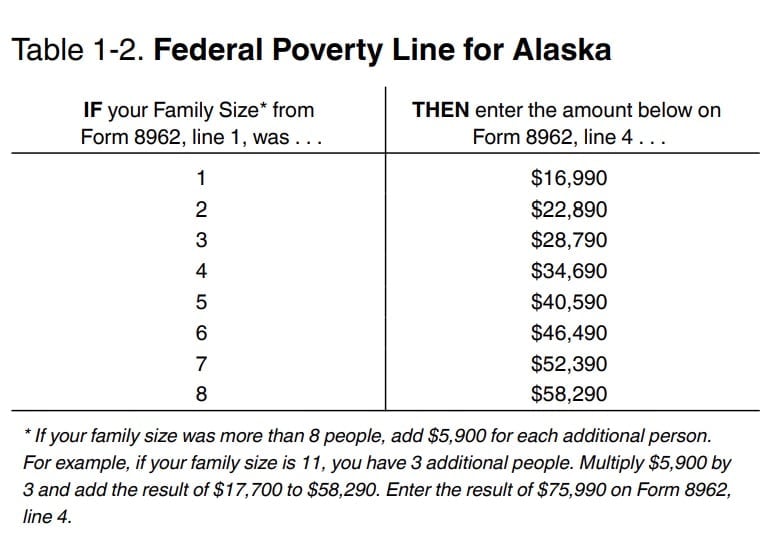

Table 1-2: Federal Poverty Line for Alaska

If you used Table 1-2, be sure to check Box a under Line 4.

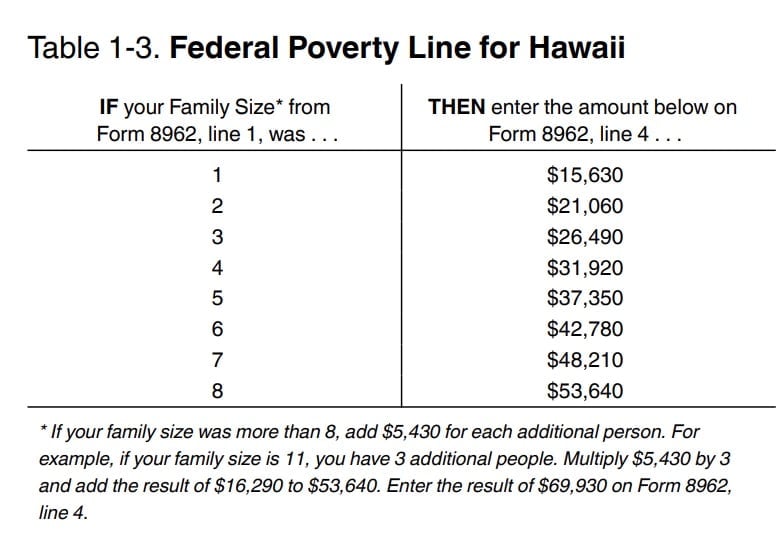

Table 1-3: Federal Poverty Line for Hawaii

If you used Table 1-3, be sure to check Box b under Line 4.

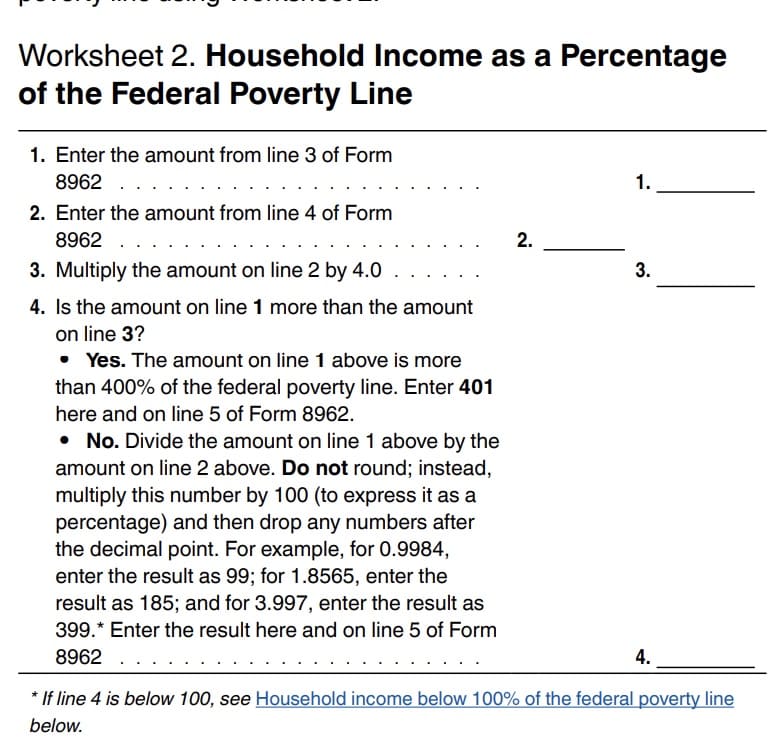

Line 5: Household income as a percentage of federal poverty line

You may use Worksheet 2 from the form instructions to calculate your household income as a percentage of the federal poverty line (see below).

To simplify this, you can:

- Multiply the Line 4 amount by 4 (400% of the federal poverty line)

- Compare this result to the number on Line 3

If the Line 3 amount is more than 4 times the Line 4 amount: Then your household income exceeds 400% of the federal poverty line. Enter 401 on Line 5.

If the Line 3 amount is less than or equal to 4 times the Line 4 amount: Then divide your household income (Line 3) by the federal poverty line number, then multiply by 100.

Enter this number on Line 5.

Line 6: Reserved for future use

Do not enter anything into Line 6.

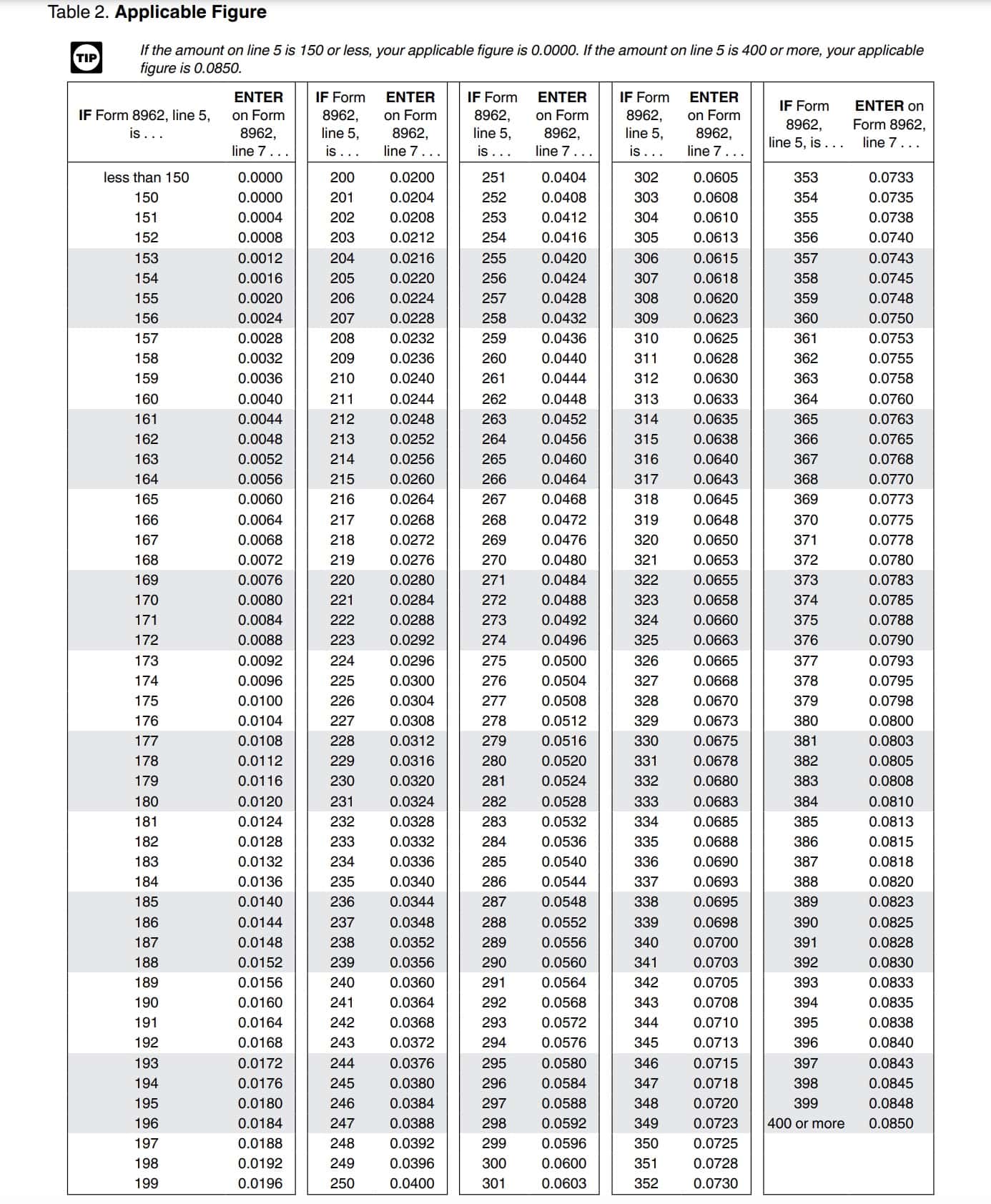

Line 7: Applicable figure

If the Line 5 amount is 150 or less, enter 0.0000.

For Line 5 amounts that are 400 or greater, enter 0.0850.

If the Line 5 amount is between 150 and 400, then use the Applicable Figure table, located below, to determine your applicable figure.

Line 8a: Annual contribution amount

Multiply Line 3 by Line 7. Round this figure to the nearest whole dollar amount, then enter this number in Line 8a.

Line 8b: Monthly contribution amount

Divide Line 8a by 12. Enter this number in Line 8b.

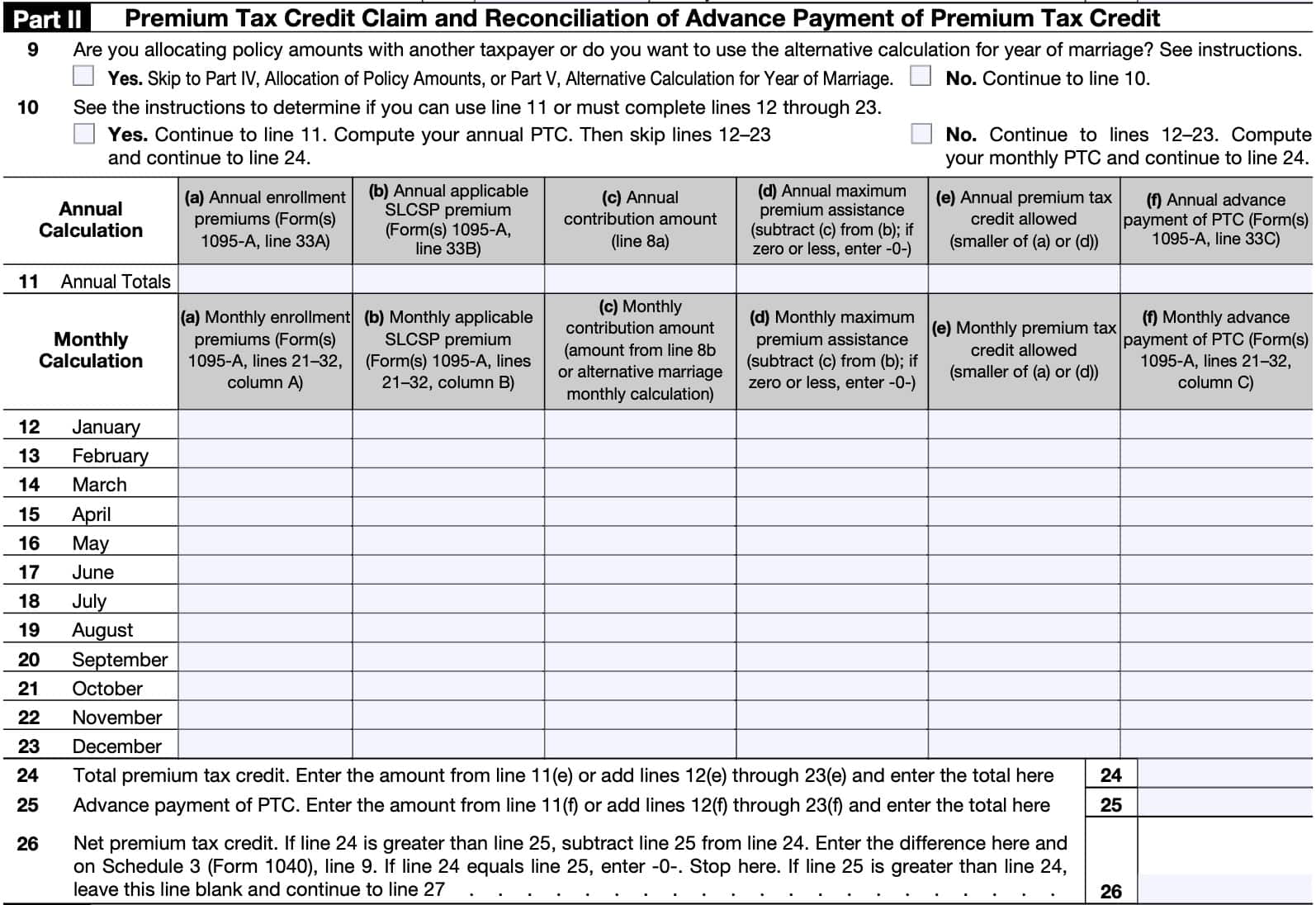

Part II: Premium Tax Credit Claim and Reconciliation of Advance Payment of Premium Tax Credit

In Part II, we’ll calculate the amount of premium tax credit you should claim, and reconcile any advance payments of the premium tax credit (APTC). Let’s start with Line 9.

Line 9

Are you allocating policy amounts with another taxpayer or do you want to use the alternative calculation for year of marriage?

If Yes, then you’ll need to complete either Part IV or Part V (or both), depending on the circumstances. If you need to complete both parts, complete Part IV in its entirety. Then go to Part V.

Select the appropriate link below to learn more before proceeding to the next part.

- Part IV, Allocation of Policy Amounts

- Part V, Alternative Calculation for Year of Marriage

If No, then proceed to Line 10, below.

Allocating policy amounts

You need to allocate policy amounts (enrollment premiums, second-lowest cost silver plan premiums, and/or advance payments of the premium tax credit) reported to you on Form 1095-A, Health Insurance Marketplace Statement, between your tax family and another tax family if:

- The policy covered at least one individual in your tax family and at least one individual in another tax family; and

- Either:

- You received a Form 1095-A for the policy that does not accurately represent the members of your tax family who were enrolled in the policy

- Meaning that it either lists someone who is not in your tax family or does not list a member of your tax family who was enrolled in the policy, or

- The other tax family received a Form 1095-A for the policy that includes a member of your tax family

- You received a Form 1095-A for the policy that does not accurately represent the members of your tax family who were enrolled in the policy

When you may need to consider allocating policy amounts

A qualified health plan may have covered at least one individual in your tax family and one individual not in your tax family if:

- You got divorced during the year

- You are married but filing a separate return from your spouse

- You or an individual in your tax family was enrolled in a qualified health plan by someone who is not part of your tax family

- Example: Your ex-spouse who enrolled a child whom you are claiming as a dependent, or

- You or an individual in your tax family enrolled someone not part of your tax family in a qualified health plan

- Example: You enrolled a child whom your ex-spouse is claiming as a dependent.

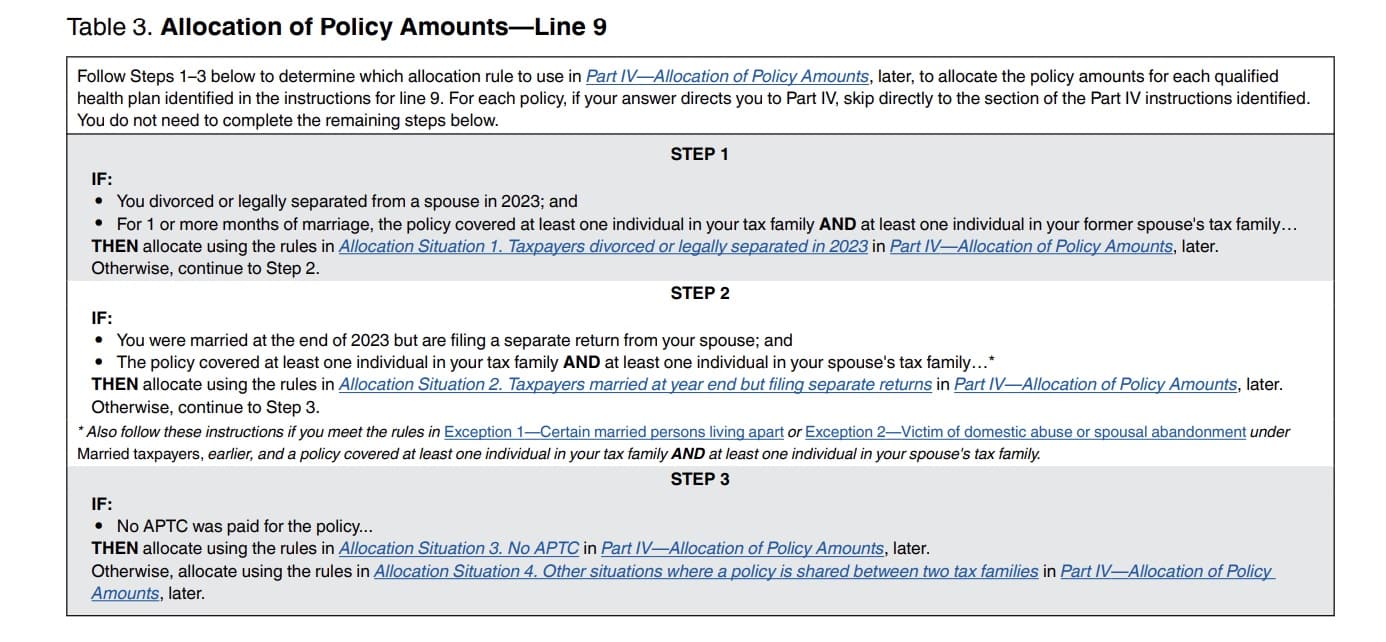

If you select ‘Yes,’ you’ll have to determine which allocation rule you’ll use when completing Part IV. You can select from the following allocation rules in Table 3:

You can find additional information about allocating multiple policy amounts in the Form 8962 instructions and in IRS Publication 974, Premium Tax Credit.

Having done this, you can proceed to Part IV, below.

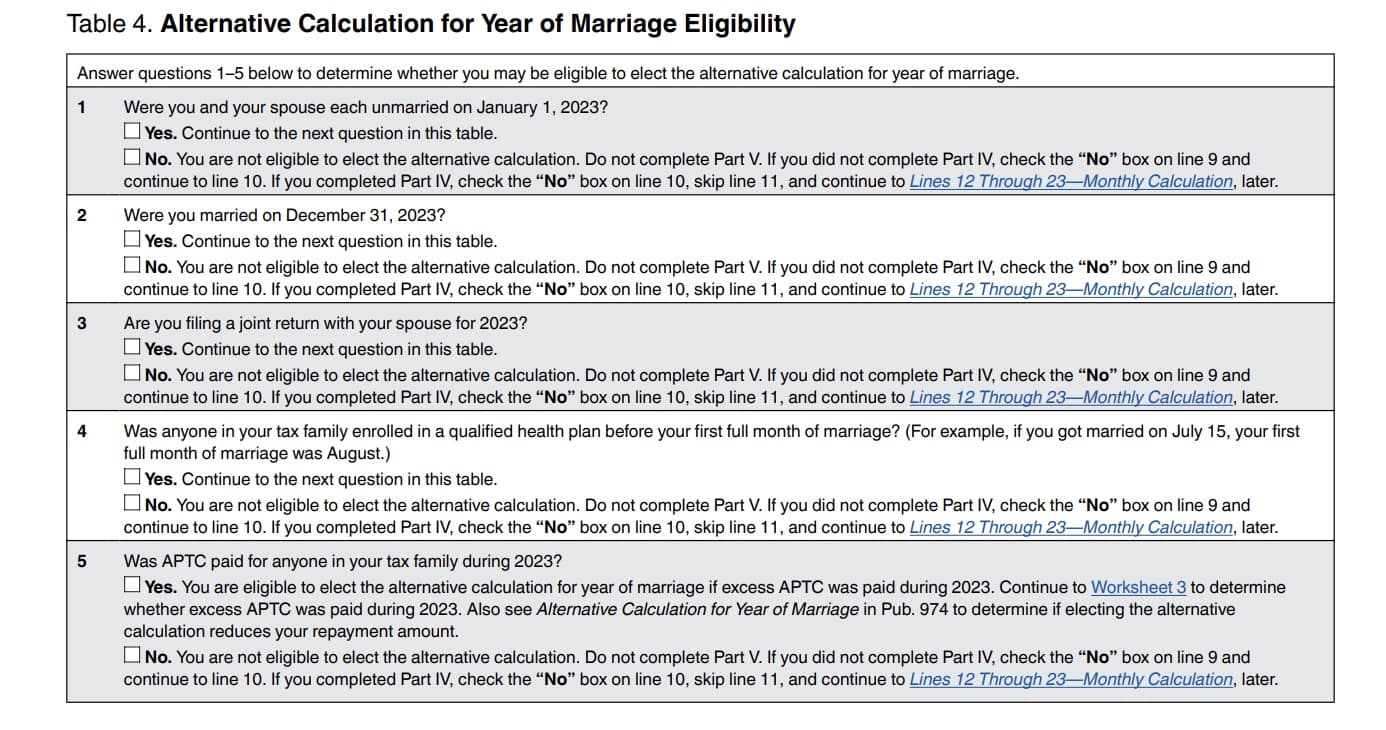

Alternative calculation for year of marriage

If you got married during the tax year and APTC was paid for an individual in your tax family, you may want to use the alternative calculation for year of marriage. The alternative calculation is an optional calculation that may allow you to repay less excess APTC than you would under the general rules.

Follow the instructions in Table 4 below to determine whether you qualify for the alternative calculation.

If you need to allocate policy amounts and are also using the alternative calculation for year of marriage, follow the instructions in Table 3 and complete Part IV before you follow the instructions for Table 4 and complete Part V.

Line 10

You may check ‘Yes’ in Line 10, enter your annual totals in Line 11 and skip Lines 12-23 if you meet all of the following eligibility criteria:

- You were enrolled in the qualified health plan for all 12 months during the calendar year.

- Your enrollment premium was the same for every month of the year

- As reported on IRS Form 1095-A, Part III, Column A, Lines 21 through 32

- Your SLCSP premium was the same for every month of the tax year.

- As reported on IRS Form 1095-A, Part III, Column B, Lines 21 through 32

If you do not meet the eligibility criteria, then you must skip Line 11 and go to Lines 12-23, below.

If you have missing or incorrect SLCPS premium information, then you will have to determine the correct applicable SLCPS, and whether it remains the same for each month. There are two tax situations in which incorrect information might be reported to you on IRS Form 1095-A.

No APTC was paid for your coverage

If no APTC was paid for your or your family member’s coverage, the SLCSP premium reported in Part III, Column B, Lines 21 through 32, of Form 1095-A may be wrong, left blank, or reported as 0.

You can use IRS Publication 974 to determine your applicable SLCSP premium for each month. If you obtained Marketplace coverage for your health insurance plan, then you can use the Tax Tool on the Healthcare.gov website.

If your correct applicable SLCSP premium is not the same for all 12 months, check the “No” box and continue to Lines 12 through 23.

Change in circumstances affecting SLCSP

If you had a change in circumstances during the year that you did not report to the Marketplace, the SLCSP premium reported in Part III, Column B, Lines 21 through 32, of Form 1095-A may be wrong.

Examples of changes in circumstances that may affect your applicable SLCSP premium include the following:

- You enrolled an individual newly added to your tax family during the year, such as a new baby

- An individual in your tax family was enrolled in your qualified health plan for some of the year, but not the entire year.

- An individual in your coverage family became eligible for or lost eligibility for employer coverage or other minimum essential coverage (MEC) during the tax year.

- You are including an individual in your tax family for the year of coverage, but you did not indicate to the Marketplace at enrollment that you would do so.

- You indicated to the Marketplace at enrollment that you would include an individual in your tax family for the year of coverage, but you are not doing so.

- An individual enrolled in the coverage died during the year.

- You changed your address during the year.

Line 11: Annual totals

If you checked the “Yes” box on Line 10 and you are completing Line 11, do not complete Lines 12 through 23. Once you complete Line 11, skip to Line 24.

If you checked the “No” box on Line 10 and you are completing Lines 12 through 23, do not complete Line 11. Start with Line 12.

If your tax filing status is married filing separately, but you did not check Box A, then skip Columns (a) through (e). You only need to complete Column (f), later.

Otherwise, complete each column in order.

Column (a): Annual enrollment premiums

Enter the annual enrollment premiums from Form 1095-A, Line 33, Column A. If you have more than one Form 1095-A, add the amounts together and enter the total here.

This amount is the total of your enrollment premiums for the year, including the portion paid by APTC.

Column (b): Annual applicable SLCSP premium

Enter the annual applicable SLCSP premium from Form 1095-A, Line 33, Column B.

If you have more than one Form 1095-A, enter the amount as follows:

More than one policy in the same state

If individuals in your coverage family enrolled in more than one policy in the same state, you will receive a Form 1095-A for each policy.

The Marketplace should have entered the same SLCSP premium, which applies to all members of your coverage family, on each Form 1095-A.

Enter the amount from column B of only one Form 1095-A. Do not add the amounts from each form.

More than one policy in different states

For individuals enrolled in qualified health plans in different states, add together the amounts from Column B of the Forms 1095-A from each state and enter the total here.

Column (c): Annual contribution amount

Enter the amount from Line 8a, above.

Column (d): Annual maximum premium assistance

Subtract the Column (c) amount from Column (b). If the result is a negative number, enter ‘0.’

Column (e): Annual premium tax credit allowed

Enter the lesser of either:

Column (f): Annual advance payment of PTC

Enter the APTC amount from Form 1095-A, Line 33, Column C.

If you have more than one Form 1095-A, add the amounts together and enter the total here.

Lines 12 through 23

For each month of the calendar year, you’ll need to enter the corresponding information for each of the columns, as described below.

Column (a): Monthly enrollment premiums

Enter on Lines 12 through 23, Column (a), the amount of the monthly premiums reported on Form 1095-A, Lines 21 through 32, column A, for the corresponding month.

If you have more than one Form 1095-A affecting a particular month, add the amounts together for that month. Enter the total on the appropriate line for Column (a).

This amount is the total of your enrollment premiums for the month, including the portion paid by APTC.

You are not allowed a monthly credit amount for any month that the enrollment premiums for the month were not paid by the due date of your federal income tax return.

If a -0- appears on any of Lines 21 through 32, column A, of Form 1095-A, you may not have paid your enrollment premiums for the month by the due date of the premium. If so, and the premiums for the month are not paid by the due date of your return, enter -0- for the month on the appropriate line for Column (a).

Column (b): Monthly applicable SLCSP premium

Enter the amount of the monthly applicable SLCSP premium reported on Form 1095-A, lines 21 through 32, column B, for the corresponding month.

If you have more than one Form 1095-A showing coverage in a particular month, use the following rules to determine the amounts to enter on Column (b) for that month.

Individuals enrolled in separate policies in the same state

If individuals in your coverage family enrolled in separate policies in the same state, you will receive a Form 1095-A for each policy. The Marketplace should have entered the same SLCSP premium, which applies to all members of your coverage family for coverage that month, on each Form 1095-A.

Enter the amount from column B of only one Form 1095-A. Do not add the amounts from each form.

If you got married during the tax year and you and your spouse (or individuals in your tax family) were enrolled in separate qualified health plans during months prior to your first full month of marriage, add together the amounts from Form 1095-A, column B, for each plan (or plans) and enter the total.

If you completed Part V below, use the instructions in IRS Publication 974 for the entries to make

for your pre-marriage months.

Individuals enrolled in separate policies in different states

Add together the amounts from column B of Forms 1095-A from each state and enter the total in Column (b) on the appropriate line.

If you completed Part IV, add the amounts of applicable SLCSP premium allocated to you, if any, using the allocation percentage you entered on Lines 30 through 33, column (f), to the applicable SLCSP premium shown on the Form(s) 1095-A that you did not allocate.

If A Zero Appears On Any of The LinesI n Column (a)

You are not entitled to a monthly credit for any month in which a -0- appears on Form 1095-A, on any of Lines 21 through 32, column A, because your enrollment premiums were not paid.

For any month in which you did not pay enrollment premiums, enter -0- on the appropriate line on Column (b).

Column (c): Monthly contribution amount

If you did not complete Part V, enter your monthly contribution amount from Line 8b on Lines 12 through 23, Column (c).

Leave Column (c) of any of Lines 12 through 23 blank if Columns (a) and (b) of the corresponding line is blank.

If you completed Part V, see Publication 974 for how to complete Column (c).

Column (d): Monthly maximum premium assistance

Subtract Column (c) from Column (b). If the result is negative, enter ‘0’ for that month.

Column (e): Monthly maximum premium tax credit allowed

For each month, enter the smaller of:

Column (f): Monthly advance payment of PTC

Enter the amount of the monthly APTC reported on Form 1095-A, Lines 21 through 32, column C in Column (f) for the corresponding month.

If you completed Part IV, include only the amounts of the monthly APTC allocated to you, if any, using the allocation percentage you entered on Lines 30 through 33, column (g), below. Combine this amount with the amount of your PTC for other policies that you did not allocate.

Line 24: Total premium tax credit

If you completed Line 11, enter the amount from Line 11, Column (e).

If you completed Lines 12-23, then add the Column (e) amounts together from all lines, then enter the total here.

Line 25: Advance payment of PTC

If you completed Line 11, enter the amount from Line 11, Column (f).

If you completed Lines 12-23, then add the Column (f) amounts together from all lines, then enter the total here.

Line 26: Net premium tax credit

If Line 24 is greater than Line 25, then subtract Line 25 from Line 24. Enter the difference here and

on Schedule 3, Line 9 as a refundable credit.

If Line 24 equals Line 25, enter ‘0’ and stop here.

If Line 25 is greater than Line 24, leave this line blank. Go to Line 27 to calculate repayment of excess advance credit payments.

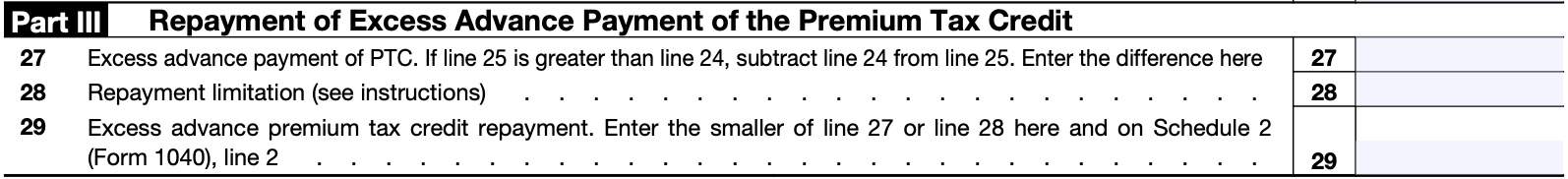

Part III: Repayment of Excess Advance Payment of the Premium Tax Credit

In Part III, we’ll determine how much, if any, excess advance premium tax credit repayments you have to report on Schedule 2 and repay when filing your federal return.

Line 27: excess advance payment of PTC

If Line 25 is greater than Line 24, subtract Line 24 from Line 25. Enter the difference here.

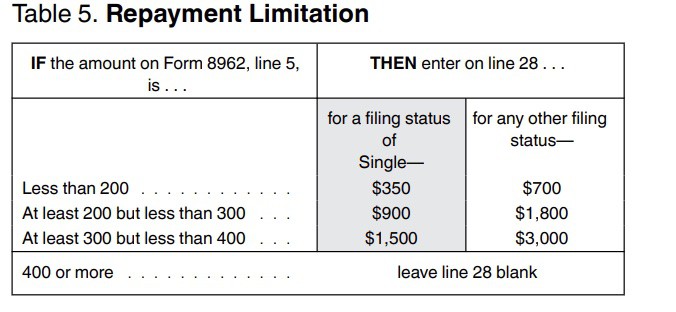

Line 28: Repayment limitation

Your repayment of advanced premium tax credit payments may be limited, unless your household income exceeds 400% of the federal poverty level, as indicated in Line 5.

If Line 5 is greater than 400, then skip Line 28. You can enter the Line 27 number on Line 29 and on IRS Schedule 2, Line 2.

If Line 5 is less than 400, then use the following repayment limitation table to determine your Line 28 amount.

If you were married at the end of the tax year but are filing separately from your spouse, the repayment limitations shown in Table 5 apply to you and your spouse separately based on the household income reported on each tax return.

Line 29: Excess advance premium tax credit repayment

Enter the smaller of Line 27 or Line 28 here and on Schedule 2, Line 2. If Line 28 is blank, carry down the Line 27 amount and enter it here.

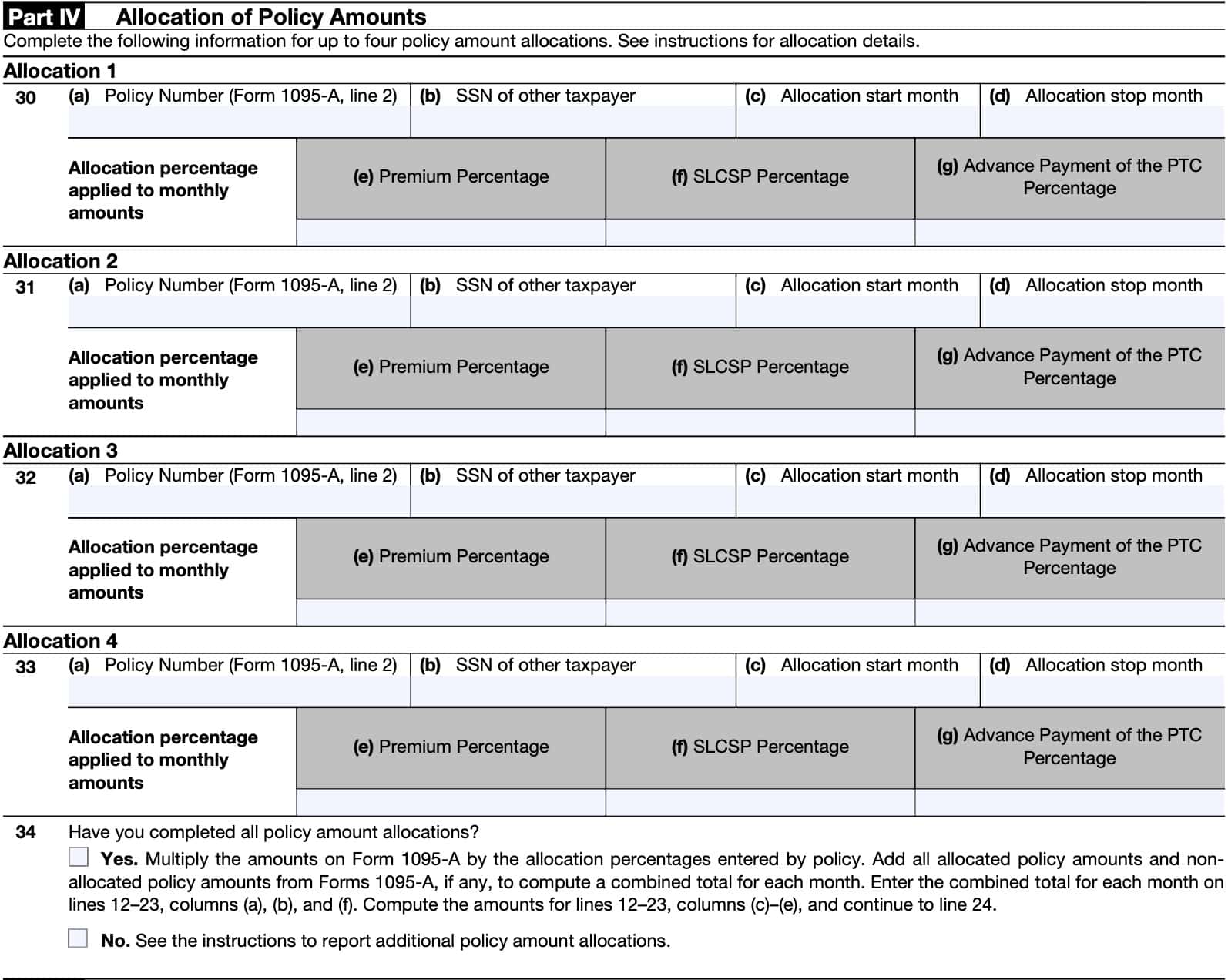

Part IV: Allocation of Policy Amounts

In Part IV, you can complete allocation of policy amounts for up to 4 policy amount allocations. We’ll outline instructions step by step for Lines 30 through 34 as a group.

Lines 30 through 33

You’ll complete each allocation in the same manner. Let’s break down the information that goes into each column.

Column (a)

Enter the Marketplace-assigned policy number from Form 1095-A, Line 2.

If the policy number on the Form 1095-A is more than 15 characters, enter only the last 15 characters.

Column (b)

Enter the SSN of the taxpayer with whom you are allocating policy amounts. This SSN may or may not be reported on your Form 1095-A, depending on your relationship to the other taxpayer.

Column (c)

Enter the first month you are allocating policy amounts.

For example, if you were enrolled in a policy with your former spouse from January through June, enter “01” in Column (c).

Column (d)

Enter the last month you are allocating policy amounts.

For example, if you were enrolled in a policy with your former spouse from January through June, enter “06” in Column (d).

Column (e)

If your allocation situation requires you to allocate the enrollment premiums on Form 1095-A, Lines 21 through 32, column A, enter your allocation percentage for that policy in Column (e).

Enter your allocation percentage as a decimal rounded to two places (for example, for 40%, enter “0.40”). Otherwise, leave column (e) blank.

Column (f)

If your allocation situation requires you to allocate the applicable SLCSP premium on Form 1095-A, Lines 21 through 32, column B, enter your allocation percentage for that policy in Column (f).

Enter your allocation percentage as a decimal rounded to two places (for example, for 67%, enter “0.67”).

Line 34

If you have completed your required allocations of policy amounts shown on Forms 1095-A using Lines 30 through 33, check the “Yes” box.

If you must make more than four allocations of policy amounts shown on Forms 1095-A, check

the “No” box. Attach a statement to your return providing the information shown on Lines 30 through 33, Columns (a) through (g), for each additional allocation.

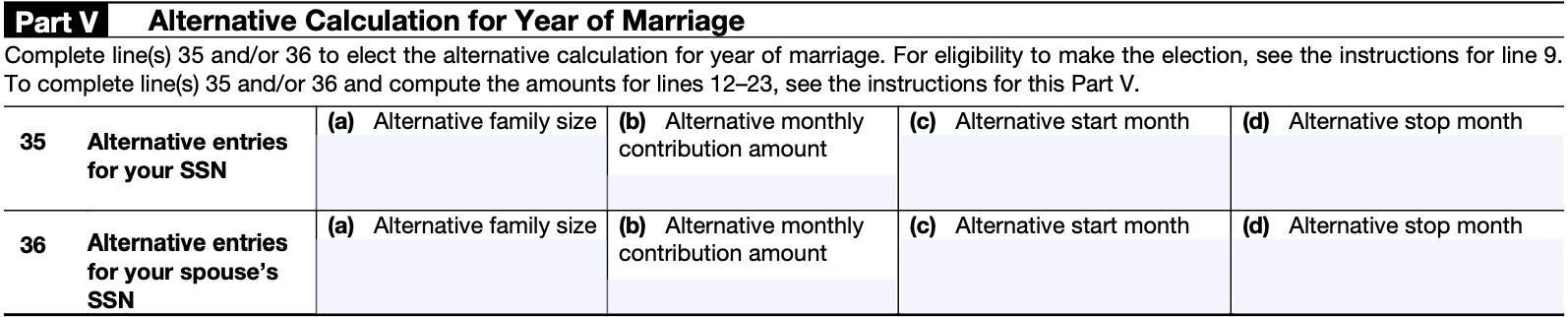

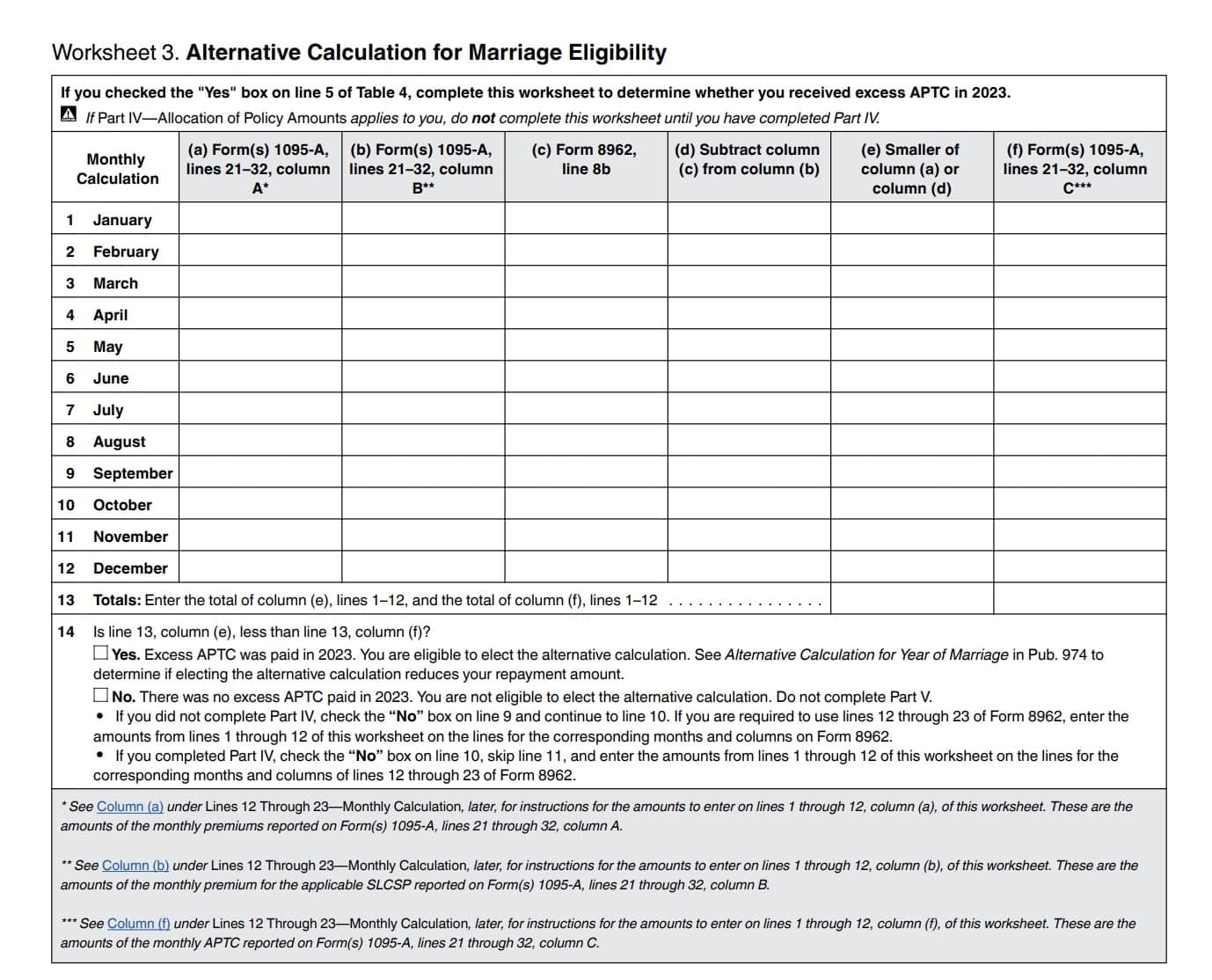

Part V: Alternative Calculation for Year of Marriage

To elect the alternative calculation for year of marriage, you’ll need to complete Lines 35 and 36, below. However, you must first determine whether you are eligible to do so.

Electing the alternative calculation is optional, but may reduce the amount of excess APTC you must repay. If you determine that the alternative calculation does not reduce the amount of excess APTC that you must repay, then you do not need to use it.

To be eligible to make this election, you must meet either of the following conditions.

- You answered “Yes” to all five questions in Table 4.

- You checked the “Yes” box on Line 14 of Worksheet 3, located below

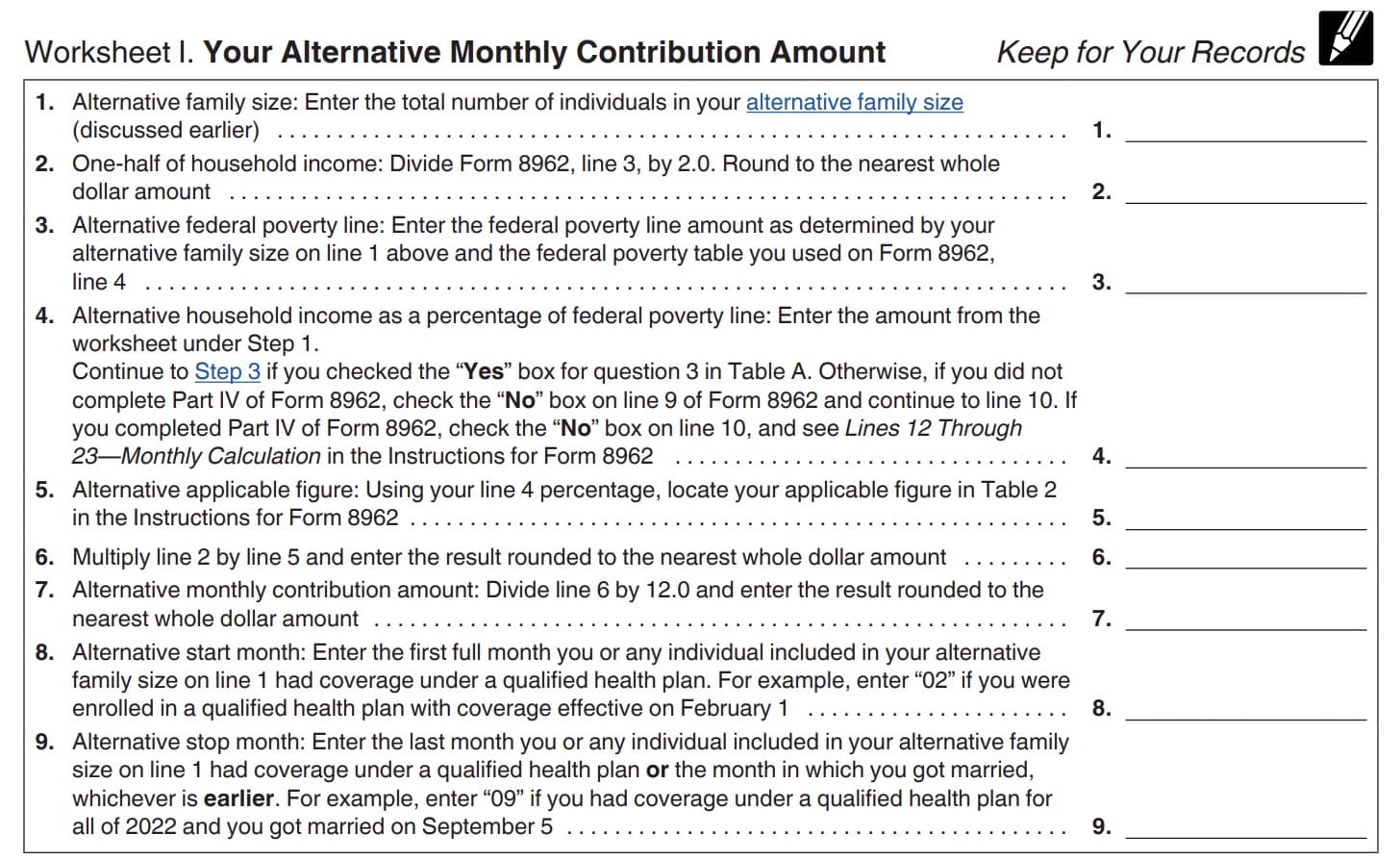

Line 35: Alternative entries for your SSN

Follow the instructions below for each column, using Worksheet I from IRS Publication 974.

Column (a): Alternative family size

Enter the family size from Worksheet I, Line 1.

Column (b): Alternative monthly contribution amount

Enter the amount from Worksheet I, Line 7.

Column (c): Alternative start month

Enter the month from Worksheet I, Line 8.

Column (d): Alternative stop month

Enter the month from Worksheet I, Line 9.

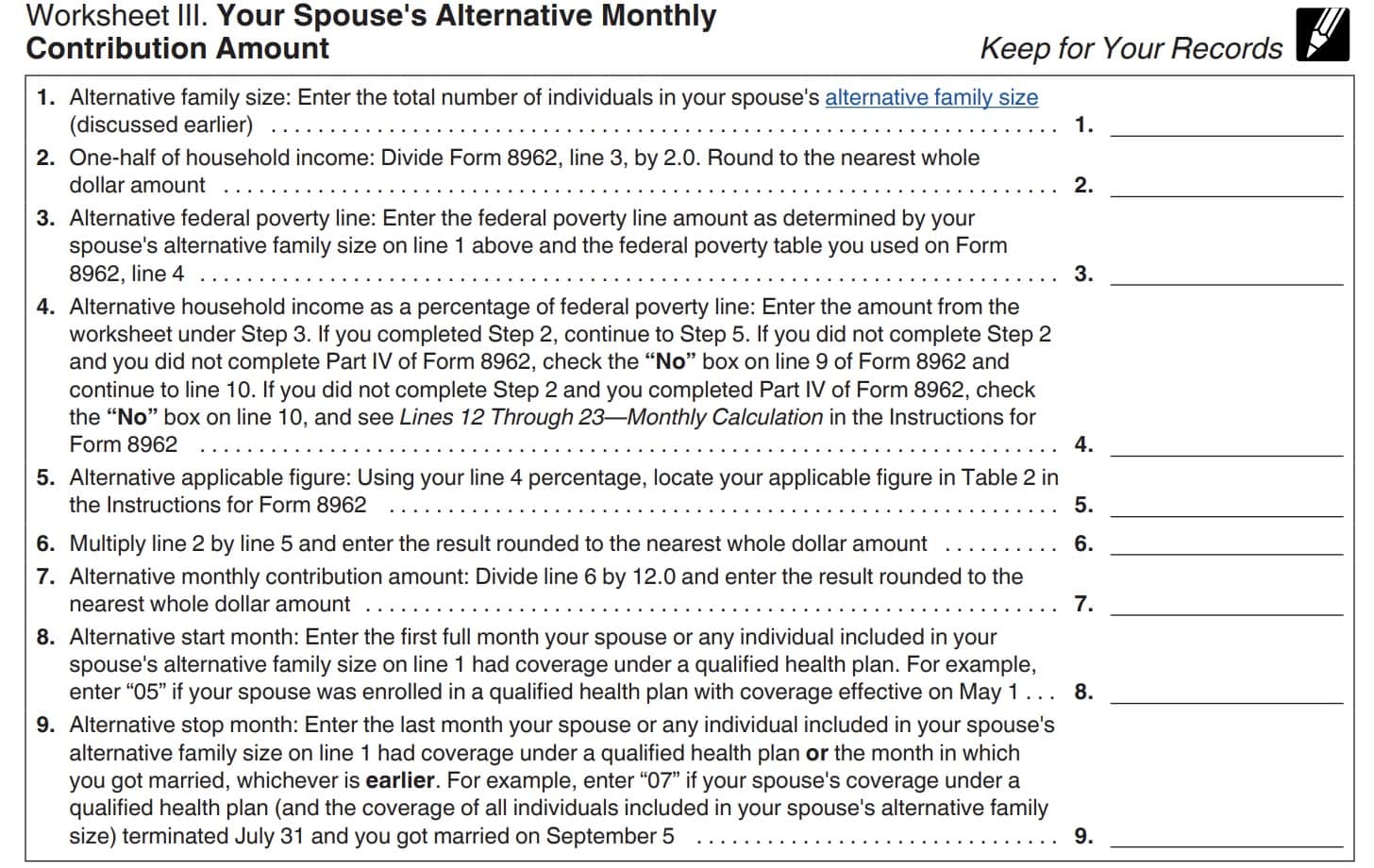

Line 36: Alternative entries for your spouse’s SSN

Follow the instructions below for each column, using Worksheet III from IRS Publication 974.

Column (a): Alternative family size

Enter the family size from Worksheet III, Line 1.

Column (b): Alternative monthly contribution amount

Enter the amount from Worksheet III, Line 7.

Column (c): Alternative start month

Enter the month from Worksheet III, Line 8.

Column (d): Alternative stop month

Enter the month from Worksheet III, Line 9.

Video walkthrough

Check out our video for an in-depth walkthrough of IRS Form 8962.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

IRS Form 8962, Premium Tax Credit, helps taxpayers calculate the amount of the premium tax credit they can take based on their health insurance coverage and household income. If you received advance premium credits, this form helps determine if you need to repay any premium credits at the end of the year.

If you received advance credit payments and do not file IRS Form 8962, the IRS may consider this a failure to reconcile your advance premium tax credit with your actual premium tax credit. In this case, you may be prevented from applying for future premium tax credits.

Where can I find IRS Form 8962?

As with most tax forms, you can find IRS Form 8962 in PDF form on the IRS website. For your convenience, we’ve included the most recent version of this tax form here.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!