IRS Form 1099-MISC Instructions

Taxpayers who receive $600 or more in miscellaneous payments may receive IRS Form 1099-MISC, Miscellaneous Information, in the year after they received this income.

In this article, we’ll cover everything you need to know about IRS Form 1099-MISC, including:

- Step by step guidance about tax information reported on your Form 1099-MISC

- How to report this information on your tax return

- Frequently asked questions

Let’s start by going over this tax form, step by step.

Table of contents

IRS Form 1099-MISC Instructions

In most of our articles, we walk you through how to complete the tax form. However, since Form-1099 is issued to taxpayers for informational purposes, most readers will probably want to understand the information reported on their 1099-MISC form, instead of how to complete it.

Before we start breaking down this tax form, it’s important to understand that there can be up to 4 copies of Forms 1099-MISC. Here is a break down of where all these forms end up:

- Copy A: Internal Revenue Service center

- Copy B: For recipient’s tax records

- Copy 1: For state, city, or local tax department

- Copy 2: To be filed with employee’s state, city, or local tax return

For employees who do not pay state, city, or local income tax, copies 1 and 2 are optional.

Let’s get into the form itself, starting with the information fields on the left side of the form.

Taxpayer identification fields

Payer’s Name, Address, And Telephone Number

You should see the payer’s complete business name, address, and telephone number in this field.

Payer’s TIN

This is the payer’s taxpayer identification number (TIN). In most situations, the payer’s tax identification number will be an employer identification number (EIN).

The payer’s TIN should never be truncated.

Recipient’s TIN

As the recipient or payee, you should see your taxpayer identification number in this field. For payees, the TIN can be any of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN)

- Employer identification number (EIN)

Please review this field to make sure that it is correct. However, you may see a truncated form of your TIN (such as the last four digits of your SSN), for privacy protection purposes. Copy A, which is sent to the Internal Revenue Service, is never truncated.

Recipient’s Name And Address

You should see your legal name and address reflected in these fields. If your address is incorrect, you should notify the payer and the IRS.

You can notify the IRS of your new address by filing IRS Form 8822, Change of Address. Business owners can notify the IRS of a change in their business address by filing IRS Form 8822-B, Change of Address or Responsible Party, Business.

Account number

On the bottom left-side of the 1099-MISC tax form, you’ll see a box marked, ‘Account number.’

The IRS requires the filer to complete this box only if the filer has multiple accounts for the same recipient, and the filer is preparing more than one Form 1099-MISC for that recipient.

The IRS also requires filers to enter account information in this field if they check Box 13, which is the FATCA filing requirement box.

Otherwise, use of this field is optional.

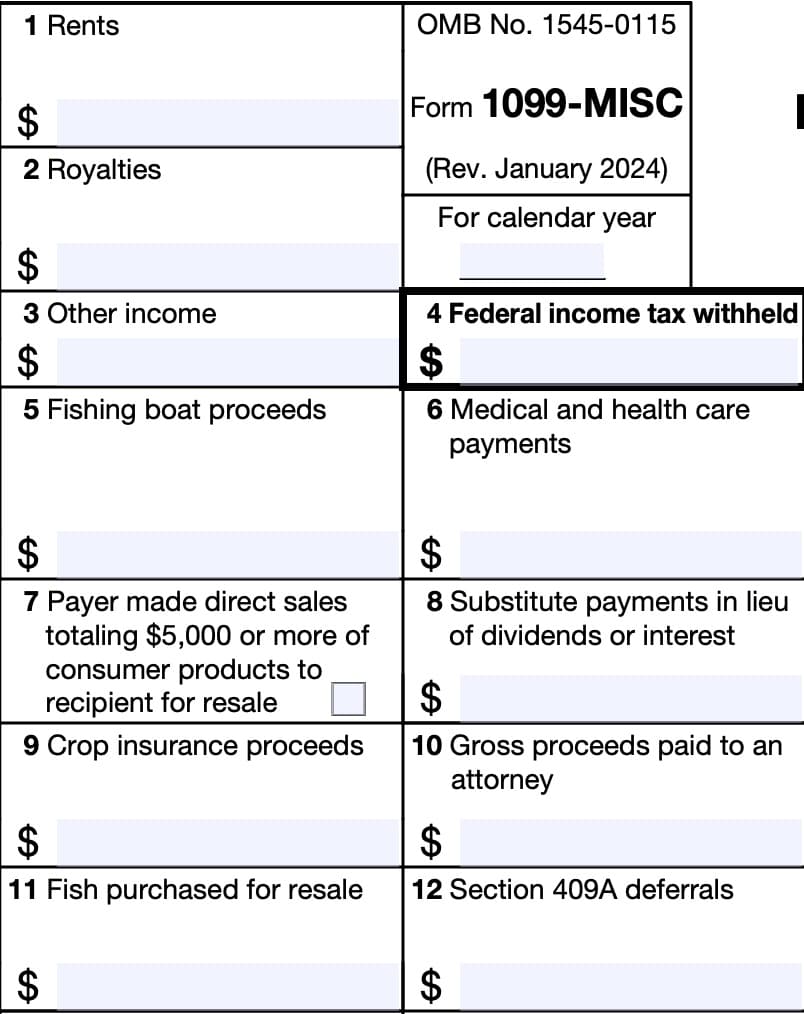

Boxes 1 through 15

On the right-hand side of the 1099-MISC tax form are Boxes 1 through 15. Let’s go through each box, one at a time.

Box 1: Rents

Payers will use Box 1 to report rents gross of $600 or more, including the following:

- Real estate rentals paid for office space

- Form 1099-MISC not required if paid to a real estate agent or property manager

- Real estate agent or property manager must use Form 1099-MISC to report rent proceeds to the property owner

- Machine rentals

- May also need to use IRS Form 1099-NEC, Nonemployee Compensation, to report combined use from a service provider, such as renting construction equipment that also requires a licensed operator

- Pasture rentals, such as farmers paying for the use of grazing land

How to report rents on your tax return

Generally, individual taxpayers should report rents as taxable income on IRS Schedule E of their federal income tax return.

However, you may report rents on Schedule C of your Form 1040, Form 1040-NR, or Form 1040-SR, if any of the following apply:

- You provided significant services to a tenant, such as cleaning services

- You sold real estate as a business,

- You rented personal property as a business

You may also need to report Schedule C income on IRS Schedule SE, to calculate self-employment taxes.

Box 2: Royalties

Payers will report royalty payments of at least $10 in Box 2. This may include royalties from:

- Oil, gas, or other mineral properties before reduction for severance and other taxes

- Intangible property such as patents, copyrights, trade names, and trademarks

However, the following should not be reported to you in Box 2:

- Surface royalties (should be reported in Box 1)

- Oil or gas payments for a working interest (also reported in Box 1)

- Timber royalties made under a pay-as-cut contract (should be reported on IRS Form 1099-S, instead)

How to report royalties on your tax return

Report royalties from the following on Schedule E of your Form 1040.

- Oil, gas, or mineral properties

- Copyrights

- Patents

However, you should follow the Schedule E instructions when reporting payments for a working interest.

IRS Publication 544, Sales and Other Dispositions of Assets, contains additional information on reporting royalties on timber, coal, and iron ore.

Box 3: Other income

Generally, the payer will complete Box 3 to enter $600 or more of other income that is not reported elsewhere on Form 1099-MISC. This may include the following:

- Prizes and awards that are not for services performed

- Fair market value of merchandise won on game shows

- Amounts paid to a sweepstakes winner not involving a wager

- If a wager is involved, this might be reported on IRS Form W-2G instead

- Deceased employee’s wages if paid in the year after death

- Wages in the year of death are reported on IRS Form W-2 and subject to FICA taxes

- Payments to tribal members that require federal income tax withholding

- Payments made to individuals participating in medical research studies

- Termination payments to former self-employed insurance salespeople that meet certain requirements

- Not subject to self-employment tax and can be reported in Box 3

- Punitive damages, damages for nonphysical injuries or sickness, or other taxable damages as employment discrimination or defamation

- Certain damages may not be reportable, and may not appear on your Form 1099-MISC

How to report other income on your tax return

Generally, most taxpayers should report miscellaneous income payments in Box 3 on the ‘Other Income’ line of IRS Schedule 1, Additional Income and Adjustments to Income, when filing their Form 1040.

When reporting on Schedule 1, taxpayers should identify the payment, such as:

- Payments received as the beneficiary of a deceased employee

- Prizes

- Taxable damages

If income reported in Box 3 is related to your trade or business income, you may be able to report it on Schedule C or Schedule F of your tax return.

IRS Publication 525, Taxable and Nontaxable Income, contains more information.

Box 4: Federal income tax withheld

You should see backup withholding amounts reported in Box 4.

If you have not given your TIN to the payer, you may be subject to backup withholding rules on payments made on IRS Form 1099-MISC.

In this case, you may be asked to complete IRS Form W-9, Request for Taxpayer Identification Number and Certification. This will allow the payer to report the correct TIN to the Internal Revenue Service.

How to report federal income tax withheld on your tax return

Report any income taxes withheld as taxes paid when filing your income tax return.

Box 5: Fishing boat proceeds

If applicable, a fishing boat captain may use Box 5 to report payments to fishing boat crew members who are considered independent contractors.

How to report Fishing proceeds on your tax return

Self-employed individuals must report these as taxable payments on Schedule C of their income tax return.

IRS Publication 334, Tax Guide for Small Business, states that these reportable payments are subject to Social Security and Medicare taxes if all of the following conditions apply:

- You do not get any pay for the work except your share of the catch or a share of the proceeds from the sale of the catch, unless the pay meets all the following conditions:

- The pay is not more than $100 per trip

- You receive the pay only if there is a minimum catch

- The pay is solely for additional duties, such as mate, engineer, or cook, for which additional cash pay is traditional in the fishing industry

- You get a share of the catch or a share of the proceeds from the sale of the catch.

- Your share depends on the amount of the catch.

- The boat’s operating crew normally numbers fewer than 10 individuals.

- If the average size of the crew made during the last 4 calendar quarters is fewer than 10, then the operating crew is considered fewer than 10

Box 6: Medical and health care payments

Filers must include payments of $600 or more made in the course of trade or business to each physician or other health care or medical provider.

This includes payments made by medical and health care insurers under health, accident, and sickness insurance programs. However, filers are not required to issue Form 1099-MISC to pharmacies for prescription drugs.

How to report medical and health care payments on your tax return

Individuals who receive IRS Form 1099-MISC for medical or health care services must report payments on Schedule C of their income tax return.

Box 7

If Box 7 is checked, this indicates that the payer made direct sales to you for consumer products totaling at least $5,000 and intended for resale. This does not include consumer products that are intended to be sold in a permanent retail establishment.

Your payer may also decide to report this in Box 2 on IRS Form 1099-NEC.

How to report direct sales on your tax return

Generally, you should report the total amount of income from the sale of these products on Schedule C of your tax return.

Box 8: Substitute payments in lieu of dividends or interest

Box 8 will contain aggregate payments of at least $10 of substitute payments received by a broker for a customer in lieu of dividends or tax-exempt interest, including original issue discount, as a result of a loan of a customer’s securities.

For this purpose, a customer can be any of the following tax entities:

- Individual

- Trust or estate

- Partnership

- Corporation (can be a C corporation or S corporation)

How to report substitute payments on your tax return

Individual taxpayers should report Box 8 amounts on the “Other income” line of IRS Schedule 1 of their income tax return.

Box 9: Crop insurance proceeds

Box 9 contains crop insurance proceeds of $600 or more paid to farmers by insurance companies unless the farmer has notified the insurance company that they have capitalized expenses under one of the following Internal Revenue Code references:

- IRC Section 278: Capital expenditures incurred in planting citrus and almond groves

- IRC Section 263A: Capitalization and inclusion in inventory costs of certain expenses

- IRC Section 447: Method of accounting for corporations engaged in farming

How to report crop insurance proceeds on your tax return

Report this amount on Schedule F of your Form 1040.

Box 10: Gross proceeds paid to an attorney

Box 10 contains gross proceeds of at least $600 paid to an attorney in connection with legal services, regardless of whether the payer received any legal services or legal advice as a result of these payments.

Only the taxable portion of these proceeds should be reported on an income tax return.

Box 11: Fish purchased for resale

Box 11 contains total cash payments of $600 or more paid during the year to any person who is engaged in the trade or business of catching fish.

Filers must keep records showing the date and amount of each cash payment. However, IRS Form 1099-MISC will only contain the total amount paid for the tax year.

Box 12: Section 409A deferrals

Filers do not need to complete Box 12.

However, if completed, Box 12 contains the total amount of deferred non-employee compensation under all nonqualified plans. The deferrals during the year include earnings on the current year and prior year deferrals.

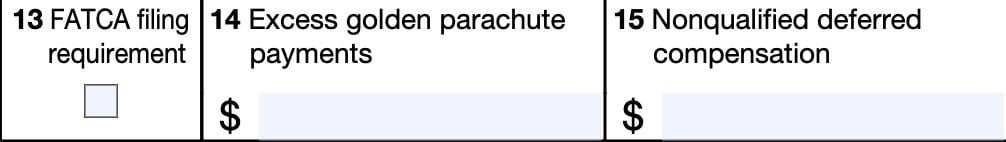

Box 13: FATCA filing requirement

If this box is checked, the payer has a filing requirement to report with respect to a U.S. financial account under Chapter 4 of the Internal Revenue Code.

Taxpayers may also have a filing requirement, based on the instructions for IRS Form 8938, Statement of Specified Foreign Financial Assets.

Box 14: Excess golden parachute payments

Box 14 contains excess golden parachute payments.

What is an excess parachute payment?

An excess parachute payment is the amount over the base amount, which is the average annual compensation for services includible in an individual’s gross income over the most recent 5 tax years.

Excess golden parachute payments may be subject to a 20% excise tax.

Box 15: Nonqualified deferred compensation

Box 15 contains deferred amounts deferred that are includible in income under IRC Section 409A

because the NQDC plan fails to satisfy the Section 409A requirements.

This will not include amounts properly reported on any of the following information returns for a prior tax year:

- IRS Form 1099-MISC

- IRS Form W-2

- IRS Form W-2c

Box 15 will also not include amounts considered to be subject to a substantial risk of forfeiture for purposes of IRC Section 409A.

How to report nonqualified deferred compensation on your tax return

Any amount included in Box 12 that is currently taxable is also included in this box. Taxpayers should report this amount as income on your tax return.

This income is also subject to a 20% additional tax on the amount includible in income. Report this additional tax on Line 17h of IRS Schedule 2, Additional Taxes, when filing your income tax return.

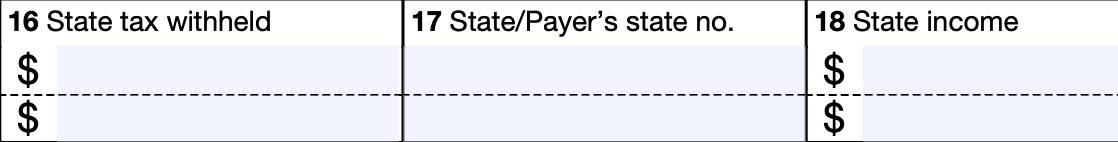

State tax information

If you live in a state without income tax, you may not see any information in Boxes 16 through 18. However, Boxes 16 through 18 may contain relevant tax information for up to 2 different states.

Box 16: State tax withheld

If applicable, Box 5 will contain the the amount of state income tax withheld from your income.

Box 17: State/Payer’s state number

If your payer has a specific state tax identification number, that TIN will appear in Box 17. You should also see the two-letter acronym for your state here.

Box 18: State income

Box 18 contains the state taxable income for any state income tax withheld in Box 16.

Filing IRS Form 1099-MISC

For tax entities who must file this tax form with the Internal Revenue Service, the IRS requires certain paper versions of information returns to be accompanied by IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Check out our step-by step instructional guide for more information on how to submit your information return with IRS Form 1096.

Video walkthrough

Watch this instructional video for a recap of tax information you can expect to see in your Form 1099-MISC.

Frequently asked questions

Payers must file Form 1099-MISC to report payments to anyone whom they paid at least $10 in royalties, $600 or more in miscellaneous payments not includible on other information returns, sold at least $5,000 of consumer products for resale, or withheld federal income tax under backup withholding rules, regardless of the amount of federal income tax withheld.

The due date for IRS Form 1099-MISC is January 31st of the following year for the tax year in question. For example, the 2023 1099-MISC form is due to non-employees by January 31, 2024.

If this form is incorrect or has been issued in error, contact the payer. If you cannot get this form corrected, attach an explanation to your tax return and report your information correctly.

Where can I find IRS Form 1099-MISC?

As with other information returns, you may find IRS Form 1099-MISC on the IRS website. For your convenience, the latest version is enclosed below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!