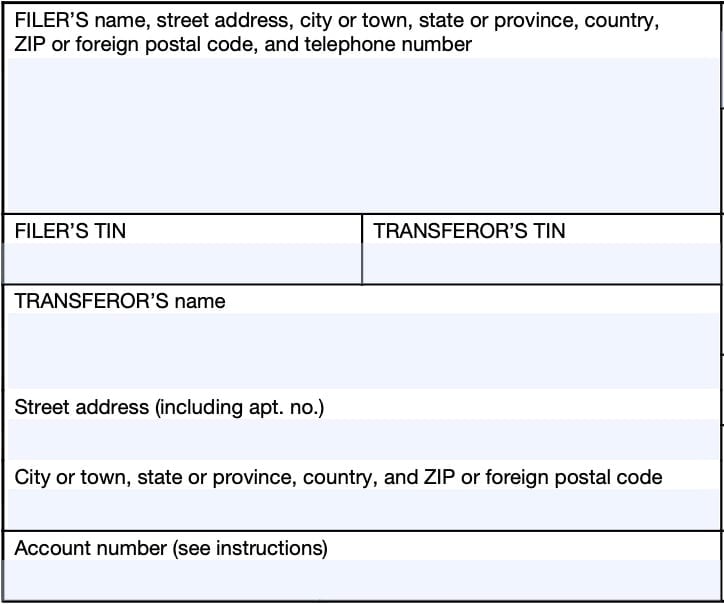

IRS Form 1099-S Instructions

When selling or exchanging real estate, you may receive a copy of IRS Form 1099-S, Proceeds From Real Estate Transactions.

In this article, we’ll walk you through everything you need to know about IRS Form 1099-S, including:

- How to read and understand IRS Form 1099-S

- When you should expect to receive a copy of this form

- When and how to report taxable income when filing your tax return

Let’s begin with an overview of this straightforward tax form.

Table of contents

IRS Form 1099-S instructions

In most of our articles, we walk you through how to complete the tax form. However, since Form-1099 is issued to taxpayers for informational purposes, most readers will probably want to understand the information reported on their 1099-S form, instead of how to complete it.

Before we start breaking down this tax form, it’s important to understand that there can be up to 3 copies of IRS Form 1099-S. Here is a break down of where all these forms end up:

- Copy A: Internal Revenue Service center

- Copy B: For transferor’s tax records

- Copy C: For the filer

Let’s get into the form itself, starting with the information fields on the left side of the form.

Taxpayer identification fields

On the left-hand side of the tax form, you’ll see taxpayer information for both the filer and the transferor.

Filer’s Name, Address, And Telephone Number

You should see the filer’s contact information, with complete business name, address, zip code, and phone number in this field.

Filer’s TIN

This is the filer’s taxpayer identification number (TIN). In most situations, this will be the employer identification number (EIN).

The filer’s TIN should never be truncated.

Transferor’s TIN

As the recipient of IRS Form 1099-S, you should see your taxpayer identification number in this field. The TIN can be any of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Adoption taxpayer identification number (ATIN)

- Employer identification number (EIN)

Please review this field to make sure that it is correct. However, you may see a truncated form of your TIN (such as the last four digits of your SSN), for privacy protection purposes.

As part of a sales transaction, you may be asked to complete IRS Form W-9, Request for Taxpayer Identification Number and Certification, among other tax documents. For real estate transactions, the transferor must furnish his or her complete, non-truncated TIN and to certify that the TIN is correct.

Copy A, which is sent to the Internal Revenue Service, is never truncated.

Transferor’s Name And Address

You should see your legal name and address reflected in these fields. If your address is incorrect, you should notify the lender and the IRS.

You can notify the IRS of your new address by filing IRS Form 8822, Change of Address. Business owners can notify the IRS of a change in their business address by filing IRS Form 8822-B, Change of Address or Responsible Party, Business.

Account Number

This field is present in many information returns, such as IRS Form 1099-INT or IRS Form 1099-DIV.

Your lender have established a unique account number for you, which may appear in this field. If the field is blank, you may ignore it.

However, IRS instructions dictate that the account number is required if the filer has:

- Created multiple accounts for a recipient, and

- Is filing more than Form 1099-S for that person

Let’s check out the information fields on the right-hand side of the form.

Boxes 1 through 6

There are 6 information fields on the right side of IRS Form 1099-S. Let’s start at the top.

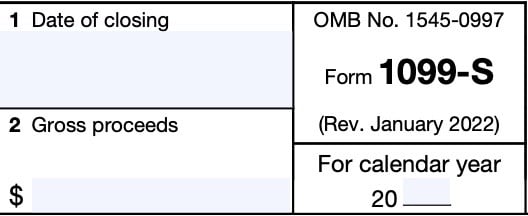

Box 1: Date of closing

In Box 1, you’ll see the closing date of the real estate transaction.

On a Closing Disclosure, the closing date is the closing disclosure date.

If a Closing Disclosure is not used, the closing date is the earlier of:

- The date of title transfer, or

- The date that the economic burdens and benefits of ownership shift to the transferee

Closing disclosure

As part of the Dodd-Frank Wall Street Reform and Consumer Protection Act, the Closing Disclosure combines and replaces the following documents:

- HUD-1 Settlement Statement

- Truth-in-Lending statement under the Real Estate Settlement Procedures Act (RESPA) of 1974, as amended, and the Federal Truth in Lending Act, as amended

A Closing Disclosure includes any amendments, variations, or substitutions that may be prescribed under Dodd-Frank if any such form discloses the following information

- Transferor and transferee

- Application of proceeds

- Identity of the settlement agent or other person responsible for preparing the form

If a settlement agent or a title company is not used, the person responsible for closing the transaction is the person who prepares a Closing Disclosure that:

- Identifies the transferor and transferee

- Reasonably identifies the real estate that was transferred

- Describes the sale price and how the proceeds were disbursed

Box 2: Gross proceeds

Box 2 shows the gross proceeds from a real estate transaction. Generally, the gross proceeds are the same as the sales price.

Gross proceeds include the following:

- Cash and notes payable to the transferor

- Notes assumed by the transferee

- Notes paid off at settlement

Box 2 does not include the value of other property or services you received or will receive. Box 4, below, reports this information separately.

If the transferee assumes a liability of the transferor or takes the property subject to a liability, such liability is treated as cash and is includible as part of gross proceeds.

For a contingent payment transaction, this field should include the maximum determinable proceeds.

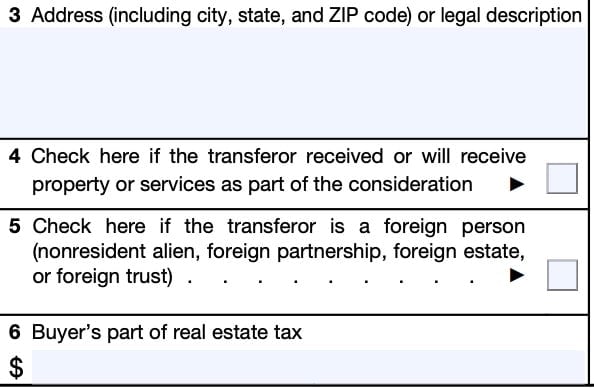

Box 3: Address

This field will contain the physical address of the property. The property address should include the city, state, and ZIP code.

If the address does not sufficiently identify the property, then you may see a legal description, containing more detailed information. This may include section, lot, and/or block.

For timber royalties, you may see “Timber royalties.” For lump-sum timber payments, you may see, “Lump-sum timber payment.”

Box 4

If you received or will receive property, other than cash and consideration treated as cash in figuring gross proceeds, you should see an ‘X’ in Box 4.

You should also see an ‘X’ here if you received services or will receive services as part of the consideration for the property.

Box 5

If you are a foreign person, the reporting person will enter an ‘X’ in Box 5.

IRS Form 8288, U.S. Withholding Tax Return for Certain Dispositions by Foreign Persons, contains additional information about tax withholding requirements for real estate transferred by a foreign person.

Foreign persons

For purposes of this tax form, a foreign person includes any of the following:

- Nonresident alien

- Foreign partnership

- Foreign estate, or

- Foreign trust

Box 6: Buyer’s part of real estate tax

Box 6 shows certain real estate tax on a residence charged to the buyer at settlement.

If you have already paid the real estate tax for the period that includes the sale date, subtract the Box 6 amount from the real estate taxes already paid to determine your deductible real estate tax. If you itemize deductions, you may be able to reduce your taxable income on Schedule A when filing your tax return.

But if you have already deducted the real estate tax in a prior year, you must generally report this amount as income on the “Other income” line of Schedule 1, Additional Income and Adjustments to Income, on your tax return.

The reporting person does not have to report any amount as allocable to the buyer for real estate taxes paid in arrears. The individual filing Form 1099-S may use the appropriate information on the Closing Disclosure, or a similar document provided at closing.

Example

For example, a taxpayer sells their primary residence in a county where taxpayers pay their real estate tax annually in advance. The seller paid real estate taxes of $1,200 for the tax year in which the sale took place.

The sale occurred at the end of the 9th month of the real estate tax year. Therefore, the closing agent allocated $300 of the tax paid in advance to the buyer, by reference to the amount of real estate tax shown on the Closing Disclosure as paid in advance by the seller.

As a result, Box 6 should contain $300.

Filing IRS Form 1099-S

Many taxpayers will not see IRS Form 1099-S for the sale of real estate. Generally, this is because they may sell their principal residence and qualify for the Section 121 tax exclusion.

Section 121 tax exclusion

Under Section 121 of the Internal Revenue Code, you may exclude up to $250,000 of a capital gain from the sale of your main home ($500,000 for a married couple), if each person meets certain ownership and use requirements.

This requires the taxpayer to certify, as part of the closing process, that they qualify for the tax exclusion, and that the proceeds from Form 1099-S are not considered reportable income.

However, in other real estate transactions, this form is required.

When IRS Form 1099-S is required

Generally, the reporting person must report a transaction that consists in whole or in part of the sale or exchange for money, debt, real property, personal property, or services of any present or future ownership interest of any of the following:

- Improved or unimproved land, including air space

- Inherently permanent structures

- This includes any residential, commercial, or industrial building

- A condominium unit and its appurtenant fixtures and common elements, including land

- Stock in a cooperative housing corporation

- As defined in IRC Section 216

- Any non-contingent interest in standing timber

How to file if IRS Form 1099-S is required

For tax entities who must file this tax form with the Internal Revenue Service, the IRS requires certain paper versions of information returns to be accompanied by IRS Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

Check out our step-by step instructional guide for more information on how to submit your information return with IRS Form 1096.

How to report the sale of real estate on your tax return

For sales or exchanges of certain real estate, the person responsible for closing a real estate transaction must report the real estate proceeds to the IRS and must furnish this statement to you. Each taxpayer must use this information to determine how to report this transaction, if required.

Selling your primary residence

Generally, each owner must have owned the property, and used it as their primary home for 2 of the previous 5 years. These are known as the ownership and use tests.

If you are not sure that you qualify for the Section 121 tax exclusion, or to determine if you have to report the sale or exchange of your main home on your tax return, you should refer to the instructions for IRS Schedule D, Capital Gains & Losses.

Selling a property that was not your primary residence or that does not qualify for the Section 121 exclusion

If the real estate was not your main home, then you must report the transaction on one (or more) of the following tax forms, as appropriate

Sales of business property

To report the gain or loss of property used for business, or the sale of an investment property, you should use IRS Form 4797, Sales of Business Property, if not already reported on Schedule D.

Installment sales

If selling real estate as part of an installment agreement, you should report this transaction on IRS Form 6252, Installment Sale Income, in addition to Schedule D.

Like-kind exchanges

If box 4 is checked and you received or will receive like-kind property, you must file IRS Form 8824, Like-Kind Exchanges.

Federal mortgage subsidies

You may have to recapture (pay back) all or part of a federal mortgage subsidy if all the following apply.

- You received a loan provided from the proceeds of a qualified mortgage bond or you received a mortgage credit certificate.

- Your original mortgage loan was provided after 1990.

- You sold or disposed of your home at a gain during the first 9 years after you received the federal mortgage subsidy.

- Your income for the year you sold or disposed of your home was over a specified amount. This will increase your tax.

For more guidance, see IRS Form 8828, Recapture of a Federal Tax Subsidy.

Video walkthrough

Watch this video tutorial to learn more about your Form 1099-S.

Frequently asked questions

IRS Form 1099-S, Proceeds From Real Estate Transactions, reports the sale or exchange of real estate to the Internal Revenue Service.

If you are not able to certify that you can exclude the capital gain from the sale of your primary residence, then you should report the transaction reported to you on IRS Form 1099-S when you file your federal income tax return.

Not necessarily. If you are able to exclude all of your capital gain from the sale of your primary residence, then your closing agent will ask you to certify this as part of their closing package. If you do this, then you will not receive IRS Form 1099-S.

Where can I find IRS Form 1099-S?

As with most tax forms, you may find IRS Form 1099-S on the IRS website. For your convenience, we’ve included the most recent version of this form below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!