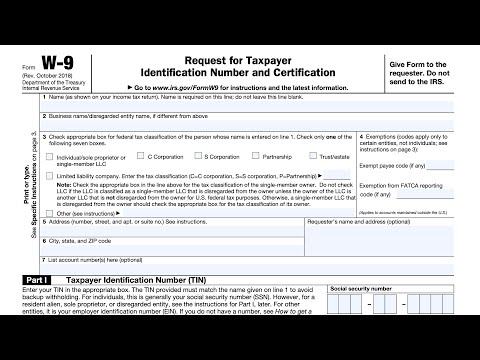

IRS Form W-9 Instructions

Intro

Table of contents

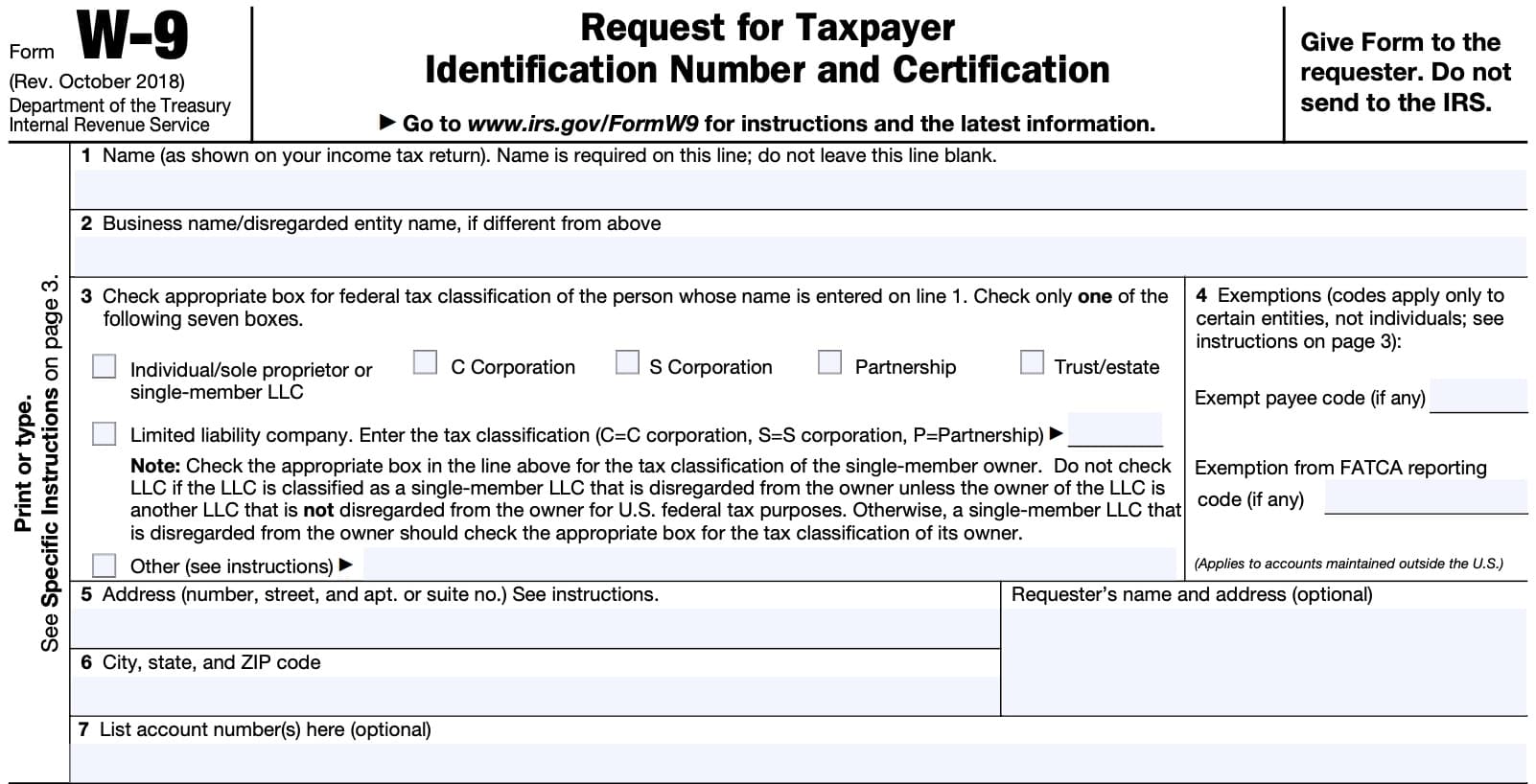

How do I complete IRS Form W-9?

There are three parts to this one-page tax form:

- Taxpayer information

- Part I: Taxpayer identification number

- Part II: Certification

Let’s start with the personal information fields at the top of the form.

Taxpayer information

At the top of the W-9 form, you’ll enter personal information about yourself. If completing this form on behalf of another tax entity, then you’ll enter tax information related to that entity.

This information will allow the requester to properly complete information returns at the end of the year. Let’s start at the top.

Line 1: Name

Enter your name as listed on your federal income tax return. Since this is a mandatory field, do not leave this line blank.

Line 2: Business name

If you are completing the W-9 tax form on behalf of a business or disregarded entity, enter the business or entity name in this line.

Disregarded entity

For tax purposes, the Internal Revenue Service considers certain business structures as disregarded entity. In other words, the IRS views the business entity as no different from the business owner or business owners.

The most common type of disregarded business entity is a single member limited liability company (LLC). For tax purposes, the IRS views this as the same thing as a sole proprietorship, unless the business owner has:

- Filed IRS Form 8832, Entity Classification Election, and

- Affirmatively elects to be treated as a corporation

Similarly, a business with two business owners will be treated as a partnership unless the owners file IRS Form 8832 to be treated as a corporation.

Line 3: Federal tax classification

In Line 3, check the appropriate box, based upon the federal tax classification of the person listed on Line 1. below are the available options:

- Individual, sole proprietor, or single-member LLC

- C corporation

- S corporation

- Election made by filing IRS Form 2553, Election by Small Business Corporation

- Partnership

- Trust or estate

- Limited liability company (LLC): Enter the tax classification, such as:

- C for C corporation

- S cor S corporation

- P for partnership

- Other

Line 4: Exemptions

In Line 4, certain entities that are exempt from backup withholding or FATCA reporting may enter their exemption codes.

What is Backup withholding?

Under certain conditions, the IRS requires certain persons to withhold 24% of gross payments to a recipient. After withholding taxes, the payer will send these tax payments to the IRS. This is known as backup withholding.

The following payments may be subject to backup withholding:

- Interest payments

- Tax-exempt interest

- Dividends

- Broker and barter exchange transactions

- Rental income

- Royalty income

- Nonemployee pay

- Payments made in settlement of payment card or third party network transactions

- Certain payments from fishing boat operators

However, real estate transactions are not subject to backup withholding. Taxpayers are not subject to backup withholding if:

- They complete Form W-9 and give the requester the correct taxpayer identification number (TIN)

- Make proper certifications

- Report all taxable interest and dividends when filing their individual tax return

Exempt payees

Certain payees may be exempt from backup withholding. In general, individuals, including sole proprietors, are not exempt from backup withholding.

Corporations are generally exempt from backup withholding for certain payments, including interest and dividends, except for:

- Payments made in settlement of payment card or third party network transactions

- Attorneys’ fees or gross proceeds paid to attorneys’

- Corporations that provide medical or health care services are not exempt regarding payments reportable on IRS Form 1099-MISC

Exempt Payee Codes

If you are one of the following entities, you may use the corresponding exemption code in the space provided in Line 4:

- Exempt Payee Code 1: Applies to:

- Tax exempt organizations

- IRAs

- Custodial accounts under IRC Section 403(b)(7), as long as the account satisfies all requirements

- Exempt Payee Code 2: The United States or any federal agency

- Exempt Payee Code 3: A state, District of Columbia, U.S. commonwealth or possession, or political subdivision

- Exempt Payee Code 4: Foreign government or subdivision or agency

- Exempt Payee Code 5: Corporation

- Exempt Payee Code 6: Dealer in securities or commodities required to register in the United States, District of Columbia, or a possession

- Exempt Payee Code 7: Futures trader registered with the Commodity Futures Trading Commission (CFTC)

- Exempt Payee Code 8: Real estate investment trusts

- Exempt Payee Code 9: Entity registered throughout the tax year under the Investment Company Act of 1940

- Exempt Payee Code 10: Common trust fund operated by a bank under IRC Section 584(a)

- Exempt Payee Code 11: Financial institutions

- Exempt Payee Code 12: Nominees or custodians (middlemen in the investment community)

- Exempt Payee Code 13: Tax-exempt trust under IRC Section 664 or described in IRS Section 4947

What is FATCA reporting?

The Foreign Account Tax Compliance Act (FATCA) requires a participating foreign financial institution to report all United States account holders that are specified United States persons.

However, certain payees are exempt from FATCA reporting.

Exemption from FATCA Reporting Code

Your requester may enter ‘Not Applicable’ on your behalf in this field. However, you may also enter one of the following FATCA reporting codes, as applicable:

- FATCA Code A: An organization exempt from tax under IRC Section 501(a) or any individual retirement plan as defined in IRC Section 7701(a)(37)

- FATCA Code B: The United States or any of its agencies or instrumentalities

- FATCA Code C: A state, the District of Columbia, a U.S. commonwealth or possession, or any of their political subdivisions or instrumentalities

- FATCA Code D: A corporation the stock of which is regularly traded on one or more established securities markets, as described in Treasury Regulations Section 1.1472-1(c)(1)(i)

- FATCA Code E: A corporation that is a member of the same expanded affiliated

- group as a corporation described in Treasury Regulations Section 1.1472-1(c)(1)(i)

- FATCA Code F: A dealer in securities, commodities, or derivative financial instruments (including notional principal contracts, futures, forwards, and options) that is registered as such under the laws of the United States or any state

- FATCA Code G: A real estate investment trust

- FATCA Code H: A regulated investment company as defined in IRC Section 851 or an entity registered at all times during the tax year under the Investment Company Act of 1940

- FATCA Code I: A common trust fund as defined in IRC Section 584(a)

- FATCA Code J: A bank as defined in IRC Section 581

- FATCA Code K: A broker

- FATCA Code L: A trust exempt from tax under IRC Section 664 or described in IRC Section 4947(a)(1)

- FATCA Code M: A tax exempt trust under a IRC Section 403(b) plan or IRC Section 457(g) plan

Line 5: Address

Enter your street address here. The requester will mail your information returns to this address until you update it.

If this address differs from the one the requester already has on file, then you should write NEW at the top.

Line 6: City, state, and ZIP code

Include your city, state, and ZIP code in this area.

Line 7: Account Number(s)

This is an optional field, and can be left blank.

Requester’s name and address

This is also an optional field. It may be pre-filled for you, but you can leave this field blank.

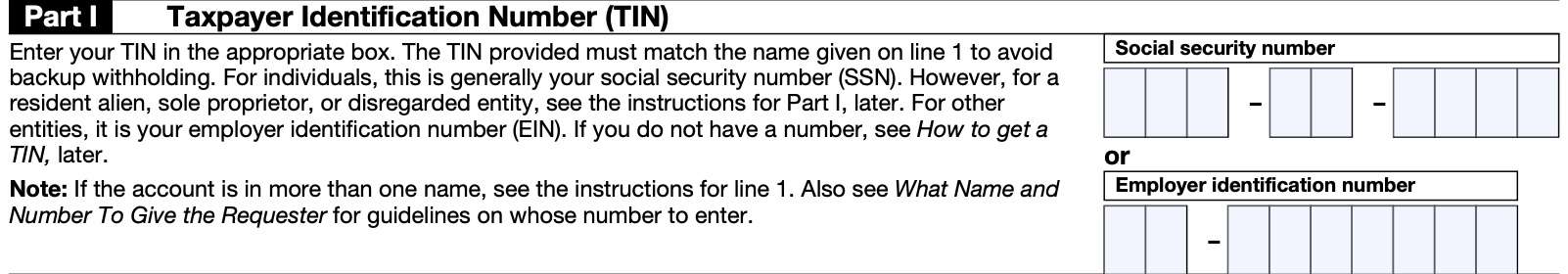

Part I: Taxpayer identification number (TIN)

In Part I, you’ll enter your TIN in the appropriate box. If you have a Social Security number, enter it in the SSN field.

If you are a resident alien and you do not have and are not eligible to get an SSN, your TIN is your IRS individual taxpayer identification number (ITIN). Enter your ITIN in this field.

If you do not have an SSN or ITIN

If you do not have an ITIN or an SSN, you may have to apply for one of them, based upon your eligibility using one of the following forms:

- IRS Form W-7, Application for Individual Taxpayer Identification Number, or

- Form SS-5, Application for Social Security Card

Once you’ve submitted your TIN application, you may enter ‘Applied For’ in the TIN space.

Employer identification number (EIN)

If you have an EIN, then you should enter it in the Employer Identification Number field. For sole proprietors who also have an EIN, you may enter either your SSN or EIN.

If you are a disregarded entity, enter either your SSN or the owner’s EIN. Do not enter the entity’s EIN.

If you do not have an EIN, but are eligible for one, you may apply using IRS Form SS-4, Application for Employer Identification Number.

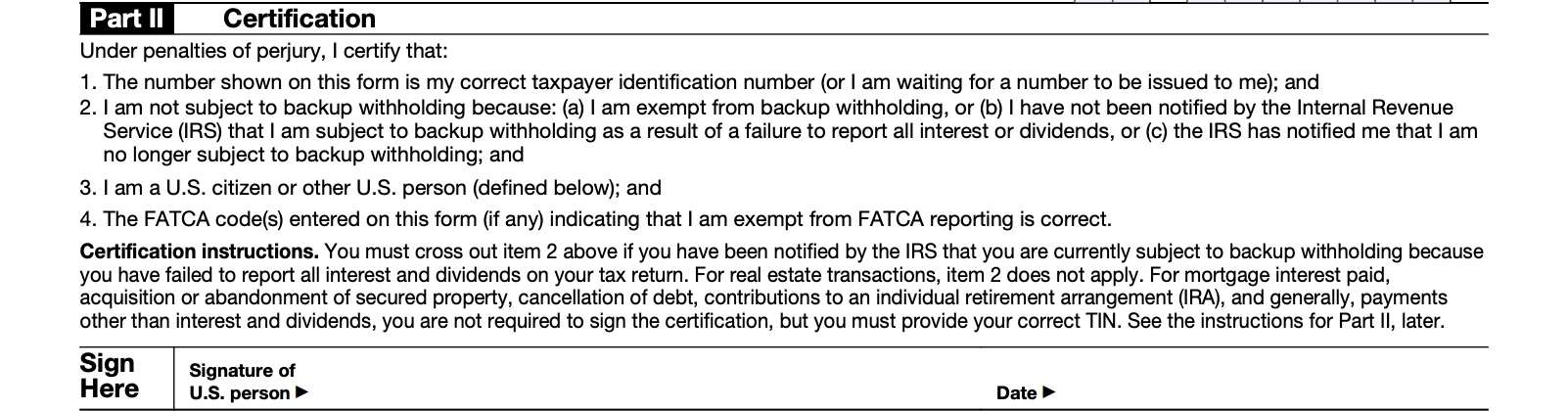

Part II: Certification

In this part, you are providing certification that:

- You have given the correct TIN, or that you are waiting for a TIN to be assigned to you

- You are not subject to backup withholding

- You are a U.S. citizen or other U.S. person, and that

- The FATCA code that you may have enter exempts you from FATCA reporting

If this information is correct, sign and date your form. However, certain exceptions apply.

If you’ve been notified by the IRS that you are subject to backup withholding

If the IRS has previously notified you that you are subject to backup withholding because you previously failed to report interest and dividend income on your previous tax returns, then you must cross out Item 2 in the certification statement.

Real estate transactions

Item 2 does not apply to real estate transactions.

Other transactions

You must provide your correct TIN, but you are not required to sign in the case of:

- Acquisition or abandonment of secured property, reported on IRS Form 1099-A

- Cancellation of debt reported on IRS Form 1099-C

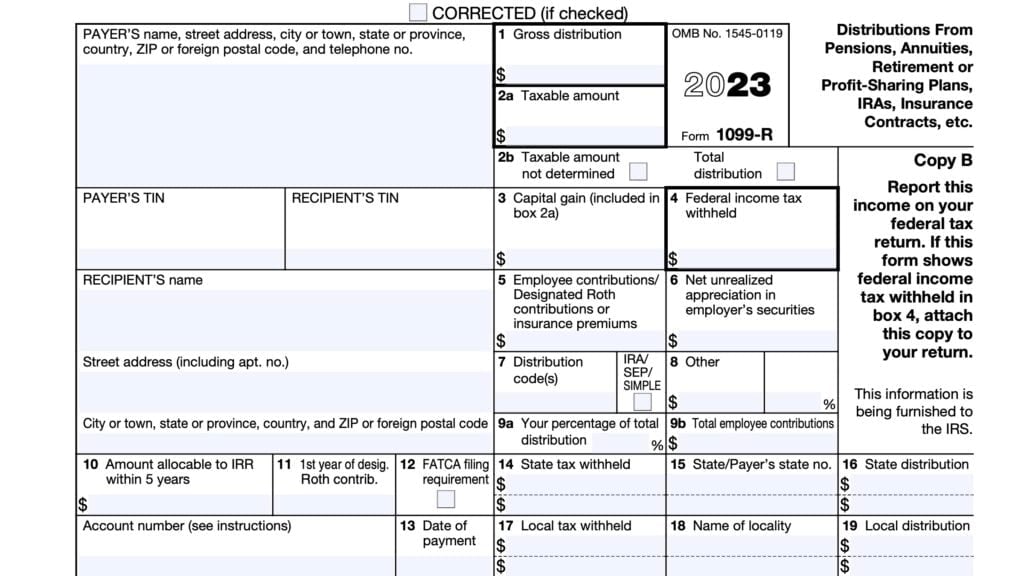

- IRA contributions or distributions

- Payments other than interest and dividends

- College 529 plan or Coverdell ESA distributions

- Archer MSA contributions or distributions

- HSA contributions or distributions

- Pension distributions

When you’ve finished, give your completed W-9 back to the requester. It odes not need to go to the IRS.

What is IRS Form W-9 used for?

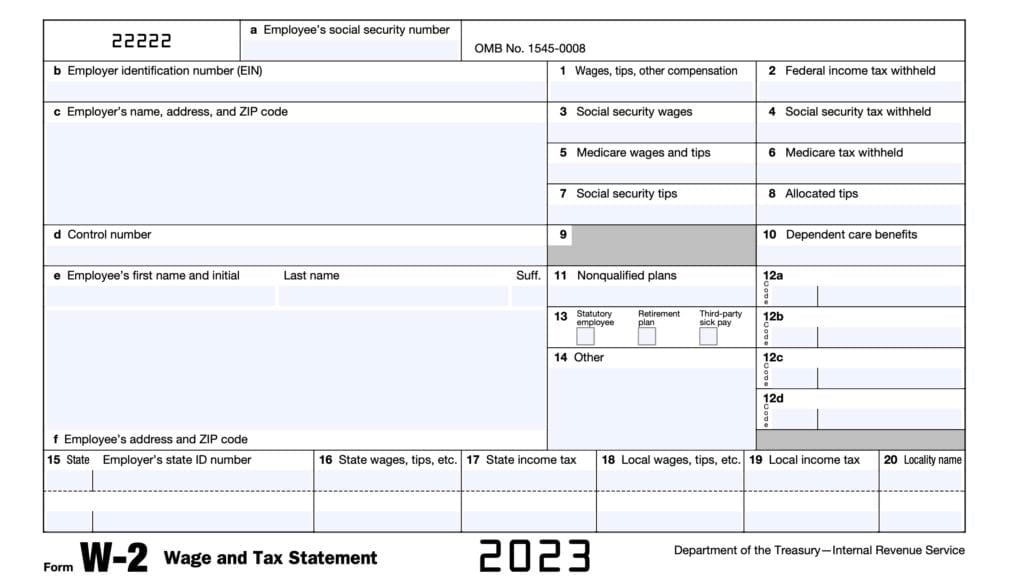

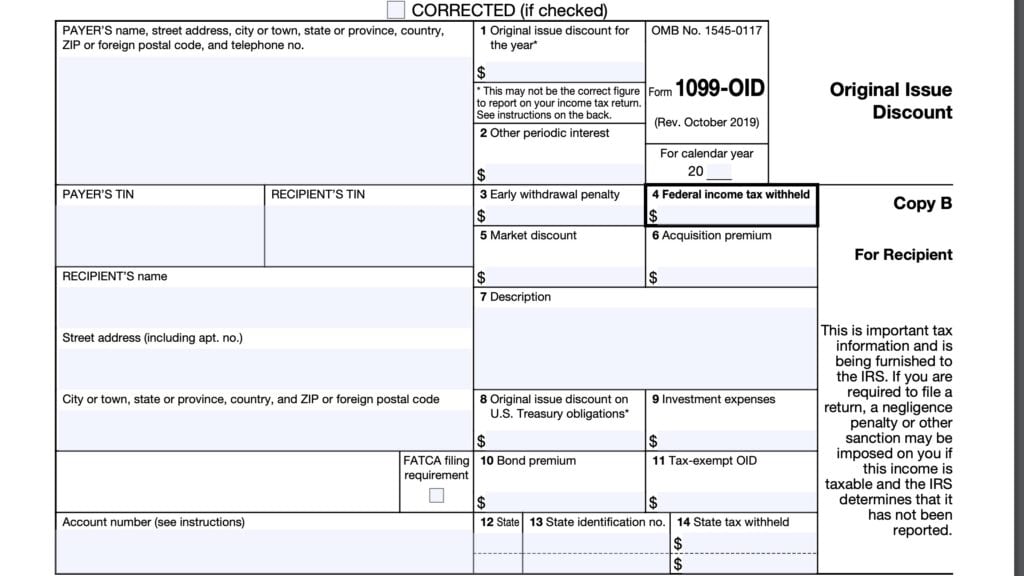

Tax entities who are required to file information returns with the IRS use Form W-9 to obtain the correct TIN. The following information returns are examples of tax documents which require the use of a correct TIN to avoid backup withholding, as applicable:

- IRS Form 1099-INT, Interest Income

- IRS Form 1099-DIV, Dividends and Distributions

- IRS Form 1099-MISC, Miscellaneous Information

- IRS Form 1099-B, Proceeds from Broker and Barter Exchange Transactions

- IRS Form 1099-S, Proceeds from Real Estate Transactions

- IRS Form 1099-K, Payment Card and Third Party Network Transactions

- IRS Form 1098, Mortgage Interest Statement

- IRS Form 1098-E, Student Loan Interest Statement

- IRS Form 1098-T, Tuition Statement

- IRS Form 1099-C, Debt Cancellation

- IRS Form 1099-A, Acquisition or Abandonment of Secured Property

Video walkthrough

Watch this video for step by step detail about completing Form W-9.

Frequently asked questions

Taxpayers use IRS Form W-9 to report their tax identification number to certain people or companies who must file information returns. Examples include mortgage companies and financial institutions.

Anyone who is an independent contractor, expecting to be paid more than $600 must complete Form W-9. Other taxpayers who do not complete Form W-9 or do not provide a correct TIN may be subject to backup withholding.

Where can I find IRS Form W-9?

As with other tax forms, you can find IRS Form W-9 on the IRS website. For your convenience, we’ve enclosed the latest version of this form below.