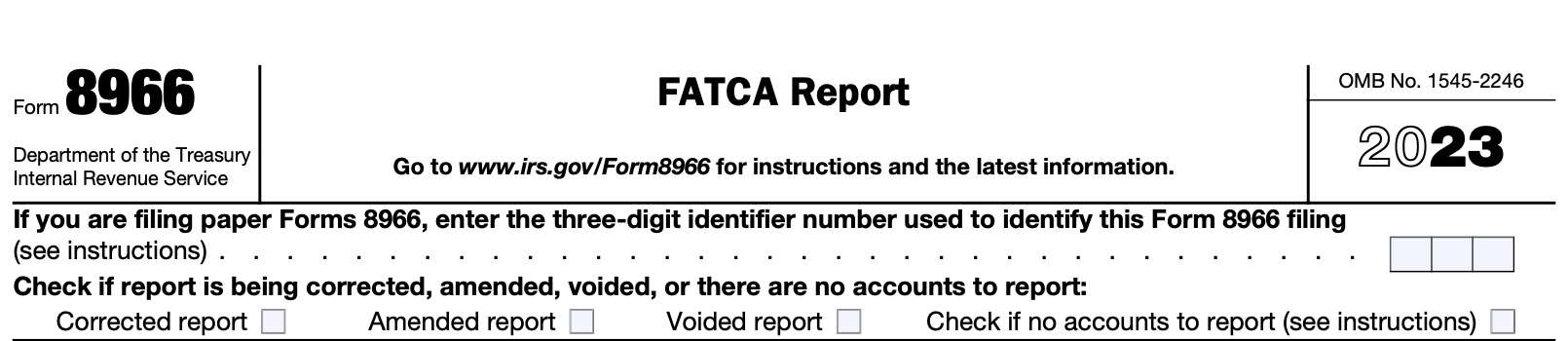

IRS Form 8966 Instructions

The Foreign Account Tax Compliance Act (FACTA) was passed to reduce tax evasion by requiring U.S. taxpayers to report worldwide income and assets held in foreign financial accounts. As part of this law, the Internal Revenue Service created IRS Form 8966 so financial institutions may report on assets held by U.S. account holders.

In this article, we’ll go over IRS Form 8966, including:

- How to file IRS Form 8966

- Other filing considerations

- Frequently asked questions

Let’s start with an overview of this tax form.

Table of contents

How do I complete IRS Form 8966?

There are five parts to this two page tax form:

- Part I: Identification of Filer

- Part II: Account Holder or Payee Information

- Part III: Owner Information

- Part IV: Financial Information

- Part V: Pooled Reporting Type

Most U.S. taxpayers will not complete this form. However, if you have assets held by a participating foreign financial institution (PFFI), you may want to understand how that PFFI is reporting your information to the U.S. government. So we’ll walk through IRS Form 8966 as if you were completing it.

Before we start with Part I, let’s take a look at the information fields at the very top of the form.

Top of the form

There are two entry fields worth looking at.

Three-digit identifier

According to the Internal Revenue Service, filers submitting Form 8966 by paper must assign a unique identifying number for each Form 8966 they file. The identifying number must be:

- Numeric (no letters or symbols)

- Exactly three digits

If applicable, enter the three-digit identifying number that you’ve assigned to this particular form.

Boxes to check

As appropriate, check one of the following boxes:

- Corrected report

- Amended report

- Voided report

- Check if no accounts to report

Below is a little more information about each option.

Corrected report

Check this box if you are filing IRS Form 8966 to correct information originally submitted to the IRS in a previously filed FATCA report in response to an IRS notification.

In this situation, you would complete the form as if it were the original Form 8966 using the corrected information. You do not have to include a copy of the original form with this submission.

Amended report

Check this box if:

- You are filing IRS Form 8966 to correct a previously filed version, and

- You have not been contacted by the IRS

In this case, you would complete the form as if it were the original FATCA report, using the corrected information. You do need to include a copy of the original submission with this amended report.

Voided report

If you are filing an amended report, also file a copy of the Form 8966 as originally filed with the IRS. Update this previously filed version by checking the “Voided report” box.

Check if no accounts to report

Direct Reporting non-financial foreign entities (NFFE) or Sponsoring Entities reporting on behalf of a Sponsored Direct Reporting NFFE that has no substantial U.S. owners to report during the calendar year should check this box and complete Part I only.

This box is optional for filers other than Direct Reporting NFFEs and Sponsoring Entities filing on behalf of a Sponsored Direct Reporting NFFE.

Direct reporting NFFE

According to Treasury Regulations Section 1.1472-1(c)(3), a Direct Reporting NFFE must file FATCA Form 8966 to report its substantial U.S. owners or report that it has none.

Sponsoring entities

A Sponsoring Entity must file Form 8966 to report an account of one or more foreign financial institutions (FFI) or a substantial U.S. owner of a passive NFFE that it has agreed to treat as a Sponsored FFI or a Sponsored Direct Reporting NFFE.

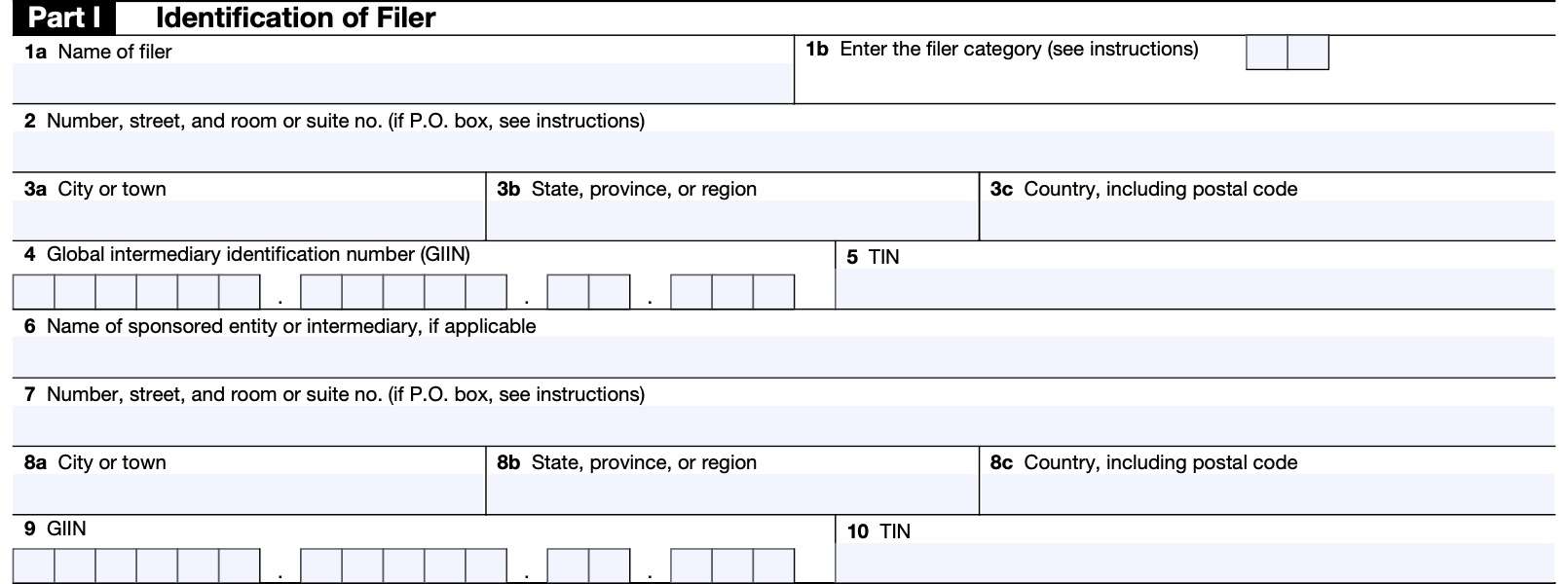

Part I: Identification of Filer

In this part, we’ll provide specific information about the entity filing IRS Form 8966.

Line 1a: Name of filer

Enter the name of the filer in Line 1a.

Direct Reporting NFFE

A Direct Reporting NFFE must identify itself as the filer and provide its identifying information on lines 1a through 3c.

Sponsoring Entity

A Sponsoring Entity or trustee must identify itself as the Form 8966 filer if it has agreed to assume the reporting obligations of a:

- Sponsored FFI

- Sponsored Direct Reporting NFFE, or

- Trustee-Documented Trust

In this situation, the Sponsoring Entity must provide its identifying information on Lines 1a through 3c.

Line 1b: Filer category

Enter the applicable filer category code in Line 1b. Below is a list of filer category codes and their respective categories.

Code 01: PFFI

Used by PFFIs other than a Reporting Model 2 FFI. Includes all U.S. branches of FFIs not treated as U.S. persons.

Code 02: RDCFFI

Used by a Registered deemed-compliant FFI (RDCFFI).

Code 03: Limited branch or limited fFI

Also used by related entities or related branches.

Code 04: Reporting Model 2 FFI

Reporting Model 2 FFIs use Code 04.

Code 05

The following entities may use Code 05:

- Qualified intermediaries

- Withholding foreign partnerships

- Withholding foreign trusts

Code 06: Direct reporting NFFE

If you are a direct reporting NFFE, use reporting Code 06.

Code 07: Sponsoring entity of a sponsored FFI

Use code 07 in this situation.

Code 08: Sponsoring Entity of a Sponsored Direct Reporting NFFE

Use Code 08.

Code 09: Trustee of a Trustee-Documented trust

A trustee of a trustee-documented trust should use Code 09.

Code 10: Withholding agent

Withholding agents use Code 10. This includes the following:

- U.S. branch of a PFFI

- Reporting Model 1 FFI

- Includes a U.S. branch of a reporting model 1 FFI

- Reporting Model 2 FFI

- RDCFFI treated as a U.S. person

- Limited FFI not treated as a U.S. person

Code 11: Territory financial institution

A territory financial institution that is treated as a U.S. person will enter Code 11.

Line 2: Number & Street address

Enter the street address here. Only enter a post office box number in the case that the postal service does not deliver mail to the filer’s street address.

Changing addresses

If you have changed your address or responsible party since your most recent tax return, you can always notify the Internal Revenue Service by filing IRS Form 8822-B, Change of Address or Responsible Party – Business.

Line 3a: City or town

Enter the city or town here.

Line 3b: State, province, or region

Enter the name of the filer’s state, province, or region.

Line 3c: Country

Enter the name of the country in Line 3c. Include the applicable postal code. If you are located in the United States, use the ZIP code for your address.

Line 4: Global intermediary identification number

If IRS has assigned a global intermediary identification number (GIIN) to the filer, enter that number here.

If applicable, use the GIIN of the branch of an FFI that maintains the account.

In the case that the filer is a Direct Reporting NFFE, enter its GIIN, regardless of whether or not the account is maintained by a branch.

A Sponsoring Entity or trustee filing Form 8966 on behalf of a Sponsored FFI, Sponsored Direct Reporting NFFE, or Trustee-Documented Trust, as applicable, should enter the Sponsoring Entity’s or trustee’s GIIN.

Line 5: Taxpayer identification number

If you entered a GIIN on Line 4, do not complete Line 5.

In the case that the IRS has assigned a U.S. taxpayer identification number (TIN), enter this number on Line 5. A filer who has not obtained a U.S. TIN does not need to obtain one for FATCA reporting purposes.

However, do not enter a foreign TIN. If the filer does not have a U.S. TIN, leave this line blank.

Line 6: Name of sponsored entity or intermediary

Lines 6 through 10 only need to be completed if the filer is:

- A Sponsoring Entity or trustee of a Trustee-Documented Trust, or

- Making a payment to:

- A Territory Financial Institution that is:

- Acting as an intermediary, or

- A flow-through entity and not treated as a U.S. person

- A certified deemed-compliant acting as an intermediary and providing the filer information on a substantial U.S. owner of a passive NFFE account holder or payee

- A Territory Financial Institution that is:

Line 7: Number and Street address

As applicable, enter the street address in Line 7.

Line 8a: City or town

If applicable, enter the city or town.

Line 8b: State, province, or region

Enter the state, province or region.

Line 8c: Country, including postal code

Enter the country, including postal code or ZIP code (if in the United States).

Line 9: GIIN

If applicable, enter the GIIN here.

Line 10: TIN

If applicable, and you did not enter a GIIN in Line 9, enter the IRS-issued taxpayer identification number here.

If the entity shown on Line 6 is a Territory Financial Institution that has not been issued a TIN by the IRS, report the EIN assigned to the entity by the relevant U.S. territory.

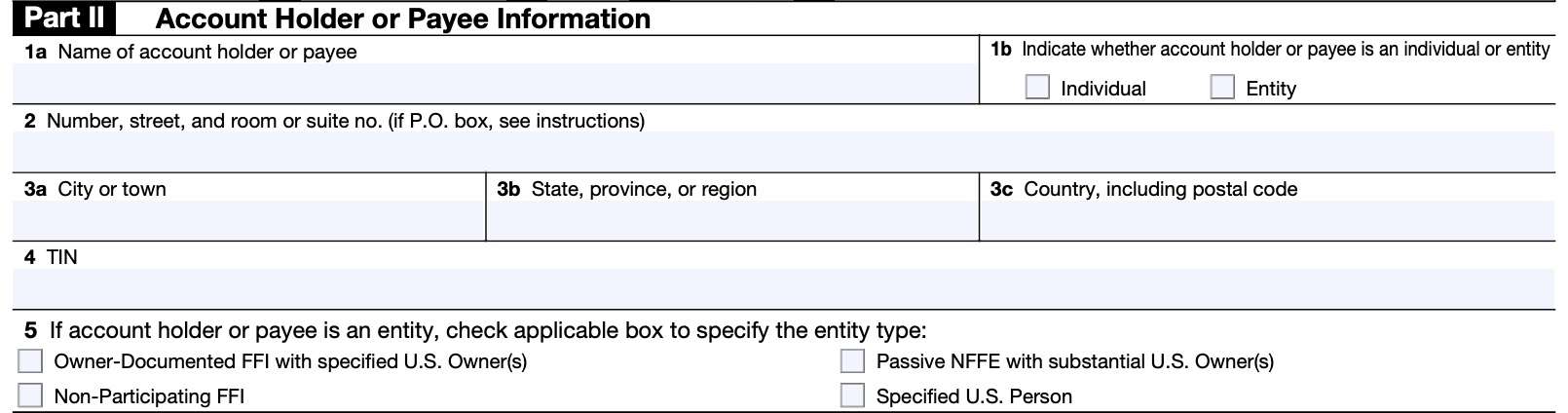

Part II: Account Holder or Payee Information

In Part II, we’ll enter information about the account holder or payee.

If you are a Direct Reporting NFFE or a Sponsoring Entity filing Form 8966 on behalf of a Sponsored Direct Reporting NFFE, do not complete Part II.

Complete Lines 1a through 5 as follows to report information with respect to:

- U.S. accounts held by a specified U.S. person and maintained by a PFFI.

- A passive NFFE with substantial U.S. owners or an ODFFI with certain equity or debt interests held by specified U.S. persons that:

- Is an account holder of a PFFI; or

- Receives withholdable payments from a withholding agent, unless the withholding agent receives the certification from a PFFI or RDCFFI receiving the payment

Line 1a: Name of account holder or payee

Enter the name of the account holder or payee.

Line 1b

Check the appropriate box to indicate whether the account holder or payee is an individual or entity.

Line 2: Number and street address

For Lines 2 through 3c, enter the account holder’s residential address.

If a residence address cannot be reported as required, report the address used for account or payee mailings by the FFI or withholding agent.

In Line 2, enter the applicable street number and name.

Line 3a: City or town

Enter the appropriate city or town in Line 3a.

Line 3b: State, province, or region

Enter the state, province, or region as applicable.

Line 3c: country, including postal code

Enter the country and postal code.

Line 4: TIN

If the IRS has assigned a TIN to the account holder or payee, enter that number on line 4. If the account holder or payee does not have a TIN, leave this line blank.

Line 5

Check the appropriate box, if the status of the account holder or payee is an entity, as noted on Line 1b.

- Owner-Documented FFI with specified U.S. owner(s)

- Non-participating FFI

- Passive NFFE with substantial U.S. owner(s)

- Specified U.S. person

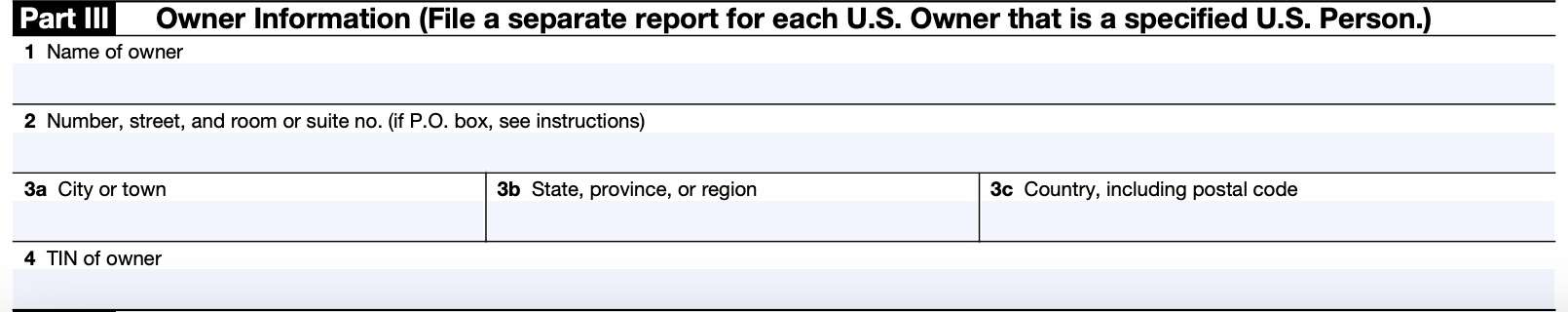

Part III: Owner Information

Use Part III to report information about:

- Substantial U.S. owners of a passive NFFE,

- Substantial U.S. owners of a Direct Reporting NFFE,

- Substantial U.S. owners of a Sponsored Direct Reporting NFFE, and

- Specified U.S. persons owning certain equity or debt interests in an ODFFI identified in Part II, Line 1a.

Complete lines 1 through 4 to report U.S. owner information as follows. You must file a separate report for each U.S. owner.

Line 1: Name of owner

Enter the U.S. owner’s name here.

Line 2: Name and Street address

Enter the U.S. owner’s street address in Line 2.

Line 3a: City or town

In Line 3a, enter the owner’s city or town.

Line 3b: State, province, or region

Enter the state, province, or region.

Line 3c: Country, including postal code

Enter the country, including the postal code. If the owner’s address is located in the United States, only enter the nine-digit zip code assigned to that owner’s address.

Line 4: TIN of owner

Enter the owner’s TIN here. The TIN can be one of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN), or

- Employer identification number (EIN)

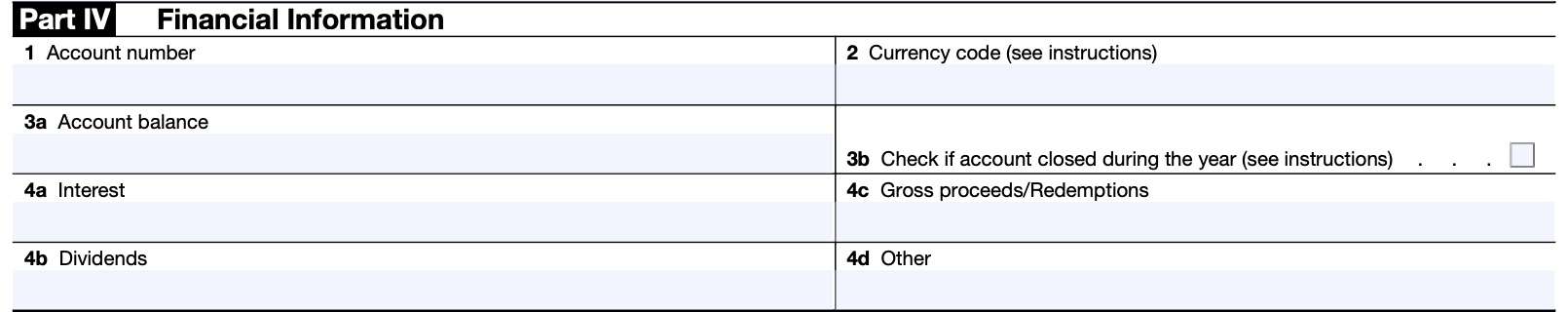

Part IV: Financial Information

Use Part IV to enter financial information about:

- An account maintained by a PFFI and held by a specified U.S. person, passive NFFE with substantial U.S. owners, or ODFFI with specified U.S. persons holding certain equity or debt interests in the ODFFI reported on Part II, Line 1a

- A withholdable payment made to a passive NFFE with a substantial U.S. owner or an ODFFI with a specified U.S. person holding certain equity or debt interests in the ODFFI reported on Part II, line 1a, by a withholding agent that is not a PFFI

- The value of each substantial U.S. owner’s equity interest in the Direct Reporting NFFE or the Sponsored Direct Reporting NFFE, or

- The total of all payments made to each substantial U.S. owner of a Direct Reporting NFFE or a Sponsored Direct Reporting NFFE during the calendar year by such NFFE with respect to each such owner’s equity interest in the NFFE.

Line 1: Account number

Enter the account number here.

The account number is the identifying number assigned by the PFFI for a purpose other than the filing of this form.

If no such number is assigned to the account, the account number is a unique serial number or other number the PFFI assigns to the account for purposes of filing this form that distinguishes it from other accounts maintained by the PFFI.

Line 2: Currency code

If the amounts reported in Lines 3a through 4d below are not in U.S. dollars, then enter the applicable three-character ISO 4217 currency code. The ISO website contains a list of currency codes you may use.

If the amounts below are reported in U.S. dollars, then enter ‘USD.’

Line 3a: Account balance

In Line 3a, enter the average calendar year account balance or value if that amount is reported to the account holder. Otherwise, report the account balance or value as of the end of the calendar year.

Treasury Regulations Section 1.1471-5(b)(4) contains detailed rules for determining an account’s balance or value.

Line 3b

Check this box if the account reported in Part IV was closed or transferred in its entirety during the calendar year.

However, do not check this box if an account holder rolls over the amounts in one account into

another account (of the same or different type) with the same FFI during the calendar year.

Line 4a: Interest

Enter the aggregate gross amount of interest paid or credited to the account being reported for the calendar year.

Line 4b: Dividends

Enter the aggregate gross amount of dividends paid or credited to the account being reported for the calendar year.

Line 4c: Gross proceeds/redemptions

Enter the aggregate gross proceeds from the sale or redemption of property paid or credited to the account being reported for the calendar year.

Line 4d: Other

Enter the aggregate gross amount of all income paid or credited to an account for the calendar year, except for interest income, dividend income, and gross proceeds reported on Lines 4a through 4c

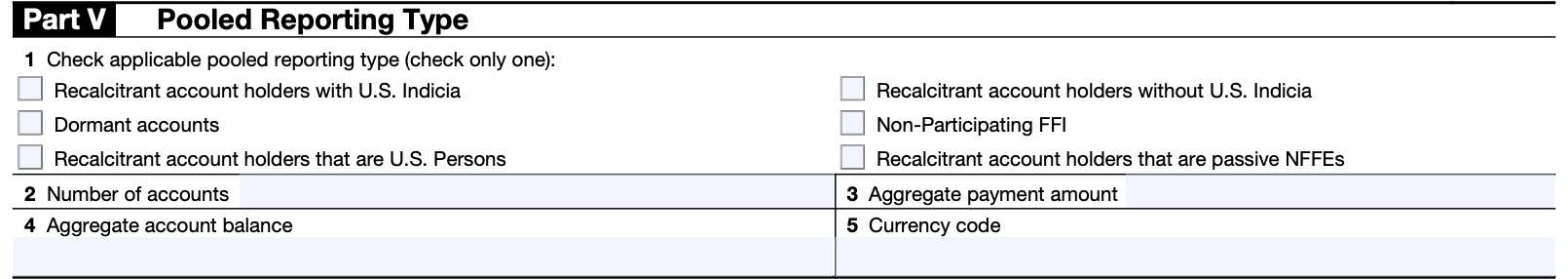

Part V: Pooled Reporting Type

If you are a PFFI, use Part V to report information about the accounts held by recalcitrant account holders (or, for a Reporting Model 2 FFI, non-consenting U.S. accounts) on a pooled basis.

If you are required to report more than one type of pooled reporting account, file a separate Form 8966 for each type.

Line 1

Check the appropriate box based upon the pooled reporting type.

Line 2: Number of accounts

Enter the total number of accounts reported in Part V here.

Line 3: Aggregate payment amount

Leave this line blank.

Line 4: Aggregate account balance

In Line 4, enter the aggregate balance or value of the accounts held by recalcitrant account holders (or, for Reporting Model 2 FFIs, non-consenting U.S. accounts) at the end of the year.

Line 5: Currency code

If the amounts reported in Lines 3 and 4 above are not in U.S. dollars, enter the appropriate 3-digit ISO 4217 currency code. If the amounts are reported in U.S. dollars, then enter ‘USD.’

Filing IRS Form 8966

The IRS website contains significant detail about the Foreign Account Tax Compliance Act (FATCA) and how to complete IRS form 8966. Below are some basic details about this form.

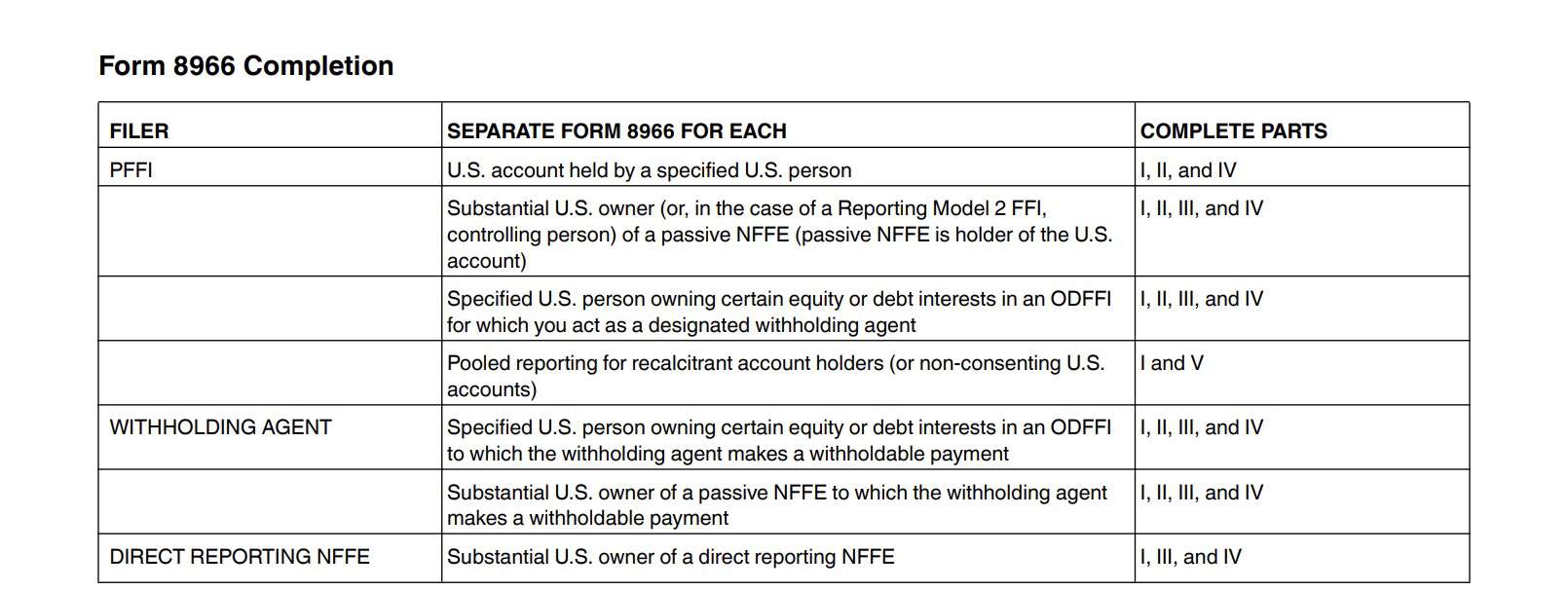

What parts to complete

Not every filer needs to complete the entire form. Below is a chart outlining which parts of IRS Form 8966 are required, based upon the filer’s status.

When to file

For the 2023 tax year, the filing deadline for IRS Form 8966 is March 31, 2024. If the due date falls on a weekend or on a U.S. legal holiday, the due date will be the next business day.

Extension of time to file

Taxpayers may file IRS form 8809-I to request an automatic 90-day extension of time to file Form 8966.

How to file

An entity that is a financial institution must file Form 8966 electronically, irrespective of the number of Forms 8966 filed. All other filers are strongly encouraged to use electronic filing to file Form 8966.

Filing paper versions of Form 8966

If you have received a waiver of the Form 8966 electronic filing requirement from the IRS or are not otherwise required to file Form 8966 electronically, you may send all paper Forms 8966, along with Form 8966-C, Cover Sheet for Form 8966 Paper Submissions, to the following address:

Internal Revenue Service

FATCA, Stop 6052 AUSC

3651 South IH 35

Austin, Texas 78741

Video walkthrough

Watch this instructional video to learn more about FATCA reporting on IRS Form 8966.

Frequently asked questions

In accordance with the Foreign Account Tax Compliance Act (FATCA), certain U.S. persons must disclose certain foreign assets or foreign financial accounts. IRS Form 8966, FATCA Report, is filed by foreign financial institutions (FFIs) as part of this requirement

Certain U.S. individuals and domestic entities file IRS Form 8938 to disclose certain foreign financial assets being held abroad. Financial institutions generally file IRS Form 8966 to report on financial assets being held in their accounts.

Where can I find IRS Form 8966?

You may find IRS Forms, both current versions and those from prior years, on the IRS website. For your convenience, we’ve enclosed the latest version of IRS Form 8966 in our article.