IRS Form 2553 Instructions

If you’re a small business owner, you might want to elect S corporation status for your company. Electing S corporation status might help taxpayers avoid double taxation: paying taxes at the corporate level, then paying more taxes on personal tax returns.

In this article, we’ll walk through IRS Form 2553, Election by a Small Business Corporation, which is the form that certain pass-through entities may use to be treated as an S-corporation. Let’s begin with step by step instructions for completing Form 2553.

Table of contents

How do I complete IRS Form 2553?

Let’s walk through this tax form, step by step, beginning with Part I.

However, this is not tax advice nor is this legal advice. Be sure to talk with your attorney or CPA to make sure that S corporation election is the right decision for you.

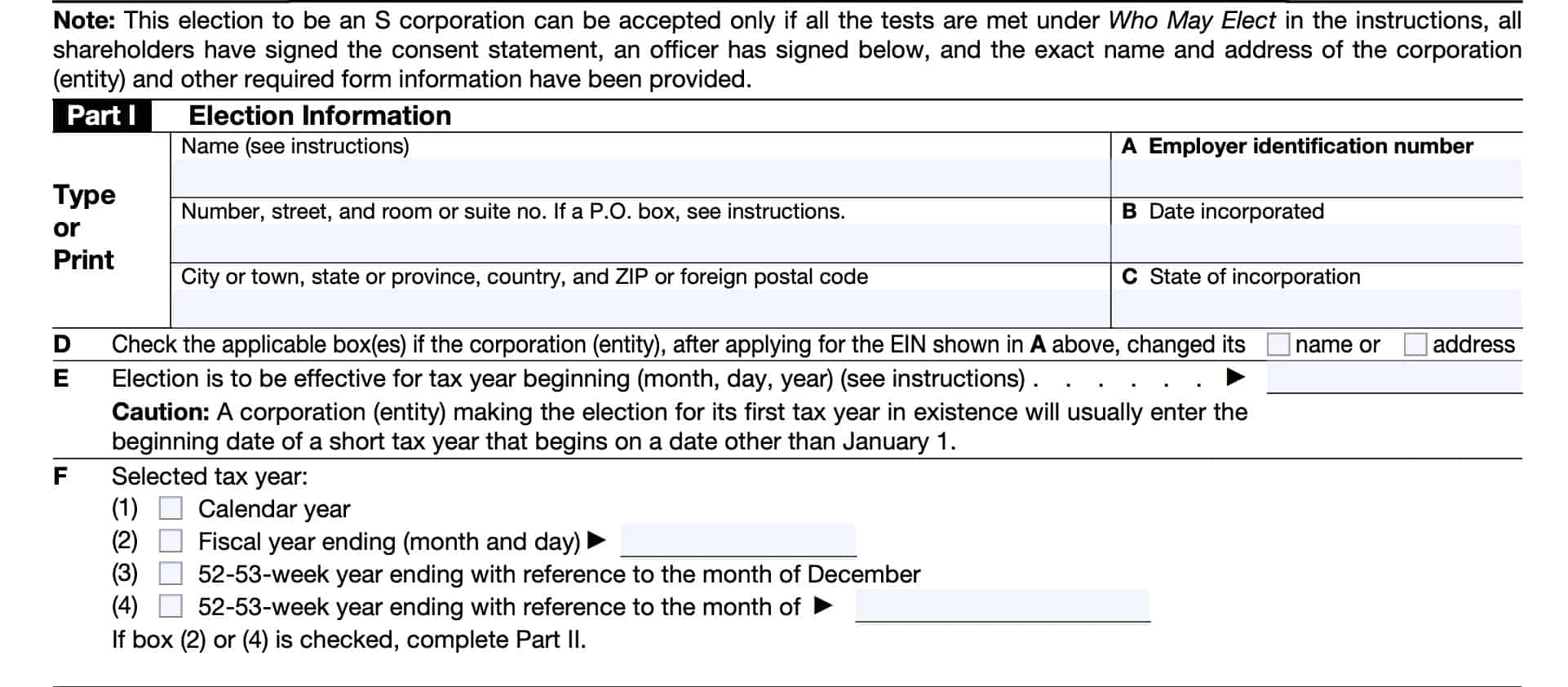

Part I: Election information

In Part I, you’ll give the Internal Revenue Service information about your corporation’s election status.

At the top, enter the name of the corporation as it appears in the articles of incorporation, corporate charter, or other documents that created the entity. Enter the address, to include:

- Street address or P.O. box number

- City

- State

- Zip code

If your address is a P.O. box, only list the P.O. box number if the U.S. Postal Service does not deliver mail to your street address. If you receive your mail at another location, such as your accountant’s or attorney’s address, be sure to mark ‘C/O,’ and the individual’s name.

Item A: Employer identification number

Enter your corporation’s employer identification number, or EIN, in Item A. If your corporation does not have an EIN, it must file for one by doing one of the following:

- Applying online through the IRS website

- Filing Form SS-4, Application for Employer Identification Number

Item B: Date incorporated

Enter the date that your company was formed.

Item C: State of incorporation

List the state of incorporation for your company.

Item D

Check the appropriate box(es) if the entity has either changed its name or address since applying for the EIN listed in Item A.

Item E: Effective date of election

Select a date that makes sense based upon the circumstances surrounding your company. The guidance contained in the form instructions indicate that your date of S-corp election should be the earlier of the following dates:

- The date the corporation (entity) first had shareholders (owners),

- The date the corporation (entity) first had assets, or

- The date the corporation (entity) began doing business

Item F: Selected tax year

Check the appropriate box, according to when you’ve decided the beginning of the tax year to begin. Most companies operating on a calendar year tax schedule will select either (1) or (3).

If you decide that your fiscal tax year will have an accounting period that differs from the calendar year, you may check box (2) or box (4). Here are some examples:

- Natural business year: The IRS defines a natural business year as a period of 12 consecutive months ending at the company’s lowest activity level.

- Fiscal year: Some companies elect a fiscal year similar to the federal government’s fiscal year cycle. This cycle goes from October 1 to September 30 of the following year

If you check box (2) or box (4), then you must complete Part II.

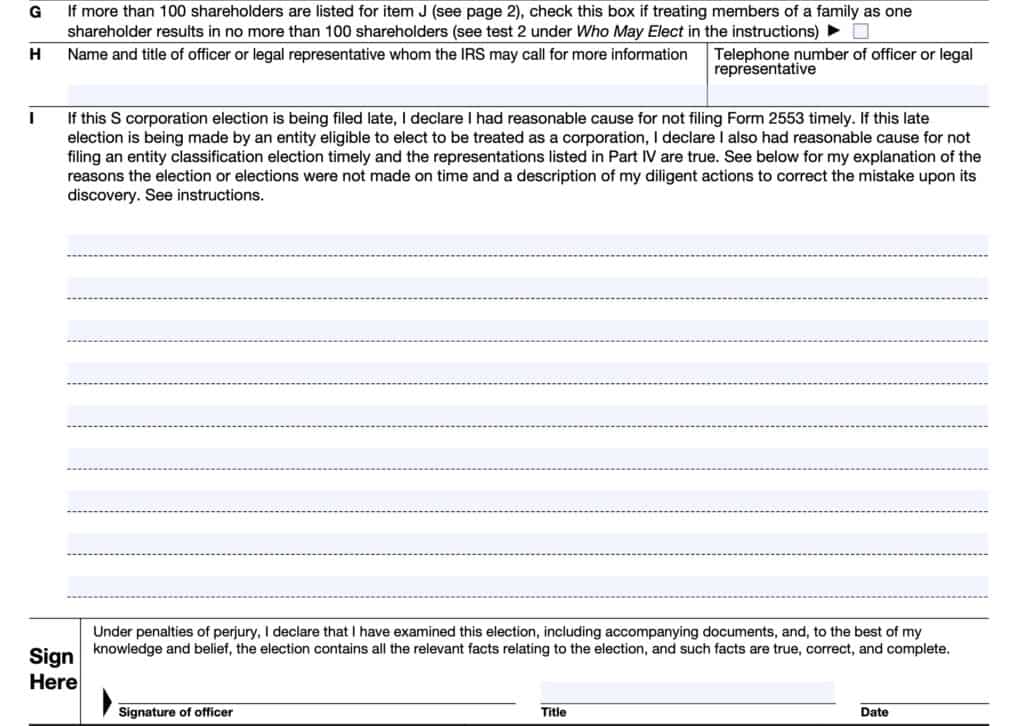

Item G

Check this box if the following requirements are met:

- There are more than 100 shareholders listed in Item J, below

- Treating members of a family as one shareholder results in 100 shareholders or fewer

Item H: Officer or legal representative

List the name, title, and telephone number of a corporate officer or point of contact that the IRS may call to obtain more information.

Item I

In Item I, if this is a late election, provide a written explanation:

- Why the required election or elections were not made in a timely manner, and

- What reasonable and diligent action you took to correct this mistake once you discovered it

Below the remarks field in Item I, sign and date the form as an accountable officer of the company, under penalties of perjury.

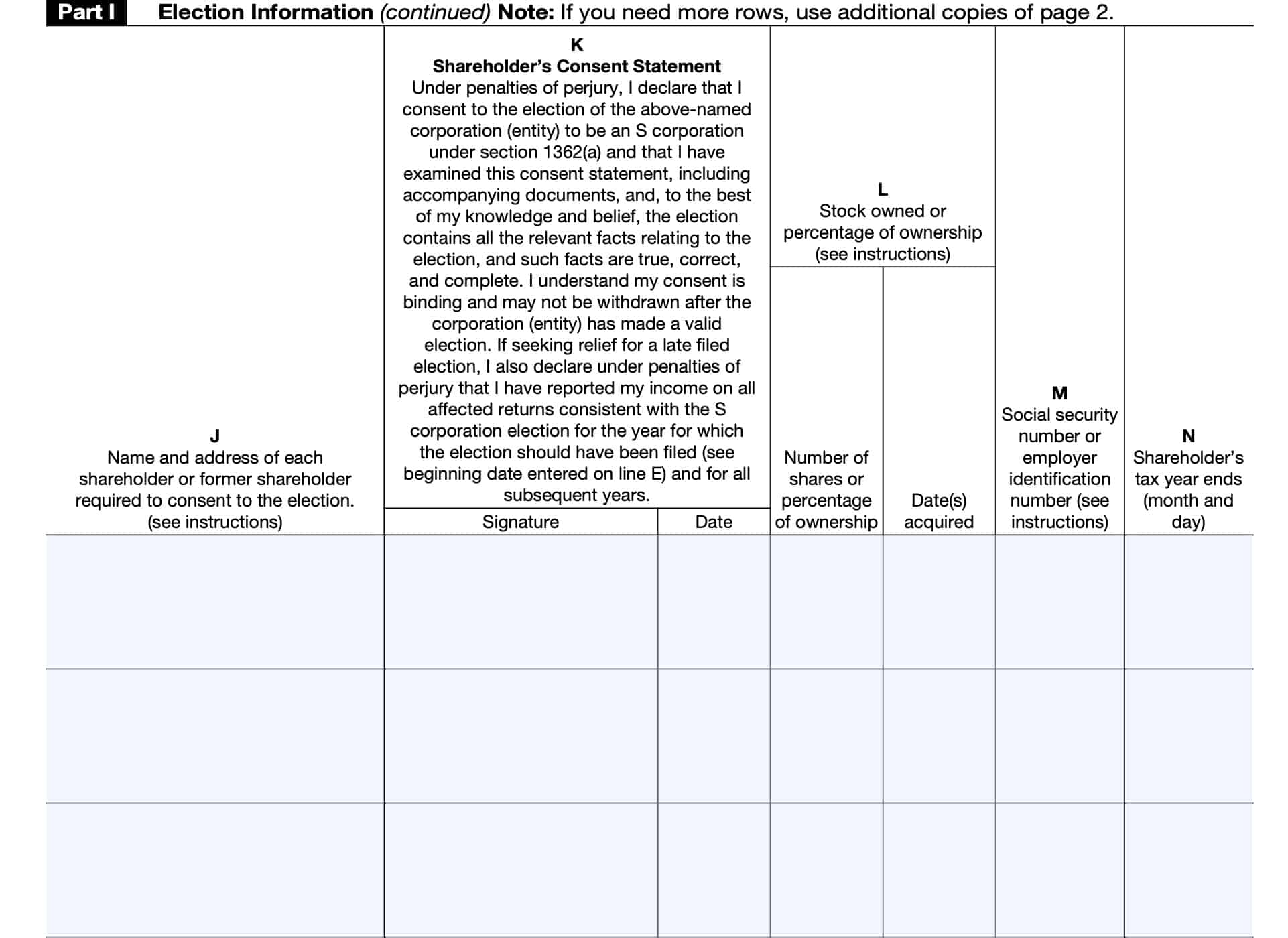

In the rest of Part I, you’ll enter the following information for each shareholder required to consent to this election.

Item J: Name and address of shareholder

Enter the name and address of each shareholder or former shareholder required to consent to the election. There are a couple of guidelines to follow.

If stock of the corporation is held by a nominee, guardian, custodian, or an agent, enter the name and address of the person for whom the stock is held.

If a single member limited liability company (LLC) owns the corporation’s stock, and the LLC is treated as a disregarded entity for federal income tax purposes, enter the owner’s name and address. The owner must be eligible to be an S corporation shareholder.

For an election filed before the effective date entered for Item E, only shareholders who own stock on the day the election is made need to consent to the election.

For an election filed on or after the effective date entered for Item E, all shareholders or former shareholders must consent to the election who owned stock at any time during the period:

- Beginning on the effective date entered for item E and

- Ending on the day the election is made

Item K: Shareholder’s consent statement

Each listed shareholder must provide their written consent, either by signing and dating the form itself, or by providing a separate consent document. Below are some guidelines to help determine who must sign as a shareholder:

- Community property states: If an individual and his or her spouse have a community interest in the stock or in the income from it, both must consent. IRS Publication 555 contains more detail about community property

- Tenants in common, joint tenancy, and tenants by the entirety (TBE): Each tenant in common, joint tenant, and tenant by the entirety must consent to the election

- Minor shareholders: A minor’s consent is made by the minor, legal representative of the minor, or a natural or adoptive parent of the minor if no legal representative has been appointed.

- Estates: The consent of an estate is made by the executor or administrator.

- ESBT: The consent of an electing small business trust (ESBT) is made by the trustee and, if a grantor trust, the deemed owner. See Regulations section 1.1362-6(b)(2)(iv) for details.

- QSST: If the stock is owned by a qualified subchapter S trust (QSST), the deemed owner of the trust must consent.

- Trusts: If the stock is owned by a trust (other than an ESBT or QSST), the person treated as the shareholder by Internal Revenue Code Section 1361(c)(2)(B) must consent.

Item L: Percentage of ownership or shares owned

Enter the number of shares owned as of the election date, and the date or dates the stock was acquired. Former shareholders should list ‘0’ in Item L.

For entities without stock shares, such as a limited liability company (LLC), indicate ownership in terms of percentage.

Item M: Tax identification number

For individuals, list the SSN for each individual listed. For trusts, estates, or exempt organizations, list the EIN.

Item N: Shareholder’s tax year ending date

Indicate the ending date of the tax year for each shareholder.

If the shareholder is changing tax years, enter the tax year the shareholder is changing to. Attach an explanation indicating:

- Present tax year and

- Basis for the change

For example, the basis for changing from the current tax year could be an automatic revenue procedure or a letter ruling request.

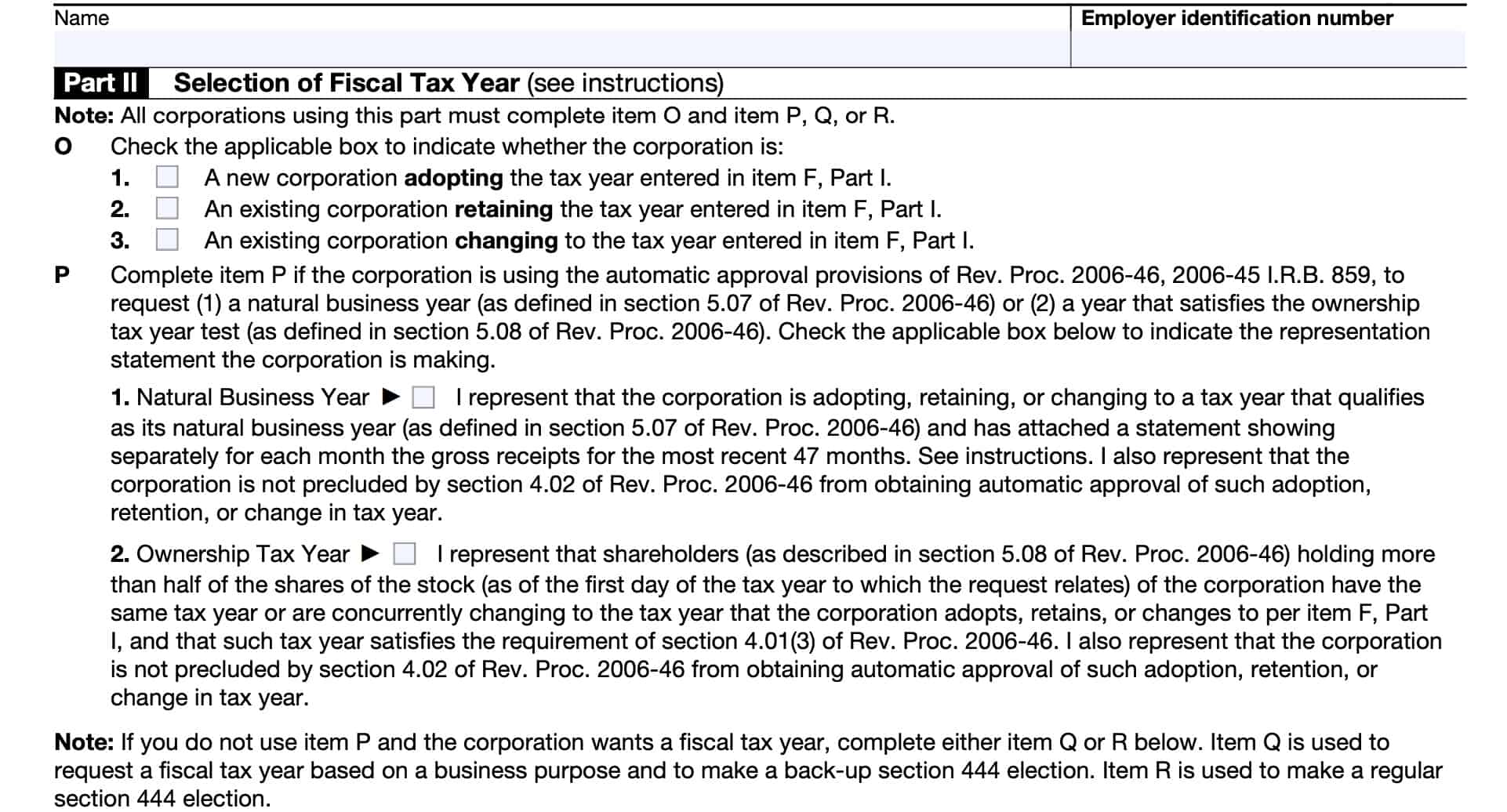

Part II: Selection of fiscal tax year

Once you’ve completed Part I, determine whether or not you need to complete Part II. Only complete Part II if you checked one of the following boxes in Item F.

- Box 2

- Box 4

If you checked one of the other boxes, go to Part III, below.

Item O

Check the applicable box depending on which of the following actions your small business corporation is taking with regards to the tax year that you entered in Item F:

- Adopting the tax year entered in Item F as a new corporation

- Retaining the tax year entered as an existing corporation

- Changing to the tax year entered in Item F as an existing corporation

Item P

Complete Item P if the corporation is using automatic approval provisions outlined in Rev. Proc. 2006-46 to request either:

- A natural business year, as defined in Section 5.07 of Rev. Proc. 2006-46, or

- A year that satisfies the ownership tax year test defined in Section 5.08 of Rev. Proc. 2006-46

What is a natural business year?

According to Section 5.07, a natural business year exists when an entity passes the 25% gross receipts test. To determine whether the entity passes the 25% gross receipts test, the owner must do the following:

- Determine if the gross receipts for the last 2 months of the requested accounting period meets or exceeds 25% of the gross receipts for the entire 12-month period. This is the 25% gross receipts test.

- Determine if the previous two reporting periods also pass the 25% gross receipts test

- Determine that no other possible reporting periods would result in a gross receipts average that is higher than the requested reporting period

Unless a corporation has at least 47 months’ gross receipts in its history, it cannot automatically establish a natural business year.

What is the ownership tax year test?

For an S corporation or electing S corporation, an “ownership taxable year” is the taxable year (if any) that, as of the first day of the first effective year, constitutes the taxable year of one or more shareholders, holding more than 50- percent of the corporation’s issued and outstanding shares of stock. This includes any shareholder that concurrently changes to such taxable year.

If you do not select either box in Item P, and the corporation wishes to use a fiscal year for federal tax purposes, then you must either complete Item Q or Item R, below.

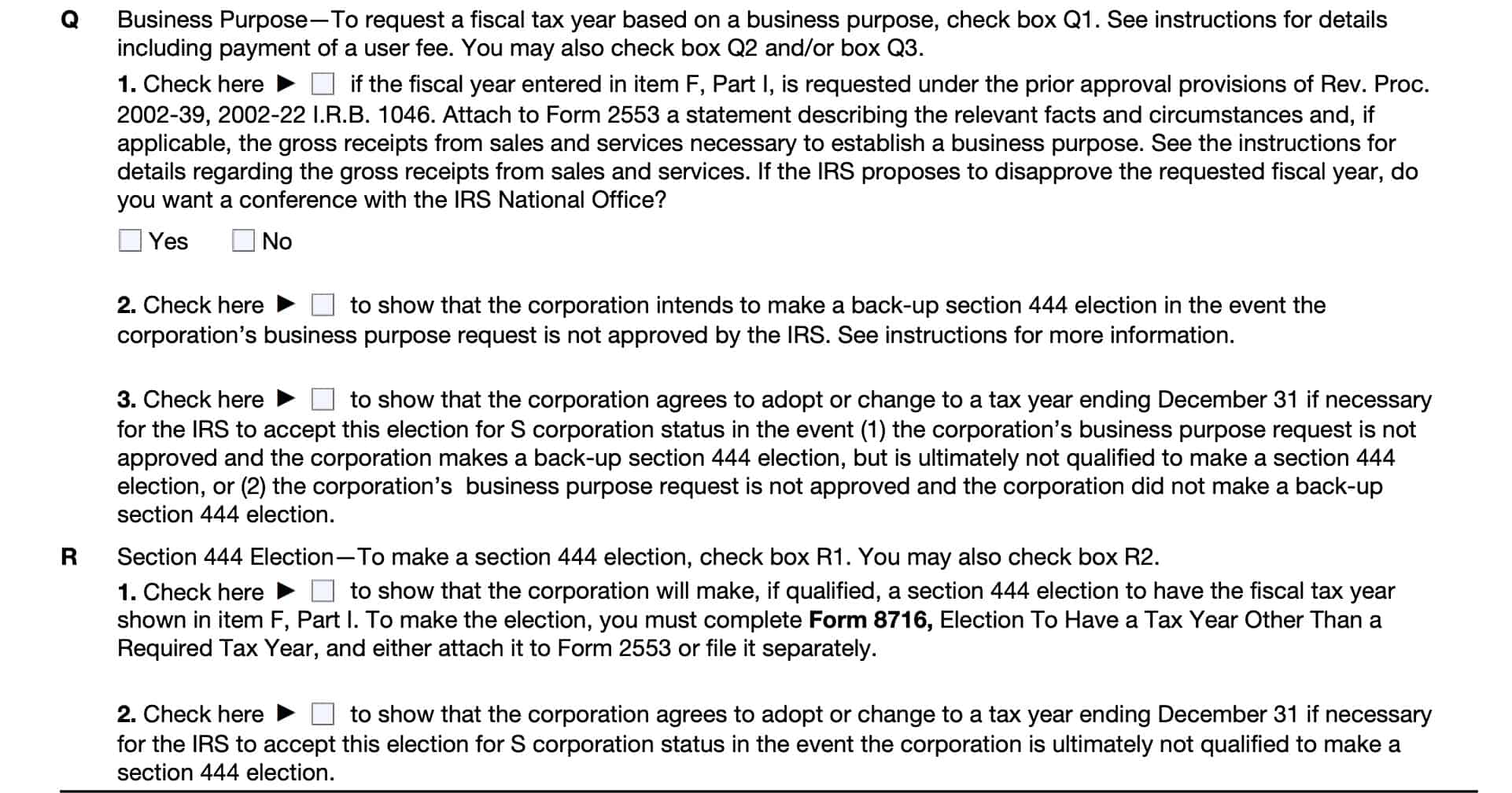

Item Q

Check Box Q1 if you wish to request a fiscal tax year based on a business purpose. Rev. Proc. 2002-39, Section 5.02 contains additional guidance and examples of an acceptable business purpose for requesting a fiscal tax year.

If you check Box Q1, a user fee of $6,200 will apply. Do not send payment with your completed Form 2553, as you will receive a bill after the form has been processed.

Also check the appropriate box to indicate whether you would like to automatically request a conference with the IRS National Office should your requested fiscal year be disapproved.

Select Box Q2 if the corporation intends to make a back-up Section 444 election should the IRS not approve the corporation’s business purpose request. The form instructions for IRS Form 8716, Election To Have a Tax Year Other Than a Required Tax Year, contain more guidance about making a back-up Section 444 election.

Select Box Q3 to indicate that the corporation agrees to adopt or change to a tax year ending on December 31, if this is required for the IRS to accept the election for S corporation status in the event:

- Corporation’s business purpose request is not approved, and the corporation makes a back-up Section 444 election, but is not qualified to do so, or

- Corporation’s business purpose request is not approved and the corporation did not make a back-up Section 444 election.

Item R: Section 444 Election

Check Box R1 to make a Section 444 election. You must also complete Form 8716, and either attach the completed form to Form 2553 or file it separately.

Check Box R2 to show that the corporation agrees to have a tax year ending December 31 if the IRS requires this for S corp status, should the IRS deem that the corporation is not qualified to make a Section 444 election.

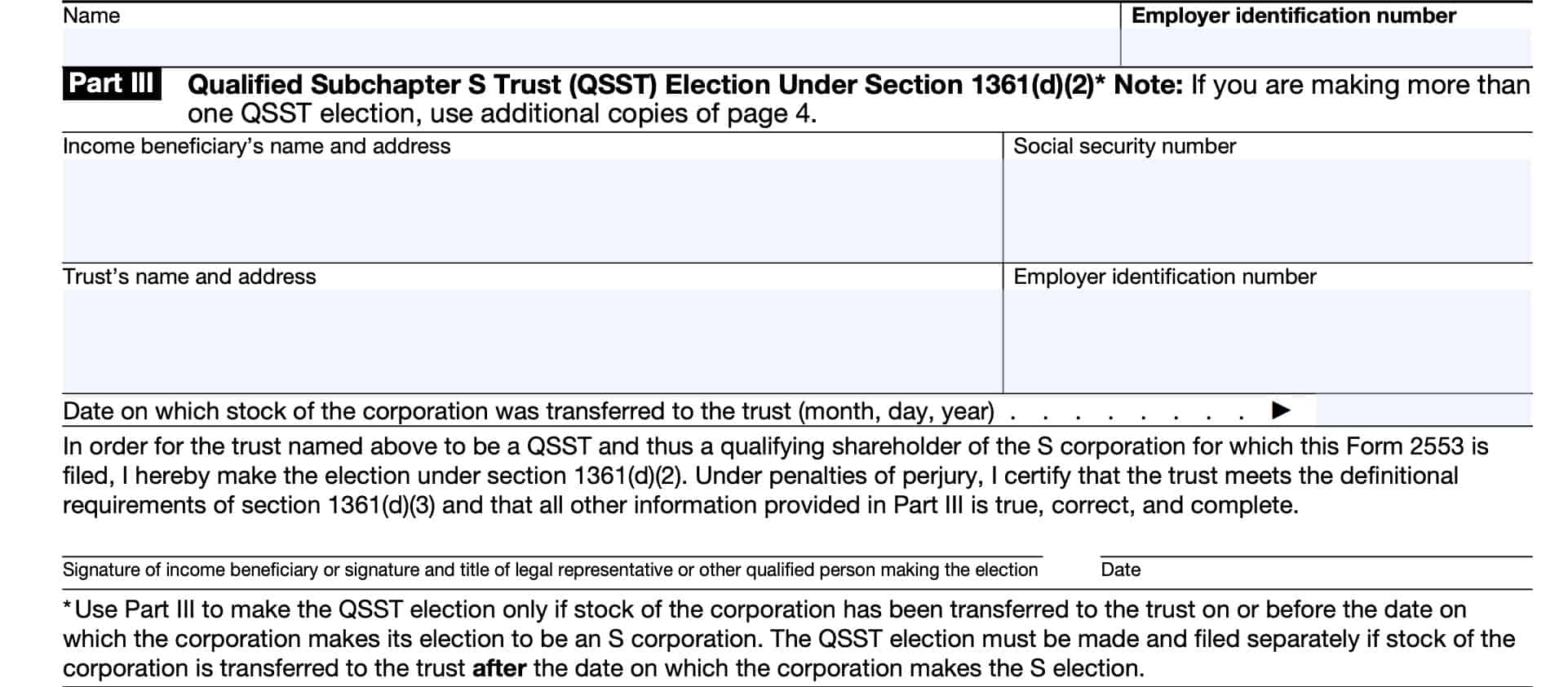

Part III: Qualified Subchapter S Trust (QSST) election under Section 1361(d)(2)

Only complete Part III if you made the election in Part I.

In Part III, the income beneficiary (or legal representative) of certain qualified subchapter S trusts (QSSTs) may make the QSST election required by IRC Section 1361(d)(2). A filer may use Part III to make the QSST election only if corporate stock has been transferred to the trust on or before the date on which the corporation makes its election to be an S corporation.

However, a taxpayer may submit a statement instead of Part III to make the election. If there was an inadvertent failure to timely file a QSST election, Rev. Proc. 2013-30 contains relief provisions.

The deemed owner of the QSST must also consent to the S corporation election in column K of Form 2553.

Additional QSST election.

If you are making more than one QSST election, you may use additional copies of page 4 or use a separate election statement, and attach it to Form 2553. The separate election statement must contain all information requested under Part III.

This includes:

- Name

- EIN

- Income beneficiary’s name and address

- Beneficiary’s SSN

- Trust’s name and address

- Trust’s EIN

- Date on which the corporation’s stock was transferred to the trust

- Date & signature of beneficiary or signature & title of legal representative

If the corporation’s stock is transferred to the trust after the date of the S corporation election, then you must file the QSST election separtely.

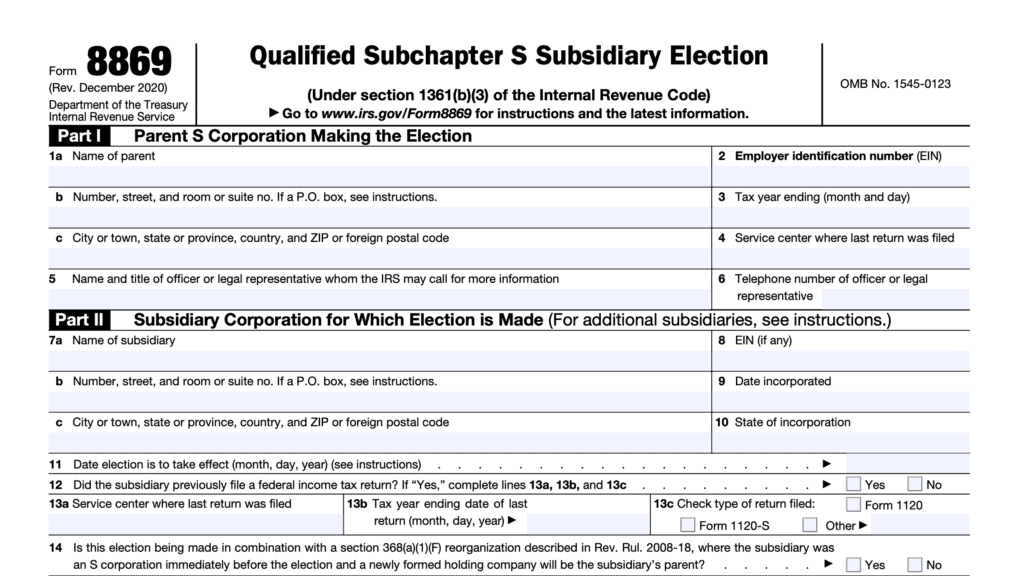

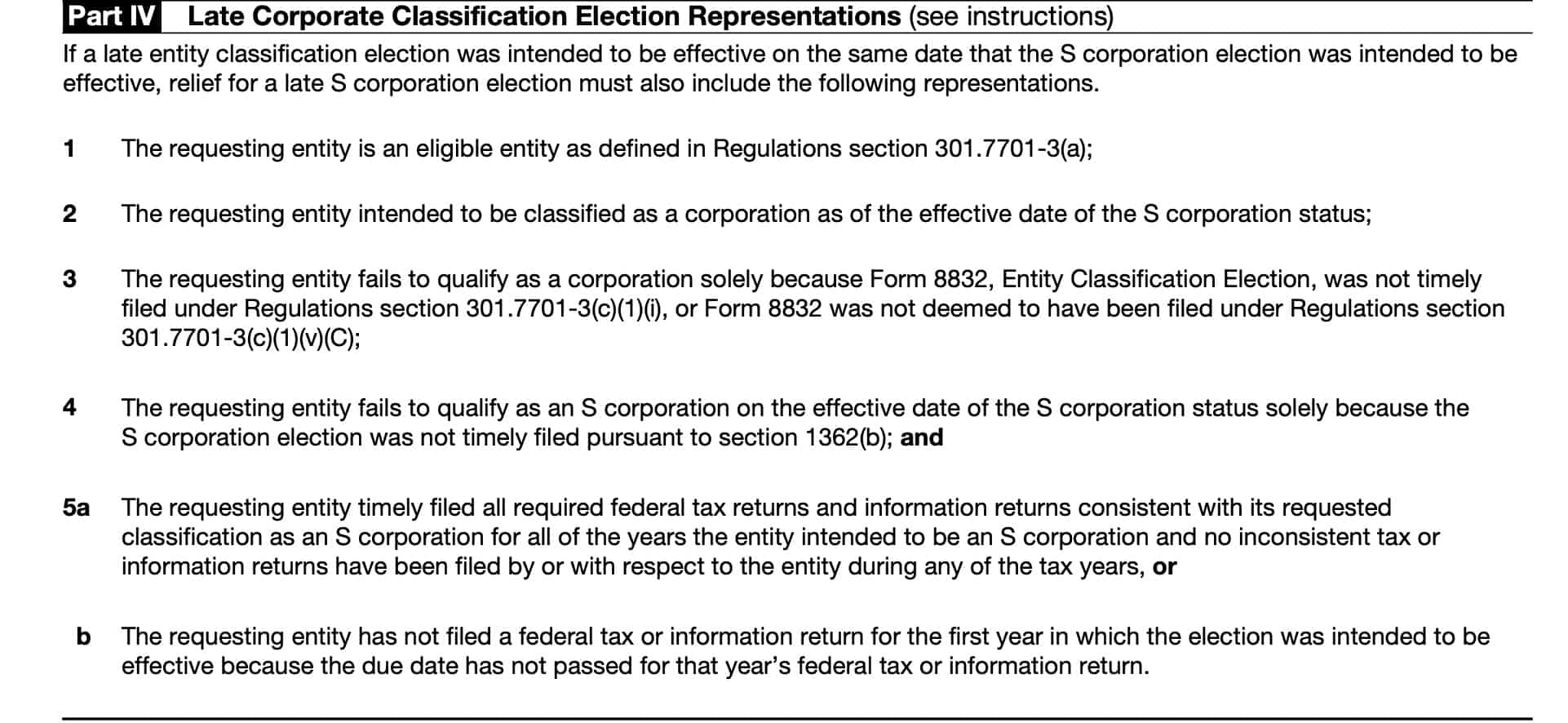

Part IV: Late corporate classification election representations

Part IV contains required late corporation classification election representations. By filing, the signer effectively makes these representations and intends for the election to be effective on the same date as the S-corporation election. Relief for a late election requires the following:

Eligibility

The requesting entity is eligible as outlined in Treasury Regulations Section 301.7701-3(a)

Intent

The requesting entity intended to be classified as a corporation as of the effective date of the S corporation status

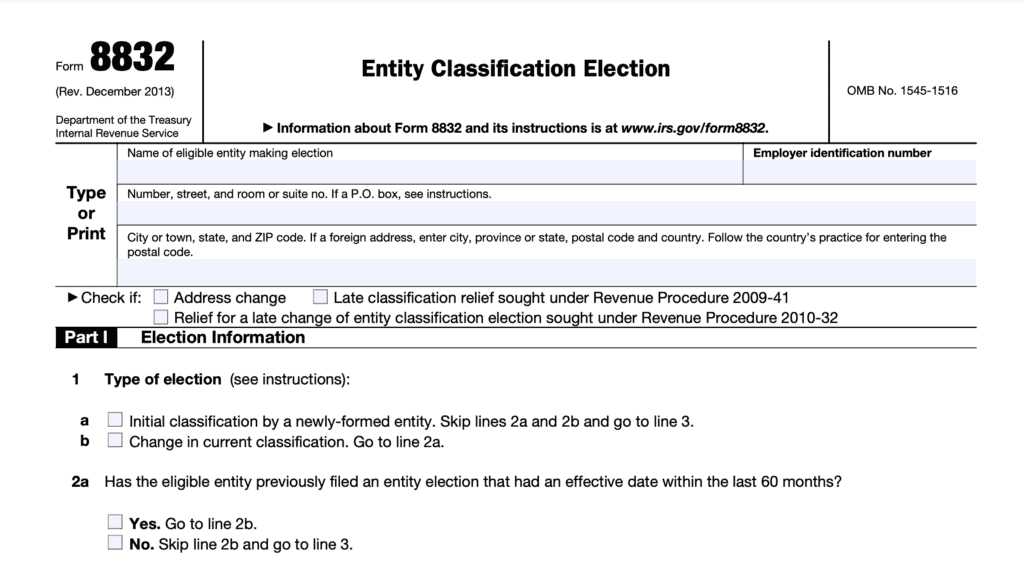

Filing of Form 8832

The requesting entity fails to qualify as a corporation solely because either:

- Form 8832, Entity Classification Election, was not timely filed under Regulations section 301.7701-3(c)(1)(i), or

- Form 8832 was not deemed to have been filed under Regulations section 301.7701-3(c)(1)(v)(C);

Timing of S-corporation election

The requesting entity fails to qualify as an S corporation on the effective date of the S corporation status solely because the S corporation election was not timely filed pursuant to Section 1362(b);

The corporation must have filed All required tax returns in a timely manner.

One of the following must be true.

- The requesting entity timely filed all required federal tax returns and information returns consistent with its requested classification as an S corporation for all of the years the entity intended to be an S corporation and no inconsistent tax or information returns have been filed by or with respect to the entity during any of the tax years, or

- The requesting entity has not filed a federal tax or information return for the first tax year in which the election was intended to be effective because the due date has not passed for that year’s federal tax or information return.

Video walkthrough

Watch this instructional video to learn more about completing Form 2553 to elect S-corporation status.

Frequently asked questions

You may file this form by fax or mail to the IRS service office assigned to your state of incorporation.

There a number of legal and tax considerations for S-corporation election. Many taxpayers elect for the IRS to treat their company as an S-corp to minimize the amount of double taxation that may occur at the corporate and individual income tax levels.

You may file Form 2553 at any time before the tax year that the election will take place. To elect S corporation status in the current tax year, you must file Form 2553 no later than 2 months and 15 days after the beginning of the taxable year.

How do I find IRS Form 2553?

You may find this form on the IRS website. For your convenience, we’ve enclosed the latest version in this article.