IRS Form 13844 Instructions

The Internal Revenue Service allows taxpayers who are behind on their federal taxes to enter into a monthly payment plan to reduce their tax debt. Usually, there is a one-time setup fee to enter an IRS installment agreement. But if you’re a low-income taxpayer, you may be eligible to set up a tax payment plan for a reduced fee by filing IRS Form 13844.

This article will walk you through your reduced user fee request form, including:

- How to complete IRS Form 13844

- Who is eligible for a reduced user fee

- Background information on installment payment plans

Let’s start with step by step guidance on completing this tax form.

Table of contents

How do I complete IRS Form 13844?

This IRS form is fairly straightforward. Let’s take a closer look at each part of the form, beginning with Page 1.

Page 1

The first page of this form contains background information about reduced installment agreement fees and how low-income taxpayers might be eligible. Before we start with Item 1 below, let’s look at what the IRS is trying to tell us at the top of the form.

Top of page 1

There are some key points that the IRS wants you to understand before completing Form 13844. In order, we’ve paraphrased these key points here.

Exact user fee amount

For low-income taxpayers who enter into installment agreements, the user fee is reduced to $43. Conversely, taxpayers who do not qualify as low-income have to pay setup fees as follows:

- Online applications: $130

- Applications by mail, phone, or in person: $225

Taxpayers who meet certain criteria may have their setup fees reimbursed or eliminated, as outlined below (see Difference Between Electronic Debit Payments and Regular Payments).

How the IRS determines eligibility as a low-income taxpayer

In general, the Internal Revenue Service defines the term, ‘low-income taxpayer,’ as individuals with adjusted gross income at or below 250% of the Department of Health and Human Services Poverty Guidelines.

The Department of Health and Human Services updates these guidelines annually.

Difference between electronic debit payments and regular payments

The primary difference between electronic debit payment agreements and non-direct debit agreements is that taxpayers who elect to use direct debit may have their user fee completely waived as long as they continue to make their minimum monthly payment to pay down their outstanding tax bill.

Low-income users who enter into non-direct debit agreements may have their user fee refunded after having paid their outstanding tax liability.

Who is eligible

Only individual taxpayers are eligible. A reduced user fee application is not available to corporations or partnerships.

How to file

Send your completed form to the following address:

Internal Revenue Service

P.O. Box 219236, Stop 5050

Kansas City, MO 64121-9236

Let’s take a closer look at the information fields. Although there are only 3 information fields you need to complete, we’ll cover each one in depth.

Item 1

If you are unable to make electronic payments or direct debit payments, check the block in Item 1.

What happens if you do not check the box?

If you check the box indicating that you are unable to make electronic payments as one of your tax payment options.

If you do not check this box, the IRS will assume that you are able to, but choose not to, pay your unpaid tax balances using a debit instrument.

Item 2: Family unit size

Enter the total number of dependents that you claimed on your most recent income tax return. Include yourself and your spouse, if applicable.

This number should match the number of dependents on your most recent federal tax return.

Item 3: Adjusted gross income

Enter your adjusted gross income (AGI) from the most recent tax year available. You can find this number on Line 11 of your IRS Form 1040 or Form 1040-SR.

As with Item 2, this should match the number shown on your most recent tax return.

Item 4

Items 4 through 6 do not contain any required information fields for you to complete. However, a brief summary of each item might help to better understand how to use the low-income taxpayer adjusted gross income guidance table on Page 2.

As outlined in Item 4, perform the following steps:

- Use the Item 2 (family size) to find the ‘Size of Family Unit’ located in the table

- Find the column that represents where you live

- 48 contiguous states, Washington D.C., and U.S. territories

- Alaska

- Hawaii

- The contents of that column indicate the maximum allowable AGI to qualify as a low-income taxpayer

Item 5

Compare the amount that you entered into Item 3 (Adjusted Gross Income) to the amount identified in the Low-Income Taxpayer Adjusted Gross Income Guidance Table.

If your AGI is above this amount, then you do not qualify as a low-income taxpayer. Do not submit this form.

Item 6

If the adjusted gross income you entered in Item 3 is equal to or less than the amount shown for your family unit size and residence in the Low-Income Taxpayer Adjusted Gross Income Guidance table, you are a low-income taxpayer.

If you are a low-income taxpayer based on your income level, you must sign and date the certification portion of this form and submit it to the IRS within 30 days from the date of the Installment Agreement acceptance letter that you received.

Please note: The IRS will not consider any applications for low income taxpayer status, for installment agreement purposes, for taxpayers who submit the application more than 30 days after the date of their installment agreement acceptance letter.

Page 2

The top of page 2 contains the low-income taxpayer AGI guidance, based upon family size and location. There are 3 locality categories, depending on where you reside:

- 48 contiguous states, Washington D.C., and U.S. territories

- Alaska

- Hawaii

Below this field, you and your spouse will enter your names and Social Security numbers. If either of you does not have a Social Security number, you may use your taxpayer identification number (TIN) instead.

Below your name and SSN, you and your spouse will sign the certification stating that you certify, under penalty of perjury, that you are eligible for status as a low-income taxpayer for installment agreement purposes based upon your family unit size and adjusted gross income.

Now that we’ve covered IRS Form 13844, let’s take a closer look at setting up an installment plan.

How do I set up an installment plan?

The IRS website contains a lot of information on how to set up installment plans for taxpayers trying to pay their tax bill. There are three categories of payment options available:

- Immediate payment

- Short-term payment plan

- Long-term payment plan

Let’s take a closer look at each of these in depth.

Immediate payment

To completely avoid any additional fees or penalty charges, the IRS highly encourages taxpayers to pay their unpaid taxes with a lump sum payment.

Taxpayers may pay directly from their bank account online through direct deposit or over the phone through the Electronic Federal Tax Payment System (EFTPS).

Taxpayers may also make immediate payment by:

- Check

- Money order

- Credit card (additional fees may apply)

There is no installment plan fee if the taxpayer makes a full payment of their back taxes. However, for many taxpayers, the best option is setting up an IRS payment plan.

Let’s look a little more closely at the payment plan options.

Short-term payment plan

A short-term payment plan is an IRS payment plan that pays the total amount of taxes, penalties, and interest in 180 days or less.

Only individuals are eligible to sign up for a short-term payment plan. If you are a sole proprietor, you may apply for a short-term payment plan.

There are no fees to set up a short-term payment plan. Short term payment plans are only available to taxpayers with unpaid tax balances of $100,000 or less.

Long-term payment plan

A long-term payment plan is one in which the full amount of tax debt is paid in installment payments lasting over 6 months. Long-term installation agreements are only available in cases where the balance due is $50,000 or less.

There are two ways to set up a long-term payment plan:

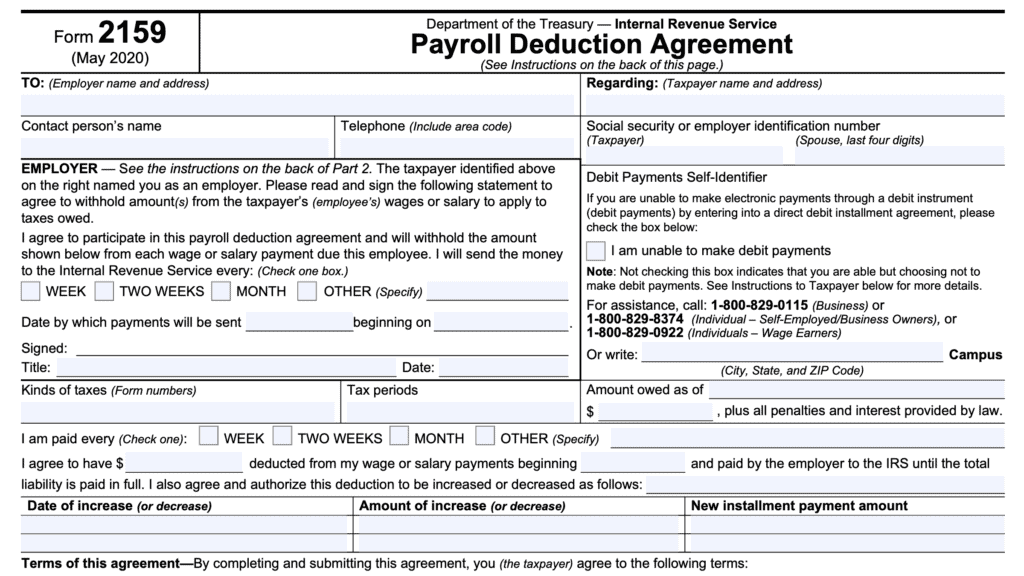

- Direct debit installment agreement (DDIA)

- Applying for a long-term payment plan

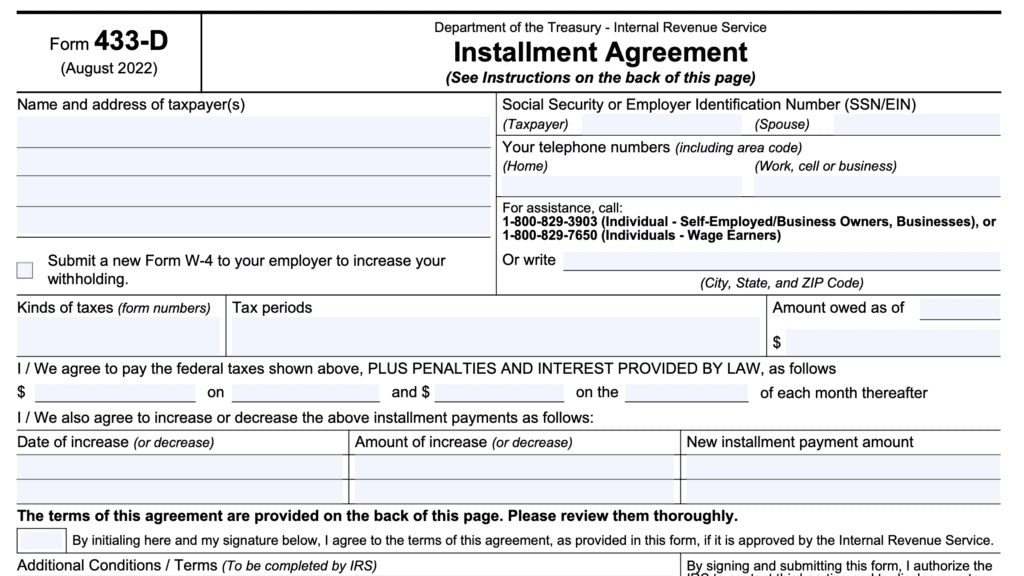

You can set up the payment plan by filing IRS Form 9465, Installment Agreement Request.

Setting up a direct debit installment agreement

Within Form 9465, you can enter your financial institution’s bank routing number and account number to make include the direct debit agreement as part of your monthly installment plan.

Taxpayers do this by completing Lines 13a and 13b of their Form 9465.

Long-term payment plan without a direct debit agreement

If the direct debit option is not available or if the taxpayer chooses not to do this, the taxpayer is responsible for making their own monthly payments.

These can be done:

- Directly from a checking or savings account (Direct Pay)

- Using Electronic Federal Tax Payment System (EFTPS) (enrollment required)

- Via monthly payment by:

- Check

- Money order

- Debit/credit card (Fees apply when paying by debit card or credit card)

Regardless of how the long-term installment agreement is set up, there are user fees involved. Let’s take a closer look at those user fees.

How much does it cost to set up an installment plan?

The user fees differ depending on whether you sign up for direct debit payments or make your own installment payments. They also depend on how you submit the request. Online requests are easier to process, and cheaper than manual requests done by phone, in person, or via mail.

Below is the cost breakdown for each type of payment agreement.

Direct debit installment agreement

For online applications, the setup fee is $31 for non low-income taxpayers. To apply by phone, mail, or in-person, the setup fee is $107.

For low-income taxpayers, the setup fee is waived as long as there is a direct debit agreement in place.

Installment agreement

For an installment agreement request in which the taxpayer is responsible for their own payments, the application fee schedule is as follows:

- Apply online: $130 setup fee

- Apply by phone, mail, or in-person: $225 setup fee

- Low income:

- Apply online, by phone, or in-person

- $43 setup fee which may be reimbursed if certain conditions are met

Generally, a low income taxpayer who does not have their setup fee waived may be eligible for a refund of their setup fee at the end of their payments.

Who is eligible to set up an installment agreement?

Individual taxpayers may submit an online installment agreement request if they meet the following criteria:

- Long-term payment plan (installment agreement): A taxpayer may request a long-term payment plan if the taxpayer

- Owes $50,000 or less in combined tax, penalties and interest, and

- Has filed all required income tax returns.

- Short-term payment plan: Taxpayer must owe less than $100,000 in combined tax, penalties and interest.

A business may request a long-term payment plan as long as the business:

- Owes $25,000 or less in taxes, interest, and late payment penalties

- Has filed all required tax returns

Any individual taxpayer may complete Form 13844 if they’re experiencing financial hardship and they feel their financial situation warrants a waiver of the user fee.

Where can I learn more about installment plans?

When I was a practicing financial advisor, I worked with many client families to help them with their tax situation. I wrote a case study about helping a high-earning family pay down six figures of tax debt, which you can read in depth here.

The IRS website also contains a lot of information about installment agreements.

Video walkthrough

Watch this instructional video for a step by step break down of Form 13844.

Frequently asked questions

IRS Form 13844, Application For Reduced User Fee For Installment Agreements, is the tax form that individual taxpayers may use to reduce or eliminate the installment agreement user fee that the IRS charges.

Most likely, an installment agreement is in your best interest for several reasons, even if you’re facing financial hardship. First, as long as your monthly installment payments are made on time, the IRS cannot take collection actions. While interest will continue to accrue on your outstanding balance, you cannot be subject to IRS levy action. Second, you may be eligible for a penalty abatement under one of several IRS penalty abatement policies after you’ve completed the installment agreement or paid your balance in full.

You can file your reduced user fee application by mailing your completed form to the IRS at:

Internal Revenue Service

P.O. Box 219236, Stop 5050,

Kansas City, MO 64121-9236

According to the IRS, a low-income applicant is an individual with adjusted gross income of less than 250% of the federal poverty level. The Department of Health and Human Services updates the income level threshold annually.

Depending on the type of plan you establish with the IRS, and your income level, the setup fee can range from $43 to $225. In some situations, low-income taxpayers may be able to reduce this fee to zero with an approved Form 13844.

Where can I find a copy of IRS Form 13844?

As with other tax forms, you can find a copy of this tax form on the IRS website. You can also download the below. Be sure to download the most recent version of Form 13844, as it is regularly updated to reflect current low-income taxpayer AGI thresholds.