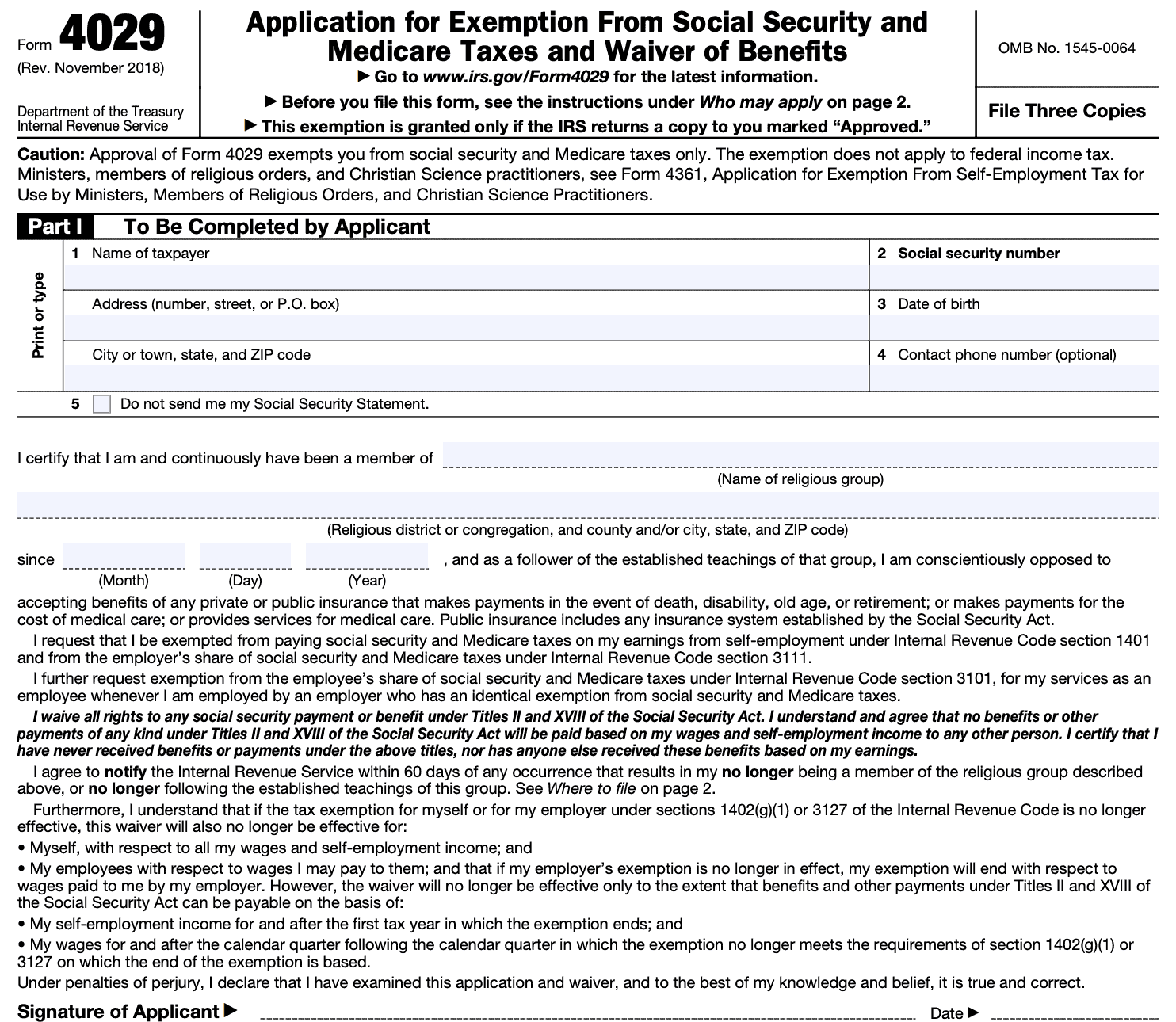

IRS Form 4029 Instructions

Members of certain recognized religious groups may be able to exempt themselves from paying Social Security and Medicare tax. To apply for this tax exemption, an eligible member of a recognized religious sect would file IRS Form 4029 to:

- Become exempt from employment tax withholdings

- Waive any Social Security or Medicare benefits they may be entitled to

This article will walk you through some of the details about this tax form, including:

- Who might be eligible to file IRS Form 4029

- How to complete Form 4029

- Where and when you should file Form 4029

Contents

Table of contents

Let’s start with step by step instructions on completing this tax form.

How do I complete IRS Form 4029?

Fortunately, this one-page form is fairly straightforward. We’ll cover it in two parts:

- Part I: Applicant section

- Part II: Section for an authorized member of the religious group

Let’s go through each part in order.

Part I: To Be Completed by Applicant

Part I contains the taxpayer information as well as the applicant’s sworn statement, under penalties of perjury, as to certain representations. Before going through the form, let’s take some time to go through the fine print.

Caution

At the top of the form, there are two statements.

The first statement contains the following:

“Approval of Form 4029 exempts you from Social Security and Medicare taxes only. The exemption does not apply to federal income tax.”

In other words, the federal government recognizes the right of certain members of a religious group with well-established religious objections to public insurance to opt out of public benefits provided by the Social Security Act. But all taxpayers must pay income tax to the extent required by federal law.

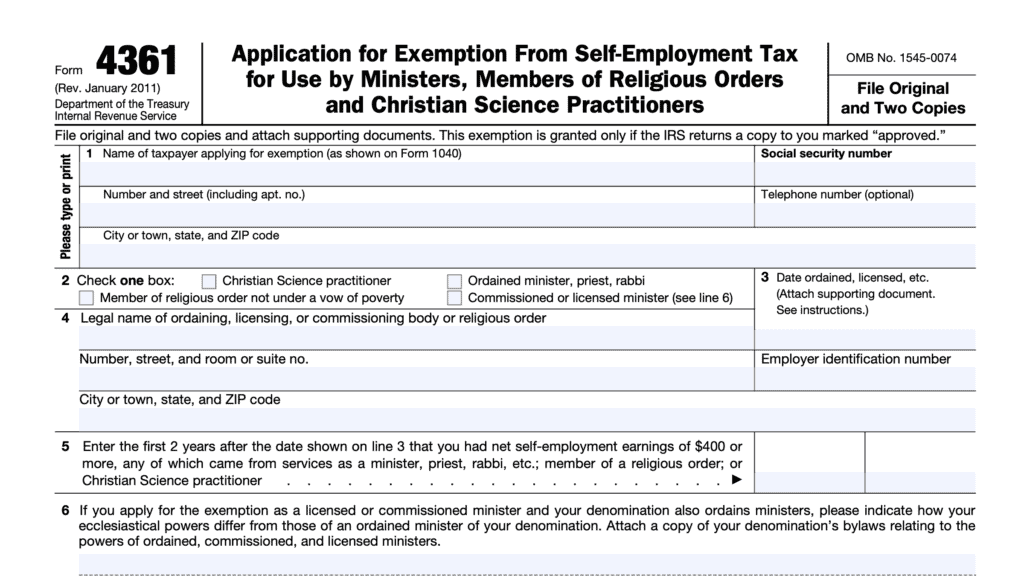

The second statement is for members of the clergy with ministerial earnings and are considered self-employed for tax purposes.

“Ministers, members of religious orders, and Christian Science practitioners, see Form 4361.”

In other words, if you are considered self-employed for income tax purposes, you must use IRS Form 4361 to apply for a self-employment tax (SE tax) exemption. Until that exemption is approved, the taxpayer is responsible for all taxes on self-employment income.

Line 1: Taxpayer name and address

Enter your name and address in Line 1. Enter your full address, to include:

- Street name and number, or P.O. Box number

- City

- State

- Zip code

Line 2: Social Security number

Enter your full SSN in Line 2.

Line 3: Date of birth

Self-explanatory

Line 4: Contact phone number

This field is optional. However, providing your phone number may help the IRS or SSA representative contact you if there are any questions.

Line 5

Select this box if you do not want to receive a copy of your Social Security statement

Certifications

At the bottom of Part I, the applicant must:

- Certify that he or she is and continuously has been a member of a religious group, and

- Provide the date of their membership

Additionally, the taxpayer must certify that as a follower of the established teachings of this group, their religious beliefs do not allow them to accept benefits of any public or private insurance that:

- Makes payments in the event of death, disability, old age, or retirement

- Makes payments for the cost of medical care

- Provides services for medical care

Since the Social Security Act established Medicare and Social Security, they are considered public insurance.

By completing this part of the form, the taxpayer requests the following:

- A religious exemption from paying Social Security and Medicare taxes on their self-employment earnings under Internal Revenue Code (IRC) Section 1401

- To be exempted from the employer’s share of these taxes under IRC Section 3111

- Exemption from the employee’s share of these taxes under IRC Section 3101 when employed by an employer who has an identical exemption

Finally, the taxpayer recognizes that this exemption only exists for as long as:

- He or she is a member of the religious group, and

- He or she continues to follow the teachings of such sect

If either of these ceases to be the case, the taxpayer must notify the Internal Revenue Service within 60 days. To do this, the taxpayer must send a letter to:

Department of the Treasury

Internal Revenue Service Center

Philadelphia, PA 19255-0733

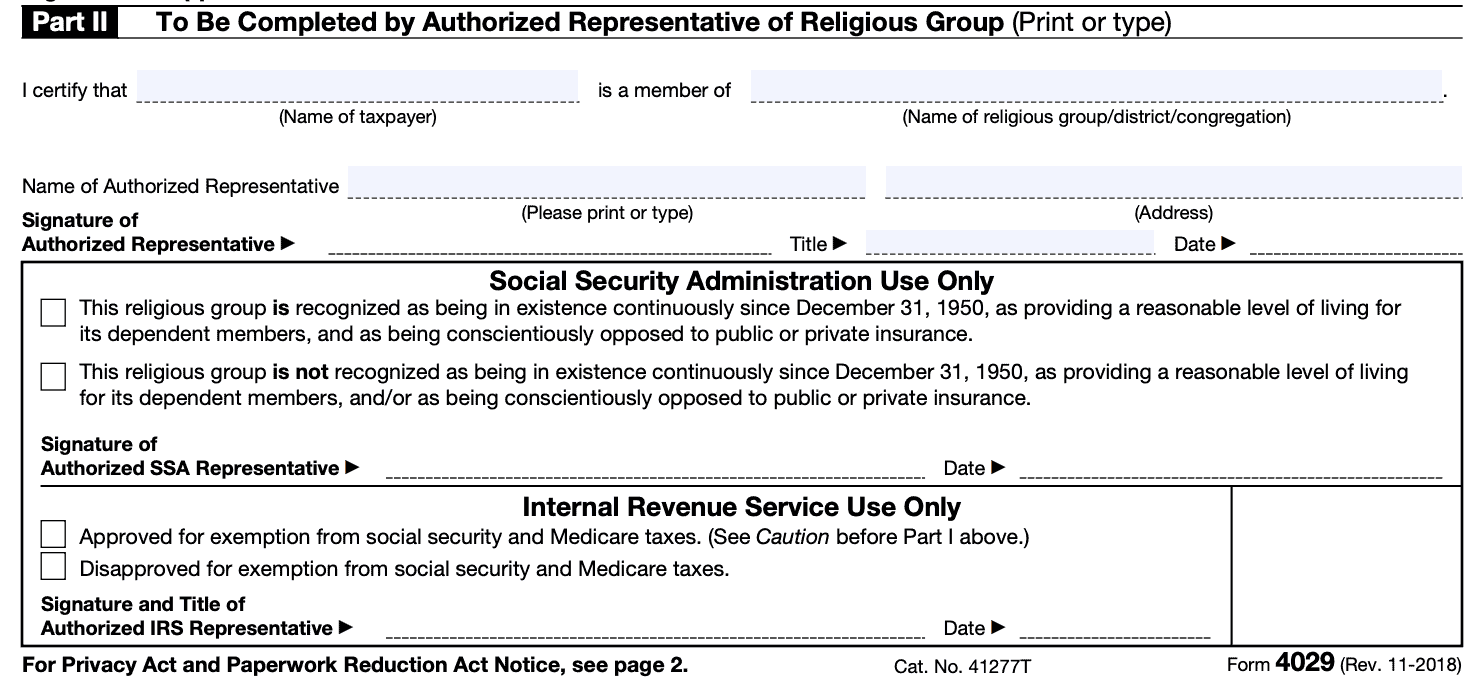

Part II: To Be Completed by Authorized Representative of Religious Group

Part II of this form must be completed by an authorized representative of the religious group that the taxpayer claims to be a member of. This could be the minister of a church or other member of the clergy, so long as their religious group has authorized that person to represent them.

In this section, the representative will certify that the taxpayer is a member of the religious organization in question.

Below Part II are two fields for administration use only.

Social Security Administration Use Only

Before the IRS can approve this form, the SSA must certify that the religious group is or is not recognized as meeting the aforementioned criteria.

Internal Revenue Service Use Only

After certification by the SSA representative, the IRS will either approve or disapprove the exemption. If the taxpayer has met all of the criteria, the IRS representative should approve this form.

How do I file Form 4029?

According to the form instructions, you must first send this form to the Social Security Administration, before IRS approval. You need to send 3 copies of this form (original and two copies) to the SSA at the following address:

Social Security Administration

Security Records Branch

Attn: Religious Exemption Unit

P.O. Box 7

Boyers, PA 16020

What is a recognized religious group?

According to the Internal Revenue Service, a recognized religious group must meet all of the following requirements:

- The religious group is conscientiously opposed to accepting any private or public insurance benefits that:

- Make payments in the event of death, disability, old age or retirement (including Social Security benefits)

- Make payments for the cost of medical care or provides medical care services (including Medicare benefits)

- The group has existed continuously since December 31, 1950

- The group is recognized as having continuously provided a reasonable level of living for its dependent members

The Internal Revenue Service provides the final approval for these exemptions. However, the Social Security Administration maintains a list of the following types of recognized religious groups:

- Religious orders

- Religious sects

- Other organizations

Before IRS final approval, an authorized SSA representative must certify that the religious organization is a recognized religious group.

Video walkthrough

Watch this instructional video for step by step guidance on completing Form 4029.

Frequently asked questions about IRS Form 4029

IRS Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits, is the tax form that certain members of religious orders may file to apply for an exemption from Social Security taxes and Medicare taxes. However, not all people may apply.

A taxpayer may apply for an exemption from Social Security and Medicare tax if he or she is a member of, and follows the teachings of, a recognized religious group and he or she has never taken Social Security benefits, and no one else has claimed Social Security benefits based upon his or her earnings.

A taxpayer may still file Form 4029 and be considered for approval if they repay the benefits received.

20 CFR § 404.1075 provides that members of religious groups that oppose insurance may request a religious exemption from Social Security self-employment tax. The member must be a member of a recognized religious sect or division of the sect, and adhere to tenets or teachings which compels the member to become conscientiously opposed to receiving benefits from any insurance that makes payments in the event of death, disability, old age, or retirement, or pays for medical care.

IRS Form 4029 is to grant a religious exemption for employees against Social Security and Medicare deductions from their payroll. IRS Form 4361 requests a religious exemption for self-employed individuals, such as the minister of a church, who otherwise would have to pay self-employment tax as both an employee and employer.

According to the IRS instructions, if you have a Form 4361 on file, there is no need to file Form 4029.

If the IRS returned your copy of Form 4029 marked “Approved,” write “Exempt—Form 4029” on the “Self-employment tax” line.

If you do not have an approved Form 4029, you cannot claim the exemption on your tax return. However, you may be able to amend a previously filed tax return and claim the exemption.

See your tax professional for more tax advice.

Where can I find a copy of IRS Form 4029?

You may download a copy of this form from the IRS web site or by clicking the file below.