Form SSA-8: Applying For A Lump-Sum Death Benefit

If you’re the surviving beneficiary of a Social Security recipient or wage earner in the United States, you may be entitled to Social Security survivor benefits. One of those Social Security benefits is a $255 lump-sum death payment, which you can apply for using Form SSA-8.

This in-depth guide will walk you through Form SSA 8, including:

- Background information on SSA’s lump sum death benefit

- Who might be eligible for the lump sum payment

- How to complete Form SSA-8 to receive your death benefit

Let’s start with a walkthrough on the SSA-8 form itself.

Table of contents

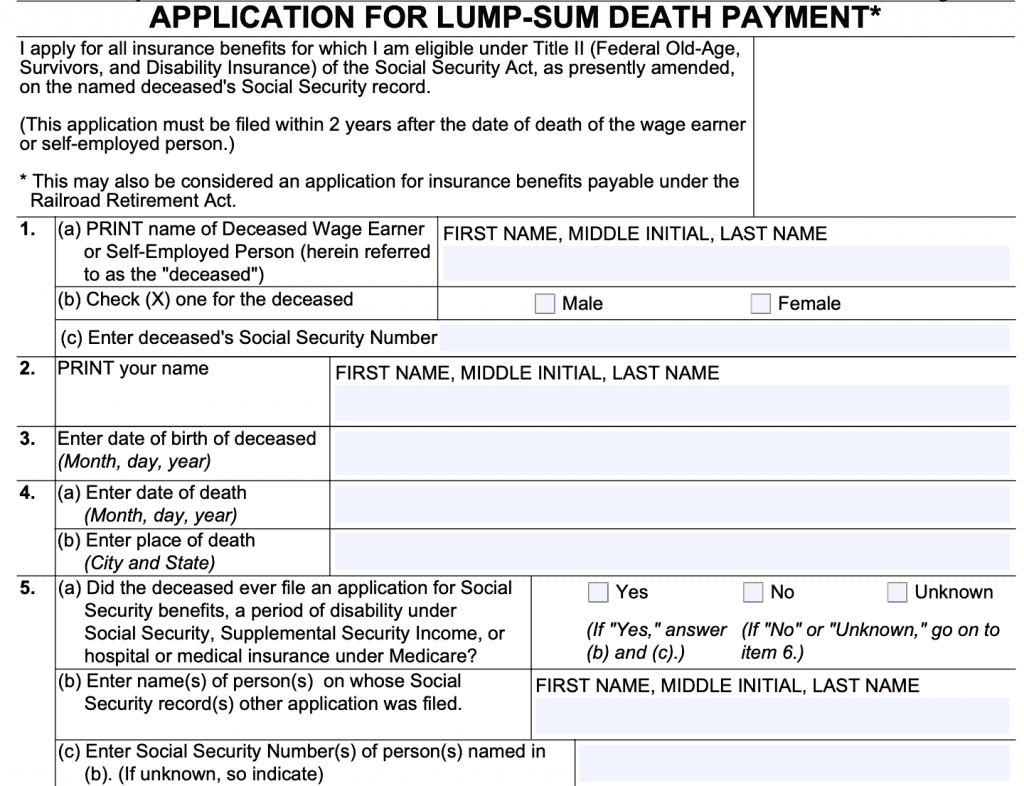

How do I complete Form SSA-8?

This form appears intimidating, but is actually straightforward. You may complete it by yourself and submit it to the SSA. You can also schedule an interview at your local Social Security office and complete these questions in person. This might be the better option if you:

- Have a specific question

- Are concerned about identity theft or having your sensitive information in the postal system

- Are looking for additional information about survivor benefits, such as supplemental security income, or SSI benefits

Let’s proceed to the top of the form.

Line 1: Deceased Wage Earner information

In Line 1, do the following:

- Print the decedent’s full first name, middle initial, and last name

- Check the appropriate box (male or female)

- Enter the decedent’s Social Security number

Line 2: Claimant’s name

Print your name in Line 2, including:

- Full first name

- Middle initial

- Last name

Line 3: Decedent’s date of birth

Enter the decedent’s date of birth, in MM/DD/YYYY format.

Line 4: Date and place of death

Enter the date (Line 4a) and place (Line 4b) of the wage earner’s death.

Line 5: Decedent’s Social Security filing history

Line 5 contains 3 questions, starting with the application history.

Did the deceased file an application for:

- Social Security benefits

- A period of disability under Social Security

- Supplemental Security Income

- Hospital or medical insurance under Medicare

If so, answer the other 2 questions:

- Name(s) of person(s) under whose record the application was filed

- Social Security number(s) of such persons

If the answer to the first question is “No” or “Unknown,” skip the last two questions and proceed to Question 6.

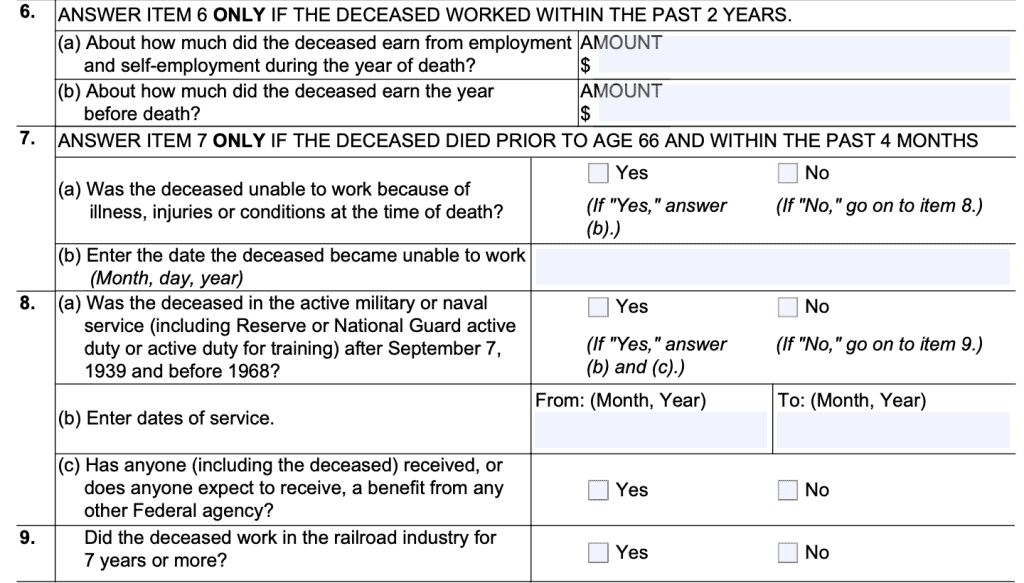

Line 6: Earnings history

Only answer these questions if the decedent worked within the past 2 years.

- About how much did the deceased earn from employment and self-employment during the year of death?

- About how much did the deceased earn the year before death?

You may be able to obtain this information if you:

- Recently obtained the decedent’s Social Security Earnings information

- Have access to the decedent’s my Social Security account*

- Have access to the decedent’s earning history through the SSA mobile app

*Please note: The Social Security Administration, like most official websites of any official government organization, is a *.gov website. Although these websites provide increased protection against identity theft, please observe best practices to avoid fraud and scams.

Line 7: Disability

Two questions:

- Was the deceased unable to work because of an illness, injuries, or conditions at the time of death?

- If ‘Yes,’ enter the date the deceased became unable to work.

- If ‘No,’ proceed to Line 8

Only answer these questions if the deceased passed away:

- Prior to age 66, and

- Within the past 4 months

Line 8: History of work in other federal agencies

Was the deceased on active duty in the military or naval service:

- After September 7, 1939, and

- Before 1968?

If ‘No,’ proceed to Question 9. If ‘Yes,’ answer the following:

- Dates of service (month, year format)

- Expected benefits from other government agencies

- Common examples include veterans benefits and military retirement pensions

Line 9: Did the deceased work in the railroad industry for 7 years or more?

Self-explanatory.

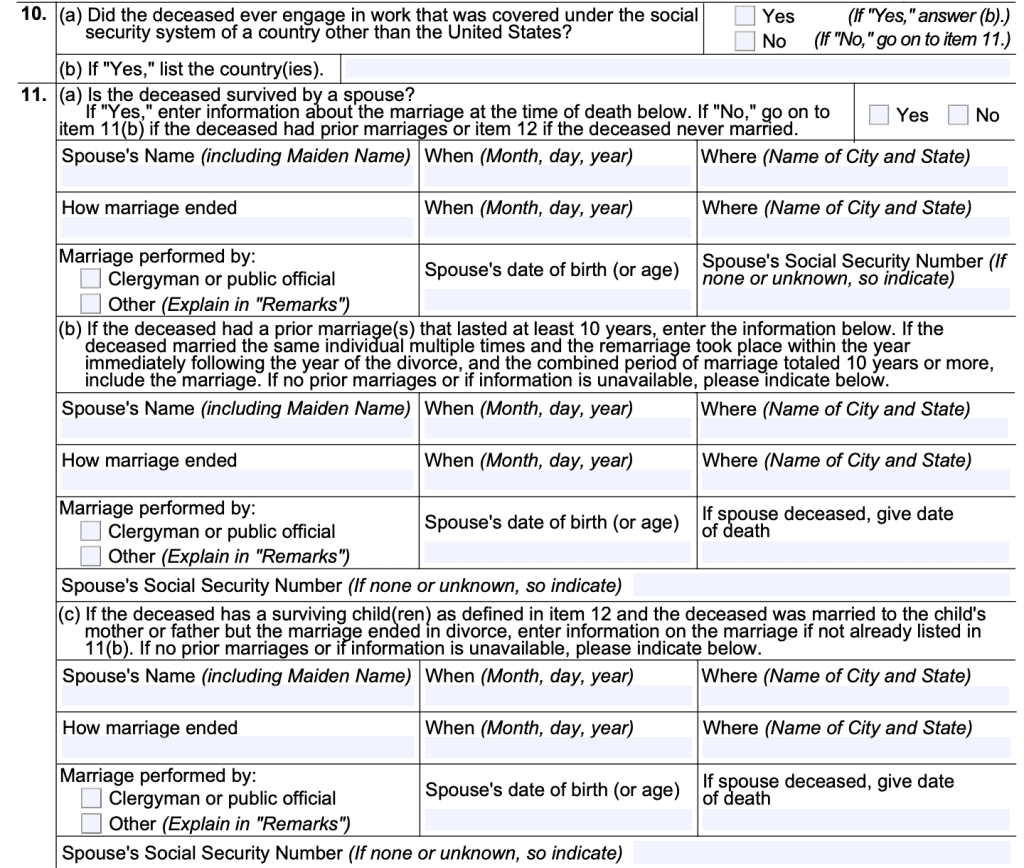

Line 10: Other nations’ Social Security benefits

For most people, this does not apply. If the decedent participated in work covered by a social security system outside the United States, check “Yes” and list the appropriate country(ies). If no, check “No” and proceed to Line 11.

Line 11: Spouse information

For Line 11(a), if you are the surviving spouse, enter “Yes” and complete the rest of Line 11(a). If not, choose one of the following:

- Go to Line 11(b) if the deceased had prior marriages

- Go to Line 12 if the decedent was never married

Line 11(a)

Enter the following:

- Spouse’s name (including maiden name)

- Date of marriage (MM/DD/YYYY)

- Location of marriage (city & state)

- How the marriage ended

- Most likely, “Death,” followed by date and location of death

- Who performed the marriage

- Spouse’s date of birth (or age)

- Spouse’s Social Security number

- Indicate if the surviving spouse does not have an SSN or if it’s unknown

Line 11(b)

Only complete this section if:

- The prior marriage(s) lasted at least 10 years

- The decedent married the same individual multiple times, and:

- Remarriage occurred within the year following the year of divorce, and

- Combined period of marriage was at least 10 years

If no other applicable marriages exist, indicate this.

Line 11(c)

Only complete this if:

- The deceased has surviving child(ren), and

- The decedent’s marriage to the other parent ended in divorce, and

- The marriage is not already listed in Line 11(b)

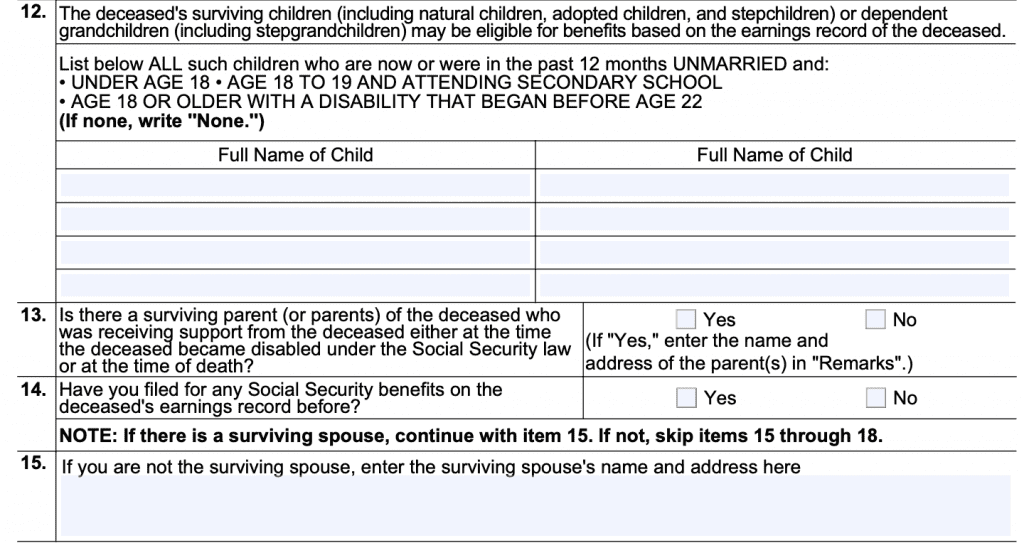

Line 12: Surviving children information

List the full name of all the decedent’s surviving children who are now, or in the past 12 months, were unmarried and one of the following:

- Under age 18

- Age 18 or 19, attending a secondary school (college)

- Age 18 or older with a disability that began before age 22

If there are no children meeting this criteria, write “None” and move to Line 13.

Line 13: Surviving parent information

Is there a surviving parent (or parents) who was receiving support from the deceased, either:

- At the time the decedent became disabled under Social Security law, or

- At the time of death

If so, enter “Yes” and provide the parent(s) name and address in the “Remarks” section. If not, enter “No” and move to Line 14.

Line 14: Have you filed for Social Security benefits on the decedent’s earnings record before?

Self-explanatory

Line 15: Surviving spouse’s information

If you are the surviving spouse, skip this question. Enter the surviving spouse’s name and address here if you are completing the SSA death benefit form on the surviving spouse’s behalf.

If there is no surviving spouse, skip Lines 15 through 18.

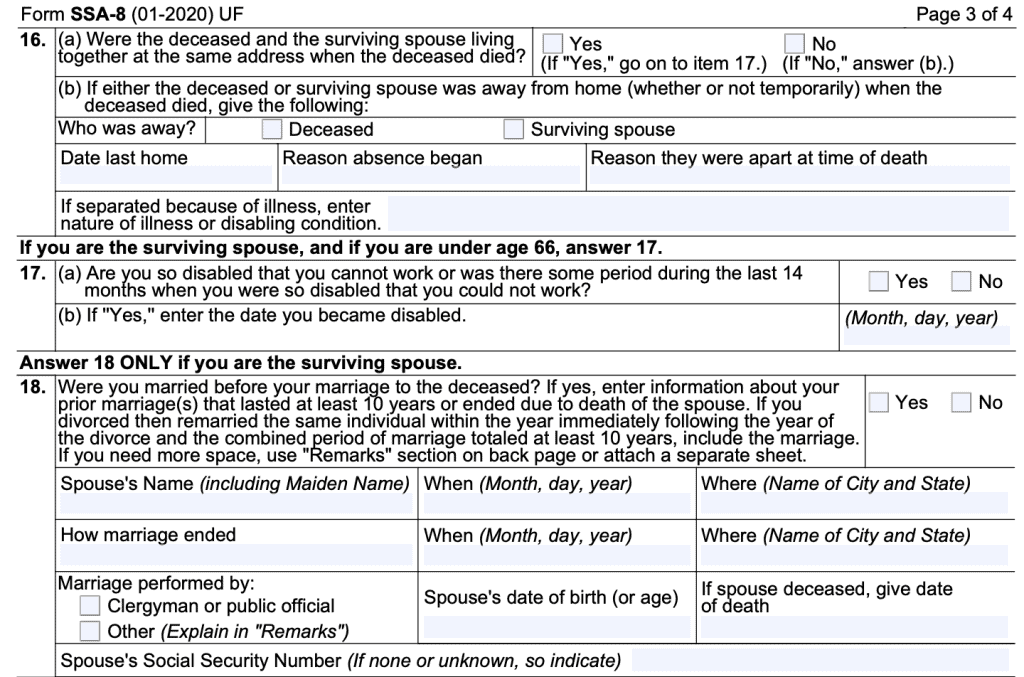

Line 16

Were the decedent and surviving spouse living together at the same address on the date of death? If so, answer “Yes” and move to Line 17. If not, answer the rest of Line 16, including:

- Who was away

- Date the spouse was last at home

- Reason the absence began

- Reason they were apart at the time of death

- Illness or disabling condition information (if applicable)

Line 17

Only answer if:

- You are the surviving spouse, and

- You are under age 66

Are you so disabled that you cannot work, or was there a period during the last 14 months that you could not work?

If “Yes,” enter the date you became disabled.

Line 18: Prior marriages

Answer Line 18 only if you are the surviving spouse. If you were previously married before marrying the deceased, only enter information about a marriage that lasted at least 10 years or ended due to the death of the previous spouse.

If you were divorced, then remarried the same individual within the year immediately following divorce, and the total period of marriage was at least 10 years, include that information as well.

Claimant information

There are several fields here worth noting:

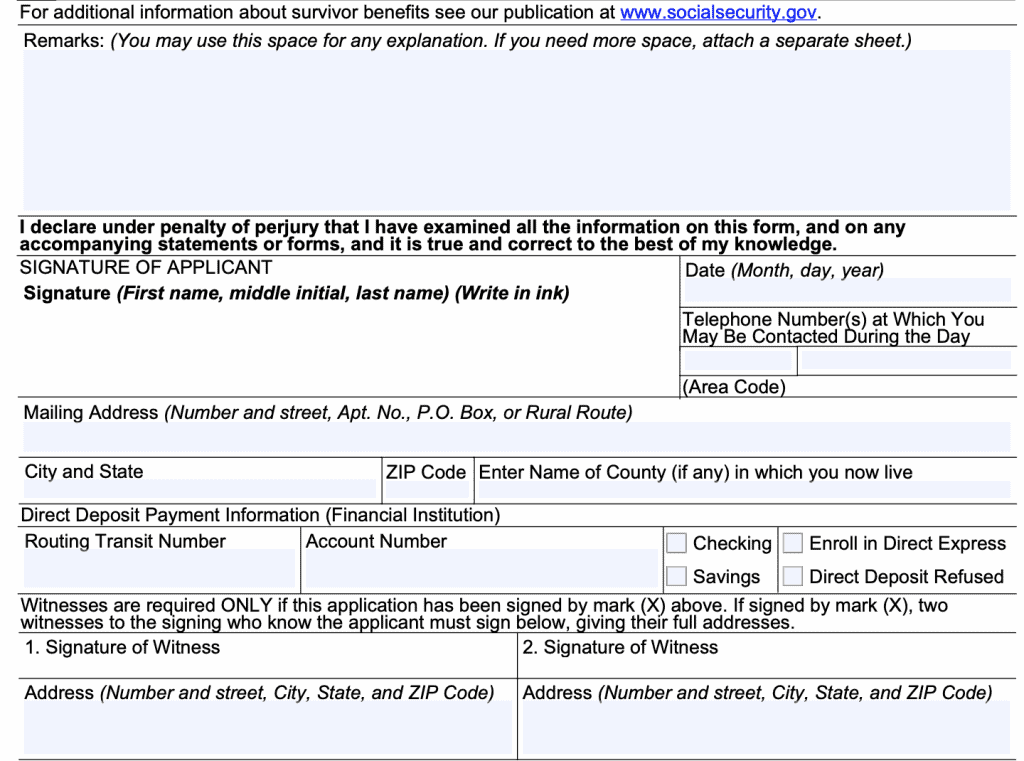

Remarks

For any previous answers that require additional information or an explanation. Attach separate sheets as required.

Signature

When you sign this document, you attest that this information is accurate to the best of your knowledge under penalties of perjury. If you are caught making a fraudulent claim, the federal government may take disciplinary action.

Financial institution information

Enter the routing number and account number for direct deposit purposes.

What is Form SSA-8?

Form SSA-8, Application for Lump-Sum Death Payment, is the SSA death benefits form. A surviving spouse or family member uses Form SSA-8 to apply for the lump sum death payment (LSDP) from the Social Security Administration.

Applicants may apply using this paper form or via personal interview with an SSA employee. This interview may be done in person, at an SSA field office, or over the phone.

What is the SSA Lump Sum Death Benefit?

In 1935, Congress passed the original Social Security Act, signed into law by President Franklin D. Roosevelt. The LSDP was included as part of the original act, for an amount no greater than 3.5% of a worker’s covered annual earnings.

Subsequent law changes adjusted the total benefits slightly, as Congress introduced survivor benefits into later versions of the Social Security Act.

Why is the Lump Sum Death Benefit only $255?

In 1954, Congress changed the Social Security lump sum death benefit to be the lesser of:

- 3 times the worker’s Primary Insurance Amount (PIA), or

- $255

PIA is essentially the monthly benefit a worker would receive at full retirement age.

In 1954, the maximum PIA was $85 per month, so many payouts were actually less than $255. Over time, PIAs rose with inflation, but the $255 cap has never been adjusted.

Now that Social Security earnings are much higher than in the 1950s. In fact, in 1974, the $85 monthly PIA became the minimum possible PIA. Now, that ‘cap’ serves as the payout floor, so covered workers will receive no more than $255.

Who is eligible for the SSA Lump Sum Death Benefit?

According to Section 202(i) of the Social Security Act, the surviving widow or widower who was living with the covered worker at the time of death may apply for the lump sum death benefit. If there is no surviving widow or widower living with the decedent, then the following eligible individuals may apply for the lump sum death benefit:

- Surviving widow or surviving widower who entitled to benefits based upon the worker’s history, or

- Surviving children, parents, or other persons entitled to Social Security benefits based upon the worker’s history

By law, the federal government will not process any claims for a lump sum death benefit submitted more than 2 years from the date of death.

Video walkthrough

Watch this instructional video to learn more about completing Form SSA-8.

Frequently asked questions

Here are some frequently asked questions about Form SSA-8.

All eligible beneficiaries must submit the completed SSA-8 form within 2 years of death to claim the lump sum death benefit.

You can apply by phone at (800) 772-1213. Hearing impaired persons may call via relay service or TTY at: (800) 325-0778.

Once you’ve completed the form, you may drop it off at your local Social Security office. You may be asked to bring identity documents, such as:

-A birth certificate or other proof of birth

-Proof of U.S. citizenship or lawful alien status if you were not born in the United States

-U.S. military discharge paper(s) for military service before 1968

-W-2 forms(s) and/or self-employment tax returns for last year and

-A death certificate for the decedent

Upon receipt, the SSA should send the claimant a receipt (see below). The receipt should tell you:

-When SSA received the claim

-Which SSA office is handling the claim and contact information for that office

-Number of business days it should take for a response

How do I find a copy of SSA-8?

You may find a copy of this form on the Social Security website or by downloading the file below.