IRS Form 433-F Instructions

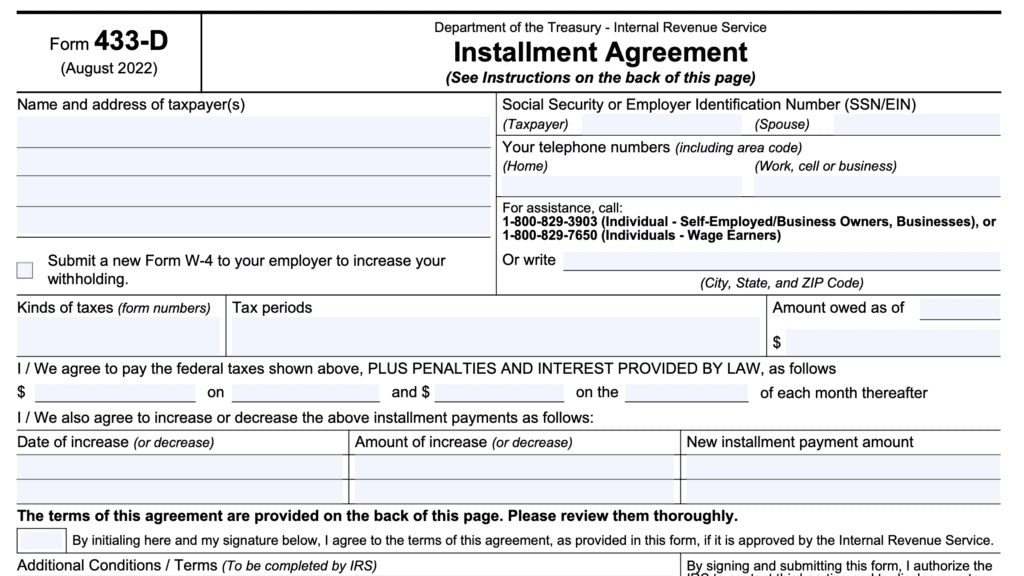

If you’re looking to pay down federal tax debts, the Internal Revenue Service may recommend that you complete IRS Form 9465, Installment Agreement Request to set up a payment plan. In certain circumstances, the IRS may also require you to complete IRS Form 433-F, Collection Information Statement, to provide detailed financial information.

This article will walk you through:

- What IRS Form 433-F is

- When you might need to complete IRS Form 433-F

- How to complete IRS Form 433-F

Let’s begin with step by step instructions on how to complete Form 433-F.

Table of contents

How do I complete IRS Form 433-F?

This two-page tax form appears more intimidating than it actually is. We’ll break it down into sections and go through them, one at a time.

Let’s start with the taxpayer collection at the top of the form.

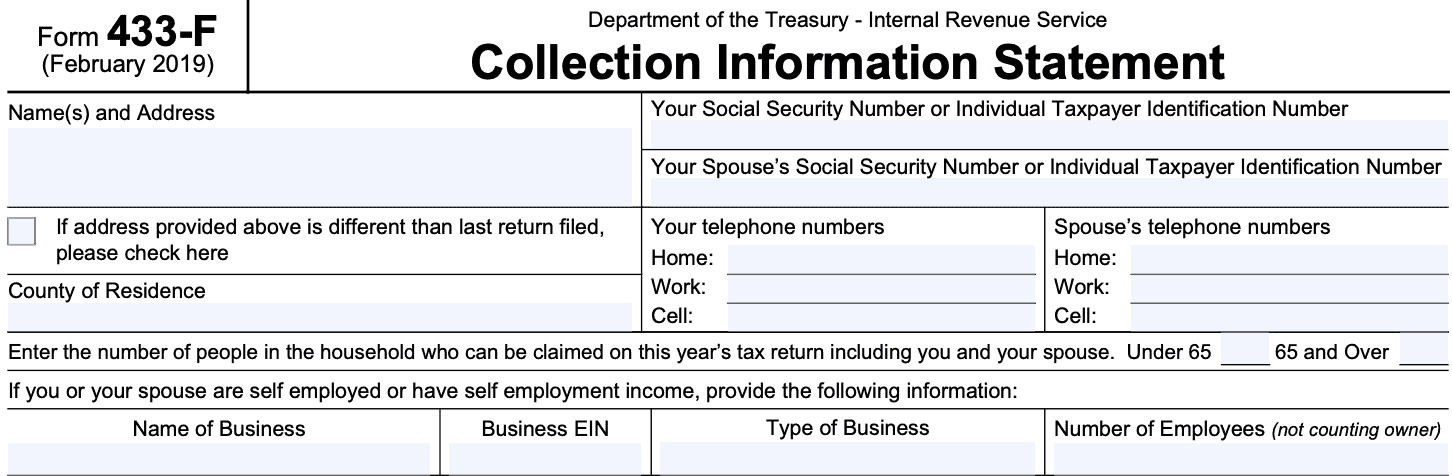

Taxpayer information

This section collects personal information about the taxpayer and taxpayer’s spouse. You’ll include the following:

- Taxpayer name

- Social Security number (and spouse’s SSN as well)

- Phone numbers (home, work, and cell phone) for both taxpayer and spouse

You’ll also need to check:

- Whether the address is different from the one you used when filing your most recent income tax return

- Number of people who are:

- Under age 65

- Age 65 or older

Finally, if you or your spouse have self-employment income or business income, you’ll need to complete the following:

- Business name

- Business employer identification number (EIN)

- Type of business

- Number of employees (not including the owner(s))

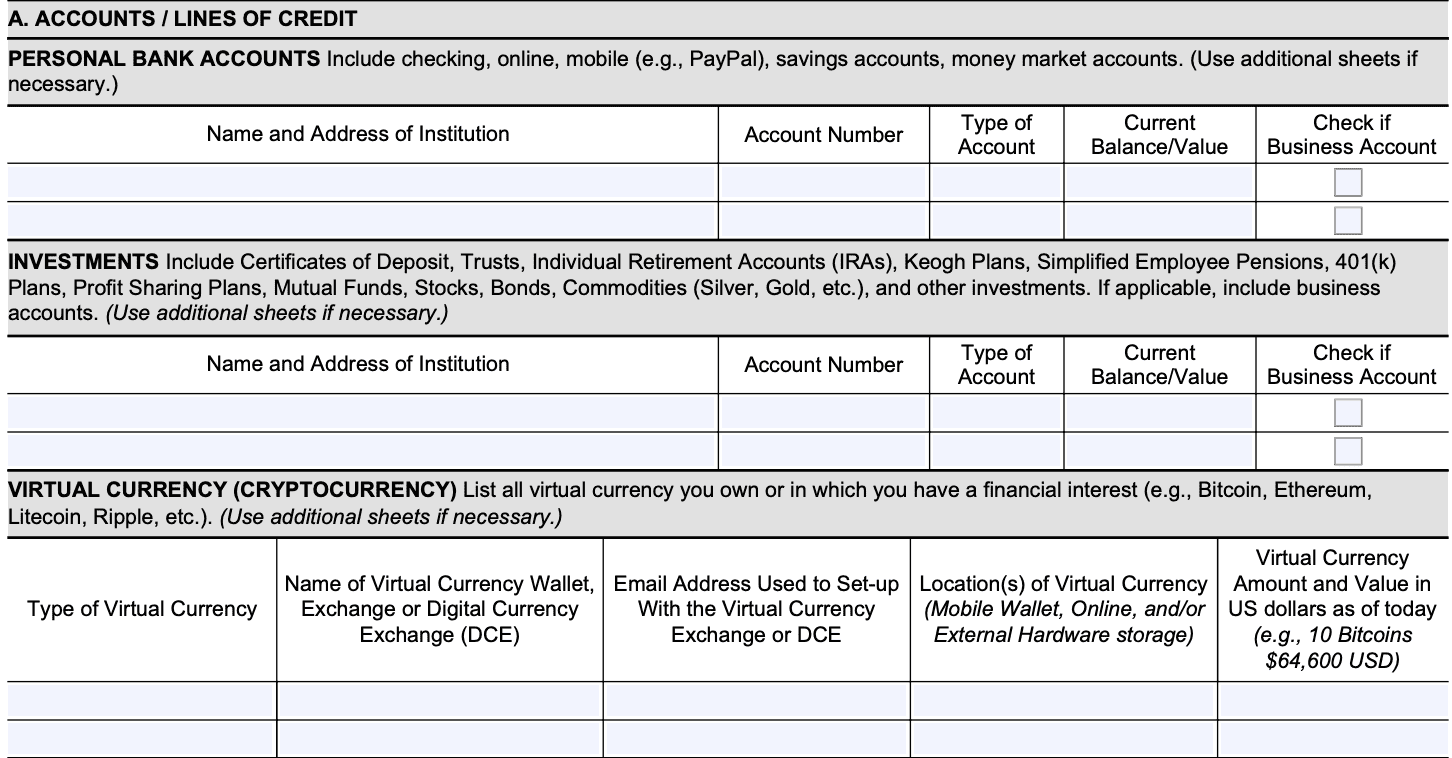

Section A: Accounts/Lines of Credit

In Section A, you’ll include financial assets, including bank accounts, investment accounts, and cryptocurrency.

Bank accounts

This includes the following:

- Checking accounts

- Savings accounts

- Money market accounts

- Mobile accounts, such as PayPal, Venmo, or Zelle

For each account, you’ll list:

- Name and address of the financial institution

- Account number

- Type of account

- Account balance

- Whether or not it is a business account

The form instructions state that you should list all accounts, even if there is a zero balance.

Investments

In this section, you’ll include the following:

- Certificates of deposit (CDs)

- Trusts

- Individual Retirement Accounts (IRAs). This includes Roth IRAs

- Pensions, such as Keogh plans, Simplified Employee Pensions (SEP plans), 401(k) plans and other employer-sponsored retirement plans

- Investments, or investment accounts containing stocks, bonds, mutual funds, or commodities

For each account, you’ll list:

- Name and address of the financial institution

- Account number

- Type of account

- Account balance

- Whether or not it is a business account

Virtual currency

In this section, you’ll list all of your cryptocurrency assets, such as Bitcoin or Ethereum. For each currency, you’ll list:

- Type of currency

- Name of your cryptocurrency wallet, exchange, or digital currency exchange

- Email address associated with the virtual currency

- Amount and current value of each currency

For all accounts, you may need to use additional sheets.

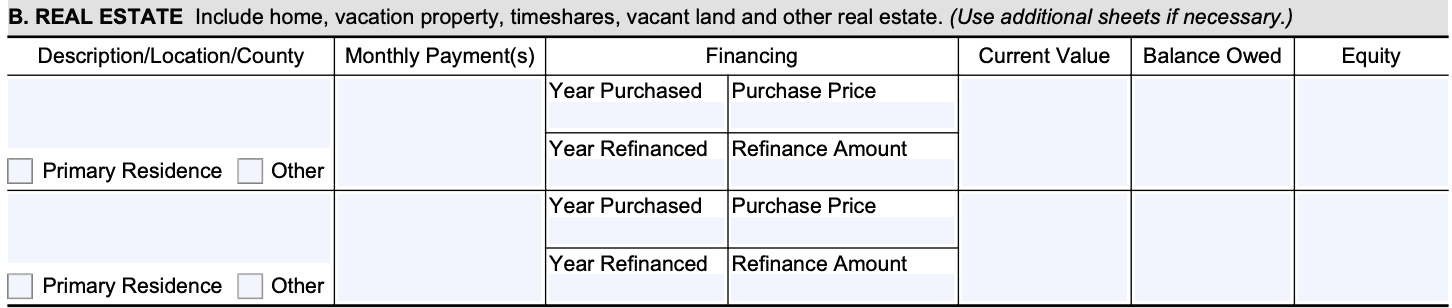

Section B: Real estate

List all real property that you own, including:

- Your primary residence

- Secondary or vacation homes

- Timeshares

- Vacant land

For each property, you’ll list:

- Description, including location & county

- Whether it is your primary residence

- Monthly payment(s) for any loans or mortgages

- Financing information, such as:

- Year of purchase or refinance

- Purchase price or refinance amount

- Current value of the property

- Balance owed

- Equity

For each property, include insurance and tax payments, if they are part of the mortgage. To calculate equity, simply subtract the balance owed from the current value.

For example, if your property is worth $200,000 and you owe $120,000, then your equity is $80,000 ($200,000 minus $120,000).

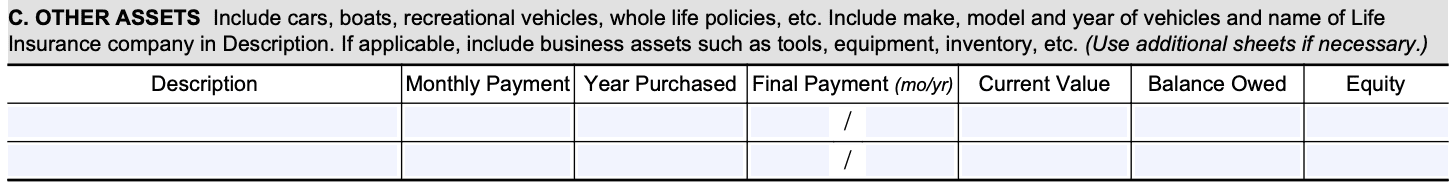

Section C: Other assets

In Section C, you’ll list other assets that you may own not listed in Section A or Section B.

This includes:

- Cars and recreational vehicles

- Boats

- Whole life insurance policies

- Business assets

- Other personal assets not previously listed

For each item, include:

- A description

- Monthly payment

- Year of purchase

- When your final payment is due

- Current value and balance owed

- Equity

When listing vehicles, include make, model, and the year of the vehicle in the description. For life insurance polices, include the name of the life insurance company in the description.

Section D: Credit cards

List all credit cards you own, even if you do not currently owe a balance. For each credit card account, you’ll need to include:

- The type of card

- Credit limit

- Current balance owed

- Minimum monthly payment

Include business credit cards in this section.

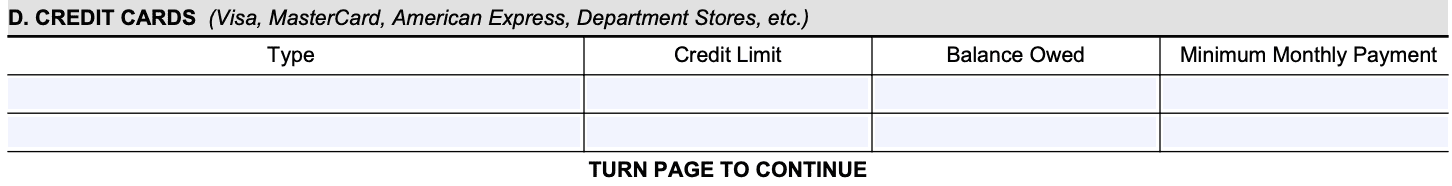

Section E: Business information

Complete Section E if you are a business owner or have income from self-employment. There are two parts to this section.

Part E1: Accounts receivable owed to your or your business

For anyone or any business who owes you money, list:

- Person or business’ name

- Address

- Amount owed

You’ll total all accounts receivable to report to the IRS.

Part E2: Name of individual or business on account

Complete Part E2 if your business accepts credit cards, cryptocurrency, or other digital payments. You’ll need to list the following:

- Type of credit card or account

- Issuing bank name and address

- Merchant account number

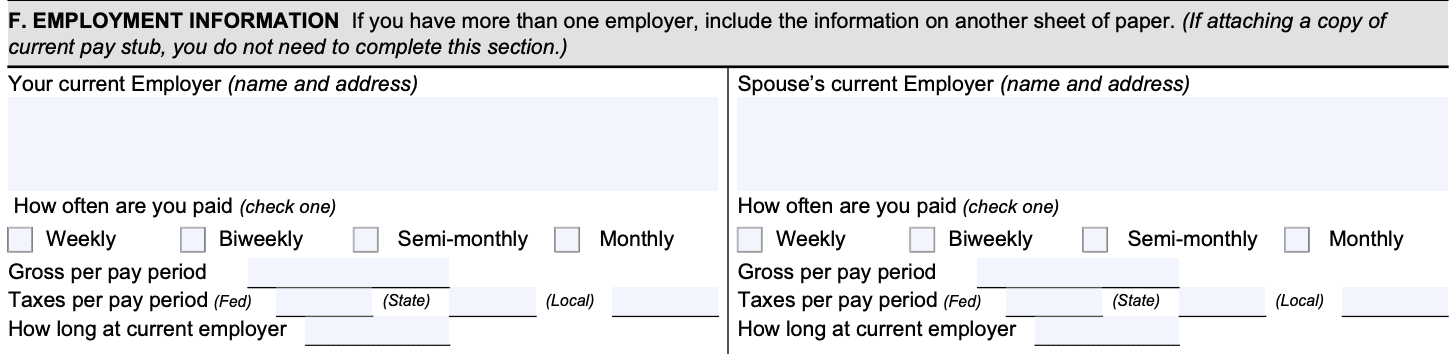

Section F: Employment information

In Section F, include all employment information for both yourself and your spouse. If you have more than one employer, you may need to use an additional sheet.

Include the following information:

- Employer name and address

- How often you are paid

- Biweekly paychecks are issued 26 times per year

- Semi-monthly paychecks are issued twice a month (24 times per year)

- Gross income per pay period

- Taxes per pay period

- Federal, state, and local taxes

- How long you’ve worked at your employer

If you include a copy of your pay stub, you do not need to complete Section F.

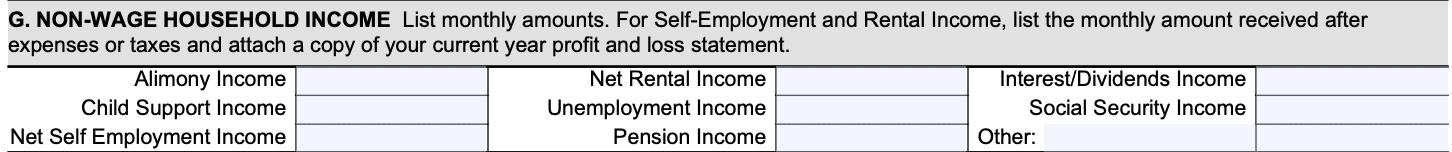

Section G: Non-wage household income

In Section G, you’ll list all sources of non-wage income. List the monthly income amounts for the following:

- Alimony income

- Child support

- Net self-employment (after taxes and expenses)

- Net rental income (after taxes and expenses)

- Unemployment income

- Pension income

- Interest and dividends

- Social Security income

- Other sources of income

For rental income or self-employment income, include a copy of your current year’s profit and loss statement. Your monthly self-employment income should roughly reflect what you report on Schedule C of your federal income tax return. Your monthly rental income should be in line with what you report on Schedule E.

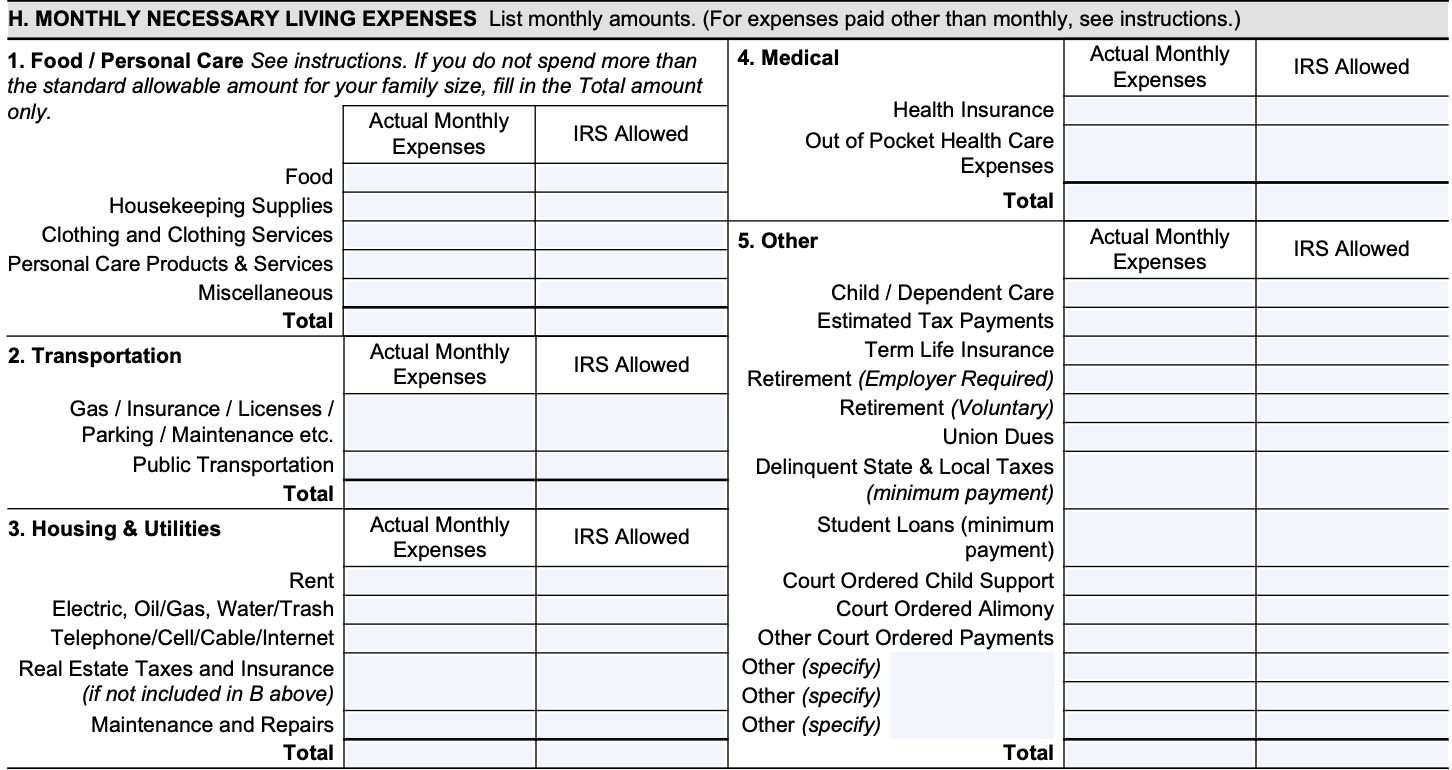

Section H: Monthly necessary living expenses

In Section H, include monthly amounts for your necessary living expenses. You’ll notice that there are two columns for each type of expense:

- Actual monthly expenses

- IRS allowed monthly expenses

The monthly expenses allowed by the IRS are determined by IRS Collection Financial Standards. Within each category, the federal government has established an allowable limit based upon information gathered by the Bureau of Labor Statistics. These limits are per person and are updated regularly.

If you do not spend more than the allowable limit, you do not need to complete the second column.

If there is a bill that you do not pay on a monthly basis, use the following calculations to determine the monthly amount:

- Quarterly: Divide quarterly payment by 3 to arrive at your monthly amount

- Weekly: Multiply by 4.3

- Bi weekly (every 2 weeks): Multiply by 2.17

- Semimonthly (twice per month): Multiply by 2

There are 5 parts to Section H.

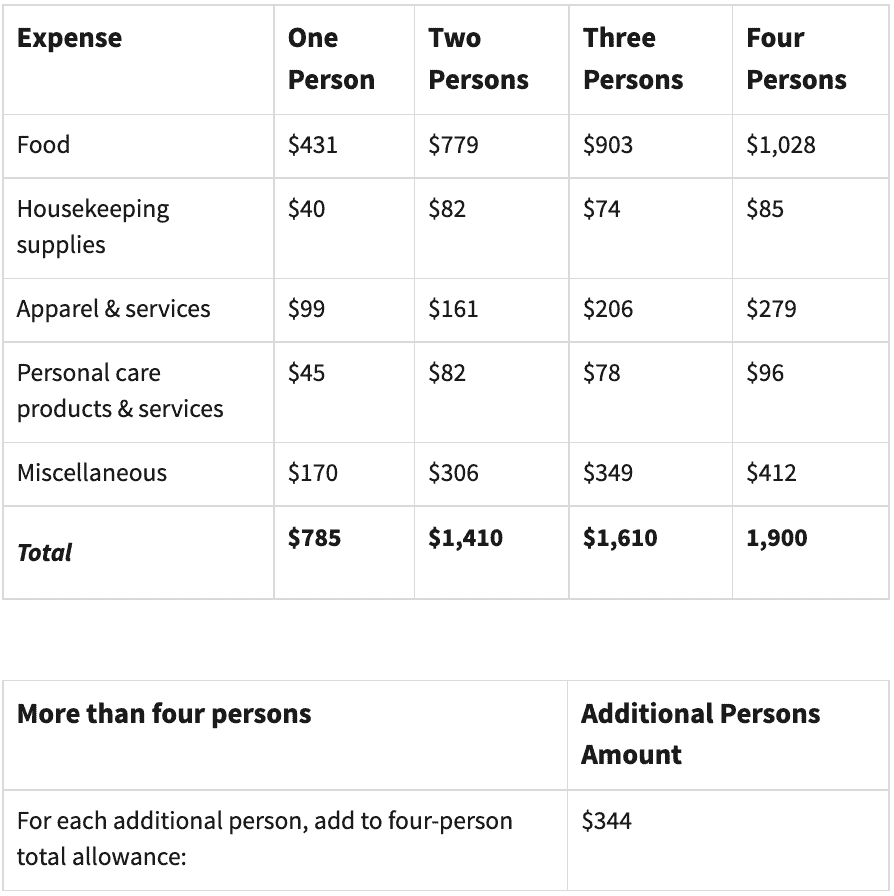

Part 1: Food and personal care

List the monthly amount you spend in the following categories:

- Food

- Housekeeping supplies

- Clothing and clothing services

- Personal care products and services

- Miscellaneous expenses

Below are the federal standards for food, clothing, and other items.

Part 2: Transportation

List the monthly amount spent on the following:

- Gas, insurance, licenses, parking, and maintenance: Expenses associated with owning and operating a motor vehicle

- Public transportation: Mass transit fares, to include bus, train, ferry, or taxi

Financial standards for transportation costs differ by region. You can find the applicable standards for your region on the IRS website.

Part 3: Housing and utilities

In Part 3, include the following expenses for housing and utilities:

- Rent

- Utilities, such as electricity, oil/gas, water, trash and sewer

- Telephone, cell phone, cable, and internet

- Real estate taxes and insurance (if not included in Section B)

- Housing maintenance and repairs

Like transportation costs, allowable expenses for housing costs may vary based upon where you live. To find the applicable standards for your location, refer to the IRS website.

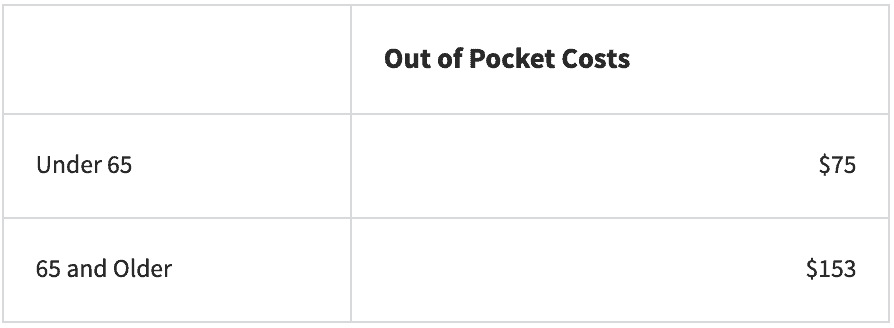

Part 4: Medical

Include the following medical costs:

- Health insurance

- Out of pocket health care expenses

According to the form instructions, out of pocket costs include costs you pay for the following:

- Medical services

- Prescription drugs

- Dental expenses

- Medical supplies, including eyeglasses and contact lenses.

Below are the national standards for monthly out of pocket medical expenses:

Part 5: Other

Here, you will include other expenses that may or may not be discretionary. There are no national standards set for these expenses, so the IRS may allow them or disallow them based upon your specific situation.

Enter the monthly amounts you pay for the following:

Child or dependent care

Enter the monthly amount you pay for the care of dependents that you may claim on your Form 1040.

Estimated tax payments

Calculate the monthly amount you pay for estimated taxes by dividing the quarterly amount due on your Form 1040-ES by 3.

Term life insurance

Enter the amount you pay for term life insurance only. Do not include permanent policies with a cash value, such as whole life insurance. These should be listed in Section C.

Retirement

There are two sections: payments required by your employer and discretionary savings into your retirement plan.

Delinquent state and local taxes

Enter the minimum monthly payment. Be prepared to provide a copy of the statement showing the amount you owe and if applicable, any agreement you have for monthly payments.

Student loans

Minimum payments on student loans for the taxpayer’s post-secondary education may be allowed if they

are guaranteed by the federal government. Be prepared to provide proof of loan balance and payments.

Court-ordered payments, including child support and alimony

For any court ordered payments, be prepared to submit a copy of the court order portion showing the amount you are ordered to pay, the signatures, and proof you are making the payments.

Acceptable forms of proof are copies of cancelled checks or copies of bank or pay statements.

Other

The IRS may allow other expenses in certain circumstances.

For example, if the expenses are necessary for the health and welfare of the taxpayer or family, or for the production of income. Specify the expense and list the minimum monthly payment you are billed.

Signature

In the signature section, you (and your spouse, if applicable), will sign and date the form. Please note that this signature is made under penalty of perjury.

What is IRS Form 433-F?

IRS Form 433-F is a tax form that the IRS uses to obtain information about a taxpayer’s financial situation. The IRS then uses this information to determine how wage earners or self-employed individuals may satisfy an outstanding tax liability.

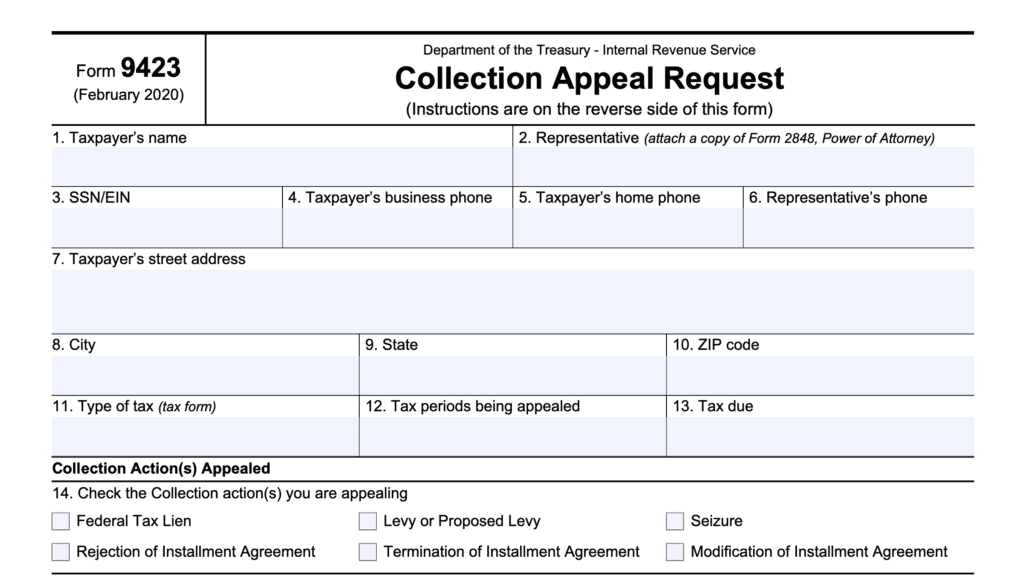

What is the difference between Form 433-F, Form 433-A, and Form 433-B?

There are actually 3 different tax forms named Collection Information Statement:

- IRS Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals

- IRS Form 433-B, Collection Information Statement for Businesses

- IRS Form 433-F, Collection Information Statement

The primary difference between these three forms is that Form 433-F is the form taxpayers use when they are trying to set up a payment plan.

Conversely, IRS Forms 433-A and 433-B are the forms taxpayers use when they owe the IRS back taxes they cannot pay and are seeking tax relief through an Offer In Compromise. Because the offer-in-compromise seeks to completely erase some or all of the federal income tax debt, it requires a more in-depth financial statement than what Form 433-F provides.

Taxpayers may also use IRS Form 433-F when applying for uncollectible status.

When Do I Need To Complete IRS Form 433-F?

Usually, the IRS revenue officer involved in your case will let you know if you need to complete this tax form with your installment request. Not all installment requests require a full financial statement.

However, if you’re considering an installment agreement request, you may expect to file Form 433-F in the following situations:

- If your outstanding balance (as noted on Line 9 of Form 9465) is greater than $50,000.

- This does not include any lump sum payments you make when you submit the installation agreement request. Your balance must be below $50,000 after you’ve completed the down payment to avoid filing the collection information statement.

- If you cannot afford to make the minimum monthly payment required to pay down your tax debt within 6 years (72 months).

- If Line 11a is greater than Line 10 on your Form 9465

- If your balance is between $25,000 and $50,000, you may not have to complete Form 433-F if you agree to one of the following:

- Payment by direct debit from one of your bank accounts, or

- Payroll deduction by filing IRS Form 2159

If your tax debt is between $25,000 and $50,000 but you do not agree to either direct debit or payroll deduction, then you must complete this form.

Video walkthrough

Watch this instructional video that walks you through the collection information statement.

Frequently asked questions

If you’re working with a revenue officer, he or she will generally let you know when Form 433-F is needed. Generally, you can expect to file this form if your outstanding tax debt is greater than $50,000 or if you cannot complete your installment plan within 72 months. If your debt is between $25,000 and $50,000, you may have to complete this form if you do not have tax payments automatically scheduled.

Formally known as “currently not collectible,” or CNC status, this simply means that the IRS has evaluated a taxpayer’s financial status and determined that the taxpayer cannot pay both its outstanding tax liabilities and monthly living expenses. However, CNC status does not forgive tax debt. In fact, while an account is in CNC status, penalties and interest may continue to accrue.

Where can I find IRS Form 433-F?

You may download a PDF version of this form from the IRS website or by selecting the file below.