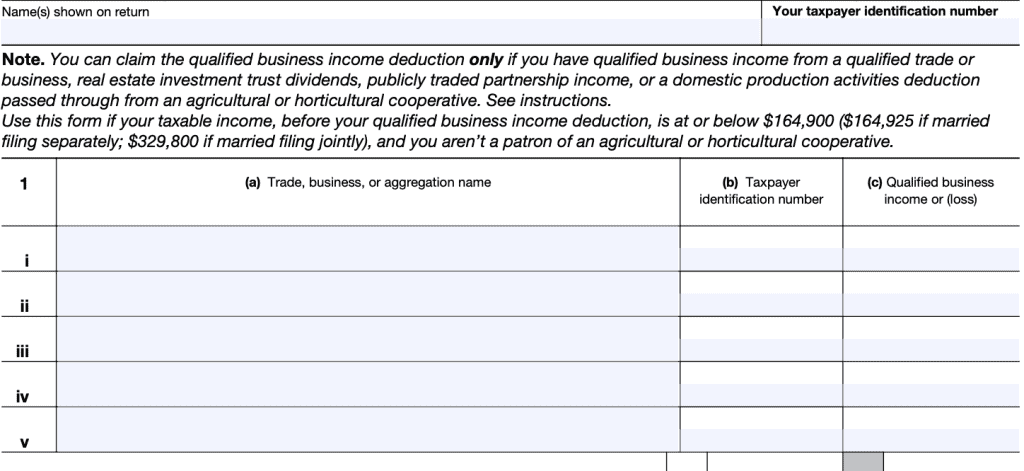

IRS Form 8995 Instructions

In 2018, the Tax Cuts and Jobs Act (TCJA) introduced a new type of tax deduction for businesses operating as pass-through entities: the qualified business income deduction, or QBI. This article walks you through how to use IRS Form 8995 to determine:

- Whether you are eligible to take the QBI deduction on your federal income tax return

- Any limits on your QBI deduction

- How to calculate the amount of your QBI deduction

Let’s start by going over how to complete IRS Form 8995, step by step.

Table of contents

How do I complete IRS Form 8995?

We’ll walk through the simplified version of this form, step by step. To make things easier, we’ve broken down this one-page form into two sections, top and bottom.

Top section

The top section contains the following:

Taxpayer name

Enter your full name, as shown on the tax return.

Taxpayer identification number

Enter your tax ID number, normally your Social Security number.

Line 1

Line one contains the following information for each

- Qualified trade or business you receive income from

- Real estate investment trust (REIT) for which you receive dividend income

- Publicly traded partnership for which you receive income

For each source of QBI, you’ll enter:

- Name of the trade or business.

- Employer identification number (EIN) for the business

- Amount of QBI or qualified business loss

If you aggregated trade or businesses into a single business, enter the aggregation name. Also, you must complete Schedule B (Form 8995-A) or similar schedule and attach it.

Real estate investors engaged in the rental of real property may rely on the safe harbor contained in Rev. Proc. 2019-38. In this case, enter each enterprise as identified on the statement required for use on the safe harbor. For example, Enterprise 1, 2, 3, etc.

Enter on Line 1(b) the employer identification number (EIN). If you don’t have an EIN, enter your Social Security number (SSN) or individual taxpayer identification number (ITIN).

For taxpayers who are the sole owner of an LLC treated as a disregarded entity for federal income tax purposes, enter the EIN given to the LLC.

If you don’t have an EIN, enter the owner’s name and TIN.

Enter on line 1(c) the net QBI or (loss) for the trade, business, or aggregation reported in the corresponding row. Do not include here:

- Any losses or deductions suspended from use in calculating taxable income in the current year or

- Any portion of qualified losses or deductions previously suspended by other Code provisions that are allowed in calculating taxable income in the current year.

Bottom section

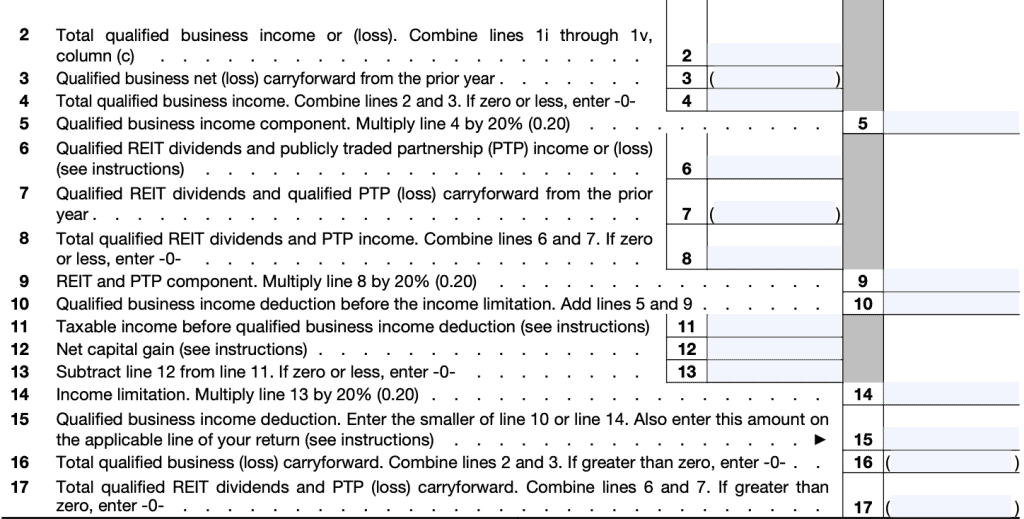

The bottom section contains the rest of the form, Lines 2 through 17. Let’s go through each of them.

Line 2: Total qualified business income or (loss)

Combine Lines 1i through 1v, Column c. Enter the total under Line 2.

If you have more than 5 trades or businesses with QBI, you’ll need to attach a statement with the name and TIN of the trade(s) or business(es). Include the income and loss from those trade(s) or business(es) in the total for Line 2.

Line 3: Qualified business net (loss) carryforward from the prior year

You should find this number on Line 16 of the previous year’s Form 8995.

Line 4: Total qualified business income

Combine Lines 2 and 3.

If zero or less, enter ‘0.’ Also, unless you have qualified REIT dividends and PTP income, your net loss must be carried forward to subsequent years.

Line 5: Qualified business income component

Multiply Line 4 by 20%. 20% is the maximum percentage of pass-through income that you may take as a QBI deduction.

Line 6: Qualified REIT dividends and PTP income (or loss)

Enter income as a positive number and losses as a negative number.

Line 7: Qualified REIT dividends and PTP income (loss) carryforward

You may find this on the prior tax year’s return:

- Form 8995: Line 17

- Form 8995-A: Line 40

Line 8: Total qualified REIT dividends and PTP income

Combine Lines 6 and 7. If zero or less, enter ‘0.’ Any negative amount will be carried forward to next year.

Line 9: REIT & PTP component

Multiply Line 8 by 20%.

Line 10: QBI deduction before income limitation

Add Lines 5 and 9. This represents the total possible deduction from qualified trade or business, REIT dividends, and PTP income.

Line 11: Taxable income before QBI deduction

This represents one of the following:

- Form 1040, 1040-SR, or 1040-NR filers: Line 11 minus Line 12c.

- Form 1041 filers: Form 1041, Line 23, plus Form 1041, Line 20.

- Form 1041-N filers: Form 1041-N, Line 13, plus qualified income deduction reported on Form 1041-N, Line 9.

In most circumstances, your tax preparation software will carry these fields over from other forms.

Line 12: Net capital gain

This field requires you to record the total capital gains from your other forms. Here’s how you would do that.

- Form 1040, 1040-SR, or 1040-NR, Line 3a, plus your net capital gain.

- If you’re not required to file IRS Schedule D (Form 1040), your net capital gain is the amount reported on Form 1040, 1040-SR, or 1040-NR, line 7.

- If you file Schedule D (Form 1040), your net capital gain is the smaller of:

- Line 15 or

- Line 16, unless line 15 or 16 is zero or less, in which case nothing is added to the qualified dividends.

- Form 1041, Line 2b(2), plus your net capital gain.

- For estates or trusts required to file Schedule D (Form 1041), add the qualified dividends to the smaller of:

- Line 18a(2) or

- Line 19(2), unless either line 18a(2) or 19(2) is zero or less, in which case nothing is added to the qualified dividends.

- For estates or trusts required to file Schedule D (Form 1041), add the qualified dividends to the smaller of:

- Form 1041-N, Line 2b, plus the smaller of:

- Schedule D, Line 10 or

- Schedule D, Line 11, unless line 10 or 11 is zero or less, in which case nothing is added to the qualified dividends.

Line 13

Subtract Line 12 from Line 11. If zero or less, enter ‘0.’

Line 14: Income Limitation

Multiply Line 13 by 20%.

Line 15: Qualified business income deduction

Enter the smaller of:

- Line 10

- Line 14

This number also goes on one of the following lines of your respective tax return:

- Form 1040 or Form 1040-SR: Line 13

- Form 1040-NR, Line 13a

- Form 1041, Line 20

- Form 1041-N, Line 9

Line 16: Total Qualified Business Loss carryforward

Combine Lines 2 and 3. If zero or less, enter ‘0.’ Carry this amount forward to next year’s tax return to offset future QBI.

Line 17: Total qualified REIT dividends and PTP (loss) carryforward.

Combine Lines 6 and 7.

If the amount is more than zero, the loss must be carried forward to next year. This amount will offset REIT dividends and PTP income in later tax years.

What is IRS Form 8995?

IRS Form 8995 is the tax form that taxpayers use to determine the amount of their QBI deduction.

There are actually two versions of this form:

- IRS Form 8995: Qualified Business Income Deduction Simplified Computation

- IRS Form 8995-A: Qualified Business Income Deduction

Who can use IRS Form 8995?

Taxpayers, including individuals, certain estates and trusts, may use the simplified form if:

- They have QBI, qualified REIT dividends, or qualified PTP income or loss

- For tax year 2022, their taxable income, before the QBI deduction, is no more than:

- $170,050 (single taxpayer)

- $170,050 (married couple filing separate return)

- $340,100 (married filing jointly)

- The taxpayer is not a patron of an agricultural or horticultural cooperative

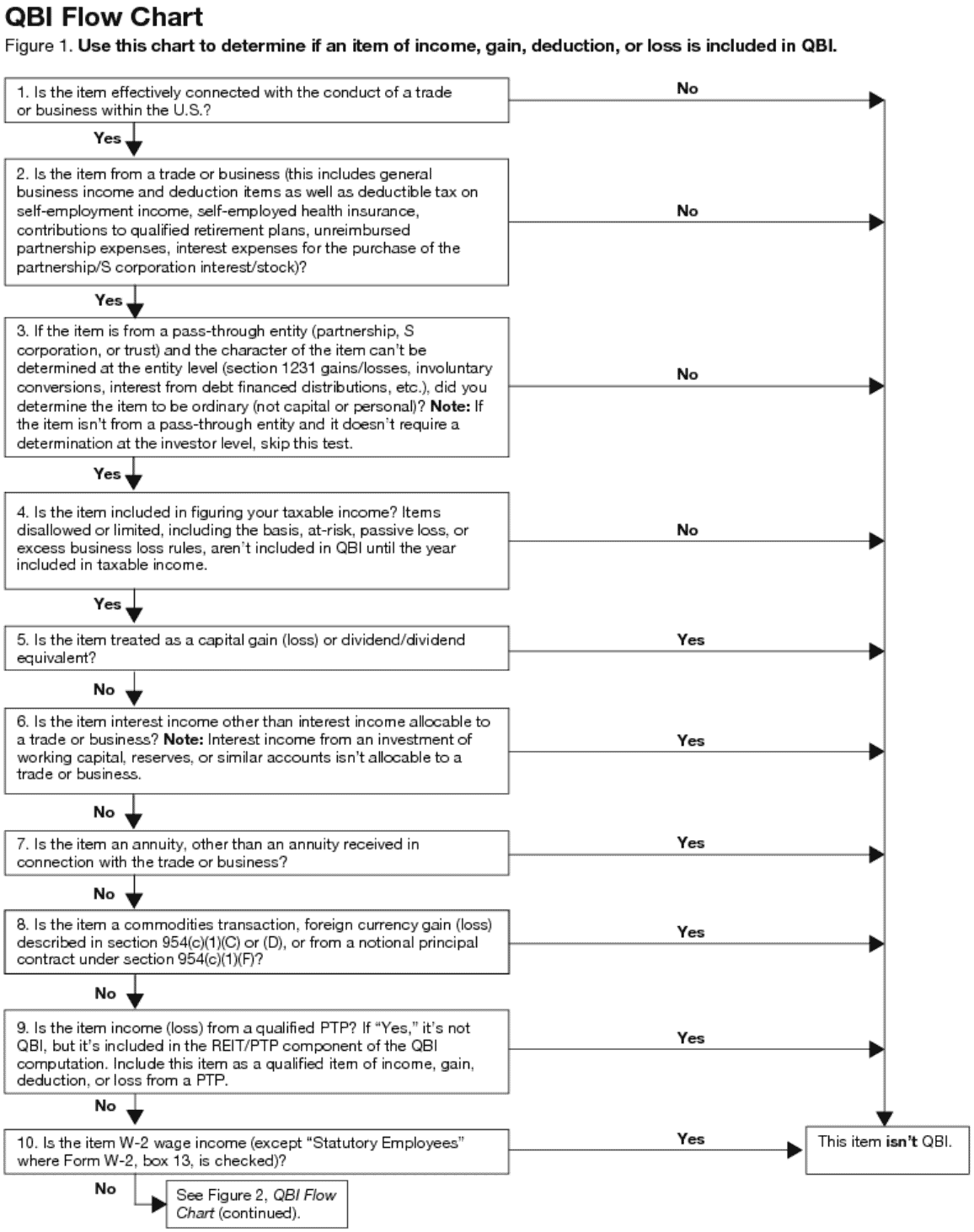

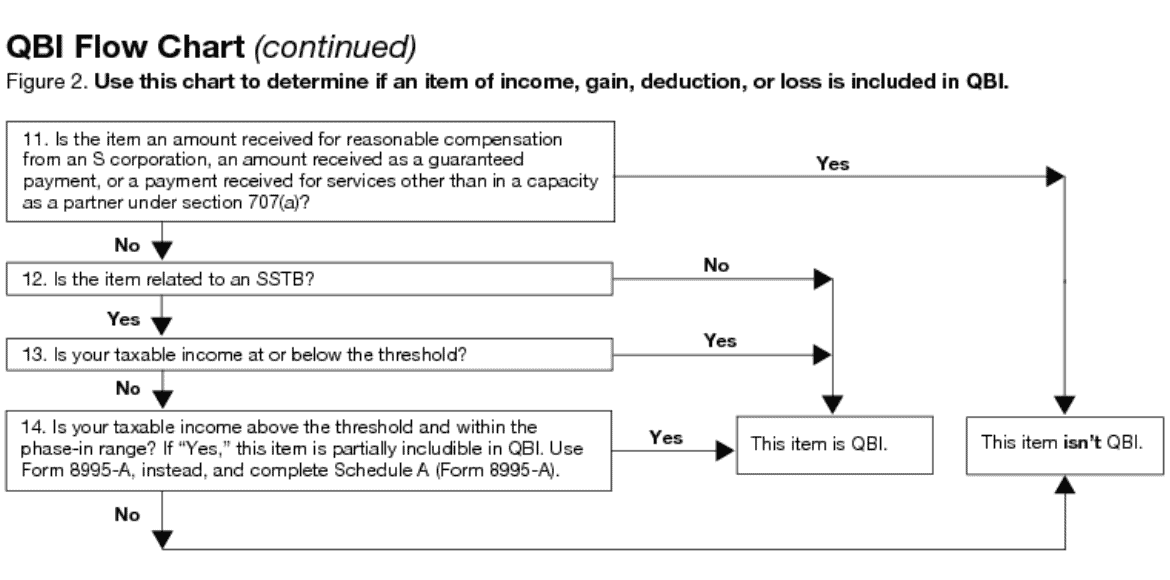

Watch this flowchart video to determine whether or not you can use IRS Form 8995 or IRS Form 8995-A to determine QBI:

All other taxpayers, including agricultural and horticultural cooperatives, must use IRS Form 8995-A.

QBI Terminology

As part of the TCJA, the tax code introduced some new definitions to help the Internal Revenue Service determine which taxpayers can take advantage of the QBI deduction.

Before going too far into the form itself, it’s important to understand some basic terms to help better understand the QBI deduction.

What is a pass-through entity?

A pass-through entity is any corporate structure that passes on its income and losses onto its owners. The owners then report their share of the income or loss on their individual income tax return.

Examples of pass through entities include:

- Sole proprietorships

- S corporations

- Limited liability companies (LLCs)

- Partnerships: including general partnerships, limited partnerships, and limited liability partnerships (LLPs)

For purposes of the QBI deduction, pass through entities pass on each owner’s QBI share so each owner can record the deduction on their own tax return.

What is qualified business income?

Qualified business income, or QBI, includes qualified items of income, gain, deduction, and loss from your trades or businesses that are connected with the conduct of a trade or business in the United States.

According to the IRS website,

Individual taxpayers and some trusts and estates may be able to deduct up to 20% of their net QBI from a trade or business, including income from a pass-through entity, but not from a C corporation. Also, taxpayers may be able to deduct up to 20% of qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income.

However, your total QBI deduction is limited to 20% of your taxable income, calculated before the QBI deduction, minus net capital gain.

What are qualified REIT dividends?

Qualified REIT dividends include:

- Any dividends received from a REIT:

- Held for more than 45 days and

- For which the payment isn’t obligated to someone else and

- That isn’t a capital gain dividend or qualified dividend

- Plus your qualified REIT dividends received from a regulated investment company (RIC)

What is qualified PTP income?

Qualified PTP income or loss includes the taxpayer’s share of qualified items of income, gain, deduction, and loss from a publicly traded partnership (PTP). This may also include gain or loss recognized on the disposition of your partnership interest that isn’t treated as a capital gain or loss.

What is a qualified trade or business?

A qualified trade or business include is one in which the taxpayer qualifies for a deduction of ordinary and necessary business expenses under IRC Section 162. Generally speaking, specified service trades or businesses are not considered qualified trades or businesses.

What is a specified service trade or business?

A specified service trade or business (SSTB) is any business operating in the fields of:

- Health

- Law

- Accounting

- Actuarial science

- Performing arts

- Consulting

- Athletics

- Financial services

- Brokerage services

- Investing and investment management

- Trading or dealing in securities, partnership interests, commodities; or

- Any trade or business where the principal asset is the reputation or skill of one or more employees or owners as demonstrated by:

- Receiving fees, compensation, or other income for endorsing products or services

- Licensing or receiving fees, compensation, or other income for the use of taxpayer’s image, likeness, name, signature, trademark, or other symbols associated with the individual’s identity, or

- Receiving fees, compensation, or other income for appearing at an event or on radio, television or other media format

Generally, since SSTBs are not qualified trades or businesses, they are not eligible for QBI deduction. There a two exceptions:

Exception 1

In calendar year 2022, if your taxable income before the QBI deduction is less than or equal to:

- $170,050 if single, head of household, qualifying widow(er), or are a trust or estate,

- $170,050 if married filing separately, or

- $340,100 if married filing jointly,

then your SSTB is treated as a qualified trade or business, and you can deduct QBI from your income. You may use Form 8995 to calculate your QBI deduction.

Exception 2

If your 2022 taxable income before the QBI deduction is less than or equal to:

- $220,050 if single, head of household, qualifying widow(er), or are a trust or estate,

- $220,050 if married filing separately, or

- $440,100 if married filing jointly,

then your SSTB may be eligible for a partial QBI deduction. However, you must use Form 8995-A to calculate your QBI deduction.

How do I determine what is QBI and what is not QBI?

Fortunately, the IRS gives some guidance, in the form of a flowchart, that helps taxpayers determine when an item of income is QBI, and when that item of income is not QBI.

Video walkthrough

Watch this instructional video to learn more about how to complete IRS Form 8995 and claim the QBI deduction.

IRS Form 8995 Frequently Asked Questions

Taxpayers file IRS Form 8995 with their federal income tax return. This form should accompany the taxpayer’s return as well as any additional worksheets or documentation.

IRS Form 8995 is due at the same time as the taxpayer’s income tax return, including extensions.

Taxpayers may file IRS Form 8995 if they

-Have QBI, qualified REIT dividends, or qualified PTP income or loss; and

-Have taxable income (before QBI deduction) of less than or equal to:

-Married taxpayers filing jointly: $340,100

-All other tax filing statuses: $170,050; and

-Are not a patron in a specified agricultural or horticultural cooperative.

Any taxpayer not meeting this criteria must file IRS Form 8995-A.

Where can I find a copy of IRS Form 8995?

You may find a copy of this form on the IRS website. For your convenience, we’ve enclosed the latest version of the form below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!