IRS Form 2439 Instructions

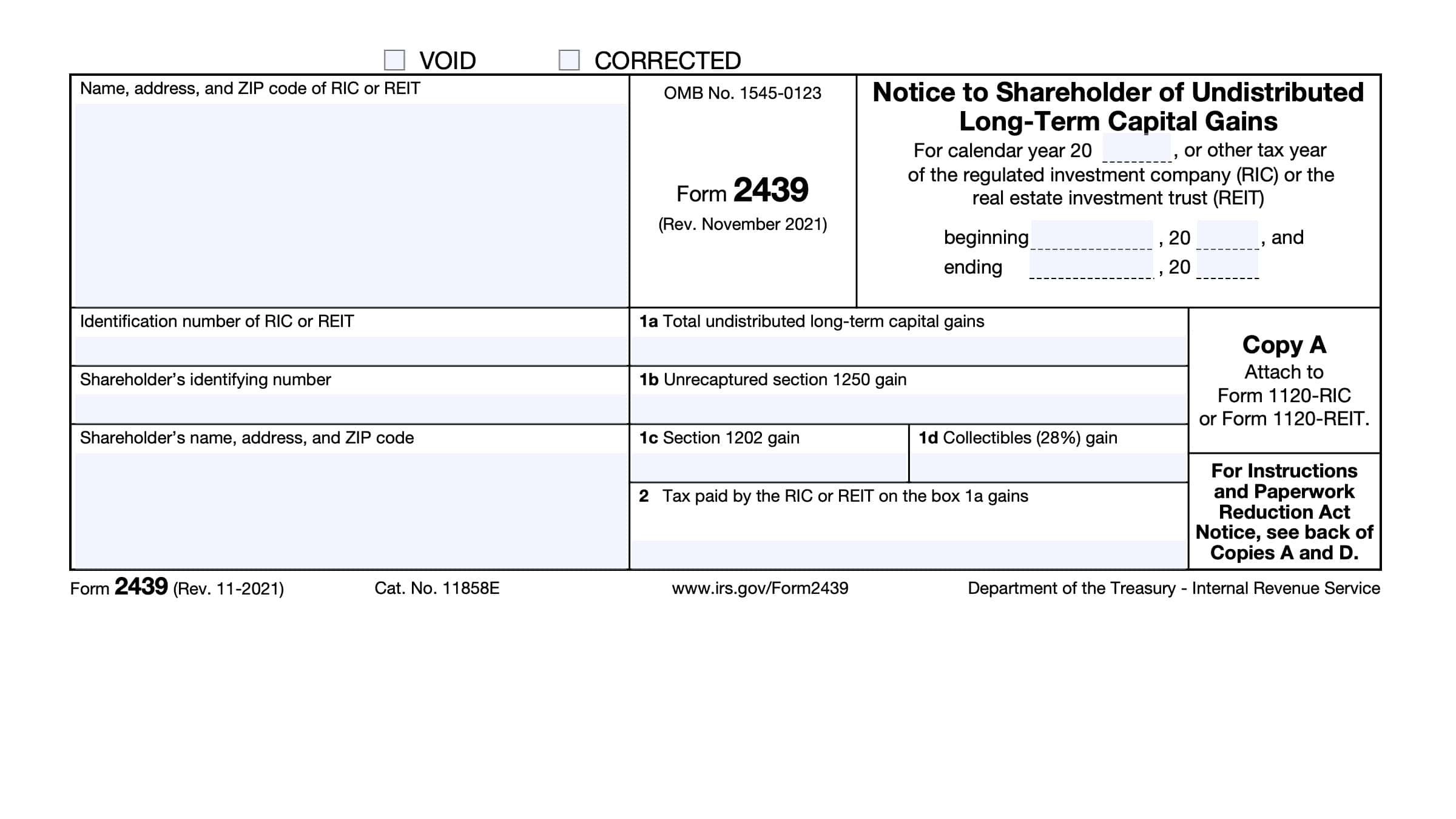

Registered investment companies (RICs) and real estate investment trusts (REITs) are required by federal law to report certain tax information on behalf of shareholders each year. For reporting undistributed long-term capital gains, fund companies and trusts must report certain information on IRS Form 2439, Notice to Shareholder of Undistributed Long-Term Capital Gains.

In this article, we’ll go over the information taxpayers must know about IRS Form 2439, including:

- Tax information you can expect to see on IRS Form 2439

- Reporting obligations that RICs and REITs have to the Internal Revenue Service and to shareholders

- How shareholders should report this tax information when filing their income tax returns

Let’s start by taking a closer look at IRS Form 2439.

Table of contents

IRS Form 2439 Instructions

Even if you are the recipient of this form, it’s important to understand how this form works from the perspective of the regulated investment company (RIC) or the real estate investment trust (REIT). That way, you can better understand how to report this tax information when you file your income tax return.

There are 4 identical copies of IRS Form 2439:

- Copy A: The RIC or REIT will attach Copy A of all Form 2439 to their Form 1120-RIC or Form 1120-REIT when it is filed at the appropriate IRS service center

- Copy B: Given to the account owner to attach to their federal income tax returns

- Copy C: Given to the accountholder for their records

- Copy D: Kept by the RIC or REIT for their records

Let’s go over this form in more depth. As we go through each section of the form, we’ll go over the IRS instructions for the RIC or REIT, then we’ll review the IRS expectations for shareholders.

Left side of the form

Let’s start with the information on the left-hand side of the form.

RIC or REIT information

In the top left corner, you’ll see the RIC’s name or REIT’s name, address, and zip code. Just below that, you’ll see the entity’s employer identification number. This will be identical to the tax information that the RIC or REIT reports when filing IRS Form 2438, Undistributed Capital Gains Tax Return.

Shareholder information

Below the RIC or REIT’s information, you should see the shareholder’s identifying number, name and address.

For individuals, the identifying number should be the taxpayer’s Social Security number (SSN). For individual retirement accounts (IRAs), this will be the identification number of the IRA, not necessarily the IRA holder’s SSN.

If the shareholder is not an individual or IRA, then the identifying number will be the employer identification number, or EIN.

Shareholder’s note: The IRS allows the RIC or REIT to truncate the identifying number on shareholder copies of the form. However, the RIC or REIT cannot truncate this number on Copy A, which is sent to the IRS, nor can they truncate their own EIN on any version of the form.

If truncated, you will see the first 5 digits of the 9-digit number replaced with asterisks or Xs. Treasury Regulations Section 301.6109-4 contains additional information.

Right side of the form

On the right hand side, you’ll see the following:

- Tax year information

- Capital gains information

- Taxes paid on undistributed long-term capital gains

Let’s start with what shareholders should know about tax year information.

Tax year information

In the top right-hand corner, you’ll notice dates for the calendar year or other tax year used by the RIC or REIT.

Shareholder’s note: The RIC or REIT is required to furnish all shareholders Copies B and C by the 60th day following the end of the year for which they are reporting tax information.

Box 1a: Total undistributed long-term capital gains

The RIC or REIT will enter the amount of undistributed capital gains from Line 11 on IRS Form 2438, each shareholder’s allocable share.

Shareholder’s note: This amount is the total undistributed long-term capital gain from your RIC or REIT. You’ll need to report the total amount as a long-term capital gain on the appropriate Schedule D.

Individual investors will report this amount on Line 11, Column (h) of their Schedule D of IRS Form 1040.

Estates & Trusts will report this amount on IRS Form 1041, Schedule D.

Corporate shareholders will report these long-term gains on IRS Form 8949, Sales and Other Dispositions of Capital Assets.

Box 1b: Total unrecaptured Section 1250 gain

The RIC or REIT will enter the shareholder’s allocable portion of the amount from Box 1a that has been designated as unrecaptured Section 1250 gain from the disposition of depreciable real property.

Shareholder’s note: Individual filers will report this amount on Line 11 of the Schedule D Unrecaptured Section 1250 gain worksheet when filing Form 1040.

Estates and trusts will report this amount in the Unrecaptured Section 1250 Gain worksheet of Schedule D for their Form 1041.

Box 1c: Section 1202 gain

The Section 1202 gain is the portion of Box 1a that is attributable to the sale or exchange by the RIC of qualified small business stock that was:

- Issued after August 10, 1993, and

- Held for more than 5 years

The RIC should also attach a statement that separately reports the following information:

- Amount of Section 1202 gain

- Name of the corporation that issued the qualified stock

- Dates on which the RIC acquired and sold the stock

- Shareholder’s portion of the RIC’s adjusted basis

- Sales price of the stock

Shareholder note: Taxpayers should refer to the instructions for the Exclusion of Gain on Qualified Small Business (QSB) Stock. You’ll find this in Schedule D of your respective Form 1040 or Form 1041.

Box 1d: Collectibles (28%) gain

Collectibles are subject to a 28% capital gains tax rate. The RIC will enter the shareholder’s allocable portion of the amount from Box 1a attributable to collectibles gain. The RIC should not include any Section 1202 gain in Box 1d.

Shareholder note: Taxpayers should enter this amount on Line 4, or the applicable line, of the 28% Rate Gain Worksheet on Schedule D for Form 1040 or Form 1041.

Box 2: Tax paid by the RIC or REIT on box 1a gains

In Box 2, the RIC or REIT will enter the total tax they paid, based upon the undistributed capital gain information reported in Box 1a.

Shareholder note: This amount is the tax paid by the RIC or REIT on the undistributed long-term capital gains shown in Box 1a. In the next section, we’ll show taxpayers how they can apply for a refund or a tax credit.

Additional shareholder instructions

There are additional instructions for shareholders who are looking to apply for a refund of income tax paid, or a tax credit for the undistributed capital gains reported in Box 1a.

Individuals, nonresident aliens, estates, and trusts

For IRS Form 1040 filers, report this information in Line 13a of Schedule 3, Additional Credits & Payments. This line is in Part II, which reports other tax payments and refundable credits.

Form 1041 filers will report this information on Line 16a, Schedule G of their tax return.

Corporations (besides S corporations)

Corporations based in the United States reporting on IRS Form 1120 will report this information on Line 20a of Schedule J.

Foreign corporations should report this on Line 5f of Form 1120-F.

All other corporations report this amount on the line designated as “Credit for tax paid on undistributed capital gains.”

S corporations and partnerships

S corporations and partnerships should refer to the appropriate information section of their form instructions for both Schedules K (Shareholders’ Pro Rata Share Items) and Schedule K-1 (Shareholder’s Share of Income, Deductions, Credits, etc.):

- S corporations: IRS Form 1120-S

- Partnerships: IRS Form 1065

Schedule K contains a summary of the pro rata share of each line for all shareholders.

Conversely, Schedule K-1 reports each shareholder’s actual income, tax deductions, tax credits, and more.

Tax exempt organizations and certain trustees

See the Instructions for Form 990-T if it is filed by:

- Organizations exempt from tax under Internal Revenue Code Section 501(a) filing Form 990-T to claim their refund of income tax paid on undistributed long-term capital gains, or

- Trustees for individual retirement arrangements (IRAs) described in IRC Section 408 filing a single composite Form 990-T to claim the income tax refund

- This includes custodial accounts as described in IRC Section 408(h)

Nominees

A nominee is not the actual owner of the shares for which IRS Form 2439 was issued. However, each nominee must do the following:

- Complete all copies of IRS Form 2439 for each owner.

- The amounts reported in each box must agree with the amounts on Copy B that the nominee received from the RIC or REIT.

- Write their name as ‘Nominee’ and their address in addition to the RIC’s or REIT’s name in the RIC or REIT information field at the top left corner of the form.

- Write ‘Nominee’ in the upper right corner of the Copy B received from the RIC or REIT

- Must be attached to the Copy A completed by the nominee

- File the Copy B received, along with attached Copy A, wit the U.S. Internal Revenue Service Center where the nominee normally files their tax return

- Give the actual owner copies B and C of the form that the nominee completed

- Copy D is to be maintained by the RIC or REIT

A nominee usually has 90 days after the close of the RIC’s or REIT’s tax year to complete items 1 through 5 above. However, this requirement may differ depending on the nominee’s status:

- Custodian of a unit investment trust described in IRC Section 851(f)(1): 70 days

- Resident of a foreign country: 150 days

Video walkthrough

Watch this instructional video to learn about the information you can expect to see as a shareholder of undistributed long-term capital gains when you receive IRS Form 2439.

Frequently asked questions

IRS Form 2439 provides shareholders of a regulated investment company (RIC) or a real estate investment trust (REIT) the amount of undistributed long-term capital gains.

A registered investment company (RIC) is any domestic company that acts as an agent on behalf of its shareholders. Real estate investment trusts (REITS), unit investment trusts (UITs) and mutual funds are examples of registered investment companies.

Where can I find IRS Form 2439?

You may find a copy of this tax form on the IRS website. For your convenience, we’ve attached the most recent version of this form to this article.

Related tax forms

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!