IRS Form 4255 Instructions

The investment credit allows business owners to lower their tax bill by taking a tax credit against the costs of certain qualifying property. However, if the business sells or disposes of that property too early, then they may need to pay recapture that credit and pay income tax. Businesses do this by filing IRS Form 4255, Recapture of Investment Credit.

In this article, we’ll walk through this tax form, including:

- Conditions when you need to recapture investment credit

- How to calculate investment credit recapture

- How to file IRS Form 4255

Let’s start with a step-by-step walkthrough of this tax form.

Table of contents

How do I complete IRS Form 4255?

This one-page tax form contains 3 parts:

- Part I: Original Investment Credit

- Part II: Recapture From Increase in Nonqualified Nonrecourse Financing

- Part III: Recapture from Disposition of Property or Cessation of Use as Investment Credit Property

Before we go to Part I, let’s start at the top.

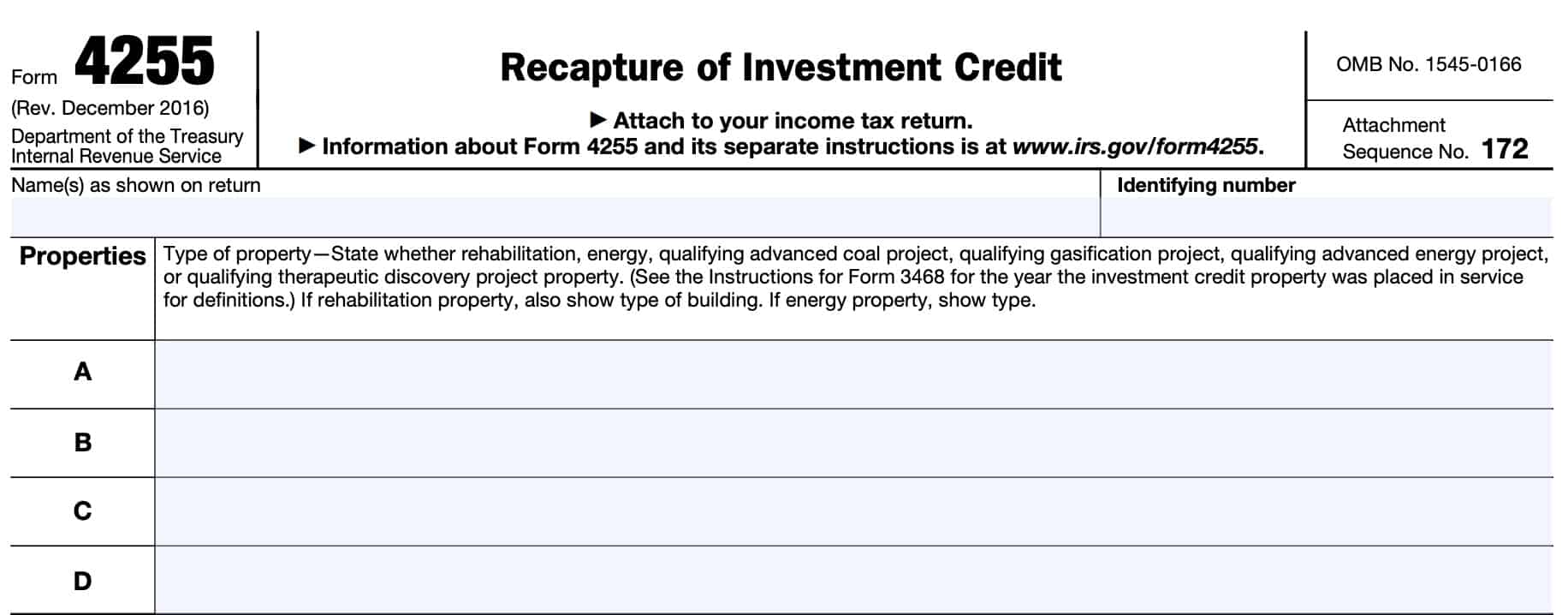

Top of the form

At the top of the form, enter the taxpayer’s name and identifying number, as shown on the income tax return. The identifying number can be any of the following:

- Social Security number (SSN)

- Individual taxpayer identification number (ITIN)

- Employer identification number (EIN)

Below the taxpayer information fields, enter up to 4 types of property for which you are recalculating the investment tax credit. If you need to list more than 4 properties, you may use another Form 4255 or a similar statement that shows all the information required in Form 4255.

For each investment credit property, you must state the type of property from the following:

- Rehabilitation

- Must show type of building

- Energy

- Indicate the type of energy property

- Qualifying advanced coal project

- Qualifying gasification project

- Qualifying advanced energy project

- Qualifying therapeutic discovery project

Eventually, you will enter the totals from all statements on Line 17 & Line 18. Let’s complete Part I by calculating the original investment tax credit.

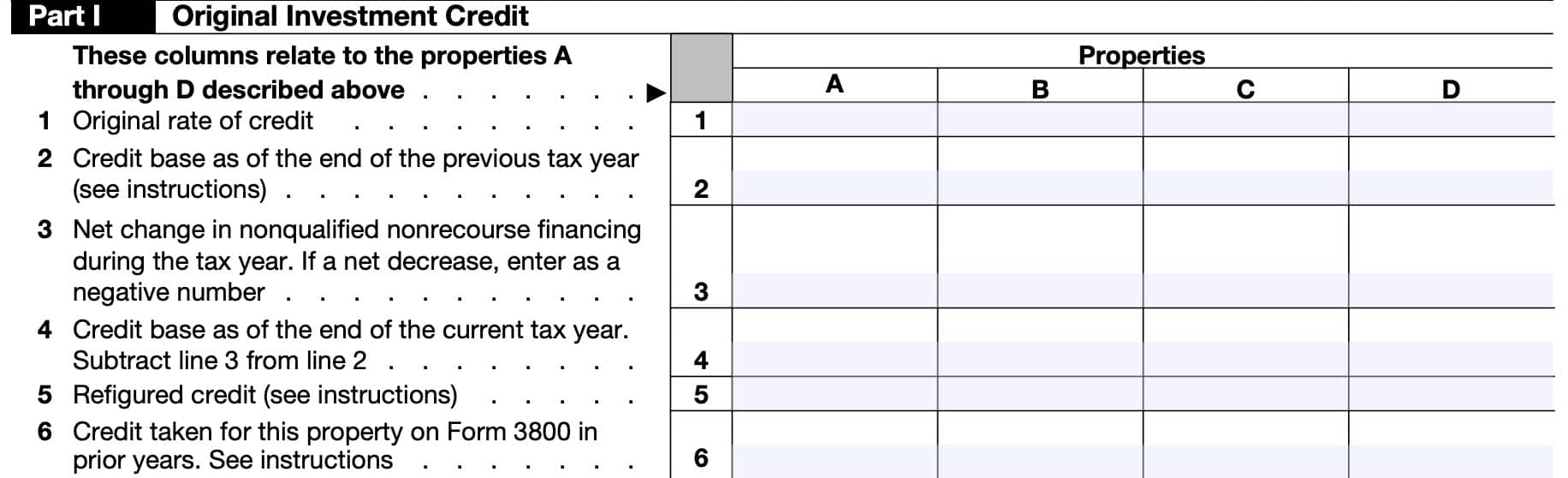

Part I: Original Investment Credit

Let’s start with a recomputation of the original credit. For each property listed above, use the appropriate column.

Line 1: Original rate of credit

Enter the rate you used to figure the original credit from the IRS Form 3468 that you previously filed.

For combined heat and power system property, enter the effective rate used to figure the original credit, taking into account the limit under Internal Revenue Code Section 48(c)(3)(B).

Line 2: Credit base as of the end of the previous tax year

Enter the energy credit base that you used to calculate the tax credit. This can be adjusted cost basis or other basis.

If IRC Section 49(a)(1) at-risk rules applied to the property and there was a net increase in nonqualified nonrecourse financing with respect to the property in previous tax years, then

- Enter the credit base you used to figure the original credit,

- Reduced by the amount of that net increase

If there was a net decrease in nonqualified nonrecourse financing with respect to the property in previous tax years,

- Enter the credit base you used to figure the original credit,

- Increased by the amount of that net decrease

Line 3: Net change in nonqualified nonrecourse financing during the tax year

If Section 49(a)(1) did not apply to the property, enter -0-.

If Section 49(a)(1) applied to the property, enter the net change in nonqualified nonrecourse financing related to the property during the tax year:

- Enter a net increase as a positive number

- Enter a net decrease as a negative number

Line 4: Credit base as of the end of the current tax year

Subtract Line 3 from Line 2. The result is the energy credit base as of the end of the current year.

If Line 3 is a negative number, then Line 4 may be larger than Line 2.

Line 5: Refigured credit

If the amount of the credit for the property for which you must refigure the credit was limited to a specific dollar amount, do not enter more than the amount of the applicable limit on Line 5.

For example, Section 48(c)(1)(B) contains a kilowatt limit for qualified fuel cell property ($1,500 per 1/2 kilowatt. Your maximum credit cannot exceed the dollar limit contained in the statute.

Line 6: Credit taken for this property on Form 3800 in prior years

Enter the total of all credits taken for the property, as general business credits on IRS Form 3800 in previous years.

However, do not include the amount of any credit previously recaptured due to an increase in nonqualified nonrecourse financing.

Part II: Recapture from Increase in Nonqualified Nonrecourse Financing

In Part II, we’ll figure any increase in tax for the recapture of an investment tax credit under IRC Section 49.

Generally, Section 49(a)(1) applies to property:

- Placed in service by individuals or certain closely held corporations during a tax year in which they were engaged in activities described in IRC Section 465, and

- Used in connection with an activity subject to the at-risk limitations under IRC Section 465.

The credit base of this property for investment credit purposes may be limited if:

- You borrowed against the property and are protected against loss, or

- You borrowed money from a person who is related or who has an interest (other than as a creditor) in the business activity.

You must reduce the credit base by the amount of any nonqualified nonrecourse financing related to the property at the end of the tax year. The changes may result in an increased credit or a recapture of the credit in the year of the change.

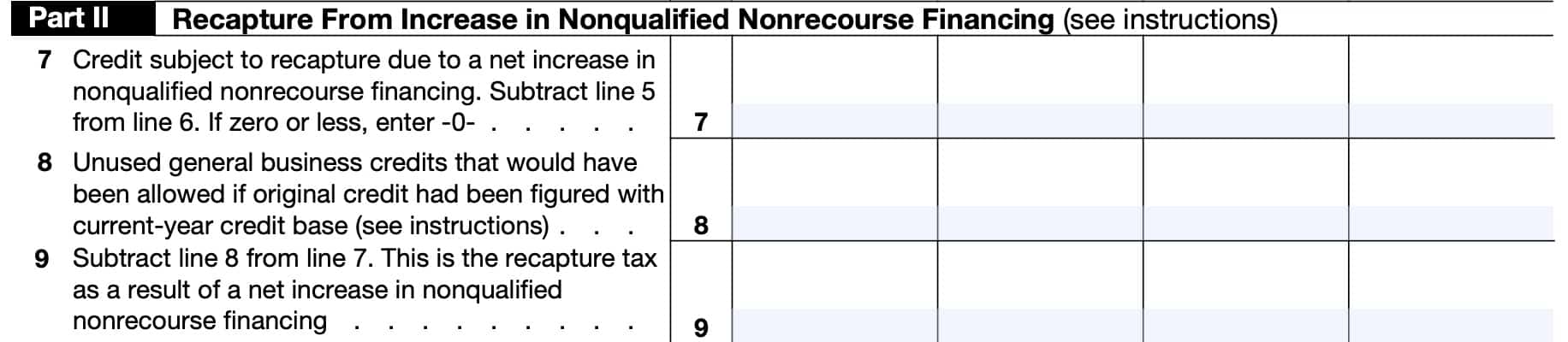

Line 7: Credit subject to recapture due to a net increase in nonqualified nonrecourse financing

Subtract Line 5 from Line 6. The result is a project credit subject to recapture.

If the result is zero or a negative number, enter ‘0.’

Line 8: Unused general business credits that would have been allowed

For Line 8, we’ll calculate the amount of general business credits that became unused credit because the investment credit was used to reduce taxable income instead.

If you had figured the original credit using the current-year tax base in the year the property was first placed in service, you may have been able to use other general business credits instead.

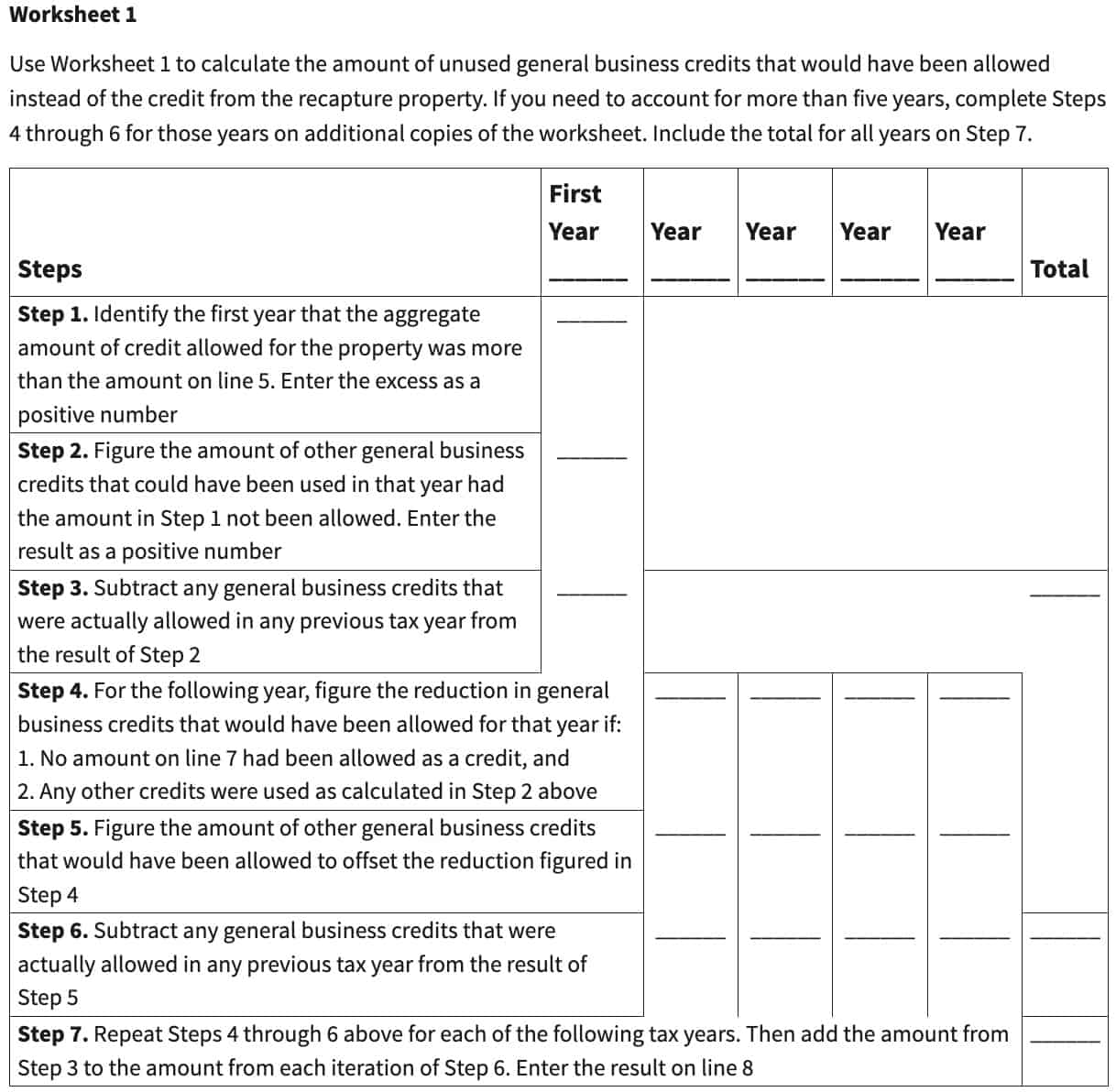

You can use Worksheet 1 from the Form 4255 instructions to calculate these general business credits or follow these instructions:

Step 1. Identify the first tax year that the aggregate amount of credit allowed for the property was more than the amount on Line 5. Enter the excess as a positive number.

Step 2. Figure the amount of other general business credits that you could have used if you had not used the amount in Step 1. Enter this as a positive number.

Step 3. Subtract general business credits actually allowed in a prior year from Step 2.

Step 4. For the following year, enter the reduction in general business credits that would have been allowed if:

- No amount from Line 7 had been allowed as a federal tax credit

- You had used any other credits as calculated in Step 2.

Step 5. Figure the amount of other general business credits that would have been allowed to offset the reduction calculated in Step 4.

Step 6. Subtract any general business credits actually allowed in any previous tax year because of Step 5.

Step 7. Repeat Steps 4 through 6 for each of the following tax years.Add the result from Step 3 to each result at the end of Step 6. Enter the result on Line 8.

Line 9: Recapture tax

Subtract Line 8 from Line 7. The result is the recapture tax resulting from a net increase in nonqualified nonrecourse financing.

Part III: Recapture from Disposition of Property or Cessation of Use as Investment Credit Property

In Part III, we’ll figure any increase in tax for:

- Recapture of an investment tax credit or

- Recapture of a qualified therapeutic discovery grant under IRC Section 50

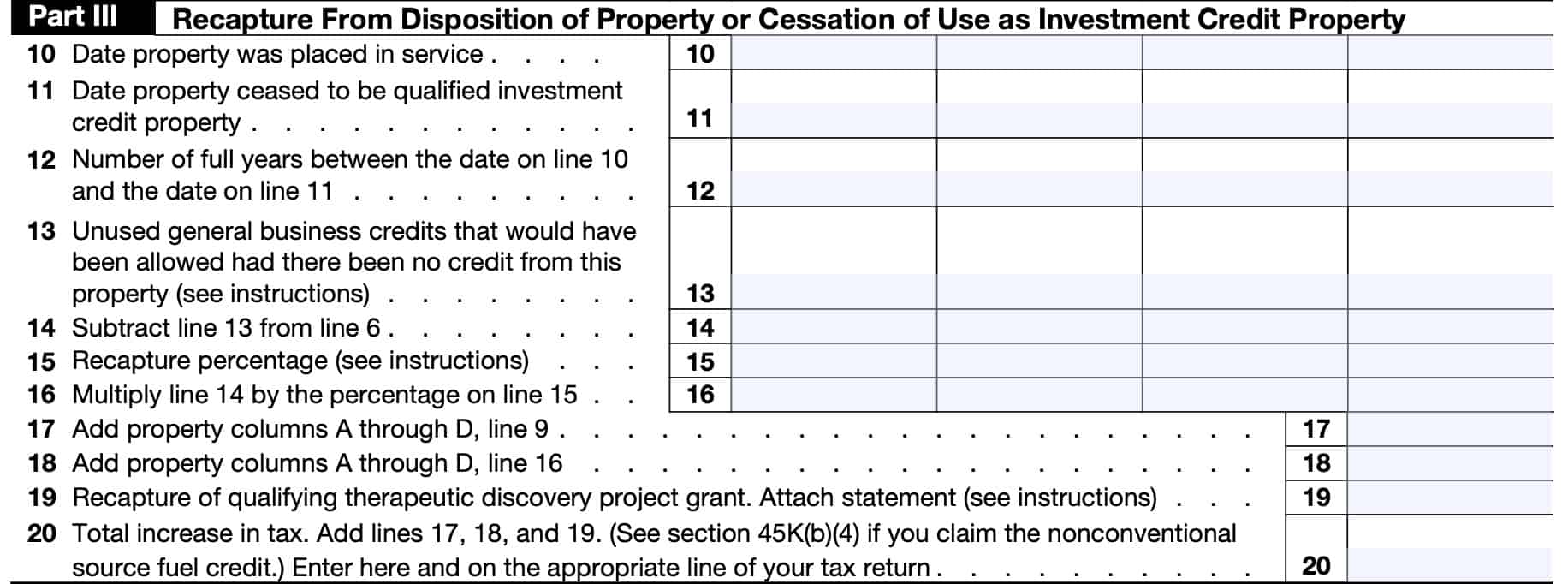

Line 10: Date property was placed in service

Enter the first day of the month that you placed the property into service, using mm/dd/yyyy format.

For example, if you placed a qualifying property into service on February 20, 2019, this entry would look like: 02/01/2019.

Treasury Regulations Section 1.47-1(c) contains more information.

Line 11: Date property ceased to be qualified investment property

Using the same format as Line 10, enter the date that the property ceased to be a qualified investment property. Generally, this is the date that you disposed of the property.

Line 12: Number of full years between date placed into service & taken out of service

Enter the number of full years the property was in service. Do not enter partial years.

If you held the property less than 12 months, enter .’0.’

In case of failure to attain or maintain the separation and sequestration requirements applicable to a Phase II or III gasification program or a Phase II or III advanced coal program, enter ‘0.’

If you received a grant under Section 1603 of the American Recovery and Reinvestment Act of 2009, enter .’0.’

Line 13: Unused general business credits that would have been allowed

In Line 13, you’ll calculate the amount of general business credit that you could have used if you did not use the recaptured project credit.

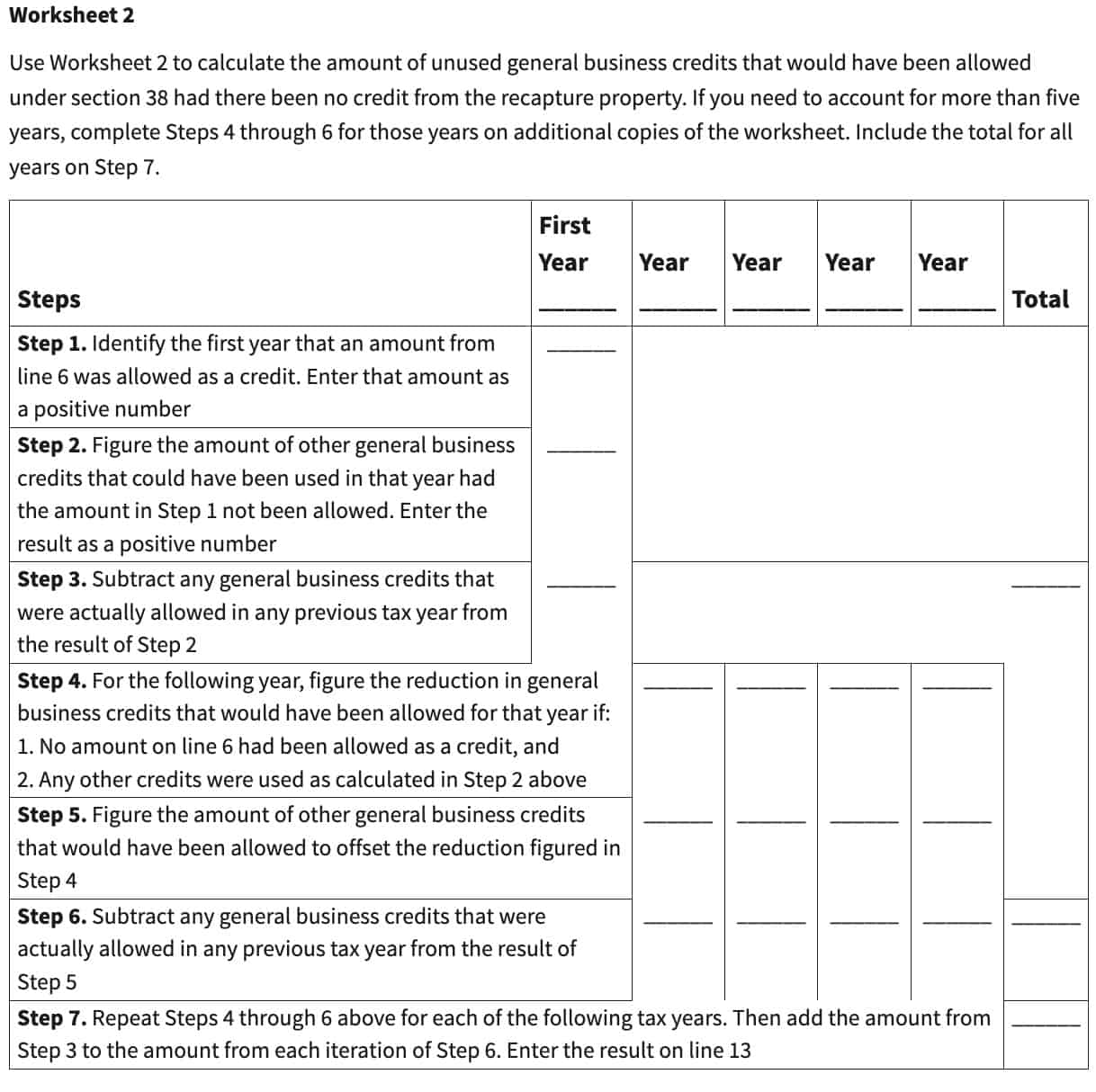

You can use Worksheet 2 from the Form 4255 instructions to calculate these general business credits or follow these instructions:

Step 1. Identify the first year that you used an amount from Line 6 as a tax credit. Enter that amount as a positive number.

Step 2. Figure the amount of other general business credits that you could have been used if you had not used the amount in Step 1. Enter this as a positive number.

Step 3. Subtract general business credits actually allowed in a prior year from Step 2.

Step 4. For the following year, enter the reduction in general business credits that would have been allowed if:

- No amount from Line 7 had been allowed as a federal tax credit

- You used any other credits as calculated in Step 2.

Step 5. Figure the amount of other general business credits that you could have used to offset the reduction calculated in Step 4.

Step 6. Subtract any general business credits actually allowed in any previous tax year because of Step 5.

Step 7. Repeat Steps 4 through 6 for each of the following tax years.Add the result from Step 3 to each result at the end of Step 6. Enter the result on Line 13.

Multiple recapture properties

If you are recapturing investment credits from multiple properties in Part III, complete Line 6 for each property before using Worksheet 2.

When you complete Worksheet 2, reapply any allowable investment credits as if you had not taken a credit for any of the properties.

Separately identify the amount of unused general business credits that could have been used instead of the recaptured credit from each property. If an unused general business credit could have been used instead of a recaptured credit from more than one property, apply the unused credit first to the property with the highest recapture percentage on Line 15.

When completing Step 7, add the amounts from Steps 3 and 6 separately by property and enter the results in the corresponding property column of Line 13.

Line 14

Line 15: Recapture percentage

Enter the appropriate percentage from the following table:

| Number of full years on Line 12 | Recapture percentage |

| 0 | 100% |

| 1 | 80 |

| 2 | 60 |

| 3 | 40 |

| 4 | 20 |

| 5 or more | 0 |

Line 16: Tentative recapture tax

Multiply the amount on Line 14 by the percentage on Line 15. The result is the recapture tax due to disposition or cessation of use as an investment credit property.

Line 17

For all properties, add the totals from Line 9, then enter the result here.

If you used separate statements to list additional properties, write to the left of the entry space “Tax from attached” and the total tax from the separate statements. Include the amounts from these statements in the totals for Line 17.

Line 18

For all properties, add the totals from Line 9, then enter the result here.

If you used separate statements to list additional properties, write to the left of the entry space “Tax from attached” and the total tax from the separate statements. Include the amounts from these statements in the totals for Line 18.

Line 19: Recapture of qualifying therapeutic discovery project grant

Enter the amount of any qualifying therapeutic discovery project credit or grant required to be recaptured under Section 9023(e) of the Affordable Care Act.

Do not complete lines 1 through 18 to figure this increase in tax. Attach a tax statement showing how you figured the increase in tax. Do not adjust the increase in tax for any unused investment credit.

If this is on behalf of a partnerships, S corporation, estate, trust, or other pass-through entity, then determine the increase in tax at the entity level. This amount will pass down to the entity owners as a tax credit recapture.

Line 20: Total increase in tax

Add the following:

Enter the total on the appropriate line of your tax return.

- Partnerships will enter the amount from Line 20 on Form 1065, Schedule K, Line 20c, using code H.

- S corporations will enter the result on Form 1120-S, Schedule K, Line 17d, using code G.

- Estates and trusts will enter the amount from Line 20 on Form 1041, Schedule G, Line 5.

Video walkthrough

Watch this instructional video to learn more about recapturing the investment credit using IRS Form 4255.

Frequently asked questions

Taxpayers use IRS Form 4255 to calculate the tax increase for the recapture of investment credit claimed and for the recapture of a qualifying therapeutic discovery project grant.

There are several exceptions to the recapture rule. If the property was transferred due to taxpayer death, divorce, within a trade or business, then generally recapture of the investment credit will not apply.

Taxpayers will enter the number from Line 20 in the appropriate schedule of their tax return and file Form 4255 with their tax return.

How do I find IRS Form 4255?

Like most tax forms, you may find IRS Form 4255 on the Internal Revenue Service website. For your convenience, we’ve attached the latest version as a PDF file in this article, just below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!