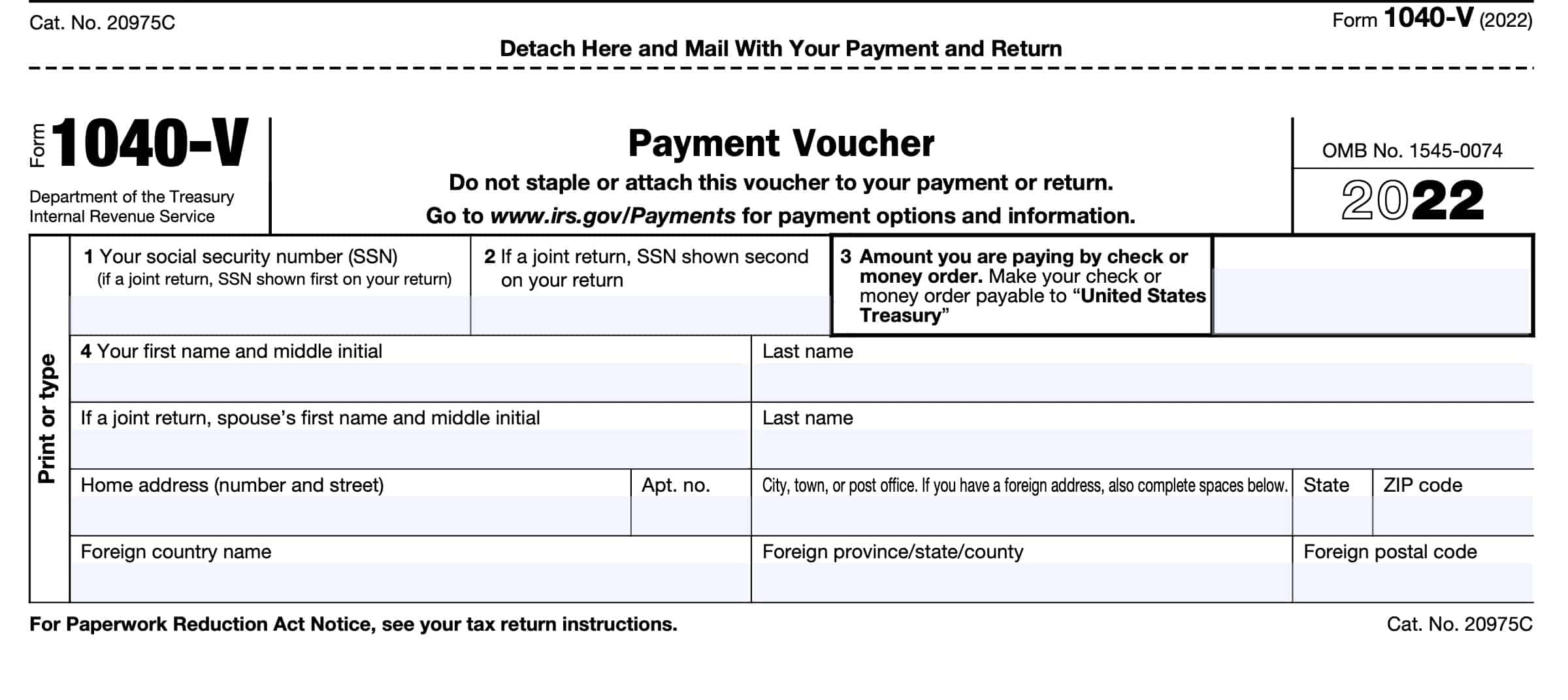

IRS Form 1040-V Instructions

The Internal Revenue Service offers a variety of ways for taxpayers to make tax payments. Although most taxpayers pay their taxes electronically, you may still send a check or money voucher to the IRS, using IRS Form 1040-V.

In this article, we’ll walk through this tax form, including:

- How to complete IRS Form 1040-V

- How to send your tax payment and completed form to the IRS

- Alternate payment methods

Let’s start by walking through this brief form.

Table of contents

How do I complete IRS Form 1040-V?

We will walk through this tax form, step by step. Let’s start at the top.

Line 1: Taxpayer Social Security Number

In Line 1, enter your Social Security number (SSN). If you have an individual taxpayer identification number (ITIN), you may use that in place of an SSN.

Line 2: Spouse Social Security Number

This field is for the second SSN listed on your individual income tax return. If you are married, filing a joint return, enter your spouse’s SSN or ITIN here.

Line 3: Amount you are paying by check or money order

In Line 3, enter the dollar amount that you are submitting along with your completed IRS Form 1040-V. Although the IRS offers multiple payment options, you may only send a check or money order with your Form 1040-V payment voucher.

Do not send cash through the mail.

If you are using the IRS’ electronic federal tax payment system to submit your payment amount, do not complete a Form 1040-V voucher.

Line 4: Taxpayer name

In Line 4, enter your name in the following manner:

- First name & middle initial

- Last name

If filing a joint tax return, enter the same information on your spouse’s behalf.

Below the taxpayer name fields, enter your mailing address starting on the next line of your Form 1040-V. This should include the following information:

- Street number

- Street name

- City name

- State

- Zip code

Your name and address should appear exactly as they do on your income tax return. Since this voucher is on the bottom of Form 1040-V, you may tear the payment coupon on the dotted line to send with your payment.

Sending your tax payment to the IRS

Depending on your preferred form of payment, the IRS has very specific guidance to ensure that taxpayers’ tax payments go to the correct tax account. We’ll outline the IRS guidance for each form of payment.

Payment by check or money order

If submitting a check or money order, make your check or money order payable to: U.S. Department of the Treasury or to United States Treasury. You’ll send your tax payment, along with your completed payment coupon, to the IRS Service Center that corresponds to where you live.

IRS Service Center Charlotte

If you live in Alabama, Florida, Georgia, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee, or Texas, then send your payment to:

Internal Revenue Service

P.O. Box 1214

Charlotte, NC 28201-1214

If you live in a foreign country, American Samoa, or Puerto Rico, or if you:

- Use an APO or FPO address

- File IRS Form 2555 or IRS Form 4563, or

- Are a dual-status alien or nonpermanent resident of either Guam or the U.S. Virgin Islands

Send your payment to the following address instead:

Internal Revenue Service

P.O. Box 1303

Charlotte, NC 28201-1303

IRS Service Center Louisville

If you live in Arkansas, Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, or Wisconsin, then send your payment to:

Internal Revenue Service

P.O. Box 931000

Louisville, KY 40293-1000

IRS Service Center Cincinnati

If you live in Alaska, Arizona, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oregon, Pennsylvania, South Dakota, Utah, Washington, or Wyoming, then send your payment coupon and check or money order to:

Internal Revenue Service

P.O. Box 802501

Cincinnati, OH 45280-2501

Electronic payment

The IRS offers several electronic payment methods. We’ll outline each one below, so you can decide which is best.

IRS Direct Pay

IRS Direct Pay allows taxpayers to make an electronic payment from their banking account via direct debit. Direct Pay also allows taxpayers to schedule tax payments up to 365 days in advance.

You can also use Direct Pay in conjunction with filing an extension for filing your tax return.

Between January 1st and the original due date of your tax return, visit the main Direct Pay page and select the “Make a Payment” button. From there you can,

- Select “Extension” as your reason for payment.

- This will automatically start with 4868, which stands for IRS Form 4868, the IRS extension request form for individual tax returns

- Verify your identity and make a payment

If you complete this process successfully, your payment will be credited towards the tax year for which you are requesting a filing extension. Additionally, you will automatically receive the extension without having to file IRS Form 4868.

Keep in mind that while your extension to file a tax return can last for up to 6 months beyond the due date, this does not extend your requirement to pay your taxes. The IRS generally expects taxpayers to pay the full amount of the balance due by the tax return’s due date.

Electronic Federal Tax Payment System

The Electronic Federal Tax Payment System, or EFTPS, is a free payment system that the U.S. Department of the Treasury offers. Similar to IRS Direct Pay, EFTPS allows taxpayers to make real-time payments, schedule payments, and track payments or payment histories.

Although EFTPS requires users to register for access, it also offers phone access for customer service representatives. This is a service that IRS Direct Pay does not offer.

Both EFTPS and Direct Pay are free, but they only allow direct debit options from your financial institution. You may also pay by credit card or debit card, but not directly to the government.

Payment by credit card or debit card

You can make payment to the IRS through one of three IRS-approved third party processors. While the federal government websites do not charge processing fees, these third-party processors do charge additional fees to process your payment.

There are three IRS-authorized payment processors:

- payUSAtax

- Pay1040

- ACI Payments, Inc.

You may choose any of these vendors to pay your taxes. Below is a comparison of the three vendors, based upon fee & forms of payment accepted.

| Debit card fee | Credit card fee | Accepted forms of payment | |

| payUSAtax | $2.20 | 1.85% ($2.69 min.) | Visa, Mastercard, Discover, American Express, STAR, Pulse, NYCE, Accel; PayPal, Click to Pay |

| Pay1040 | $2.50* | 1.87% ($2.50 min.) | Visa, Mastercard, Discover, American Express, STAR, Pulse, NYCE, Accel, AFFN, Cirrus, Interlink, Jeanie, Shazam, Maestro; Click to Pay; PayPal; Pay With Cash |

| ACI Payments, Inc. | $2.20 | 1.98% ($2.50 min.) | Visa, Mastercard, Discover, American Express, STAR, Pulse, NYCE; PayPal, Click to Pay; Pay With Cash |

*: Pay1040 charges a $2.50 flat fee if using a consumer or personal debit card. For all other debit card transactions, the credit card fee (1.87%) applies.

For more information, visit the respective company’s home page.

Finally, you can make electronic tax payments through the IRS’ mobile app.

IRS mobile app

The IRS has a mobile application for smartphones, IRS2Go. IRS2Go allows taxpayers to:

- Check the status of their tax return

- Obtain free tax assistance

- Stay informed of IRS news

- Make electronic payments through IRS Direct Pay

You may download IRS2Go from Google Play, the Apple App Store, or through Amazon.

If electronic payment is not acceptable, the IRS does accept cash payment.

Payment by cash

Taxpayers may make cash payments in one of several ways:

- Visiting an IRS Taxpayer Assistance Center (TAC)

- Through a third-party payment processor

Taxpayer Assistance Center

IRS TACs have security checkpoints to ensure taxpayer safety.

The IRS recommends that taxpayers schedule an appointment 30 to 60 days in advance. You can schedule this appointment by calling the daytime phone number: 844-545-5640.

When paying in person, the IRS recommends advance preparation, particularly if you expect to make a large tax payment.

Third-party processor

If there is not an IRS TAC near you, you can still go through two of the three electronic payment processors for your cash payment. Each processor has unique procedures, but below is a summary:

- Choose a payment processor

- ACI Payments, Inc. ($1.50 service fee per payment)

- Pay1040.com ($2.50 fee per payment)

- Enter the required information

- Tax form & year that payment applies to

- Taxpayer information

- Select ‘Pay With Cash’ option

- Enter email address

- Check your email for confirmation and barcode

- ACI Payments, Inc.: customerservice@acipayonline.com

- Pay1040.com: noreply@pay1040.com

- Take your barcode & cash payment to a participating retailer

- List of participants includes: Dollar General, Family Dollar, CVS Pharmacy, Walgreens, Pilot Travel Centers, 7-Eleven, Speedway, Kum & Go, Royal Farms, Go Mart, and Kwik Trip

- Keep receipt from the store after making your payment. This confirms your payment.

Video walkthrough

Watch this instructional video to learn more about completing your tax payment voucher, known as IRS Form 1040-V

Frequently asked questions

IRS Form 1040-V is the IRS payment voucher that taxpayers may use to make tax payments when finding their federal tax return. Taxpayers who use an electronic payment method to pay their income tax bill are not required to use IRS Form 1040-V.

The Internal Revenue Service accepts a variety of tax payments. You may make a partial payment at any time through the IRS website with a credit card or bank account withdrawal, send a check or money order with a completed IRS Form 1040-V, or pay with cash at any of the IRS-approved third-party payment processors.

In general, taxpayers who are making estimated payments for the given tax year should use IRS Form 1040-ES. In addition to a voucher, there is an estimated tax worksheet that you can use to calculate your tax liability and quarterly payments.

How do I find IRS Form 1040-V?

You can find this tax form on the IRS website. For your convenience, we’ve included the most recent version in this article.