IRS Form 8866 Instructions

Certain taxpayers may need to calculate interest under the look-back method for property depreciated under the Income Forecast Method, as outlined in IRS Form 8866.

In this article, we’ll walk through everything you need to know about IRS Form 8866, including:

- How to complete IRS Form 8866

- How to calculate interest under the look-back method

- Frequently asked questions

Let’s start by taking a closer look at this tax form.

Table of contents

How do I complete IRS Form 8866?

Let’s walk through this one-page tax form, beginning at the top.

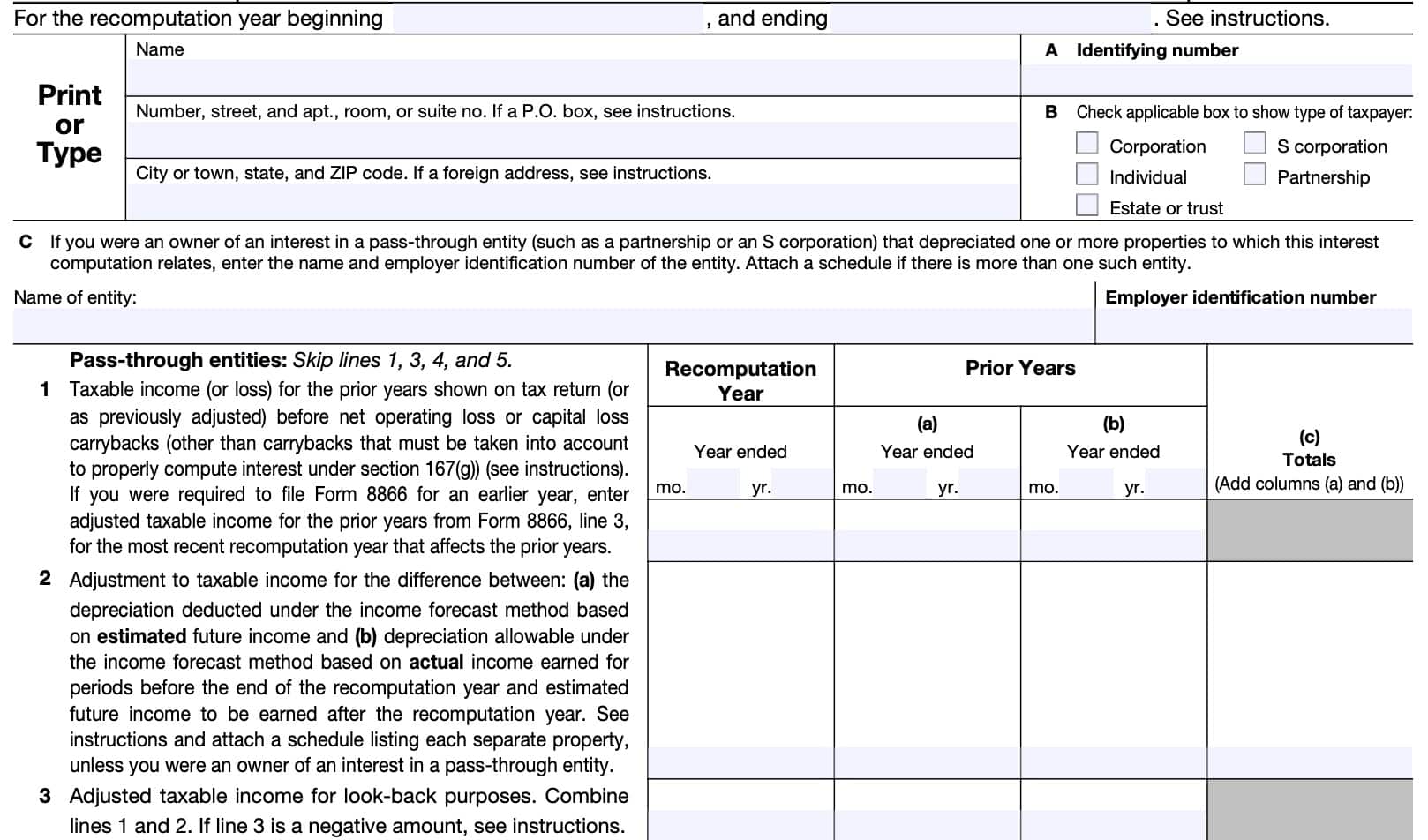

Recomputation Year

Fill in the recomputation year line at the top of the form to show the tax year for which you are filing IRS Form 8866.

If you were an owner of an interest in a pass-through entity that has depreciated one or more properties under the income forecast method, enter your tax year that ends with or includes the end of the entity’s recomputation year.

Taxpayer information

Name

In the name section, enter the name shown on your federal income tax return for the recomputation year. For married couples filing a joint return, also enter your spouse’s name as shown on your income tax return.

Address

Only enter a mailing address if you are not filing IRS Form 8866 with your income tax return. Otherwise, you do not need to complete the address fields. Only enter a P.O. Box if the postal service does not deliver mail to your street address.

Identifying number

Under identifying number, individual taxpayers calculating their personal taxes should enter your Social Security number.

Otherwise, enter the employer identification number (EIN) for the tax entity represented on this form.

Just beneath the identifying number, check the applicable box:

- Corporation

- S corporation

- Individual

- Partnership

- Estate or trust

Finally, if you were the owner of an interest in a pass-through entity that depreciated one or more properties related to this interest computation, enter the following information

- Entity’s name

- Employer identification number

If necessary, attach a schedule for multiple pass-through entities.

Completing the form

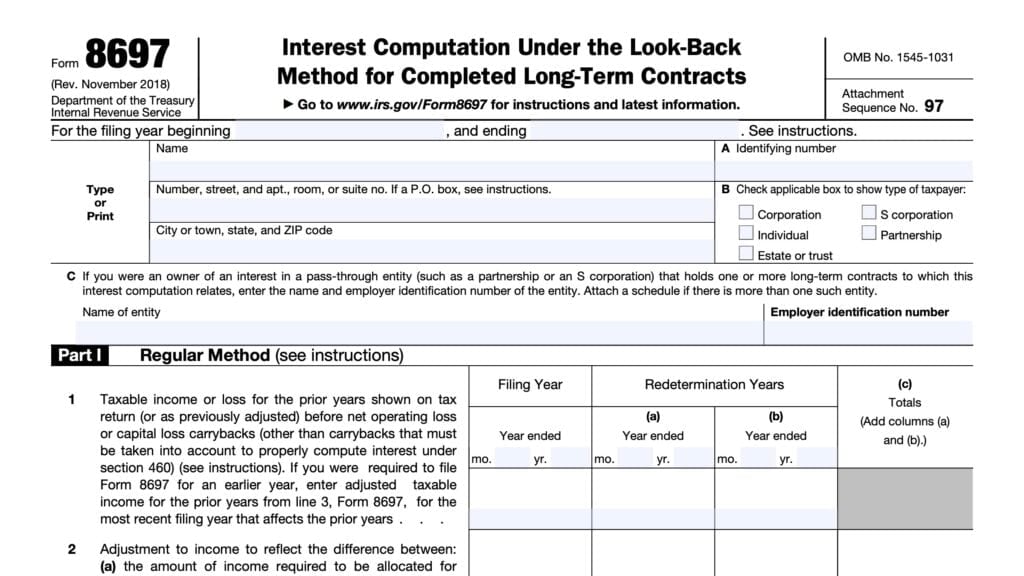

Before starting with Line 1, we should go over some details for how to complete Lines 1 through 8.

In these lines, there are 4 columns:

- Recomputation year

- Prior year: Column (a)

- Prior year: Column (b)

- Totals: Column (c)

Recomputation year

At the very top, enter the month and year for the recomputation year that you entered at the top of the form.

Column (a) & Column (b)

At the column heading near the top of Line 1, enter the ending month and year for:

- Each tax year prior to the recomputation year in which you depreciated property under the income forecast method to which this form applies and

- Any other tax year affected by such years.

If there are more than 2 prior tax years, attach additional forms as needed.

On the additional Forms 8866, enter the following:

- Taxpayer name

- Identifying number

- Tax year

Complete Lines 1 through 8 as applicable. However, only enter totals in column (c) of the first Form 8866. Do not complete column (c) for any additional forms.

Column (c)

As you go through this form, you’ll be prompted to enter totals of column (a) and column (b) in certain lines, specifically:

For Line 9 and Line 10, column (c) is the only available column, as it represents the total of either:

Line 1

Pass-through entities can skip Line 1.

Enter any taxable income (or loss) for the prior years shown on tax return (or as previously adjusted) before:

- Net operating loss, or

- Capital loss carrybacks

- Other than carrybacks that must be accounted for to property compute interest under Internal Revenue Code (IRC) Section 167(g)

Do not reduce taxable income or increase a loss on Line 1 by any of the following:

- Carryback of a net operating loss

- Net Section 1256 contracts loss, or

- Capital loss

- Except to the extent that carryback resulted from or was adjusted by the redetermination of depreciation under the income forecast method for look-back purposes

If you were required to file IRS Form 8866 for an earlier year, enter adjusted taxable income for the prior years from Form 8866, Line 3, for the most recent recomputation year that affects the prior years.

The 2-year carryback rule does not apply to net operating losses arising in the tax years ending after 2017.

An exception applies to farmers and non-life insurance companies. IRC Section 172(b) contains additional information.

Line 2

In Line 2, enter any adjustment to taxable income for the difference between:

- The depreciation deducted under the income forecast method based on estimated future income, and

- Depreciation allowable under the income forecast method based on actual income earned for periods before the end of the recomputation year and estimated future income to be earned after the recomputation year

Unless you are the owner of an interest in a pass-through entity, you should attach a schedule listing each separate property.

Additional instructions for Line 2

In figuring the net adjustment for each column, take into account any other income and expense adjustments that may result from the increase or decrease to depreciation under the income forecast method.

For example, a change to adjusted gross income may affect the deductibility of medical expenses on IRS Schedule A.

If there are no adjustments besides the look-back adjustments, the sum of all Line 2 amounts should be zero and reflected in column 2(c).

If there are additional adjustments that result from the application of the look-back method, leave column 2(c) blank and reflect the amounts in the schedule below as described in item 3.

Attached schedule

If you need to attach a separate schedule, include the following items:

- Identify each property depreciated under the income forecast method for this form

- For each property, report in columns for each prior year:

- The amount of depreciation previously deducted based on estimated future income, and

- The amount of depreciation allowable for each prior year based on actual income earned

before the end of the recomputation year and estimated future income to be earned after the recomputation year. - Total the columns for each prior year and show the net adjustment to depreciation.

- Identify any other adjustments that result from a change in depreciation under the income forecast method and show the amounts in the columns for the affected years so that the net

adjustment shown in each column on the attached schedule agrees with the amounts shown on Line 2.

An owner of an interest in a pass-through entity is not required to provide the detail listed in Lines 1 and 2 with respect to prior tax years. The entity should provide the Line 2 amounts with Schedule K-1 or on a separate statement for its recomputation year.

Taxpayers reporting Line 2 amounts from more than one Schedule K-1 or similar statement

must attach a schedule detailing by entity the net change to depreciation under the income forecast method.

Line 3: Adjusted taxable income for look-back purposes

If Line 3 results in a negative amount, it represents a look-back net operating loss (NOL).

The Line 2 adjustment either created, increased, or decreased the net operating loss. The change in the amount of the net operating loss would be carried back or forward to the appropriate tax year.

From there, you would recompute the hypothetical tax in the carryback/forward year.

However, there is a different computation period for computing interest on NOLs, as outlined in Line 7 and Line 8, below.

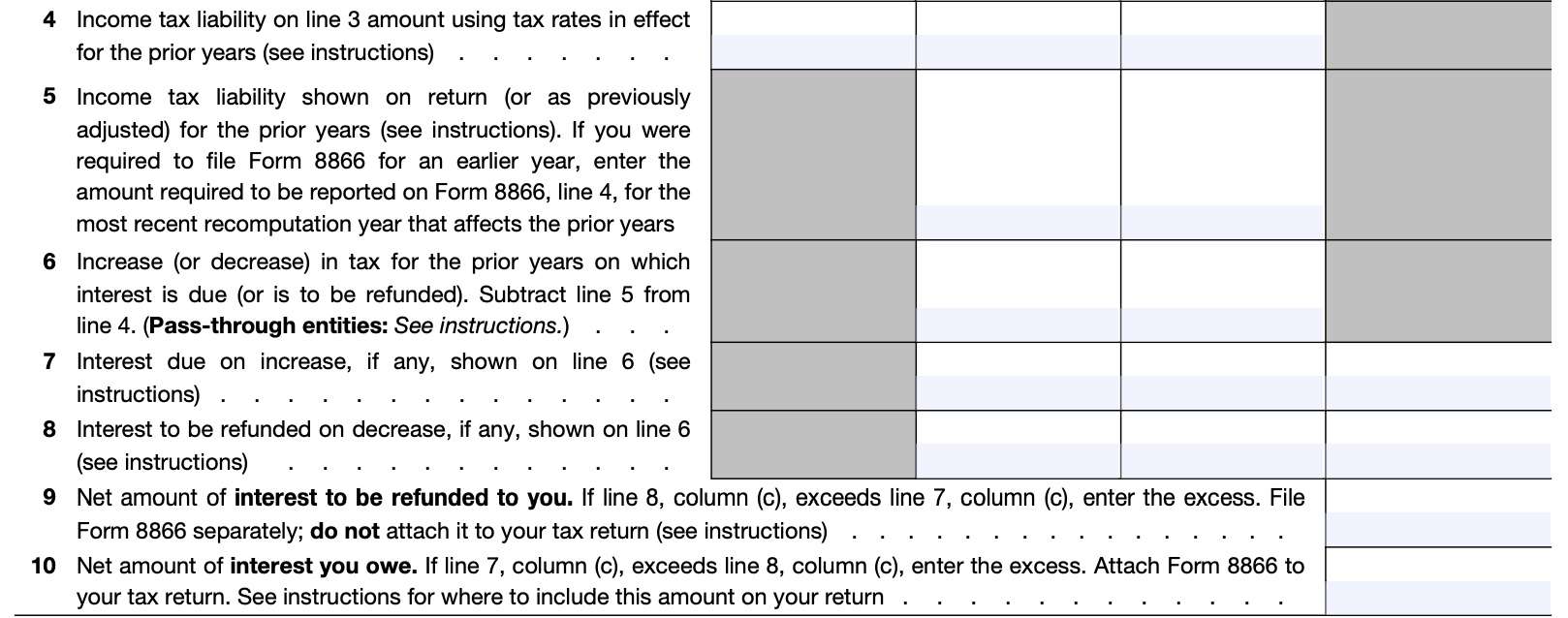

Line 4

In Line 4, calculate the income tax liability on the Line 3 amount by using the tax rates in effect for the previous tax years.

Reduce the tax liability by any allowable credits, other than refundable credits, such as:

- Credit for taxes withheld on wages

- Earned income credit

- Additional child tax credit

- Credit for federal tax paid on fuels

Do not consider any credit carrybacks to the prior year when computing the Line 4 amount, except for any carrybacks that resulted from or were adjusted by the redetermination of depreciation for look-back purposes.

Also include any taxes, such as alternative minimum tax, required to be taken into account in computing your tax liability.

Line 5: Income tax liability shown on return for prior years

For prior tax years, enter the tax liability as shown on your previous tax return, or as previously adjusted.

If you filed IRS Form 8866 in a prior year, enter the Line 4 amount for the most recent recomputation year affecting prior tax years.

Line 6: Increase (or decrease) in tax for prior years

Subtract Line 5 from Line 4, then enter the result here.

Pass-through entities

Pass throught entities must multiply the Line 2 amount on by the applicable regular tax rate for each prior year shown in either column (a) or (b).

The applicable regular tax rate is as follows:

Pass-through entities in which more than 50% of interests are held directly by individuals or through other pass-through entities

- In 2000 or earlier ………….. 39.6%

- In 2001 ………………………….. 39.1%

- In 2002 ………………………… 38.6%

- In 2003 through 2012 …… 35.0%

- In 2013 through 2017 ……. 39.6%

- In 2018 or later ……………… 37.0%

All other pass-through entities

- In 2017 or earlier ……………. 35%

- In 2018 or later ………………. 21%

Line 7: Interest due on increase

For Lines 7 and 8: You must calculate interest for any tax increase or decrease in each prior year. Calculate the interest by using the applicable interest rate, compounded on a daily basis, generally from the tax return’s original due date until the earlier of:

- The due date (not including extensions) of the return for the recomputation year, or

- The date the return for the recomputation year is filed and any income tax due for that year has been fully paid.

For calculating interest for each interest accrual period, refer to the Quarterly Interest Rates page on the IRS web site.

Exceptions

There are exceptions, as follows:

NOL, capital loss, Net Section 1256 contracts loss, or credit carryback

If a net operating loss, capital loss, net section 1256 contracts loss, or credit carryback is being increased or decreased as a result of the adjustment made to net income due to refiguring depreciation under the income forecast method, the interest due or to be refunded must be computed on the increase or decrease in tax attributable to the change to the carryback only from the due date of the return for the prior year that generated the carryback.

Do not calculate the interest from the due date of the return for the year in which the carryback was absorbed. IRC Section 6611(f) contains additional details.

Decrease in tax

In the case of a decrease in tax on Line 6, interest is allowed on the excess only until the original due date for the tax return in which the carryback arose, if a refund has been shown on Line 5 as a result of any of the following:

- Net operating loss

- Capital loss

- Net Section 1256 contracts loss

- Credit carryback

Enter any interest due that you calculate in Line 7.

Line 8: Interest to be refunded on decrease

Using the instructions outlined in Line 7, enter the full amount of any interest to be refunded in the appropriate column on Line 8.

Once all calculations for Line 7 and Line 8 are complete, be sure that the line totals entered into column (c) match the sum of columns (a) and (b) for each line.

Line 9: Net amount of interest to be refunded to you.

If column (c) in Line 8 exceeds column (c) in Line 7, enter the excess amount in Line 9.

Do not file IRS Form 8866 with your income tax return. Instead, file your completed form with the IRS at the address listed below, based upon your taxpayer status.

Individuals

Individual taxpayers should mail their completed Form 8866, along with any necessary information, to:

Department of the Treasury

Internal Revenue Service

Philadelphia, PA 19255-0001

All other taxpayers

All other taxpayers should mail their completed form and supporting documents to:

Department of the Treasury

Internal Revenue Service

Cincinnati, OH 45999-0001

Complete the Signature section by following the Signature section instructions, indicated below.

The IRS will compute any additional interest to be refunded for periods after the due date of the return, and include such interest in your tax refund. Report the Line 9 amount or any IRS refunded amount as interest income on your income tax return for the tax year in which you received it.

Line 10: Net amount of interest you owe

If column (c) in Line 8 is less than column (c) in Line 7, enter the excess amount in Line 10. This is the amount of interest you owe the Internal Revenue Service.

File your completed Form 8866 with your income tax return. You do not need to sign this form separately because it is a part of your tax return.

Corporations (other than S corporations) may deduct this amount (or the amount computed by the IRS if different) as interest expense for the tax year in which it is paid or incurred.

For individuals and other taxpayers, this interest is not tax-deductible.

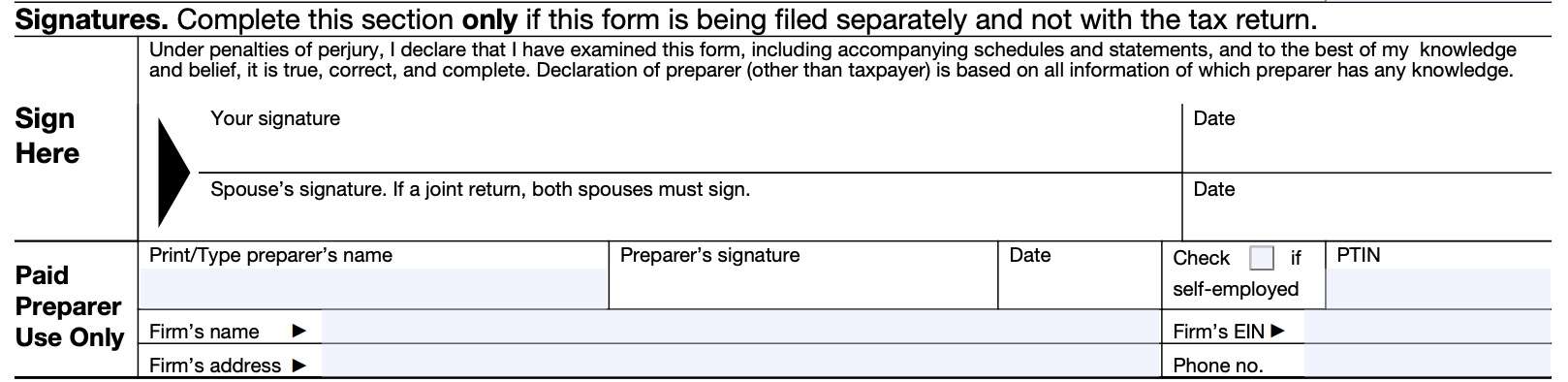

Signature

For a married couple filing Form 8866 jointly, both spouses must sign. Paid preparers must also complete the Signature section.

If you must attach additional copies of Form 8866, sign only the first one. File this form by the due date of your income tax return, and keep a copy for your tax records.

Video walkthrough

Watch this informative video to learn more about calculating interest under the lookback method on depreciation taken using the income forecast method with IRS Form 8866.

Frequently asked questions

Taxpayers use IRS Form 8866 to figure the interest due or to be refunded under the look-back

method of IRC Section 167(g)(2) for property placed in service after September 13, 1995, depreciated under the income forecast method.

The income forecast method allows taxpayers to recover the depreciable basis in certain property over the anticipated income to be earned from the property.

Generally, the income forecast method is limited to assets with unique earning characteristics that cannot be measured by physical condition or the passage of time. This includes items such as motion picture films, video tapes, sound recordings, copyrights, books, and patents.

Where can I find IRS Form 8866?

As with other IRS tax forms, you may find IRS Form 8866 on the IRS website. For your convenience, we’ve placed the most recent version just below, in this article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!