IRS Schedule B Instructions

Taxpayers who receive interest income or ordinary dividends from investments or other assets may be required to report them on IRS Schedule B when they file their annual income tax return.

In this article, we’ll walk you through everything you need to know about IRS Schedule B, including:

- How to complete and file Schedule B

- Types of income to report in Schedule B

- Other tax situations in which filing Schedule B is required

Let’s begin by walking through this tax form, step by step.

Table of contents

How do I complete IRS Schedule B?

There are 3 parts to this one page tax schedule:

Let’s take a closer look, starting with Part I.

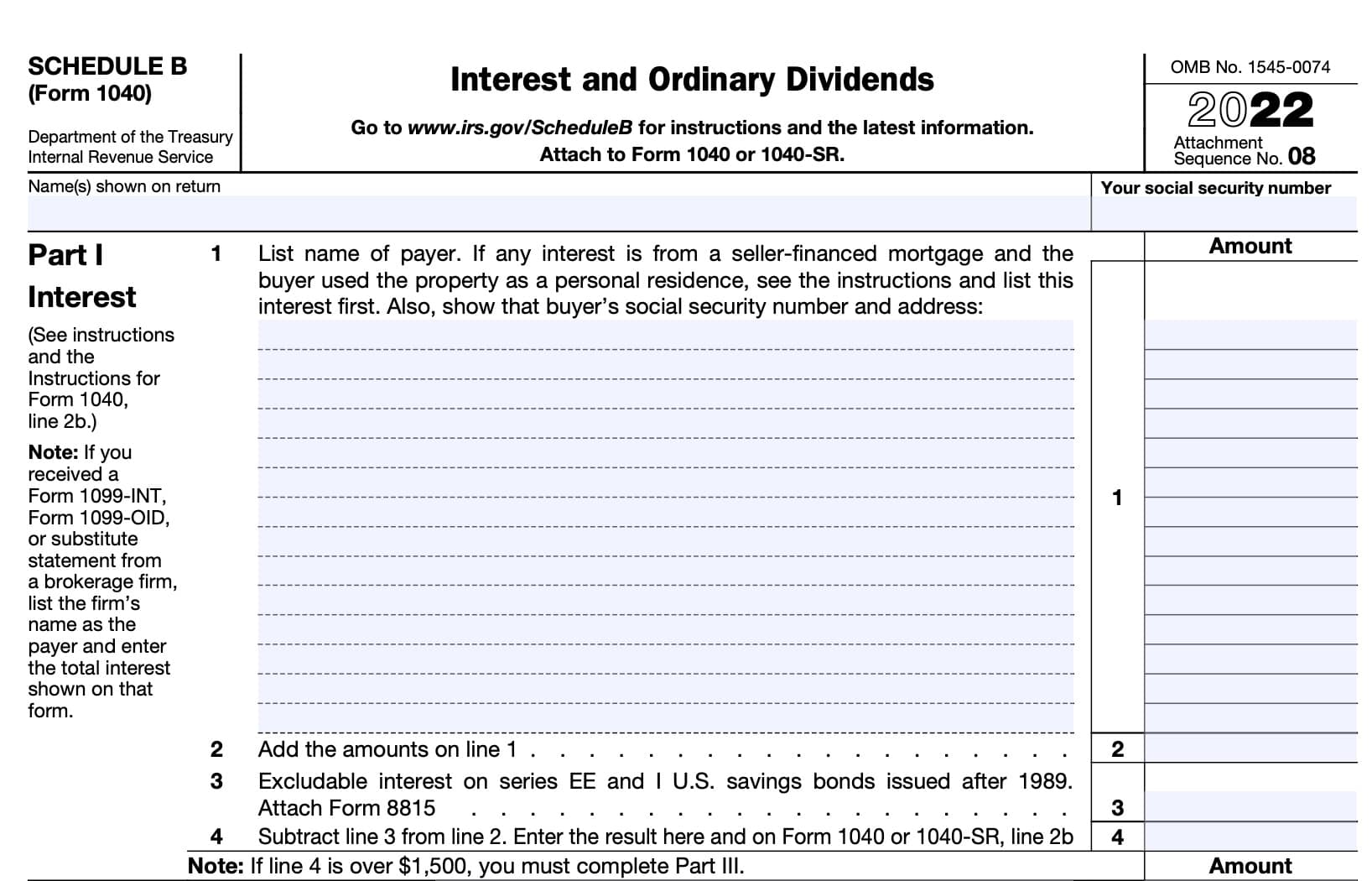

Part I: Interest

In Part I, we’ll enter the interest you received over the course of the tax year.

Before starting with Line 1, take a look at the taxpayer name and Social Security number at the top of IRS Schedule B. After you’ve confirmed that they match the rest of your tax return, proceed to Line 1.

Line 1: Name of payer

In Line 1, you’ll include each item of taxable interest, to include the name of the payer and the amount of interest paid.

Taxable interest generally is shown on the following statements or substitute statements:

- IRS Form 1099-INT, Interest Income

- IRS Form 1099-OID, Original Issue Discount

Also include interest from the following savings bonds:

- Series EE bonds, also known as 30-year bonds

- Series H bonds or Series HH bonds, which are no longer issued by the Treasury Department

- Series I bonds, 30-year bonds with inflation adjustments on interest payments

- Treasury-Inflation Protection Securities (TIPS)

You should also include any

- Accrued market discount that is includible in taxable income, and

- Gain on a contingent payment debt instrument that is includible as interest income

Do not report any tax-exempt interest.

Seller-financed mortgages

If you sold your home or other property and the buyer used the property as a personal

residence, list any interest the buyer paid you on a seller-financed mortgage or other form of seller financing.

You’ll need to include the following information from the buyer:

- Name

- Address

- Social Security number

The buyer must also know your Social Security number. Failure to either indicate the buyer’s information or to present the buyer with your SSN can result in a $50 penalty.

Nominees

If you received interest as a nominee, this means that the interest actually belongs to someone else. Report the total on Line 1, even if you later distributed some or all of this income to other taxpayers.

Under your last Line 1 entry, put a subtotal of all interest listed in Line 1. Below the subtotal, enter ‘Nominee Distribution,’ then show the total interest that you received as a nominee. You’ll subtract this amount from the subtotal, then enter the result on Line 2.

Accrued interest

When you buy bonds between interest payment dates, then pay accrued interest to the seller,

this interest is taxable to the seller.

If you received a Form 1099 for interest as a purchaser of a bond with accrued interest, follow the rules earlier under Nominees to see how to report the accrued interest. But identify the amount to be subtracted as ‘Accrued Interest,’ instead of ‘Nominee Distribution.’

Original issue discount (OID)

Follow the rules under Nominees if you are reporting OID in an amount less than the amount shown in either of the following boxes of IRS Form 1099-OID:

- Box 1: Original issue discount for the year

- Box 8: Original issue discount on U.S. Treasury obligations

Identify the amount to be subtracted as ‘OID Adjustment‘ instead of ‘Nominee Distribution.’

However, if the payer reported to you a net amount of OID on the bond that reflects the offset of the gross amount of OID by any acquisition premium, no reduction of the amount of OID income

reported to you by the payer may be needed on Schedule B for the bond.

Amortizable bond premium

If you elect to reduce your interest income on a taxable bond by the amount of taxable amortizable bond premium, follow the rules earlier under Nominees to see how to report the interest.

Identify the amount to be subtracted as ‘ABP Adjustment‘ instead of ‘Nominee Distribution.’

However, if the payer reported to you a net amount of interest income on the bond reflecting the offset of the gross amount of interest income by the amortizable bond premium, no reduction of the amount of interest income reported to you by the payer is needed on IRS Schedule B for the bond.

Tax-exempt interest

If you received any tax-exempt interest (including tax-exempt OID), such as from municipal bonds, each payer should send you a copy of Forms 1099-INT or Forms 1099-OID.

As a general rule, your tax-exempt stated interest should be shown in either:

- IRS Form 1099-INT, Box 8

- IRS Form 1099-OID, Box 2

Tax-exempt OID appears in IRS Form 1099-OID, Box 11.

Enter the total of tax-exempt interest on Line 2a of your IRS Form 1040 or Form 1040-SR.

If you bought a tax-exempt bond at a premium, only report the net amount of tax-exempt interest on Line 2a. The net amount is the excess of tax-exempt interest received during the tax year over the amortized bond premium for that year.

If you purchased a tax-exempt OID bond at a premium, only report the net amount of tax-exempt OID on Line 2a of your tax return. The net amount is the excess of tax-exempt OID for the tax year over the amortized bond premium for that year.

IRS Publication 550 contains additional information about OID, bond premium, and acquisition premium.

Also include any exempt-interest dividends from a mutual fund or other regulated investment company on Line 2a of your federal income tax return. You should see this amount in Box 12 of your IRS Form 1099-DIV.

General instructions

You can list more than one payer for each entry space for Line 1. However, you need to clearly show the amount paid next to each payer’s name.

Add the separate amounts paid by the interest payers listed on an entry space. Enter the total in the

Amount column.

If you still need more space, you can attach separate statements using the same format as Line 1. However, you should show your totals on the Schedule B form itself.

Put your name and Social Security number on the statements, then attach them to the end of your income tax return.

Line 2

Add the total amounts in the Amount column from Line 1. Enter the sum here.

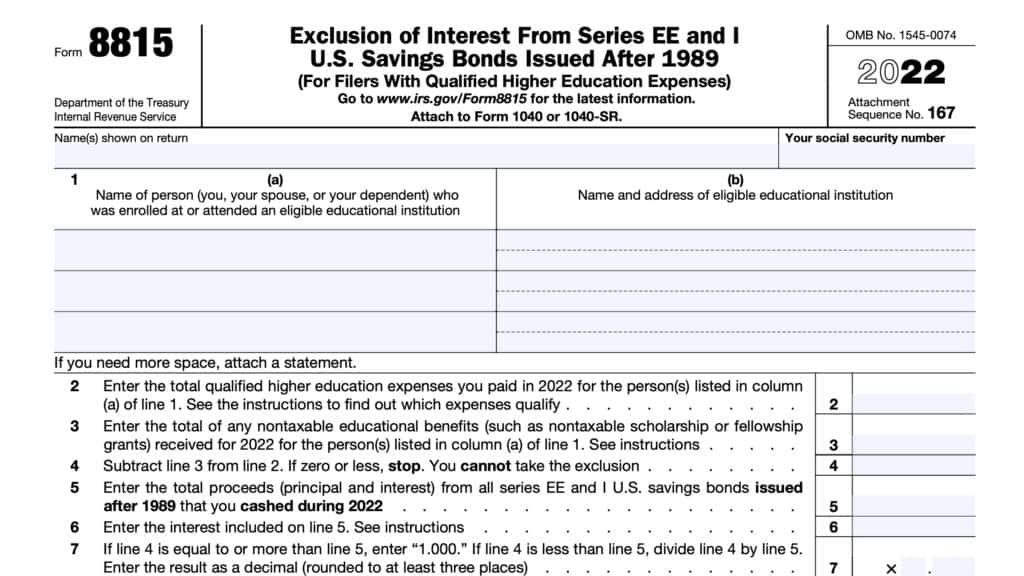

Line 3: Excludable interest on Series EE and I U.S. Savings bonds issued after 1989.

You may be able to exclude part or all of the interest earned if:

- You cashed out Series EE or Series I U.S. Savings bonds issued after 1989, and

- You paid qualified higher education expenses for:

- Yourself

- Your spouse

- Your dependents

You’ll need to include this on IRS Form 8815, Exclusion of Interest From Series EE and I U.S. Savings Bonds Issued After 1989, and include your completed tax form with your income tax return.

Line 4

Subtract Line 3 from Line 2. Enter the result in Line 4, and in Line 2b of your Form 1040 or Form 1040-SR.

If the Line 4 amount exceeds $1,500, then you must complete Part III below.

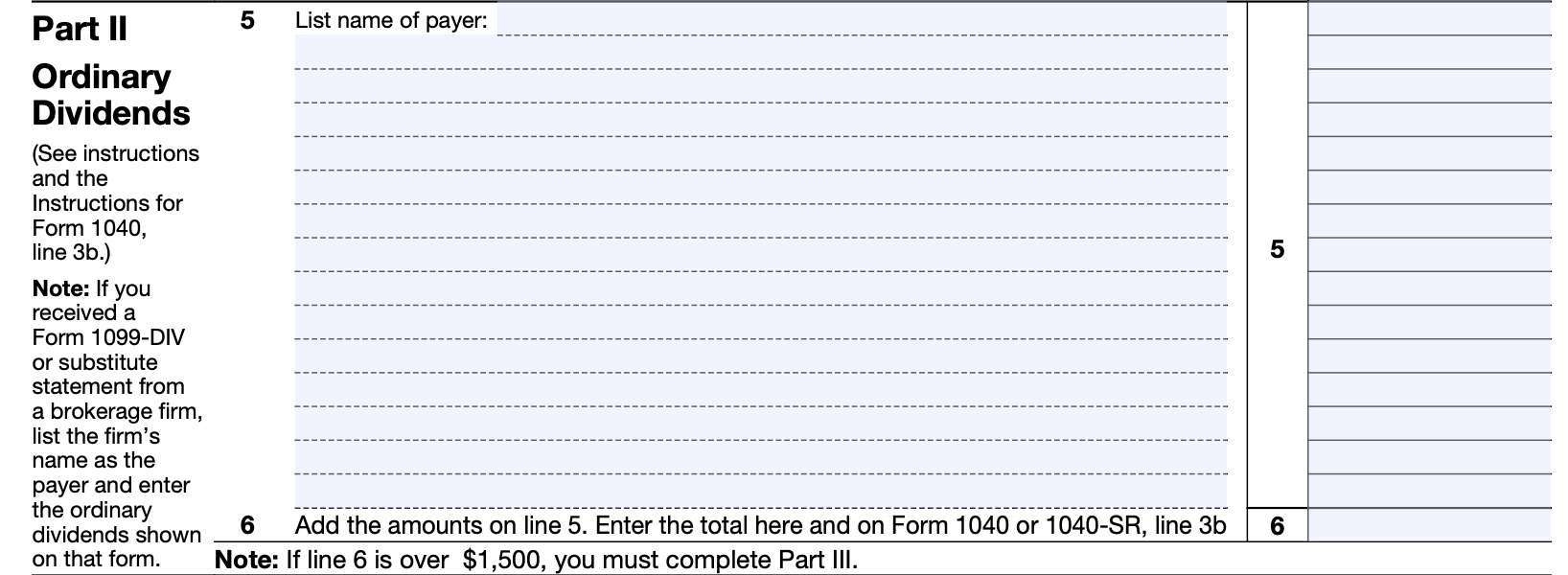

Part II: Ordinary dividends

Taxpayers will enter ordinary dividends in Part II.

According to IRS Publication 550, ordinary dividends are the most common type of distribution from a corporation or a mutual fund. They are paid out of earnings and profits and are considered to be ordinary income to the taxpayer, not capital gains.

You can assume that any dividend you receive on common or preferred stock is an ordinary dividend unless the paying corporation or mutual fund tells you otherwise.

Ordinary dividends will appear in Box 1a of the Form 1099-DIV you receive from your financial institution.

Line 5: Name of payer

Report all ordinary dividend income here, as reflected in Box 1a of your Forms 1099-DIV or substitute statements.

Foreign corporations

You may have to file IRS Form 5471 if you were an officer or director of a foreign corporation during the taxable year. You may also have to file Form 5471 if you owned 10% or more of the total

- Value of a foreign corporation’s stock, or

- Combined voting power of all classes of a foreign corporation’s stock with voting rights

Nominees

If you received a Form 1099-DIV that includes ordinary dividends as a nominee, this means that the ordinary dividends actually belong to someone else. Report the total on Line 5, even if you later distributed some or all of this income to other taxpayers.

Under your last Line 5 entry, put a subtotal of all ordinary dividends listed in Line 5. Below the subtotal, enter ‘Nominee Distribution,’ then show the total ordinary dividends that you received as a nominee. You’ll subtract this amount from the subtotal, then enter the result on Line 6.

Line 6

Add the total from the Amount column in Line 5. Enter the result here and on Line 3b of your Form 1040 or 1040-SR.

If the Line 6 amount exceeds $1,500, you must complete Part III, below.

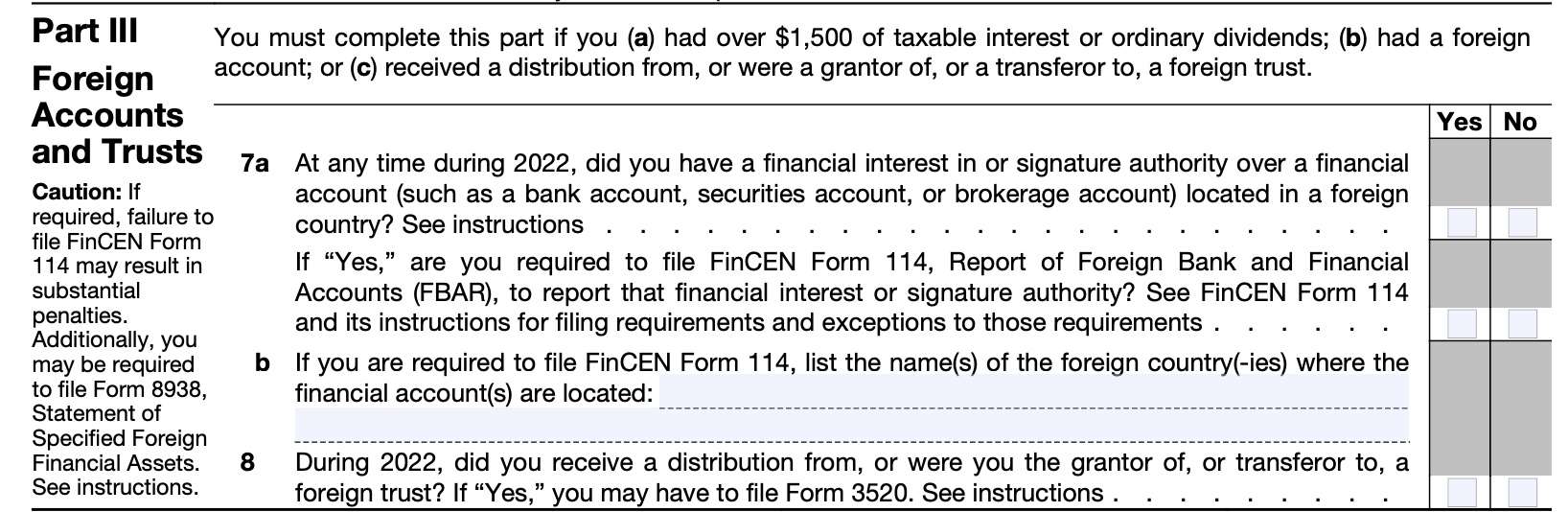

Part III: Foreign accounts and trusts

Taxpayers must complete Part III if any of the following conditions apply:

- You had over $1,500 of taxable interest as reported in Part I, above

- You had over $1,500 of ordinary dividend income, as reported in Part II, above

- You had a foreign account

- You received a distribution from a foreign trust

- You were a grantor of a foreign trust, or

- You were a transferor to a foreign trust

For each question below, indicate either ‘Yes’ or ‘No.’

Line 7a

At any time during the tax year, did you have a financial interest in, or signature authority over a financial account located in a foreign country?

This could include a bank account, securities account, or a brokerage account.

If you answered ‘Yes,’ then indicate whether you are required to file FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR), to report your financial interest or signature authority.

Line 7b

If you are required to file FinCEN Form 114, as indicated in Line 7a, then list the name or names of the foreign country or countries where the financial account(s) are located.

Line 8

During the tax year, did any of the following occur:

- You received a distribution from a foreign trust

- You were a grantor of a foreign trust

- You were a transferor to a foreign trust

If so, you may be required to file IRS Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts.

If you were treated as the owner of a foreign trust under the grantor trust rules, you are also responsible for ensuring that the foreign trust files IRS Form 3520-A, Annual Information Return of Foreign Trust With a U.S. Owner.

Who must file IRS Schedule B?

According to the Internal Revenue Service, taxpayers must file Schedule B with their federal tax return if any of the following conditions apply:

- You had over $1,500 of taxable interest or ordinary dividends in the taxable year

- You received interest from a seller-financed mortgage and the buyer used the property as a personal residence.

- You have accrued interest from a bond.

- You are reporting original issue discount (OID) of less than the amount shown on Form 1099-OID.

- You are reporting interest income of less than the amount shown on a Form 1099 due to amortizable bond premium.

- You are claiming the exclusion of interest from series EE or I U.S. savings bonds issued after 1989.

- You received interest or ordinary dividends as a nominee.

- You had a financial interest in, or signature authority over, a financial account in a foreign country or you received a distribution from, or were a grantor of, or transferor to, a foreign trust.

Video walkthrough

Watch this instructional video to learn more about reporting interest and ordinary dividend income on IRS Schedule B.

Frequently asked questions

Schedule B reports taxable interest income and ordinary dividend income. Certain taxpayers may be required to disclose relationship with foreign corporations or foreign trusts on Schedule B.

If required, file Schedule B with your income tax return and accompanying forms and schedules by the tax return’s due date.

Ordinary dividend income is taxed at the taxpayer’s ordinary income tax rate, while qualified dividends are taxed at preferable capital gains rates. Shareholders must own the underlying stock for a minimum time in order to receive qualified dividend income.

How do I find IRS Schedule B?

You can find this tax form on the IRS website. For your convenience, we’ve included the latest version in this article, below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!