IRS Form 3520-Reporting Transactions With Foreign Trusts

If you’re reading this article, you might be wondering if you need to file IRS Form 3520. This probably is because you’ve either:

- Received money, assets, or property from a foreign source, or

- Transferred money, assets, or property to a foreign source

This in-depth article will serve as a guide for the most commonly asked questions about this form, including:

- What is Form 3520

- Who must file IRS Form 3520

- When Form 3520 needs to be filed

- How to complete the form

- How to obtain a copy and submit the form

Let’s begin with an overview on what IRS Form 3520 actually is.

Contents

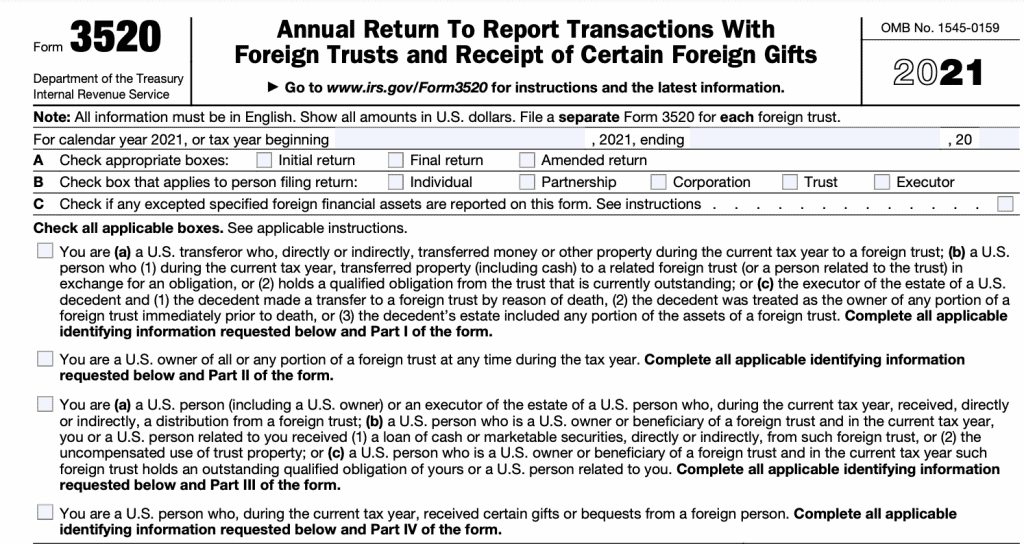

What is IRS Form 3520?

IRS Form 3520 is known as the Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts. It is an informational form that certain individuals, trusts, or entities, must file with the Internal Revenue Service.

According to the IRS website, Form 3520 reports the following types of information:

- Certain transactions with foreign trusts,

- Ownership of foreign trusts under the rules of sections 671 through 679, and

- Receipt of certain large gifts or bequests from certain foreign persons.

However, not everyone who interacts with a foreign person is required to file this form.

Who must file IRS Form 3520?

According to the IRS, you must file Form 3520 if any of the following apply:

You are a responsible party reporting a reportable event that occurred during the current tax year.

This brings up two important questions:

- What is a responsible party?

- What is a reportable event?

Responsible party

A responsible party is defined as any one of the following:

- The grantor or creator of an inter vivos trust. An inter vivos trust, also known as a living trust, is a trust created by one living person for the benefit of another person.

- The transferor in the case of a reportable event.

- The executor of the decedent’s estate in any case (whether the executor is a US citizen or not)

Anyone meeting the definition of a responsible party must report any reportable event on Form 3520. So what is a reportable event?

Reportable event

A reportable event is defined as one of the following:

- A United States person creating a foreign trust

- The transfer of property by a U.S. person into a foreign trust. This can be a direct transfer or indirect transfer, and includes transfers upon death.

- The death of a U.S. citizen or resident if:

- The decedent was considered the owner of any part of a foreign trust under the rules of the Internal Revenue Code, Sections 671 through 679, or

- Any part of a foreign trust was included in the decedent’s gross estate

Even if you’re not a responsible party reporting a reportable event, you may still be required to file this form, especially if you transferred property to a foreign trust.

If this is true, the IRS expects you to complete the identifying information on page 1 and applicable portions of Part I of this form.

You are a US person who transferred property to a foreign trust in exchange for an obligation.

Or if you currently hold an outstanding qualified obligation from the foreign trust. There is also an IRS definition of what a qualified obligation is.

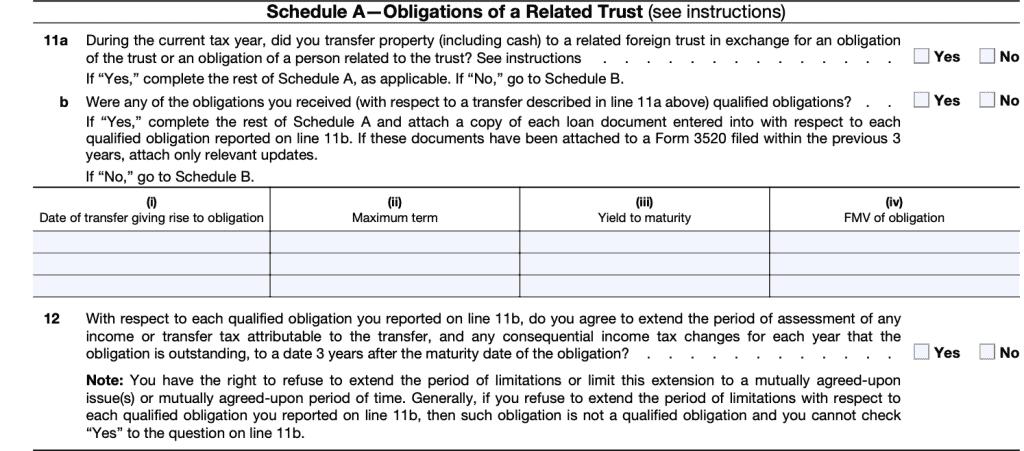

What is a qualified obligation?

For purposes of completing this tax form, a qualified obligation is one that:

- Is in writing

- Does not exceed 5 years

- Is in U.S. dollars

- Has a yield to maturity (YTM) of at least 100% of the applicable federal rate, but not more than 130% of the federal rate on the date issued

- The U.S. person agrees to extend the period of assessment of any income or transfer tax attributable to the transfer and any consequential income tax changes for each year to a date at least 3 years after the maturity date. The exception exists if the maturity date does not go past the end of the U.S. person’s tax year and is paid within such period.

- The U.S. person reports the status of the obligation every year that it is outstanding

If applies to you, the IRS expects you to complete the identifying information on page 1 and applicable portions of Part I of this form.

You are a U.S. person who is treated as the owner of any part of the assets of the foreign trust.

If this is your situation, the IRS expects you to complete the identifying information on page 1 and applicable portions of Part II of this form.

You are a U.S. person who received a distribution from a foreign trust during the tax year.

Filing this form is mandatory if you received a distribution from a foreign trust. You also must file this form if any of the following apply:

- You received a loan of cash or marketable securities during the year. This also includes lines of credit.

- You received the uncompensated use of property owned by a foreign trust.

- If you are the U.S. owner or beneficiary of a foreign trust, and the foreign trust holds an outstanding qualified obligation of yours

If any of these apply to you, you’ll have to complete the identifying information on page 1 and applicable portions of Part III of this form.

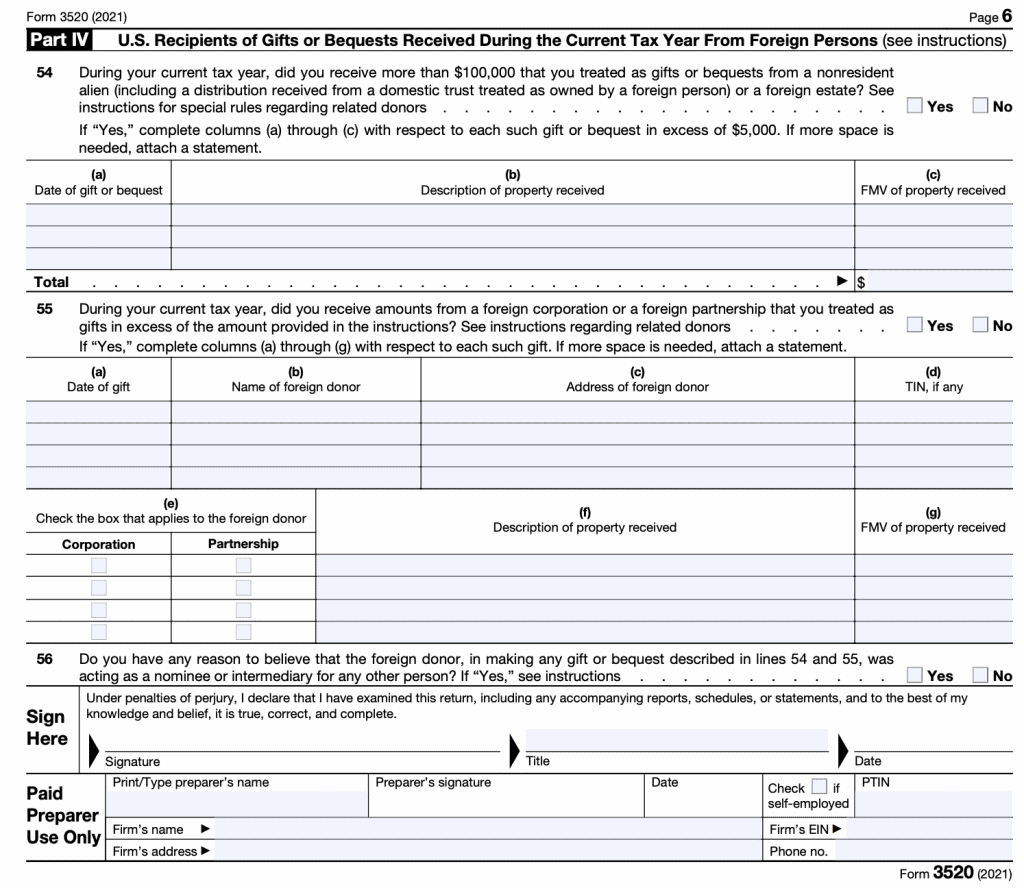

You are a U.S. person who received above a certain amount from foreign sources

Filing this form is either of the following apply:

- You received $100,000 or more in gifts from a nonresident alien individual or foreign estate that you treated as gifts or bequests. This includes related foreign persons.

- You received more than a certain amount from a foreign corporation or a foreign partnership. This is known as the IRC Section 6039F threshold. For 2021, the 6039F threshold is $16,815.

When is IRS Form 3520 due?

According to the IRS filing requirements, Form 3520 is an informational return that is due on the 15th day of the fourth month after an individual’s tax year is complete. For individuals, this usually is April 15th.

However, there are a couple of points worth noting:

- This is an informational return, and is filed separately from a Form 1040.

- If you live outside the United States (and Puerto Rico), or are a service member serving overseas, then your due date is June 15.

- If you are granted an extension for your income tax return, then your new due date is October 15.

- If the foreign entity or trust fails to file Form 3520-A, then the taxpayer must file a substitute Form 3520-A to accompany their Form 3520.

- The due date for the foreign trust to file Form 3520-A is the 15th day of the third month after the end of the trust’s tax year.

How do I complete IRS Form 3520?

IRS Form 3520 is one of the more complicated and difficult tax forms. According to the Paperwork Reduction Act Notice, the estimated burden of this official form includes:

| Recordkeeping | 42 hr., 34 min. |

| Learning about the law or the form | 4 hr., 50 min. |

| Preparing the form | 6 hr., 40 min. |

| Sending the form to the IRS | 16 min. |

This walk through is intended to help understand how your tax professional might complete the form on your behalf. U.S. taxpayers should hire a tax professional, such as a tax attorney, to complete this federal form.

Please note: ignorance of the applicable federal tax laws or of your state’s estate laws does not constitute a valid excuse, nor free you from your filing obligation. Significant penalties may apply to taxpayers who do not properly complete this form.

Header

In the first part of this form, you’ll provide initial information, such as:

- Applicable tax year

- Type of return (initial, final, or amended)

- Type of entity filing the return

- Individual

- Partnership

- Corporation

- Trust

- Executor

- Applicable boxes

- The box(es) that you check will determine which part of the form you will complete. For example, if you “are a U.S. person who, during the current tax year, received certain gifts or bequests from a foreign person,” then you will complete Part IV of Form 3520.

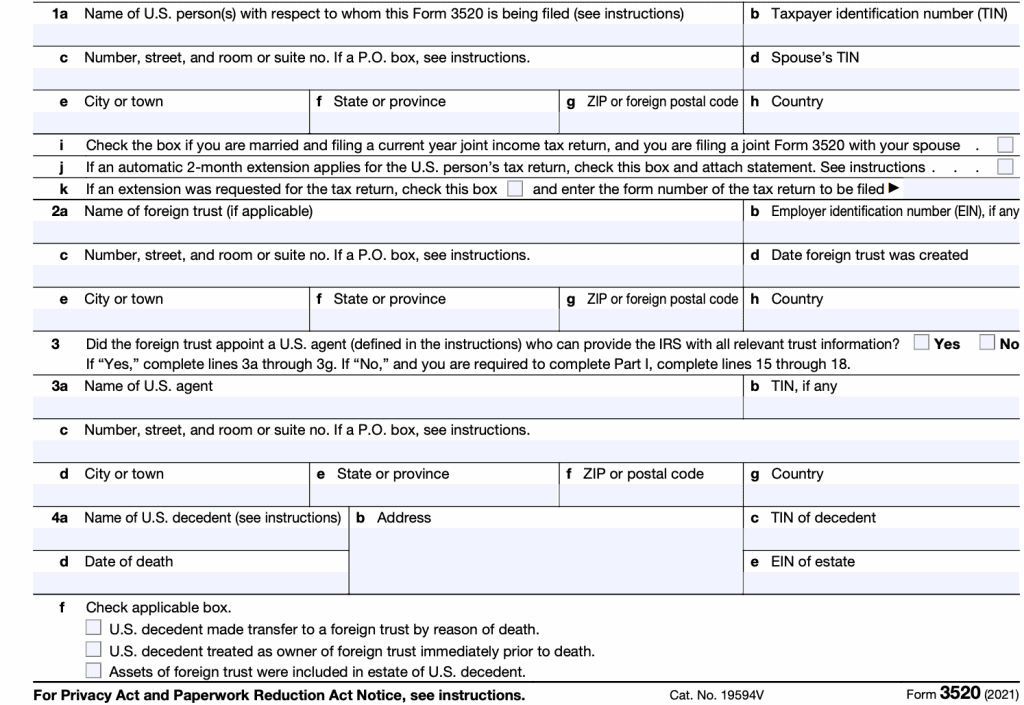

Taxpayer information

Blocks 1-4 contain taxpayer information. Below are a couple of notes from the IRS instructions.

Lines 1a and 1i.

Line 1a identifies the person that is filing Form 3520.

If you and your spouse are filing a joint Form 3520, put your names and TINs in the same order as they appear on your Form 1040, U.S. Individual Income Tax Return, or Form 1040-SR, U.S. Tax Return for Seniors, and check the box on line 1i.

Line 1j.

If you qualify for an automatic 2-month extension because you either live and work outside the United States and Puerto Rico, OR you are in the military or naval service on duty outside the United States and Puerto Rico, then you will:

- Check the box

- Attach a statement showing that you are a U.S. citizen or resident who meets the requirements

Line 1k.

If you filed for an extension of time to file your income tax return, check the box on line 1k. Also, enter the tax form number of the original tax return. For example, if you’re filing a Form 1040, you will enter “1040” on this line.

Line 2b.

Enter the employer identification number (EIN) of the foreign trust. Do not enter an SSN or ITIN.

Only EINs should be used to identify the foreign trust.

Line 3.

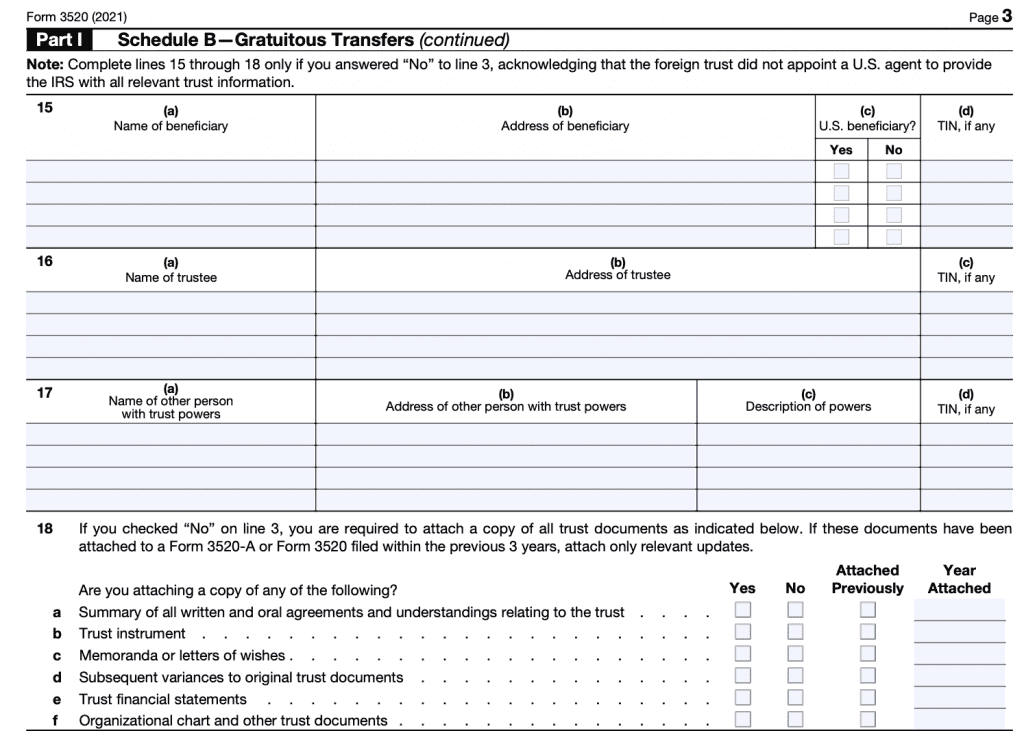

If the foreign trust did not appoint a U.S. agent who can provide the IRS with all relevant trust information, check “No” and you are required to complete lines 15 through 18.

Lines 4a through 4f.

If you are the executor of the estate of a U.S. citizen or resident, you must provide information about the decedent on lines 4a through 4e. You must also check the applicable box on line 4f to indicate which of the following applies:

- The U.S. decedent made a transfer to a foreign trust by reason of death,

- The U.S. decedent was treated as the owner of a portion of a foreign trust immediately prior to death, or

- The estate of the U.S. decedent included assets of a foreign trust.

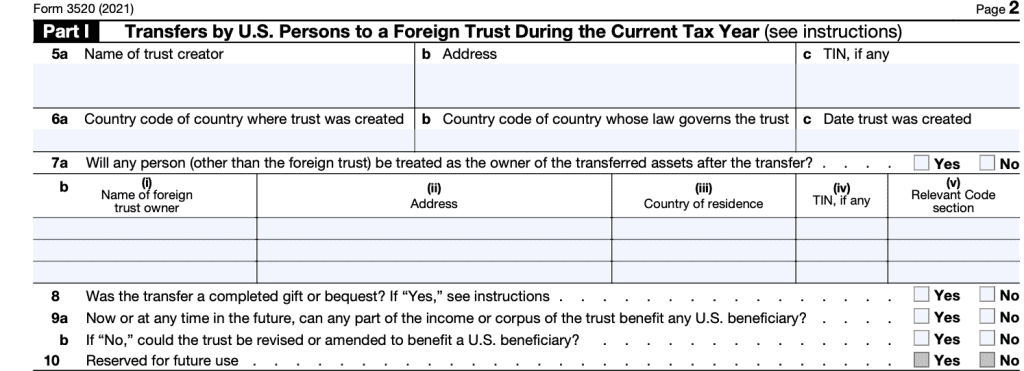

Part I-Transfers by U.S. Persons to a Foreign Trust During the Current Tax Year

In this section, you’ll complete:

- Name of trust creator.

- Address of the creator.

- TIN of the creator.

- 2-letter country code and date where foreign trust was created

- Other owners of the transferred assets

- Specific questions about whether the transfer was a completed gift, and whether any U.S. beneficiary would benefit.

Schedule A-Obligations of a Related Trust

According to the IRS instructions, taxpayers will “complete the applicable portions of Schedule A with respect to all transfers to a related foreign trust in exchange for an obligation of the trust or a person related to the trust that took place during the current tax year.”

If you answer ‘No’ to question 11a, you’ll simply skip the rest of Schedule A and go to Schedule B.

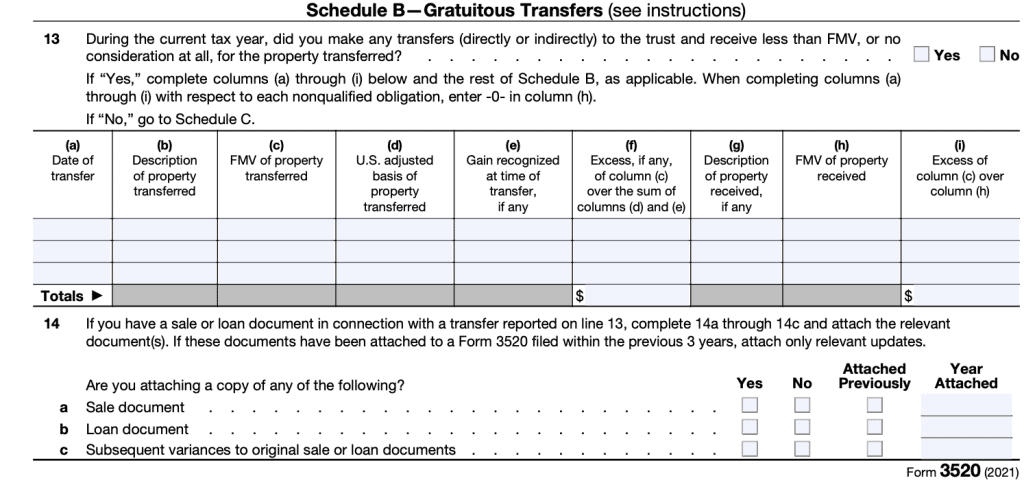

Schedule B-Gratuitous Transfers

Schedule B reports all reportable events that occurred during the tax year. You’ll also use Schedule B as the guide for the required supporting documents that you must attach to the form. A partial list of these documents includes:

- Sale or loan documents

- Trust documents

- Memoranda or letters

- Financial statements associated with the trust

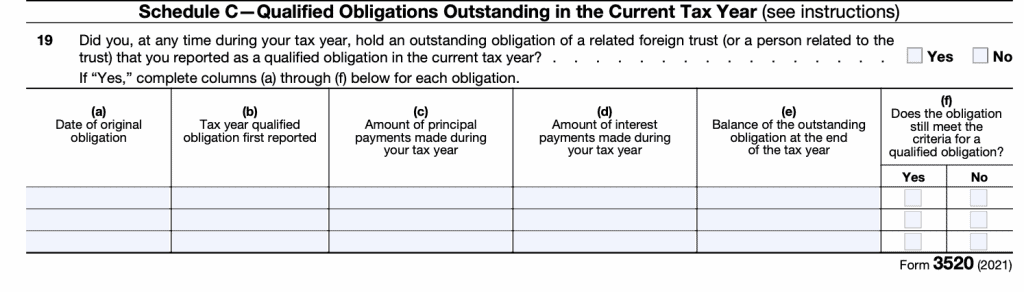

Schedule C-Qualified Obligations Outstanding in the Current Tax Year

You’ll use Schedule C to report qualified obligations outstanding in the current tax year. If the obligation is not a ‘qualified obligation,’ you may need to report it as a gratuitous transfer to the trust under Schedule B. See the instructions for more detail.

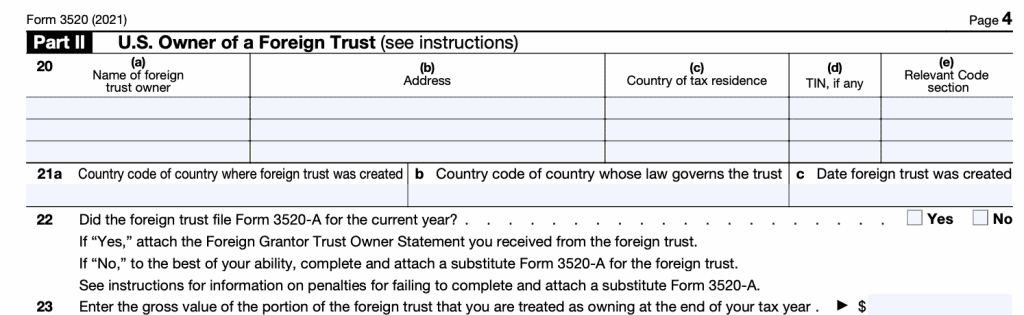

Part II-U.S. Owner of a Foreign Trust

You will complete Part II if you are considered an owner of any assets of a foreign trust under IRC Sections 671 through 679. This is required even if there are no transactions to report.

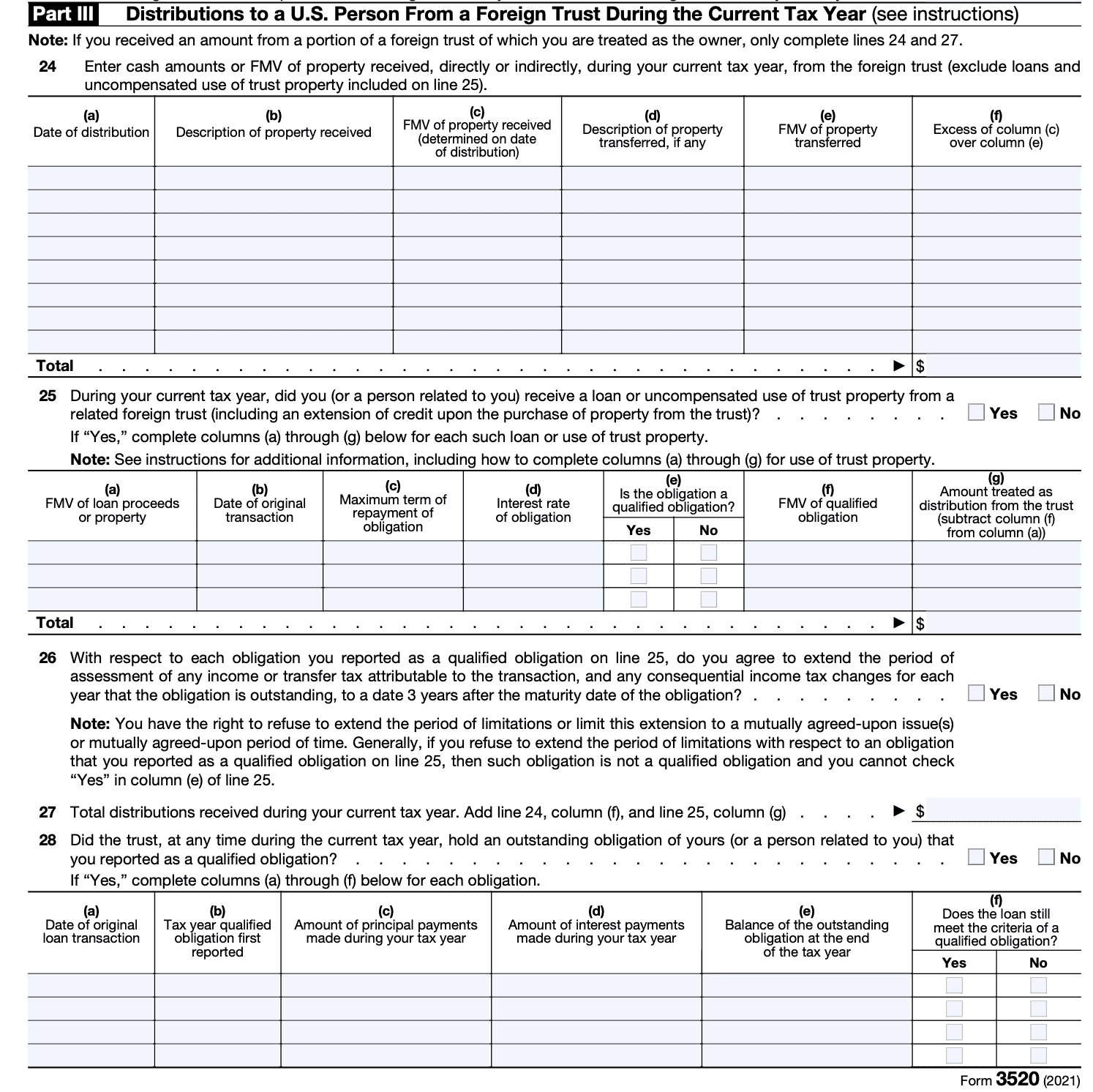

Part III-Distributions to a U.S. Person From a Foreign Trust During the Current Tax Year

Part III is used to report distributions from a foreign trust to a U.S. person during the tax year. Your answer to Part III will help to determine which Schedule you complete below:

- Complete Schedule A if:

- You may use either Schedule A or B if you answered Yes to question 30. However, if you use Schedule A in the initial year, you must continue using it in subsequent years.

- Complete Schedule B if:

- You answered Yes to Question 30

- If you’ve never used Schedule A

- You attach a copy of the Foreign Nongrantor Trust Beneficiary Statement to the return

- Complete Schedule C if:

- You entered a value in either Block 37 or Block 41a.

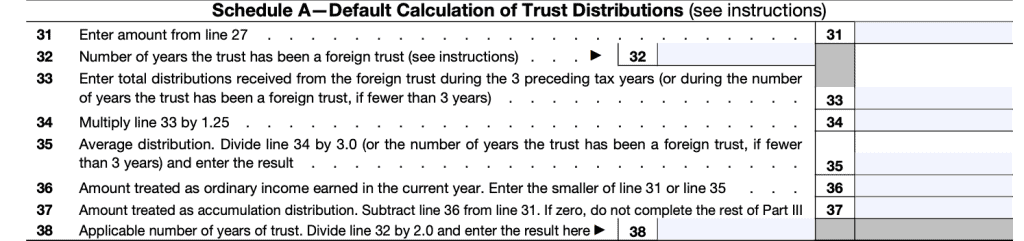

Schedule A

Schedule A is the default calculation of the trust distributions. Once you use this calculation, you must use Schedule A in future tax years.

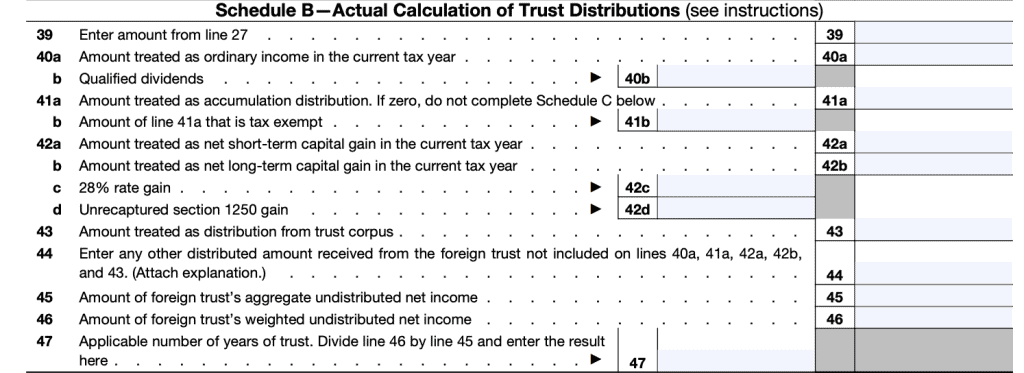

Schedule B

You can use Schedule B to calculate trust distributions if you have not already used Schedule A in previous tax years.

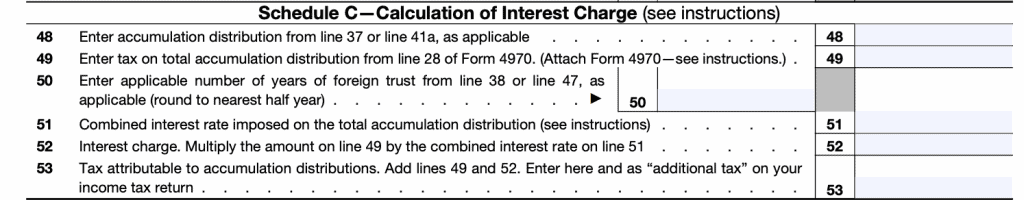

Schedule C

You’ll complete Schedule C if you entered any amount as accumulation distribution. If you did not receive any accumulation distribution, do not fill in Schedule C.

Part IV-Signature

Part IV is the section where you report reportable events. Again, reportable events include:

- Any amount over $100,000 from a nonresident alien or foreign estate, or

- Any amount from a foreign corporation or foreign partnership in excess of the annual amount ($16,815 for 2021).

Below Part IV, either you or your paid preparer (read: tax professional) will sign and date the return. Since this is a declaration under penalty of perjury, you should have a tax professional complete this informational tax return.

Where do I turn in IRS Form 3520?

When this informational return is complete, the IRS instructs taxpayers to send Form 3520 to the following address:

Internal Revenue Service Center

P.O. Box 409101

Ogden, UT 84409

Form 3520 must have all required attachments to be considered complete.

How can I obtain a copy of IRS Form 3520?

You may obtain a copy of IRS Form 3520 from the IRS website, or by clicking the link below.