IRS Form 8833: A Guide to Treaty Based Tax Returns

If you’re a U.S. person living overseas, you may be required to report your income to both the U.S. government and the foreign country where you reside. To help U.S. citizens avoid being subject to double taxation, the United States has a number of international tax treaties with many foreign countries. In some cases, U.S. taxpayers may have the option of filing IRS Form 8833 to pay federal taxes at a reduced rate than they otherwise would pay under U.S. tax law and the laws of the foreign country in which they reside.

These international tax treaties may affect income taxes as declared on a federal tax return. However, a tax treaty may also impact:

- Estate taxes

- Gift tax

- Excise tax and other taxes on corporations

This in-depth guide will walk you through how to complete Form 8833. We’ll also provide some background information on:

- Reporting requirements when filing a tax return based on a tax treaty position

- When the Internal Revenue Service requires taxpayers to complete Form 8833

- When US taxpayers are exempt from filing this tax form

Let’s start with a primer on IRS Form 8833 itself.

Contents

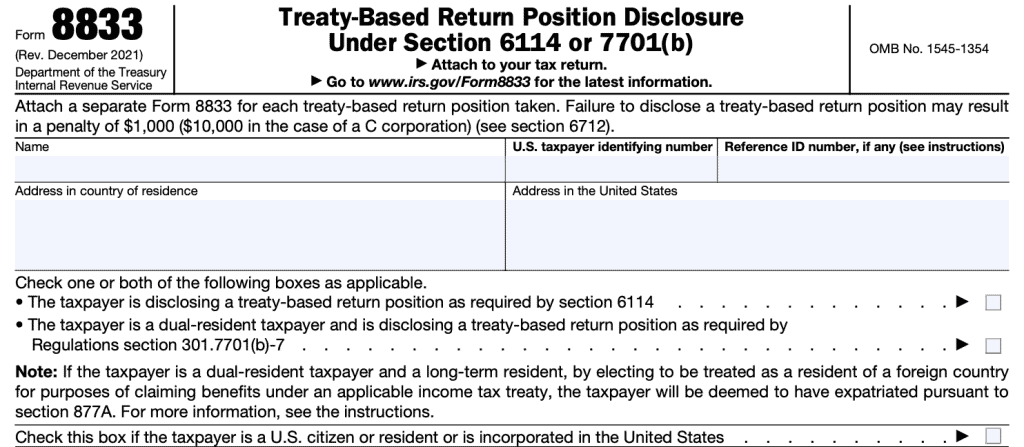

What is IRS Form 8833?

IRS Form 8833, Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b), is the tax form taxpayers must complete when taking a treaty-based position that results in a reduction of tax on their U.S. tax return. This includes individuals and corporations as well.

What is a treaty-based return position?

As a general rule, U.S. tax law requires U.S. taxpayers to report worldwide income to the U.S. government. However, the taxpayer can claim tax treaty benefits if they meet the requirements of that particular tax treaty.

A treaty-based return position on a US tax return is one that relies on a tax treaty provision to override a provision of the Internal Revenue Code to lower a taxpayer’s U.S. tax liability.

This tax form focuses on two specific authority references:

- IRC Section 6114

- Treasury Regulations Section 301.7701(b)-7

We’ll go through each of these tax authorities for a better understanding.

What is IRC Section 6114?

IRC Section 6114 simply states that if a taxpayer takes a certain tax treaty position to lower their US taxes, then the taxpayer must provide specific information to the federal government about their position.

The law gives the Secretary of the Treasury (and the IRS, which falls under the Department of Treasury), a lot of latitude on reporting requirements, which we’ll discuss in a moment.

What is Section 7701(b)?

Treasury Regulations Section 301.7701(b)-7, also referred to as Section 7701(b), establishes reporting requirements for dual-resident taxpayers.

What is a dual-resident taxpayer?

Section 7701(b) answers this question:

According to the regulations, a “dual resident taxpayer” is:

An individual who is considered a resident of the United States pursuant to the internal laws of the United States and also a resident of a treaty country pursuant to the treaty partner’s internal laws.

Treasury Regulations Section 301.7701(b)-7(a)(1)

Specifically, Section 7701(b) also addresses a couple of things that a dual resident taxpayer may or may not do.

Taxpayers cannot pick and choose which parts of a tax treaty to claim.

If a taxpayer elects to use a tax treaty to lower their U.S. tax liability, then they are subject to all of the applicable sections of that tax treaty.

Claiming benefits of the treaty means that the taxpayer will be considered a nonresident alien for U.S. income tax purposes

Specifically, this Section states:

If the alien individual determines that he or she is a resident of the foreign country for treaty purposes, and the alien individual claims a treaty benefit (as a nonresident of the United States) so as to reduce the individual’s United States income tax liability with respect to any item of income covered by an applicable tax convention during a taxable year in which the individual was considered a dual resident taxpayer, then that individual shall be treated as a nonresident alien of the United States for purposes of computing that individual’s United States income tax liability under the provisions of the Internal Revenue Code and the regulations thereunder (including the withholding provisions of Section 1441 and the regulations under that section in cases in which the dual resident taxpayer is the recipient of income subject to withholding) with respect to that portion of the taxable year the individual was considered a dual resident taxpayer.

Treasury Regulations Section 301.7701(b)-7(a)(1)

In short, if you claim an income tax treaty benefit as a resident of a treaty country, the United States will consider you to be a nonresident alien for income tax purposes only.

Who must fill out IRS Form 8833?

The form instructions maintain a long list of situations in which a taxpayer may be required to file this form. However, the instructions state that this is not an all-inclusive list.

Let’s take a closer look at situations in which a taxpayer must file this tax form.

A provision of the treaty prevents the application of a tax code provision that would otherwise apply.

The exception to this is the election of a foreign corporation to be treated as a domestic corporation as outlined under IRC Section 897(i). This does not necessitate filing Form 8833.

The treaty impacts the tax treatment of real estate sales

If a treaty reduces or modifies the taxation of gains or losses from the disposition of a U.S. real property interest, then the taxpayer must file.

The treaty modifies branch profits tax or taxes on excess interest

Generally speaking, a foreign company with branches in the United States must pay a 30% tax on any excess income produced by US branches, but not reinvested in them. Under Section 884, this includes:

- The profits themselves

- Excess interest earned on the profits

If a treaty reduces or modifies this tax, then the taxpayer must file.

The treaty reduces taxes on certain dividend or interest income

If a tax treaty reduces the income tax liability for dividend and interest income paid by a foreign corporation, but U.S.-sourced, the taxpayer must file. The following code provisions apply, and will provide more specific detail:

- IRC Section 861(a)(2)(B): Certain dividends from a foreign corporation

- IRC Section 884(f)(1)(A): Interest on profits excluded from branch profits tax

The treaty reduces certain fixed, determinable, annual, periodical (FDAP) income

This is the section that might apply to most taxpayers who are individuals. It maintains that anyone who receives FDAP income may be required to file this form if their treaty position lowers their tax bill. The form instructions contain more detailed information on when a taxpayer must file based on FDAP income tax reduction.

What is FDAP income?

The IRS considers all sources of income to be FDAP income, unless it’s specifically excluded. Below are some important references for individuals.

Determining FDAP

The IRS considers income to be:

- Fixed when paid in amounts that are known ahead of time

- Determinable when there is a basis for figuring out how much is paid

- Periodic if paid from time to time.

- Does not have to be annual, or even at regular intervals

Here are some common types of FDAP:

- Compensation for personal services

- This might include commissions and gross proceeds from performances

- Dividends

- Interest

- Original issue discount

- Pensions and annuities

- Alimony

The IRS website maintains a list of all income sources, then describes the treatment of each. We’ll touch base on some particulars of other sources of FDAP.

Social Security benefits

The IRS considers U.S. source FDAP to include 85% of any U.S. Social Security benefit (or the Social Security equivalent part of a Tier 1 railroad retirement benefit). Some tax treaties exclude Social Security income.

IRS Publication 901, U.S. Tax Treaties, contains a complete list of tax treaties that exempt U.S. Social Security benefits from U.S. income tax.

Capital gains

Capital gains are subject to varying types of treatment, based upon:

- Source of income

- Length of residency in the United States

Refer to the IRS website for more specific details.

Installment payments

Income can be FDAP income whether it is paid in a series of repeated payments or in a single lump sum. The IRS example states that $5,000 in royalty income would be FDAP income whether paid in:

- 10 payments of $500 each, or

- 1 payment of $5,000

Insurance proceeds

If an insured nonresident alien surrenders a life insurance policy, or receives income at the policy’s maturity, the proceeds are considered FDAP income to the extent they exceed the policy’s cost.

Certain payments, such as accelerated death benefits or payments received as part of a viatical settlement contract, might not be taxable. IRS Publication 525, Taxable and Nontaxable Income, contains more detail.

Income connected with a U.S. trade or business, but not attributable to a source in the United States

If income is effectively connected with a U.S. trade or business of a taxpayer, but is not attributable to a permanent establishment or a fixed base in the United States, the taxpayer must file.

The treaty modifies profits attributable to U.S. sources

If a treaty modifies the amount of business profits of a taxpayer attributable to a permanent establishment or a fixed base in the United States, the taxpayer must file IRS form 8833.

The treaty makes certain alterations

This includes:

- Altering the source of an item of income or deduction

- Granting a foreign tax credit otherwise not allowed under the Internal Revenue Code

- Determining an individual’s residency for tax purposes

If any of these apply, the taxpayer must file.

Exceptions to filing Form 8833

The Treasury Regulations also provide guidance for filing exceptions. While you can find the guidance in Section 301.6114-1(c), a partial list is below. Since exceptions are generally narrow, you may need to consult the Regulations or seek legal advice before applying them to your specific situation.

Certain sources of income

If a treaty reduces or modifies an individual’s income from certain sources or for certain individuals, the reporting requirement is waived. This includes income from:

- Dependent personal services

- Pensions

- Annuities

- Social Security or other public pensions

It also may income earned by:

- Artists

- Athletes

- International students

- Trainees

- Teachers

Excise tax under certain conditions

If a treaty exempts a taxpayer from excise tax imposed by IRC Section 4371, the filing requirement may be waived if certain conditions are met.

An example could be if the taxpayer has already entered into an excise tax closing agreement with the IRS.

The treaty position has already been disclosed

If a partnership, trust, or estate has disclosed a treaty position that the partner or beneficiary would otherwise be required to disclose, they do not need to file this form to disclose that treaty position.

How do I complete IRS Form 8833?

This one-page form appears relatively straightforward to complete. We’ll walk through this form, step by step. At the end of this section, we’ll outline the other filing requirements, such as where and how to file.

Form 8833 step by step directions

Let’s start with the top of the form.

Taxpayer information

This section contains basic taxpayer information, such as:

- Name

- Taxpayer identification number. This may be one of the following:

- Social Security Number (individuals only)

- Individual Taxpayer Identification Number (ITIN) (individuals only)

- Employer Identification number (EIN) (all others)

- Reference ID number, if applicable

- This might be the same ID number used on IRS Form 5471 or IRS Form 5472

- Address in country of residence

- Enter in order: city, state or province, country

- Do not abbreviate the country’s name

- U.S. address

Below the taxpayer information, you may check one of several boxes:

- Taxpayer is disclosing a treaty-based return position as required by IRS Section 6114

- Taxpayer is a dual-resident taxpayer and disclosing a treaty-based return position as required by Regulations Section 301.7701(b)-7

- The taxpayer is a U.S. citizen, resident, or incorporated in the United States

You’ll note that if the taxpayer elects to be treated as a resident of a foreign country in order to claim treaty benefits, then that taxpayer will be considered an expatriate, per IRC Section 877A.

Termination of U.S. residency

According to the IRS, if you are a dual-resident taxpayer and a long-term resident (LTR) and you are filing this form to be treated as a resident of a foreign country for purposes of claiming benefits under an applicable U.S. income tax treaty, you will be deemed to have terminated your U.S. residency status for federal income tax purposes.

This means that you may be subject to tax under IRC Section 877A, and you must file IRS Form 8854, Initial and Annual Expatriation Statement.

The federal government considers you to be an LTR if you were a lawful permanent U.S. resident for 8 of the previous 15 tax years ending with the year you file Form 8833. IRS Pub. 519, U.S. Tax Guide for Aliens contains more details.

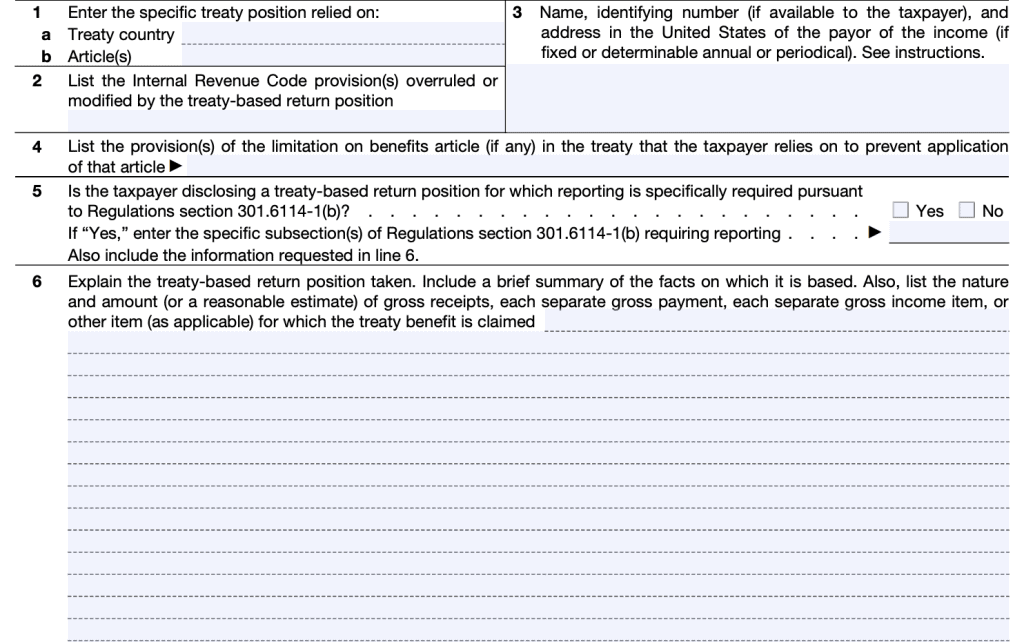

Treaty information

Although not marked on the form, this section contains information about the treaty, the position the taxpayer chooses to take, and the Code Section that the treaty overrules.

Line 1: Specific treaty

Enter the treaty country in Line 1a. For Line 1b, list the article or articles that the treaty position relies upon.

Line 2: IRC provision overruled

List the provisions that the treaty-based return position either overrules or modifies.

Line 3: FDAP income payor

List the name, ID number (if available), and address of the payor for the FDAP income declared. If there is more than one position, or more than one source of income declared, you may need to file a separate form for each.

For more information, individuals should consult Section 871(a) and Treasury Regulations Section 1.871-7(b) and (c). Foreign corporations should see Section 881(a) and Treasury Regulations Section 1.881-2(b) and (c).

Line 4: Provisions cited

In Line 4, name the specific test in the Limitations on Benefits (LOB) article that’s met. The IRS website contains an LOB table, with a summary of the various tests for each treaty.

If you have made a request with the U.S. competent authority for a discretionary determination, and that request is still pending, you may not claim benefits, unless the treaty or technical explanation specifically states otherwise.

Line 5

Select the appropriate box.

If ‘Yes,’ Enter the subsection of Regulations Section 301.6114-1(b) that is pertinent to your treaty-based return position and proceed to Line 6.

If ‘No,’ simply proceed to Line 6.

Line 6

Unless specifically waived under Treasury Regulations Section 301.6114-1(c), all taxpayers taking a treaty-based return position must include all requested information.

If applicable, explain:

- Why this position meets the LOB test identified on Line 4

- Basis for meeting any special requirements

- Amount of the income affected by the treaty claim

How do I file IRS Form 8833?

When filing your tax return, such as Form 1040-NR or Form 1120-F, you should attach all completed copies of Form 8833 to your tax return. Normal filing timelines apply, as this form is due with your completed tax return.

If you would not have to file a tax return, you must file one at the IRS Service Center where you would

normally file a return.

Where can I find IRS Form 8833?

You can download IRS Form 8833 from the IRS website or by selecting the file below.

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!