IRS Form 6251 Instructions

In 1969, Congress changed the tax law to institute an alternative minimum tax (AMT) to ensure wealthy people paid their fair share of income tax. Today, over 50 years later, there exists a lot of confusion over AMT, and how to minimize tax liability.

This in-depth guide will walk you through IRS Form 6251, Alternative Minimum Tax-Individuals, and help you understand:

- How AMT works

- What tax preference items are included in calculating AMT

- How tax planning can help you avoid AMT and lower your total tax bill

Let’s start with some background information about the alternative minimum tax.

How to complete IRS Form 6251

In this section, we’ll work through this tax form, step by step. That way, you can better understand how to complete this form.

Fortunately, tax software makes this easier than it used to be. And for taxpayers who have to complete this tax form, your accountant may very well earn their tax preparation fees simply by taking this off your hands.

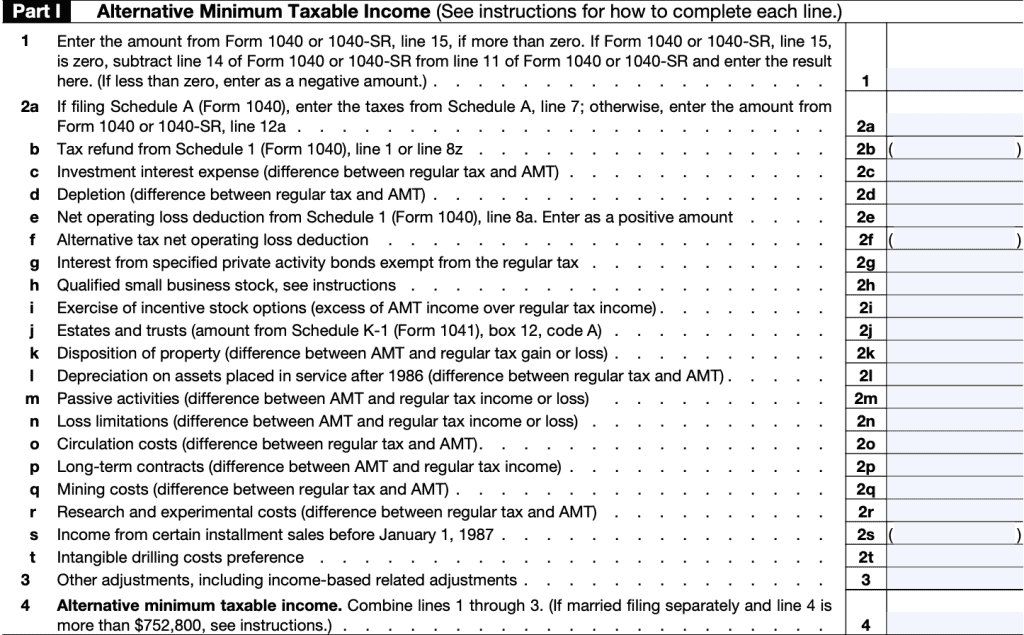

There are 3 parts to this form:

- Part I: Alternative Minimum Taxable Income

- Part II: Alternative Minimum Tax (AMT)

- Part III: Tax Computation Using Maximum Capital Gains Rates

Let’s start with calculating alternative minimum taxable income in Part I.

Part I: Alternative Minimum Taxable Income

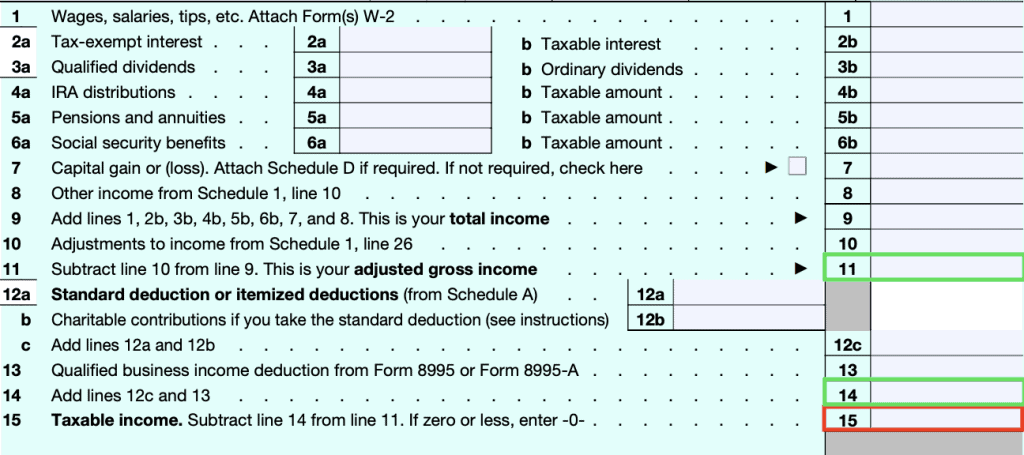

Line 1: Starting amount

Enter the amount from line 15 of your Form 1040 or 1040-SR. This is the line marked, Taxable Income.

If your taxable income is zero, then subtract Line 14 from Line 11, which is your adjusted gross income (AGI). Essentially, you’re subtracting the following deductions from your AGI:

- Standard deduction or itemized deductions from Schedule A

- Charitable contributions

- Qualified business income deduction, as calculated on IRS Form 8995

This is the number that goes into Line 1.

After Line 1 come a series of adjustments to help you arrive at your alternative minimum taxable income. Not all of these apply to every taxpayer.

Line 2a: Taxes

If you’re filing Schedule A (itemized deductions worksheet), you’ll enter the taxes from Line 7. Otherwise, enter the amount from your Form 1040, Line 12a.

Line 2b: Tax refunds

If you received a tax refund for state or local taxes paid, you’ll find that on Schedule 1 (Additional income and adjustments to income). Enter the amount from either:

- Line 1: Taxable refunds, credits, or offsets of state and local income taxes

- Line 8z: Other income

Line 2c: Investment interest expense

This line adds back any investment interest expense that you might have claimed as a deduction on either Schedule A or Schedule E.

You might have completed IRS Form 4952 to calculate the investment interest deduction for regular federal income tax purposes. If so, you’ll need to complete a second Form 4952 for AMT liability purposes. In that case, you’ll follow these steps:

- Follow the Form 4952 instructions for Line 1. But also include any interest that would have been deductible if tax-exempt interest on private activity bonds were includible in gross income.

- Enter the AMT disallowed investment interest expense from the previous tax year on Line 2.

- In Part II, recalculate the following, with the appropriate adjustments:

- Gross income from property held for investmentNet gain from the disposition of property held for investmentNet capital gain from the disposition of property held for investmentInvestment expenses

After completing Part III on Form 4952, you’ll need to calculate the difference between Line 8 of the regular Form 4952 and the AMT Form 4952. This number will go into Line 2c.

Line 2d: Depletion

As with Line 2c, you’ll need to recalculate the amount of depletion allowed based on:

- Taxable income from the property under Section 613(a),and

- The limit based on taxable income, with certain adjustments, under Section 613A(d)(1)

Additionally, depletion deduction for mines, wells, and other natural deposits under Section 611 is limited to the property’s adjusted basis at the end of the year, as refigured for AMT. An exception applies to independent producers or royalty owners claiming percentage depletion for oil and gas wells under Section 613A(c).

Enter the difference between the AMT amount and the regular amount. If the AMT amount is more than the regular deduction, enter this as a negative number.

Line 2e: Net operating loss deduction

Enter the number from Schedule 1, Line 8a. This should be a positive amount.

Line 2f: Alternative tax net operating loss deduction (ATNOLD)

This is the sum of the alternative tax net operating loss (ATNOL) carrybacks and carryforwards to the tax year. If this applies to your situation, the form instructions contain detailed guidance on this calculation.

This should be entered as a negative number.

Line 2g: Interest from specified private activity bonds exempt from regular tax

This is interest income from “specified private activity bonds” reduced (but not lower than zero) by any deduction that would have been allowable if the interest were includible in gross income for the regular tax.

Each payer of this interest should send you a Form 1099-INT. This amount should be included in Box 9.

Line 2h: Qualified small business stock

Applicable if you claimed the exclusion under Section 1202 for gain on qualified small business stock:

- Acquired before September 28, 2010, AND

- Held more than 5 years

If this is the case, multiply the excluded gain by 7%. This will be in Form 8949, column (g). Enter this result in Line 2h as a positive number.

Line 2i: Incentive stock options

For regular tax purposes, the exercise of incentive incentive stock options (ISO) in accordance with Section 422(b) has no tax impact. Under AMT rules, it does. Generally, you must include the difference, if any, of:

- The fair market value of the stock acquired through exercise of the option (determined without regard to any lapse restriction) when your rights in the acquired stock first become transferable or when these rights are no longer subject to a substantial risk of forfeiture; AND

- The amount you paid for the stock, including any amount you paid for the ISO used to acquire the stock

If you received IRS Form 3921-Exercise of an Incentive Stock Option Under Section 422(b), you might be able to use those numbers to calculate your adjustment.

As a general rule, if you exercise an ISO and sell the underlying stock in the same year, there should be no difference between the AMT treatment and regular tax treatment of those transactions.

Line 2j: Estates & trusts

Include the amount from IRS Form 1041, Schedule K-1, Box 12, Code A. According to the Schedule K-1 instructions, Code A simply is the total of the following adjustments on a beneficiary’s K-1 statement:

- AMT adjustment attributable to qualified dividends

- AMT adjustment attributable to net short-term capital gain

- AMT adjustment attributable to net long-term capital gain

- AMT adjustment attributable to unrecaptured section 1250 gain

- AMT adjustment attributable to 28% rate gain

- Accelerated depreciation

- Depletion

- Amortization

- Exclusion items

In other words, the AMT adjustments for the beneficiaries of estates and trusts look similar to the adjustments on a U.S. individual tax return.

Line 2k: Disposition of property

This line will include the AMT adjustment for any gains or losses on the disposition of property. Use this line to report any of the following:

- Gain or loss from the sale, exchange, or conversion of property reported on Form 4797, Sales of Business Property

- Casualty gain or loss to business or income-producing property reported on Form 4684, Casualties and Thefts

- Ordinary income from the disposition of property not already accounted for, or on another line on Form 6251

- Capital gain or loss reported on Form 8949 or Schedule D

For more detailed instructions, or for examples of calculations, please refer to the form instructions.

Line 2l: Depreciation on assets placed in service after 1986

This is a very confusing line. AMT adjustments for depreciation consider some depreciation. However, other depreciation is not included. Some must be recalculated, while some are not. Here is a list of each:

Do not use depreciation for the following:

- Passive activities. Take this adjustment into account on line 2m

- An activity for which you aren’t at risk. Take this adjustment into account on line 2n

- Income or loss from a partnership or an S corporation if the basis limitations apply. Take this adjustment into account on line 2n

- A tax shelter farm activity. Take this adjustment into account on line 3

Recalculate the following:

- Property placed in service after 1998 that is depreciated for the regular tax using the 200% declining balance method (generally 3-, 5-, 7-, and 10-year property under the modified accelerated cost recovery system (MACRS), except for certain qualified property eligible for the special depreciation allowance

- Section 1250 property placed in service after 1998 that isn’t depreciated for the regular tax using the straight line method; and

- Tangible property placed in service after 1986 and before 1999. (If the transitional election was made under Section 203(a)(1)(B) of the Tax Reform Act of 1986, this rule applies to property placed in service after July 31, 1986.)

Other depreciation that is NOT refigured:

- Residential rental property placed in service after 1998

- Nonresidential real property with a class life of 27.5 years or more placed in service after 1998 that is depreciated for the regular tax using the straight line method

- Other section 1250 property placed inservice after 1998 that is depreciated for the regular tax using the straight line method

- Property (other than section 1250property) placed in service after 1998that is depreciated for the regular tax using the 150% declining balance method or the straight line method

- Property for which you elected to use the alternative depreciation system(ADS) of section 168(g) for the regular tax

- Qualified property that is or was eligible for a special depreciation allowance if the depreciable basis of the property is the same for the AMT and the regular tax

- Any part of the cost of any property for which you elected to take a Section 179 expense deduction. The reduction to the depreciable basis of Section 179 property by the amount of the Section 179 expense deduction is the same for the regular tax and the AMT

- Motion picture films, videotapes, or sound recordings

- Property depreciated under the unit-of-production method or any other method not expressed in a term of years

- Indian reservation property that meets the requirements of Section 168(j)

- A natural gas gathering line placed in service after April 11, 2005

Please refer to the instructions for more details on how to re-calculate depreciation for AMT purposes.

Line 2m: Passive activities

You may need to recalculate passive activity gains and losses for AMT by accounting for all adjustments and preferences, as well as any AMT prior year unallowed losses that apply to that passive activity.

You’ll enter the difference between AMT-allowed and regular gain/loss as calculated on:

- IRS Schedule C, Profit or Loss From Business

- IRS Schedule E, Supplemental Income and Loss

- IRS Schedule F

- IRS Form 4835, Farm Rental Income and Expenses

Line 2n: Loss limitations

You’ll need to refigure gains and losses from the following by accounting for all AMT adjustments and preferences that apply:

- Activities for which you aren’t at risk, and

- Basis limitations applicable to partnerships and S corporations

Line 2o: Circulation costs

Circulation costs are the expenses to establish, maintain, or increase circulation of a newspaper, magazine, or other periodical. These are normally fully deductible in the year they were paid or incurred. For AMT purposes, the taxpayer must capitalize and amortize these costs over 3 years.

Enter the difference in Line 2o, even if it’s a negative number.

If you had a loss on property, but the circulation costs were not fully amortized, then your AMT deduction is the smaller of:

- The allowable loss for the costs, had they remained capitalized, OR

- Remaining costs to be amortized for AMT purposes

Line 2p: Long-term contracts

For AMT purposes, most taxpayers must use the percentage-of-completion method described in Section 460(b) to determine income from a long-term contract. However, this rule doesn’t apply to home construction contracts.

For contracts excepted from the percentage-of-completion method by Section 460(e)(1), you’ll use simplified procedures for allocating costs in Section 460(b)(3) to determine percentage of completion.

Taxpayers required to use percentage-of-completion method may owe interest or be entitled to a refund of interest for the tax year the contract is completed. See IRS Form 8697-Interest Computation Under the Look-Back Method for Completed Long-Term Contracts, for details.

Line 2q: Mining costs

Mining exploration and development costs deducted in full for the regular tax in the tax year they were paid or incurred must be capitalized and amortized over 10 years for AMT calculations. Enter the difference between the regular tax deduction and the AMT amortization.

However, you do not need to do this for costs where you elected the optional 10-year write-off.

Line 2r: Research and development costs

In a similar manner to mining costs, taxpayers must amortize research and development costs over a 10-year period. Enter the difference between the regular tax deduction and AMT-allowed deduction.

Line 2s: Income from certain installment sales before January 1, 1987

Enter the amount of installment sale income reported for regular tax purposes as a negative amount on Line 2s.

Line 2t: Intangible drilling costs preference

This is also a preference item that warrants an adjustment for AMT purposes. If this applies to your situation, you’ll want to follow the Form 6251 instructions closely.

Line 3: Other adjustments

You’ll enter other income-related adjustments that might apply to your situation. This could include:

- Depreciation figured using pre-1987 rules on equipment placed into service after 1987

- Pollution control facilities

- Tax shelter farm activities

- Charitable contributions of certain property

- Business interest limitation

- Biofuel producer credit and biodiesel and renewable diesel fuels credit

- Mortgage interest deducted on Schedule A on a non-primary residence

- Net qualified disaster loss

It’s important to note that adjustments to one item might warrant a recalculation to another item.

Possible affected items

Examples of items that could be affected by adjustments elsewhere include:

- Section 179 expense deduction (Form 4562, Line 12)

- Expenses for business or rental use of your home

- Conservation expenses (Schedule F, Form 1040, Line 12)

- Taxable IRA distributions, if prior year IRA deductions were different for AMT and regular tax purposes (Form 1040, Line 4b)

- Self-employed health insurance deduction (Schedule 1, Line 17)

- Self-employed SEP, SIMPLE, and qualified plans deduction (Schedule 1, Line 16)

- IRA deduction (Schedule 1, Line 20)

Line 4: AMT Income

Combine Lines 1 through 3.

If your filing status is married filing separately, and Line 4 is more than $752,800, then you must include an additional amount. If Line 4 is greater than $982,000, then add another $57,300. Otherwise, include 25% of the excess above $752,800.

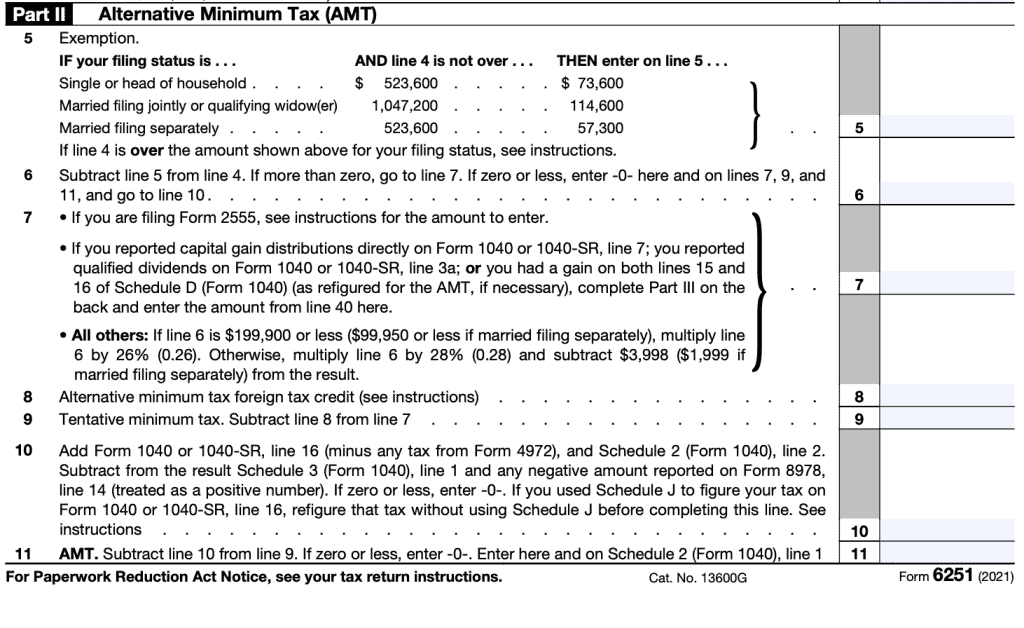

Part II: Alternative Minimum Tax (AMT)

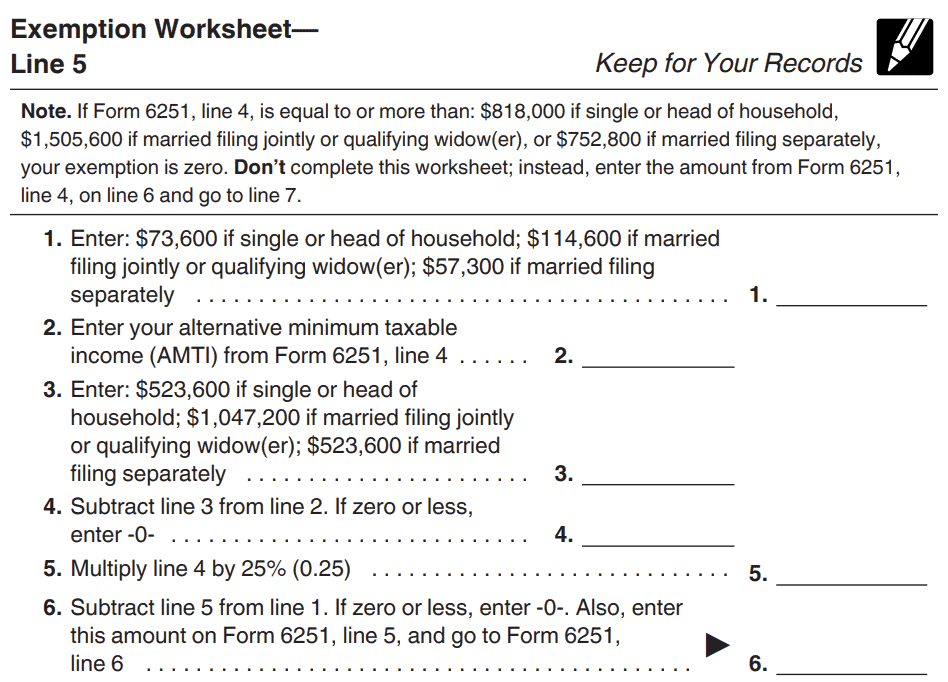

Line 5: Exemption amount

Your AMT exemption amount depends on your filing status and the amount of income you have. See the table below.

| Filing status | Line 4 is not over: | Enter this amount on Line 5 |

| Single or head of household | $523,600 | $73,600 |

| Married filing jointly or qualifying widow(er) | $1,047,200 | $114,600 |

| Married filing separately | $523,600 | $57,300 |

Exemption amounts based on filing status

If Line 4 is over the respective amount for your filing status, you’ll need to complete an exemption amount worksheet. See below.

Line 6: Subtract Line 5 from Line 4

If more than zero, go to Line 7.

If zero or less, enter ‘0’ on Lines 6, 7, 9, and 11. Go to Line 10.

Line 7

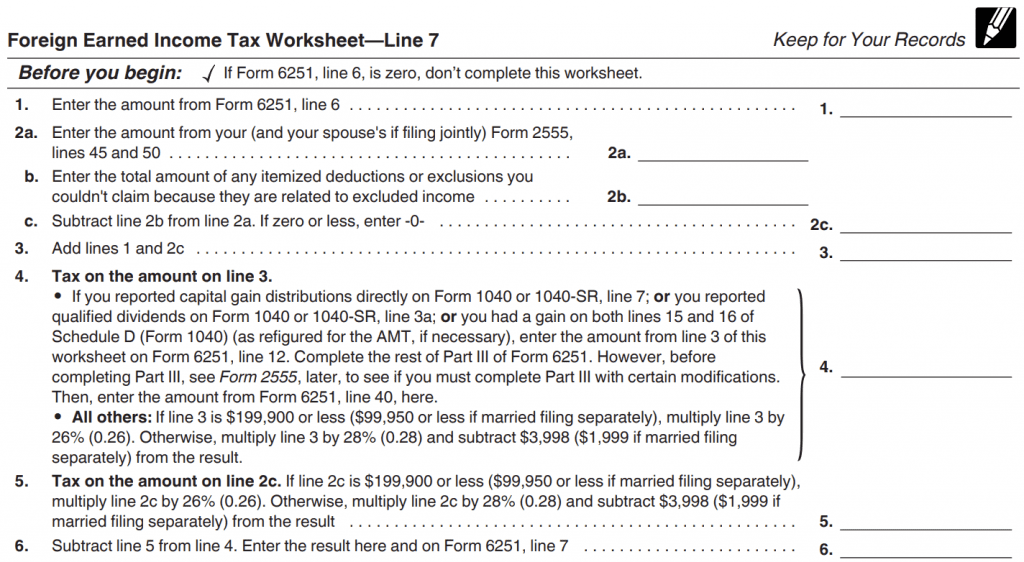

If you are filing Form 2555 (Foreign Earned Income), you’ll need to complete a Foreign Earned Income worksheet (see below).

If you reported capital gain distributions on Form 1040, Line 7, qualified dividends on Line 3a, or had a gain on both Lines 15 and 16 of Schedule D, you’ll need to complete Part III and enter the amount from Line 40 here.

Everyone else: If Line 6 is $199,900 or less ($99,950 if married filing separately), multiply Line 6 by 26%. Otherwise, multiply Line 6 by 28% and subtract $3,998 ($1,999 for married filing separately) from the result.

Line 8: Alternative minimum tax foreign tax credit

If foreign tax credits apply to you, you may need to refer to the instructions to determine your foreign tax credit under AMT.

Line 9: Tentative minimum tax

Subtract Line 8 from Line 7.

Line 10

This primarily applies to people who filed Form 8978-Partner’s Additional Reporting Year Tax, or farmers and fishermen who filed Schedule J on their Form 1040.

If either applies, follow the instructions to determine your adjustment.

Line 11

Subtract Line 10 from Line 9. Enter the amount here and on Schedule 2-Additional Taxes. This is your alternative minimum tax.

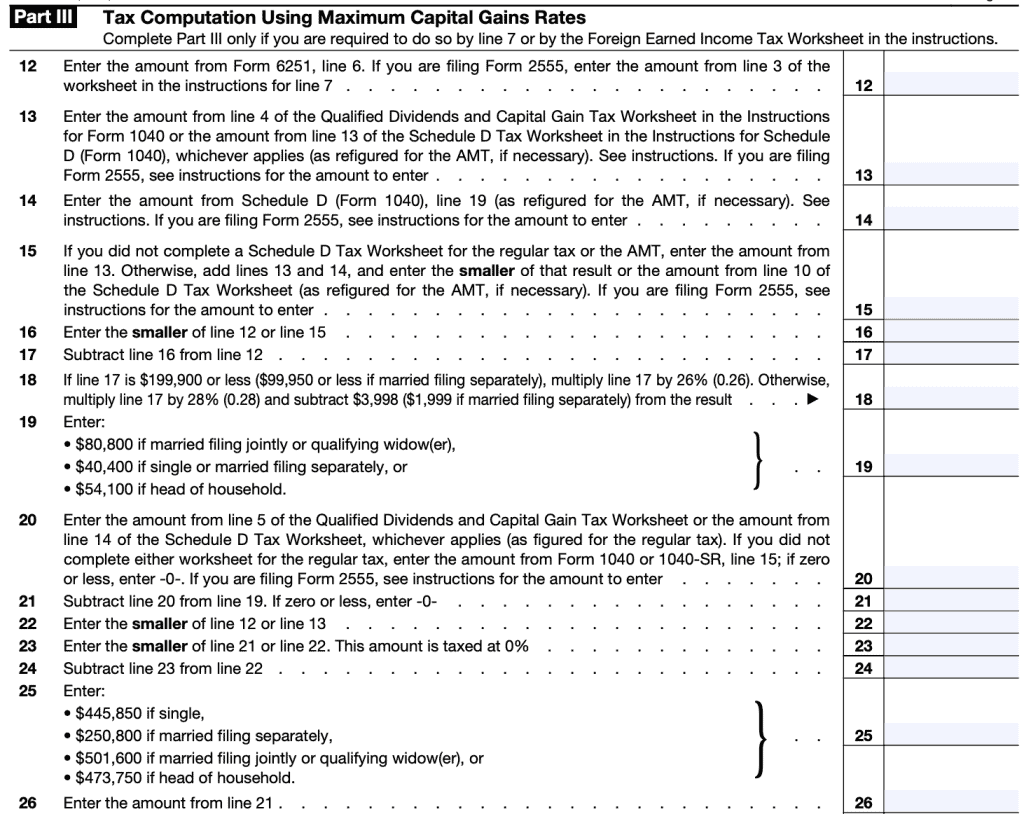

Part III: Tax Computation Using Maximum Capital Gains Rates

Not all taxpayers must complete Part III. Only complete Part III if one of the following applies:

- You followed the instructions for Line 7, and they directed you to complete Part III,

- The Foreign Earned Income Tax Worksheet directs you to do so

Line 12: Enter amount from Line 6

Unless you’re filing Form 2555, then enter the amount from Line 3 of the worksheet in Line 7’s instructions

Line 13:

Follow the instructions for Lines 13-15 if any of the following apply:

- The gain or loss from any transaction reported on Form 8949 or Schedule D is different for AMT and regular tax purposes because of a different basis due to:

- Depreciation adjustments

- ISO adjustments

- Different AMT loss carryover from the previous tax year

- You didn’t complete either the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet because Form 1040, 1040-SR, or Form 1040-NR, line 15, is zero

- You received a Schedule K-1 that shows an amount in Box 12 with code B, C, D, E, or F.

If any of these apply, follow the respective instructions.

Enter the amount from:

- Line 4 of the Qualified Dividends and Capital Gain Tax Worksheet in the Form 1040 instructions, or

- Line 13 of the Schedule D Tax Worksheet

These are capital gains distributions

Line 14: Enter amount from Schedule D, Line 19

This is unrecaptured Section 1250 depreciation.

Line 15

If you did not complete Schedule D, enter the amount from Line 13. If you did, add Lines 13 and 14, then enter the smaller of:

- That result, OR

- Line 10 from Schedule D

Line 16: Enter the smaller of Line 12 or Line 15

Self-explanatory

Line 17: Subtract Line 16 from Line 12

Self-explanatory

Line 18: AMT Tax Brackets

If Line 17 is $199,900 or less ($99,950 for married couples filing separately), multiply Line 17 by 26%. Otherwise, multiply by 28%, and subtract $3,998 (or $1,999 if married filing separate returns)

Line 19:

Enter:

- $80,800 if married filing jointly or qualifying widow(er)

- $40,400 if single or filing separately

- $54,100 for head of household

Line 20:

Enter the one that applies:

- Line 5 of the Qualified Dividends and Capital Gain Tax Worksheet

- Line 14 of the Schedule D Tax Worksheet

- Form 1040, Line 15 (taxable income)

If filing Form 2555, see instructions.

Line 21: Subtract Line 20 from Line 19

Self-explanatory. If result is negative, enter ‘0.’

Line 22: Enter the smaller of Line 12 or Line 13

Self-explanatory

Line 23: Enter the smaller of Line 21 or Line 22

Self-explanatory. This amount is taxed at 0%.

Line 24: Subtract Line 23 from Line 22

Self-explanatory.

Line 25: Enter based upon filing status

- Single

- Married filing separately

- Married filing jointly or qualifying widow(er)

- Head of household

Enter the number that applies:

| Filing Status | Number |

| Single | $445,800 |

| Married filing separately | $250,800 |

| Married filing jointly or qualifying widow(er) | $501,600 |

| Head of household | $473.750 |

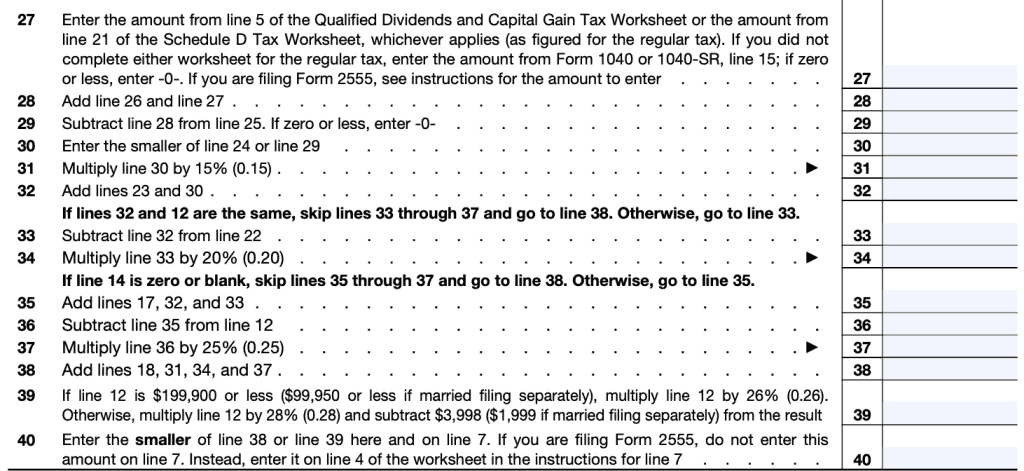

Line 26: Enter the amount from Line 21

Self-explanatory

Line 27: Enter one of the following:

- Amount from Line 5 of the Qualified Dividends and Capital Gain Tax Worksheet

- Amount from Line 21 from Schedule D

- Form 1040, Line 15 (taxable income)

Line 28: Add Line 26 and Line 27

Self-explanatory

Line 29: Subtract Line 28 from Line 25

If zero or less, enter ‘0.’

Line 30: Enter the smaller of Line 24 or Line 29

Self-explanatory

Line 31: Multiply Line 30 by 15%

Self-explanatory

Line 32: Add Lines 23 and 30

If Lines 32 and 12 are identical, go directly to Line 38. If they are not identical, go to Line 33.

Line 33: Subtract Line 32 from Line 22

Self-explanatory

Line 34: Multiply Line 33 by 20%

If Line 14 is zero or blank, skip Lines 35 through 37 and go to Line 38. Otherwise, go to Line 35.

Line 35: Add Lines 17, 32, and 33

Self-explanatory.

Line 36: Subtract Line 35 from Line 12

Self-explanatory

Line 37: Multiply Line 36 by 25%

Self-explanatory

Line 38: Add Lines 18, 31, 34, and 37

Self-explanatory

Line 39: AMT percentages

If Line 17 is $199,900 or less ($99,950 for married couples filing separately), multiply Line 17 by 26%. Otherwise, multiply by 28%, and subtract $3,998 (or $1,999 if married filing separate returns).

Line 40: Enter the smaller of Line 38 or Line 39 here and on Line 7

If filing Form 2555, do not enter this amount on Line 7. Instead, enter on Line 4 of the worksheet in the instructions for Line 7.

How do I file Form 6251?

Taxpayers who must file IRS Form 6251 will generally complete it with their personal income tax return. However, they do not need to attach the form to their tax return unless one of the following is true:

- Form 6251, Line 7 is greater than Line 10

- You claim any general business credit, and either Line 6 or Line 25 of Form 3800 is more than zero

- You claim one of the following:

- Qualified electric vehicle credit (using IRS Form 8834)

- Personal use part of the alternative fuel vehicle refueling property credit (IRS Form 8911)

- Credit for prior year minimum tax (IRS Form 8801)

- The total of Lines 2c through 3 is negative, and Line 7 would be greater than Line 10 if you did not account for Lines 2c through 3.

How do I determine whether I’m subject to AMT?

The IRS Form 1040 instructions help taxpayers determine whether AMT applies to them. According to the instructions, taxpayers may use one of two methods to do this:

- Schedule 2, Line 1 Instructions

- IRS Form 6251

In either case, if AMT applies, then the taxpayer must complete Form 6251. Let’s take a look at the Schedule 2 instructions.

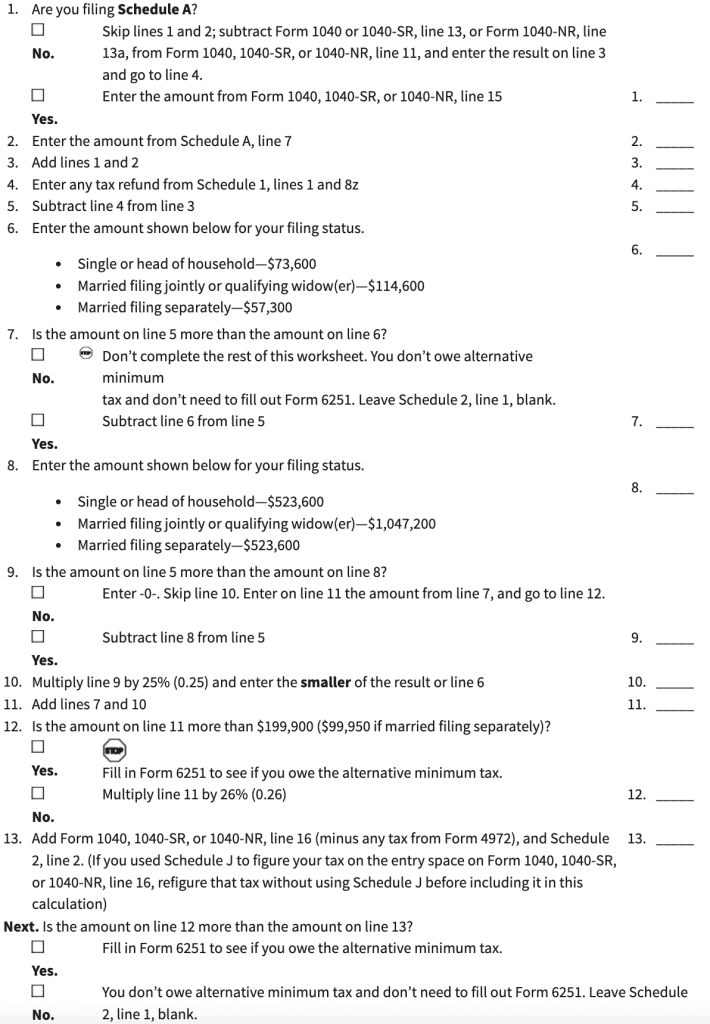

Schedule 2, Line 1 instructions

These instructions contain a worksheet that taxpayers may use to determine whether AMT applies in their situation. If it does, then they will complete IRS Form 6251 to calculate their tax liability.

IRS Form 6251

However, the instructions also state that taxpayers who may have received or claimed any of the following do not need to complete the worksheet. Simply go straight to Form 6251 to calculate the amount of alternative minimum tax that may apply.

- Accelerated depreciation

- Tax-exempt interest from private activity bonds

- Intangible drilling, circulation, research, experimental, or mining costs

- Amortization of pollution-control facilities or depletion

- Income or (loss) from tax-shelter farm activities, passive activities, partnerships, S corporations, or activities for which you aren’t at risk

- Income from long-term contracts not figured using the percentage-of-completion method

- Investment interest expense reported on Form 4952

- Net operating loss deduction

- Alternative minimum tax adjustments from an estate, trust, electing large partnership, or cooperative

- Section 1202 exclusion

- Stock by exercising an incentive stock option and you didn’t dispose of the stock in the same year.

- Any general business credit claimed on Form 3800 if either line 6 (in Part I) or line 25 of Form 3800 is more than zero

- Qualified electric vehicle credit

- Alternative fuel vehicle refueling property tax

- Credit for prior year minimum tax

- Foreign tax credit

- Net qualified disaster loss and you are reporting your standard deduction on Schedule A, line 16

If any of the above apply to your situation, you’ll need to complete Form 6251.

IRS Form 6251 Walkthrough

Watch this video for step by step instructions on completing Form 6251.

Frequently asked questions

Below are some frequently asked questions about AMT and Form 6251.

According to the Internal Revenue Service, certain tax benefits can significantly reduce a taxpayer’s regular tax amount. The alternative minimum tax (AMT) applies to taxpayers with high economic income by setting a limit on those benefits. It helps to ensure that those taxpayers pay at least a minimum amount of tax. To achieve this goal, the taxpayer will usually perform AMT calculations in parallel to the regular income tax calculations. But not all taxpayers are subject to AMT.

Yes, if you file Form 1040 electronically as well.

Where can I find a copy of Form 6251?

You may find Form 6251 on the IRS website. For your convenience, we’ve included the latest version below.

Related Posts

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!