When Do You Pay Capital Gains on a Roth IRA?

Generally speaking, you do not pay capital gains on a Roth IRA. When you sell investments, such as mutual funds, in a Roth IRA, it is not considered taxable income. Additionally, qualified distributions from a Roth account can be made as tax-free withdrawals.

This article will discuss in more depth:

- What a Roth IRA (individual retirement account) is

- The tax treatment on Roth IRA contributions, conversions, and earnings

- How to benefit from tax-free withdrawals from a Roth IRA

Contents

What is a Roth IRA?

There are two types of individual retirement accounts (IRAs). There are traditional IRAs and Roth IRAs, which the IRS officially calls Individual Retirement Arrangements.

Both types of IRAs allow an individual investor to put some of their earned income into a retirement savings account. From there, the earnings in an IRA grow tax-deferred.

But there are some differences. Before we describe the Roth IRA, we need to define its counterpart. The traditional IRA.

Traditional IRA

A traditional IRA is a retirement savings account where the account owner makes tax-deferred contributions to the account. In other words, the contributions can be deducted from taxable income in the tax year that they are made.

This generally is known as pre-tax contributions. The IRA is referred to as a deductible IRA.

However, a taxpayer might not always be able to take a tax deduction on their traditional IRA contribution. First, you have to determine whether the taxpayer is contributing to a workplace retirement plan, like a 401(k).

If neither the taxpayer nor the taxpayer’s spouse participates in an employer-sponsored retirement plan, then the IRA contribution is always deductible, regardless of income level.

If the taxpayer or the taxpayer’s spouse participates in a workplace retirement plan, then the deductibility of IRA contributions is subject to income limits. In other words, a taxpayer might be able to make a traditional IRA contribution, but might not be able to deduct that contribution on their tax return. This would be considered after-tax contributions.

Regardless, withdrawals of pre-tax money from a traditional IRA are always taxed at ordinary income tax rates. The same goes for earnings on any investments within a traditional IRA.

Taxes in a traditional IRA

Withdrawal of after-tax contributions are not taxed. After-tax contributions in a traditional IRA are also known as tax basis. Tax basis is used to help calculate how much of a traditional IRA withdrawal (or Roth conversion) is taxed.

However, the earnings on those after-tax contributions is always taxed. At ordinary income tax rates.

At no point does capital gains tax treatment apply to a traditional IRA. Simply put, any capital gains on sales within an IRA are tax-deferred. And when the money is finally withdrawn, it’s at ordinary income tax rates, not capital gains rates.

Roth IRA

The Roth IRA is almost the opposite of a traditional IRA. With a Roth IRA, the good news is that contributions are always after-tax contributions. This is because you’re paying taxes up front in exchange for tax-free growth.

Once the contributions are in the Roth IRA, they grow tax-deferred. And when they are made, qualified withdrawals are tax-free, which means you benefit from years of tax-free growth.

Roth IRA withdrawal rules

Not all withdrawals from a Roth IRA are tax-free. Qualified withdrawals are. There are a couple of IRS rules to keep in mind to avoid penalties.

To better understand these rules, it’s important to keep in mind the three types of money that are in a Roth IRA account:

- Contributions. Contributions are directly deposited into the Roth IRA by the account owner.

- Roth conversions. Roth conversions are transferred to a Roth IRA from another IRA (usually a pre-tax one). If the IRA owner is converting pre-tax money into the Roth IRA, the owner will owe income tax in the tax year of the conversion.

- Earnings. Any income generated by money in the Roth IRA. This could be interest income, dividends, or capital gains.

Let’s break down the taxation on each of these.

Taxation on Roth IRA Contributions

Contributions to a Roth IRA are generally not taxable. Since this is after-tax money, you’ve already paid taxes on a Roth IRA contribution.

Roth IRA contributions are reported on IRS Form 5498 in the year they are made.

Taxation on Roth conversions

Roth conversions are a little trickier for a couple of reasons.

Roth conversions are reported on a different form from contributions.

In the tax year they are performed, Roth conversions are reported on IRS Form 8606.

Withdrawals are subject early withdrawal penalty

Withdrawals of Roth conversions are subject to Internal Revenue Code Section 72(t). This section outlines the penalties on early withdrawals from an IRA.

There are exceptions to the early withdrawal penalty under IRC§ 72(t). They include:

- Taxpayer reaches the age of 59½

- Death of taxpayer (beneficiary does not pay income taxes on withdrawals)

- Disability of taxpayer

- If withdrawals are part of a series of substantially equal periodic payments (at least annually) made for the life (or life expectancy) of the taxpayer or the joint lives (or joint life expectancies) of the taxpayer and his/her designated beneficiary

Five-year rule

On top of the IRC§ 72(t) early withdrawal rule, there exists a 5-year rule for withdrawals of Roth conversions.

A converted amount has to remain in the Roth IRA for at least 5 years before it can be withdrawn tax-free. In other words, if you make a Roth conversion in 2022, you will pay taxes on any withdrawal of that converted amount before January 2027.

A couple of thoughts here.

Each conversion has its own withdrawal 5-year rule. If you engage in a Roth conversion strategy, then you’ll want to track each Roth conversion.

Any Roth IRA conversion in a calendar year is treated as if it were made on January 1. Using the example above, if you did a Roth conversion in June 2022, it would be treated as if you made the conversion on January 1. Then, you would be subject rule, making it eligible for tax-free withdrawal on January 1, 2027.

You don’t pay the 10% penalty, unless you don’t meet one of the exceptions for the early withdrawal rule. Just because you pay taxes doesn’t mean you’ll pay a tax penalty. Unless you’d otherwise be subject to the penalty.

Earnings in a Roth IRA

Earnings in a Roth IRA are subject to the IRC§ 72(t) early withdrawal rule. This applies to earnings on Roth contributions and conversions.

Earnings are also subject to a 5-year rule. This 5-year rule is different from the 5-year rule for Roth conversions.

A different 5-year rule

In addition to the IRC§ 72(t) early withdrawal rule, taxpayers are subject to a 5 year rule on earnings. In short, earnings cannot be withdrawn tax free until 5 years have passed from the time that the taxpayer originally contributed to the Roth account.

For purposes of the 5-year rule, the date of the first contribution is the beginning of the tax year in which the contribution was made. And Roth IRA contributions can be made in the following calendar year, as long as it is for the tax year in question.

For example, a Roth IRA contribution made on April 10, 2022, would be considered to have been made on January 1, 2021. From there, you would calculate 5 years. So the first withdrawal will be allowed on January 1, 2026. Not April 10, 2027.

This 5-year rule applies even if you turn 59½

If you turn 59½ during this 5 year period, the IRC§ 72(t) early withdrawal restriction no longer applies to you. However, the 5-year rule still does.

How are Roth IRA withdrawals treated for tax purposes?

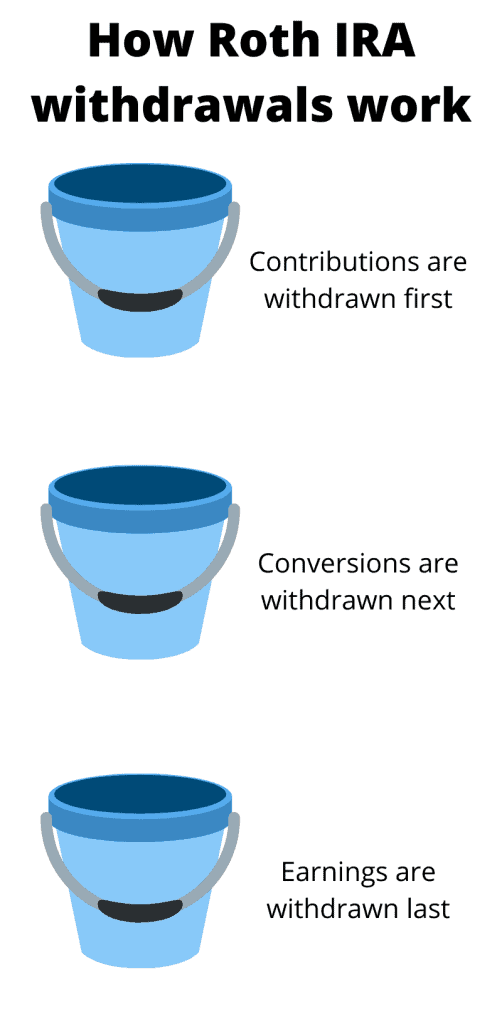

Because of these confusing rules, the IRS outlines the treatment of IRA withdrawals. According to IRS Publication 590-B, the ordering rules for IRA distributions are:

- Contributions

- Conversions

- Earnings

If you’ve met the 5-year rules, and are no longer subject to the IRC§ 72(t) restrictions, you probably don’t have to worry about this. All of your withdrawals will be considered tax-free income. But if you aren’t sure, then you might want to know a little about how withdrawals work.

It’s best if you start by thinking of your Roth account as a series of buckets. As outlined below, you’ll go through your contributions bucket first.

After your contributions have been completely withdrawn, then you’ll start on your conversions bucket. Finally, you’ll withdraw from your earnings.

Example

Let’s imagine you wanted to make a $50,000 withdrawal. You have $300,000 in your Roth IRA, as follows:

- $60,000 in contributions

- $100,000 in Roth conversions

- $140,000 in earnings

Making a $50,000 withdrawal would simply reduce your contributions down to $10,000. And since Roth IRA contributions can be withdrawn tax-free, there is no tax impact. And your accounts would now look like this:

- $10,000 in contributions

- $100,000 in Roth conversions

- $140,000 in earnings

Let’s imagine that you need to withdraw $50,000 the following year. Then, you would use up your $10,000 in original IRA contributions, and $40,000 would be considered a withdrawal from your Roth conversions.

Your tax advisor would then have to see if you meet the 5-year rule for those conversions, as well as the IRC§ 72(t) early withdrawal rules. The same would apply in subsequent tax years until you start dipping into earnings.

Then, you would have to evaluate the 5-year rule that applies to penalty-free withdrawals on earnings, as well as the IRC§ 72(t) rules.

Since this article started by asking about capital gains, let’s talk about some other ways to lower your tax bill. By getting more of your money into a Roth IRA account.

Can Roth IRA conversions help lower my taxes?

Used properly, Roth conversions can be a great way to help you keep your tax liability low. Here are 3 scenarios when Roth conversions might be a good option for you.

1. You expect to be in a higher tax bracket in the future.

You just retired. From your job. But you’re in your sixties.

Or you just sold your business and want to take some time off before jumping back into the game. Perhaps you got laid off with a nice severance. You know you’ll go back to work, but not this year.

One of the great advantages of Roth conversions is being able to choose when to do them. You can simply do Roth conversions in years when you are in a lower tax bracket. Then you would avoid them in years when you are in higher tax brackets.

All this is tied into your marginal tax rate. Using this to determine what your tax liability has been in the past, you can compare your tax scenario to what you might see in the future.

But the future isn’t just about your employment. What about income tax rates? If you think that the federal government will raise tax rates in the future, you might be better off doing Roth conversions now. Then, you can enjoy the tax savings from having your investments grow without consequence.

2. You want to avoid required minimum distributions.

One advantage that Roth IRAs have over their traditional counterparts is that a Roth IRA holder does not have required minimum distributions (RMDs).

The IRS has recently changed some of the calculations that make RMDs less onerous. And the SECURE Act has raised the RMD age from 70½ to 72.

But there are still some people who detest the fact that the federal government would compel them to take withdrawals from an IRA if they didn’t need the money for living expenses. But maybe you want your beneficiaries to avoid paying taxes.

3. You want your beneficiaries to avoid paying taxes on their IRA distributions.

When I was a financial advisor, I had clients who wanted Roth conversions so their children wouldn’t pay taxes when they inherited their IRA accounts. Even though it made no sense, that’s what these clients wanted for their children.

And in certain cases, where the account owner is retired and the children are in high-paying professions, it might make tax sense. We’ve written an entire article about paying taxes on your Roth conversions as part of an estate planning strategy.

How are earnings in a Roth IRA treated for tax purposes?

Qualified withdrawals can be done tax free, as long as they comply with IRC§ 72(t) and the early-withdrawal rule for earnings.

Conclusion

None of this should be construed as tax advice, financial advice, or legal advice. While Roth conversions are an important consideration to any investment planning strategy, it’s best to discuss this with a Certified Financial Planner before proceeding.