IRS Form 8881 Instructions

In 2022, Congress passed SECURE Act 2.0 (Setting Every Community Up for Retirement Enhancement Act), which gave additional tax benefits to business owners for certain programs. By filing IRS Form 8881, eligible small businesses can claim tax credits for:

- Starting up a pension plan

- Creating an automatic enrollment feature for their pension plan

- Employing military spouses

In this article, we’ll walk through IRS Form 8881 including:

- How to complete and file IRS Form 8881

- Eligibility requirements for available small employer retirement plan tax credits

- Frequently asked questions

Let’s start by walking through the tax form itself.

Table of contents

How do I complete IRS Form 8881?

There are three parts to this one-page tax form:

- Part I: Credit for Small Employer Pension Plan Startup Costs (including Employer Contributions)

- Part II: Small Employer Auto-Employment Credit

- Part III: Military Spouse Participation Credit

At the top, enter the name and identifying number as it appears on your company’s federal income tax return.

After that, let’s begin with Part I.

Part I: Credit for Small Employer Pension Plan Startup Costs

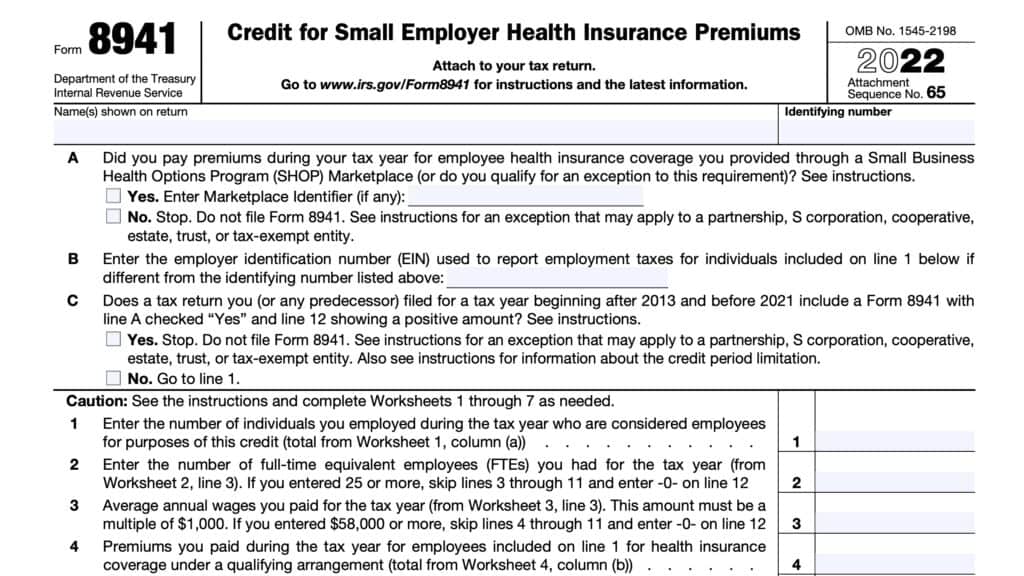

Eligible small employers use Form 8881, Part I, to claim the credit for qualified startup costs incurred in establishing or administering an eligible employer plan.

The Part I credit is allowed under Internal Revenue Code Section 45E, although taxpayers may elect to have IRC Section 45E not apply simply by not claiming it on their tax return for the given year.

Line A

In Line A, enter the number of qualifying employees.

Qualifying employees

Employees who received at least $5,000 of compensation during the tax year preceding the first credit year that applies to the small employer plan startup costs credit. For example, an employee who received $5,000 in compensation during the 2022 tax year would be considered a qualifying employee for a small employer plan that the employer started in 2023.

Line 1: Qualified startup costs incurred during the tax year

In Line 1, enter the total amount of eligible startup costs that you incurred during the year to create your employee pension plan.

Qualified startup costs

Qualified startup costs are necessary expenses paid or incurred in connection with:

- Establishing or administering an eligible employer plan, or

- Retirement related education of employees about the retirement plan

Calculating the plan startup costs credit

For tax years 2023 and later, the qualified employer plan startup costs credit consists of the following, based upon employer size:

- Employers with 1-50 employees: 100% of qualified startup costs paid or incurred during the tax year

- Employers with 51-100 employees: 50% of qualified start up costs paid or incurred during the year

The credit is limited to the greater of:

- $500, or

- The lesser of:

- $250 multiplied by the number of non-highly compensated employees (NHCEs) who are eligible to participate in the plan, or

- $5,000.

The tax credit for qualified plan costs is allowed for the first credit year and each of the following 2 tax years. No credit is allowed for the fourth year or any other taxable years.

Line 2

If you are an employer with 50 or fewer employees, enter the Line 1 amount.

If you have 51-100 employees, enter 1/2 of the Line 1 amount. For example, if you entered $5,000 in Line 1, enter $2,500 in Line 2.

Line 3

Enter the number of employees eligible to participate in the pension plan. Do not include any employee who is considered a highly compensated employee under IRC Section 414(q).

Multiply the number of qualified employees by $250. Enter the result in Line 3.

Line 4

Enter the greater of:

- $500

- Line 3 amount

Do not enter a number greater than $5,000.

Line 5

In Line 5, enter the smaller of:

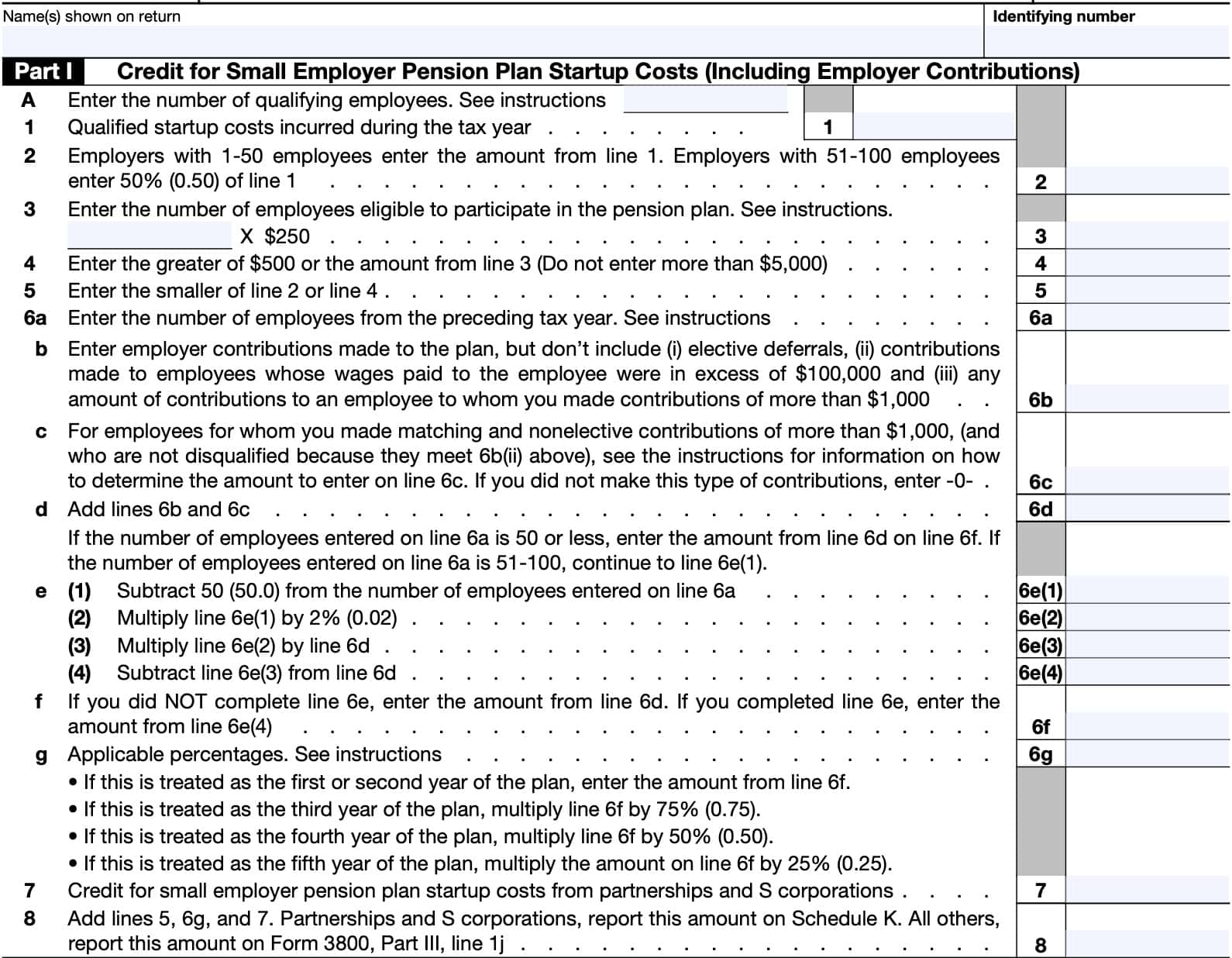

Line 6

Line 6 is broken down into several parts. Let’s start with Line 6a.

Line 6a

Enter the number of employees from the preceding tax year. If you’re trying to claim a tax credit for 2023, you would enter the number of employees from the 2022 tax year.

Line 6b

In Line 6b, enter the total amount of employer contributions made to the retirement plan. However, do not include:

- Elective deferrals

- Contributions made to employees whose wages exceeded $100,000, and

- Any amount of contributions to an employee to whom you made contributions of more than $1,000

Line 6c

For employees who are NHCEs, and to whom you made contributions of more than $1,000, you must calculate the amount that you can enter on Line 6c.

You may enter the amount of contributions made for each individual, not to exceed a certain dollar threshold. This dollar threshold depends on how many years the qualified employer plan has been in place.

Do not enter amounts that exceed the following:

- $1,000 per employee if the plan is in its first year or second year

- $1,333 per employee if the plan is in its third year

- $2,000 per employee if the plan is in its fourth year

- $4,000 per employee if the plan is in its fifth year

If you did not make employer contributions other than what you entered in Line 6b, you can simply enter ‘0.’

Line 6d

Add Line 6b and Line 6c. Enter the total here.

If the number of employees on Line 6a is 50 or less, then enter the Line 6d amount in Line 6f. You may skip Line 6e. If your number of employees is between 51 and 100, go to Line 6e.

Line 6e

There are several steps in Line 6e.

Line 6e(1)

Subtract 50 from the number of employees entered on Line 6a. For example, if you entered 85 in Line 6a, then you would end up with 35 after this step.

Line 6e(2)

Multiply the Line 6e(1) amount by 2% (0.02). For example, 35 times 2% equals 0.7.

Line 6e(3)

Multiply the Line 6e(2) amount by Line 6d.

Let’s imagine that the Line 6d amount was $10,000. Using the current example of 0.7 from Line 6e(2), we would come up with $7,000.

Line 6e(4)

Subtract the Line 6e(3) amount from the Line 6d amount. Using the current example, we would end up with $3,000 ($10,000 minus $7,000).

Enter this amount in Line 6e(4).

Line 6f

Enter the amount from Line 6e(4) if you completed that portion of the form. Otherwise, enter the amount from Line 6d.

Line 6g: Applicable percentages

The amount that you enter here depends on which year of the plan you are in.

If this is the first tax year or second tax year of the plan

Enter the Line 6f amount here.

If this is the third year of the plan

Multiply the Line 6f amount by 75%. Enter the result here.

If this is the fourth year of the plan

Multiply the Line 6f amount by 50%. Enter the result here.

If this is the fifth year of the plan

Multiply the Line 6f amount by 25%. Enter the result here.

Line 7: Credit for small employer pension plan startup costs from partnerships and s corporations

In Line 7, enter any credit you received from partnerships and S-corporations for small employer pension plan startup costs.

Line 8

Add Line 5, Line 6g, and Line 7. This represents your total tax credit for small employer pension plan startup costs.

Partnerships and S corporations will report this amount on Schedule K.

All other taxpayers report this amount as a general business credit on IRS Form 3800, Part III, Line 1j.

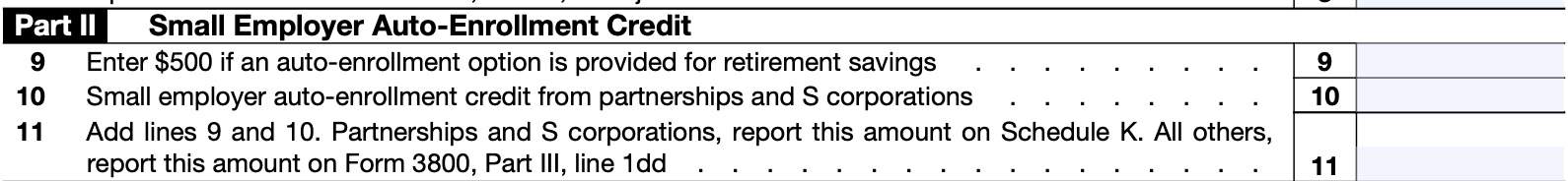

Part II: Small Employer Auto-Enrollment Credit

In Part II of Form 8881, eligible small employers can claim the credit for including an eligible automatic contribution arrangement in an eligible employer plan.

The Part II credit is allowed under IRC Section 45T.

Line 9

If an auto-enroll feature is provided as part of the qualifying retirement plan, enter $500 in Line 9.

Line 10: Small employer auto-enrollment credit from partnerships and S corporations

In Line 10, enter any auto-enrollment tax credit passed through from either an S-corporation or partnership.

Line 11

Add Line 9 & Line 10, then enter the result here. This represents the total tax credit for having an auto-enrollment feature for your retirement benefits.

Partnerships & S-corporations will also enter this tax credit on Schedule K. All other taxpayers will report this tax credit as part of the general business credit on IRS Form 3800, Part III, Line 1dd.

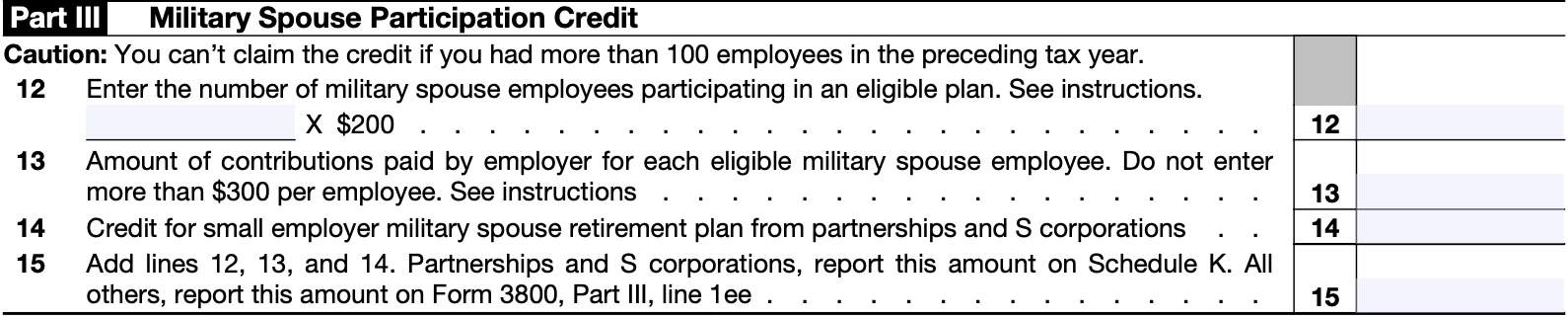

Part III: Military Spouse Participation Credit

Before starting Part III, you should know that this portion of the credit is not available for employers with over 100 employees in the preceding tax year.

Line 12

Enter the number of military spouse employees participating in an eligible plan. However, only include an employee if he or she:

- Was a plan participant in the eligible defined contribution plan during the tax year

- Did not participate in the plan prior to the 2 tax years preceding the tax year

Let’s imagine that we’re calculating this for the 2023 tax year. The two preceding tax years would be 2021 and 2022. So we would only consider an employee if he or she:

- Was a plan participant in 2023

- Was not a plan participant in 2020 or in prior years

Line 13

In Line 13, enter the amount of employer contributions for each eligible military spouse employee. However, do not enter more than $300 per employee.

Only include employer contributions, not employee elective deferrals.

Line 14: Credit for small employer military spouse retirement plans from partnerships and s-corporations

Enter any credits that were passed through from partnerships or S-corporations your company owns.

Line 15

Add the following and enter the result in Line 15:

Partnerships & S-corporations will also enter this tax credit on Schedule K. All other taxpayers will report this tax credit as part of the general business credit on IRS Form 3800, Part III, Line 1ee.

Video walkthrough

Watch this instructional video for step by step guidance on claiming pension plan tax credits on IRS Form 8881.

Frequently asked questions

For both the start-up credit and the automatic enrollment credit, eligible small businesses must have 100 or fewer employees who received compensation of at least $5,000 during the preceding year.

The maximum credit for incurring start-up costs associated with a new plan is $5,000 per year, with a maximum limit of a three-year period. The maximum additional tax credit for having an automatic enrollment feature is $500 per year for up to three years. There is no credit after the third year.

According to the Internal Revenue Service, you may not take the tax credit for small employer pension plan startup costs for your existing plan. However, if you add an auto-enrollment feature to your existing retirement plan, you may be eligible for the auto-enrollment tax credit.

Qualified startup costs can include administrative costs and other expenses paid or incurred in connection with establishing or maintaining an eligible employer plan, or by providing the retirement-related education of employees about the plan.

Where can I find IRS Form 8881?

You may download this tax form from the IRS website. However, we’ve made the latest version of this form available for download, just below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!