IRS Form 8846 Instructions

The Internal Revenue Code allows for certain business owners to take business tax credits to reduce their employee payroll costs. In the restaurant and beverage industry, business owners may take a federal tax credit for certain employment taxes, specifically Social Security and Medicare taxes withheld from employees’ tip income.

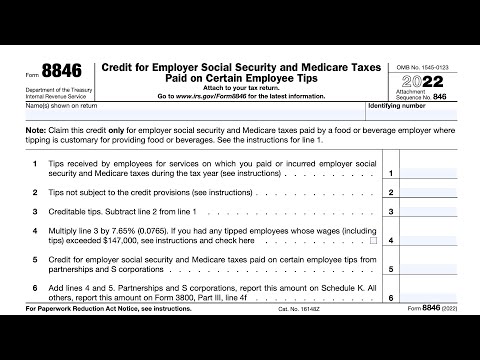

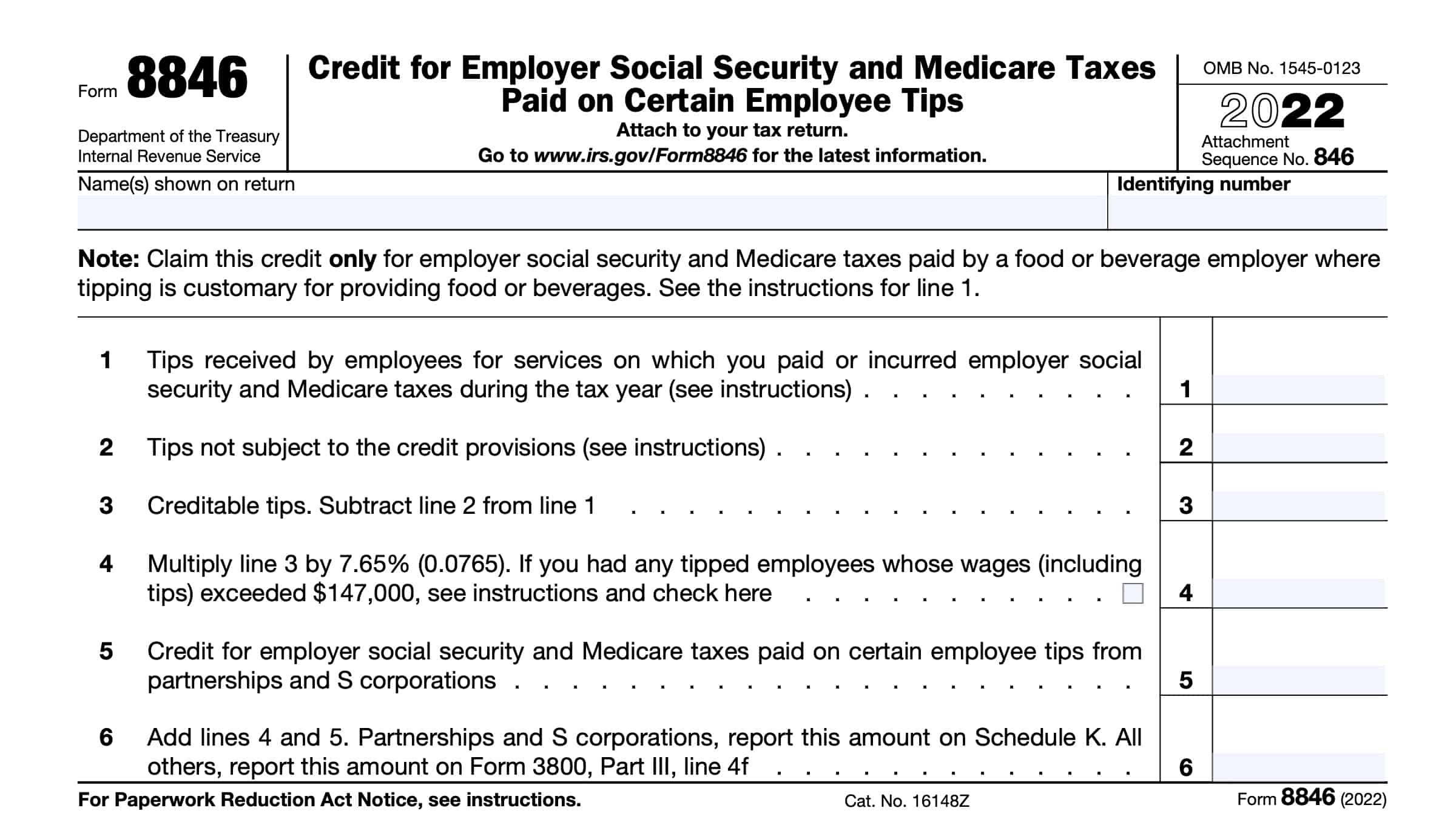

Taxpayers use IRS Form 8846, Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips, to claim this nonrefundable tax credit.

In this article, we’ll walk you through:

- How to properly calculate the available tax credit

- How to claim this tax credit on IRS Form 8846

- Frequently asked questions

Let’s start with an overview of this tax form itself.

Table of contents

How do I complete IRS Form 8846?

This one-page tax form is fairly straightforward. Let’s go through it, line by line.

Line 1: Tips received by employees on which you paid FICA taxes

In Line 1, enter the tips that employees received for services on which you either paid or incurred employer Social Security and Medicare taxes on during the tax year.

This should include tips received from customers for providing, delivering, or serving food and beverages for consumption if employee tips for this service is customary.

Line 2: Tips not subject to credit provisions

If you pay each tipped employee wages (excluding tips) equal to or more than $5.15 an hour, enter zero on Line 2.

Otherwise, figure the amount of tips included on Line 1 that are not creditable for each employee on a monthly basis. This is the total amount that would be payable to the employee at $5.15 per hour, reduced by the wages actually paid to the employee during the month.

Credit provisions

To be eligible for the FICA tip tax credit, employers must first ensure that tipped employees are compensated at the federal minimum wage rate of $5.15 per hour, or higher. This employer tax credit cannot be taken on any employee tips used to close the gap between the employee’s actual compensation and the federal minimum wage rate.

For example, an employee worked 100 hours and received $450 in tips for October 2022. The worker received $375 in wages (excluding tip amount) at the rate of $3.75 an hour.

If the employer had paid this person $5.15 an hour, the employee would have received wages, not including tips, of $515. For employer credit purposes, you must reduce the $450 in tips by $140. This is the difference between:

- $515, which the employee should have received from the employer, and

- $375, which the employee actually received from the employer

Therefore, only $310 of the employee’s tip amount for October 2022 is taken into account when calculating the employer’s FICA tip credit.

Line 3: Creditable tips

Subtract the figure in Line 2 from Line 1. Enter the result in Line 3.

This represents the total tip income that the business owner can claim the FICA tip credit for.

Line 4

Multiply Line 3 by 7.65%, or 0.0765. This represents the employer’s share of FICA taxes paid on employees’ tips. However, if any tipped employees received total compensation (including tip income) of more than $147,000, you must check the box in Line 4.

Employees whose wage and tip income exceed the Social Security tax wage base

For these employees, check the box on Line 4. Then, attach a separate computation showing the amount of tips subject to only the Medicare tax rate of 1.45%.

Subtract these tips from the total on Line 3. Multiply the difference by 7.65% (0.0765). Next, multiply the tips subject to only Medicare tax by 1.45% (0.0145). Enter the sum of these amounts on Line 4.

Reduce the income tax deduction for employer Social Security and Medicare taxes by the amount on Line 4.

Fiscal year taxpayers

If you have an employee with hourly wages and tips paid in 2023 that exceeded the 2023 Social

Security wage base of $160,200 by the end of the 2022 fiscal year, follow the Line 4 instructions above to determine the amount to enter on that line.

The determination whether the tipped employee’s wages exceeds the Social Security wage base is made for each calendar year.

Line 5: credit for FICA Taxes paid on Certain employee tips from partnerships & S-corporations

In Line 5, enter the amount of any tax credit for Social Security taxes and Medicare taxes paid, that were reported from either a partnership or an S corporation.

If your only source of this tax credit is from a partnership or S corporation, you do not need to complete IRS Form 8846. Instead, report this tax credit directly on IRS Form 3800, Part III, Line 4f, as part of the general business credit.

Line 6

Add Line 4 and Line 5. Enter the result in Line 6. This represents the total amount of the tax credit available for paying the employer’s share of FICA tax.

For partnerships and S-corporations, report this number on Schedule K. According to the Internal Revenue Service instructions, partnerships will report this with code ‘N’ on IRS Form 1065, Schedule K, Line 15f. S-corporations will report this with code ‘N’ on IRS Form 1120-S, Schedule K, Line 13g.

All other taxpayers should report this amount on IRS Form 3800, Part III, Line 4f, as part of the general business tax credit.

As with other business tax credits, this is a nonrefundable credit. Nonrefundable credits may reduce your tax liability to zero, but not below. Any unused credit is simply carried forward to the next taxable year.

Video walkthrough

Watch this instructional video to learn how to take advantage of the FICA tip credit using IRS Form 8846.

Frequently asked questions

Restaurant owners & beverage establishments should file Form 8846 if they had employees who received tip income during the tax year, and the employer paid FICA taxes on that tip income.

IRS Form 8846 helps taxpayers calculate and report Social Security & Medicare taxes paid on employee tip income. These taxes can be used as a federal tax credit on the taxpayer’s income tax return.

According to the Internal Revenue Code, cash tips are considered taxable income, and must be reported to the IRS. Large restaurants and businesses report tip income on IRS Form 8027. Employees may use IRS Form 4070 to report their tip income to their employer.

Federal Insurance Contributions Act, or FICA taxes, are a type of federal payroll tax that employers must pay, based upon employee earnings. FICA tax consists of Social Security tax and Medicare tax, which both the employer and employee pay as a percentage of employee income.

Where can I find IRS Form 8846?

Taxpayers may find this tax form on the IRS website. For your convenience, we’ve included the most recent version of this form below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!