Roth TSP vs Roth IRA: What You Should Know

As they start their careers, federal employees and members of the uniformed services often ask:

Should I contribute to my Roth TSP account or a Roth IRA?

However, the answer is not so straightforward. While prudent retirement savings includes maximizing your retirement accounts, there might be situations where one choice is better than the other.

There might be situations where one choice isn’t available. And finally, there might be situations where both options are the best choice.

This article aims to give you an in-depth look at the federal Thrift Savings Plan (TSP) and IRAs. Specifically, the details about the Roth options for each.

That way, you can evaluate the facts in your situation and make the best decision for yourself. Let’s start with the TSP, and specifically, the Roth Thrift Savings Plan.

Contents

What is the Roth TSP?

To better understand what the Roth TSP is, perhaps we should take a closer look at the federal government’s Thrift Savings Plan. From there, we can drill further into the Roth option within that plan.

Thrift Savings Plan at a glance

In 1986, the Thrift Savings Plan, or TSP, was created as part of the Federal Employees Retirement System (FERS). The intent of the FERS retirement system was to move from a completely defined benefit retirement plan to a partially defined contribution plan. This move would help save the federal government money, but also allow allow employees to receive some retirement benefits if they left government service before reaching full retirement.

The TSP is managed by the Federal Retirement Thrift Investment Board. The Federal Retirement Thrift Investment Board was created in 1986 as part of the FERS Act, and is an independent agency of the federal government. Its sole purpose is to administer the TSP for the benefit of federal workers and service members.

TSP is available for both federal government employees and military members. In essence, the TSP program is like a 401k for federal government workers. Here are some of the basics.

Contribution limits

TSP contribution limits are subject to the same IRS limitations as ERISA plans like 401k plans or 403b plans. For 2022, the annual contribution limit to a TSP account is broken down as follows:

- Elective deferral limit: $20,500. Elective deferrals are the employee contributions to a TSP account.

- Catch-up limit: $6,500. This is an additional contribution amount that employees can make if they are age 50 or older.

- Annual addition limit: $63,000. This is the limit for total contributions to a TSP account. This includes both employee contributions and employer contributions.

Automatic contributions

If you are a FERS employee, or if you’re participating in the military’s blended retirement system (BRS), you probably already have some contributions automatically made on your behalf.

For example, you already have a 1% agency contribution made to your TSP account. This happens regardless of your participation and does not come out of your compensation.

If you’re a FERS employee, you might have additional automatic contributions, depending on when you entered service. If you joined between August 1, 2010, and September 30, 2020, you were automatically entered with a 3% contribution from your paycheck. And if you joined federal service after September 30, 2020, your automatic contribution is 5%.

Matching contributions

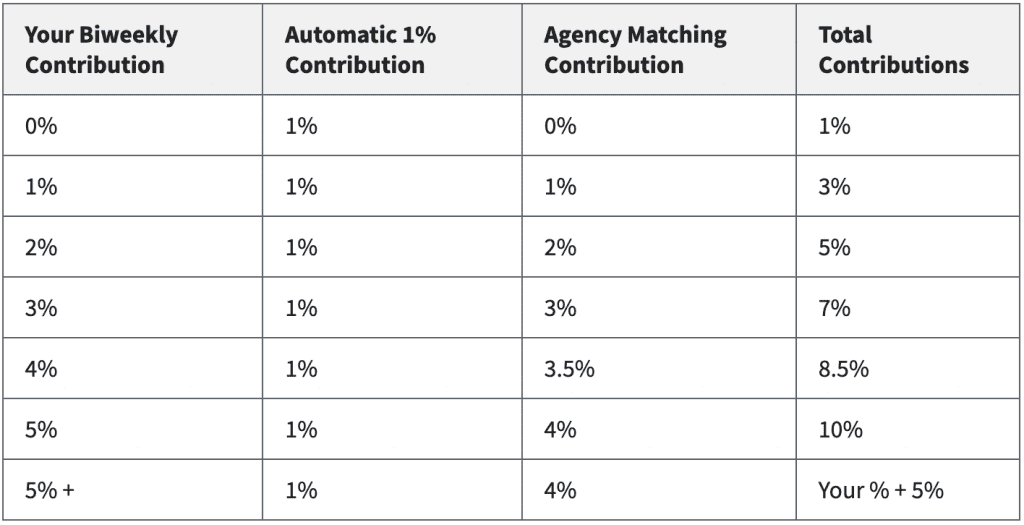

In addition to the automatic 1% agency contribution, TSP participants can receive matching contributions, depending on their participation level.

Beyond the automatic 1% contribution, the federal government will match up to 3% of your contributions, dollar for dollar. That free money represents an immediate 100% return on your investment, even if it sits in the G-fund.

On top of that, the government will match your contributions an additional 50%, up to 4% total (based on your 5% contribution election). For BRS participants, these matching contributions are calculated against your basic pay.

Below is a matching contributions chart.

Vesting

The automatic agency contribution is subject to vesting requirements. That means if you leave federal service (either as a civilian or uniformed member) before you a certain time, you forfeit any agency contribution placed into your TSP account.

For civilians, this vesting requirement could be 2 years time in service, or 3 years, depending on your career field. For service members participating in BRS, the requirement is 2 years.

Matching contributions are not subject to vesting requirements. That means a BRS or FERS participant can transfer any matching contributions in their TSP account upon separation from service.

Roth TSP Explained

TSP participants can choose either Roth TSP contributions or traditional TSP contributions. The difference between the two is when you are taxed on income.

Traditional, or regular TSP contributions are considered pre-tax. This means that employee elective deferrals to a traditional TSP account are excluded from a participant’s adjusted gross income in the given tax year.

However, qualified withdrawals are subject to income tax in the calendar year they are taken.

Roth TSP contributions are considered after-tax. This means that employee elective deferrals to a Roth TSP account are included in a participant’s taxable income in that tax year.

Qualified withdrawals from a Roth TSP account are tax-free.

What is an IRA?

An IRA, or individual retirement account, is another type of retirement account. However, instead of being managed by one’s employer, an IRA is self-managed by the individual.

As with the TSP, an IRA can be a traditional IRA or a Roth account. For purposes of this article, we’ll focus on the Roth IRA.

Characteristics of a Roth IRA

There are several things about a Roth IRA you should be aware of. We’ll go through them in this section.

Contribution limits

Any individual can contribute to an IRA, as long as they have earned income. In the case of a married couple, a non-working spouse can contribute to an IRA as long as the other spouse has earned income. In any case, the annual IRA contributions cannot exceed earned income.

Additionally, there is a dollar limit to annual Roth contributions. In 2022, that contribution limit is $6,000.

For earners age 50 and older, there is an additional $1,000 catch-up contribution allowed. This means that those taxpayers can contribute a total of $7,000 in 2022.

Income limits

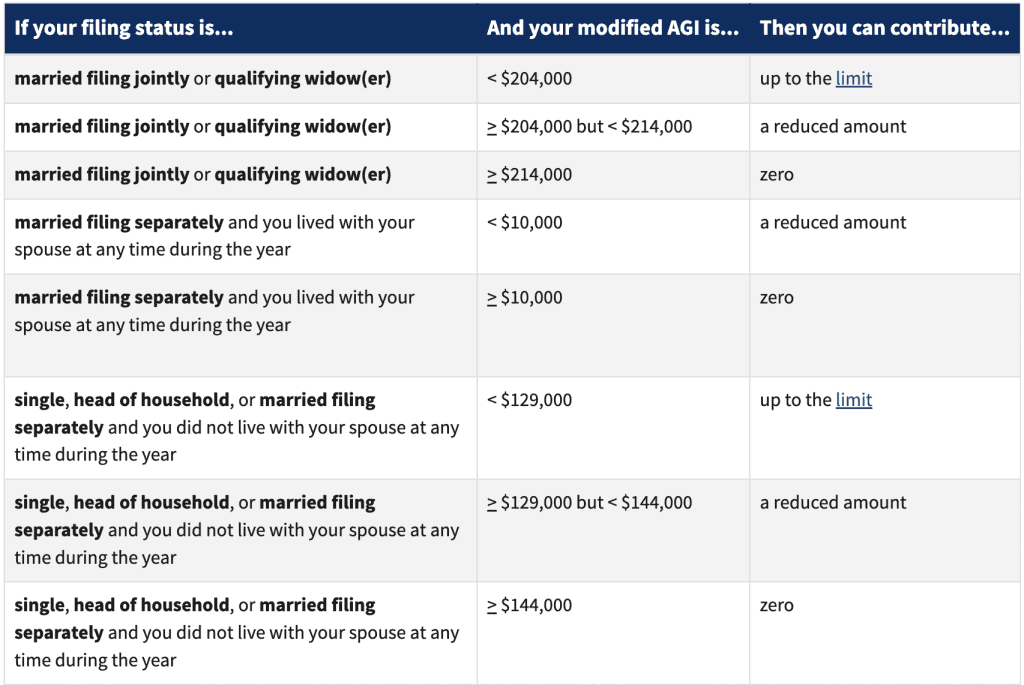

Any taxpayer may contribute to an IRA. However, there are income restrictions that apply to Roth IRA owners. These are known as phaseouts.

Once the taxpayer’s adjusted gross income (AGI) reaches a certain income level, then their ability to contribute is reduced. Once the AGI reaches another level, it is phased out completely.

In 2022, those limits are outlined in the following chart:

Distribution rules

With traditional retirement plans, early withdrawal penalties apply to most taxpayers under the age of 59½. This applies to IRAs and ERISA plans. There are exceptions, under Internal Revenue Code (IRC) §72(t).

Traditional IRAs

For traditional IRA accounts, these exceptions include death, disability, and other limited exceptions for first-time homebuyers, qualified reservist distributions, and certain medical expenses.

For taxpayers aged 72 or older, there are rules requiring a minimum amount to be withdrawn each year. These are known as required minimum distributions, or RMDs.

Roth IRAs

With Roth IRAs, the rules are different. Roth contributions can be withdrawn without penalty.

For Roth conversions, there exists a five-year rule. A Roth conversion must be in the account for at least 5 years before it can be withdrawn without penalty.

Earnings within a Roth IRA are also subject to a five year rule. The Roth IRA must have been open for at least 5 years, and the taxpayer must either be 59½ years of age or otherwise qualify under IRC §72(t) to be withdrawn tax-free.

Once the five year rules have been met, then there are no income taxes or penalties on Roth IRA withdrawals.

RMDs do not apply to Roth IRAs.

Similarities between the Roth TSP & a Roth IRA

There are several similarities between the two Roth accounts worth noting.

Both are after-tax accounts

Once money goes into either a Roth IRA or the Roth TSP account, any qualified withdrawal from your Roth balance is tax-free. This means that you can enjoy decades of tax-free investment growth, regardless of your tax rates or your tax brackets.

Even after you pass away, your beneficiaries can withdraw the entire account balance with no tax consequences. This is especially good for heirs in a higher tax bracket.

Both are subject to a 5-year rule

Before your earnings withdrawals can be considered qualified, your Roth accounts must have been open for at least five years. Additionally, your first Roth contribution must have been made at least five years before a withdrawal from the Roth account.

Differences between Roth TSP and Roth IRAs

While Roth TSP accounts and Roth IRAs are largely similar, there are some differences worth noting.

Required distributions apply to Roth TSPs, not Roth IRAs

We’ve already established that Roth IRAs do not have required distributions (RMDs). However, Roth TSP accounts do.

There are no taxes associated with Roth TSP accounts. However, RMDs apply to all ERISA-eligible plans, including Roth TSPs.

An easy way to avoid required distributions from a Roth TSP account would be to simply convert it to a Roth IRA. This can be done with no tax consequence.

Income limits do not apply to TSP accounts

As outlined above, there are income limitations associated with eligibility to contribute directly to a Roth IRA. However, these limits do not apply to any TSP account.

Neither traditional TSP contributions nor Roth TSP contributions are subject to income limits.

Contribution limits are higher for TSP accounts

As mentioned previously, the contribution limits for a TSP account are about three to four times higher than that of an IRA. This applies to either traditional contributions or Roth contributions. If you’re familiar with other eligible employer plans, like a 401k or 403b, the contributions limits are the same.

Early withdrawal exceptions are slightly different

Both the Roth IRA and Roth TSP have exceptions to the early withdrawal penalties outlined in IRC §72(t). But they’re slightly different.

As an employer-sponsored retirement plan, Roth TSP allows withdrawals as early as age 55 upon separation from service. Roth IRAs do not.

However, Roth IRAs are a little more complicated. Contributions to a Roth IRA can be taken out without tax or penalty.

Roth conversion withdrawals

Roth conversions can be withdrawn without penalty, subject to a five-year rule. This five year rule applies to each Roth conversion. So if you end up implementing a long-term Roth conversion strategy, you’ll want to keep track of those Roth conversions to make sure you stay within the rules.

Roth IRA earning withdrawals

Earnings within a Roth IRA are subject to a different five year rule than for Roth conversions. That five year rule states that penalties do not apply to withdrawal of earnings as long as:

- The account has been open for at least 5 years, and it has been five years or longer since the first contribution was made, AND

- The account holder is age 59½ or older

Assuming those two conditions apply, then earnings can be withdrawn tax and penalty free.

Order of withdrawals from a Roth IRA

Fortunately, the order of withdrawals from a Roth IRA favors the account holder. When withdrawals are made, they are made in this order:

- Contributions

- Conversions

- Earnings

In other words, you don’t have to worry about the earnings penalties unless you’ve withdrawn all of the original contributions AND conversions. And you don’t have to worry about the conversion penalties until you’ve gone through the Roth contributions.

You can contribute directly to a Roth TSP from your paycheck

One of the best qualities of the TSP is your ability to ‘set it and forget it,’ just like a 401k. For servicemembers getting ready to deploy, that’s one less hassle to worry about.

With Roth IRAs, you can set a monthly funding amount, but you have the additional hassle of ensuring that the money is in your banking account in the first place. Not a big deal, just a nuisance.

Let’s look at situations when you might prefer the Roth TSP to a Roth IRA.

Roth TSP over Roth IRA

Let’s be clear. There’s nothing that says you have to choose one or the other. You can have and contribute to both a Roth TSP account and a Roth IRA account.

But, if you had to pick or choose one, there might be times where you decide that the Roth TSP investment plan is the better place to invest for now.

When you’re just starting out

When I first joined the Navy, it seemed that there were so many financial decisions to make. And not much money to make them with.

So if you’re looking for an easy way to start early, then you should start with the Roth TSP option. You can adjust your payroll to withdraw from your basic pay. You don’t have to look for financial advisors to tell you how to invest your money.

And if you don’t know anything about your investment options, the TSP defaults to an age-appropriate lifecycle fund. That means your TSP funds are automatically invested for long-term growth.

You can always change your investments when you’ve learned a little more about your TSP options. But you don’t have to worry that all of your savings get stuck in the G fund any more.

If you’re a BRS participant and want the matching contribution

If you’re a member of the military who joined after 2017, you’re already a BRS participant. Just like taking part in a civilian 401(k), BRS matching contributions are free money to you.

There’s no reason not to contribute enough to get the match. And the more promotions you get, the more matching contributions you are entitled to.

If your income is too high to directly contribute to a Roth IRA

Most servicemembers do not have to worry about this. However, Roth IRAs do have an earnings limit.

If you’re a dual income family, or you have significant outside income, you might not be able to contribute directly to a Roth IRA. This limitation does not apply to Roth TSP. You can always contribute to a Roth TSP account, regardless of your income.

And if you’re looking to put LOTS of money away, the Roth TSP option will help you do that.

If you want to contribute significant amounts of money

As we mentioned earlier, the annual contribution limit to a TSP account is 3-4 more than the Roth IRA contribution limit. So, if you’re looking to supercharge your savings, and could only pick one, then you’d want to pick the Roth TSP.

But there might be situations in which you’d rather contribute to a Roth IRA. Here are a couple.

Roth IRA over Roth TSP

If you need to start the five-year clock

In order to eventually withdraw money from a Roth IRA tax and penalty free, you have to meet the five year rule for earnings.

You don’t have to contribute much. But it’s important to start, just to get this out of the way. Once you’ve made your contribution, you can go back to maxing out your TSP account.

If you want more diverse investment options

Let’s be honest. The TSP funds are probably diverse enough for the vast majority of investors. They’re super expensive, and they expose an investor to most of the desirable parts of the securities market.

But they’re boring. And they don’t allow you to invest in individual stocks, securities, or other investments.

Many investors can make a LOT of money by simply investing for the long term in the TSP funds. But if that’s not your cup of tea, you’ll want to have some of your money in a Roth IRA.

When you might want to contribute to both

Let’s be honest. If you’re hyper-focused on maximizing your retirement savings, there’s no reason you can’t do both. The good news is that there’s nothing that says you can’t contribute to the Roth TSP AND a Roth IRA.

But there might be some hurdles. For example, income.

Backdoor Roth conversions

If your income prohibits you from directly contributing to a Roth IRA, you can always contribute to a nondeductible IRA. From there, you can do Roth conversions.

There are some complexities involved in backdoor Roth conversions. With that in mind, you’ll probably want to discuss them with a financial planner or tax professional before moving forward.

For information purposes, we’ve written a separate article on how backdoor Roth conversions worked for a client using her TSP account.

Not enough cash flow

Perhaps you want to max out your retirement accounts, but you simply don’t have enough money.

Patience is the key. A military career can provide ample opportunities for pay raises and promotions. As long as you set aside part of each pay raise towards your retirement savings, you’ll get there.

A good rule of thumb for highly motivated people is 50%. That means for each pay raise, promotion, incentive pay or special pay that you earn, you set aside 50% towards your retirement savings. You’ll max out your accounts sooner than you think!

Conclusion

While many people think of Roth TSP vs Roth IRA as an ‘either-or’ situation, it’s not so simple. In fact, there’s no reason you can’t do both, if you’re committed to getting ahead on your retirement planning and maximizing your retirement savings.