IRS Form 8880 Instructions

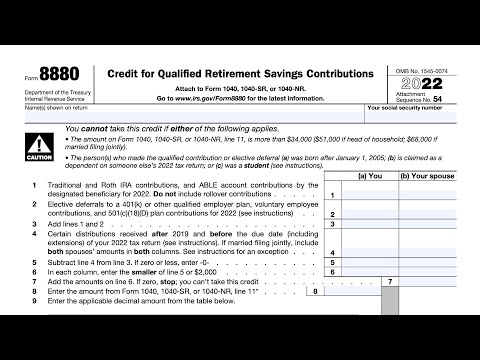

The Internal Revenue Service allows certain taxpayers who contribute to qualified retirement accounts to claim a tax credit, on their income tax return. Eligible taxpayers may use IRS Form 8880 to claim a credit for qualified retirement savings contributions, known as the saver’s credit.

In this article, we’ll walk through the retirement savings credit, including:

- How to calculate and claim a retirement savings credit on Form 8880

- Eligibility requirements for claiming the saver’s credit

- Frequently asked questions

Let’s start with walking through this tax form.

Table of contents

- How do I complete IRS Form 8880?

- Line 1: IRA and ABLE account contributions

- Line 2: Retirement plan contributions

- Line 3

- Line 4: Certain distributions made before tax return due date

- Line 5

- Line 6

- Line 7

- Line 8: Adjusted gross income

- Line 9

- Line 10

- Line 11: Limitation based on tax liability

- Line 12: Credit for qualified retirement savings contributions

- Video walkthrough

- Frequently asked questions

- Where can I find IRS Form 8880?

- Related tax articles

- What do you think?

How do I complete IRS Form 8880?

Let’s walk through this one-page tax form, step by step.

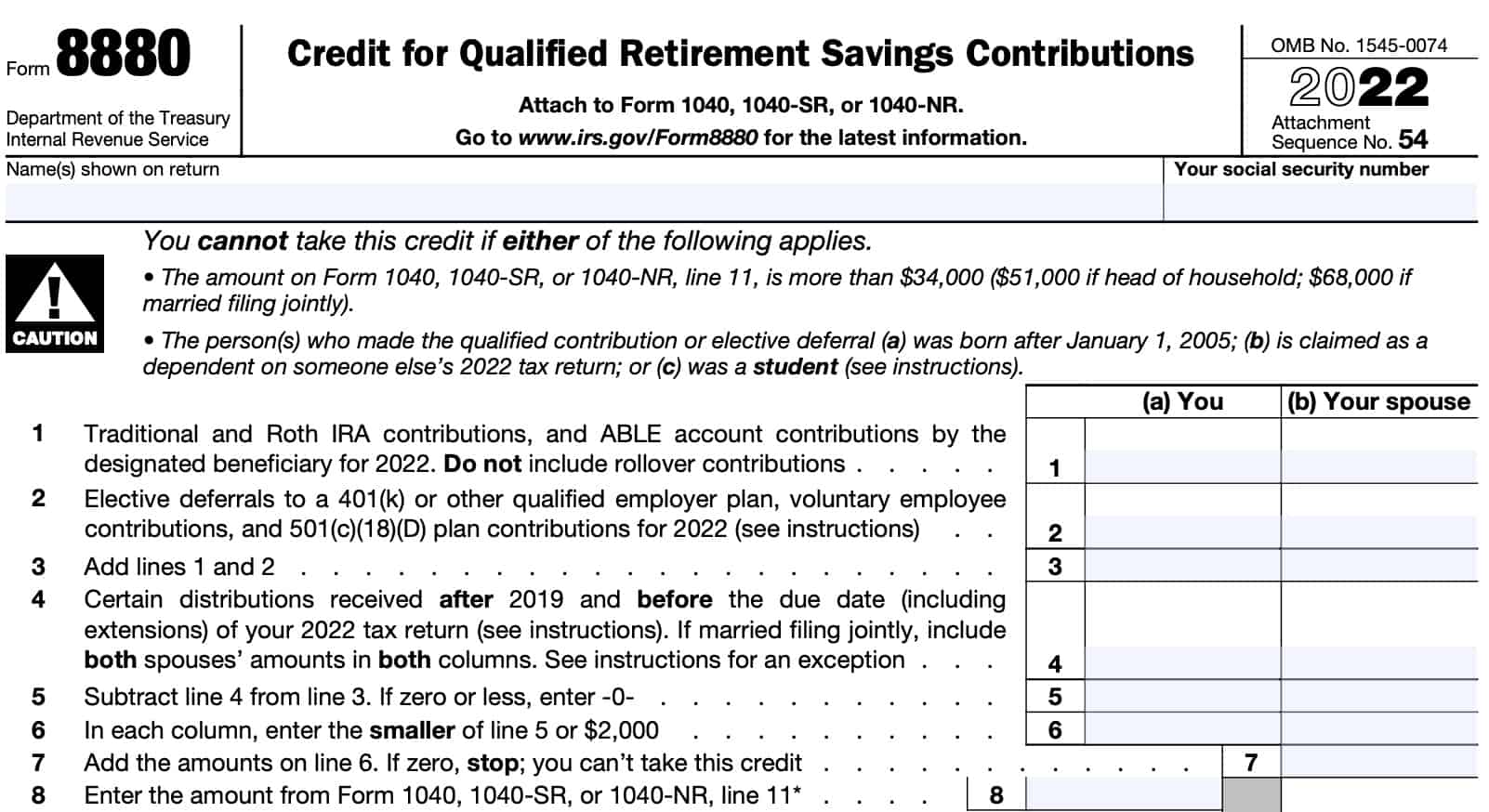

For married taxpayers, enter separate figures in column (a) and column (b) for each spouse in Lines 1 through 6. Single filers do not need to use column (b).

At the top of the form, enter the taxpayer’s name and Social Security number. For married couples, this will likely be the primary taxpayer’s information, or the taxpayer who is listed first on the tax return.

Line 1: IRA and ABLE account contributions

In Line 1, enter any of the following retirement contributions that you made during the tax year:

- Traditional IRA contributions

- Roth IRA contributions

- ABLE account contributions

However, do not include rollover contributions to any of these accounts from an employer-sponsored retirement plan, such as a 401k or 403b. Enter the total contributions for each account separately

Line 2: Retirement plan contributions

Enter any elective deferrals to a qualified employer plan. This might include the following:

- Elective deferrals to:

- 401(k) plan

- 403(b) plan

- Governmental 457 plan (known as deferred compensation plan)

- SEP IRA or SIMPLE IRA

- Federal Thrift Savings PLan (TSP)

- Voluntary employee contributions to a qualified retirement plan, as defined in Internal Revenue Code Section 4974(c)

- Contributions to a 501(c)(18)(D) plan

- This is a type of tax-exempt designation that applies to certain employee pension benefit plans

These contributions should appear on your Form W-2 in Box 12. However, they should not include employer ‘pick up’ contributions designated as employee contributions under IRC Section 414(h)(2). These are considered to be employer contributions for purposes of calculating the retirement saver’s credit.

Line 3

Add the totals of Lines 1 and 2. Enter the result in Line 3.

Line 4: Certain distributions made before tax return due date

Enter the total amount of distributions that you received after 2019 and before the due date of your 2022 return (including extensions) from any of the following types of plans:

- Traditional or Roth IRAs

- ABLE accounts

- 401(k), 403(b), governmental 457(b), 457(b), 501(c)(18)(D) plans

- SEP or SIMPLE IRAs

- Federal TSP plan

- Qualified retirement plans, defined in IRC Section 4974(c)

However, do not include any of the following distributions:

- Rollover distributions

- Includes taxable in-plan rollovers to a designated Roth account

- Trustee to trustee transfers

- Distributions from an eligible retirement plan that were rolled over or converted to a Roth IRA

- Loans from a qualified employer plan treated as distributions

- Distributions of excess contributions or deferrals

- Including income allocable to such contributions or deferrals

- Distributions of IRA contributions made during the tax year that were returned on or before the due date

- Distributions of dividends paid on stock held by an employee stock ownership plan (ESOP) under IRC Section 404(k)

- Distributions from a military retirement plan, aside from the federal TSP plan

- Distributions from an inherited IRA by a nonspousal beneficiary

If you’re filing a joint return, include both spouses’ amounts in both columns. However, do not include your spouse’s distributions with yours when entering an amount on Line 4 if you and your spouse didn’t file a joint income tax return for the year the distribution was received.

Line 5

Subtract Line 4 from Line 3. If the result is zero or less, enter ‘0.’

Line 6

For each column, enter the smaller of:

- Line 5

- $2,000

Line 7

Add the amounts in both columns from Line 6. If the result is zero, then you cannot use Form 8880 to claim the retirement savings contributions credit.

Line 8: Adjusted gross income

Enter your adjusted gross income (AGI) from Line 11 of your income tax return.

Refer to IRS Publication 590-A, Contributions to Individual Retirement Arrangements, if you plan to claim any of the following exclusions or deductions:

- Foreign earned income

- Foreign housing

- Income from Puerto Rico

- Income as a bona fide resident of American Samoa

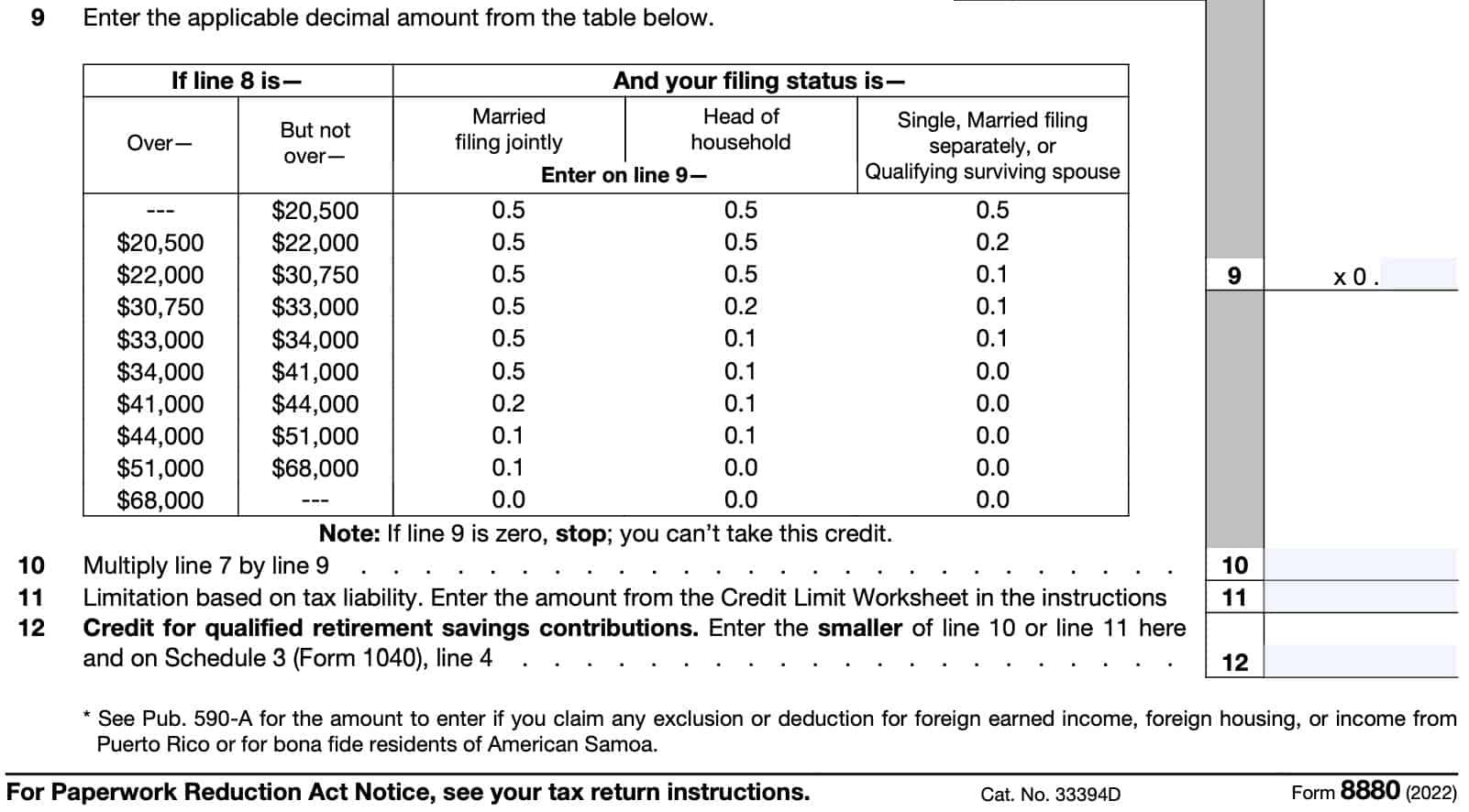

Line 9

Using the enclosed table, enter the applicable decimal amount. For example, if your AGI is $25,000, and your filing status is married filing jointly, then your decimal amount would be 0.5.

Enter the appropriate decimal in Line 9. If your Line 9 number is zero, then the amount of credit that you may claim in the current tax year is zero.

For quick reference, you cannot claim a credit, regardless of contribution amount, if your AGI exceeds the following income limits:

- Married filing jointly: $68,000

- Head of household: $51,000

- All other filing statuses: $34,000

Line 10

In Line 10, multiply Line 7 by Line 9. Enter the result here.

This represents the maximum amount of the credit that you may be eligible for. However, you must also apply any limitations based on your actual tax liability, as calculated in Line 11, below.

Line 11: Limitation based on tax liability

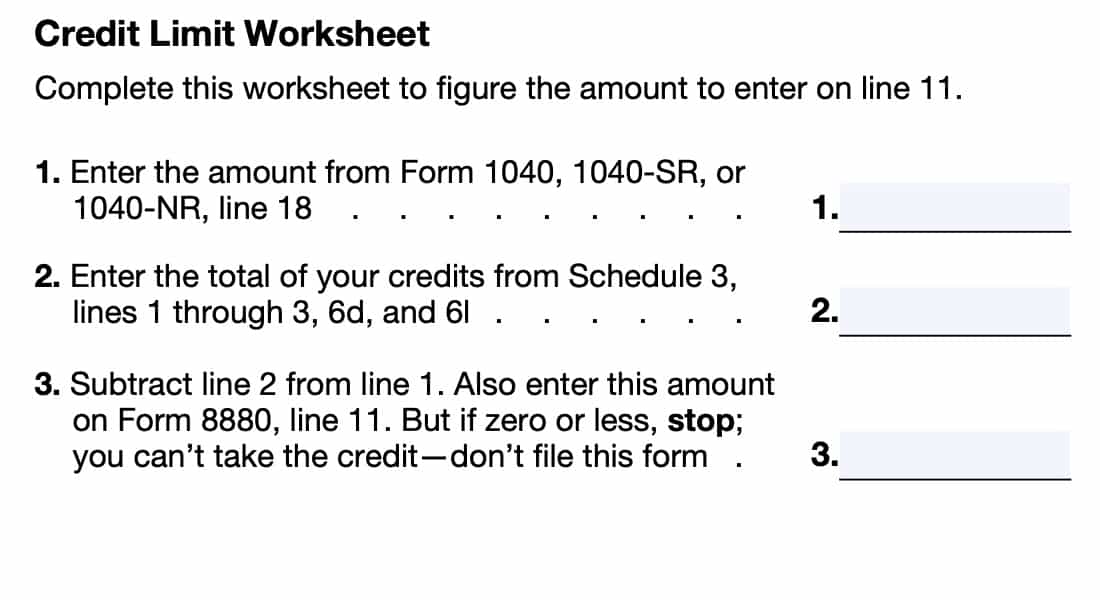

The maximum credit amount that you may deduct from your income tax bill is limited by your actual tax bill itself. To calculate this, you must follow these steps, as outlined in the Credit Limit Worksheet, located in the instructions on the back of the tax form.

Credit Limit Worksheet calculations

There are three steps you must complete to determine any limitations for Line 11.

First, enter the amount from your IRS Form 1040, 1040-SR or 1040-NR, Line 18. This represents the sum of the following:

- Overall tax liability from your income tax return

- Alternative minimum tax as calculated on IRS Form 6251

- Excess advance premium tax credit repayment as calculated on IRS Form 8962

This is Line 1 of the credit limit worksheet.

Second, enter the total of the following nonrefundable tax credits from IRS Schedule 3 on your federal income tax return:

- Line 1: Foreign tax credit, calculated on IRS Form 1116

- Line 2: Credit for child & dependent care expenses, calculated on IRS Form 2441, Line 11

- Line 3: Education credits, annotated on IRS Form 8863, Line 19

- Line 6d: Credit for the elderly or disabled, on Schedule R

- Line 6l: Amount shown on IRS Form 8978, Line 14

This represents Line 2 of the credit limit worksheet.

Finally, subtract Line 2 from Line 1. Enter this amount on Line 11 of the Form 8880. If this number is zero or less, you cannot take this income tax credit.

Line 12: Credit for qualified retirement savings contributions

Enter the smaller of:

This represents the available retirement saver’s tax credit that you may take in the current tax year. Enter this number here and on Schedule 3, Line 4, of your tax return.

Video walkthrough

Watch this instructional video to learn more about claiming the saver’s non-refundable tax credit by using IRS Form 8880.

Frequently asked questions

The retirement savings contribution credit, known as the saver’s credit, is a non-refundable tax credit that moderate-income workers may use to lower the amount of tax due with their tax return. This tax credit is only available to taxpayers who meet certain income thresholds and who are not college students or dependents on another taxpayer’s tax return.

To take this tax credit, you must have contributed to a qualified retirement plan within the tax year and your adjusted gross income must not exceed a certain threshold. For tax year 2022, the AGI threshold is $68,000 for married couples filing jointly, $51,000 for heads of household, and $34,000 for all other taxpayers.

Where can I find IRS Form 8880?

You can find this tax form as a PDF file on the IRS website. For your convenience, we’ve included the most recent version below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!