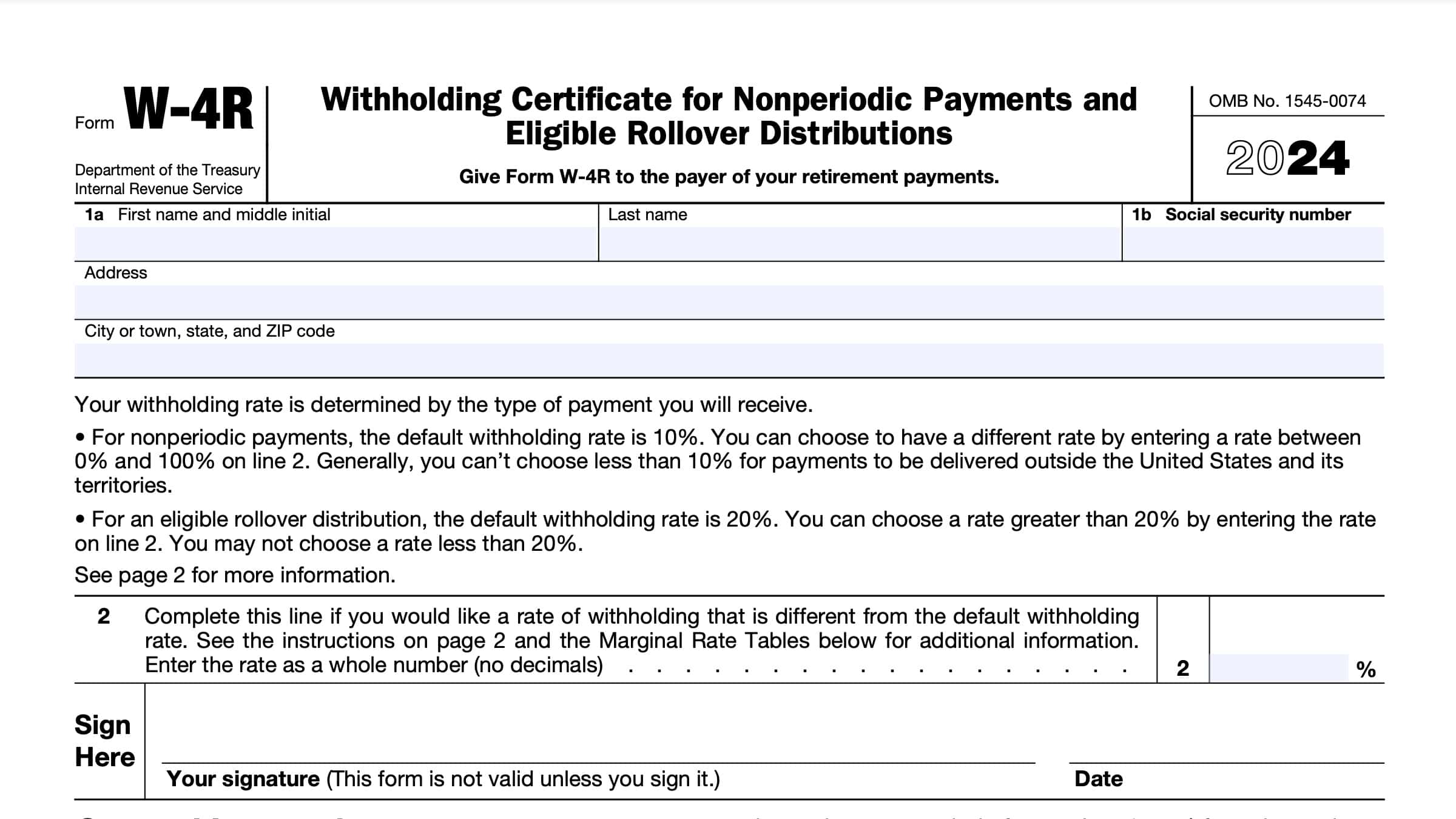

IRS Form W-4R Instructions

In 2017, the Tax Cuts and Jobs Act introduced new withholding rules for taxpayers. As a result, in 2022 the Internal Revenue Service introduced IRS Form W-4R to help simplify federal income tax withholding methods for certain nonperiodic payments and rollover distributions.

In this article, we’ll go over what you need to know about IRS Form W-4R, including:

- How to complete IRS Form W-4R

- Specific situations that require you to use IRS Form W-4R

- Frequently asked questions

Let’s start by walking through this tax form.

Table of contents

How do I complete IRS Form W-4R?

This one-page tax form is very simple to complete. However, there are some recent changes to the IRS guidance which are worth going over.

Let’s first look at the specific instructions, then discuss some of the finer points of using the relatively new W-4R form.

Line 1a: Taxpayer name and address

Enter your complete name and address as they appear on your income tax return. If you have recently moved since filing your last income tax return, you may consider updating your address by filing IRS Form 8822, Change of Address.

Line 1b: Social security number

In Line 1b, enter your complete Social Security number as it appears on your income tax return. Please note that if you do not give a Social Security number, or give an inaccurate SSN, this will become an invalid form. As a result, you may revert back to the default withholding rate.

For an estate, enter the estate’s employer identification number (EIN) in this field.

Line 2: Preferred withholding election

Enter your preferred federal tax withholding rate. This will directly impact the amount of federal taxes withheld from your nonperiodic payments or eligible rollover distributions.

However, there are a couple of nuances worth looking at, for each situation. Let’s take a closer look.

Nonperiodic payments

The Internal Revenue Service mandated the use of the new Form W-4R for nonperiodic payments in January 2023. Prior to this, taxpayers used the existing W-4P form to determine the withholding amount on all taxable IRA distributions, including nonperiodic and periodic pension payments.

Nonperiodic payments vs Periodic payments

IRS Publication 15-A, Employer’s Supplemental Tax Guide, provides the clearest guidance on the difference between the two, when it comes to federal income tax withholding that applies to the

taxable part of payments made from any of the following retirement plans:

- Pension plans

- Profit-sharing plans

- Stock bonus plans

- Annuity payments

- Deferred compensation plans

- Individual retirement arrangements (IRAs)

Periodic pension payments

Periodic pension payments are made in installments at regular intervals over a period of more than 1 year. They may be paid annually, quarterly, monthly, or any other regular interval throughout the tax year.

Recipients of periodic payments must complete the revised Form W-4P instead of IRS Form W-4R, to calculate their withholding amount.

The default rate for federal income tax withholdings for periodic pension payments is based on that of a single filer with no adjustments.

Nonperiodic pension payments

Nonperiodic payments are one-time payments, or distributions otherwise not made on a regular schedule. For example, IRA distributions made on an on-demand basis are considered nonperiodic payment.

The W-4P form allows for more accurate federal income tax withholding than IRS Form W-4R. However, IRS Form W-4R allows taxpayers to elect their tax withholding in terms of a flat percentage rate, while the revised Form W-4P does not.

Under default withholding rules, the default rate for nonperiodic pension payments is 10% of the total payment or distribution. However, the account holder can select any percentage, even selecting zero withholding.

Eligible rollover distributions

Rollover distributions have different default withholding rules. The default rate for any eligible rollover distribution from an IRA or retirement plan is 20% of the rollover.

What is an eligible rollover distribution?

Eligible rollover distributions include distributions from eligible retirement plans, other than IRAs that are eligible to be rolled over tax-free to an IRA or another eligible retirement plan. Eligible retirement plans include:

- Qualified plans

- Section 401(k) plans

- Section 457(b) plans maintained by a governmental employer

- Section 403(a) annuity plans

- Section 403(b) tax-sheltered annuities

The default rate is for eligible rollover distributions is 20% of the rollover amount. While you can use IRS Form W-4R to change the percentage, you cannot choose a withholding amount lower than 20 percent. Don’t give Form W-4R to your payer unless you want more than 20% withheld.

And this is one of the reasons you should consider an alternative to eligible rollover distributions.

Tax consequences of eligible rollover distributions

Eligible rollover distributions are part of what is known as a 60-day rollover. As the name indicates, a distribution from an IRA or a retirement plan is considered to be a tax-free transaction, as long as it is done within 60 days.

The hidden part is this:

- Using IRS Form W-4R is required for your rollover distribution

- You cannot select a withholding rate lower than 20% of the rollover amount

- You have to replace the entire rollover amount, including the taxes that were withheld, within 60 days

Example of an eligible rollover distribution

Let’s imagine that you’re rolling over your $100,000 401(k) balance into an IRA. You submit your Form W-4R to the plan administrator. The plan administrator cuts you a check for $80,000 while sending $20,000 in estimated tax payments to the IRS.

You have two choices, here.

Choice 1: Roll over the $80,000 into your IRA, but not the $20,000. In this case, you’ll have the following:

- $80,000 tax-free rollover

- $20,000 taxable distribution

- $20,000 taxes paid

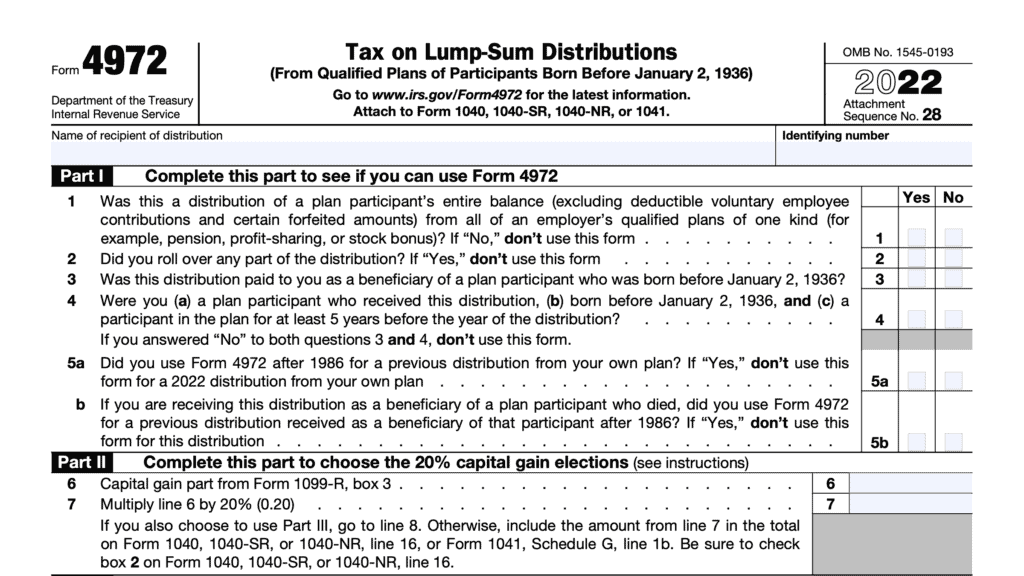

On top of that, unless you meet one of the exception criteria, you’ll have to calculate your 10% additional tax penalty for early withdrawals on IRS Form 5329, and report the additional taxes on Schedule 2 of your tax return.

Choice 2: Roll over the $80,000 into your IRA, and find $20,000 that you have laying around elsewhere. In this case, you would have the following:

- $100,000 tax-free rollover

- $0 taxable distribution

- $20,000 taxes paid

You’ll eventually get the money back when you file your income tax return, but there exists the obvious problem of finding $20,000 within such a short period of time without creating additional tax problems for yourself.

So here’s what you should do instead.

Tax-free alternative to eligible rollover distributions

The IRS allows two other tax-free methods to move money between retirement accounts and IRAs:

- Direct rollovers

- Trustee-to-trustee transfers

Technically, these are the same thing, with one slight difference. A direct rollover is a rollover from one retirement plan to another retirement plan or IRA. A trustee-to-trustee transfer is a transfer from one IRA to another IRA or to another retirement plan.

By having your plan administrators or IRA custodians move your money, you can avoid:

- Any taxable IRA distributions or retirement plan withdrawals

- Having to worry about finding money to complete the rollover

- Early withdrawal penalties or other tax consequences

Each retirement plan and IRA has different guidelines on how they do direct rollovers or trustee-to-trustee transfers. IRA owners can contact their custodian for additional detail, while employees should contact their plan administrator.

What is not an eligible rollover distribution?

For purposes of this form, the following transactions are not considered eligible rollover distributions, and have different withholding rules:

- Qualifying “hardship” distributions

- Distributions required by federal law, such as required minimum distributions

- Distributions from a pension-linked emergency savings account

- Eligible distributions to a domestic abuse victim

- Qualified disaster recovery distributions

- Qualified birth or adoption distributions and

- Emergency personal expense distributions

Reporting taxes withheld on IRS Form W-4R

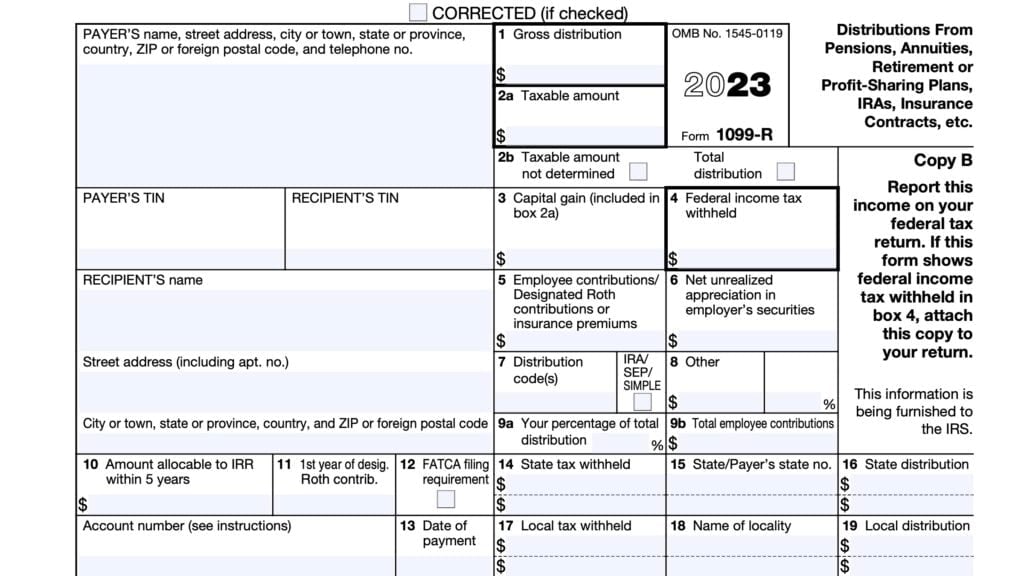

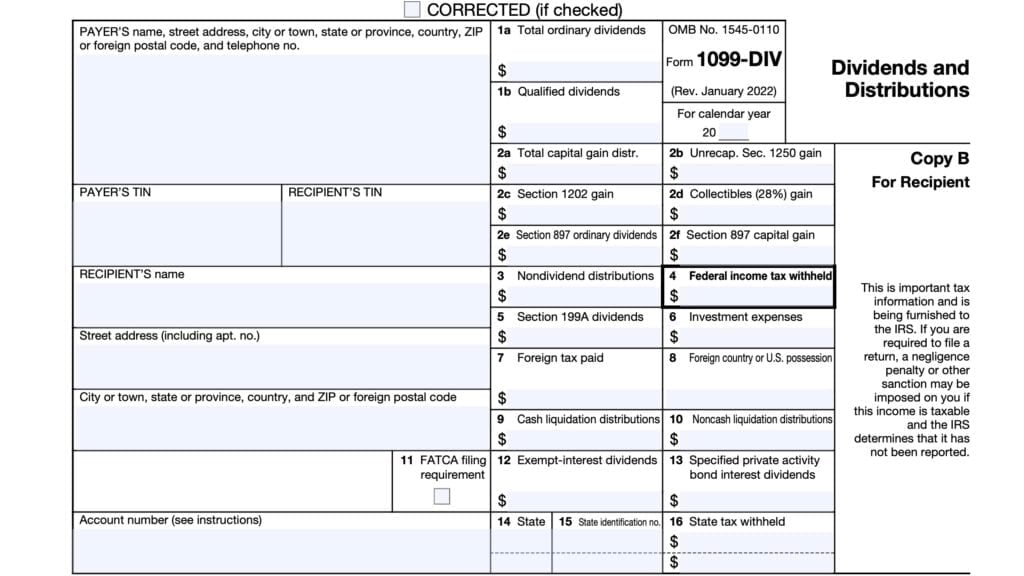

At the end of the tax year, you should receive a copy of IRS Form 1099-R, Distributions from Pensions, Retirement Plans, etc. Any withheld taxes will be reported on IRS Form 1099-R.

When filing in the new tax season, enter these taxes on Line 25b of your Form 1040 when you file your income tax return.

Do you have the correct withholding form?

Not sure if you have the correct tax withholding form? Here are other forms in the Form W-4 series that you may consider.

IRS Form W-4, Employee’s Withholding Certificate

Taxpayers complete Form W-4, Employee’s Withholding Certificate, to give their employer instructions on the withholding of federal income tax from their earned income based on their available tax credits, deductions, and filing status.

Watch this instructional video to learn more about how IRS Form W-4 works.

IRS Form W-4P, Withholding Certificate For Periodic Pension Or Annuity Payments

Taxpayers complete IRS Form W-4P, Withholding Certificate for Periodic Pension or Annuity Payments to give their payer instructions on tax withholding for regular pension or annuity payments.

Watch this brief educational video to learn more IRS Form W-4P.

IRS Form W-4S, Request for Federal Income Tax Withholding from Sick Pay

Taxpayers who wish to have taxes withheld from sick pay issued by a third-party payer may complete IRS Form W-4S, Request for Federal Income Tax Withholding From Sick Pay.

For more detail on how IRS Form W-4S works, check out this video.

IRS Form W-4V, Voluntary Withholding Request

IRS Form W-4V, Voluntary Withholding Request, is the tax form that taxpayers may use to determine the amount of tax withheld from various government payments, such as:

- Social Security payments

- Tier 1 Railroad retirement benefits

- Unemployment benefits

- Payments from certain federal government benefit programs

Watch this video to learn more about how IRS Form W-4V works.

Video walkthrough

Frequently asked questions

For taxpayers who want to change their tax withholding, you can make a new election by submitting a new Form W-4R to your plan administrator or IRA custodian.

IRS Form W-4R is not the correct form for periodic pension payments or withdrawals. Instead, taxpayers should use IRS Form W-4P, Withholding Certificate for Periodic Pension or Annuity Payments.

Where can I find IRS Form W-4R?

As with other tax forms, you can find IRS Form W-4R on the IRS website. We’ve included the most updated W-4 form right here.