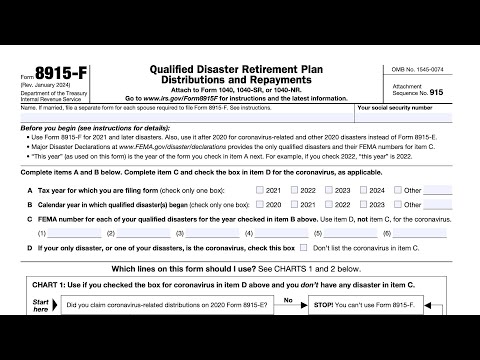

IRS Form 8915-F Instructions

Taxpayers who are impacted by qualified disasters may be eligible for special tax consideration on qualified disaster distributions from their IRAs or retirement plans. By filing IRS Form 8915-F, Qualified Disaster Retirement Plan Distributions and Repayments, these taxpayers may be able to:

- Report their income over as many as 3 tax years, instead of reporting their distribution in the year received

- ‘Repay’ distributions within a certain period of time with zero tax impact

- Avoid additional tax on early distributions

In this article, we’ll walk through everything you need to know about IRS Form 8915-F, including:

- How to complete IRS Form 8915-F

- Key terms and phrases

- Special tax considerations for qualified disaster distributions

Let’s start with a review of IRS Form 8915-F.

Table of contents

How do I complete IRS Form 8915-F?

There are four parts to this tax form:

- Part I: Total Distributions From All Retirement Plans (Including IRAs)

- Part II: Qualified Disaster Distributions From Retirement Plans (Other Than IRAs) for the Coronavirus and Disaster(s) Listed in Item C

- Part III: Qualified Disaster Distributions From Traditional, SEP, SIMPLE, and Roth IRAs for the Coronavirus and Disaster(s) Listed in Item C

- Part IV: Qualified Distributions for the Purchase or Construction of a Main Home in the Area of Disaster(s) Listed in Item C

Before going through each part, you must complete the information fields at the top of the form. From there, you’ll be able to decide:

- Whether you can file IRS Form 8915-F

- Which flowchart to use

- Which parts and lines to complete on IRS Form 8915-F

Let’s take a look at the top of IRS Form 8915-F.

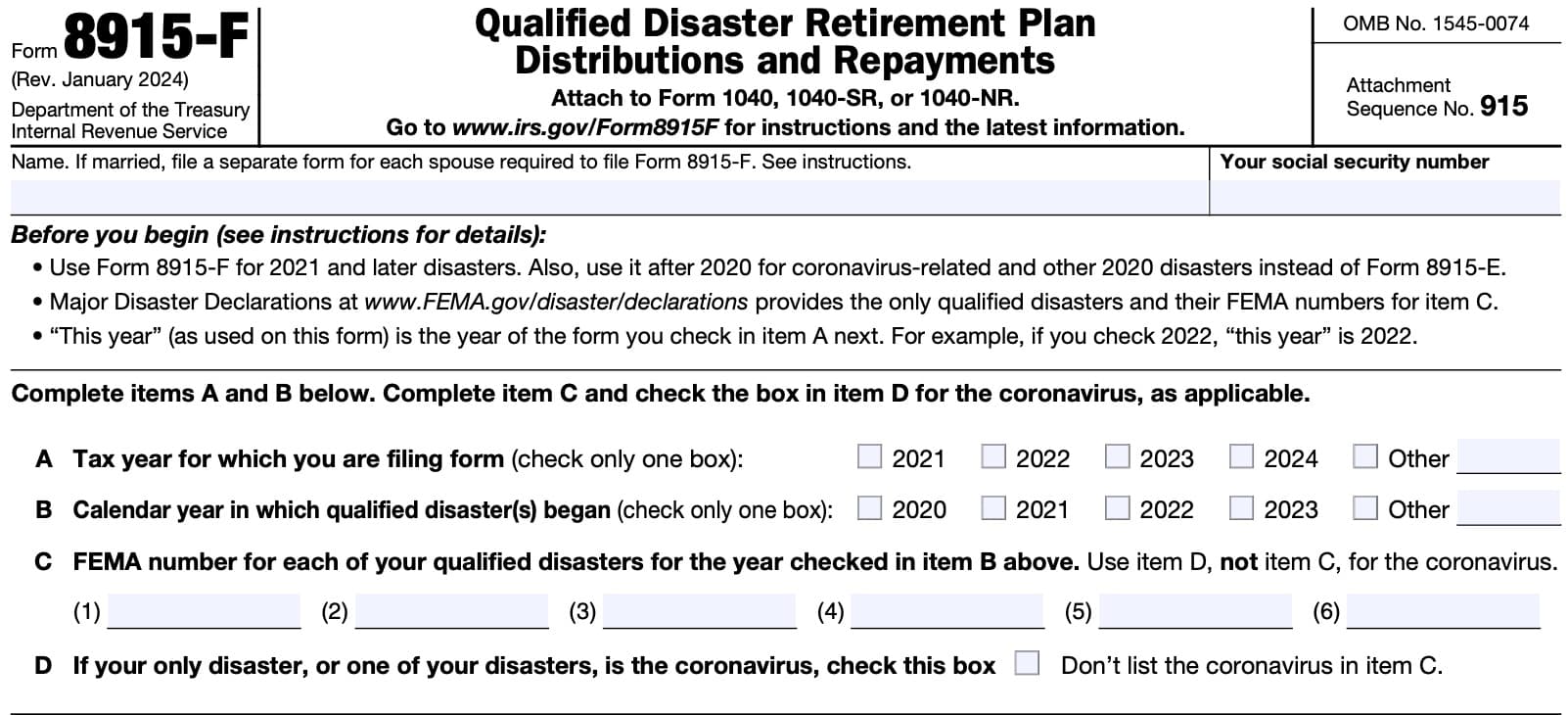

Top of IRS Form 8915-F

At the very top of IRS Form 8915-F, enter the taxpayer name and Social Security number as they appear in your tax return. If you are married, then each spouse must complete a separate Form 8915-F.

From there, let’s spend some time understanding some of the notes at the top of the form, in the Before you begin section.

Before you begin

There are several notes in this section, which will help better understand how to complete this form.

Form 8915-F replaces Form 8915-E for 2021 and later years.

IRS Form 8915-E was used for coronavirus-related and other 2020 disaster distributions. If you filed Form 8915-E in the past, then:

- Also use Form 8915-F for 2021 and later disaster distributions. Qualified disaster recovery distributions are qualified disaster distributions.

- Major Disaster Declarations, located on the FEMA website, provides the only qualified disasters and their FEMA numbers for item C.

- “This year” (as used on this form) is the year of the form you check in item A next. For example, if you check 2022, “this year” is 2022.

Taxpayer name & Social Security number

Enter only the name and Social Security number (SSN) of the spouse whose information will appear on IRS Form 8915-F. If both spouses must file this tax form, then each spouse must complete a separate Form 8915-F.

Item A: Tax year for which you are filing form

Check the box describing the tax year of your tax return. You can only check one box in Item A.

If the tax year of the return to which you are attaching your Form 8915-F is 2023, check the “2023” box in Item A.

Item B: Calendar Year in Which Qualified Disaster(s) Began

Check the box that describes the calendar year in which the disaster or disasters for which you are reporting distributions on your Form 8915-F began.

You can only check one box in Item B.

The disasters for which you are reporting distributions, repayments, and/or income on your Form 8915-F must have all started in the same calendar year. If the disasters all started in 2023, check the box for “2023” in Item B.

Item C: FEMA number for each qualified disaster

Enter the FEMA disaster number from the Major Disasters Declarations page on the FEMA website. For example, for the 2021 Louisiana Hurricane Ida disaster, you would enter DR-4611-LA.

However, do not enter ‘COVID-19’ or ‘coronavirus’ in Item C. Instead, check the Box in Item D, below.

Item D: Coronavirus

Check the box in Item D if the coronavirus is one of the disasters for which are filing IRS Form 8915-F.

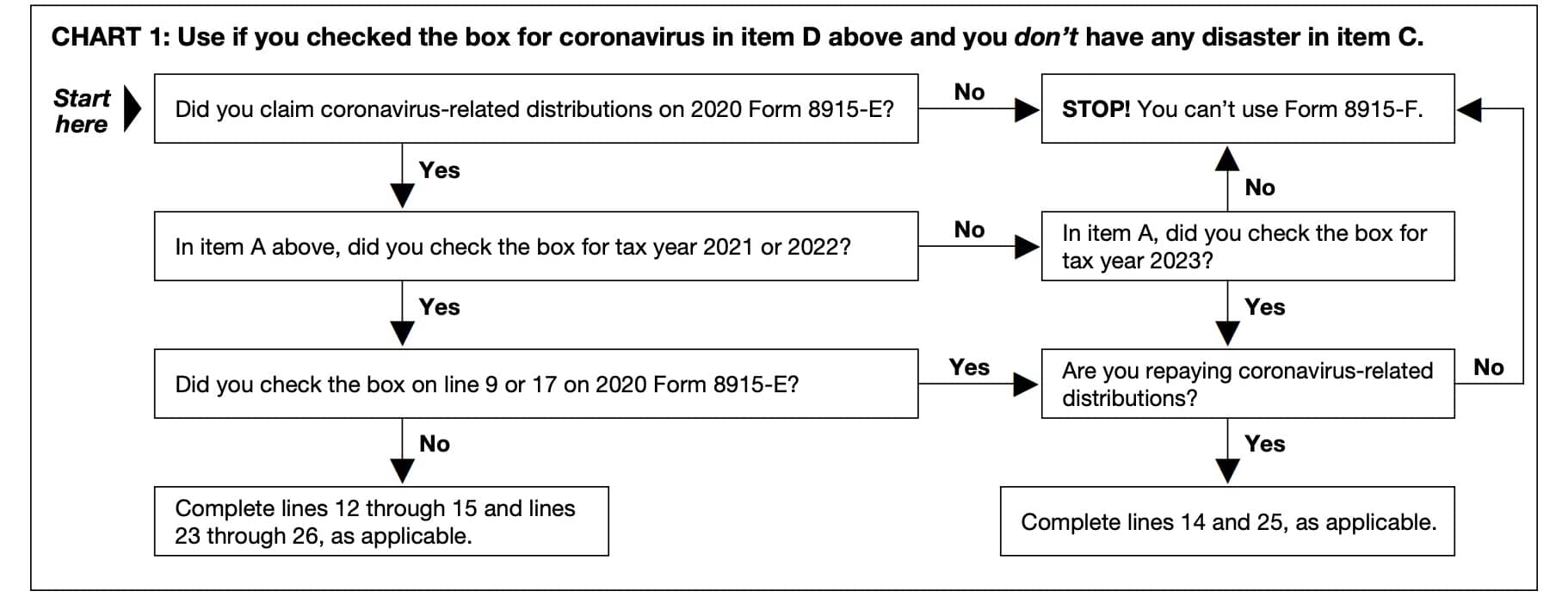

Deciding which chart to use

The form contains two charts that will help you determine which steps to take when completing Form 8915-F.

Chart 1

Use Chart 1 if both of the following conditions apply:

If Chart 1 applies to your tax situation, then use it to determine which line you should begin with. However, you cannot use IRS Form 8915-F if any of the following apply:

- You did not claim coronavirus-related distributions on IRS Form 8915-E in 2020

- If you claimed coronavirus-related distributions on 2020 Form 8915-E, but you did not check the box in Item A for 2021, 2022, or 2023

- If you checked the box on Line 9 or Line 17 on 2020 Form 8915-E, but you are not repaying coronavirus-related distributions

- Line 9: Box indicates that you wish to spread the taxable amount of distributions from a workplace retirement plan over a 3 year period

- Line 17: Box indicates that you do not wish to spread the taxable amount of distributions from one of the following retirement plans over a 3-year period:

- Traditional IRA or Roth IRA

- Simplified employee pension plan (SEP) or SIMPLE IRA

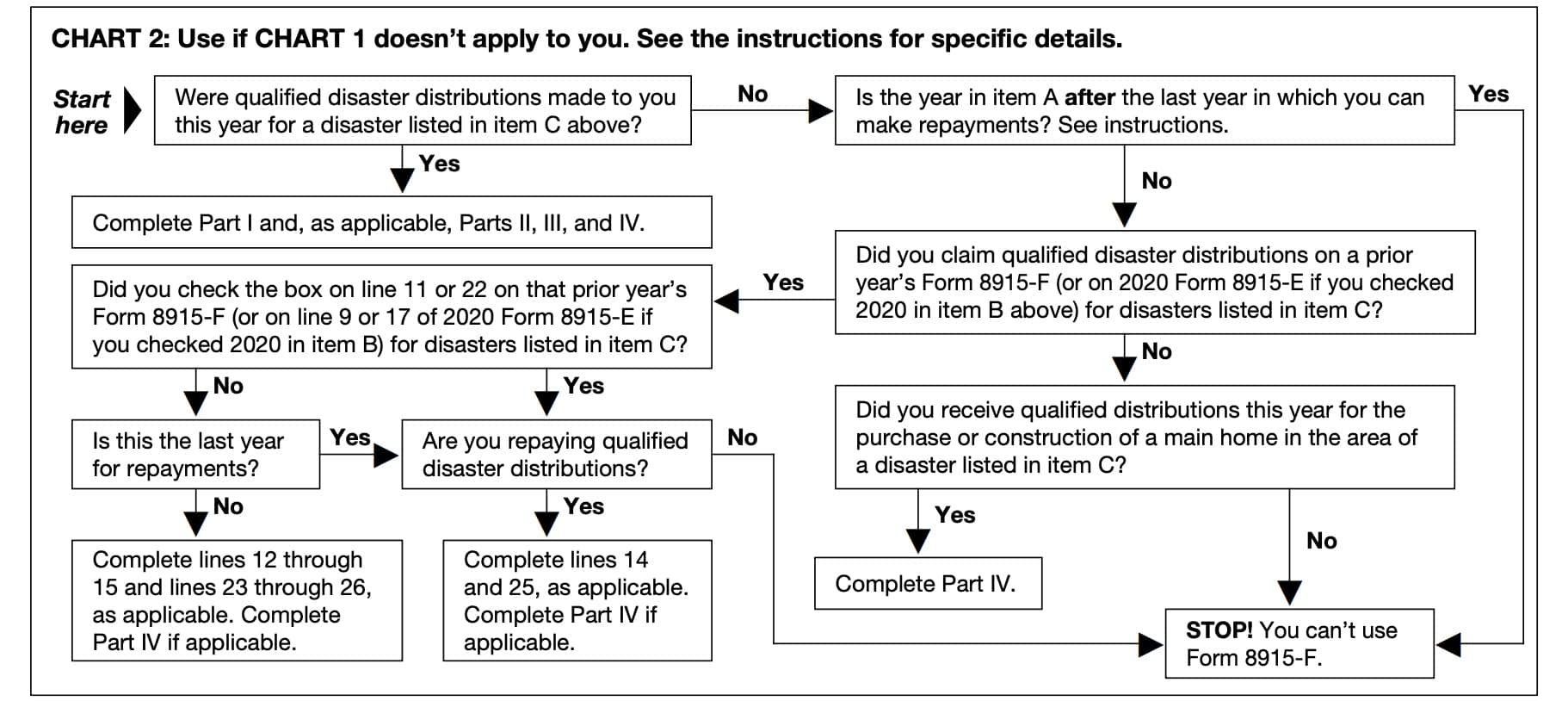

Chart 2

Use Chart 2 if Chart 1 does not apply to you. If you’re able to file IRS Form 8915-F, then use the chart to determine where you should begin.

If you are reporting qualified disaster retirement plan distributions for a disaster that occurred this year, you’ll probably end up starting with Part I.

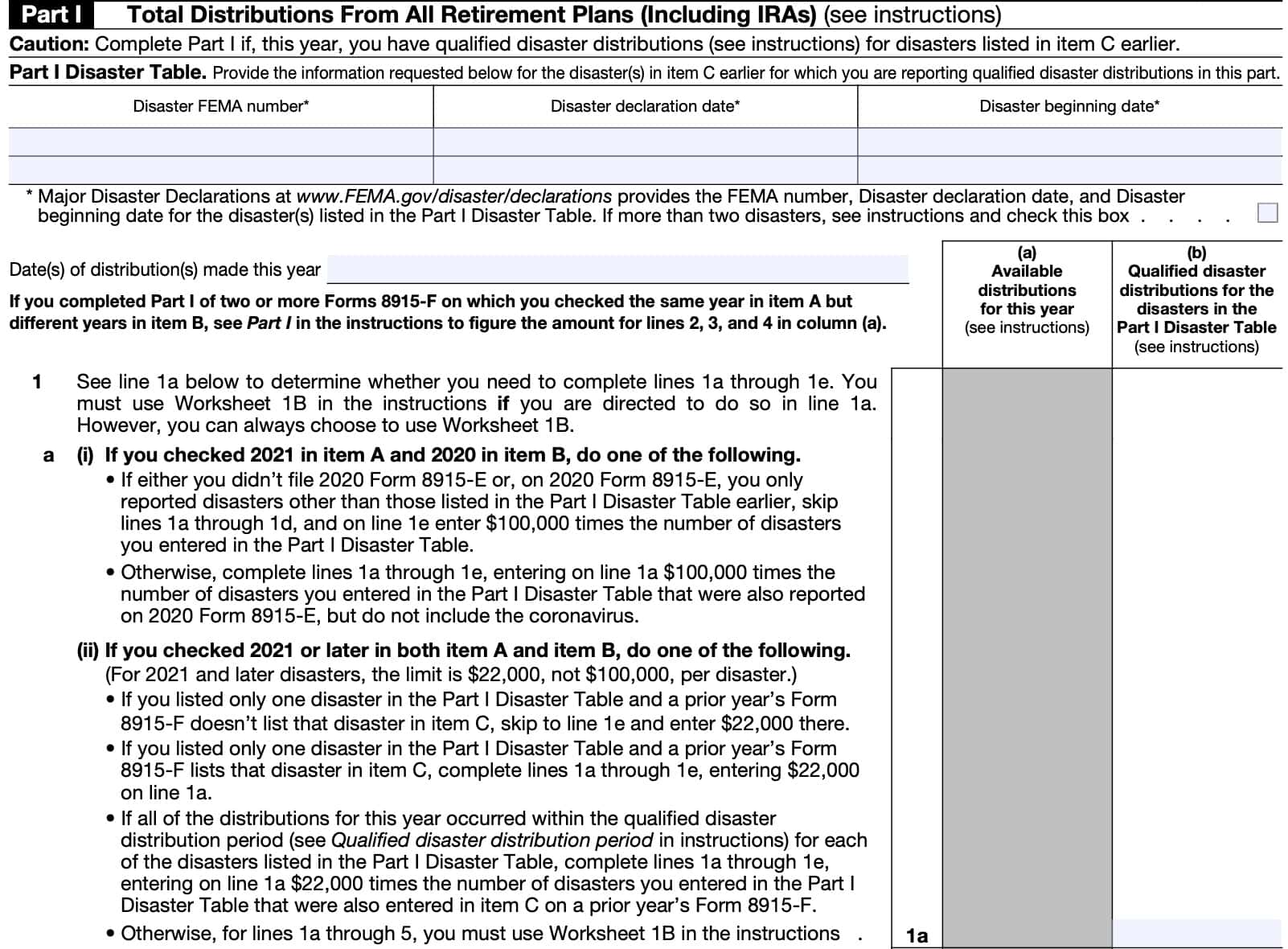

Part I: Total Distributions From All Retirement Plans (Including IRAs)

Complete Part I if you have a qualified distribution for disasters that you reported in Item C, earlier.

Part I Disaster table

In the Part I Disaster Table at the top of Part I, you’ll need to enter the following information for each disaster that you reported in Item C:

- Disaster FEMA number

- Disaster declaration date

- Disaster beginning date

You can find a list of qualified disasters on the FEMA website. If there are more than two disasters, then you ‘ll need to check the applicable box, then attach a statement to the back of your Form 8915-F with the following information:

- Taxpayer name

- Social Security number

- FEMA number for each disaster

- Disaster declaration date for each disaster

- Each disaster’s beginning date

Below this, enter the date or dates for each qualified distribution.

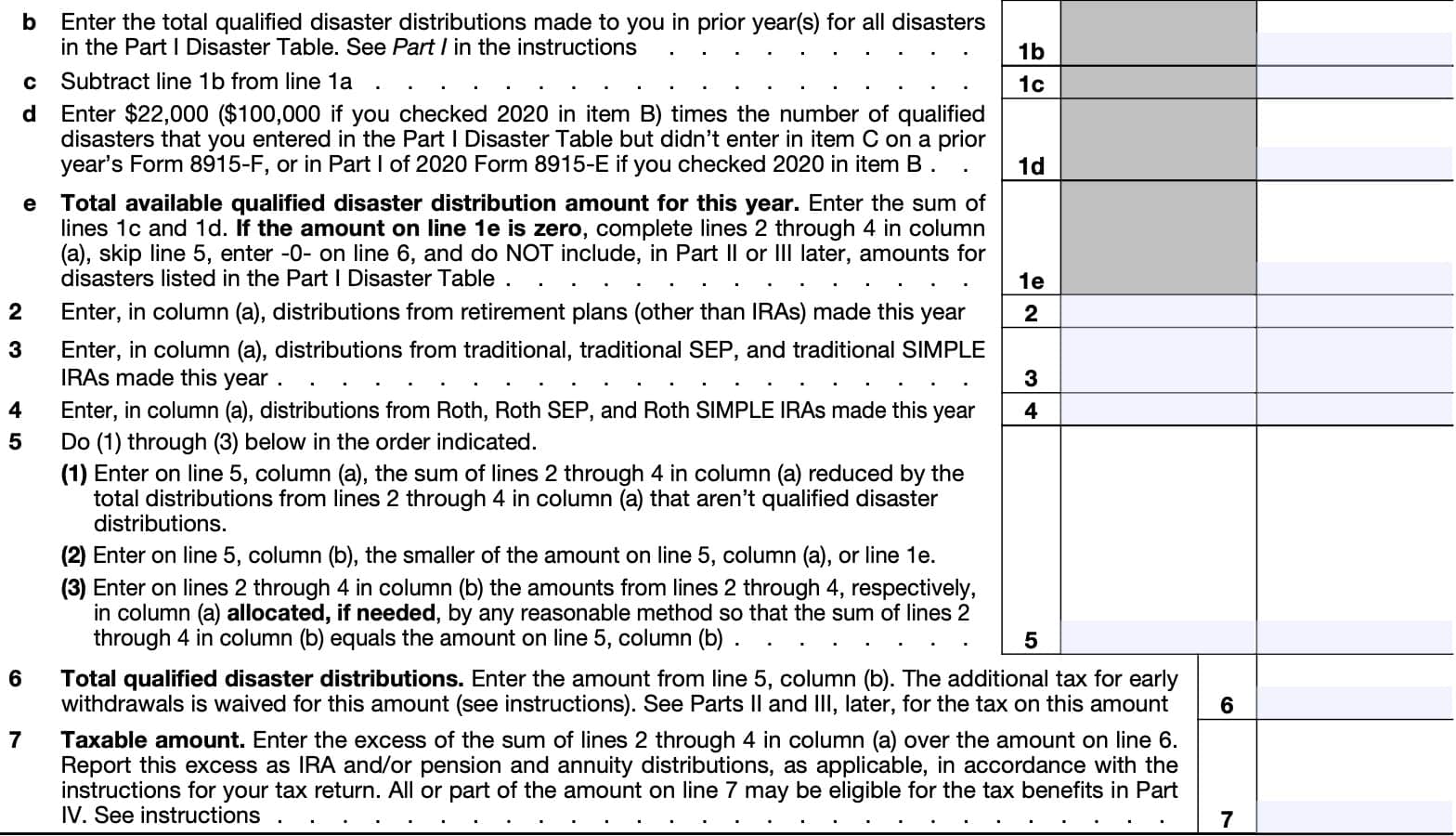

Line 1

Before going into detail on Lines 1a through 1d, let’s first look at situations where you may be able to skip these entries. You can skip Lines 1a through 1d if:

- Your 2021 Form 8915-F (for 2020 disasters) if either:

- You didn’t file 2020 Form 8915-E or

- The only disaster you reported on 2020 Form 8915-E was the coronavirus;

- This year’s Form 8915-F if:

- You listed only one 2021 or later disaster in the table at the top of Part I and

- A prior year’s Form 8915-F doesn’t list that disaster in item C;

- This year’s Form 8915-F if:

- You have listed 2021 or later disasters in the table at the top of Part I and

- No prior year’s Form 8915-F lists any of those disasters in item C.

- For example, when you have checked the same year in item A and item B; or

- This year’s Form 8915-F if you are using Worksheet 1B.

If you make entries for Lines 1a through 1e, you should note that there are two columns for Lines 1 through 5:

- Column (a): Available distributions for this year

- Column (b): Qualified disaster distributions for disasters in the Part I Disaster Table

For Lines 1a through 1e, you’ll only enter values in Column (b).

Line 1a

There are two possible options for Line 1a:

- If you checked 2021 in Item A and 2020 in Item B, see the instructions for Line 1a(i), below

- If you checked 2021 or later in both Item A and Item B, see the instructions for Line 1a(ii), below

Line 1a(i)

If you did not file 2020 Form 8915-E, or if you only reported disasters other than those listed in the Part I Disaster Table on your Form 8915-E, then skip Lines 1a through 1d. Enter $100,000 times the number of disasters that you entered on the Part I Disaster Table on Line 1e.

Otherwise, complete Lines 1a through 1e. Enter $100,000 times the number of disasters you entered on the Part I Disaster Table, but do not include the coronavirus pandemic.

Line 1a(ii)

For 2021 and later disasters, the qualified distribution dollar limit is $22,000 per disaster, not $100,000.

If you checked 2021 or later for both Item A and Item B, then you’ll need to do one of the following:

- If you listed only one disaster in the Part I disaster, and a prior year’s Form 8915-F does not list that disaster in Item C, then:

- Skip to Line 1e and enter $22,000

- If you listed only one disaster in Part I, and a prior year’s Form 8915-F lists that disaster in Item C, then:

- Complete Lines 1a through 1e, entering $22,000 on Line 1a

- If all of the distributions occurred within the qualified disaster distribution period, then do the following for each disaster:

- Complete Lines 1a through 1e

- Enter on Line 1a $22,000 times the number of disasters entered in the Part I Disaster Table that you also entered in Item C on a prior year’s Form 8915-F

- If none of these scenarios applies, then you’ll need to complete Worksheet 1B.

Line 1b

In Line 1b, enter the total amount of qualified disaster distributions made to you in prior tax years for all disasters in the Part I Disaster Table.

Line 1c

Subtract Line 1b from Line 1a. Enter the result here.

Line 1d

Enter $22,000 times the number of qualified disasters that you entered in the Part I Disaster Table, but did not enter in Item C on a prior year’s Form 8915-F.

If you checked 2020 in Item B, use $100,000 instead of $22,000.

Line 1e: Total available qualified disaster distribution amount for this year

Enter the sum of Lines 1c and 1d.

If the result is zero, then:

- Complete Lines 2 through 4 in Column (a)

- Skip Line 5

- Enter ‘0’ on Line 6

- Do not include amounts for disasters listed in the Part I Disaster Table

Line 2

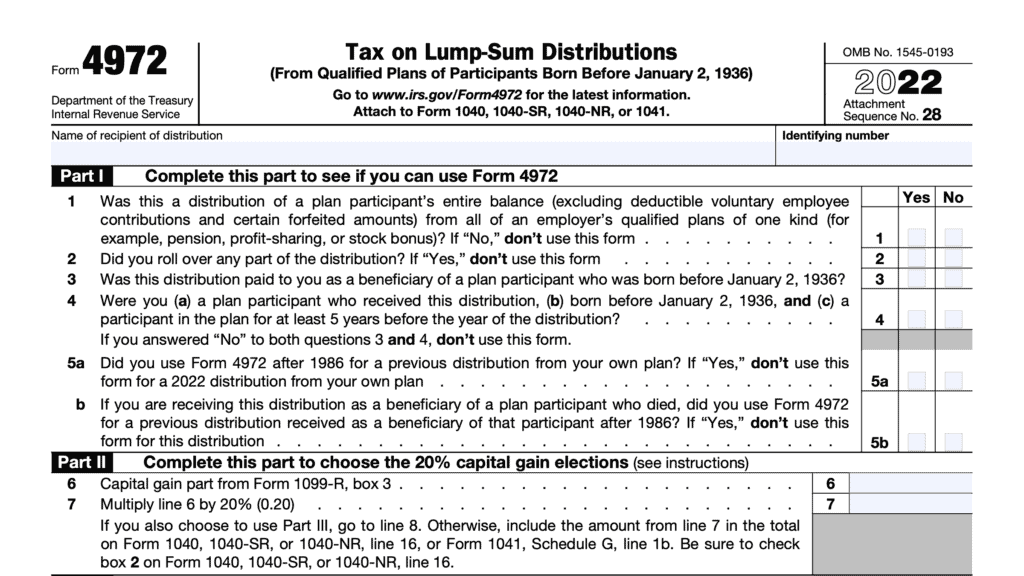

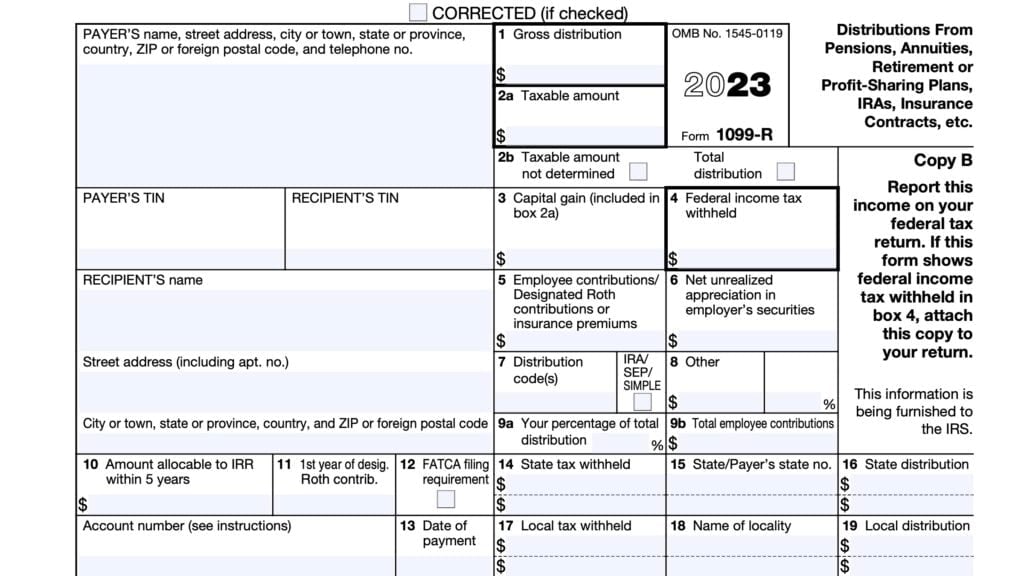

For Lines 2 through 4, Column (a): If you received a distribution from an eligible retirement plan (including an IRA), you should receive a copy of IRS Form 1099-R at the end of the year. The amount of the distribution should be shown in box 1 of Form 1099-R.

In Line 2 enter the amounts from Box 1 of all your Forms 1099-R for any qualified retirement account (not including IRAs) for the tax year.

Using Worksheet 1B

If you are using Worksheet 1B, follow the instructions for the worksheet when completing these lines.

The amounts entered on Lines 2 through 5 in column (b) depend on whether the amount on Line 5 in column (a) is more than the amount on Line 1e.

The amount on Line 5, column (a), is the sum of Lines 2 through 4 in column (a) reduced by the total distributions from Lines 2 through 4 in column (a) that aren’t qualified disaster distributions.

- If the amount on Line 5 in column (a) is equal to or less than the amount on Line 1e, enter the amounts on Lines 2 through 5 in column (a) on Lines 2 through 5 in column (b).

- If the amount on Line 5 in column (a) is more than the amount on Line 1e, enter on Lines 2 through 4 in column (b) the amounts on Line 5 in column (a) adjusted by any reasonable means so that their sum on Line 5 in column (b) equals the amount on Line 1e.

Line 3

In Line 3 enter the amounts from Box 1 of all your Forms 1099-R for any of the following traditional accounts:

- IRA

- SEP IRA

- SIMPLE IRA

Line 4

In Line 4 enter the amounts from Box 1 of all your Forms 1099-R for any of the following Roth accounts during the year:

- IRA

- SEP IRA

- SIMPLE IRA

Line 5

For Line 5, do Steps (1) through (3) below in the order indicated.

Step 1

Enter on Line 5, column (a):

- The sum of Lines 2 through 4 in column (a) reduced by the

- Total distributions from Lines 2 through 4 in column (a) that aren’t qualified disaster distributions.

Step 2

On Line 5, column (b), enter the smaller of:

- Line 5, column (a), or

- Line 1e

Step 3

Enter on Lines 2 through 4 in column (b) the amounts from Lines 2 through 4, respectively,

in column (a) allocated, if needed, by any reasonable method so that the sum of Lines 2

through 4 in column (b) equals the amount on Line 5, column (b)

Line 6: Total qualified disaster

Enter the amount from Line 5, column (b). The additional tax for an early distribution is waived for this amount.

See Part II and Part III, later, to determine the tax on your qualified disaster distribution.

Line 7: Taxable amount

In Line 7, enter the excess of the sum of Lines 2 through 4 in column (a) over the amount on Line 6, unless if you are:

- Also completing Part IV, or

- All or part of the Line 7 amount may be eligible for the tax benefits in Part IV

- Claiming qualified disaster distributions on Part I of more than one Form 8915 for this year

Report this excess as IRA and/or pension and annuity distributions, as applicable, in accordance with the instructions for your tax return.

If completing both Part I and Part IV or filing more than one Form 8915

Follow these steps if completing both Part I and Part IV or filing more than one Form 8915.

Step 1

If you are completing both Part I and Part IV on this year’s Form 8915-F:

- On Line 7, enter the:

- Excess of the sum of Lines 2 through 4 in column (a) over the amount on Line 6 reduced by

- The amount from Line 7 that is included on Line 28 in Part IV.

- On the dotted line to the left of Line 7, enter “$________ qualified distribution for Part IV, Line 28.”

Step 2

If you are claiming qualified disaster distributions on Part I of more than one Form 8915 for this year, and you are not completing Part IV on this year’s Form 8915:

- On Line 7, enter ‘0’ and use that dollar amount as your available distributions on the other Form 8915 that you are filing

- On the dotted line to the left of Line 7, enter “$________ used as available distribution on Part I of ______ Form 8915-F.”

- Should refer to the disaster name

Step 3. If you are claiming qualified disaster distributions on Part I of more than one Form 8915-F for this year and you are completing Part IV on this year’s Form 8915-F for the earliest disasters.

- If, on the Form 8915-F for this year with the earliest disasters, the amount on Line 30 reduced by the amount on Line 31 is ‘0,’ you don’t have any available distributions for the other Forms 8915-F you are filing this year.

- However, if the amount on Line 30 reduced by the amount on Line 31 is a positive dollar amount, then:

- Enter ‘0’ on Line 32

- Use that dollar amount as your available distributions on the other Form 8915-F you are filing for this year.

- On the dotted line to the left of Line 32, enter “$________ used as available distribution on Part I of * Form 8915-F (* disasters).”

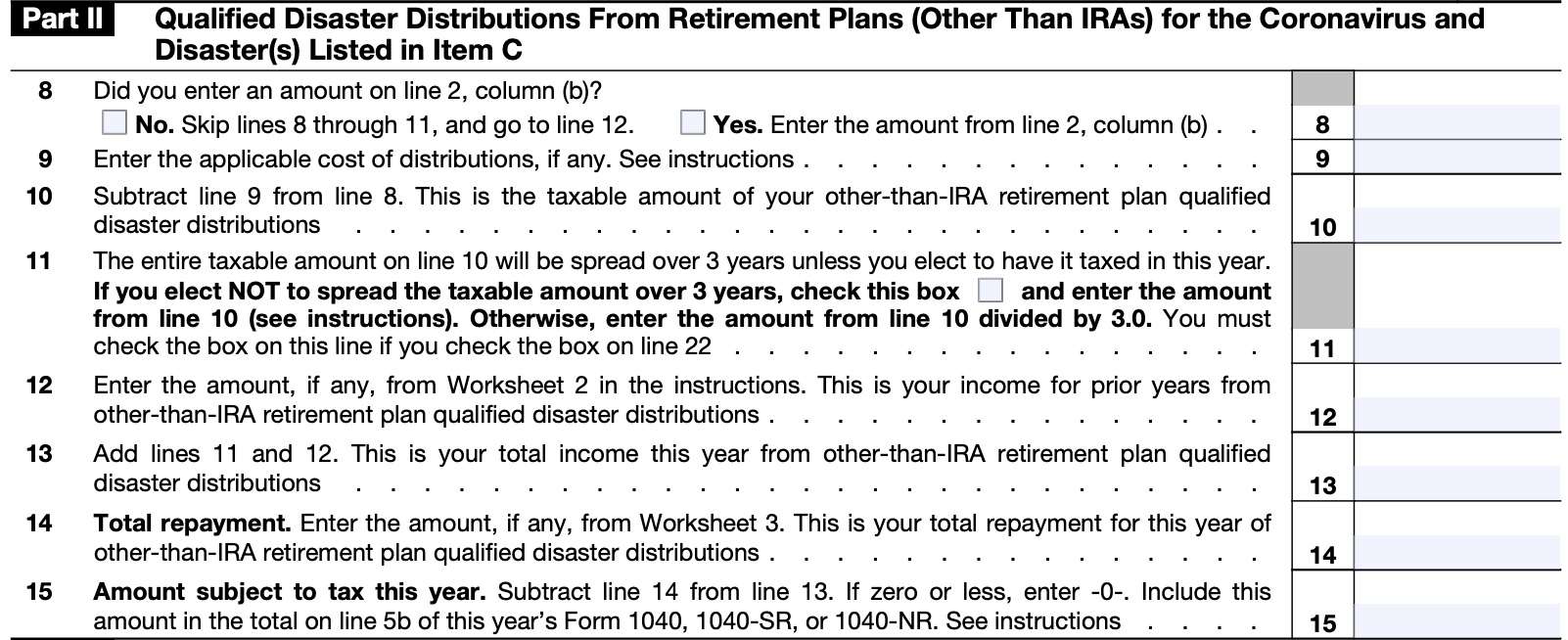

Part II: Qualified Disaster Distributions From Retirement Plans (Other Than IRAs) for the Coronavirus and Disaster(s) Listed in Item C

In Part II, we’ll calculate the amount of qualified disaster distributions from retirement plans. Let’s start with Line 8.

Line 8

If you entered any amount on Line 2, Column (b), enter that number here. This represents the amount of disaster distributions from qualified plans allocated to the disaster(s) listed on this Form 8915-F.

If not, then skip Lines 8 through 11, and proceed to Line 12.

Line 9: Applicable cost of distributions

Enter on your cost, if any. Your cost is generally your net investment in the plan, but does not

include pre-tax contributions.

If there is an amount in Box 2a of Form 1099-R, the difference between Box 1 and Box 2a of Form 1099-R is usually your cost. Enter the difference between Box 1 and Box 2a on Line 9.

Line 10

Subtract Line 9 from Line 8.

This is the taxable amount of your qualified disaster distributions from retirement plans other than IRAs.

Line 11

If you check the box on Line 22, then you must check the Line 11 box as well.

If you wish not to spread the taxable income from your retirement plan distributions over 3 taxable years, then check this box.

Otherwise, divide the Line 10 amount by 3.0, then enter the result in Line 11.

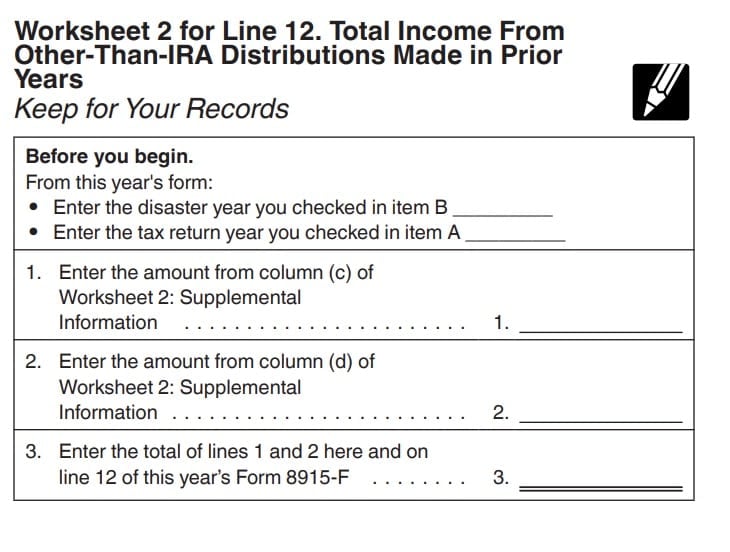

Line 12: Income from prior years from other-than-iRA retirement plan qualified disaster distributions

Complete Worksheet 2 located in the Form 8915-F instructions (as outlined below).

You’ll need to refer to the Supplemental Information for Worksheet 2, which you can find on page 18 of the form instructions. Once you have the result, enter that amount in Line 12.

Line 13

Add Line 11 and Line 12. This is your total income this year from other-than-IRA retirement plan qualified disaster distributions

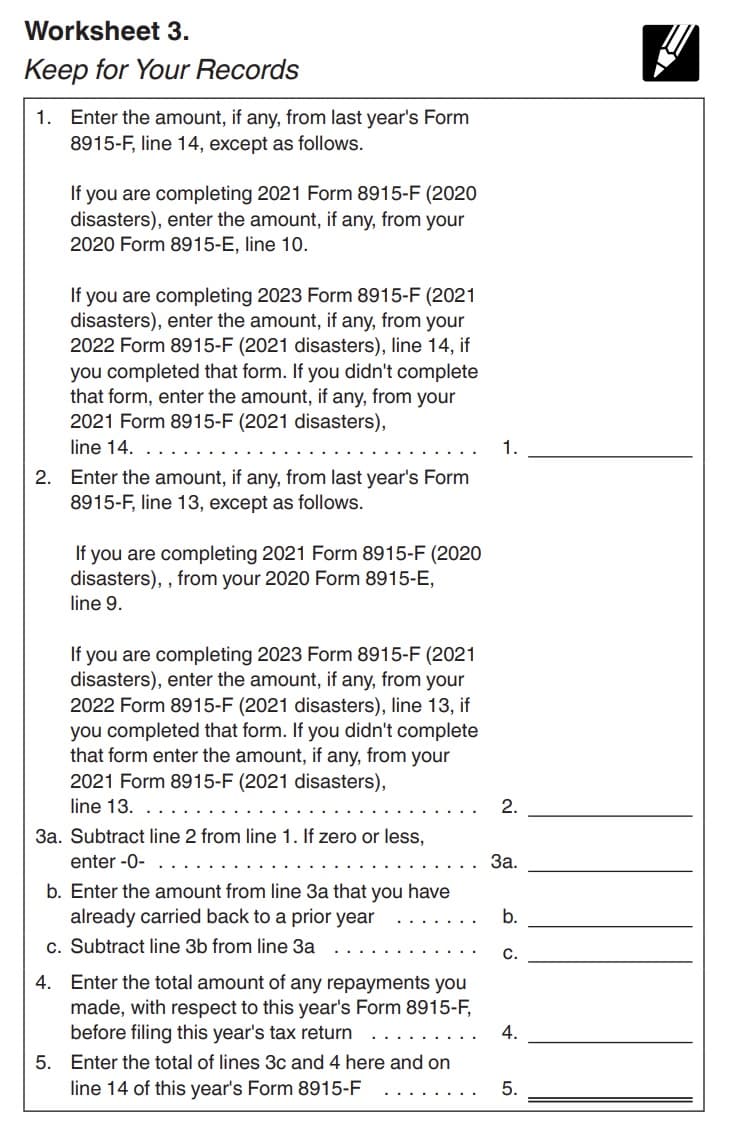

Line 14: Total repayment

Complete Worksheet 3 from the form instructions, as indicated below. When completing Step 4 of this worksheet, do not include:

- Repayments that you made after the due date for this year’s income tax return, or

- Repayments of nontaxable amounts

Enter the results of your calculations in Line 14.

At any time during the 3-year period that begins the day after the date you received a qualified disaster distribution, you can repay any portion of the distribution to an eligible retirement plan that accepts rollover contributions.

However, you cannot repay more than the amount of the original distribution.

Line 15: Amount subject to tax this year

Subtract Line 14 from Line 13, then enter the result here.

Also, include this amount in the total on Line 5b of this year’s Form 1040, Form 1040-SR, or Form 1040-NR.

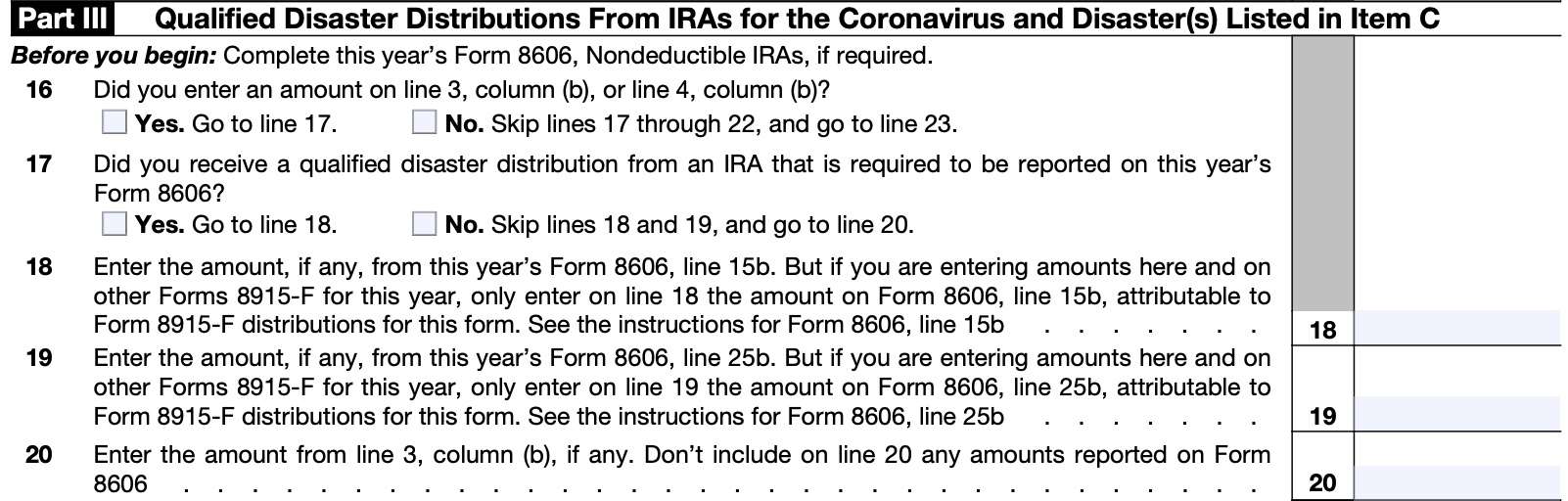

Part III: Qualified Disaster Distributions From Traditional, SEP, SIMPLE, and Roth IRAs for the Coronavirus and Disaster(s) Listed In Item C

In Part III, we’ll calculate the amount of qualified disaster distributions from IRAs. Before beginning Part III, you may need to complete this year’s IRS Form 8606, Nondeductible IRAs, if applicable.

Line 16

If you entered an amount on Line 3, column (b) or Line 4, column (b), then go to Line 17. Otherwise, skip Lines 17 through 22, and go to Line 23.

Line 17

If you received a qualified disaster distribution from an IRA that you must also report on this year’s IRS Form 8606, complete Line 18. Otherwise, go directly to Line 20.

Line 18

Enter the amount attributable to qualified disaster distributions, located on Line 15b of your Form 8606.

If you’re entering amounts on this form and on other Forms 8915-F for this year, only enter the amount attributable to Form 8915-F distributions for this form. If you have no disaster-related distributions from an IRA, this number will be zero.

Line 19

Enter the amount attributable to qualified disaster distributions, located on Line 25b of your Form 8606.

If you’re entering amounts on this form and on other Forms 8915-F for this year, only enter the amount attributable to Form 8915-F distributions for this form. If you have no disaster-related distributions from a Roth IRA, Roth SIMPLE IRA, or Roth SEP, this number will be zero.

Line 20

Enter the amount from Line 3, column (b), if applicable. Do not include any amounts reported on Form 8606.

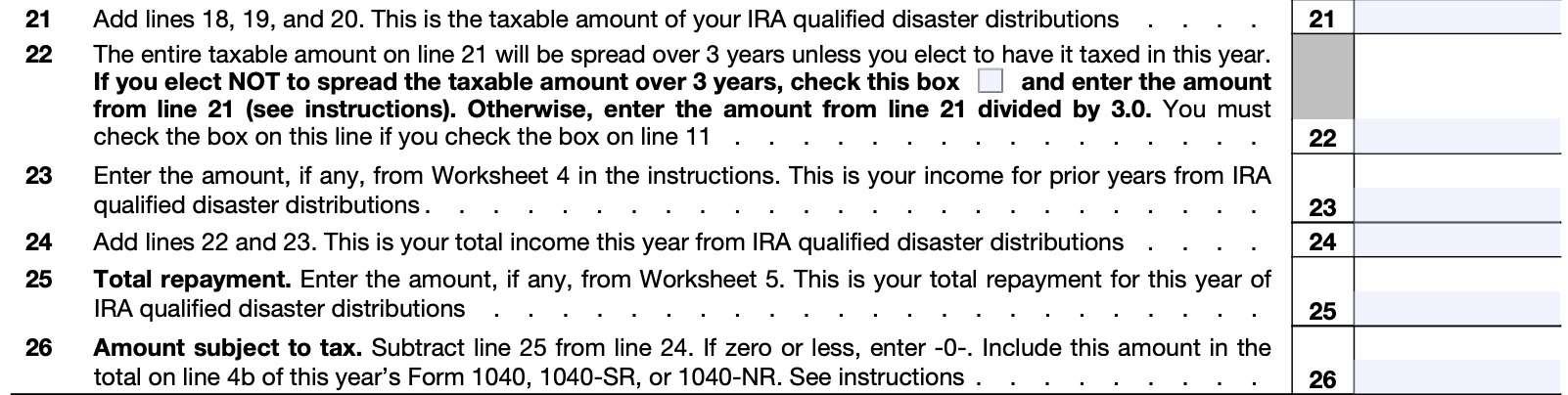

Line 21: Taxable IRA qualified disaster distributions

Add Lines 18, 19, and 20. Enter the result here.

Line 22

If you check the box on Line 11, then you must check the Line 22 box as well.

If you wish not to spread the taxable income from your retirement plan distributions over 3 taxable years, then check this box.

Otherwise, divide the Line 21 amount by 3.0, then enter the result in Line 22.

Line 23

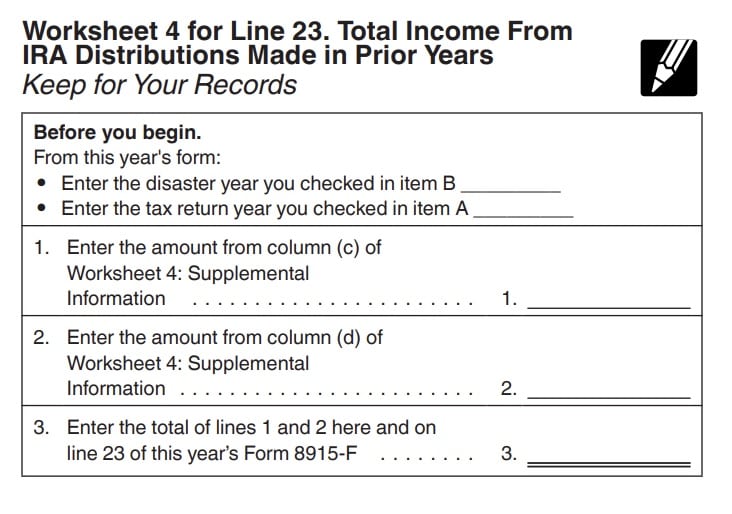

Complete Worksheet 4 from the form instructions, as indicated below. This is your income for prior years from IRA qualified disaster distributions.

You’ll need to refer to the Worksheet 4 Supplemental Information, which you can find on Page 20 of the form instructions.

Line 24

Add Lines 22 and 23. This is your total income this year from IRA qualified disaster distributions.

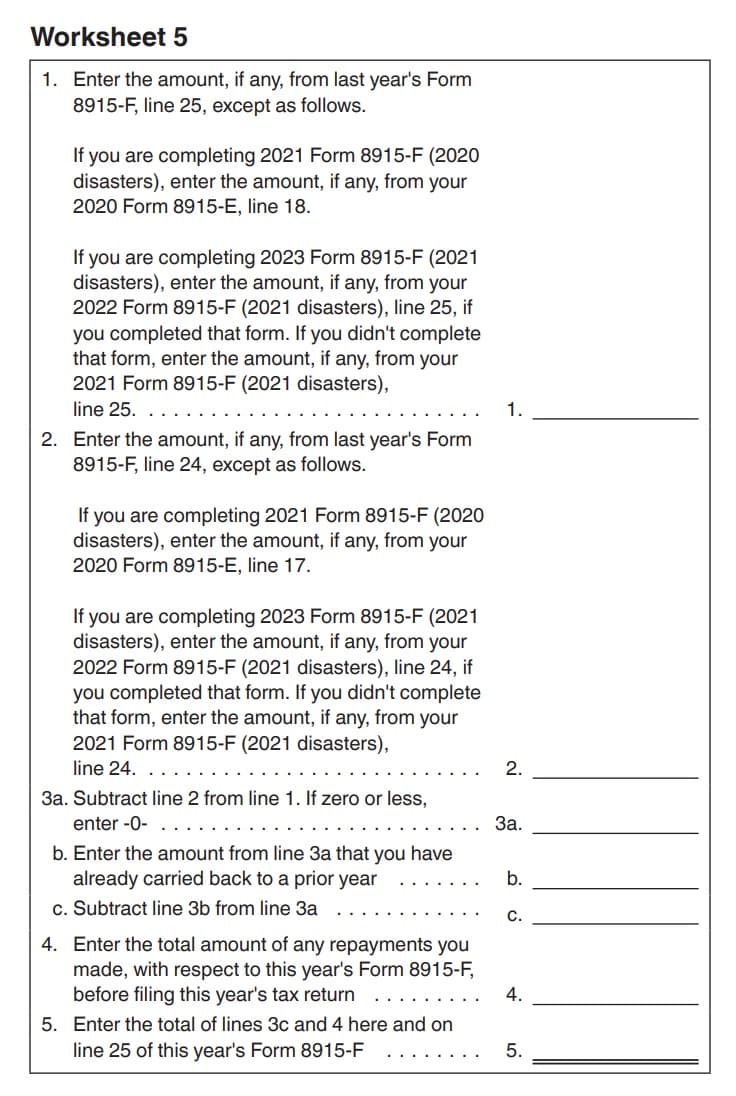

Line 25: Total repayment

If applicable, enter any amount from Worksheet 5.

Line 26: Amount subject to tax

Subtract Line 25 from Line 24. If zero or less, enter ‘0.’

Include this amount in the total on Line 4b of this year’s Form 1040, 1040-SR, or 1040-NR.

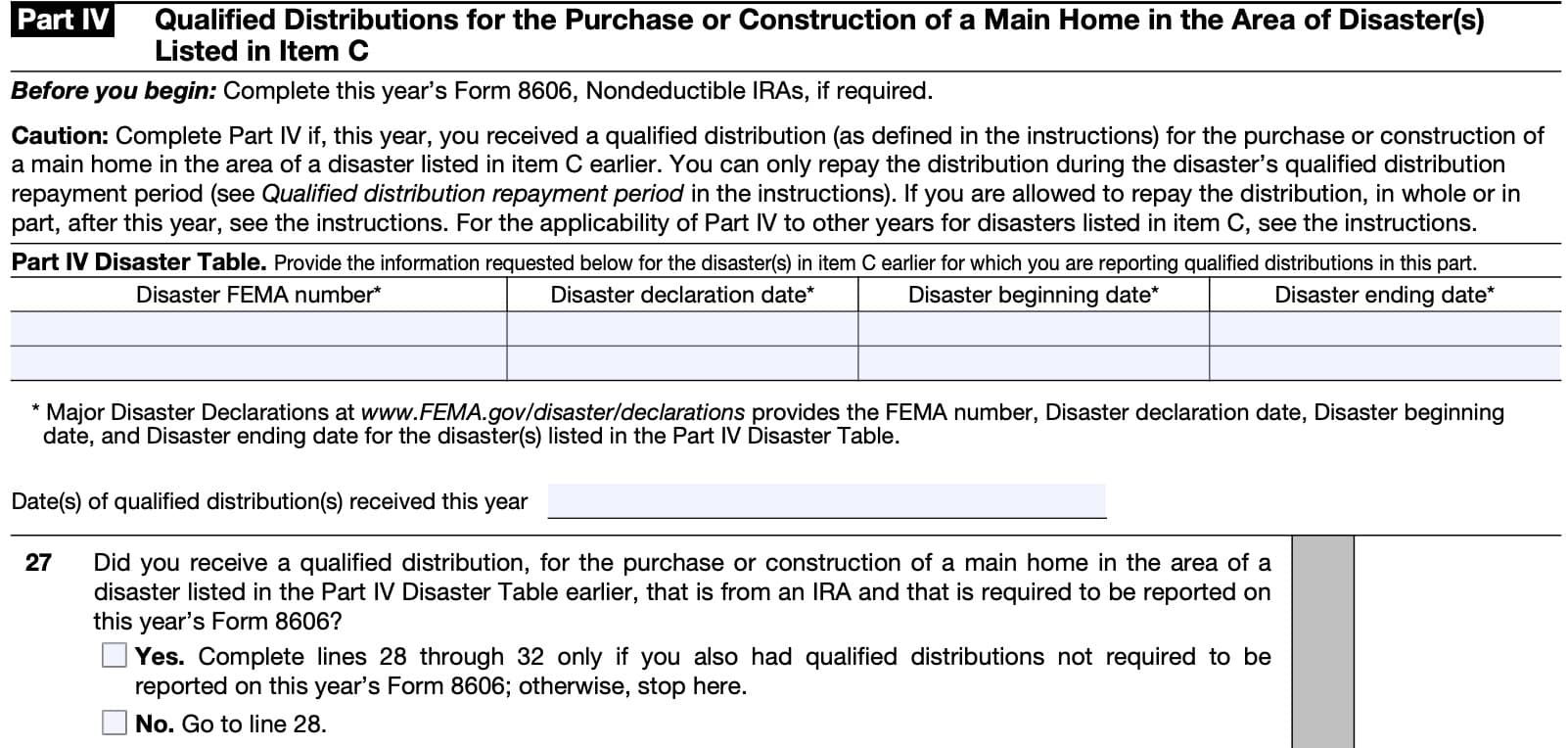

Part IV: Qualified Distributions for the Purchase or Construction of a Main Home in the Area of Disaster(s) Listed in Item C

Complete Part IV if you received a qualified distribution, earlier this year, for the purchase or construction of a main home in one of the qualified disaster areas listed in Item C earlier. You can only repay the distribution during the disaster’s qualified distribution repayment period.

You must complete the required lines of Part IV if you received a qualified distribution, even if you made no repayments this year. Any portion of the qualified distribution not repaid by the end of the disaster’s qualified distribution repayment period will not be allowed the special tax benefits available to qualified distributions.

If the repayment period for a qualified distribution for a disaster ends next year, repayments for that qualified distribution can be made in the next year and will be reported on an amended return for this year.

Before beginning with Line 27, you need to complete the Part IV Disaster Table, outlined below.

Part IV Disaster Table

Complete this table in a similar manner as the Part I Disaster Table, located at the top of this form. For each qualified disaster, enter the following information:

- Disaster FEMA number

- Disaster declaration date

- Disaster beginning date

- Disaster ending date

Also, enter the date or dates of all qualified distributions that you received this year.

Line 27

Check Yes if you received a qualified distribution that meets the following criteria:

- Is for the purchase or construction of a main home in the area of a disaster listed in the Part IV Disaster table

- Is from an IRA

- Is required to be reported on IRS Form 8606 this year

If you select Yes, then complete Lines 28 through 32 only if you also had qualified distributions that were not required to be reported on Form 8606 this year.

Otherwise, select No and go to Line 28.

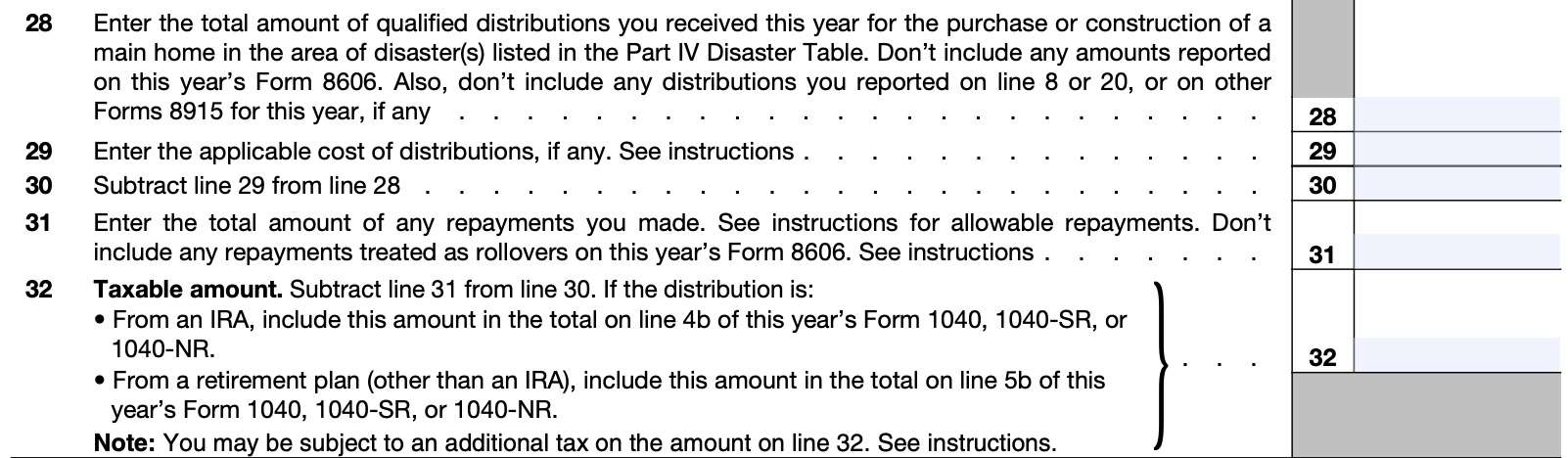

Line 28

In Line 28, enter the total amount of qualified distributions you received for the purchase or construction of a main home in the area of a disaster or disasters listed in the Part IV Disaster Table.

Do not include any of the following:

- Amounts reported on Form 8606

- Distributions reported on Line 8 or Line 20

- Distributions reported on other Forms 8915 this year

Line 29

Subtract Line 29 from Line 28. Enter the result here.

Line 30

Line 31: Total amount of repayments

You can repay any portion of a qualified distribution to an eligible retirement plan that accepts

rollovers but the repayments must be made within the qualified distribution repayment period.

Qualified distribution repayment period

As a result of the SECURE 2.0 Act of 2022, enacted December 29, 2022, the period for repaying a qualified distribution for a disaster that begins after 2020 does not have a set ending date, but must be calculated.

The qualified distribution repayment period for each of those qualified disasters will begin on the date the disaster begins and will end 180 days after whichever of the following occurs the latest:

- Disaster beginning date.

- Disaster declaration date

Line 32: Taxable amount

Subtract Line 31 from Line 30. Based on the nature of the distribution, include the amount on one of the following:

- For distributions from an IRA: Line 4b of your Form 1040, Form 1040-SR, or Form 1040-NR

- For distributions from a retirement plan: Line 5b of your Form 1040, Form 1040-SR, or Form 1040-NR

Video walkthrough

Watch this instructional video to learn more about IRS Form 8915-F!

Frequently asked questions

According to the IRS, qualified distributions are not subject to additional taxes for early distributions. However, the Line 32 amount on Form 8915-F may be subject to additional tax.

No. You may elect to report all income from qualified disaster area distributions in the year received. However, the default option is to report the income in equal amounts over a three year period, beginning with the year income was received.

For disasters declared after December 29, 2022, the repayment period is 180 days after the later of the disaster beginning date or the disaster declaration date.

Where can I find IRS Form 8915-F?

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!