IRS Form W-4S Instructions

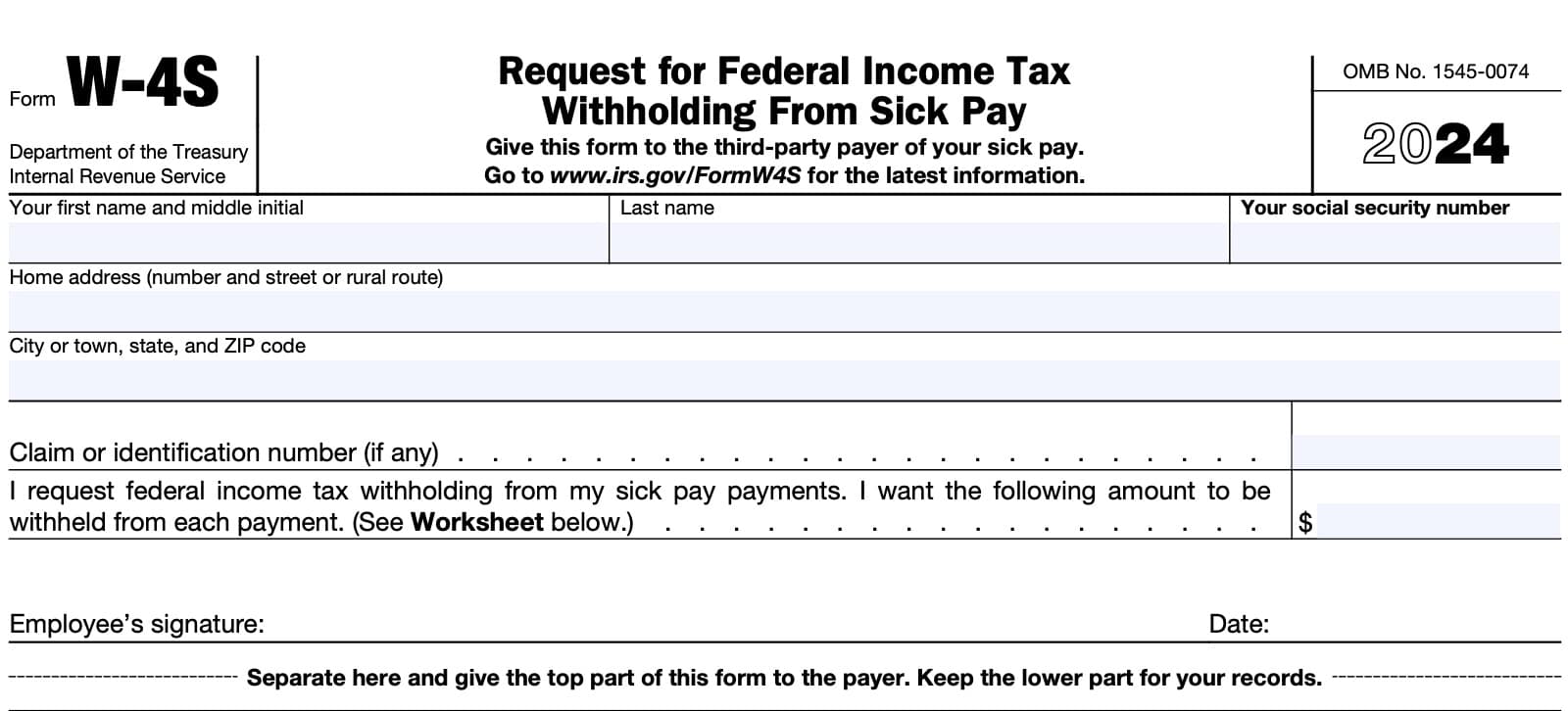

If you are expecting to receive a significant amount of sick pay from your employer, it might be a good idea to complete IRS Form W-4S, Request for Federal Income Tax Withholding From Sick Pay. Completing this tax form will help you stay on top of your federal tax liability so you’re not left scrambling at tax time.

In this article, we’ll walk through everything you need to know about IRS Form W-4S, including:

- How to complete and file IRS Form W-4S

- How to calculate the amount of tax you should withhold from your sick pay

- Other filing considerations

Let’s start with a top-down overview of this tax form.

Table of contents

How do I complete IRS Form W-4S?

There are two parts to this one-page tax form:

- Withholding certificate (filed with the third-party payer of your sick pay)

- Worksheet (retained for your tax records)

Let’s take a closer look at each part.

Withholding certificate

At the top of the form, you’ll complete the personal information fields for your third party payer to withhold federal income taxes from your sick pay.

Taxpayer name

In the provided spaces, enter your first name, middle initial, and last name.

Social Security number

Enter your Social Security number (SSN) in this field.

Address

Enter your complete home address here. This should include:

- Street address and number

- City & state

- ZIP code

Changing your address

Although not mentioned in the form instructions, if you’ve changed addresses since your most recent individual tax return, you may consider filing IRS Form 8822, Change of Address. This will help you stay on top of any correspondence from the Internal Revenue Service.

Claim number or identification number

If you have a claim number or identification number that was assigned to your case, enter it here.

Requested tax withholding

Based on your Form W-4S worksheet calculations, you may request specific dollar amounts to be withheld from your sick pay. However, there are some guidelines you must follow.

Withholdings must be in whole dollars

You must use whole dollars. For example, you may request $35 per week, but not $34.50.

There is a minimum withholding required

Based upon your payroll period, you must withhold a certain amount of federal tax. According to the form instructions, you cannot withhold less than the following amounts:

- $4 per day

- $20 per week

- $88 per month

You cannot reduce your net pay below a certain amount

Whatever your withholdings, the net amount of each sick pay payment cannot be less than $10.

For payments larger or smaller than a regular full payment of sick pay, the amount withheld will be in the same proportion as your regular withholding from sick pay. For example, if your regular full payment of $100 a week normally has $25 (25%) withheld, then $20 (25%) will be withheld from a partial payment of $80.

Signature

Sign and date the bottom of IRS Form W-4S.

Let’s turn to the worksheet calculations, which will help you determine the withholding amount.

IRS Form W-4S worksheet

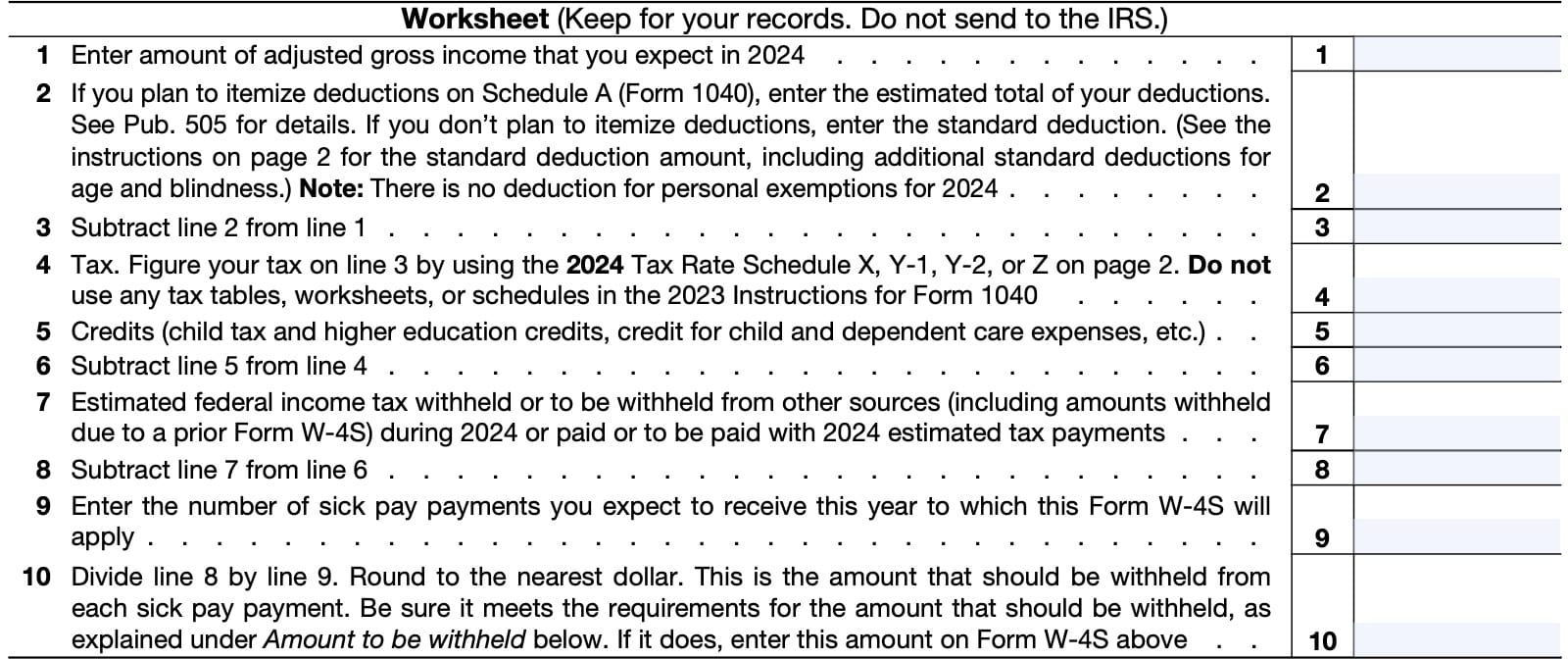

In this worksheet, we will calculate how much you should withhold from your sick pay, based upon your tax situation.

Line 1: Estimated adjusted gross income

Enter the amount of adjusted gross income that you expect in the current tax year.

Line 2: Deductions

If you plan to itemize deductions on Schedule A of your Form 1040, then you should enter the estimated total of your tax deductions in Line 2.

If you believe that you will be using the standard deduction, then enter the standard deduction amount.

Standard deduction amounts for 2024

Below are standard deduction amounts for 2024, based upon tax filing status:

- Single or married filing separately: $14,600

- Head of household: $21,900

- Married filing jointly or qualifying surviving spouse: $29,200

Additional deductions for blind or elderly taxpayers

In addition to the standard deduction amounts listed above, married taxpayers who are considered legally blind or who are age 65 years or older may receive an additional deduction of $1,550, per person. If a taxpayer is legally blind and age 65 or older, that person may receive an additional deduction of $3,100.

Taxpayers who are either single or head of household and age 65 or older or blind, may receive $1,950 as an additional deduction. If age 65 or older and blind, then the taxpayer is entitled to a deduction of $3,900.

Line 3

Subtract Line 2 from Line 1. Enter the total here.

Line 4: Tax

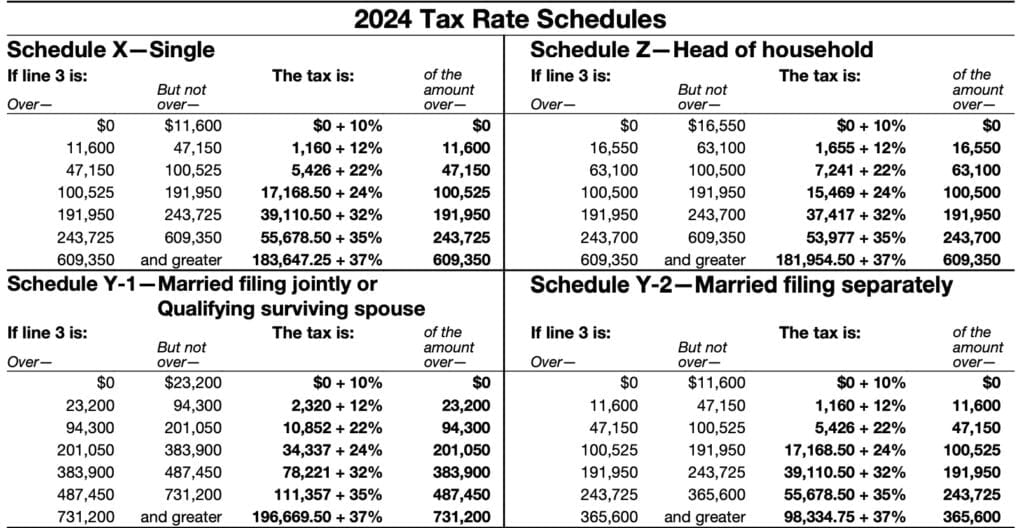

Calculate your estimated tax by using one of the tax rate schedules, listed below by marital status:

- Single: Schedule X

- Married filing jointly or qualifying surviving spouse: Schedule Y-1

- Married filing separately: Schedule Y-2

- Head of household: Schedule Z

Line 5: Tax credits

Enter any tax credits that you expect to claim this year. Below is a list of some of the most common tax credits, and the form you may use to claim them:

- Adoption credit: IRS Form 8839

- Credit for child and dependent care expenses: IRS Form 2441

- Child tax credit or the credit for other dependents: Schedule 8812

- Earned income credit: Schedule EIC

- Education credits: IRS Form 8863

- Credit for the elderly or disabled: Schedule R

- Foreign tax credit: IRS Form 1116

- General business credit: IRS Form 3800

- Mortgage interest credit: IRS Form 8396

- Qualified electric vehicle credit: IRS Form 8834

- Credit for prior year minimum tax: IRS Form 8801

- Retirement savings contribution credit (saver’s credit): IRS Form 8880

- Credit to holders of tax credit bonds: IRS Form 8912

- Premium tax credit: IRS Form 8962

For additional information on these tax credits, please refer to IRS Publication 505, Tax Withholding and Estimated Tax.

Line 6

Subtract your tax credits in Line 5 from the tax liability in Line 4. Enter the result here.

Line 7: Estimated federal tax withholding

Enter the amount of estimated federal income tax withheld, or that you expect to be withheld from other sources. Below, we’ll briefly discuss other sources of tax withholding.

Other W-4 tax forms

This can include amounts withheld from any of the following:

- IRS Form W-4, Employee’s Withholding Certificate

- The IRS suggests that you complete a new Form W-4 if:

- You haven’t updated your W-4 tax form since 2019

- You’ve recently started a new job

- The IRS suggests that you complete a new Form W-4 if:

- IRS Form W-4R, Withholding Certificate for Nonperiodic Payments and Eligible Rollovers

- IRS Form W-4P, Withholding Certificate for Periodic Pension or Annuity Payments

- IRS Form W-4V, Voluntary Withholding Certificate

- This form is used for tax withholdings from unemployment compensation or to withhold taxes from your Social Security benefit

Estimated tax payments

Many taxpayers expecting a big tax bill during tax time may decide to make additional tax payments, either through the IRS website, or by submitting estimated tax payments with IRS Form 1040-ES, Estimated Tax Voucher.

Line 8: Additional tax

Subtract Line 7 from Line 6. Enter the result here.

This represents how much federal income tax you must withhold from your sick pay to ensure that you have paid enough tax throughout the year.

Line 9: Number of sick pay payments you expect in the current year

Enter the number of sick pay payments that you expect to receive by the end of the year.

Line 10: Amount to be withheld from each payment

Divide Line 8 by Line 9. This represents the amount of additional withholding you should apply to each payment from your sick pay payer.

Enter this additional amount in the Form W-4S that you plan to submit to your payer.

Filing IRS Form W-4S

Unlike most other W-4 forms, you can instruct the payer on the amount of federal income tax to withhold from your sick pay for each pay period. However, this requires you to have a decent understanding of the correct federal income tax withholding for your tax situation.

Here are some other considerations to think about.

Do not forget to sign your IRS Form W-4S.

Form W-4S is not valid unless you sign it.

How to file IRS Form W-4S

Give this form to the third-party payer of your sick pay, such as an insurance company, if you want federal income tax withheld from the payments.

You aren’t required to have federal income tax withheld from sick pay paid by a third party. However, if you choose to request such withholding, Internal Revenue Code Sections 3402(o) and 6109 and their regulations require you to provide the information requested on this form.

Don’t use this form if your employer (or its agent) makes the payments because employers are already required to withhold federal income tax from sick pay.

You will receive a Form W-2 at the end of the year

Your W-2 form will contain the amount of taxable sick pay that you received, as well as federal income tax withheld during the last year. The Internal Revenue Service will also receive a copy of this Form W-2, so be sure to include this in your tax return.

Changing your withholding

Form W-4S remains in effect until you change or revoke it.

You may update your tax withholdings by giving a new Form W-4S or a written notice to the payer of your sick pay.

To revoke your previous Form W-4S, complete a new Form W-4S and write “Revoked” in the money amount box, sign it, and give it to the payer.

Video walkthrough

Check out this instructional video to learn more about IRS Form W-4S.

Frequently asked questions

Taxpayers may use IRS Form W-4S to specify the amount of tax payments to be withheld by a third party payer of sick pay. This is a separate tax withholding form from the employee’s W-4 tax form that may have previously been filed with his or her employer.

No. Taxpayers may choose to withhold taxes from sick pay, or from other sources of income. However, it is a good idea to understand whether you are paying enough tax throughout the year before deciding not to have taxes withheld from sick pay.

Where can I find IRS Form W-4S?

As with other tax forms, you may download IRS Form W-4S from the IRS website. For your convenience, we’ve enclosed the latest version of this tax form here, in this article.