IRS Form W-4 Instructions

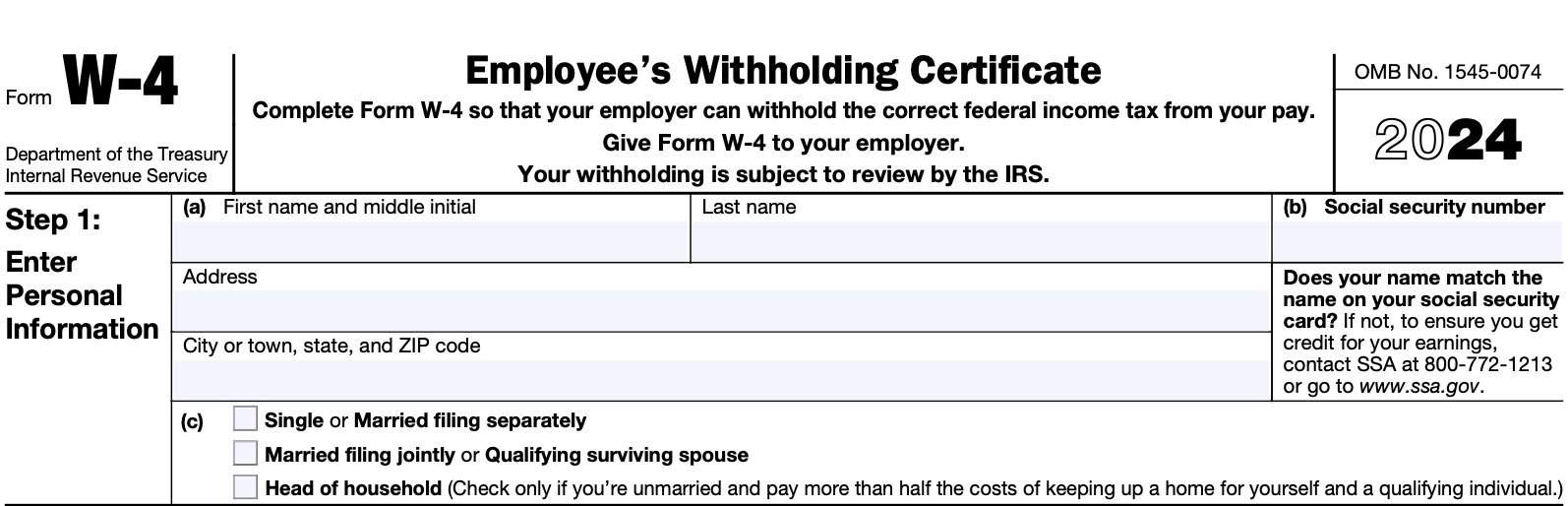

In 2020, the Internal Revenue Service made major changes to IRS Form W-4, Employee’s Withholding Certificate. These changes are meant to help taxpayers ensure the proper amount of federal income tax is withheld from their paychecks.

In this article, we’ll walk you what you need to know about IRS Form W-4, including:

- How IRS Form W-4 works and how to complete it

- How to make adjustments based upon your tax return

- Frequently asked questions

Let’s start with a walkthrough of this tax form.

Table of contents

How do I complete IRS Form W-4?

There are 5 steps to completing IRS Form W-4:

- Step 1: Enter Personal Information

- Step 2: Multiple Jobs or Spouse Works

- Step 3: Claim Dependent and Other Credits

- Step 4: Other Adjustments

- Step 5: Sign Here

Let’s walk through each step, one at a time.

Step 1: Enter Personal Information

In this first step, you’ll enter your personal information.

Step 1(a)

Enter the following information

- First name & initial

- Last name

- Mailing address, including city, state, and zip code

Step 1(b)

Enter your Social Security number (SSN) as it appears on your Social Security card. If, for some reason, the name on your Social Security card doesn’t match your name, then you should check your earnings history with the Social Security Administration to make sure you’re receiving the appropriate credit for your Social Security withholding.

If you’re missing your Social Security card, you can request a new copy by filing Form SS-5, Application for Social Security Card.

Step 1(c)

Check the correct marital status. You can choose between:

- Single or married filing separately

- Married filing jointly or qualifying surviving spouse

- Head of household

- Only available if you are unmarried and you pay more than 50% of the costs to maintain a home for yourself and a qualifying individual

According to the form instructions, your selected marital status will be used to determine:

- Your standard deduction, and

- Tax rates used to calculate your tax withholding

Standard deductions for tax year 2024 are listed below.

2024 Standard deductions

According to the IRS, below are the 2024 standard deductions by tax filing status:

| Filing status | Standard deduction amount |

| Single | $14,600 |

| Married filing separately | $14,600 |

| Married filing jointly | $29,200 |

| Head of household | $21,900 |

Step 2: Multiple Jobs or Spouse Works

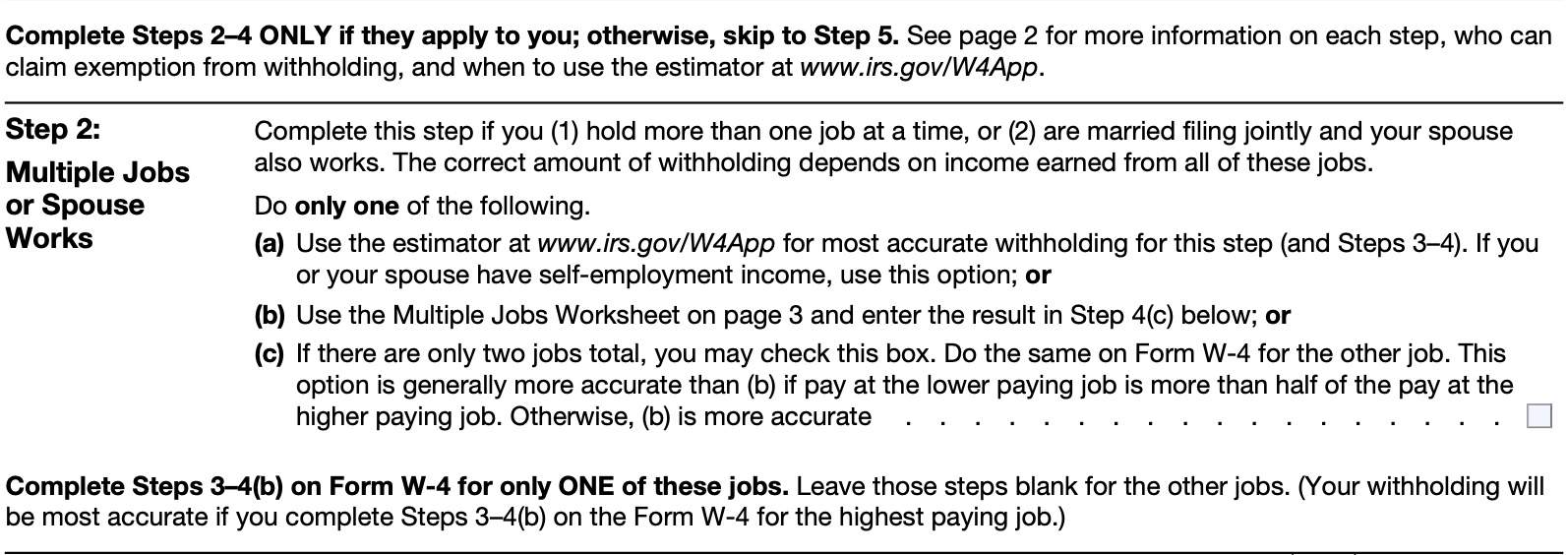

The form instructions state that for Steps 2-4, you should only complete the ones that apply to your tax situation.

This means that you should only complete Step 2 if:

- You have a second job, or

- You are married filing a joint tax return, and both spouses work

In this situation, you have the choice between one of 3 federal income tax withholding methods:

- Use the IRS tax withholding estimator

- Complete the Multiple Jobs Worksheet on Page 3 of Form W-4, or

- Check the indicated box

Let’s evaluate each option a little more closely.

Use the tax estimator on the IRS website

You can use the online tax estimator, located on the IRS website, to help calculate your tax withholding, which will also help you with Steps 3 & 4, below.

The form instructions state that this is the most accurate withholding method of the three options available to you, particularly if you have self-employment income.

Below is an instructional YouTube video on how to use the online tax withholding tool.

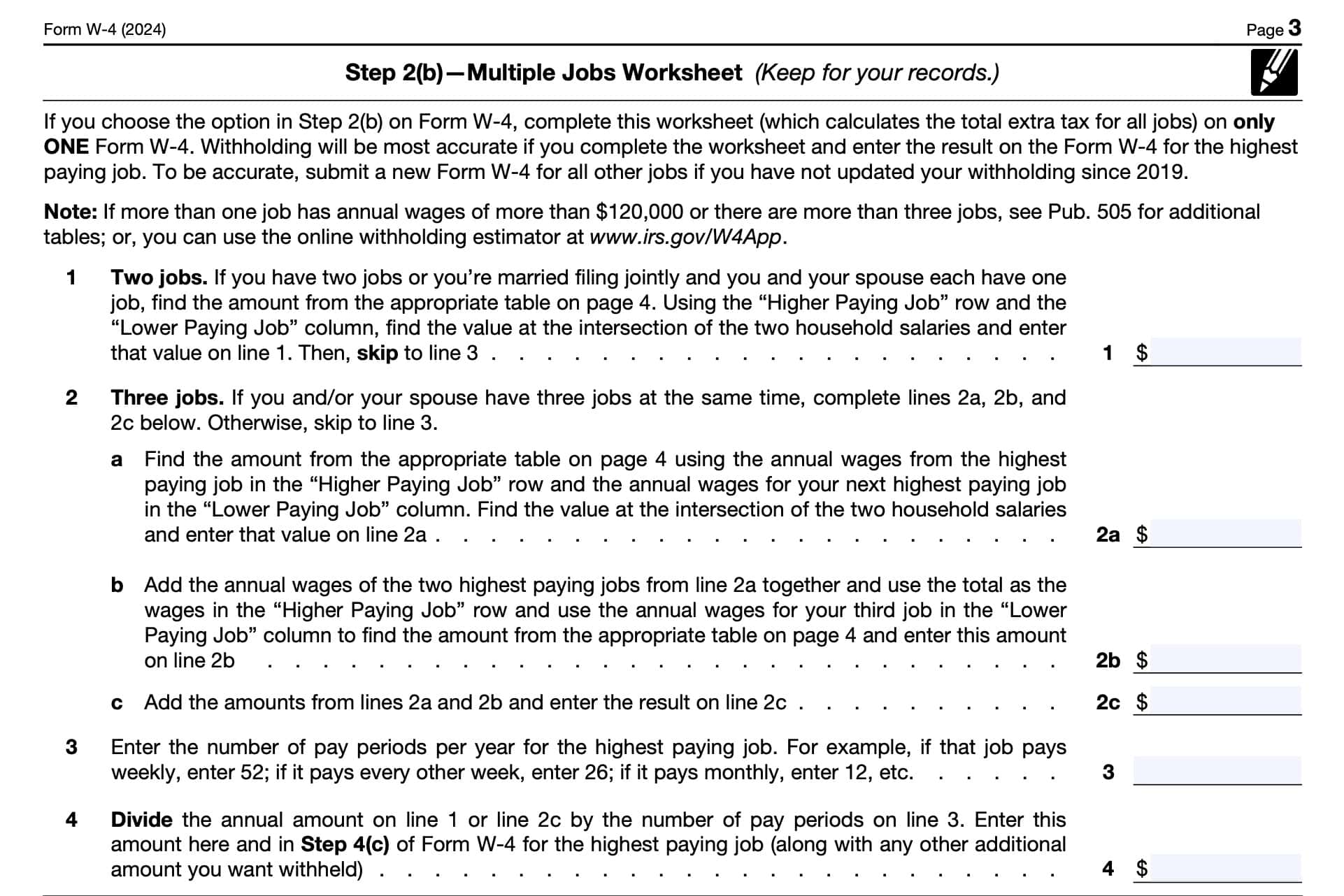

Complete the Multiple Jobs Worksheet on Page 3 of Form W-4

If you don’t have access to the online withholding estimator, you can complete the multiple jobs worksheet to determine how much federal income tax to withhold. Let’s take a closer look.

Line 1: Two jobs

You should use the appropriate withholding table, based upon your tax filing status if either of the following apply:

- You have two jobs, or

- You’re married filing jointly, and you and your spouse each have one job

Using the ‘Higher Paying Job’ row and the ‘Lower Paying Job’ column, you’ll find the correct dollar amount at the intersection of the two household salaries. Enter this value on Line 1, then skip to Line 3, below.

Below are the tables by filing status.

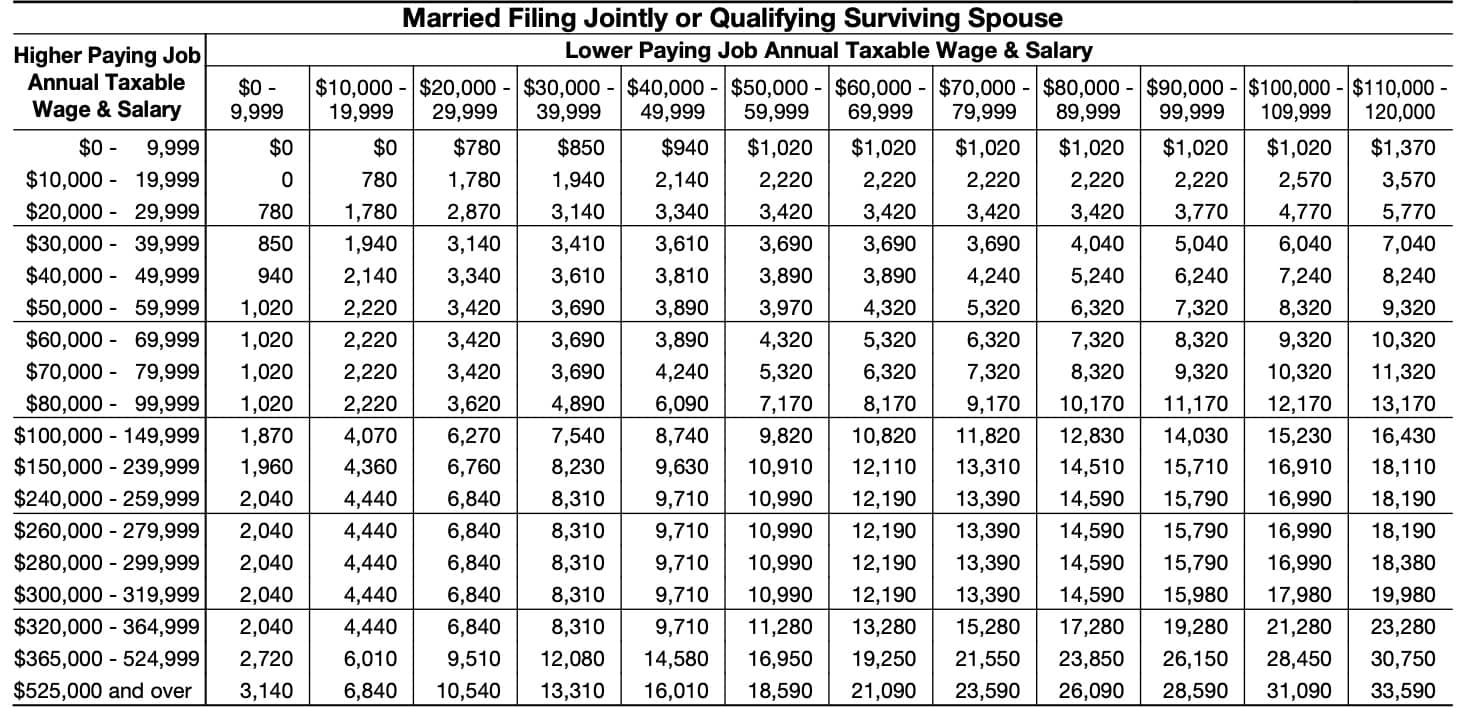

Married filing jointly or qualifying surviving spouse

Use this table for married couples filing a joint tax return or for qualifying surviving spouses.

For example, if one spouse earns $75,000 per year and the other spouse earns $50,000 per year, the intersection of these two shows a value of: $5,320. You would enter $5,320 in Line 1 of this worksheet, then move on to Line 3.

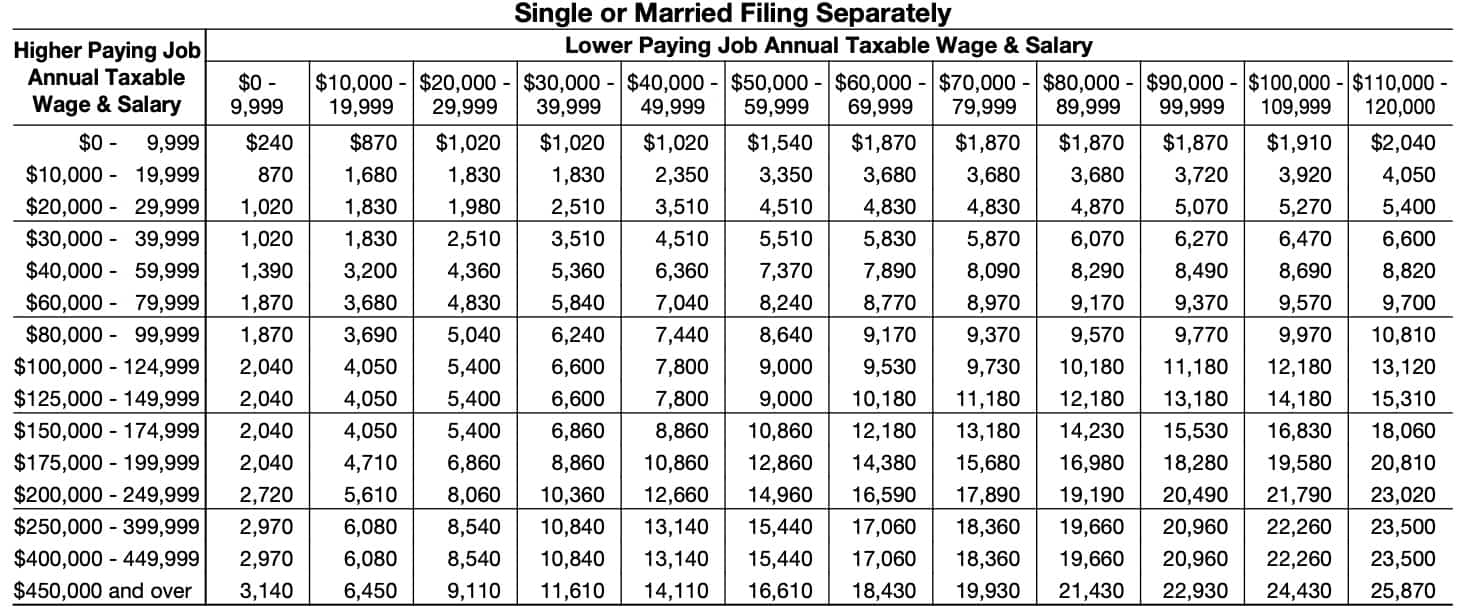

Single or married filing separately

Use this table for single taxpayers or married couples filing separate returns.

For example, if one spouse earns $75,000 per year and the other spouse earns $50,000 per year, the intersection of these two shows a value of: $8,240. You would enter $8,240 in Line 1 of this worksheet, then move on to Line 3.

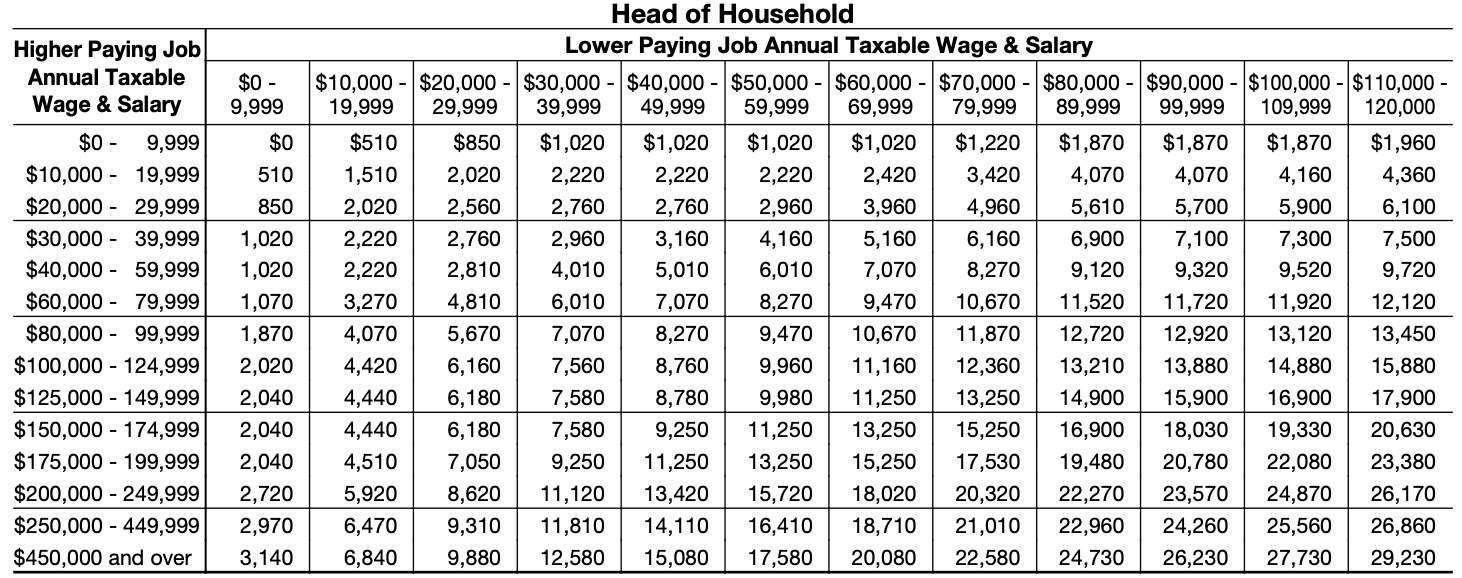

Head of household

Use this table if you are a head of household.

For example, if you have one job earning $75,000 per year, and second job earning $50,000 per year, the intersection of these two shows a value of: $8,270. You would enter $8,270 in Line 1 of this worksheet, then move on to Line 3.

Line 2: Three jobs

If you and/or your spouse have 3 jobs, then you’ll need to complete Lines 2a-2c below. Otherwise, head directly to Line 3. Let’s start at Line 2a.

Line 2a

From the list below, use the appropriate table to determine the amount you should enter on Line 2a, with the values from your highest paying job and your next highest paying job.

- Married filing jointly or qualifying surviving spouse

- Single or married filing separately

- Head of household

Go to Line 2b.

Line 2b

Using the appropriate tables, add the annual wages of the two highest paying jobs from Line 2a together. Use this total in the ‘Higher Paying Job’ row. Use the annual salary for your third job in the ‘Lower Paying Job’ column.

Enter the amount from this intersection on Line 2b.

Line 2c

Add the amounts from Line 2a and Line 2b. Enter the total in Line 2c.

Line 3

Enter the number of pay periods per year for the highest paying job. Generally, pay periods follow one of the following patterns:

- Monthly: 12 pay periods per year

- Semi-monthly: 24 pay periods per year

- Bi-weekly: 26 pay periods per year

- Weekly: 52 pay periods per year

Helpful hint

Keep in mind the difference between biweekly pay period and a semimonthly pay period. Biweekly means that you are paid every two weeks. Semimonthly means that you are paid twice per month.

There are 2 additional pay periods for biweekly pay schedules (26) versus semimonthly schedules (24). Keeping this difference in mind can help you ensure the proper amount of taxes are being withheld.

Line 4

Divide either the Line 1 amount or the Line 2c amount by Line 3. This shows how much federal income tax you should add in the Extra withholding line in Step 4c for the highest-paying job, below.

If you had already calculated additional withholding to go into Step 4c, you may choose to add this result to the additional amount, then put the total in Step 4c.

Check the indicated box

If there are only two jobs, then you may check the box here. If there are two Forms W-4, then check the box on the other form as well.

What happens if you check the indicated box

If the box is checked, the standard deduction and tax brackets will be cut in half for each job to calculate withholding.

This option is accurate for jobs with similar pay, specifically if the lower paying job is more than half the pay of the higher paying job. Otherwise, more tax than necessary may be withheld. The extra withholding becomes larger as the difference in pay between the two jobs increases.

While this might result in a larger refund come tax time, you’re giving Uncle Sam an interest-free loan by doing so. You’ll likely receive a bigger paycheck (and a smaller tax refund) if you use the Multiple Jobs Worksheet when necessary.

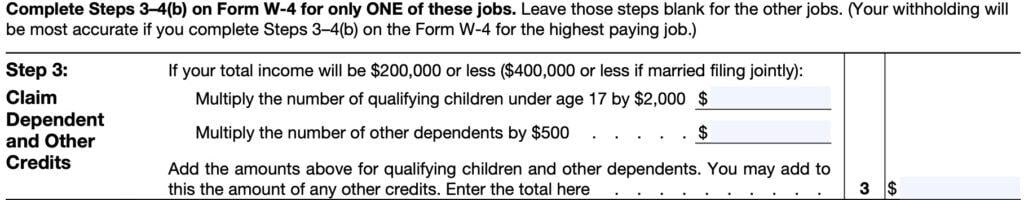

Step 3: Claim Dependent and Other Credit

You should complete Step 3 for only one of your jobs. Leave the steps blank for the other jobs.

The Internal Revenue Service suggests that you complete Steps 3-4(b) for the highest paying job to ensure the most accurate tax withholding.

You only need to complete Step 3 if you are eligible for the child tax credit or credit for other dependents on Schedule 8812.

However, you may also enter other tax credits that you may be eligible for at the bottom of Step 3. Below is a partial list of tax credits that you may enter here, as well as the associated tax form:

- Foreign tax credit: IRS Form 1116

- Education credits: IRS Form 8863

- Residential energy credits: IRS Form 5695

You can find a more comprehensive list of available tax credits on Schedule 3, Additional Credits & Payments.

Child tax credit or credit for other dependents

To qualify for the child tax credit, your child must:

- Be under age 17 as of December 31 of the current year

- Be your dependent who generally lives with you for more than half the tax year

- Have a Social Security number

You may be able to claim a tax credit for other dependents if you cannot claim the child tax credit. This could include an older child or a qualifying relative.

In Step 3, you’ll multiply the number of qualifying children by $2,000. Enter this amount in the top row.

Next, multiply the number of dependents that you can claim by $500. Enter the total in the next line.

Finally, add the total amount of tax credits (including any other tax credits you may be eligible for) in Step 3.

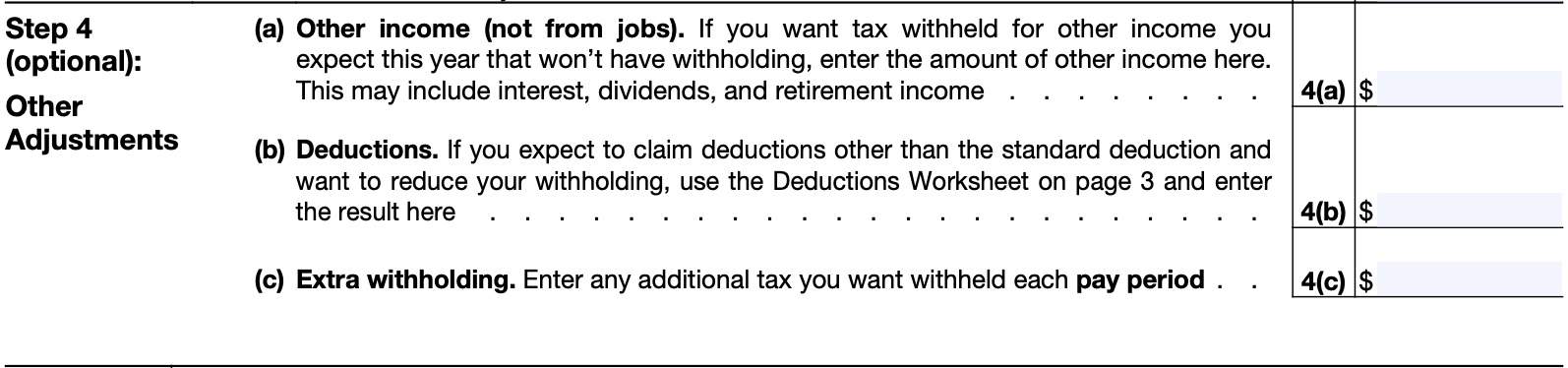

Step 4: Other Adjustments

These are optional fields.

You should only complete Steps 4a and 4b for one of your jobs. Leave the steps blank for the other jobs. The Internal Revenue Service suggests that you complete Steps 3-4(b) for the highest paying job to ensure the most accurate tax withholding.

Step 4(a): Other income (not from jobs)

Use Step 4(a) if you are expecting additional income that does not have withholding. This might include income items such as:

- Interest income (reported on IRS Form 1099-INT)

- Dividend income or capital gains distributions (from IRS Form 1099-DIV)

- Retirement income (from IRS Form 1099-R)

Before making any adjustments to your current tax withholding for these items, it’s a good idea to double check your 1099 forms from the prior year to make sure you’re not already having taxes withdrawn from these income sources.

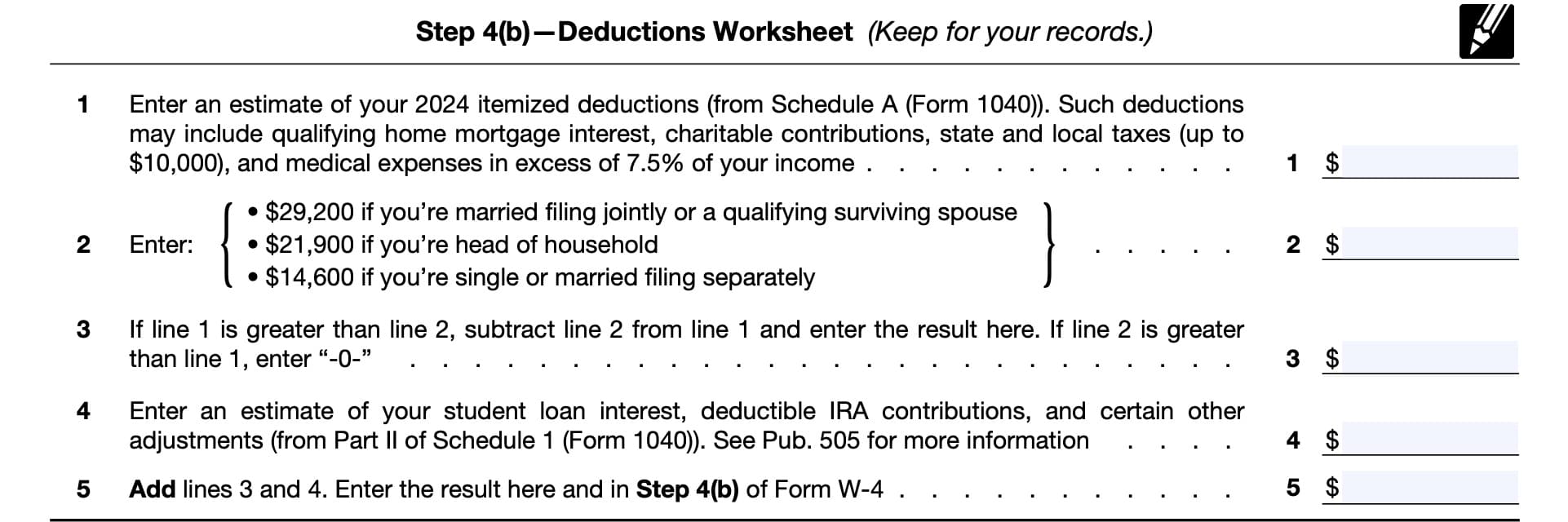

Step 4(b): Deductions

If you do not expect to claim the basic standard deduction (such as itemized deductions on Schedule A), then you can use the Deductions Worksheet to determine what to enter here.

Let’s take a closer look.

Line 1

Enter your estimated itemized deduction. You may consider using estimates based on your Schedule A from last year. Deductions can include:

- Qualifying home mortgage interest

- Charitable contributions

- State and local taxes (up to a limit of $10,000 per year)

- Medical expenses (in excess of 7.5% of adjusted gross income)

Certain taxpayers may also be able to include casualty and theft losses from IRS Form 4684.

Line 2

In Line 2, enter one of the following, based on your filing status:

- Married filing jointly or qualifying surviving spouse: $29,200

- Head of household: $21,900

- Single or married filing separately: $14,600

Line 3

If Line 1 is greater than Line 2, then subtract Line 2 from Line 1 and enter the difference.

Otherwise, enter ‘0.’

Line 4

Enter an estimate of any income adjustments from Schedule 1 on your tax return. Below is a partial list of example tax deductions on Part II of Schedule 1:

- Deductible IRA contributions

- Student loan interest, reported on IRS Form 1098-E

- Business expenses claimed on IRS Form 2106

- Health savings account deduction, from IRS Form 8889

- Moving expenses for members of the Armed Forces, from IRS Form 3903

- Deductible part of self-employment tax, as reported on Schedule SE

You may find additional information in IRS Publication 505, Tax Withholding and Estimated Tax.

Line 5

Add Lines 3 & 4. Enter the total result here and in Step 4b on the Form W-4.

Step 4(c): Extra withholding

Enter the amount of federal income tax withholding that you calculated in Step 2 here. If you want to withhold additional federal taxes to avoid a big tax bill, you can increase this amount as you feel necessary.

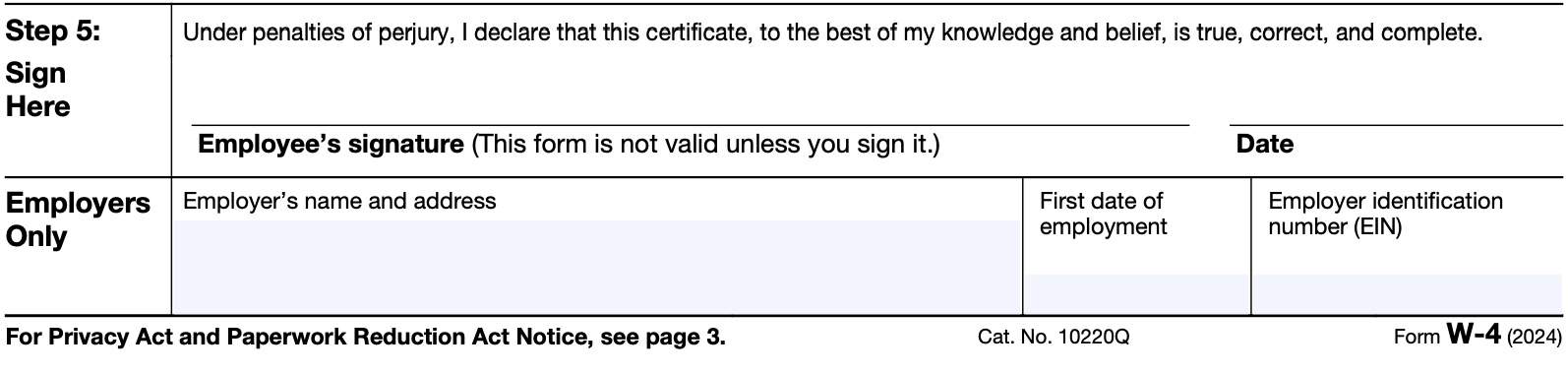

Step 5: Sign here

Sign in Step 5. If you don’t sign this part of the form, then your employer cannot withhold the correct amount of federal income taxes. Instead, your employer will have to rely strictly on guidance from IRS Publication 15-T, Federal Income Tax Withholding Methods.

Do you have the correct withholding form?

If you’re reading this section, perhaps you’re not sure if you have the correct withholding form. Before you leave, here is a brief overview of the other tax withholding forms and their purpose.

IRS Form W-4P, Withholding Certificate For Periodic Pension Or Annuity Payments

Taxpayers complete IRS Form W-4P, Withholding Certificate for Periodic Pension or Annuity Payments to give their payer instructions on tax withholding for regular pension or annuity payments.

Watch this brief educational video to learn more IRS Form W-4P.

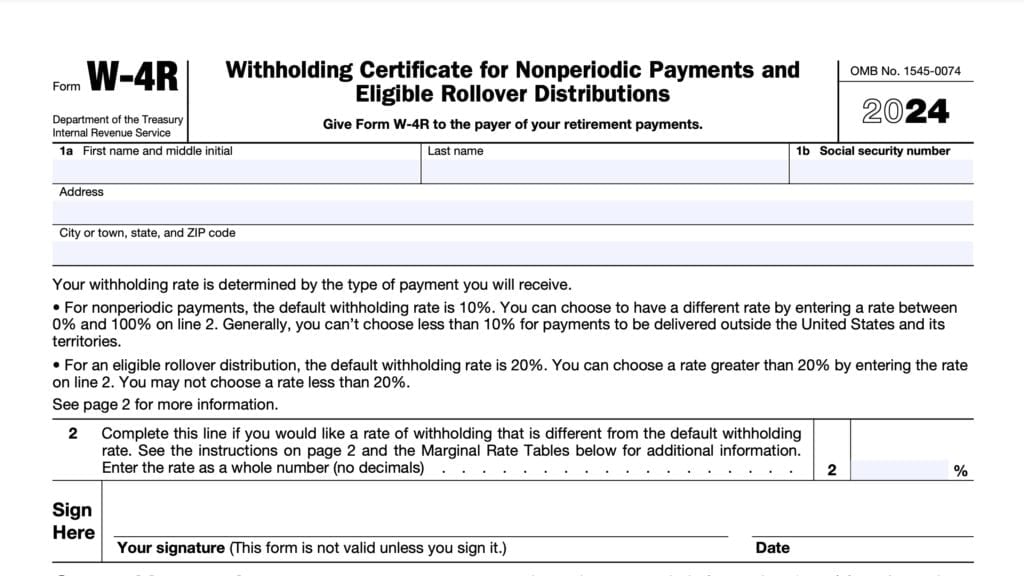

IRS Form W-4R, Withholding Certificate for Nonperiodic Payments and Eligible Rollovers

Taxpayers who wish to give instruction on nonrecurring payments, such as one-time IRA withdrawals, or eligible rollovers, can complete Form W-4R, Withholding Certificate for Nonperiodic Payments and Eligible Rollovers.

Watch this instructional video to learn more about how IRS Form W-4R works.

IRS Form W-4S, Request for Federal Income Tax Withholding from Sick Pay

Taxpayers who wish to have taxes withheld from sick pay issued by a third-party payer may complete IRS Form W-4S, Request for Federal Income Tax Withholding From Sick Pay.

For more detail on how IRS Form W-4S works, check out this video.

IRS Form W-4V, Voluntary Withholding Request

IRS Form W-4V, Voluntary Withholding Request, is the tax form that taxpayers may use to determine the amount of tax withheld from various government payments, such as:

- Social Security payments

- Tier 1 Railroad retirement benefits

- Unemployment benefits

- Payments from certain federal government benefit programs

Watch this video to learn more about how IRS Form W-4V works.

Video walkthrough

Watch this instructional video to learn about IRS Form W-4.

Frequently asked questions

When you get a new job, your employer will usually offer a new W-4 form to complete. Otherwise, it’s a good idea to review your current tax withholding each year and file a new Form W-4 to make adjustments from the previous year as needed.

If a new employee doesn’t complete a Form W-4, then your employer may need to follow IRS guidance to employers. This generally will not provide the most accurate tax withholding. You may receive a much larger refund than expected, or owe more in federal income taxes.

Where can I find IRS Form W-4?

As with other tax forms, you may find IRS Form W-4 on the IRS website. For your convenience, we’ve enclosed the latest version here.