IRS Schedule R Instructions

If you are a senior citizen or permanently disabled, you may be eligible for an additional tax credit on your income tax return. Eligible taxpayers use IRS Schedule R to calculate and tax a tax credit to help lower their tax liability when they file their IRS Form 1040.

In this article, we’ll help you walk through Schedule R, including:

- How to complete and file Schedule R with your tax return

- Eligibility requirements for taxpayers to use Schedule R

- Frequently asked questions

Let’s start with a comprehensive review of Schedule R itself.

Table of contents

How do I complete Schedule R?

There are 3 parts to this two-page tax form:

- Part I: Check the Box for Your Filing Status and Age

- Part II: Statement of Permanent and Total Disability

- Part III: Figure Your Credit

Before we dive into Part I, let’s take a look at the taxpayer information field at the very top of the form.

Taxpayer information

At the very top of this for, you’ll enter the taxpayer name and Social Security number as they appear on your income tax return. However, there is additional information you should know before continuing.

Eligibility criteria

Taxpayers may be able to calculate a tax credit on Schedule R if either of the following are true:

- Taxpayer is age 65 or older by the end of the current year

- Taxpayer retired on permanent and total disability, and received taxable disability income during the tax year

However, there are additional criteria outlined in the form instructions. The first group of criteria have to do with the taxpayer’s status.

Status-based limitations

There are two specific limitations each taxpayer should be aware of.

Tax filing status: You cannot take the credit for the elderly or the disabled if:

- Your taxpayer status is married, filing separately, and

- You lived with your spouse at any point during the tax year

Citizenship status: If you were a nonresident alien at any point during the tax year, you may only take the credit if your taxpayer status is married filing jointly, and your spouse is a U.S. citizen.

Additionally, there are some income-based limitations to this tax credit.

Income limits

You are ineligible to take the if your adjusted gross income (AGI) is above a certain threshold or if you received too much nontaxable disability income.

According to the Internal Revenue Service, below are the income-based thresholds for taxpayers, based upon filing status.

| You generally can’t take the credit if: | ||

|---|---|---|

| If your tax filing status is … | The amount of Adjusted Gross Income reported on Form 1040 or Form 1040-SR, Line 11, is . . . | Or if you received . . . |

| Single Head of Household Qualifying Widow(er) | $17,500 or more | $5,000 or more of nontaxable Social Security benefits or other nontaxable pensions, annuities, or disability income |

| Married filing a joint return and only one spouse is eligible for the credit | $20,000 or more | $5,000 or more of nontaxable Social Security benefits or other nontaxable pensions, annuities, or disability income |

| Married filing jointly and both spouses are eligible for the credit | $25,000 or more | $7,500 or more of nontaxable Social Security benefits or other nontaxable pensions, annuities, or disability income |

| Married filing separately and you lived apart from your spouse for all of 2022 | $12,500 or more | $3,750 or more of nontaxable Social Security benefits or other nontaxable pensions, annuities, or disability income |

Disability income definition

For eligibility purposes, the Internal Revenue Service considers disability income to be the total amount you were paid under your employer’s accident and health plan or pension plan that is included in your income as wages or payments instead of wages for the time you were absent from work because of permanent and total disability.

However, any payment you received from a plan that doesn’t provide for disability retirement isn’t disability income. Also, disability income does not include any amount you received from your employer’s pension plan after you have reached mandatory retirement age.

Let’s move on to Part I.

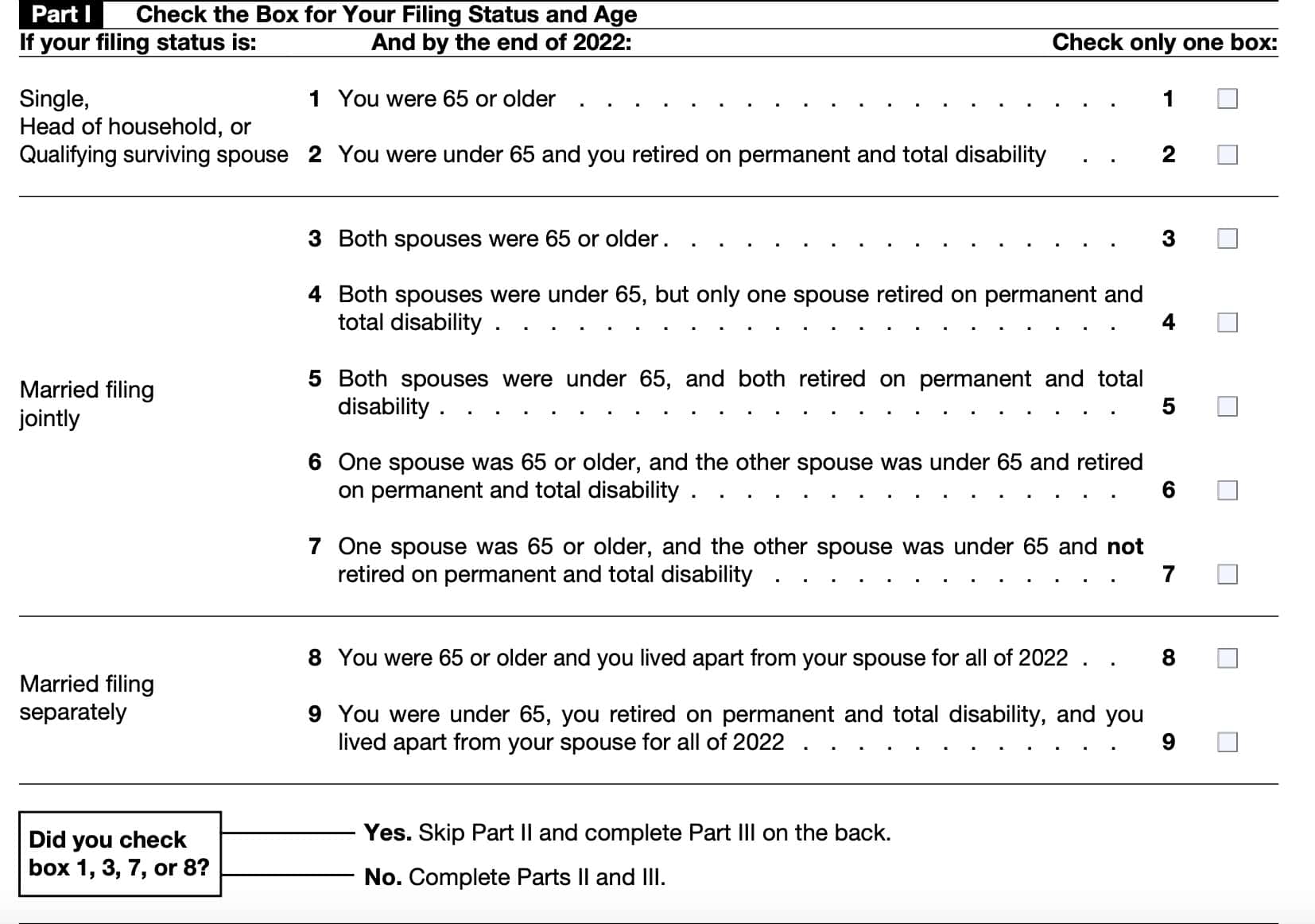

Part I: Check the Box for Your Filing Status and Age

In Part I, you will check only one box, depending on the following factors:

- Tax filing status

- Age at the end of the taxable year

- Disability status

Let’s look at each category, differentiated by filing status.

Single, head of household, or qualifying surviving spouse

Box 1

If you were age 65 or older at the end of the tax year, check Box 1.

Box 2

If you were under age 65, and you retired on permanent and total disability, check Box 2.

Married filing jointly

Box 3

If both spouses were 65 years old or older by the end of the tax year, check Box 3.

Box 4

If both spouses were under the age of 65, but one spouse retired on permanent and total disability, then check Box 4.

Box 5

If both spouses were under the age of 65, and both spouses retired on permanent and total disability, then check Box 5.

Box 6

Check Box 6 if one spouse was age 65 or older, but the other spouse was under age 65 and retired on permanent and total disability.

Box 7

Check Box 7 if one spouse was age 65 or older, but the other spouse was under age 65 and not retired on permanent and total disability.

Married filing separately

Box 8

If you were age 65 or older, and you lived apart from your spouse for the entire tax year, check Box 8.

Box 9

Check Box 9 if all of the following apply:

- You were under age 65

- You retired on permanent and total disability, and

- You lived apart from your spouse for the entire tax year

If you checked any of the following boxes, then skip Part II, and proceed to Part III:

Otherwise, proceed to Part II.

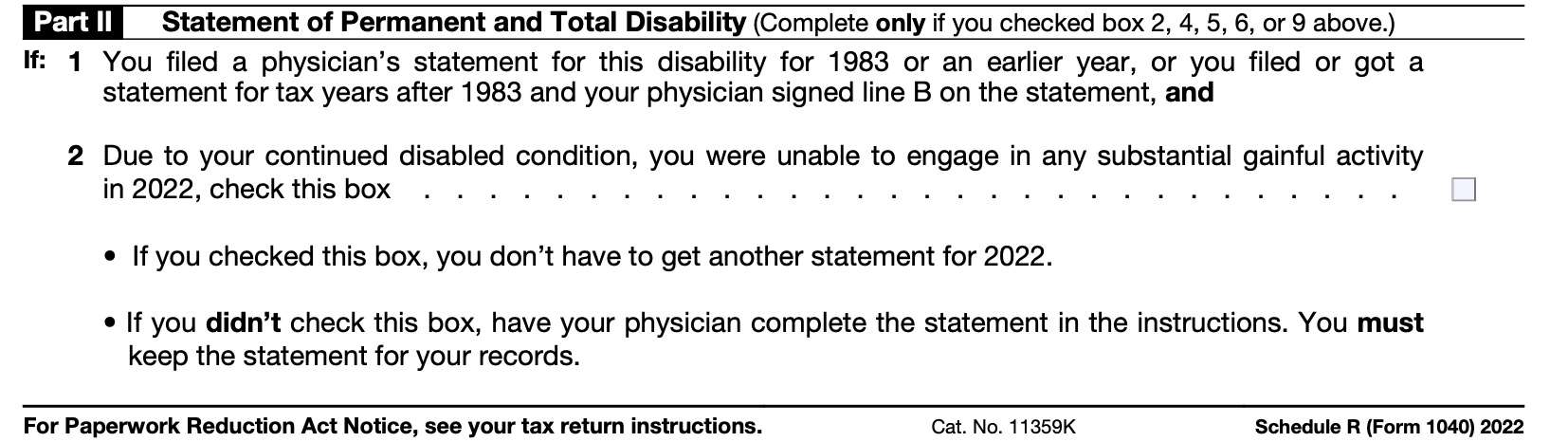

Part II: Statement of Permanent and Total Disability

You only need to complete Part II if you checked one of the following boxes:

If you checked a different box, skip Part II, and proceed directly to Part III. Otherwise, we’ll continued with Part II, after we discuss how the IRS defines permanent and total disability.

Permanent and Total Disability

The IRS considers a person to be permanently and totally disabled if both 1 and 2 below apply.

- The taxpayer can’t engage in any substantial gainful activity because of a physical or mental condition.

- A qualified physician determines that the disabled condition either:

- Has lasted or can be expected to last continuously for at least a year, or

- Can be expected to result in the taxpayer’s death

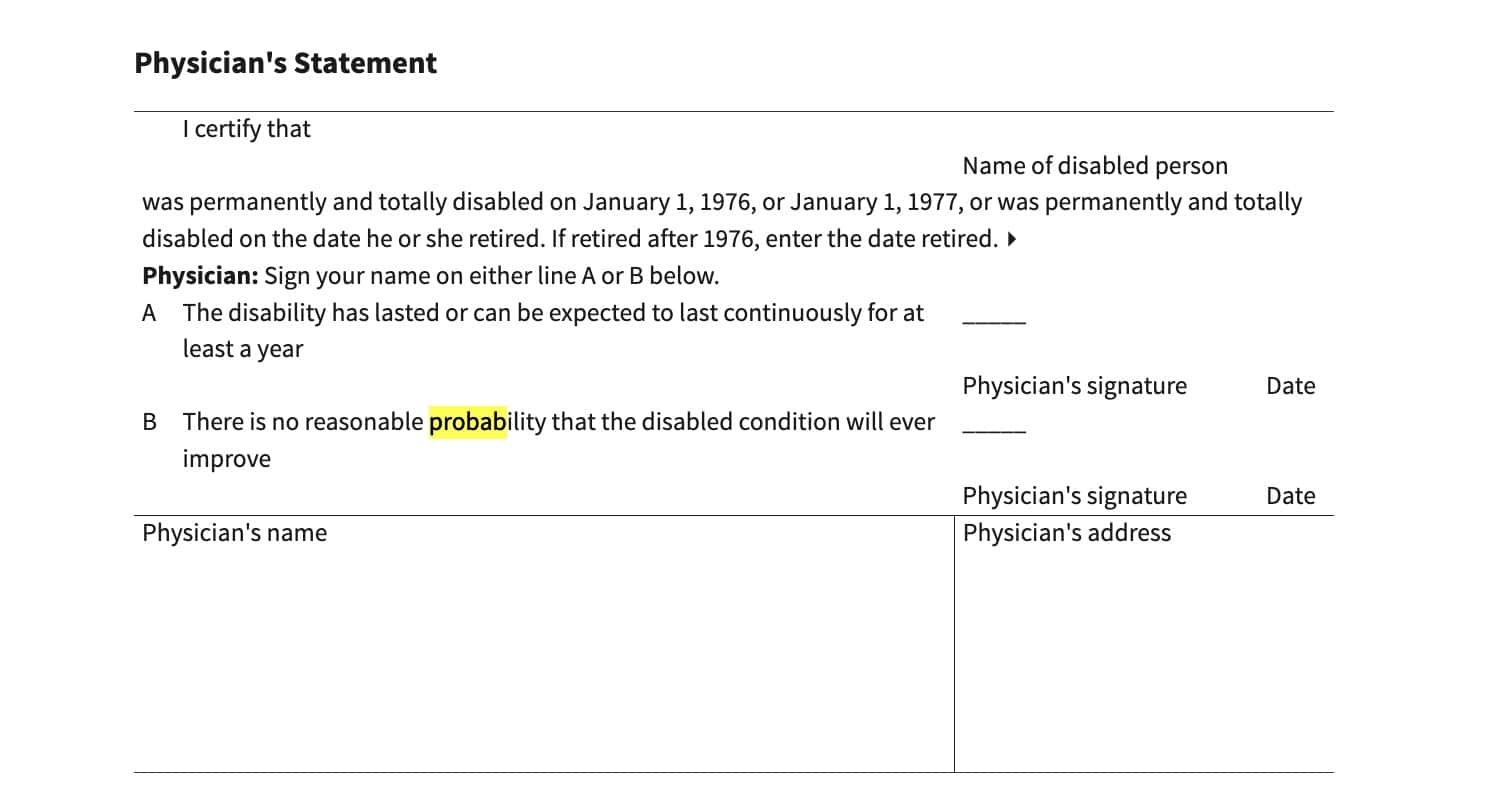

Physician’s statement of disability

In Part II, you must have your physician complete a statement from the form instructions if:

- You didn’t file a physician’s statement for 1983 or an earlier year, or

- You filed or got a statement for tax years after 1983 and your physician signed on Line A of the statement stating that the disability has lasted or can be expected to last continuously for at least a year

Physician’s signature

In this statement, from the form instructions, there are two lines for the physician’s signature:

- Line A: The disability has lasted or can be expected to last continuously for at least a year

- Line B: There is no reasonable probability that the disabled condition will ever improve

In either case, you must have your physician complete a statement certifying that:

- You were permanently and totally disabled on the date you retired; or

- If you retired before 1977, you were permanently and totally disabled on January 1, 1976, or January 1, 1977.

Keep this physician’s statement in your tax records. Do not file this statement with your income tax return.

In Part II, check the box if both of the following apply:

- You filed a physician’s statement for this disability for 1983 or an earlier year, or you filed and got a statement for tax years after 1983, and your physician signed Line B of the statement, and

- You were unable to engage in any substantial gainful activity in the tax year due to your continued disabled condition

If you checked Box 4, 5, or 6 in Part I, enter in the space above the box on Line 2 in Part II the first name of the spouse for whom the box is checked.

If the Department of Veterans Affairs (VA) certifies that you are permanently and totally disabled, you can use VA Form 21-0172 instead of the physician’s statement. VA Form 21-0172 must be signed by a person authorized by the VA to do so. You can get this form from your local VA regional office.

Let’s move on to Part III, where we’ll calculate your tax credit.

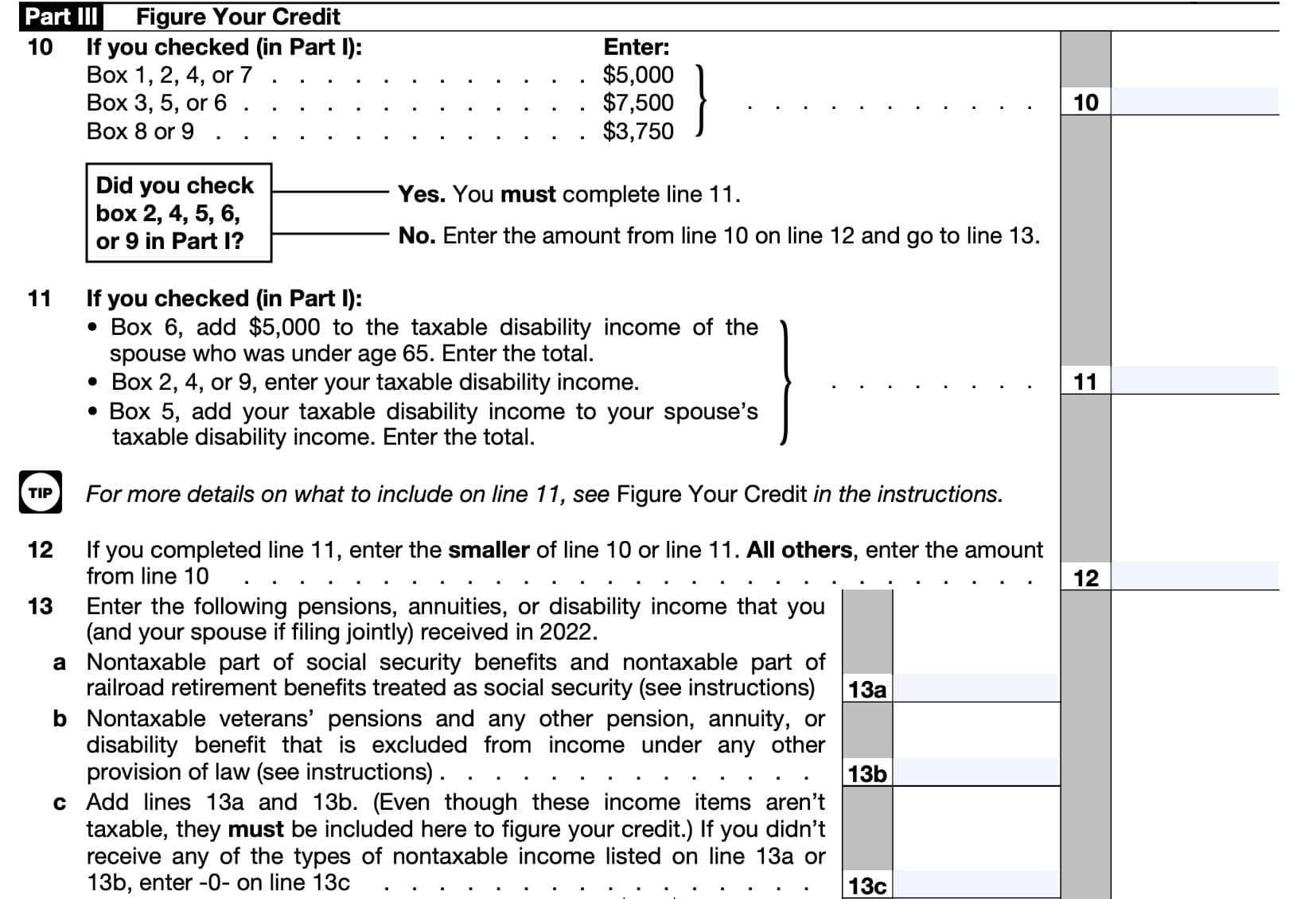

Part III: Figure your Credit

In Part III, we’ll finally use Schedule R to calculate the amount of our tax credit.

Line 10

In Line 10, enter the corresponding dollar amount, based upon which box you checked in Part I.

If you checked one of the following, enter $5,000 in Line 10:

If you checked one of the following, enter $7,500 in Line 10:

If you checked either Box 8 or Box 9, enter $3,750 in Line 10.

Once you’ve entered a value in Line 10, you’ll make your next move depending on which box you checked.

If you checked one of the following, go directly to Line 11, below:

- Box 2

- Box 4

- Box 5

- Box 6

- Box 9

Otherwise, enter the Line 10 number in Line 12, then go directly to Line 13.

Line 11

Enter the dollar amount, based upon the box that you checked in Part I.

Box 6

Add $5,000 to the taxable disability income of the spouse who was under the age of 65 in the year. Enter the total in Line 11.

Box 2, Box 4, or Box 9

Enter your taxable disability income in Line 11.

Box 5

Add your taxable disability income to your spouse’s taxable disability income. Enter the total taxable from disability compensation for both spouses in Line 11.

Line 12

If you completed Line 11, enter the smaller of:

Otherwise, enter the Line 10 number here, then go to Line 13.

Line 13

In Line 13, you’ll enter various pensions, annuities, or disability income that you and your spouse (if filing a joint tax return) may have received during the year.

In Line 13a, enter the following:

- Nontaxable part of Social Security benefits (before the deduction of Medicare premiums), and

- Nontaxable part of equivalent railroad retirement benefits treated like Social Security income

If you have taxable Social Security benefits, then this line should contain the difference between Lines 6a (Social Security benefits) and 6b (taxable Social Security benefits) on your IRS Form 1040.

If you have reduced Social Security or retirement benefits because of workers’ compensation benefits, then include workers’ compensation as part of the total in Line 13a.

For Line 13b, enter:

- Nontaxable pensions received from the Department of Veterans Affairs, and

- Not including military disability pensions

- Any other pension, annuity, or disability benefit excluded from taxable income under any provision of federal law except the Internal Revenue Code

- Do not include any amount that is treated as a return of the cost of a pension or annuity

Don’t include any pension, annuity, or similar allowance for personal injuries or sickness resulting from active service in the armed forces of any country, or in the National Oceanic and Atmospheric Administration or the Public Health Service.

Also, don’t include a disability annuity payable under Section 808 of the Foreign Service Act of 1980.

Add Lines 13a and 13b. Enter the total in Line 13c. If you did not receive any nontaxable benefits or pensions, enter ‘0’ and move to Line 14.

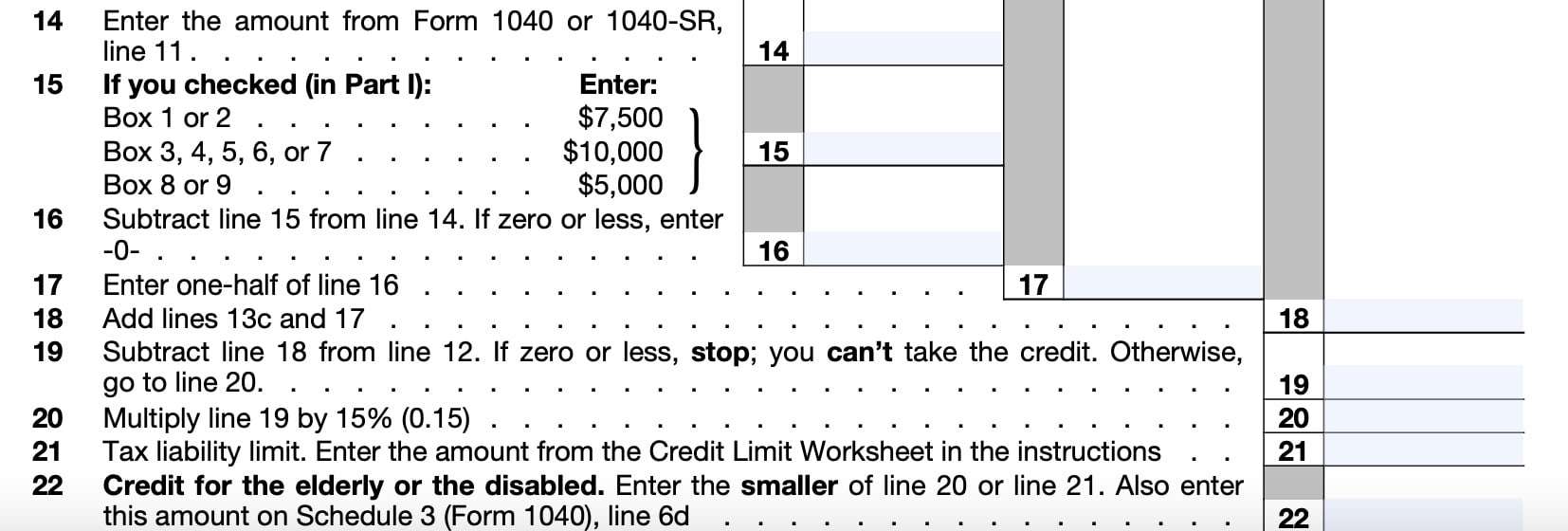

Line 14: Adjusted gross income

Enter your AGI from Line 11 from your Form 1040 or Form 1040-SR.

Line 15

If you checked either Box 1 or Box 2 in Part I, enter $7,500 in Line 15.

Enter $10,000 if you checked any of the following boxes in Part I:

If you checked Box 8 or Box 9, enter $5,000.

Line 16

Subtract Line 15 from Line 14. Enter the result here.

If the result is zero or a negative number, enter ‘0.’

Line 17

Multiply Line 16 by 50% (0.50). Enter the result in Line 17.

Line 18

Add Line 13c & Line 17. Enter the result here.

Line 19

Subtract Line 18 from Line 12.

If the answer is zero or a negative number, then stop. You cannot take the tax credit for the elderly or the disabled. Otherwise, enter the result in Line 19, then go to Line 20.

Line 20

Multiply the Line 19 amount by 15% (0.15). Enter the result here.

Line 21: Tax liability Limit

To determine this amount, follow these steps from the IRS Schedule R instructions:

- Enter the amount from Line 18 of your Form 1040 or Form 1040-SR

- This represents your tax liability, plus

- Alternative minimum tax from IRS Form 6251 plus

- Any repayment of the excess advance premium tax credit from IRS Form 8962

- Enter the amount from Schedule 3, Lines 1, 2, and 6l

- This represents foreign tax credit from IRS Form 1116 plus

- Credit for child and dependent care expenses from IRS Form 2441 plus

- Increase or decrease in partner’s reporting year tax from IRS Form 8978

- Subtract Line 2 from Line 1

Enter this amount on Line 21. If the result is zero or a negative number, stop. You cannot take the tax credit.

Line 22

In Line 22, enter the smaller of:

Enter this number on Schedule 3, Line 6d, as well.

Video walkthrough

Watch this instructional video to learn more about how to use Schedule R to claim the tax credit for the elderly or disabled.

Do you use TurboTax?

If you don’t, is it because the choices are overwhelming to you?

If so, you should check out our TurboTax review page, where we discuss each TurboTax software product in depth. That way, you can make an informed decision on which TurboTax offering is the best one for you!

Click here to learn more about which TurboTax option is best for you!

Frequently asked questions

This tax credit is nonrefundable. This means that the tax credit may reduce your tax liability to zero. However, you cannot use this credit to generate a tax refund.

Yes. IRS Forms 940 and 941 each have Schedule R, as well as IRS Form 1040. However, each of these is an aggregate form for employer tax returns. Only Schedule R from Form 1040 will help taxpayers calculate the credit for the elderly or the disabled on their U.S. Individual Income Tax Return.

Where can I find Schedule R?

You may find this tax form on the IRS’ official website. For easier access and convenience, we’ve attached the most recent version of this form to this article below.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!