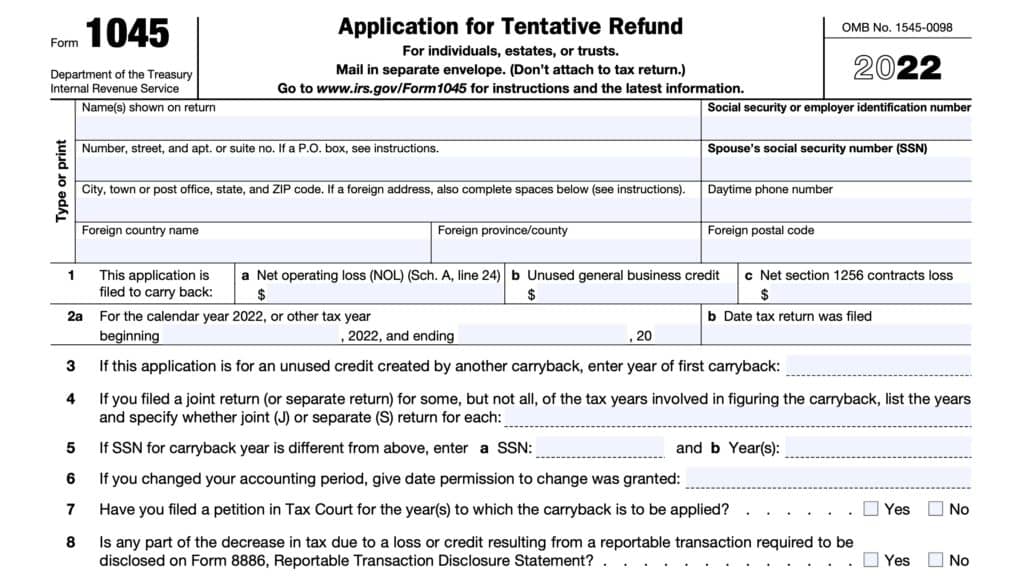

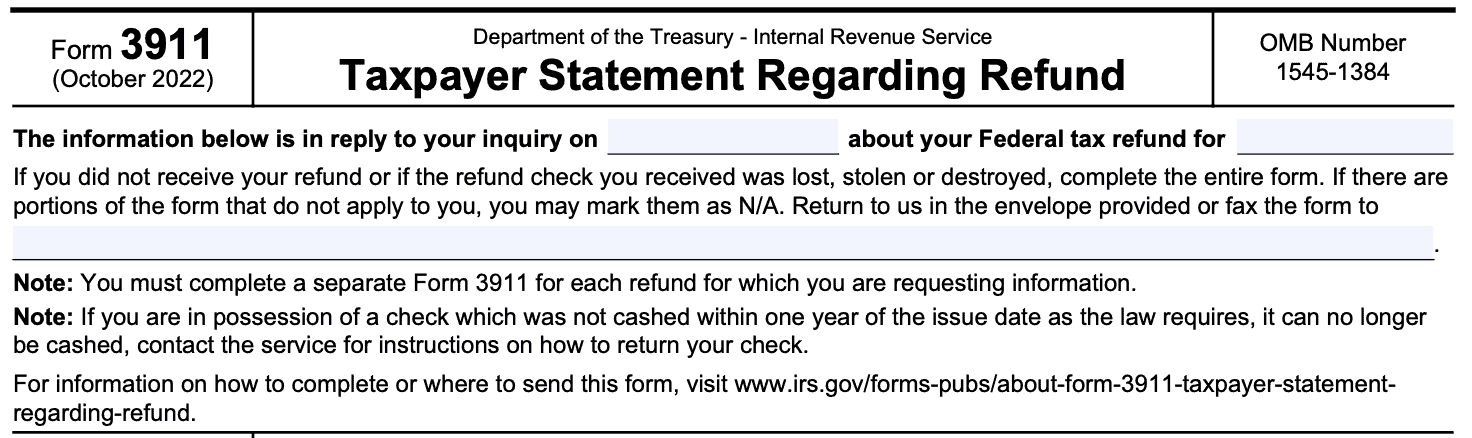

IRS Form 3911 Instructions

If you were expecting a tax refund but have not received it, the IRS has several options available to you. You can contact the Internal Revenue Service by phone or research the status on the IRS website using the Where’s My Refund tool. You can also file IRS Form 3911 to declare a lost refund check.

In this article, we’ll cover what you need to know about IRS Form 3911, including:

- How to complete IRS Form 3911

- How the refund payment trace process works

- Frequently asked questions about IRS Form 3911

Let’s start with step by step guidance on how to fill out Form 3911.

Table of contents

How do I fill out IRS Form 3911?

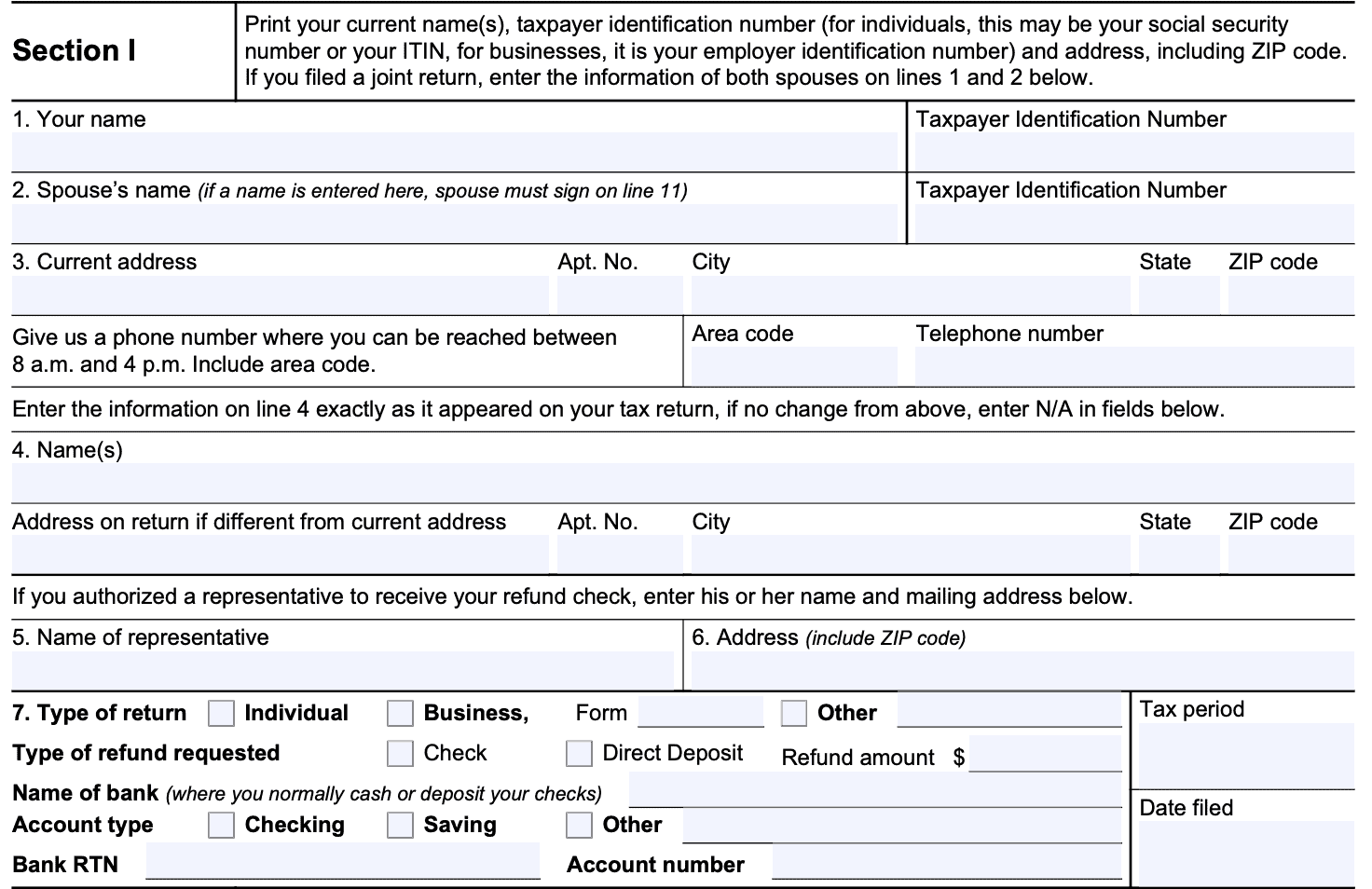

There are 3 sections to this one-page tax form:

- Section I: Taxpayer Information

- Section II: Refund Information

- Section III: Certification

We’ll walk through this one page form step by step, beginning at the top of the form.

Top of the form

Most of the information in the top section of Form 3911 will pertain to any IRS correspondence that you receive. As part of the first step, you should take a look at the top section of the form.

If you requested that the IRS send you a copy of Form 3911 to initiate a trace for the original check, then you may see that some of the respective fields have been completed. If you downloaded a new form, then these fillable fields will be blank.

However, there are a couple of notes worth emphasizing.

You must file a separate form for each missing refund

If you have more than one missing refund, or are missing refunds from more than tax period, you must file a separate check for each of the missing payments.

If you have held onto a check for more than one year and can no longer deposit or cash it, contact the IRS for instructions before continuing.

This appears to be fairly straightforward. However, the guidance on the form is somewhat lacking.

You might have received an IRS notice, known as CP 237, informing you to contact the IRS to request a new federal tax refund check. Watch this YouTube video to learn more.

Let’s move on to Section I.

Section I

When you complete Section I, you will enter the personal information that the IRS requires in order to research your tax return, and if possible, issue a replacement check.

Line 1: Taxpayer information

Enter your name and your taxpayer identification number. For individuals, this will be your Social Security number or individual tax identification number (ITIN). For business owners, this number will be the employer identification number (EIN).

Line 2: Spouse information

For married couples filing a joint tax return, your spouse’s information should go into Line 2. Otherwise, enter N/A.

If your spouse’s information is in Line 2, then your spouse must sign Line 11, at the end of the form.

Note: If your filing status is as a married couple filing jointly, filing IRS Form 3911 is the only way to initiate a trace of your paper check or direct deposit. Calling the automated number will not work because the IRS’ automated systems are not able to trace your tax return. However, you can still check your refund status under the IRS Check Your Refund tool.

Line 3: Address & phone number

Enter your contact information, including:

- Street name

- Apartment number (if applicable)

- City

- State

- Zip code

Below your mailing address, include your complete phone number, beginning with the area code. This should be a number where the IRS can contact you during the workday.

Line 4: Name as it appears on your tax return

If your name or address appears differently on your tax return than the information indicated in Line 1 or Line 3, then enter your name or address as it appears on your tax return.

Line 5: Authorized representative

If you have an authorized representative whom you would like to receive your refund check on your behalf, enter that person’s name in Line 5.

If you do not wish to make a declaration of representative, enter ‘N/A.’

Line 6: Representative’s address

If you entered the name of an authorized representative on Line 5, enter that person’s address here.

Line 7: Tax return information

You’ll need to complete this tax return information so the IRS knows exactly what to look for. This includes:

- Type of return: Check individual or business

- Tax return form number: Enter the form number of your income tax return (i.e. IRS Form 1040, IRS Form 1040-SR, IRS Form 1040-NR, etc.)

- Type of refund requested: (check, direct deposit)

- Refund amount: Enter the refund amount, according to your tax return

- Tax period: This can be a tax year, or a shorter period for certain tax returns

- Date filed: When did you file your tax return?

If you wish for the IRS to send your entire refund electronically, you’ll also need to include your bank’s direct deposit information. This includes:

- Bank account type (savings, checking, or other)

- Bank’s routing number: This is the 9 digit number located on the left hand side of a check

- Account number: Make sure your account number matches the type of account listed

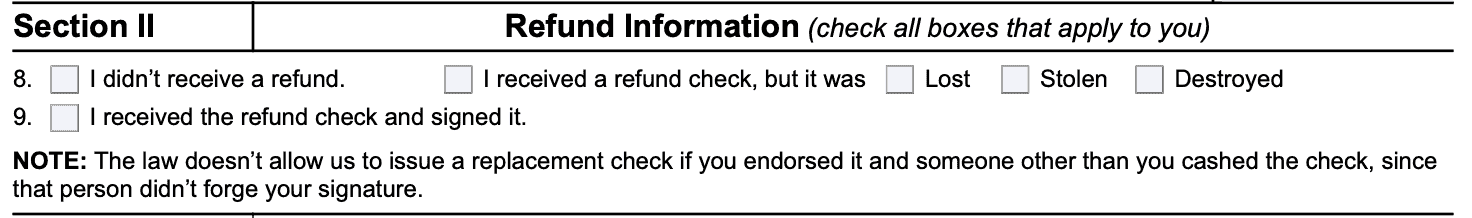

Section II: Refund Information

In Section II, you’ll give the IRS additional information about your check.

Line 8

Check the appropriate box here. You can select whether or not you received a refund. If you received a tax refund check, then you can state whether it was:

- Lost

- Stolen

- Destroyed

Line 9

If you received a check and signed it, check this box.

You might not have many options if the IRS determines that the signed check actually cleared. However, the Department of the Treasury will conduct research to determine what happened to the refund check.

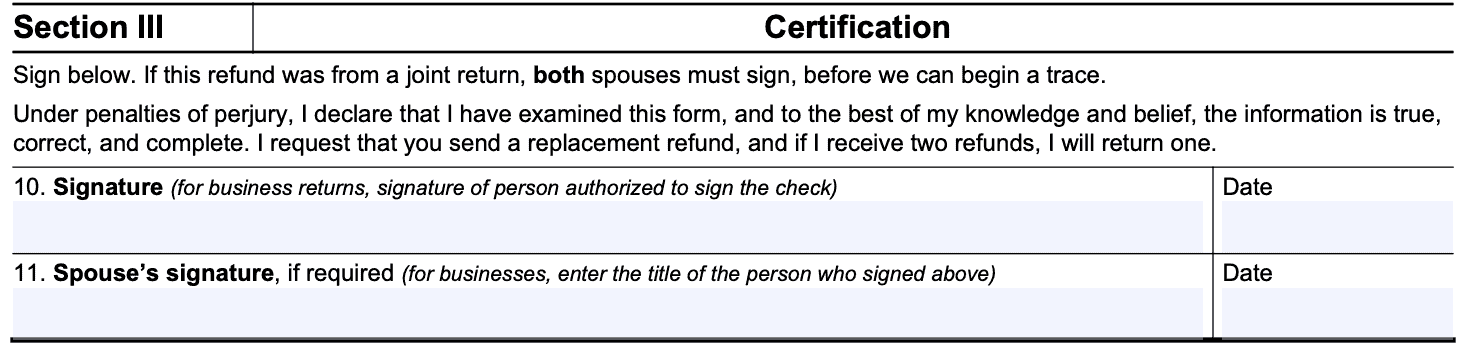

Section III: Certification

In Section III, you’ll sign the form to certify the facts that you’ve reported to the IRS. Before you sign, you should make sure that you’ve provided complete information that is true and accurate to the best of your knowledge.

Line 10: Taxpayer signature

Sign and date here. Recognize that your signature comes under penalties of perjury. Only sign this document if this information is true to the best of your knowledge.

Line 11: Spouse’s signature

If your spouse’s information is in Line 2, your spouse needs to sign and date here, under penalties of perjury.

How do I file IRS Form 3911?

You can file Form 3911 by fax or mail. However, do not send this form to the Internal Revenue Service Center where you normally file your tax return.

Instead, you must send this request to the appropriate refund inquiry unit, based upon your location. We’ve included a list of refund inquiry units below, with complete mailing address and fax numbers.

Tip: Double-check to make sure you have the correct return address before you mail your completed form. Also, do not fax other paperwork to the listed fax numbers. The IRS highly stresses that taxpayers should only submit Form 3911 to the respective fax number.

If you reside in: Maine, Maryland, Massachusetts, New Hampshire, Vermont

Send your request to:

Andover Refund Inquiry Unit

310 Lowell St

Mail Stop 666

Andover, MA 01810

Fax: 855-253-3175

If you reside in: Georgia, Iowa, Kansas, Kentucky, Virginia

Send your request to:

Atlanta Refund Inquiry Unit

4800 Buford Hwy

Mail Stop 112

Chamblee, GA 30341

Fax: 855-275-8620

If you reside in: Florida, Louisiana, Mississippi, Oklahoma, Texas

Send your request to:

Austin Refund Inquiry Unit

3651 S Interregional Hwy 35

Mail Stop 6542 AUSC

Austin, TX 78741

Fax: 855-203-7538

If you reside in: New York

Send your request to:

Brookhaven Refund Inquiry Unit

1040 Waverly Ave

Mail Stop 547

Holtsville, NY 11742

Fax: 855-297-7736

If you reside in: Alaska, Arizona, California, Colorado, Hawaii, Nevada, New Mexico, Oregon, Utah, Washington, Wisconsin, Wyoming

Send your request to:

Fresno Refund Inquiry Unit

3211 S Northpointe Dr.

Mail Stop B2007

Fresno, CA 93725

Fax: 855-332-3068

If you reside in: Arkansas, Connecticut, Delaware, Indiana, Michigan, Minnesota, Missouri, Montana, Nebraska, New Jersey, Ohio, West Virginia

Send your request to:

Kansas City Refund Inquiry Unit

333 W Pershing Rd

Mail Stop 6800, N-2

Kansas City, MO 64108

Fax: 855-344-9993

If you reside in: Alabama, North Carolina, North Dakota, South Carolina, South Dakota, Tennessee

Send your request to:

Memphis Refund Inquiry Unit

5333 Getwell Rd

Mail Stop 8422

Memphis, TN 38118

Fax: 855-580-4749

If you reside in: District of Columbia, Idaho, Illinois, Pennsylvania, Rhode Island

Send your completed form to:

Philadelphia Refund Inquiry Unit

2970 Market St

DP 3-L08-151

Philadelphia, PA 19104

Fax: 855-404-9091

For other taxpayers

If any of the following apply:

- You reside outside the United States (i.e. foreign country, U.S. possession or territory)

- You use an APO or FPO address

- You file IRS Form 2555 because you have foreign earned income

- You file IRS Form 4563 as a resident of American Samoa

- You are a dual-status alien

Then mail Form 3911 to:

Austin Refund Inquiry Unit

3651 S Interregional Hwy 35

Mail Stop 6542 AUSC

Austin, TX 78741

Fax: 855-203-7538

For Business Entities

There are two different IRS locations for business entities to send their inquiry.

Businesses located in states west of the Mississippi (except for Arkansas and Louisiana), and Wisconsin should submit authorizations to:

Ogden Refund Inquiry Unit

1973 N Rulon White Blvd

Mail Stop 6733

Ogden, UT 84404

Fax: 855-578-2550

Businesses located in states east of the Mississippi (except for Wisconsin), and Arkansas and Louisiana should submit authorizations to:

Cincinnati Refund Inquiry Unit

PO Box 145500

Mail Stop 536G

Cincinnati, OH 45250

Fax: 855-307-3124

Video walkthrough

Watch this instructional video for step-by-step guidance on completing Form 3911.

Frequently asked questions

IRS Form 3911, Taxpayer Statement Regarding Refund, is the tax form that a taxpayer may use to inform the IRS of a missing tax refund. By filing this form, the taxpayer initiates a refund trace. If successful, the IRS will issue a replacement check to the taxpayer.

When you file IRS Form 3911 in search for a missing check, the IRS will process your request. If your check was not already cashed or deposited, then the IRS will cancel your check and send you a replacement check. If your check was already cashed or deposited, then the Department of Treasury will contact you through its Bureau of the Fiscal Service (BFS). The BFS will send you a claim package that includes a copy of the cashed check.

You can check the status of your tax refund without filing Form 3911 in one of several ways. You can use the IRS Check Your Refund online tool on the IRS web site, call the IRS’ automated number: (800) 829-1954 to initiate the trace. However, married taxpayers filing a joint tax return cannot use this option. Finally, you can call the IRS and speak with an IRS representative at: (800) 829-1040

Where can I find a copy of Form 3911?

Like most reproducible copies of federal tax forms, Form 3911 can be found on the IRS website. For your convenience, we’ve included a copy at the bottom of this article.