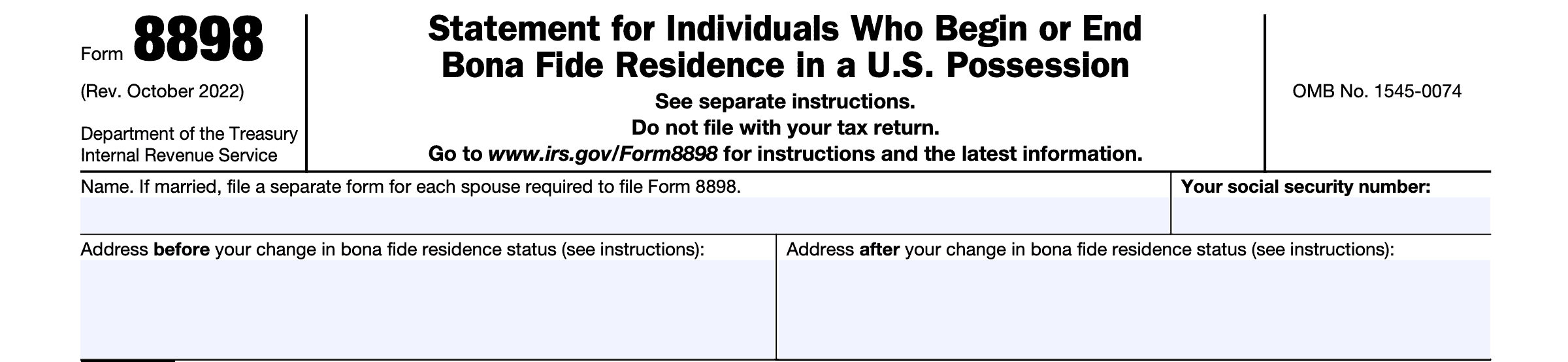

IRS Form 8898 Instructions

If you are a citizen or resident alien of the United States and you’ve either become a bona fide resident of a U.S. territory or stopped being one, you might need to file IRS Form 8898. By filing Form 8898, you notify the Internal Revenue Service of your change in status, under Internal Revenue Code Section 937(c).

In this tax guide article, we’ll cover what you need to know about IRS Form 8898, to include:

- How to complete and file IRS Form 8898

- Who must file IRS Form 8898

- Other frequently asked questions

Let’s start with some step by step instructions on completing this tax form.

Table of contents

How do I complete IRS Form 8898?

Let’s go through this tax form step by step, beginning with the taxpayer information fields at the top of the form. There are 5 sections of this tax form, including the taxpayer information fields:

- Taxpayer Information

- Part I: General Information

- Part II: Presence in the United States or Possession

- Part III: Closer Connection

- Part IV: Source of Income

Let’s take a closer look at the taxpayer information fields at the top.

Taxpayer information

At the top of Form 8898, you’ll see the name and Social Security number fields. For a married couple, each spouse will need to file a separate Form 8898, if the situation applies to both spouses.

Additionally, you’ll enter your address before your change in bona fide residence status, and your new address, after your change in bona fide residency status.

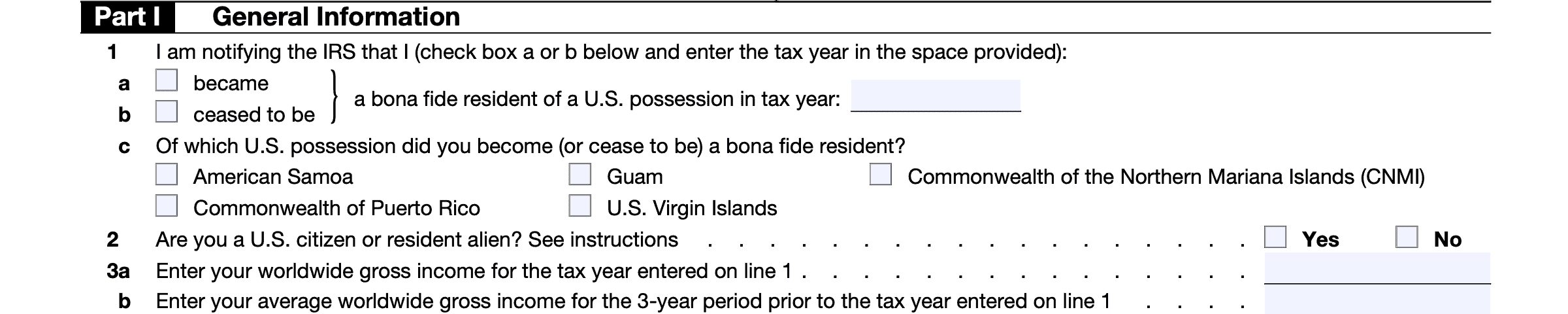

Part I: General Information

Part I contains general information about the change in status.

Line 1

In Line 1, select one of the following, as well as the applicable tax year:

- Line 1a: I became a bona fide resident of a U.S. possession

- Line 1b: I ceased to be a bona fide resident of a U.S. possession

For Line 1c, select the relevant U.S. territory or possession that applies to your change in residence:

- American Samoa

- Guam

- Commonwealth of the Northern Mariana Islands (CNMI)

- Commonwealth of Puerto Rico

- U.S. Virgin Islands

Line 2

U.S. citizens and resident aliens should check Yes.

If you are a non-resident alien, check No.

Line 3: Worldwide income

For Line 3a, enter your worldwide gross income for the tax year that you indicated in Line 1.

In Line 3b, you will calculate the average worldwide gross income for the three-year period prior to the calendar year indicated in Line 3a.

For example, if you use Form 8898 for tax year 2024, then your three year average would include the average worldwide gross income from tax years 2021, 2022, and 2023.

Worldwide gross income

According to the form instructions, worldwide gross income includes all income you received in the form of money, goods, property, and services. This includes any income from sources outside the United States, even if partially or totally excluded, and before any deductions, credits, or rebates.

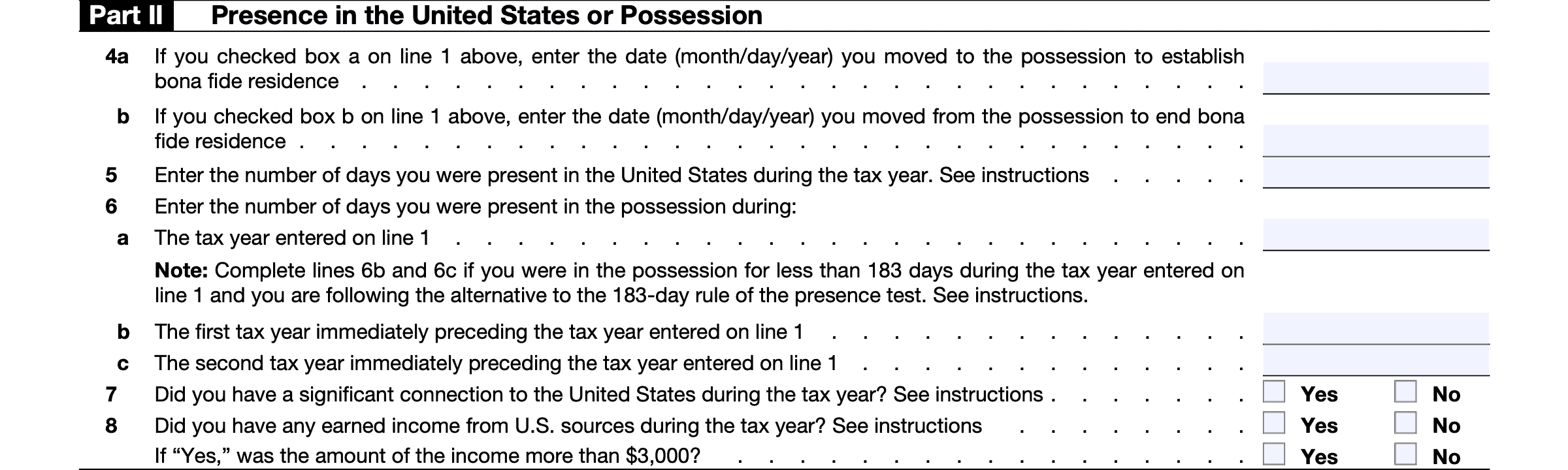

Part II: Presence in the United States or Possession

Line 4: Date you moved

In Line 4a: If you checked box a on Line 1, enter the date that you moved to the applicable possession. You will need to provide this information in month/day/year format. If you checked Box 1b, leave this line blank.

In Line 4b: If you checked box b on Line 1, enter the date that you moved from the applicable possession to end bona fide residence. If you checked Box 1a, leave this line blank.

Line 5: Number of days present in the United States during the tax year

Enter the number of days present in the United States during the tax year, according to the following guidelines:

Days of presence Test

In general, you are considered to be present in the United States on any day that you are physically present in the United States. Likewise, you are considered present in the possession on any day that you are physically present in that possession.

If, during a single day, you were physically present on the U.S. mainland and a possession, you should count that as a day of physical presence in the possession. If, during a single day, you were physically present in two possessions, that day is counted as a day of presence in the possession in which you have your tax home.

For additional detail, please refer to the form instructions.

Line 6: Number of days present in the possession

In Line 6a, enter the number of days present in the present during the tax year.

You do not need to complete Lines 6b and 6c if you were in the possession more than 183 days during the tax year. If you were in the possession for less than 183 days, and you are following the alternative to the 183-day rule for the presence test, then enter the same information for the two prior years:

- Line 6b: Number of days present in the first tax year immediately preceding the tax year

- Line 6c: Number of days present in the second tax year immediately preceding the tax year

For example, if you entered 2024 for the calendar year in Line 1, then Line 6 would look like this:

- Line 6a: Number of days present in the possession during 2024

- Line 6b: Number of days present in the possession during 2023 (if required)

- Line 6c: Number of days present in the possession during 2022 (if required)

Line 7

Did you have a significant connection to the United States during the tax year? Select Yes or No.

Significant connection

You have a significant connection to the United States if:

- You have a permanent home in the United States,

- You are registered to vote in any political subdivision of the United States, or

- You have a spouse or child under 18 whose principal home is in the United States.

Additional information is available in the form instructions.

Line 8: Earned income from U.S. sources during the year

In Line 8, indicate whether you had earned income from U.S. sources during the year. If you answer ‘Yes,’ answer the following question to indicate whether this income exceeded $3,000.

Earned income

The IRS defines earned income as “Wages, salaries, professional fees, and other amounts received as compensation for personal services actually rendered, including the fair market value of all earnings paid in any medium other than cash.”

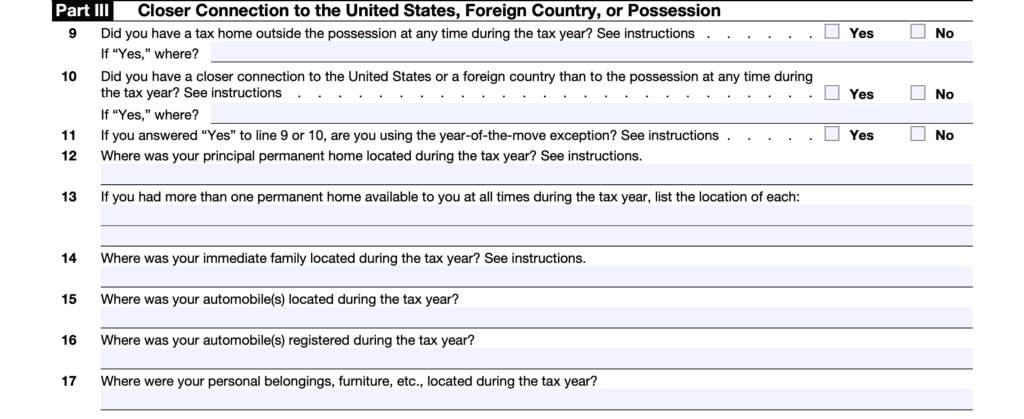

Part III: Closer connection

In Part III, we’ll take a look at whether you have a closer connection to the United States, the relevant U.S. territory, or a foreign country.

Line 9:

In Line 9, indicate whether you had a tax home outside the possession at any time during the tax year. If the answer is ‘Yes,’ enter the location of your tax home.

Tax home test

Under the tax home test, you cannot have a tax home outside the possession during any part of the tax year. For tax purposes, your tax home is your regular or main place of business, employment, or post of duty regardless of where you maintain your family home.

If you do not have a regular or main place of business because of the nature of your work or because you are not engaged in a trade or business activities, then your tax home is the place where you regularly live.

If you do not fit either of these categories, you are considered an itinerant and your tax home is wherever you work.

Line 10

In Line 10, indicate whether or not you had a closer connection to the United States or a foreign country than to the possession during the tax year.

Closer connection test

The closer connection test indicates which location you have a stronger connection to.

If you have maintained more significant contacts with the possession than with the United States or foreign country, then the IRS considers you to have a closer connection to a possession than to the United States or to a foreign country if.

The IRS considers the following as significant contacts:

- The location of:

- Your permanent home;

- Your family;

- Your current social, political, cultural, professional, or religious affiliations;

- Where you conduct your routine personal banking activities;

- The jurisdiction in which you hold a driver’s license; and

- Charitable organizations to which you contribute.

- The place of residence you designate on forms and documents.

Line 11: Year of the move exception

If you answered No to both Line 9 and Line 10, skip Line 11 (or select ‘No) and move to Line 12.

Otherwise, you may select ‘Yes’ if you are using the year-of-the-move exception.

Year of the move exception

For bona fide resident status matters, an exception exists to the tax home and closer connection tests, based on one of the following:

- Year of the move to the possession

- Year of the move from the possession

- Year of the move from Puerto Rico

Year of the move to the possession

You satisfy the tax home and closer connection tests for the tax year you moved to the possession if you meet all of the following:

- You were not a bona fide resident of the possession in any of the 3 taxable years immediately preceding the tax year of the move

- You did not have a tax home outside the possession or a closer connection to the United States or a foreign country than to the relevant possession during any part of the final 183 days of the tax year of the move

- You are a bona fide resident of the possession for the 3 tax years immediately following the tax year of the move

Year of the move from the possession

You satisfy the tax home and closer connection tests for the tax year you moved from American Samoa, the CNMI, Guam, or the U.S. Virgin Islands if you meet all of the following criteria:

- You were a bona fide resident of the possession for the 3 tax years immediately preceding the tax year of the move

- You did not have a tax home outside the possession or a closer connection to the United States or a foreign country than to the relevant possession during any part of the first 183 days of the tax year of the move

- You are not a bona fide resident of the possession in any of the 3 tax years immediately following the tax year of the move

Year of the move from Puerto Rico

You qualify as a bona fide resident of Puerto Rico for the part of the tax year before the date you moved from Puerto Rico if you meet all of the following requirements:

- You are a U.S. citizen.

- You were a bona fide resident of Puerto Rico for at least 2 tax years immediately before the tax year of the move.

- In the year of the move, you:

- Ceased to be a bona fide resident of Puerto Rico, and

- Ceased to have a tax home in Puerto Rico.

- You had a closer connection to Puerto Rico than to the United States or a foreign country during the part of the tax year before the date on which you ceased to have a tax home in Puerto Rico.

Line 12: Location of principal permanent home during the tax year

Enter the location of your principal permanent home during the tax year. If you had more than one permanent home, then your principal permanent home is the home where you spend the most time.

Line 13

If you only had one permanent home during the tax year, skip to Line 14. Otherwise, list the location for each permanent home here.

Line 14: Location of immediate family during the tax year

Enter the location of your immediate family during the tax year. For purposes of this form, your immediate family consists of your spouse and minor children. No other family member shall be considered part of your immediate family.

Line 15: Location of your automobile during the tax year

If you have an automobile, enter its location during the tax year in Line 15.

Line 16: Registration of your automobile

Enter the location where your automobile was registered during the tax year.

Line 17: Location of personal belongings during the tax year

Enter the location of your personal belongings during the tax year. This might include furniture, clothing, appliances, and other personal property not considered a vehicle or real property.

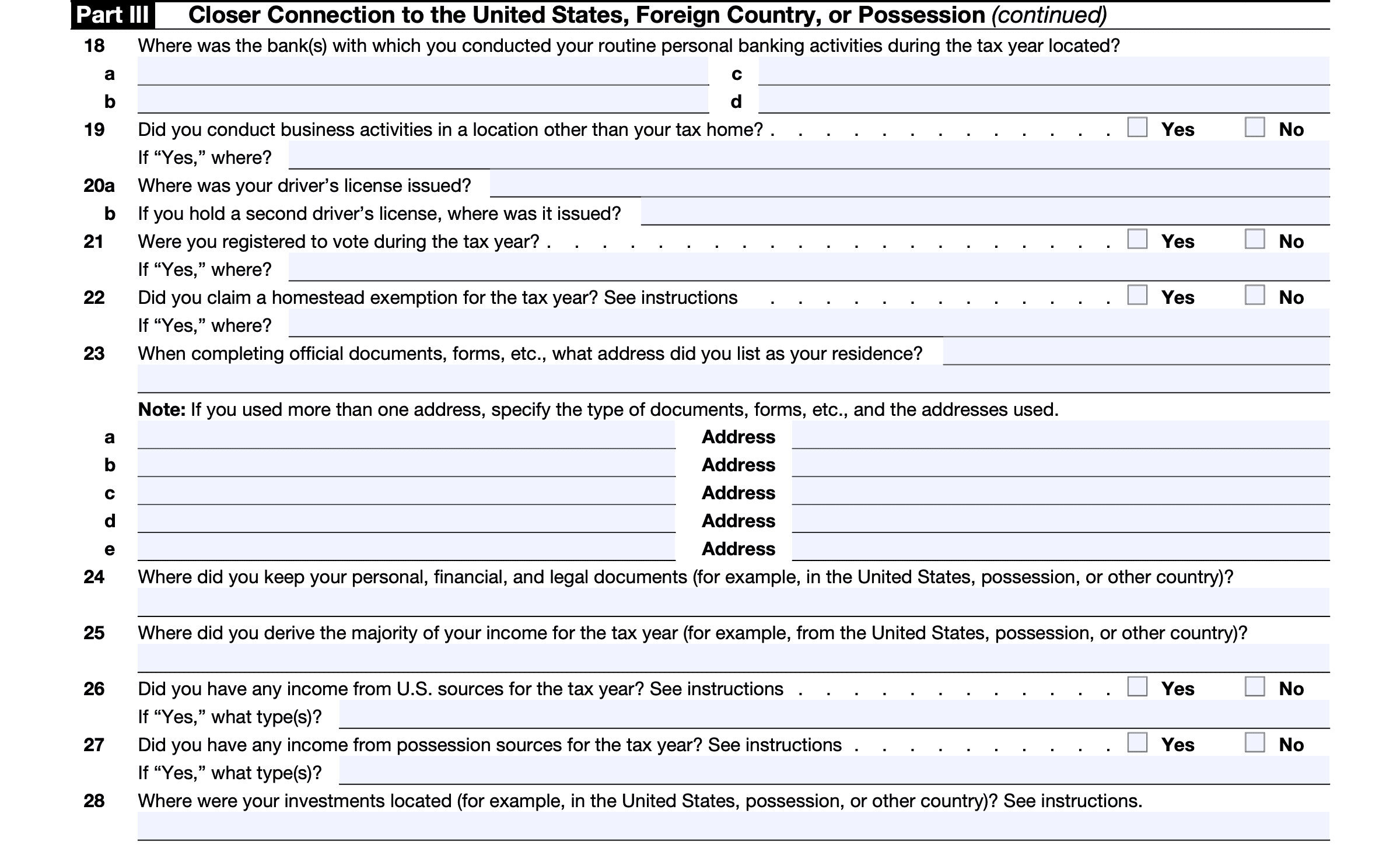

Line 18: Banks

In Line 18, enter the location of the bank or banks where you did your personal banking activities. You may enter up to 4 different banking institutions.

Line 19

Check the appropriate box to indicate whether you conducted business activities outside your tax home during the year. If so, enter the location.

Line 20: Driver’s license

State where your driver’s license was issued. If you have two driver’s licenses, indicate where the second license was issued as well.

Line 21: Voter registration

If you were registered to vote during the tax year, check ‘Yes’ and enter the jurisdiction where you were registered. If not, select ‘No’ and move on to Line 22.

Line 22: Homestead exemption

If you claimed a homestead exemption were registered to vote during the tax year, check ‘Yes’ and enter the jurisdiction where you claimed the exemption. If not, select ‘No’ and move on to Line 23.

Line 23: Listed addresses

Which address did you list as your residence for completing official documents, forms, etc. You may list up to 5 different addresses.

Line 24: Location of documents

Where did you keep your personal, financial, or legal documents.

Line 25

Where did you earn most of your income during the year? Enter your answer in Line 25.

Line 26: U.S. sourced income

If there is taxable income where the source is not clear, you may use IRS Publication 570 to help determine your income source.

Line 27: Possession sourced income

Did you have any income sourced from U.S. territories or possessions? If so, enter the type of income in Line 27.

Line 28: Location of investments

If you have investments, such as mutual funds, stocks, or certificates of deposit, where were they located?

For stocks and bonds, indicate the country of origin of the stock company or debtor. For U.S. companies or debtors, the state or possession of incorporation or formation.

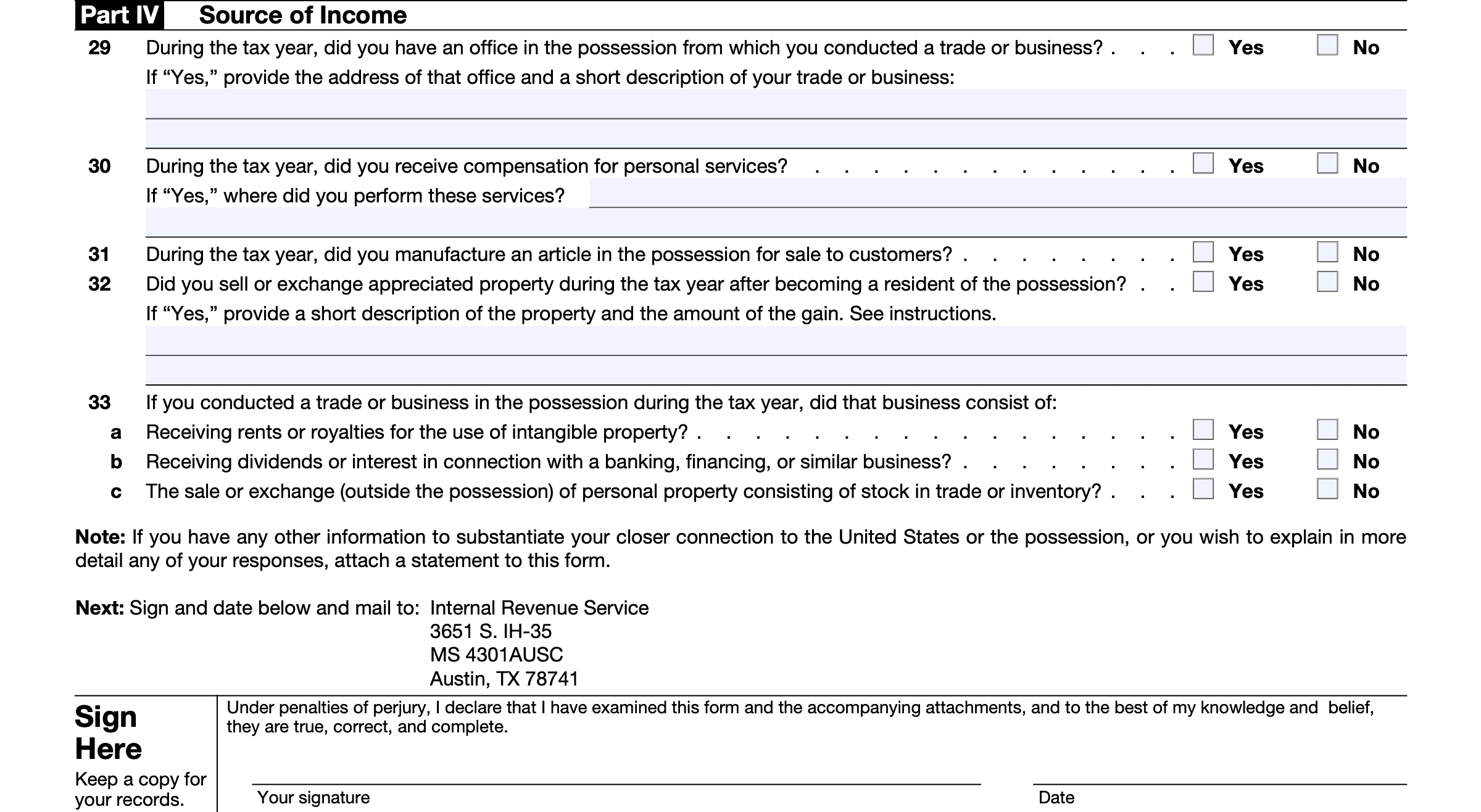

Part IV: Source of Income

Line 29: Office location

If you had an office in the U.S. possession where you conducted business, select ‘Yes,’ then enter the mailing address and a short description of your U.S. trade or business. Otherwise, select ‘No.’

Line 30: Compensation for personal services

If you were compensated for personal services, select ‘Yes’ and annotate where you performed those services. Otherwise, select ‘No.’

Line 31

Did you manufacture an article in the possession for sale to consumers? If so, select ‘Yes.’ Otherwise, select ‘No.’

Line 32: Sale of appreciated property

If you sold property and realized capital gains on the sale after becoming a resident of the possession, select ‘Yes.’ Otherwise, select ‘No.’

Special rules apply to gains from dispositions of certain property within 10 years of becoming a bona fide resident of a U.S. possession. See IRS Publication 570 for more information.

Line 33

Did you conduct any trade or business in the possession during the tax year? If no, skip Line 33 and move to the signature field.

If so, indicate whether the business consisted of:

- Receiving rents or royalties for the use of intangible property

- Receiving dividend or interest payments connected to banking or finance

- Sales or exchanges of personal property that consisted of stock in trade or inventory

Signature

Sign and date the form as applicable. Please note that this statement is signed under penalty of perjury.

Who must file IRS Form 8898?

All taxpayers must file Form 8898 for the tax year in both of the following conditions apply:

- Your worldwide gross income in that tax year is more than $75,000, and you either

- Take a position for U.S. tax purposes that you became a bona fide resident of a U.S. possession after a tax year for which you filed a U.S. income tax return as a citizen or resident of the United States, but not as a bona fide resident of the possession.

- You are a citizen or resident of the United States who takes the position for U.S. tax purposes that you ceased to be a bona fide resident of a U.S. possession after a tax year for which you filed an income tax return as a bona fide resident of the possession. This tax return filing can be filed with the IRS or the applicable territory’s tax department.

- You take the position for U.S. tax purposes that you became a bona fide resident of Puerto Rico or American Samoa after a tax year for which you were required to file an income tax return as a bona fide resident of the U.S. Virgin Islands, Guam, or the CNMI.

Video walkthrough

Watch this instructional video to learn the best way to file IRS Form 8898.

Frequently asked questions

You must file Form 8898 by the due date of your federal income tax return filing. This includes any extensions.

You must file Form 8898 by mail. Mail your completed form to the following address:

Internal Revenue Service

3651 S. IH-35

MS 4301AUSC

Austin, TX 78741

If the IRS determine that you are required to file Form 8898 for any tax year, and you either fail to file, do not include all required information, or the form includes incorrect information, you may be subject to a penalty of $1,000. Penalty relief may be available if such failure is due to reasonable cause and not willful neglect. This penalty is in addition to any criminal penalty that may be imposed.

Special residency rules may apply to military members of the U.S. Armed Forces. Please refer to the form instructions for more detail.

Where can I find a copy of IRS Form 8898?

You can find IRS forms such as IRS Form 8898 on the Internal Revenue Service website. For your convenience, we’ve uploaded the most current version of this tax form as a PDF file right here in our article.