IRS Form 5405 Instructions

If you purchased a home between 2008 and 2010, you may have taken advantage of the first-time homebuyer tax credit to help buy your first house. And you may still be responsible for paying back this credit in equal annual installments today, on IRS Form 5405.

In this article, we’ll walk through everything you need to know about IRS Form 5405, including:

- How to complete IRS Form 5405

- How to calculate your tax credit repayment

- What happens if you sell or otherwise dispose of your home

Let’s start by walking through IRS Form 5405, beginning at the top.

Table of contents

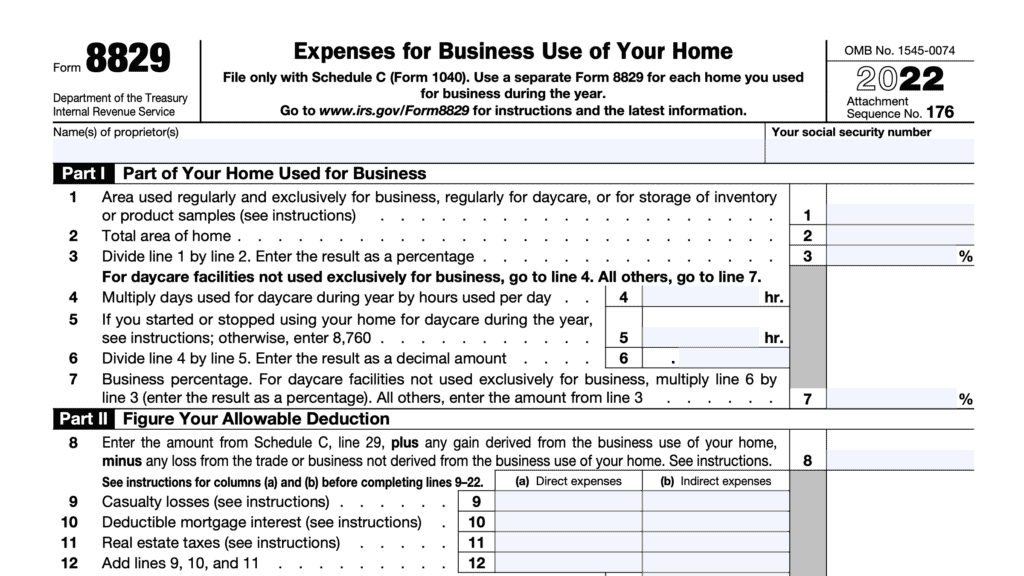

How do I complete IRS Form 5405?

There are 3 parts to this one page tax form:

- Part I: Disposition or Change in Use of Main Home for Which the Credit Was Claimed

- Part II: Repayment of the Credit

- Part III: Form 5405 Gain or (Loss) Worksheet

Let’s start with Part I.

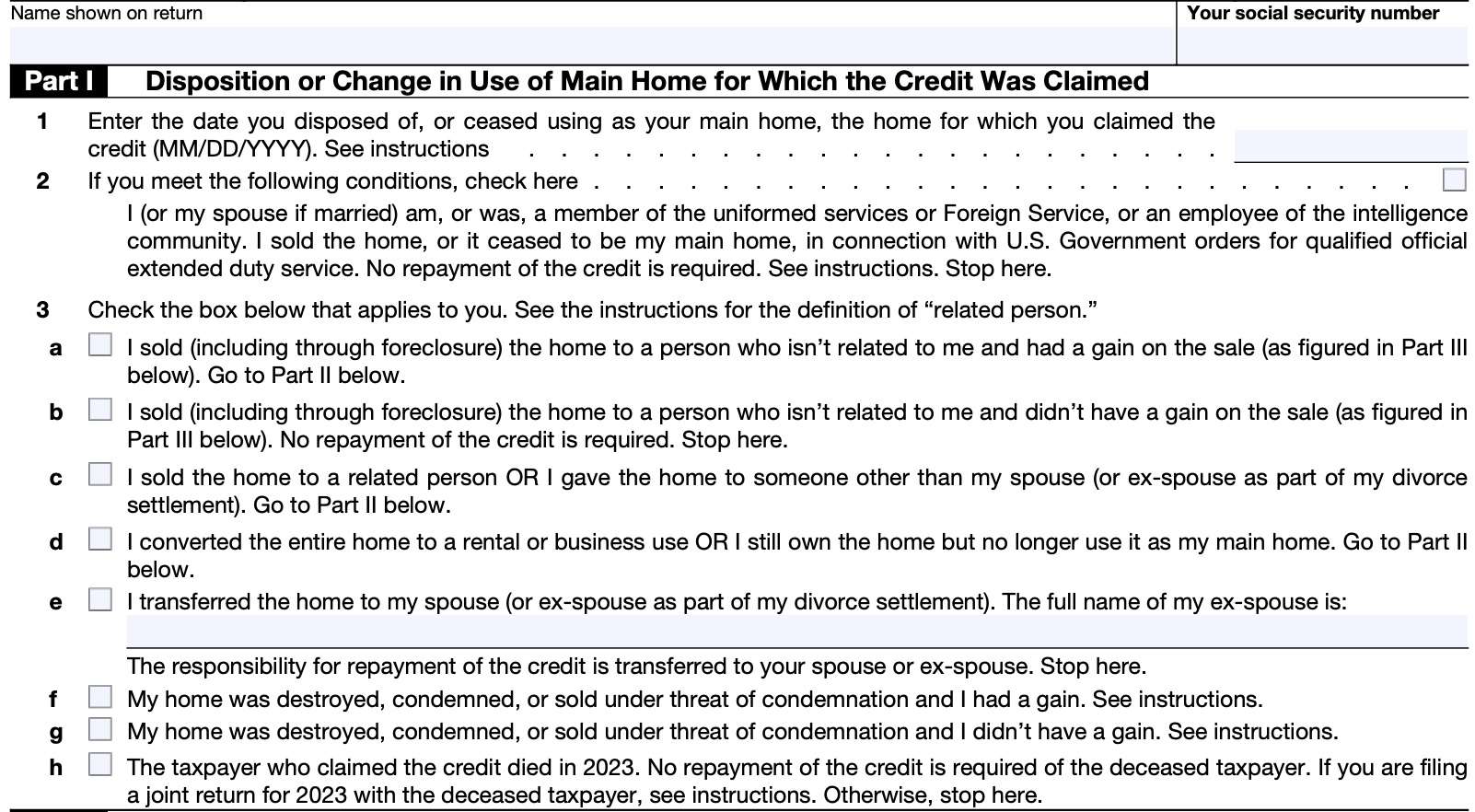

Part I: Disposition or Change in Use of Main Home for Which the Credit Was Claimed

Complete Part I if the following occured:

- You claimed the first-time homebuyer tax credit for a new home that you purchased in 2008, and

- You either disposed of the home or you stopped using it as your primary residence during the tax year

This includes situations in which:

- You sold the home (including through foreclosure)

- You converted the entire home to business or rental property

- You abandoned the home (except in connection with a sale or foreclosure)

- The home was destroyed, condemned, or disposed of under threat of condemnation; or

- The taxpayer who claimed the credit died during the tax year.

At the very top of IRS Form 5405, you’ll want to verify that your name and Social Security number are properly reflected in the same way as in your tax return.

After that, we’ll start with Line 1.

Line 1

Enter the date that you either disposed of or stopped using the home as your main home. Use the MM/DD/YYYY format for your entry.

Line 2

Check the box if either you or your spouse:

- Are, or were, a member of the uniformed services or Foreign Service, or an employee of the intelligence community, and

- You sold the home or the home stopped being your principal residence after 2008 because you or your spouse received U.S. government orders to serve on qualified official extended duty

Qualified official extended duty

The Internal Revenue Service considers you to be serving on qualified official extended duty if you:

- Serve at a duty station that is at least 50 miles from your main home, or

- Live in U.S. government quarters under U.S. government orders.

To be considered extended duty, your orders must call or order you to active duty for either:

- A period of more than 90 days, or

- An indefinite period

Uniformed services

The uniformed services are:

- The Armed Forces of the United States, which include:

- Army

- Navy

- Air Force

- Marine Corps

- Coast Guard

- The commissioned corps of the National Oceanic and Atmospheric Administration, and

- The commissioned corps of the Public Health Service

Foreign service

For purposes of the first-time home buyer credit, you are a member of the Foreign Service if you are any of the following

- A chief of mission.

- An ambassador at large

- A member of the Senior Foreign Service.

- A foreign service officer.

- Part of the Foreign Service personnel

Intelligence community

For purposes of the tax credit, you are an employee of the intelligence community if you are an employee of any of the following.

- The Office of the Director of National Intelligence

- The Central Intelligence Agency

- The National Security Agency

- The Defense Intelligence Agency

- The National Geospatial-Intelligence Agency

- The National Reconnaissance Office and any other office within the Department of Defense for the collection of specialized national intelligence through reconnaissance programs

- Any of the intelligence elements of the Army, the Navy, the Air Force, the Marine Corps, the Federal Bureau of Investigation, the Department of the Treasury, the Department of Energy, and the Coast Guard

- The Bureau of Intelligence and Research of the Department of State

- Any of the elements of the Department of Homeland Security concerned with the analyses of foreign intelligence information

Line 3

Check the applicable box from the following.

Box 3a

Check Box 3a if you:

- Sold the home (including through foreclosure) to an unrelated person, and

- You realized a gain on the sale

You must complete Part III to calculate the gain on the sale. After checking Box 3a, proceed to Part II, below.

Box 3b

Check Box 3b if you:

- Sold the home (including through foreclosure) to an unrelated person, and

- You did not realize a gain on the sale, as determined in Part III

Once you check Box 3b, stop here. You do not need to complete Part II, and there is no repayment obligation.

Box 3c

Check Box 3c if you:

- Sold the home (including through foreclosure) to a related person, or

- You gave the home to someone other than your spouse or ex-spouse as part of a divorce settlement

After checking Box 3c, proceed to Part II, below.

Related persons

Related persons include the following:

- Your spouse, ancestors (parents, grandparents, etc.), or lineal descendants (children, grandchildren, etc.)

- A corporation in which you directly or indirectly own more than 50% in value of the outstanding stock of the corporation.

- A partnership in which you directly or indirectly own more than 50% of the capital interest or profits interest.

Box 3d

Check Box 3d if you either:

- Converted your home to rental or business use, or

- No longer use it as your primary residence

However, do not check this box if you converted only a part of the home to rental or business use and you continue to use the other part as your main home. Don’t file Form 5405 for this conversion.

Enter your annual repayment on IRS Schedule 2, Line 10.

Proceed to Part II.

Box 3e

Check this box if you meet either of the following conditions:

- You transferred the home to your spouse

- You and your spouse divorced and you transferred the home to your ex-spouse as part of the divorce settlement.

- Include the full name of your ex-spouse in the space provided

The spouse who received the home is responsible for repayment of the first-time homebuyer credit under the rules provided in these instructions.

Box 3f

Check Box 3f if:

- Your home was destroyed, condemned, or sold under threat of condemnation, and

- You had a gain

Use Part III to determine if you had a gain or not. The amount of the first-time homebuyer credit that you must repay is limited to the amount of gain realized.

However, if you acquired or plan to acquire a new home within 2 years of the event, you must generally continue to repay the credit over a 15-year repayment period that began with your 2010 tax return.

Complete Part II to figure your installment payment for 2022 if the event wasn’t a sale to a related person.

If you don’t acquire a new home within the 2-year period, the following rules generally apply:

- If the event occurred in 2020, you should have repaid the full amount of the credit when you filed your your 2022 federal income return. You don’t have to file Form 5405.

- Instead, you would have entered the repayment on your 2022 Schedule 2 (Form 1040), line 10.

- If the event occurred after 2020, your annual repayment requirement continues until the year in which the 2-year period ends.

- On the tax return for the year in which the 2-year period ends, you must include all remaining installments as an increase in tax.

For example, if the event occurred in 2023, then your annual repayment would continue until 2025, when it would be due in full.

Box 3g

Check Box 3g if:

- Your home was destroyed, condemned, or sold under threat of condemnation, and

- You did not have a gain

Use Part III to determine if you had a gain or not. If you do not have a gain, then you do not have to repay the tax credit.

Box 3h

The taxpayer who claimed the credit died in 2023. No repayment of the credit is required of the deceased taxpayer.

If you are filing a joint return for 2023 with the deceased taxpayer, then complete IRS Form 5405 with the deceased taxpayer’s information only. Check Box 3h and file the completed form with your joint return.

If you claimed the credit on a joint tax return with the deceased taxpayer, the following rules also apply.

- If you didn’t dispose of the home and the home is still your main home, don’t complete a separate Form 5405 with your information

- If you disposed of the home or the home ceased to be your main home, then complete a separate Form 5405 with your information only.

- Check the appropriate box on for Line 3 then file the form with your joint return.

If you originally claimed the credit on a joint return, these instructions apply even if you aren’t filing a joint return with the deceased taxpayer for the tax year.

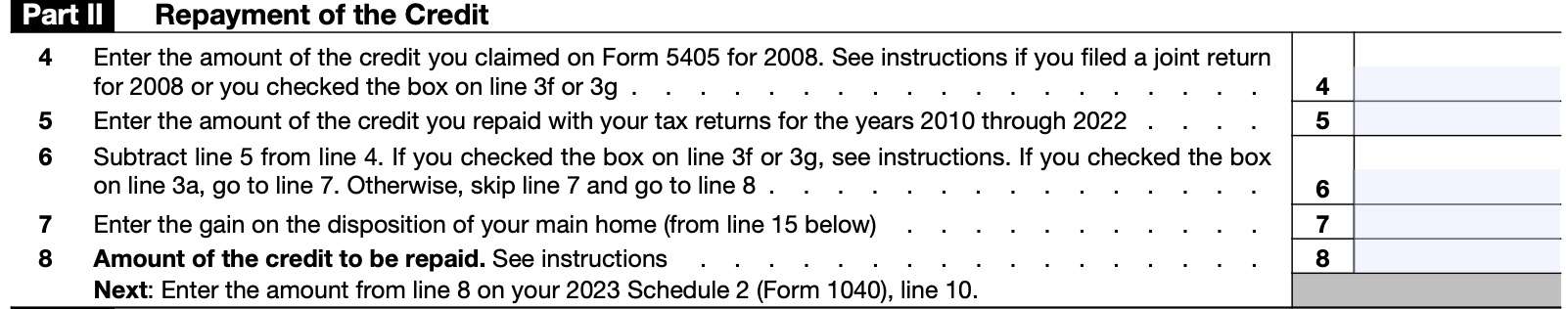

Part II: Repayment of the Credit

If you owned the home and used it as your main home during the entire tax year, you must continue repaying the credit with your personal income tax return. You don’t have to complete Form 5405.

Instead, enter the repayment on your IRS Schedule 2, Line 10.

If you are required to repay the credit because you disposed of a home you purchased, or that home ceased to be your main home, you must generally repay the balance of the unpaid credit with the following income tax return.

However, there are two exceptions that may apply:

- If your home was destroyed or condemned, or you disposed of the home under thread of condemnation, and you did not acquire a new primary residence within 2 years of event

- Exceptions exist for certain members of the uniformed services, Foreign Service, or employees of the intelligence community

If you and your spouse claimed the credit on a joint return, each spouse is treated as having been allowed half of the credit for purposes of repayment of the first-time homebuyer credit. Each of you must file a separate Form 5405 to notify the IRS that you disposed of the home or ceased to use it as your main home and figure the amount of the repayment.

Line 4

In Line 4, enter the amount of the credit you claimed on Form 5405 for 2008.

Joint return

If you claimed the credit on a joint return but your spouse died, enter one-half (½) of the credit you claimed. The remaining half (that is, your spouse’s half) doesn’t have to be repaid.

If you and your spouse claimed the credit and the home was later transferred to you by your spouse (or ex-spouse as part of a divorce settlement), enter the total credit claimed by both you and your spouse (or ex-spouse).

Condemnation

Enter the credit you claimed for a home that was destroyed or that you sold through condemnation or under threat of condemnation.

Line 5

Enter the total repayment of first-time homebuyer credit for tax years 2010 through 2022.

Line 6

If you checked Box 3a, go to Line 7. Also, if you checked Box 3f and the event was not a sale to a related person, go to Line 7.

If you checked Box 3f or Box 3g, and the event was a sale to a related person, then skip Line 7 and go to Line 8.

Otherwise, skip Line 7 and go to Line 8.

Line 7: Gain on disposition

If you were directed to Line 7, then enter the gain on the disposition of your main home from Line 15, below.

Line 8: Amount of credit to be repaid

The amount you enter here depends on which box you checked under Line 3, above.

If you checked Box 3a

Enter the smaller of:

If you checked Box 3c or 3d

Enter the Line 6 amount here.

If you checked Box 3f or 3g

The following rules apply:

If you did not sell the home to a related person, then your repayment is limited to the gain.

If Line 7 is less than Line 6, then divide Line 7 by 3.0. Otherwise, divide Line 4 by 15.0.

This is the minimum amount you must repay with your tax return. Enter this amount (or a larger amount) on Line 8.

If you sold the home to a related person

Divide Line 4 by 15.0. Enter this amount (or a larger amount) on Line 8.

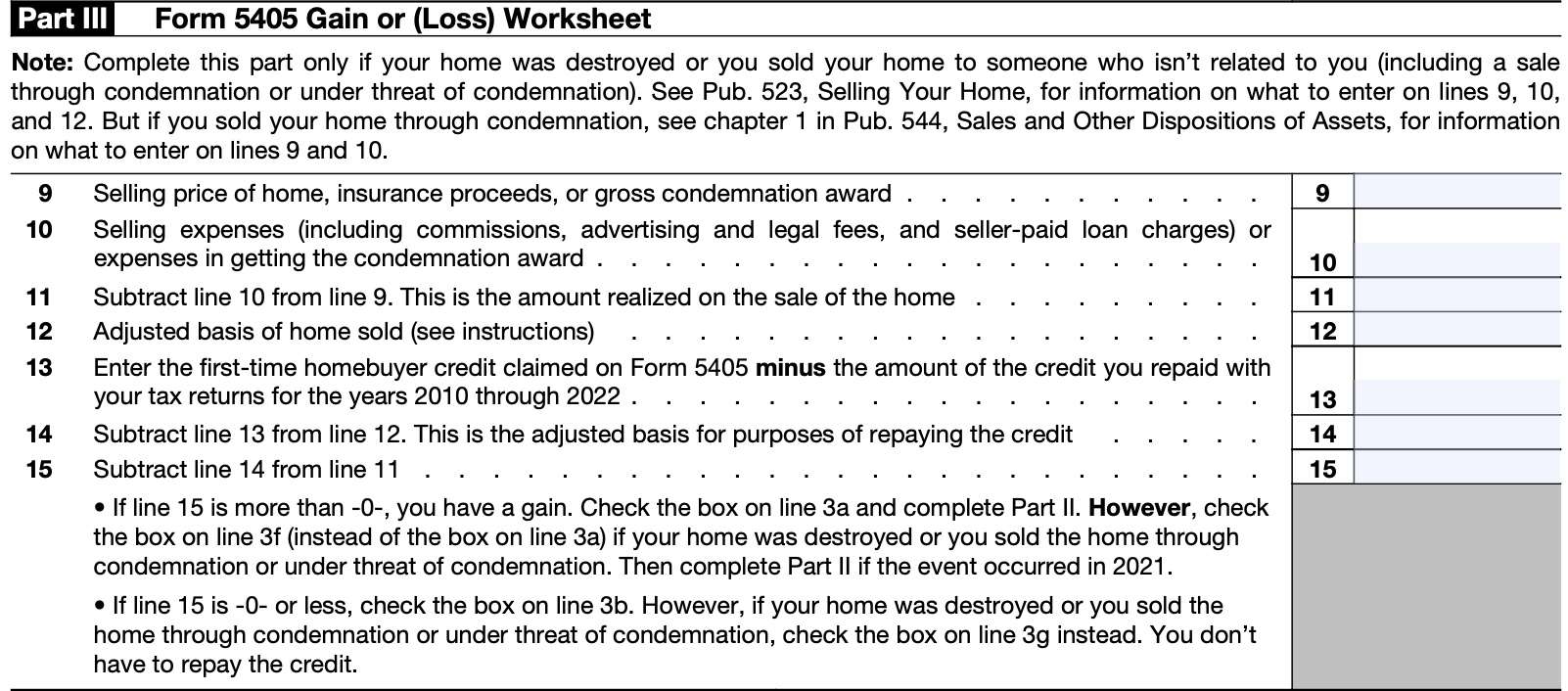

Part III: Form 5405 Gain or (Loss) Worksheet

In Part III, you’ll calculate the gain or loss on the disposition of your home. You only need to complete Part III if:

- Your home was destroyed, or

- You sold your home to someone who was not related to you

Use IRS Publication 523, Selling Your Home, if you need information for Lines 9 and 10. If you sold your home through condemnation, see IRS Publication 544, Sals and Dispositions of Assets for information on what to enter in Line 9 and Line 10.

Line 9: Selling price of home, insurance proceeds, or gross condemnation award

Enter the total amount of the sales proceeds, insurance payments, or award related to the disposition of your home.

Line 10: Selling expenses

List any expenses related to the sale or disposition of your home. This may include:

- Real estate commissions

- Advertising costs

- Legal fees

- Seller-paid loan charges

- Expenses associated with receiving a condemnation award

Line 11

Subtract Line 10 from Line 9. This is the amount realized on the sale of the home.

Line 12: Adjusted basis

Enter the adjusted basis of the home you sold.

To calculate adjustments to basis, you may need to complete Worksheet 2 in IRS Publication 523, Selling Your Home.

Watch this video for more information on this worksheet.

Line 13: remaining first-time homebuyer credit

Enter the first-time homebuyer credit previously claimed minus the amount of the credit that you’ve repaid since 2010.

Line 14: Adjusted basis

Subtract Line 13 from Line 12. This is the adjusted basis for purposes of repaying the credit.

Line 15

Subtract Line 14 from Line 11.

If the result is greater than zero, you have a gain.

Check Box 3a and complete Part II.

If your home was destroyed or you sold your home through condemnation, then check Box 3f, then complete Part II.

If the result is zero or less, then you do not have to repay the credit.

Check Box 3b.

If your home was destroyed or you sold your home through condemnation, then check Box 3g.

Video walkthrough

Watch this instructional video for step by step detail on completing IRS Form 5405 after the sale of your home.

Frequently asked questions

Taxpayers who purchased a first home between 2008 and 2010 were eligible for a maximum credit of up to $8,000, payable in equal annual installments over a 15-year repayment period. Taxpayers use Form 5405 to report their annual repayment of this tax credit or disposition of their home.

No. The eligibility period for this tax credit ended in 2010. Although there are discussions about reintroducing a similar tax credit, no new credit has been signed into law.

Where can I find IRS Form 5405?

As with other tax forms, you can find IRS Form 5405 on the IRS website. For your convenience, we’ve enclosed the latest version of this tax form here in this article.

Related tax articles

This tax form is one of the fillable tax forms provided by the Internal Revenue Service, to help taxpayers reduce their tax preparation costs. To see more forms like this, visit our free fillable tax forms page, where you’ll also find articles like this.

Unlike the IRS, our articles contain step by step instructions for each tax form, as well as video walkthroughs. You can also check out all of our videos by subscribing to our YouTube channel!