IRS Form 2159 Instructions

When a taxpayer files an installment agreement request with the Internal Revenue Service to pay down their back taxes, they may be asked to file apply for a payroll deduction installment agreement. This article will walk you through how to use IRS Form 2159 to:

- Set up a voluntary payroll deduction agreement

- Pay down your federal tax debt

- Avoid having your property seized due to a notice of levy

Let’s start with step by step guidance on completing Form 2159.

Table of contents

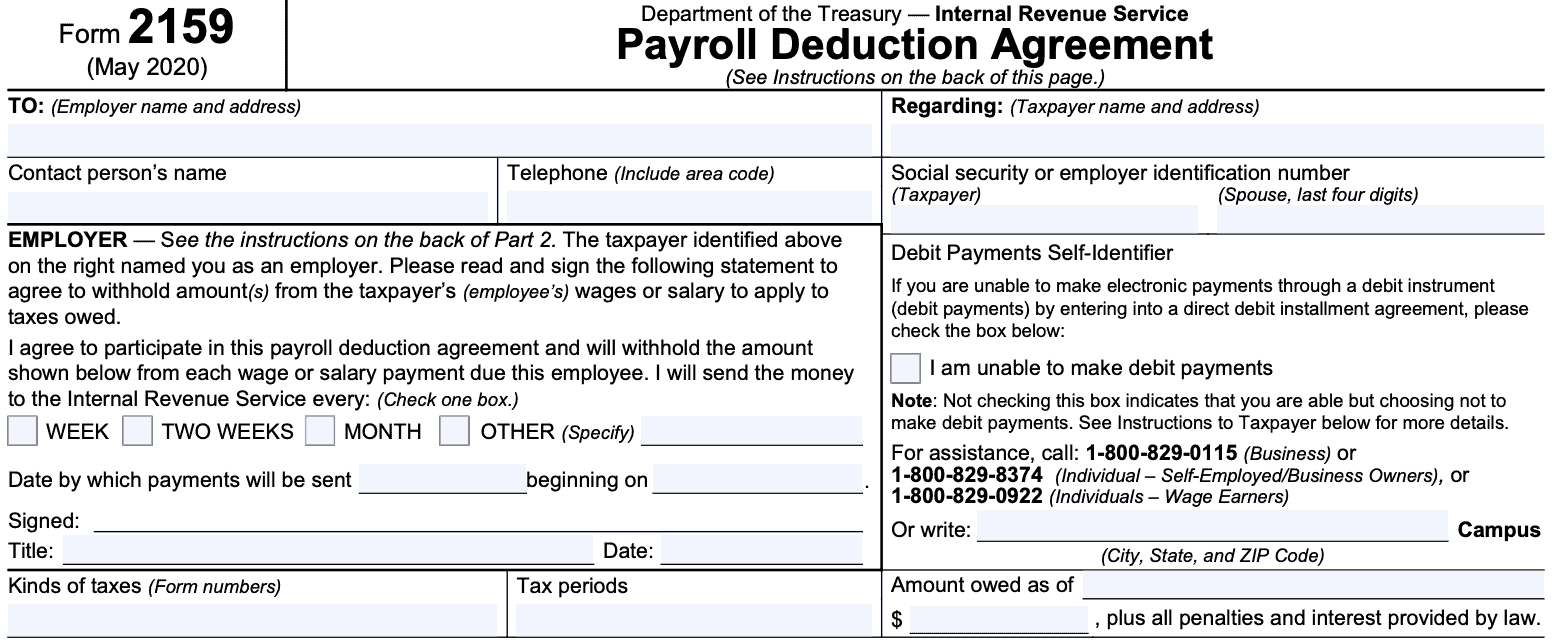

How do I complete IRS Form 2159?

We’ll go step by step through this government form, so you can better understand how to set up your tax payments. Before we begin, it’s important to point out that there are three copies of Form 2159:

- Acknowledgement copy (to be returned to IRS for processing)

- Employer copy

- Taxpayer copy

All of these copies say virtually the same thing, but we’ll only walk through one version of the form, starting with the top.

Top of Form 2159

The top of the form contains taxpayer and employer information. In the top left corner, the employer will enter the following information:

- Employer name and address

- Employer’s point of contact. This probably will be someone in the payroll or HR department.

- Telephone number

- Appropriate box for payroll schedule:

- Weekly

- Biweekly (every two weeks)

- Monthly

- Other, such as semi-monthly (twice per month)

- Date of first payment

- Signature, title, and date

The taxpayer’s information goes on the right hand side. This includes:

- Taxpayer name and address

- Social Security or employer identification number

- Full number for taxpayer

- Last 4 digits for taxpayer spouse

- Check box whether able to make debit payments

Finally, information about the tax return (or tax returns) in question:

- Type of tax form

- Tax periods covered by this payment request

- Amount owed as of the application date

IRS Form 2159: Terms of Agreement

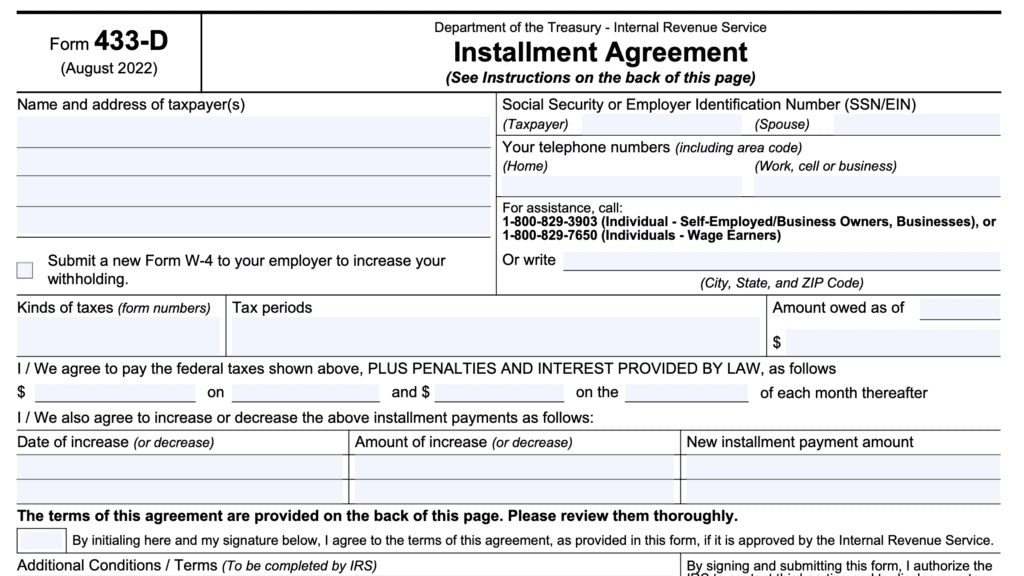

In the middle part of this tax form, the taxpayer agrees to the following:

- How often their employer pays them

- Monthly payment amount

- Date of first payment

- Whether or not to increase or decrease the monthly payment amount

Most of this section does not require the taxpayer to complete anything. But it contains some important information that each taxpayer should know.

The IRS can modify or terminate the installment agreement under certain conditions

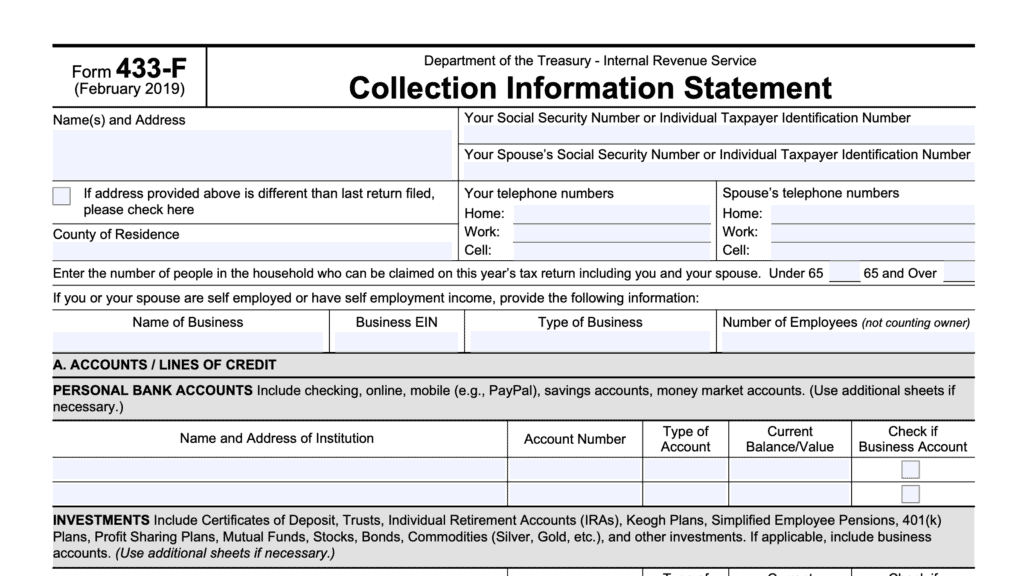

The IRS approves installment agreements based on the facts currently in their possession. This includes things like:

- Taxpayer’s current financial condition

- Payment history

- Keeping current on filing federal tax returns

If something changes, the IRS reserves the right to modify or terminate an agreement. The following are some of the changes that might cause the IRS to modify or terminate an existing agreement:

- If you do not make tax payments as agreed

- If you do not file future tax returns or pay other federal taxes when due, or

- If you do not update your financial information when the IRS asks you to

As part of the approval, the IRS will determine how often (if at all), to review your financial information and change the agreement.

You probably won’t see a tax refund while you’re making installment agreement payments

While paying down your back taxes, you might be subject to tax refund offsets. This is when the IRS garnishes your federal tax refunds to pay down your outstanding tax debt.

The IRS reserves the right to apply tax refunds towards an existing tax liability under Section 6402 of the Internal Revenue Code.

You’re going to pay a user fee

In this installment agreement, you agree to pay a one-time user fee of $225, which the IRS will deduct from your first payment. If you meet the criteria for low-income taxpayer status, you may reduce that user fee to $43 by filing IRS Form 13844, Application For Reduced User Fee For Installment Agreements. This reduced fee may be waived or reimbursed if you meet certain conditions.

Also, if you default on your original payroll deduction agreement, you’ll pay a reinstatement fee of $89 ($43 reduced fee, if applicable) to reinstate your agreement.

You may still face a tax lien

When I worked with a previous client on paying down over $100,000 in back taxes, the IRS agreed not to place a lien on her house if she could reduce the outstanding balance to under $50,000.

The only way to completely avoid a federal tax lien is to pay all federal taxes when they are due. Even the most aggressive payment plan leaves some possibility for the IRS to place a tax lien on your property.

Signature field

The signature field is fairly self-explanatory. You (and your spouse, if applicable), sign and date the form. If you are a corporate officer or partner filing on behalf of the business, put your title in the title field.

For IRS use only

You do not need to complete this field, as the revenue officer will do this, according to the terms outlined in the Internal Revenue Manual. However, a couple of things stand out:

RSI fields

To the left, you’ll see RSI boxes. RSI stands for Review Suppress Indicator, and indicates when the agreement might be subject for review.

If your review is marked ‘1,’ that indicates your payment plan is expected to pay your outstanding balance quickly enough to not warrant a future review. This is subject to change if you don’t make your timely payments.

An RSI of 5 (for individual returns) or 6 (for business returns), indicates that your record will be reviewed at the two year mark.

Earliest CSED

CSED is the collection statute expiration date. Otherwise referred to as the last day the IRS can legally pursue an outstanding tax liability.

We wrote a separate article on how to find out your IRS CSED. Or you can look in this block.

A notice of federal tax lien

You may or may not have a tax lien placed on your property. But you should be able to tell when because one of 4 fields will be marked:

- A lien has already be filed

- A lien will be filed immediately

- A lien will be filed when the outstanding tax is assessed

- A lien may be filed if the taxpayer defaults on the agreement

Approval block

PPIAs generally require a manager’s approval. If a revenue officer accepts an application, the manager reviews it before final approval to ensure the following:

- Thorough analysis of financial statement(s)

- Consideration of other available and appropriate means of collection including, but not limited to liquidation of assets, levy, and offer in compromise

- The rationale for allowing the taxpayer to retain assets with equity

- The RO did not ask the taxpayer to take actions with respect to requiring liquidation of assets that put him or her into a hardship situation

What is IRS Form 2159?

IRS Form 2159, Payroll Deduction Agreement, is the tax form that wage earners can use to set up an installment plan for their federal tax liability. These voluntary payments serve the same purpose as a direct debit installment agreement from a taxpayer’s bank accounts.

That is, having a monthly payment plan helps the United States Treasury to ensure a taxpayer’s consistent progress in paying down their back taxes.

Do I have to use IRS Form 2159 to set up an installment payment plan?

No. According to the IRS website, every taxpayer has several options to satisfy an outstanding tax bill.

Pay your balance due immediately

Of course, this is the IRS’ preferred payment method, even if it’s only a partial payment. And most taxpayers facing collection actions are probably dealing with some sort of financial hardship. So it’s the payment method that most of these taxpayers are least able to afford.

To make an immediate partial payment (or full payment) on your outstanding balance, you can go to the IRS website’s payment page. From there, you can:

- Establish or log into an online IRS account

- Pay from a bank account via DirectPay

- Make a payment through the Electronic Federal Tax Payment System (EFTPS)

- Make a payment by debit card, credit card, or digital wallet.

- Using this payment method may incur processing fees, although low-income taxpayers may qualify for a reduced user fee

Set up a short-term payment plan

According to the IRS, a short-term payment plan is one that satisfies the outstanding balance within 180 days.

There are no setup fees to establish a short-term payment plan, and you can use the various options that you would to make a lump sum payment:

- DirectPay

- EFTPS

- Debit card, credit card, or digital wallet

However, long-term payment plans are available if a short-term IRS payment plan does not allow for manageable monthly payments.

Individual taxpayers may set up a short-term payment plan as long as the unpaid balance is less than $100,000. While there are no set up fees, penalties and interest will accrue on the outstanding balance until the tax debt is completely satisfied.

Set up a long-term payment plan

There are two tax payment options for setting up a long-term plan:

Option 1

Pay through Direct Debit (automatic monthly payments from your checking account), also known as a Direct Debit Installment Agreement (DDIA).

Option 2

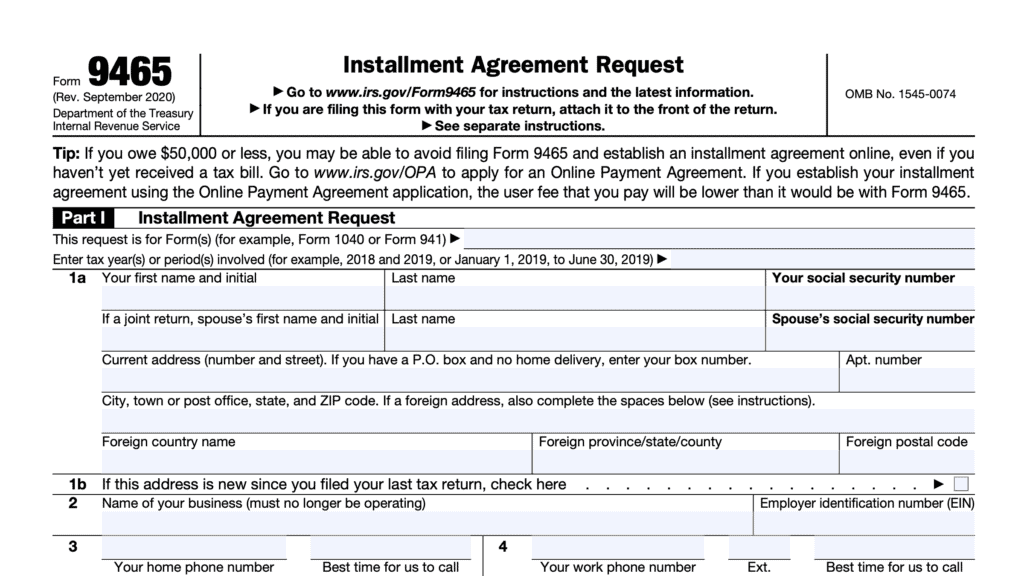

Apply for installment agreement payments using IRS Form 9465. The setup fees are a little higher than through the direct debit plan, but taxpayers have a little more control over their tax payment options.

One of those options is to request payroll deductions by selecting Box 14 and attaching a completed Form 2159 to your installment agreement request.

Let’s discuss how to complete this tax form.

What happens if I don’t file IRS Form 2159?

Things don’t get better. You can face one or more of the following:

Notice of federal tax lien

The IRS retains the right to place a lien on business or individual property in order to satisfy outstanding taxes. This doesn’t seize the property, but rather lays a first claim to proceeds should the owner sell the property.

However, the IRS can escalate this by issuing a notice of levy.

Notice of levy

A notice of levy means that the IRS will actually seize the taxpayer assets to pay and outstanding federal tax liability.

Tax Topic 201 contains more details about the collections process.

Criminal charges

The IRS cannot arrest a taxpayer for simply not paying taxes. However, if the IRS finds evidence that you committed other crimes in the act of avoiding taxes (such as committing tax fraud by filing a false return), you can face criminal or civil penalties.

Video walkthrough

Watch this brief tutorial where we go through Form 2159, step by step.

Frequently asked questions

If you do not enter into an agreement that the IRS can accept, then the IRS will continue to take collection actions against you. This might include filing a notice of federal tax lien, filing a notice of levy, seizing property, and other civil penalties. If your tax issues are related to criminal activity, you may be subject to criminal charges.

The IRS offers taxpayers several options. You may pay the complete balance due, set up a short-term payment plan (180 days or less), or establish a long-term payment plan. Certain taxpayers may be able to set up their installment plan on the IRS website.

Where can I find IRS Form 2159?

You can download a copy of this tax form from the IRS website or by selecting the file below.