Reporting Tax Fraud

If you’ve been the victim of a tax fraud, or you suspect someone is committing tax-related financial fraud, you may wish to report them to the federal government. After all, most honest taxpayers wish to see everyone pay their fair share of taxes.

However, there are many different types of tax-related criminal activity. In this article, we’ll walk through some of the most common types of tax abuse, so you know:

- How to identify the type of tax fraud being committed

- How to report the tax fraud

- Which IRS form to use to report a specific tax crime

Let’s start by jumping into a definition of tax fraud itself.

Contents

Table of contents

- What is tax fraud?

- How do I report tax fraud?

- Use IRS Form 3949-A if you suspect a person or business Is breaking tax laws

- Use IRS Form 14242 to report abusive tax promotions or tax preparers

- Use IRS Form 14157 to report a complaint about your tax return preparer

- Use IRS Form 14157-A to report suspected fraud or tax preparer misconduct

- Use IRS Form 13909 to report a complaint against a tax-exempt organization

- What if my identity is stolen?

- Am I eligible for a reward?

- Frequently asked questions

- Related articles

- What do you think?

What is tax fraud?

According to the Internal Revenue Service, tax fraud is often defined as an intentional wrongdoing, on the part of a taxpayer, with the specific purpose of evading a tax known or believed to be owing.

To be considered tax fraud, there must be two elements:

- Taxes that are due, and that the taxpayer actually owes

- Fraudulent intent

In other words, the taxpayer must actually have committed specific acts, such as filing fraudulent returns, which result in an unlawful gain. Furthermore, it is the federal government’s responsibility to prove the fraudulent intent. This can be done in a civil fraud case, in a criminal fraud case, or both.

Examples of tax fraud

Examples of tax fraud might include:

- Falsifying or altering documents to hide true income or to reduce tax responsibility

- Hiding income from the federal government

- Failure to withhold enough taxes

- Failure to pay personal income tax or business taxes

- Failure to obey applicable tax laws

- Claiming false exemptions or deductions to lower tax liability

How do I report tax fraud?

Depending on the nature of the tax fraud, you may be asked to report the incident in one of several different ways. We’ll take a look at different types of tax crimes so you can decide how to report the suspected fraudulent activity.

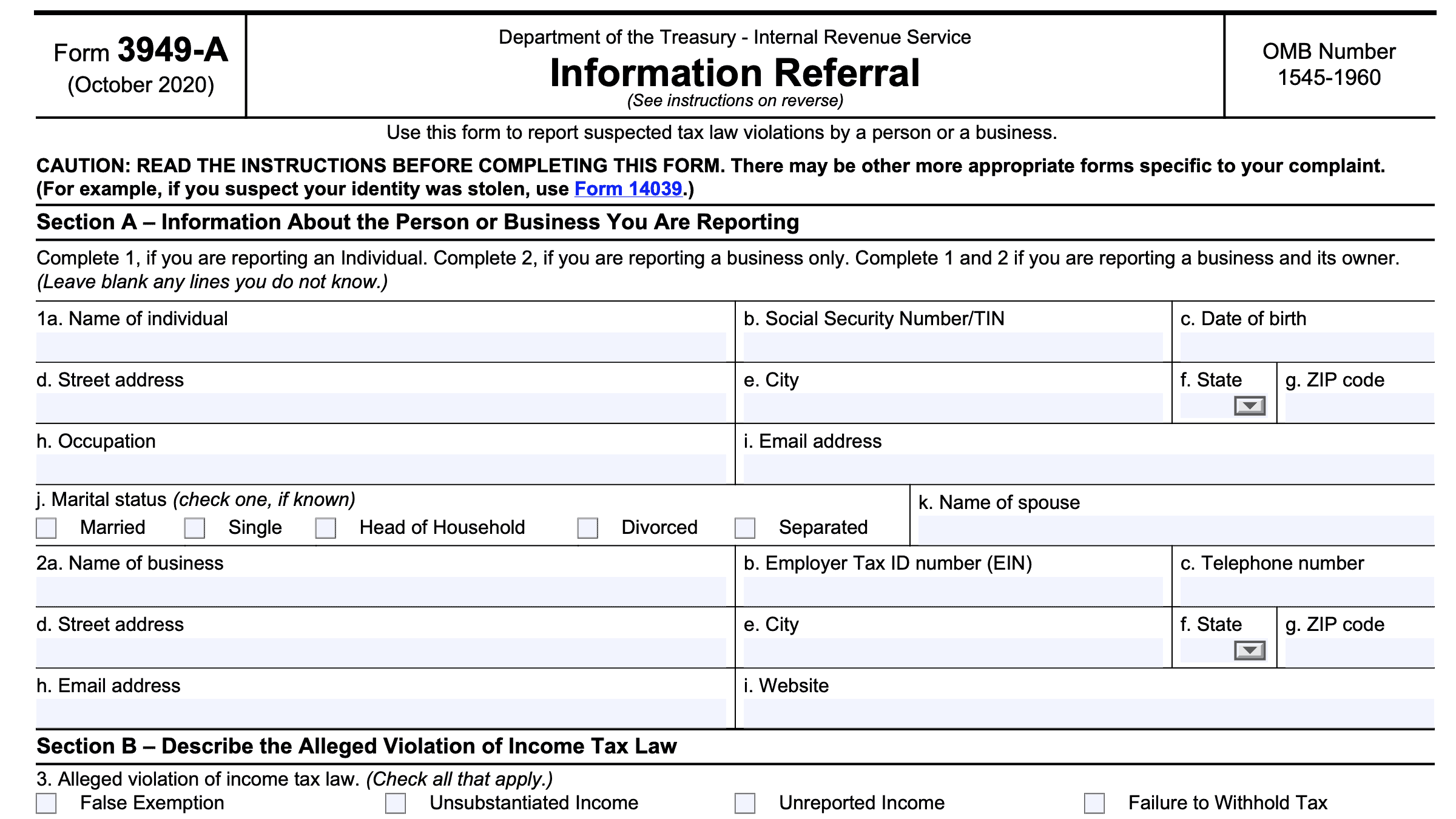

Use IRS Form 3949-A if you suspect a person or business Is breaking tax laws

IRS Form 3949-A, Information Referral, is the general tax fraud referral form that you may use if you suspect an individual or business is not complying with tax laws.

You may submit this IRS form online or by mail. However, the Internal Revenue Service will not accept this report over the phone. That is the purpose of the tax fraud hotline.

Types of violations to report using Form 3949-A

Below is a list of suspected violations that you may consider reporting using Form 3949-A:

False Exemption: Claimed persons as dependents they are not entitled to claim.

False Deductions: Claimed false or exaggerated deductions to reduce their taxable income.

Multiple Filings: Filed more than one tax return to receive fraudulent refunds.

Organized Crime: Member of a group of persons who engaged in illegal enterprises such as drugs, gambling, loansharking, extortion, or laundering illegal money through a legitimate business.

Unsubstantiated Income: Reported false income from an unverifiable source in order to get a false refund.

Earned Income Credit: Claimed Earned Income Credit which they were not entitled to receive. They may have reported income they did not earn or claimed children they were not entitled to claim.

Public/Political Corruption: Public official or politician violated laws against using their position illegally for personal gain.

False or Altered Documents: Changed documents, such as a Form W-2 or Form 1099, or created fake documents to substantiate a false tax refund.

Unreported Income: Received cash or other untraceable payments, such as goods or services, and did not report the income.

Narcotics Income: Received income from illegal drugs or narcotics.

Kickback: Received illegal payments or kickbacks in exchange for referring the business of a government agency or other business towards a company or for influencing business decisions that result in part of the payment for the business received or service performed being returned to the person who made the referral.

Failure to Withhold Tax: Individual or business did not withhold legally owed taxes from income paid to their employee(s), such as Social Security or Medicare taxes

Wagering/Gambling: Did not report income received from wagering or gambling.

Failure to File Return: Individual or business has not filed returns legally due.

Failure to Pay Tax: Individual or business has not paid taxes legally due

Call the tax fraud hotline

If you wish to make a tax fraud report, you should contact the IRS hotline. You can call this hotline phone number at: (800) 829-0433.

To file a report against an IRS employee or against a tax professional, you should contact the United States Treasury Inspector General for Tax Administration. You may initiate a complaint online or by calling the hotline phone number at: 800-366-4484.

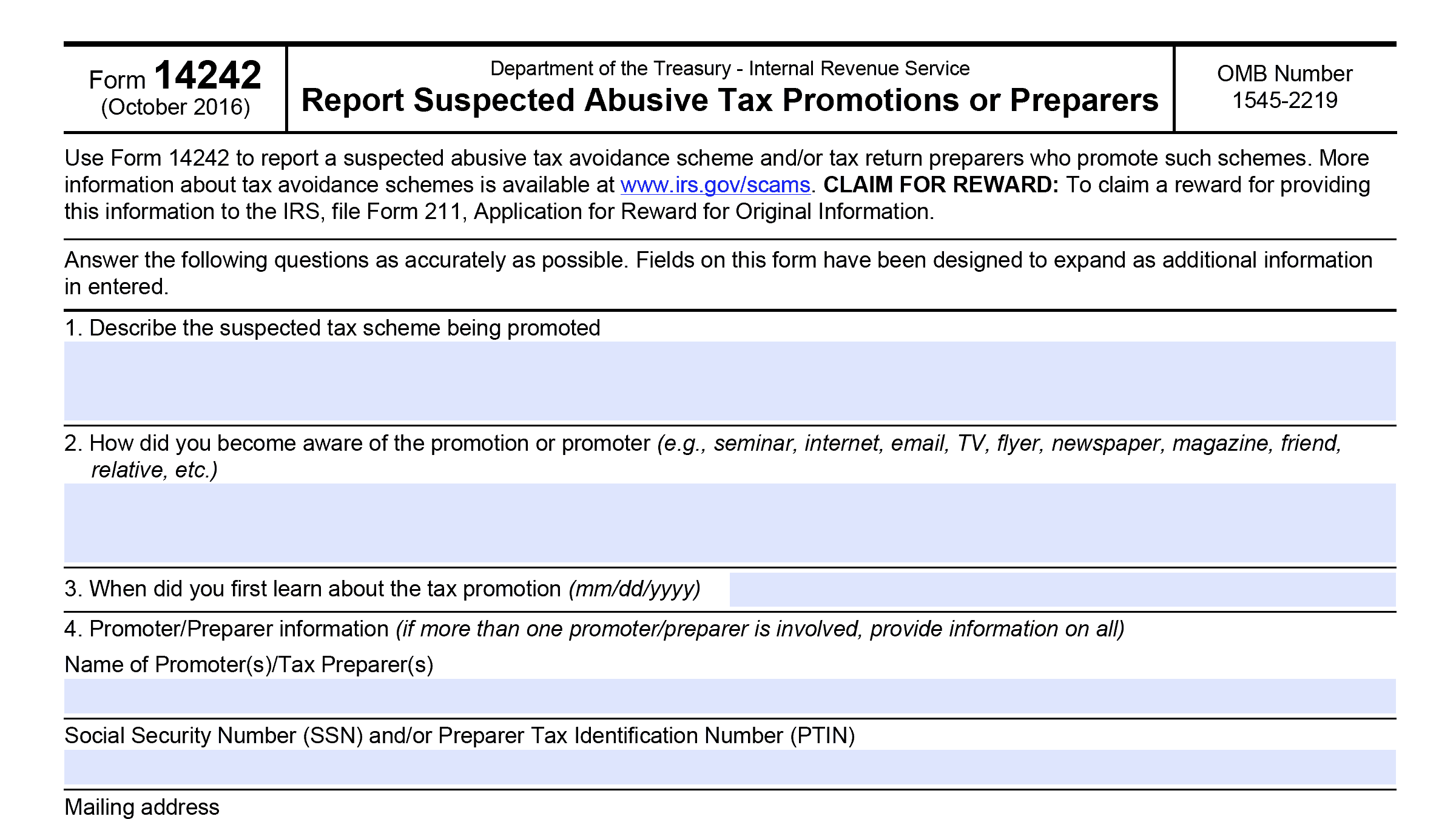

Use IRS Form 14242 to report abusive tax promotions or tax preparers

Use IRS Form 14242, Report Suspected Abusive Tax Promotions or Preparers to report a suspected business who might be running an abusive tax avoidance scheme and/or tax return preparers who promote abusive tax schemes.

You can find additional information about tax avoidance schemes on the IRS Scams website page.

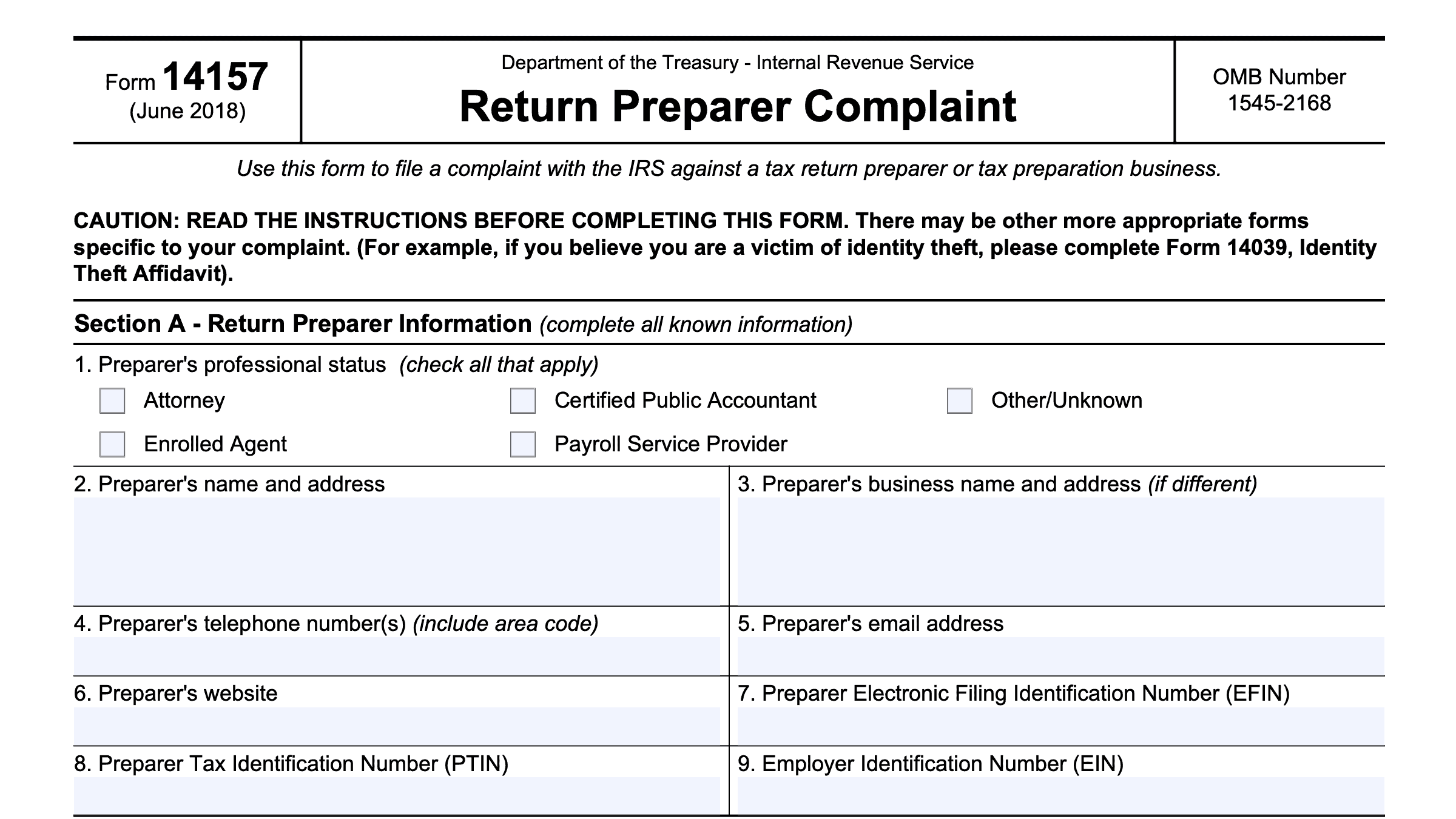

Use IRS Form 14157 to report a complaint about your tax return preparer

Individuals prepare federal tax returns for compensation must follow ethical standards and guidelines as established in Treasury Department Circular 230. If you have a complaint against your tax preparer, the IRS can hold that person accountable if they violated any standards or guidelines contained in this document.

Filing IRS Form 14157, Return Preparer Complaint, allows the IRS to open an investigation to determine whether your tax return preparer violated any federal guidelines.

Types of complaints can include the following:

- Theft of Refund: Diverted refund to unknown account; return filed does not match taxpayer’s copy

- Misuse of e-File: E-filed returns without properly securing taxpayer’s signature)

- Preparer Misconduct: Examples of preparer misconduct include:

- Failure to provide copy of return, return records, sign returns or remit payments for taxes due;

- Misrepresentation of credentials;

- Not filing a tax return on taxpayer’s behalf after agreeing to do so

- Filing a tax return without the taxpayer’s authorization or consent

- Using false Items or documents

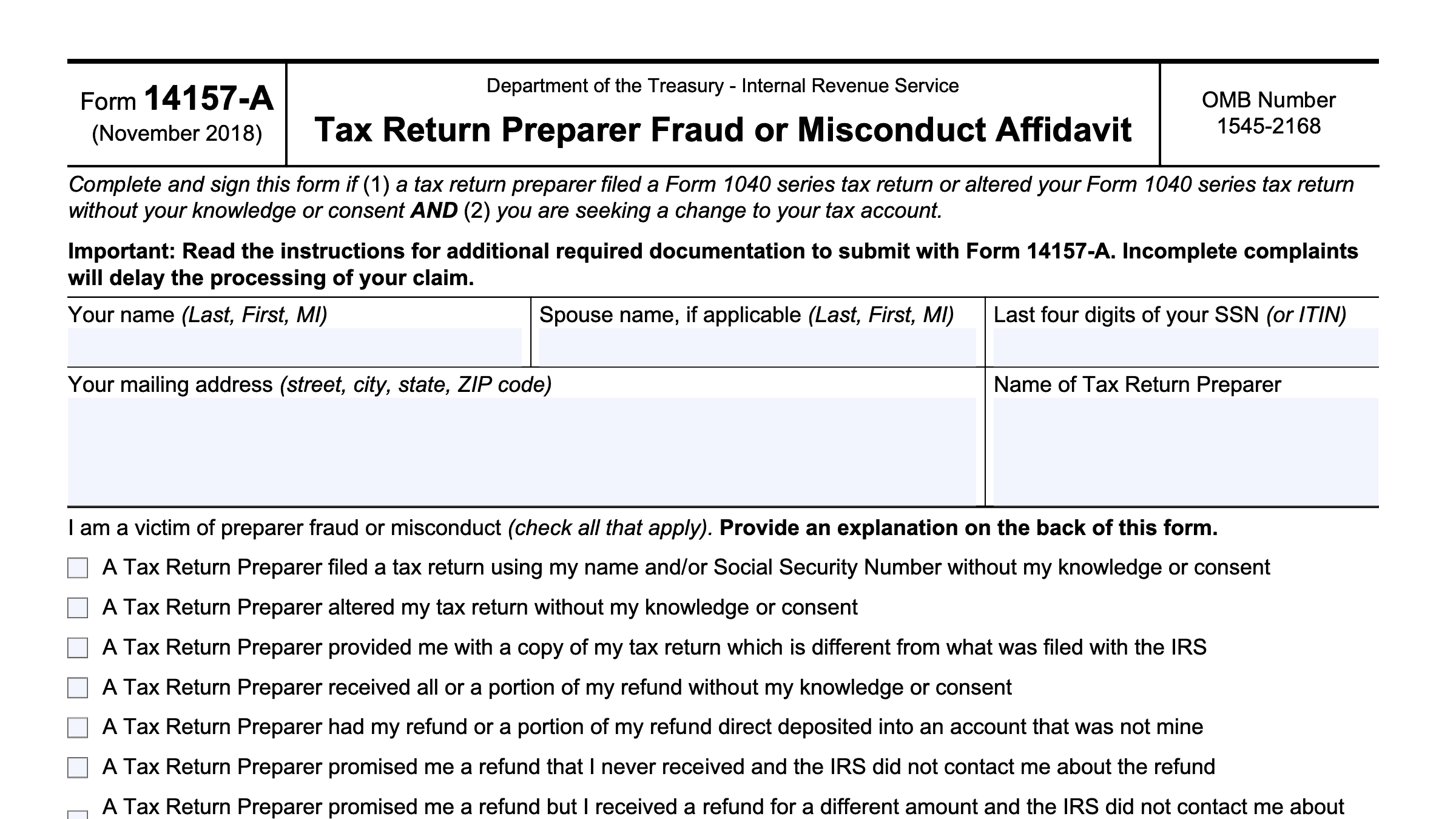

Use IRS Form 14157-A to report suspected fraud or tax preparer misconduct

If you believe that your tax return preparer committed tax fraud by using your information, you may need to file IRS Form 14157-A, Tax Return Preparer Fraud or Misconduct Affidavit, in addition to filing Form 14157 against your preparer.

Examples of events requiring this form include:

- Filing a tax return using the taxpayer’s name or SSN without the taxpayer’s knowledge

- Altering a tax return without the taxpayer’s knowledge or consent

- Providing the taxpayer with a different tax return than the one filed with the IRS

- Diverting a tax return refund to a different account not belonging to the taxpayer

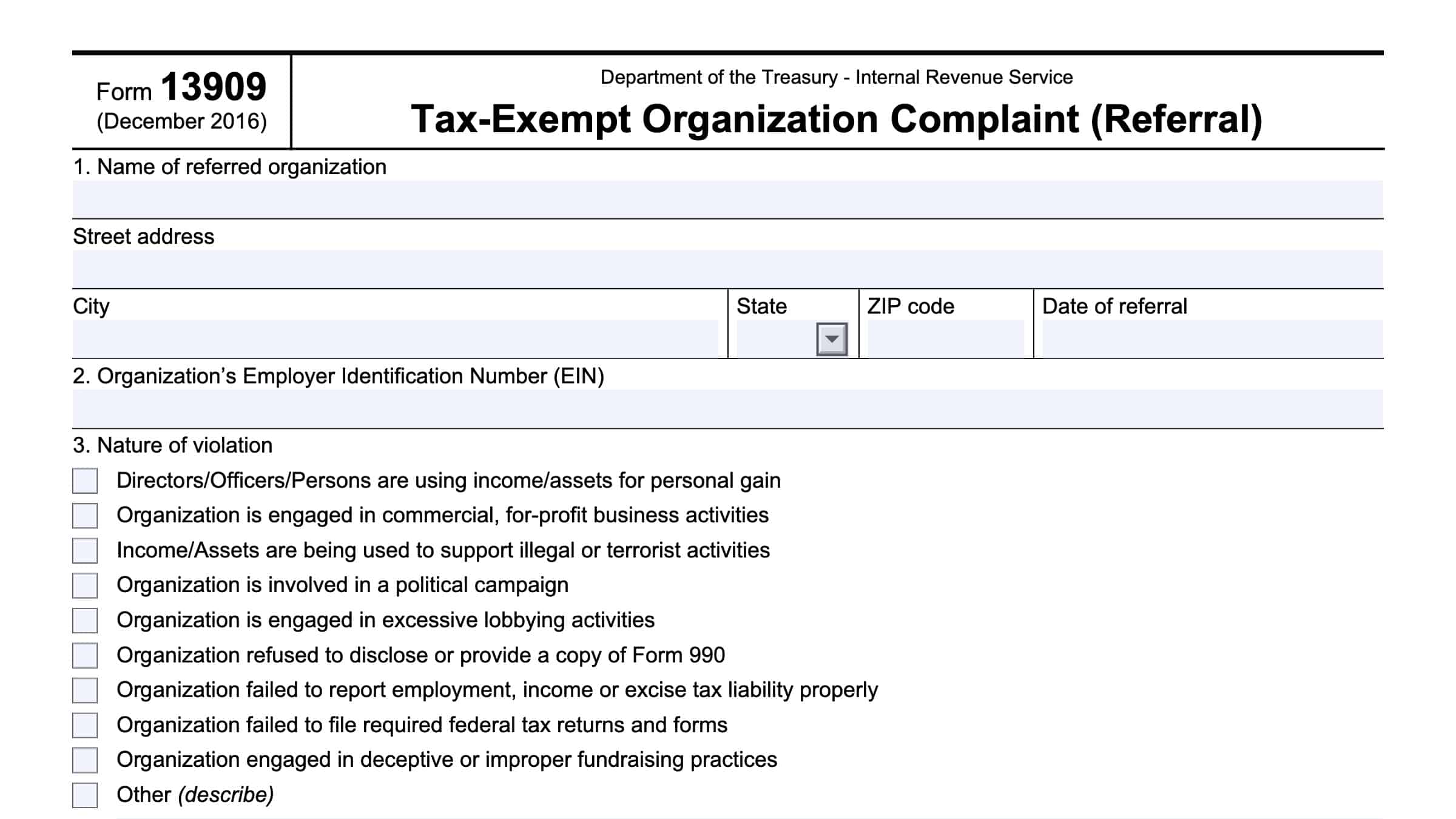

Use IRS Form 13909 to report a complaint against a tax-exempt organization

If you believe that a non-profit organization, or members of a tax-exempt organization are committing tax fraud, you should file IRS Form 13909, Tax-Exempt Organization Complaint (Referral).

By law, tax-related crimes committed by a tax exempt organization or its members may put its tax-exempt status at risk.

Examples of tax violations committed by tax-exempt organizations can include:

- Officers, directors, or key persons using assets for personal gain

- Engaging in commercial, for-profit business activities

- Involvement in political campaigns or excess lobbying activities

- Failure to report tax liabilities or file require tax returns

What if my identity is stolen?

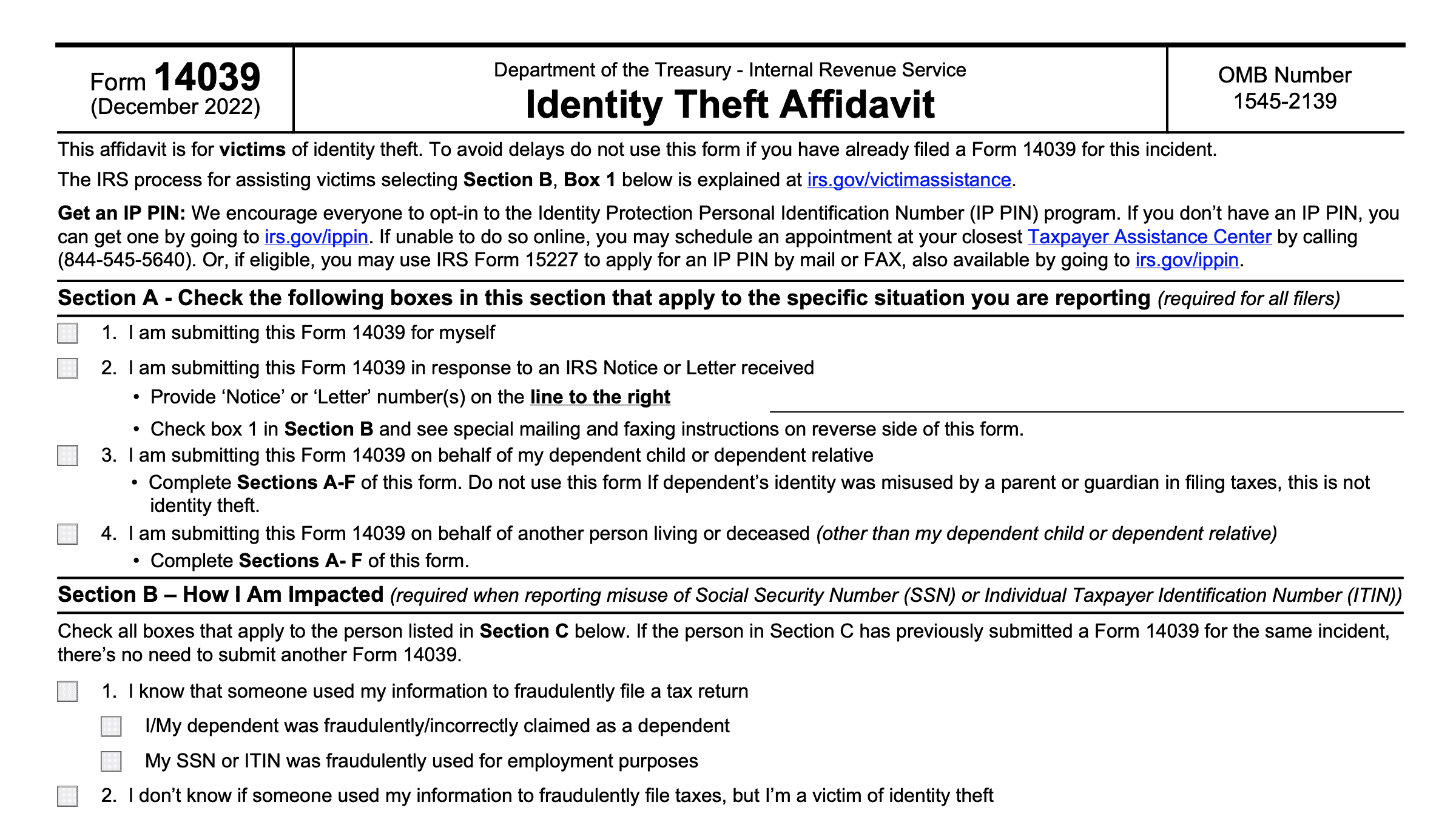

If you believe that you are the victim of identity theft and that your tax information is being used to commit fraud, then you may need to complete and submit IRS Form 14039, Identity Theft Affidavit.

How do I report email scams?

The IRS doesn’t initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information. This includes requests for any of the following:

- PIN numbers

- Passwords

- Information regarding your credit cards, banks or other financial accounts

If you receive an email from someone posing as the IRS or discussing tax-related issues, you should do the following:

If you receive an email claiming to be from the IRS that contains a request for personal information, taxes associated with a large investment, inheritance or lottery.

- Don’t reply to the email.

- Don’t open any attachments contained in the email.. They can contain malicious code that may infect your computer or mobile phone.

- Don’t click on any links in the email. Visit the IRS’ identity protection page if you clicked on links in a suspicious email or website and entered confidential information.

- Forward the email to the IRS, as-is, the Internal Revenue Service at phishing@irs.gov. Don’t forward scanned images because this removes valuable information.

- Delete the original email.

Am I eligible for a reward?

If you provide the IRS with important information that leads to the recovery of lost tax revenue, you may be eligible for a reward.

Internal Revenue Code Section 7623 authorizes the Treasury Department to pay a monetary reward to a whistleblower who provides important information that enables the IRS to recoup money on behalf of the federal government. Eligible taxpayers may apply for a reward by filing IRS Form 211, Application for Award for Original Information.

Frequently asked questions

No. Unfortunately, there are confidentiality laws that prevent the federal government from providing updates to anyone not directly involved in a tax investigation.

The primary difference between tax fraud and tax evasion appears to be their legal definition. IRC Section 7201 clearly defines tax evasion as either the willful attempt to evade or defeat the assessment of a tax, or the willful attempt to evade or defeat the payment of a tax. Conversely, the IRS defines tax fraud as an intentional wrongdoing, on the part of a taxpayer, with the specific purpose of evading a tax known or believed to be owing. Tax fraud is generally accepted as a broader definition of tax-related financial crime.