IRS Form 13909 Instructions

Federal tax law gives tax-exempt organizations certain rights to avoid taxation in the interest of public welfare. When a nonprofit organization abuses its tax-exempt status, someone can report them to the Internal Revenue Service using IRS Form 13909, Tax-Exempt Organization Complaint (Referral).

In this article, we’ll walk through this process step by step, including:

- How to complete Form 13909 to initiate your complaint

- How to file your completed form

- Additional things you should know about reporting a tax-exempt organization to the authorities

Let’s start by going through this form, step by step.

Table of contents

- How do I complete IRS Form 13909?

- What types of violations can I report on IRS Form 13909?

- Directors/Officers/Persons are using income/assets for personal gain

- Organization is engaged in commercial, for-profit business activities

- Income/Assets are being used to support illegal or terrorist activities

- Organization is involved in a political campaign

- Organization is engaged in excessive lobbying activities

- Organization refused to disclose or provide a copy of Form 990

- Organization failed to report employment, income or excise tax liability properly

- Organization failed to file required federal tax returns and forms

- Organization engaged in deceptive or improper fundraising practices

- Video walkthrough

- Frequently asked questions

- Where can I find IRS Form 13909?

- Related tax articles

- What do you think?

How do I complete IRS Form 13909?

Let’s walk through this IRS form, step by step.

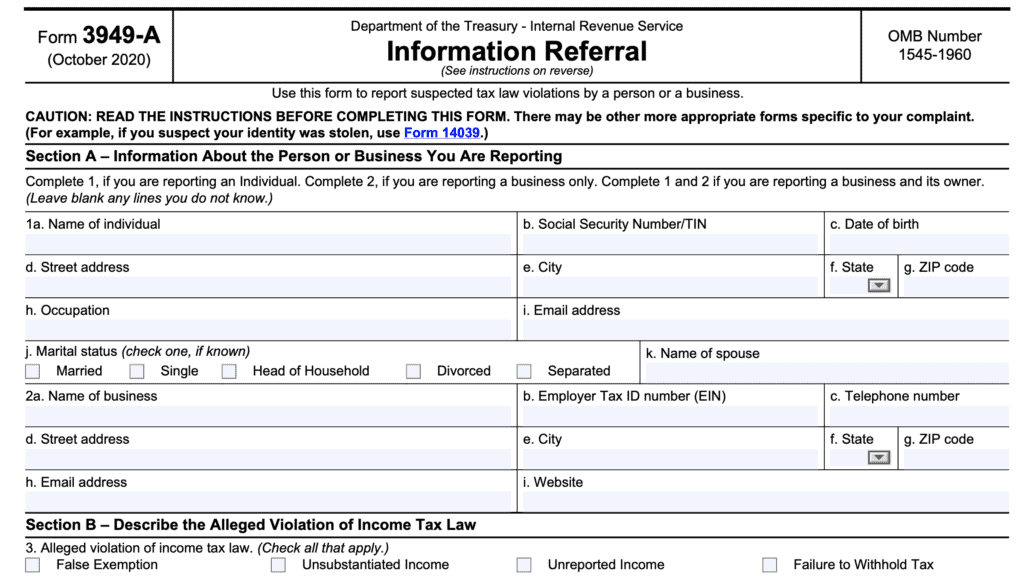

Line 1: Referred organization information

With respect to the organization that you are reporting, enter the following information:

- Organization name

- Street address

- City, state, and zip code

- Date of referral

Line 2: Organization’s employer identification number (EIN)

In this field, enter the organization’s nine-digit employer identification number, or EIN. If you do not know the organization’s EIN or cannot find it, you may enter the entity’s state nonprofit corporation registration number, if you know it.

Line 3: Nature of violation

Check the appropriate box, depending on the nature of your complaint. If this section does not list your complaint, you may use the ‘Other’ field to document the complaint.

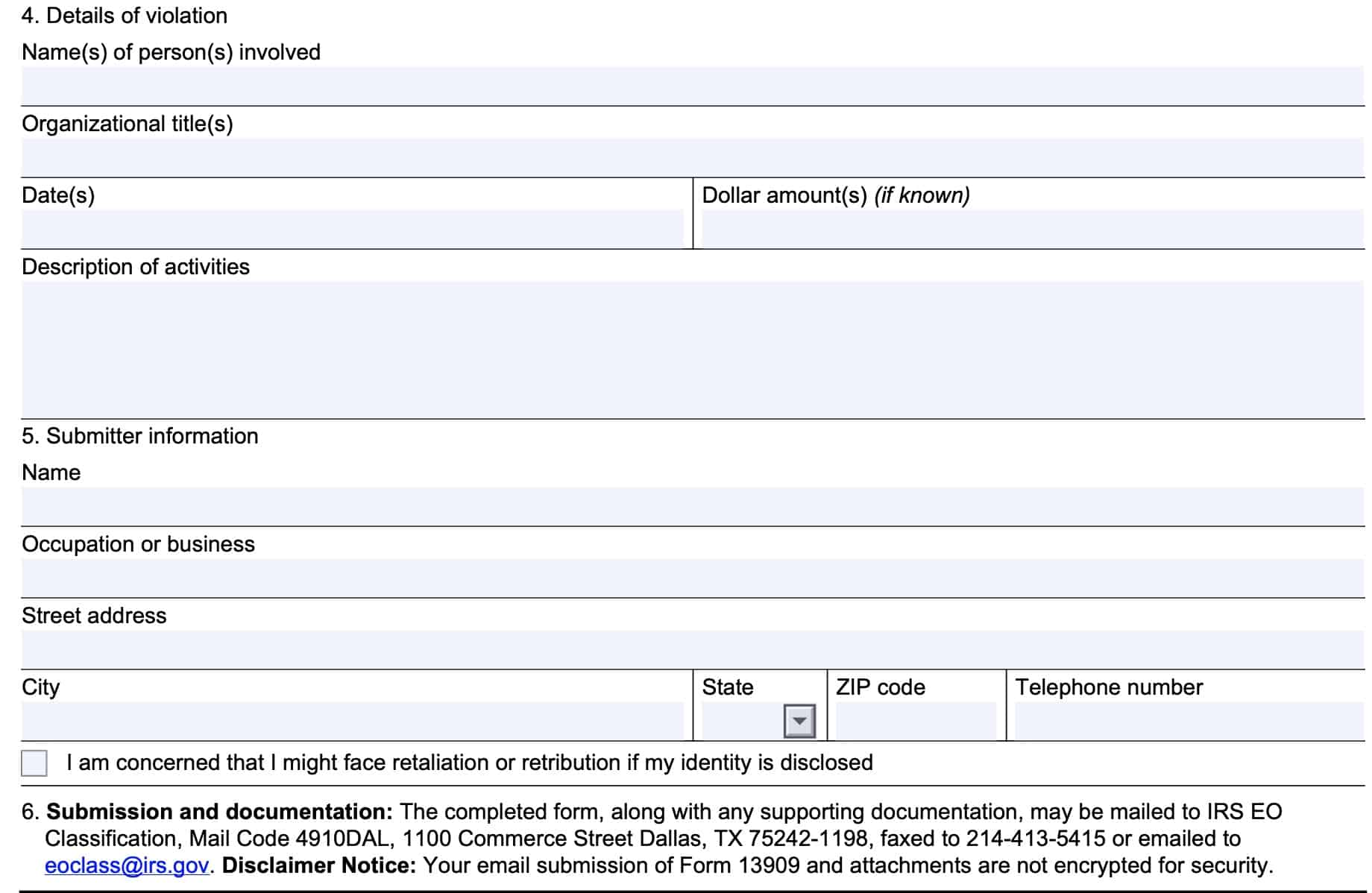

Line 4: Details of violation

In this section, you’ll provide details of the suspected

Line 5: Submitter information

In this section, you may choose to submit information about yourself. If you do, you should include:

- Name

- Occupation or business

- Address, including city, state, and zip code

- Telephone number

If you are concerned about retaliation or retribution, you may check the box at the bottom of the form. Also, you may enter ‘Anonymous’ in lieu of your actual name.

After completing Line 5, you’ll file your completed Form 13909 and any additional documents, as outlined in the next section.

How do I file IRS Form 13909?

On the form itself, there are several ways that are outlined. You may file this form by mail, fax, or email.

Regardless of how you file Form 13909, you may consider whether you are eligible for an award for a whistleblower claim. If your referral of an exempt organization is entitled to an award, you may consider filing IRS Form 211, Application for Award for Original Information, with your completed Form 13909.

File by mail

Mail your completed form as well as supporting documentation, to the following address:

IRS EO Classification

Mail Code 4910DAL

1100 Commerce Street

Dallas, TX 75242-1198

File by fax

You may also file by fax. You can fax your form and supporting documents, to the IRS at the following telephone number: (214) 413-5415.

File by email

If you prefer to send by email, you may email your documents to the IRS: eoclass@irs.gov. Please note that any submitted documents are not encrypted for security purposes.

What types of violations can I report on IRS Form 13909?

Anyone may file a complaint letter based upon suspected tax fraud, abuse, or other suspicious tax-related activity. However, Line 3 contains specific violations that are covered, either in the Internal Revenue Code, or in other guidance.

Let’s go through each of these violations to provide a little more detail.

Directors/Officers/Persons are using income/assets for personal gain

IRS guidance prohibits tax-exempt organizations from allowing insiders to use income or assets to be used for personal gain. For this purpose, the IRS considers insiders to include officers, directors, or any person with a personal or private interest in the organization’s activities.

This is known as inurement, or private benefit. Examples of inurement include:

- Payment of dividends

- Unreasonable compensation to insiders

- Transferring property to insiders for less than fair market value

Organization is engaged in commercial, for-profit business activities

A nonprofit organization qualifies for a tax exemption to the extent that they do not engage in commercial activities for profit. If the referral of an exempt organization indicates that the organization was engaging in for-profit activities, that organization can lose its exemption status. Additionally, civil and criminal charges may apply.

Income/Assets are being used to support illegal or terrorist activities

This is a fairly obvious point. If for-profit business activities can threaten an organization’s tax-exempt status, then supporting illegal activities or terrorist programs is definitely outside permissible practice.

Organization is involved in a political campaign

Under federal tax laws, all IRC Section 501(c)(3) organizations, including churches and religious organizations, are absolutely prohibited from directly or indirectly participating in, or intervening in, any political campaign on behalf of (or in opposition to) any candidate for elective public office.

Organization is engaged in excessive lobbying activities

Nonprofit organizations may engage in certain lobbying activities, if the lobbying is related to their tax-exempt

Organization refused to disclose or provide a copy of Form 990

As a requirement to maintain tax-exempt status, tax-exempt organizations must keep certain information available for public disclosure and inspection. Among these items is their annual tax return, also known as Form 990 series tax returns.

While a nonprofit organization must provide certain information in response to a reasonable request, there are certain important points:

- A tax-exempt organization may place reasonable restrictions on the time, place, and manner of in-person inspection and copying of public records

- The exempt organization may charge a reasonable fee for copies

- Cannot exceed the prescribed IRS rate (currently $.20 per page up to 8 1/2″ X 14″)

- The organization does not need to respond to individual requests if it makes the required information available to the general public

- An organization may not release any information that linked to the identity of any donors

Organization failed to report employment, income or excise tax liability properly

Most tax-exempt organizations have annual information reporting obligations under the Internal Revenue Code to maintain their tax-exempt status.

Although they are exempt from federal income tax, tax-exempt organizations may be liable for additional filing requirements related to:

- Employment taxes

- Unrelated business income tax (UBIT)

- Excise taxes, and

- Certain state and local taxes

Organization failed to file required federal tax returns and forms

Even though they may be exempt from income tax, tax-exempt organizations must file required tax returns and forms. A partial list of forms that an exempt organization may still have to file includes:

- Form W-2

- Form 941, Employer’s Quarterly Federal Tax Return

- Form 944, Employer’s Annual Federal Tax Return

- Form 990, Return of Organization Exempt From Income Tax

- May also file Form 990-T, Form 990-N, or Form 990-EZ

Organization engaged in deceptive or improper fundraising practices

Tax exempt entities can raise funds through a variety of means, as allowed by federal tax law. However, even the most well-intentioned public charities can run a foul of IRS guidelines with respect to proper fundraising practices.

Video walkthrough

Watch this video tutorial to learn more about filing your tax-exempt organization complaint with IRS Form 13909.

Frequently asked questions

Filing a tax complaint against a tax-exempt organization is completely voluntary. The IRS does not require anyone to report suspected activity.

Form 13909 may be used to report any nonprofit organization or other organization claiming tax-exempt status. This includes charitable organizations, churches and other religious organizations, or private foundations.

You can expect that the IRS to acknowledge receipt of the complaint in writing. However, if the IRS decides to take further action, such as a field examination, you will not receive a progress update or any additional information.

No. Federal law precludes the Internal Revenue Service from providing updates or disclosing information about specific actions taken as a result of an information referral. You should not expect to receive more than a standard acknowledgement letter from the IRS.

Where can I find IRS Form 13909?

You may find this tax form on the IRS website. For your convenience, we’ve attached the latest version to this article.